0001818382FALSE00018183822024-02-092024-02-090001818382us-gaap:CommonStockMember2024-02-092024-02-090001818382us-gaap:WarrantMember2024-02-092024-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2024

Humacyte, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39532 | 85-1763759 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification Number) |

| | | | | | | | |

2525 East North Carolina Highway 54 | |

| Durham, | NC | 27713 |

| (Address of principal executive offices) | (Zip code) |

(919) 313-9633

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share | | HUMA | | The Nasdaq Stock Market LLC |

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 | | HUMAW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01. Other Events.

On February 9, 2024, Humacyte, Inc. (the “Company”) issued a press release announcing that the U.S. Food and Drug Administration has accepted and granted Priority Review to the Company’s Biologics License Application seeking approval of the Company’s human acellular vessel in urgent arterial repair following extremity vascular trauma when a synthetic graft is not indicated and when autologous vein use is not feasible. A copy of this press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| HUMACYTE, INC. |

| | |

Date: February 9, 2024 | By: | /s/ Dale A. Sander |

| | Name: | Dale A. Sander |

| | Title: | Chief Financial Officer, Chief Corporate Development Officer and Treasurer |

Human Acellular Vessel™ (HAV™) Biologics License Application Granted Priority Review by U.S. FDA for the Treatment of Vascular Trauma

– BLA submission supported by results from Phase 2/3 clinical trial and outcomes of real-world use of the HAV under a Humanitarian Aid Program to treat wartime trauma injuries in Ukraine –

– The HAV had higher rates of patency, and lower rates of amputation and infection, compared to historic synthetic graft benchmarks –

– PDUFA date set for August 10, 2024 –

DURHAM, N.C., February 9, 2024 – Humacyte, Inc. (Nasdaq: HUMA), a clinical-stage biotechnology platform company developing universally implantable, bioengineered human tissue at commercial scale, today announced that the U.S. Food and Drug Administration (FDA) has accepted and granted Priority Review to Humacyte’s Biologics License Application (BLA) seeking approval of the Human Acellular Vessel (HAV) in urgent arterial repair following extremity vascular trauma when synthetic graft is not indicated, and when autologous vein use is not feasible.

The Prescription Drug User Fee Act (PDUFA) date, the FDA action date for their regulatory decision regarding the BLA, is August 10, 2024. This targeted PDUFA date is based on the Priority Review grant, which is a mechanism reserved by FDA for products that, if approved, would significantly improve the treatment, diagnosis, or prevention of serious conditions. Priority Review applications have a six-month review time instead of ten months for a standard review. The Priority Review aligns with the Regenerative Medicine Advanced Therapy (RMAT) designation granted by the FDA in May 2023 for urgent arterial repair following extremity vascular trauma. The Priority Review is also consistent with the priority designation given by the Secretary of Defense under Public Law 115-92, which was enacted to expedite the FDA’s review of products that are intended to diagnose, treat or prevent serious or life-threatening conditions facing American military personnel.

“We are very pleased that the FDA has accepted our BLA and has recognized the potential importance of the HAV technology by granting us Priority Review,” said Laura Niklason, MD, PhD, Chief Executive Officer of Humacyte. “The BLA acceptance brings us a major step closer to our goal of providing an innovative regenerative medicine product for patients suffering traumatic vascular injury. Many patients with severe injuries are underserved by the current standard of care, and we are proud of the results that have been seen in our clinical trials and real-world humanitarian efforts.”

The BLA submission is supported by positive results from the V005 Phase 2/3 clinical trial, as well as real-world evidence from the treatment of wartime injuries in Ukraine under a Humanitarian Aid Program supported by the FDA. The HAV was observed to have higher rates of patency (blood flow), and lower rates of amputation and infection, as compared to historic synthetic graft benchmarks.

The HAV, a bioengineered tissue, is under investigation as a universally implantable vascular replacement that does not require immune suppression and that resists infection after implantation. Designed to be ready off-the-shelf, the HAV has the potential to save valuable time for surgeons who treat injured patients, and to improve outcomes and reduce complications. The HAV can be produced at commercial scale in Humacyte’s existing manufacturing facilities, which are expected to have the capacity to provide thousands of vessels for treating patients in need. The HAV has accumulated more than 1,200 patient-years of experience worldwide in a series of clinical trials in multiple indications, including vascular trauma repair, arteriovenous access for hemodialysis, and peripheral artery disease.

The HAV is an investigational product and has not been approved for sale by the FDA or any other regulatory agency.

About Humacyte

Humacyte, Inc. (Nasdaq: HUMA) is developing a disruptive biotechnology platform to deliver universally implantable bioengineered human tissues, advanced tissue constructs, and organ systems designed to improve the lives of patients and transform the practice of medicine. The Company develops and manufactures acellular tissues to treat a wide range of diseases, injuries, and chronic conditions. Humacyte’s initial product candidates, a portfolio of HAVs, are currently in late-stage clinical trials targeting multiple vascular applications, including vascular trauma repair, arteriovenous (AV) access for hemodialysis, and peripheral artery disease. Preclinical development is also underway in coronary artery bypass grafts, pediatric heart surgery, treatment of type 1 diabetes, and multiple novel cell and tissue applications. Humacyte’s 6mm HAV for AV access in hemodialysis was the first product candidate to receive the FDA’s RMAT designation and has also received FDA Fast Track designation. Humacyte’s 6mm HAV for urgent arterial repair following extremity vascular trauma also has received an RMAT designation. The HAV received priority designation for the treatment of vascular trauma by the U.S. Secretary of Defense. For more information, visit www.Humacyte.com.

Forward-Looking Statements

This press release contains forward-looking statements that are based on beliefs and assumptions and on information currently available. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties, and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this press release, we caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. Forward-looking statements in this press release include, but are not limited to, statements regarding the expected PDUFA date; the initiation, timing, progress, and results of our preclinical and clinical trials; the anticipated characteristics and performance of our HAVs; our ability to successfully complete, preclinical and clinical trials for our HAVs; the anticipated benefits of our HAVs relative to existing alternatives; the anticipated commercialization of our HAVs and our ability to manufacture at commercial scale; the implementation of our business model and strategic plans for our business; the timing or likelihood of regulatory filings, acceptances and approvals, including the BLA for our V005 clinical trial; timing, scope, and rate of reimbursement for our HAVs; and our estimated available market opportunity. We cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward-looking statements are subject to a number of significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among others, changes in applicable laws or regulations, the possibility that Humacyte may be adversely affected by other economic, business, and/or competitive factors, and other risks and uncertainties, including those described under the header “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, each filed by Humacyte with the SEC, and in future SEC filings. Most of these factors are outside of Humacyte’s control and are difficult to predict. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Except as required by law, we have no current intention of updating any of the forward-looking statements in this press release. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

Humacyte Investor Contact:

Joyce Allaire

LifeSci Advisors LLC

+1-617-435-6602

jallaire@lifesciadvisors.com

investors@humacyte.com

Humacyte Media Contact:

Rich Luchette

Precision Strategies

+1-202-845-3924

rich@precisionstrategies.com

media@humacyte.com

v3.24.0.1

Cover Page

|

Feb. 09, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 09, 2024

|

| Entity Registrant Name |

Humacyte, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39532

|

| Entity Tax Identification Number |

85-1763759

|

| Entity Address, Address Line One |

2525 East North Carolina Highway 54

|

| Entity Address, City or Town |

Durham,

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27713

|

| City Area Code |

919

|

| Local Phone Number |

313-9633

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001818382

|

| Amendment Flag |

false

|

| Common Stock, par value $0.0001 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

HUMA

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

HUMAW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

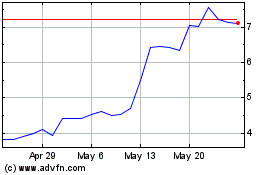

Humacyte (NASDAQ:HUMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Humacyte (NASDAQ:HUMA)

Historical Stock Chart

From Dec 2023 to Dec 2024