H World Group Limited (Nasdaq: HTHT and HKEx: 1179, the “Company”

or “H World”), a key player in the global hotel industry, today

announced that it is notifying holders of its 3.00% Convertible

Senior Notes due 2026 (CUSIP No. 44332NAB2) (the “Notes”) that

pursuant to the Indenture dated as of May 12, 2020 (the

“Indenture”) relating to the Notes by and between the Company and

Wilmington Trust, National Association, as trustee and paying

agent, each holder has the right, at the option of such holder, to

require the Company to purchase all of such holder’s Notes or any

portion of the principal thereof that is equal to US$1,000

principal amount (or an integral multiple thereof) for cash (the

“Put Right”) on May 1, 2024 (the “Repurchase Date”). The Put Right

expires at 5:00 p.m., New York City time, on Monday, April 29,

2024.

As required by rules of the United States Securities and

Exchange Commission (the “SEC”), the Company will file a Tender

Offer Statement on Schedule TO today. In addition, documents

specifying the terms, conditions and procedures for exercising the

Put Right will be available through the Depository Trust Company

and the paying agent, which is Wilmington Trust, National

Association. None of the Company, its board of directors, executive

management or its employees has made or is making any

representation or recommendation to any holder as to whether to

exercise or refrain from exercising the Put Right.

The Put Right entitles each holder of the Notes to require the

Company to repurchase all or a portion of such holder’s Notes in

principal amounts equal to US$1,000 or integral multiples thereof.

The repurchase price for such Notes will be equal to 100% of the

principal amount of the Notes to be repurchased, plus any accrued

and unpaid interest to, but excluding, the Repurchase Date, subject

to the terms and conditions of the Indenture and the Notes. The

next interest payment date for the Notes is Wednesday, May 1, 2024.

Accordingly, on May 1, 2024, the Company will pay accrued and

unpaid interest on all of the Notes through April 30, 2024, to all

holders who were holders of record on April 15, 2024,

regardless of whether the Put Right is exercised with respect to

such Notes. As a result, on the Repurchase Date, there will be no

accrued and unpaid interest on the Notes. On the Repurchase Date,

the repurchase price will be paid in cash to the holders who

exercise the Put Right. As of March 29, 2024, there was

US$499,999,000.00 in aggregate principal amount of the Notes

outstanding. If all outstanding Notes are surrendered for

repurchase through exercise of the Put Right, the aggregate cash

purchase price will be US$499,999,000.00, plus accrued and unpaid

interest to, but excluding, the Repurchase Date.

The opportunity for holders of the Notes to exercise the Put

Right commences at 9:00 a.m., New York City time, on Monday,

April 1, 2024, and will terminate at 5:00 p.m., New York City

time, on Monday, April 29, 2024. In order to exercise the Put

Right, a holder must follow the transmittal procedures set forth in

the Company’s Put Right Notice to holders (the “Put Right Notice”),

which is available through the Depository Trust Company and

Wilmington Trust, National Association. Holders may withdraw any

previously tendered Notes pursuant to the terms of the Put Right at

any time prior to 5:00 p.m., New York City time, on Monday,

April 29, 2024, which is the second business day immediately

preceding the Repurchase Date, or as otherwise provided by

applicable law.

This press release is for information only and is not an offer

to purchase, a solicitation of an offer to purchase, or a

solicitation of an offer to sell the Notes or any other securities

of the Company. The offer to purchase the Notes will be made only

pursuant to, and the Notes may be tendered only in accordance with,

the Company’s Put Right Notice dated April 1, 2024 and related

documents. Holders of Notes may request a copy of the Company’s Put

Right Notice from the paying agent, Wilmington Trust, National

Association by emailing DTC@wilmingtontrust.com.

HOLDERS OF NOTES AND OTHER INTERESTED PARTIES ARE URGED TO READ

THE COMPANY’S SCHEDULE TO, PUT RIGHT NOTICE AND OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT H WORLD GROUP LIMITED

AND THE PUT RIGHT.

Materials filed with the SEC will be available electronically

without charge at the SEC’s website, www.sec.gov. Documents filed

with the SEC may also be obtained without charge at the Company’s

website, https://ir.hworld.com/.

About H World Group Limited

Originated in China, H World Group Limited is a key player in

the global hotel industry. As of December 31, 2023, H World

operated 9,394 hotels with 912,444 rooms in operation in 18

countries. H World’s brands include Hi Inn, Elan Hotel, HanTing

Hotel, JI Hotel, Starway Hotel, Orange Hotel, Crystal Orange Hotel,

Manxin Hotel, Madison Hotel, Joya Hotel, Blossom House, Ni Hao

Hotel, CitiGO Hotel, Steigenberger Hotels & Resorts, MAXX, Jaz

in the City, IntercityHotel, Zleep Hotels, Steigenberger Icon and

Song Hotels. In addition, H World also has the rights as master

franchisee for Mercure, Ibis and Ibis Styles, and co-development

rights for Grand Mercure and Novotel, in the pan-China region.

H World’s business includes leased and owned, manachised and

franchised models. Under the lease and ownership model, H World

directly operates hotels typically located on leased or owned

properties. Under the manachise model, H World manages manachised

hotels through the on-site hotel managers that H World appoints,

and H World collects fees from franchisees. Under the franchise

model, H World provides training, reservations and support services

to the franchised hotels, and collects fees from franchisees but

does not appoint on-site hotel managers. H World applies a

consistent standard and platform across all of its hotels. As of

December 31, 2023, H World operates 11 percent of its hotel rooms

under lease and ownership model, and 89 percent under manachise and

franchise model.

For more information, please visit H World’s website:

https://ir.hworld.com.

Safe Harbor Statement Under the U.S. Private Securities

Litigation Reform Act of 1995

The information in this release contains forward-looking

statements which involve risks and uncertainties, including

statements regarding the Company’s expectations. Any statements

contained herein that are not statements of historical fact may be

deemed to be forward-looking statements, which may be identified by

terminology such as “may,” “should,” “will,” “expect,” “plan,”

“intend,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “forecast,” “project,” or “continue,” the negative of

such terms or other comparable terminology. Readers should not rely

on forward-looking statements as predictions of future events or

results. Any or all of the Company’s forward-looking statements may

turn out to be incorrect. They can be affected by inaccurate

assumptions, risks and uncertainties and other factors which could

cause actual events or results to be materially different from

those expressed or implied in the forward-looking statements. In

evaluating these statements, readers should consider various

factors, including the anticipated growth strategies of the

Company, the future results of operations and financial condition

of the Company, the economic conditions of China and Europe, the

regulatory environment in China and Europe, the Company’s ability

to attract customers and leverage its brands, trends and

competition in the lodging industry, the expected growth of the

lodging market in China and Europe, and other factors and risks

outlined in the Company’s filings with the Securities and Exchange

Commission, including its annual report on Form 20-F and other

filings. These factors may cause the Company’s actual results to

differ materially from any forward-looking statement. In addition,

new factors emerge from time to time and it is not possible for the

Company to predict all factors that may cause actual results to

differ materially from those contained in any forward-looking

statements. Any projections in this release are based on limited

information currently available to the Company, which is subject to

change. This release also contains statements or projections that

are based upon information available to the public, as well as

other information from sources which the Company believes to be

reliable, but it is not guaranteed by the Company to be accurate,

nor does the Company purport it to be complete. The Company

disclaims any obligation to publicly update any forward-looking

statements to reflect events or circumstances after the date of

this document, except as required by applicable law.

Contact InformationInvestor RelationsTel: +86 (21) 6195

9561Email: ir@hworld.comhttps://ir.hworld.com

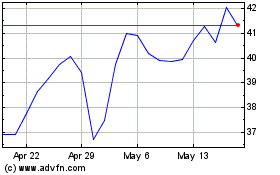

H World (NASDAQ:HTHT)

Historical Stock Chart

From Oct 2024 to Nov 2024

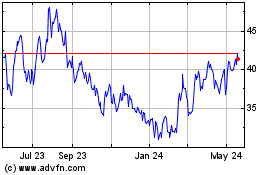

H World (NASDAQ:HTHT)

Historical Stock Chart

From Nov 2023 to Nov 2024