Hall of Fame Resort & Entertainment Company Announces Second Quarter 2022 Results

August 11 2022 - 3:48PM

Business Wire

Hall of Fame Resort & Entertainment Company (NASDAQ: HOFV,

HOFVW) (the “Company”), the only resort, entertainment and media

company centered around the power of professional football,

announced its second quarter fiscal 2022 results for the period

ended June 30, 2022.

“This quarter represented an inflection point in the Company’s

evolution as we operationalize and build upon the physical and

virtual foundation that has been set over the past couple of

years,” stated Michael Crawford, President and CEO. “We’ve made key

plays across all business verticals and we continue to move the

ball down the field. We have hosted multiple large events on campus

during the second and third quarters, where we have been able to

capitalize on the synergies across many of our assets. We welcomed

thousands of guests during Enshrinement week with the kickoff to

the NFL season, the Enshrinement ceremony, the Concert for Legends,

and then ended the weekend with Dave Chappelle. The media vertical

had an excellent showing with its pilot episode of Inspired and

launching Football Heaven, a first-of-its kind-podcast, which

highlights our access to incredible content and stories from the

world of professional football. The gaming vertical launched the

second season of Hall of Fantasy League (“HOFL”) and submitted

necessary applications to the Ohio Casino Control Commission to

obtain the necessary sports betting licenses. And while there is

still more to come, the Company has transitioned into an

operational destination offering multiple unique engagement

opportunities for fans and consumers.”

Key Financial Highlights

- Second quarter revenue was $2.7 million, an increase of 14%

compared to the same period of the prior year, primarily driven by

hotel revenue and event revenue related to events being held at the

Hall of Fame Village powered by Johnson Controls.

- Second quarter net loss attributable to shareholders was $9.2

million, compared to net income of $15.5 million in the prior year

period. The change in fair value of the warrant liability was the

primary driver in the variance between the two time periods.

- Second quarter adjusted EBITDA was a loss of $6.1 million,

compared to a loss of $5.6 million in the same period of the prior

year, primarily resulting from increased expenses related to

payroll, benefits and insurance costs. See page 3 for a

reconciliation of net loss to EBITDA and adjusted EBITDA.

- The Company finished its fiscal quarter with a cash balance,

including restricted cash, of $17.8 million, compared to $12.8

million as of March 31, 2022. The increased cash balance was due to

proceeds from construction related financing and cash from

operating activities, partially offset by increased capital

expenditures related to construction activities.

Second Quarter Business Highlights

- Hosted several large multi-day events at Hall of Fame Village

powered by Johnson Controls (“Hall of Fame Village”) including the

USFL playoffs and championship game, plus the three-day Fatherhood

Festival.

- Secured two additional sources of funding that will be used to

support construction of the Center for Performance. The Company

closed a $4 million loan with Midwest Lender Fund, LLC. In

addition, the City of Canton, in coordination with the Canton

Regional Energy Special Improvement District, approved legislation

that enabled the Company to move forward with $3.2 million in

Property Assessed Clean Energy ("PACE") financing.

- Shared details surrounding the Play-Action Plaza, which will

feature several attractions, including the only two rides of their

kind in Stark County, Ohio.

- The pilot episode for Inspired: Heroes of Change premiered

across 100 channels of Gray Television’s local stations in early

June.

- Announced a collaboration with recreational facility The

SportDome and its owners, the Kempthorn family, to transfer the

operation of local sports leagues to the Center for

Performance.

Subsequent To Quarter End Highlights

- Secured additional funding including $33.4 million in PACE

financing related to Tom Benson Hall of Fame Stadium.

- Announced Hall of Fantasy League (“HOFL”) Season 2 with Pro

Football Hall of Fame Running Back and Dallas Cowboys Legend Emmitt

Smith as commissioner.

- Announced 10-year partnership with Betr to become the Company’s

official mobile sports-betting partner. The agreement also gives

HOFV limited equity in Betr, revenue sharing, and incorporates

opportunities for cross-marketing, branding, and engagement with

consumers of both companies.

- Announced the launch of Football Heaven, a first-of-its-kind

video podcast produced in partnership with the Pro Football Hall of

Fame. Football Heaven will explore some of the most fascinating

stories and personalities in Pro Football history.

- Signed multi-year sponsorship agreements with Molson Coors and

Sugardale.

Conference Call The Company will host a conference call

and webcast Friday, August 12, 2022, beginning at 8:30 a.m. ET, to

provide commentary on the business. Investors and all other

interested parties can access the live webcast and replay at the

Company’s website: ir.hofreco.com.

About Hall of Fame Resort & Entertainment Company

Hall of Fame Resort & Entertainment Company (NASDAQ: HOFV,

HOFVW) is a resort and entertainment company leveraging the power

and popularity of professional football and its legendary players

in partnership with the Pro Football Hall of Fame. Headquartered in

Canton, Ohio, the Hall of Fame Resort & Entertainment Company

is the owner of the Hall of Fame Village powered by Johnson

Controls, a multi-use sports, entertainment and media destination

centered around the Pro Football Hall of Fame’s campus. Additional

information on the Company can be found at www.HOFREco.com.

Forward-Looking Statements

Certain statements made herein are “forward-looking statements”

within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words and phrases such

as “opportunity,” “future,” “will,” “goal,” “enable,” “pipeline,”

“transition,” “move forward,” “towards,” “build out,” “coming” and

“look forward” and other similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters. These forward-looking statements are not

guarantees of future performance, conditions or results, and

involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside

the Company’s control, which could cause actual results or outcomes

to differ materially from those discussed in the forward-looking

statements. Important factors that may affect actual results or

outcomes include, among others, the Company’s ability to manage

growth; the Company’s ability to execute its business plan and meet

its projections, including obtaining financing to construct planned

facilities; potential litigation involving the Company; changes in

applicable laws or regulations; general economic and market

conditions impacting demand for the Company’s products and

services, and in particular economic and market conditions in the

resort and entertainment industry; the effects of the ongoing

global coronavirus (COVID-19) pandemic on capital markets, general

economic conditions, unemployment and the Company’s liquidity,

operations and personnel; increased inflation; the inability to

maintain the listing of the Company’s shares on Nasdaq; and those

risks and uncertainties discussed from time to time in our reports

and other public filings with the SEC. The Company does not

undertake any obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Non-GAAP Financial Measures

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”) and corresponding metrics as non-GAAP financial measures.

The presentation includes references to the following non-GAAP

financial measures: EBITDA and adjusted EBITDA. These are important

financial measures used in the management of the business,

including decisions concerning the allocation of resources and

assessment of performance. Management believes that reporting these

non-GAAP financial measures is useful to investors as these

measures are representative of the company’s performance and

provide improved comparability of results. See the table below for

the definitions of the non-GAAP financial measures referred to

above and corresponding reconciliations of these non-GAAP financial

measures to the most comparable GAAP financial measures. Non-GAAP

financial measures should be viewed as additions to, and not as

alternatives for the Company’s results prepared in accordance with

GAAP. In addition, the non-GAAP measures the Company uses may

differ from non-GAAP measures used by other companies, and other

companies may not define the non-GAAP measures the company uses in

the same way.

For the Three Months Ended June

30,

2022

2021

Adjusted EBITDA Reconciliation Net loss

attributable to HOFRE stockholders

$

(9,202,433

)

$

15,541,053

(Benefit from) provision for income taxes

-

-

Interest expense

921,392

1,004,419

Depreciation expense

3,527,581

2,972,130

Amortization of discount on notes payable

1,122,324

1,164,613

EBITDA

(3,631,136

)

20,682,215

Change in fair value of warrant

liability

(2,423,000

)

(26,315,888

)

Adjusted EBITDA

$

(6,054,136

)

$

(5,633,673

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220811005702/en/

Media/Investor: Media Inquiries:

public.relations@hofreco.com Investor Inquiries:

investor.relations@hofreco.com

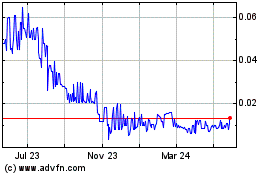

Hall of Fame Resort and ... (NASDAQ:HOFVW)

Historical Stock Chart

From Feb 2025 to Mar 2025

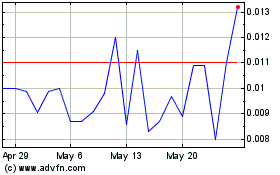

Hall of Fame Resort and ... (NASDAQ:HOFVW)

Historical Stock Chart

From Mar 2024 to Mar 2025