0001785530FALSE00017855302024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 7, 2024

___________________________________________

WEREWOLF THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

___________________________________________

| | | | | | | | |

| Delaware | 001-40366 | 82-3523180 |

| (State or Other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

| | | | | |

200 Talcott Ave, 2nd Floor | |

Watertown, Massachusetts | 02472 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (617) 952-0555

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.0001 par value per share | | HOWL | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02. Results of Operations and Financial Condition.

On March 7, 2024, Werewolf Therapeutics, Inc., a Delaware corporation (the “Company”), issued a press release announcing financial results for the quarter ended December 31, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 3, 2024, Cynthia Seidel-Dugan, Ph.D., notified the Company of her intent to retire from her position as Chief Scientific Officer of the Company, effective as of March 29, 2024.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| (d) Exhibits | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| WEREWOLF THERAPEUTICS, INC. |

| | |

Date: March 7, 2024 | By: | /s/ Timothy W. Trost |

| | Timothy W. Trost |

| | Chief Financial Officer and Treasurer |

Exhibit 99.1

Werewolf Therapeutics Reports Fourth Quarter and Full Year 2023 Financial Results and Provides Business Update

–Additional monotherapy dose-escalation data from ongoing Phase 1/1b clinical trial of WTX-124 expected to be presented in the first half of 2024 -

–WTX-124 recommended dose for expansion (RDE), initiation of monotherapy dose expansion arms and initial combination dose-escalation data also expected in the first half of 2024 -

–Preliminary data from Phase 1 clinical trial of WTX-330 expected in the second quarter of 2024-

–Updated cash guidance provides runway through at least the second quarter of 2025 -

Watertown, Mass., March 7, 2024 – Werewolf Therapeutics, Inc. (the “Company” or “Werewolf”) (Nasdaq: HOWL), an innovative biopharmaceutical company pioneering the development of conditionally activated therapeutics engineered to stimulate the body’s immune system for the treatment of cancer, today provided a business update and reported financial results for the fourth quarter and full year ended December 31, 2023.

“Werewolf made considerable progress in 2023, setting up 2024 as a year of execution across our pipeline,” said Daniel J. Hicklin, Ph.D., President and Chief Executive Officer of Werewolf. “In the first half of this year, we plan to present additional clinical data from our Phase 1/1b clinical trial of WTX-124, including updated monotherapy data and initial combination data, which we anticipate will build on the promising signals of antitumor activity and improved therapeutic index that we observed in the data presented at SITC last year. In addition, we plan to share data further demonstrating the performance of our platform in our preclinical programs at AACR. We also plan to share initial clinical data from WTX-330, our second clinical candidate, in the second quarter of 2024.”

“Additionally, I would like to express my deep appreciation to Cindy Seidel-Dugan, Ph.D., Werewolf’s Chief Scientific Officer, who is retiring effective March 29, 2024, after a long and successful career in the biopharmaceutical industry. Cindy was a founding member of the Werewolf Executive Team and has been instrumental in establishing Werewolf’s innovative science, developing our INDUKINE technology, and shepherding our lead candidates through the discovery and IND-enabling process. We have benefited greatly from Cindy’s significant expertise, and the strong scientific leadership team she has built that will ensure continued success going forward. We wish Cindy the very best in her retirement.”

Recent Highlights and Upcoming Milestones

WTX-124: a systemically delivered, conditionally activated Interleukin-2 (IL-2) INDUKINE molecule being developed as monotherapy and in combination with pembrolizumab in multiple solid tumor types.

•In November 2023, at the Society for Immunotherapy of Cancer (SITC) 38th Annual Meeting, Werewolf presented first-in-human monotherapy data from the Phase 1/1b clinical trial of WTX-124. These preliminary data established proof of mechanism for WTX-124 and proof of concept for Werewolf’s INDUKINE design hypothesis.

•In the first half of 2024, Werewolf expects to present additional interim dose-escalation data from the monotherapy dose-escalation arm, nominate a recommended dose for expansion and initiate monotherapy dose expansion arms.

•Additionally, Werewolf continues to progress combination dose escalation cohorts of the Phase 1/1b clinical trial and plans to report initial clinical data from this arm in the first half of 2024.

WTX-330: a systemically delivered, conditionally activated Interleukin-12 (IL-12) INDUKINE molecule being developed in refractory and/or immunologically unresponsive tumors.

•Werewolf is progressing Study WTX-330x2101, its Phase 1, multi-center, open-label clinical trial evaluating WTX-330 as a monotherapy in patients with immunotherapy insensitive or resistant advanced or metastatic solid tumors or non-Hodgkin lymphoma. Werewolf plans to report initial data from the Phase 1 study in the second quarter of 2024.

Preclinical Portfolio: includes development candidates WTX-712 and WTX-518, INDUKINE molecules targeting IL-21 and IL-18, respectively, for treatment of cancer.

•Werewolf plans to present preclinical data from WTX-712 and WTX-518 at the 2024 AACR Annual Meeting on antitumor activity in the delivery of IL-21 or IL-18, respectively, to the tumor microenvironment in mouse tumor models. These programs are currently progressing through IND-enabling work.

Abstract Number: 4078

Title: WTX-712, a conditionally active IL-21 INDUKINETM molecule, induces a strong anti-tumor phenotype through a differentiated mechanism

Session Date and Time: Tuesday, April 9, 2024, from 9:00 a.m. - 12:30 p.m.

Abstract Number: 4074

Title: Discovery of WTX-518, an IL-18 pro-drug that is conditionally activated within the tumor microenvironment and induces regressions in mouse tumor models

Session Date and Time: Tuesday, April 9, 2024, from 9:00 a.m. - 12:30 p.m.

Additional Updates:

•In January 2024, Werewolf appointed Michael Atkins, M.D., to its Board of Directors. Dr. Atkins has served as a member of Werewolf’s Scientific Advisory Board since August 2018 and has more than 30 years of experience in translational and clinical research, specializing in melanoma, kidney cancer, and cancer immunotherapy.

Financial Results for the Fourth Quarter and Full Year 2023:

•Cash position: As of December 31, 2023, cash and cash equivalents were $134.3 million, compared to $129.3 million as of December 31, 2022. The Company also had restricted cash and cash equivalents of $21.2 million and $1.2 million as of December 31, 2023 and December 31, 2022, respectively. Based on updated forecasting the Company now expects that its existing cash and cash equivalents at December 31, 2023, and gross proceeds of $17.7 million under the at-the-market sales facility received from January 1, 2024 through March 1, 2024, will be sufficient to fund its operational expenses and capital expenditure requirements through at least the second quarter of 2025.

•Collaboration revenue: Collaboration revenue was $1.5 million for the fourth quarter of 2023, compared to $7.3 million for the same period in 2022, and $19.9 million for the full year 2023, compared to $16.4 million for the same period in 2022. Collaboration revenue consists of revenue recognized from the Company’s licensing agreement with Jazz Pharmaceuticals (Jazz) and includes fixed payments received from Jazz, plus costs incurred for research services to be reimbursed by Jazz.

•Research and development expenses: Research and development expenses were $9.6 million for the fourth quarter of 2023, compared to $15.9 million for the same period in 2022. Research and development expenses were $41.8 million for the full year 2023, compared to $53.8 million for the full year 2022.

•General and administrative expenses: General and administrative expenses were $4.8 million for the fourth quarter of 2023, compared to $4.6 million for the same period in 2022. General and administrative expenses were $18.7 million for the full year 2023, compared to $18.7 million for the full year 2022.

•Net loss: Net loss was $12.0 million for the fourth quarter of 2023, compared to $11.9 million for the same period in 2022. Net loss was $37.4 million for the full year 2023, compared to $53.8 million for the full year 2022.

About Werewolf Therapeutics:

Werewolf Therapeutics, Inc. is an innovative clinical-stage biopharmaceutical company pioneering the development of therapeutics engineered to stimulate the body’s immune system for the treatment of cancer. We are leveraging our proprietary PREDATOR™ platform to design conditionally activated molecules that stimulate both adaptive and innate immunity with the goal of addressing the limitations of conventional proinflammatory immune therapies. Our INDUKINE™ molecules are intended to remain inactive in peripheral tissue yet activate selectively in the tumor microenvironment. Our most advanced product candidates, WTX-124 and WTX-330, are systemically delivered, conditionally activated Interleukin-2 (IL-2), and Interleukin-12 (IL-12) INDUKINE molecules for the treatment of solid tumors. WTX-124 is in development as a monotherapy and in combination with pembrolizumab in multiple

solid tumor types. WTX-330 is in development as a single agent in refractory and/or immunotherapy unresponsive or resistant advanced or metastatic solid tumors and non-Hodgkin lymphoma.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that involve substantial risk and uncertainties. All statements, other than statements of historical facts, contained in this press release, including statements regarding Werewolf’s strategy, future operations, prospects, plans, and objectives of management; the projection of the cash runway; the expected timeline for the preclinical and clinical development of product candidates and the availability of data from such preclinical and clinical development; the potential activity and efficacy of product candidates in preclinical studies and clinical trials; and the anticipated safety profile of product candidates; constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. The words “aim,” “anticipate,” “approach,” “believe,” “contemplate,” “continue,” “could,” “design,” “designed to,” “engineered,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “promise,” “should,” “target,” “will,” or “would,” or the negative of these terms, or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result of various important factors, including: uncertainties inherent in the development of product candidates, including the conduct of research activities and the initiation and completion of preclinical studies and clinical trials; uncertainties as to the availability and timing of results from preclinical studies and clinical trials; the timing of and the Company’s ability to submit and obtain regulatory approval for investigational new drug applications; whether results from preclinical studies will be predictive of the results of later preclinical studies and clinical trials; whether preliminary data from a clinical trial will be predictive of the results of the trial and future clinical trials; the Company’s ability to manage cash resources and obtain additional cash resources to fund the Company’s foreseeable and unforeseeable operating expenses and capital expenditure requirements; as well as the risks and uncertainties identified in the “Risk Factors” section of the Company’s most recent Form 10-Q filed with the Securities and Exchange Commission (“SEC”), and in subsequent filings the Company may make with the SEC. In addition, the forward-looking statements included in this press release represent the Company’s views as of the date of this press release. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this press release.

Werewolf Therapeutics, Inc.

Consolidated Statements of Operations (unaudited)

(amounts in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Collaboration revenue | $ | 1,501 | | | $ | 7,283 | | | $ | 19,943 | | | $ | 16,401 | |

Operating expenses: | | | | | | | |

Research and development | 9,649 | | | 15,859 | | | 41,776 | | | 53,761 | |

General and administrative | 4,814 | | | 4,603 | | | 18,670 | | | 18,696 | |

Total operating expenses | 14,463 | | | 20,462 | | | 60,446 | | | 72,457 | |

Operating loss | (12,962) | | | (13,179) | | | (40,503) | | | (56,056) | |

| Other income | 959 | | | 1,249 | | | 3,135 | | | 2,246 | |

Net loss | $ | (12,003) | | | $ | (11,930) | | | $ | (37,368) | | | $ | (53,810) | |

Net loss per share, basic and diluted | $ | (0.33) | | | $ | (0.39) | | | $ | (1.05) | | | $ | (1.86) | |

| | | | | | | |

Weighted-average common shares outstanding, basic and diluted | 36,570,280 | | | 30,734,797 | | | 35,646,572 | | | 28,863,935 | |

| | | | | | | |

Werewolf Therapeutics, Inc.

Selected Consolidated Balance Sheet Data (unaudited)

(amounts in thousands)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Cash and cash equivalents | $ | 134,343 | | $ | 129,315 | |

| Working capital | $ | 118,992 | | $ | 116,211 | |

| Total assets | $ | 174,833 | | $ | 160,245 | |

| Total deferred revenue | $ | 1,340 | | $ | 7,660 | |

| Total notes payable, net of discount and issuance costs | $ | 39,323 | | $ | — | |

| Total stockholders’ equity | $ | 111,374 | | $ | 122,337 | |

Investor Contact:

Josh Rappaport

Stern IR

212.362.1200

Josh.rappaport@sternir.com

Media Contact:

Amanda Sellers

VERGE Scientific Communications

301.332.5574

asellers@vergescientific.com

Company Contact:

Ellen Lubman

Chief Business Officer

Werewolf Therapeutics

elubman@werewolftx.com

v3.24.0.1

Cover Page Document

|

Mar. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity Registrant Name |

WEREWOLF THERAPEUTICS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40366

|

| Entity Tax Identification Number |

82-3523180

|

| Entity Address, Address Line One |

200 Talcott Ave

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

(617

|

| Local Phone Number |

952-0555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

HOWL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| Entity Central Index Key |

0001785530

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

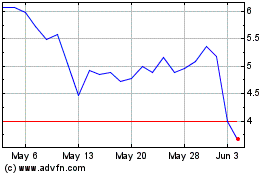

Werewolf Therapeutics (NASDAQ:HOWL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Werewolf Therapeutics (NASDAQ:HOWL)

Historical Stock Chart

From Jan 2024 to Jan 2025