UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the Month of September 2024

Commission File Number: 001-38104

IMMURON LIMITED

(Name of Registrant)

Level 3, 62 Lygon Street, Carlton South,

Victoria, 3053, Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ☐ No

☒

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82-

IMMURON LIMITED

EXPLANATORY NOTE

Immuron Limited (the “Company”) published

one announcement (the “Public Notices”) to the Australian Securities Exchange on August 30, 2024 titled:

| - | “Appendix 4E and Preliminary Final Report” |

A copy of the Public Notice is attached as an exhibit to this report

on Form 6-K.

This report on Form 6-K (including the exhibit

hereto) shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be

expressly set forth by specific reference in such filing.

EXHIBITS

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

IMMURON LIMITED |

| |

|

|

| Date: September 9, 2024 |

By: |

/s/ Phillip Hains |

| |

|

Phillip Hains |

| |

|

Company Secretary |

3

Exhibit 99.1

Immuron Limited

Appendix 4E

30 June 2024

Immuron

Limited

Appendix

4E

Preliminary

Final Report

Year

ended 30 June 2024

| Name of entity: |

Immuron Limited |

| ABN: |

80 063 114 045 |

| year ended: |

30 June 2024 |

| Previous period: |

30 June 2023 |

Results for announcement to the market

| | |

| |

| |

$ | |

| Revenue from ordinary activities | |

Up | |

171.7% to | |

| 4,902,865 | |

| Loss from ordinary activities after tax attributable to members | |

Up | |

83.2% to | |

| (6,936,957 | ) |

| Net loss for the period attributable to members | |

Up | |

83.2% to | |

| (6,936,957 | ) |

Distributions

No dividends have been paid or declared by the company

for the current financial year. No dividends were paid for the previous financial year.

Explanation of results

The reported after tax loss of the

current financial year of $6,936,957 (2023: $3,786,507) is after fully expensing the company’s research and development expenditure

of $5,375,461 incurred during the year (2023: $2,592,145). Of which, $2,599,458 (2023: $2,158,936) was funded by the R&D grant from

Medical Technology Enterprise Consortium (MTEC). Research and development expenses increased by $2,783,316 from the financial year 2023

to 2024.

The revenue from contracts with customers

for the year was $4,902,865, which is an increase of 171.7% from the prior financial year (2023: $1,804,705), primarily due to the sales

recovery in the Australian, U.S. and North American markets for Travelan®. We anticipate that revenues from sales of our

Travelan® product will continue to increase in the future.

As at 30 June 2024 the company’s

cash position was $11,657,315 (30 June 2023: $17,159,764). The company had trade and other receivables of $1,387,573 (30 June 2023: $417,420).

This receivables amount includes future receivables from the Australian Government under the R&D Tax Incentive program mentioned above.

The preliminary financial report

follows, with the further details to be included in the audited financial statements to be released by 30 September 2024.

Immuron Limited

Appendix 4E

30 June 2024

(continued)

Net

tangible assets per security

| | |

2024

Cents | | |

2023

Cents | |

| Net tangible asset backing (per security) | |

| 5.51 | | |

| 8.53 | |

Changes in controlled entities

There have been no changes in controlled entities during the

year ended 30 June 2024.

Other information required by Listing Rule 4.2A

| a. | Details of individual and total dividends or distributions and dividend or distribution payments: |

N/A |

| | |

|

| b. | Details of any dividend or distribution reinvestment plans: |

N/A |

| | |

|

| c. | Details of associates and joint venture entities: |

|

| |

| |

Ownership

interest held

by the group | |

| |

Place

of business/ | |

30 June

2024 | | |

30 June

2023 | |

| Name of entity | |

country of incorporation | |

| % | | |

| % | |

| Ateria Health

Limited | |

United Kingdom | |

| 23.6 | | |

| 17.5 | |

As at 30 June 2024, Immuron has a 23.61% interest in Ateria.

Immuron is deemed to have significant influence over Ateria.

Audit

The financial statements are currently in the process of being

audited. The audited financial statements along with the independent auditor report for the year end 30 June 2024 will be provided in

the due course.

Review

of operations and activities

Key highlights

| ● | Record sales of A$4.9 million for FY25 up A$3.1 million

on FY23 |

| ● | Immuron completes IMM-124E Phase 2 clinical trial |

| ● | Immuron completes in-patient phase of CampETEC Phase 2

clinical trial |

| ● | Uniformed Services

University Travelan® clinical field trial reaches 77% recruitment |

| ● | Immuron submits pre-IND for IMM-529 to the U.S. Food and

Drug Administration (FDA) |

| ● | Immuron presents at The Military Health System Research

Symposium (MHSRS) |

| ● | U.S. Department of Defense funds Naval Medical Research

Command and Walter Reed Army Institute of Research development of enhanced formulations of Travelan® |

Financial review

Immuron Limited has reported a

loss for the financial year ended 30 June 2024 of A$6,934,691 (30 June 2023: A$3,787,519). The group’s net assets decreased to A$12,709,444

compared with A$19,616,836 at 30 June 2023, including cash reserves of A$11,657,315 (30 June 2023: A$17,159,764).

Record sales of A$4.9

million for FY24 up A$3.1 million on FY23

Australia: Sales of Travelan®

increased to AUD $3.7 million in FY24, compared to AUD $1.1 million in FY23. Sales increased by $2.6 million (223%).

Consistent with the increase

in June 2024 quarter sales, the Australian Bureau of Statistics reported short term resident returns in April 2024 were 29% higher than

April 20231.

USA: Sales of Travelan®

increased to AUD $1.1 million in FY24, compared to AUD $0.6 million in FY23. Sales increased by $0.4 million (67%).

Immuron’s experience in

the USA follows the International Trade Administration Total U.S. citizen international visitor departures from the United States in

April 2024 being 8% higher than in April 2023.2

| 1. | https://www.abs.gov.au/statistics/industry/tourism-and-transport/overseas-arrivals-and-departures-australia/latest-

release |

| | |

| 2. | https://www.trade.gov/us-international-air-travel-statistics-i-92-data |

Immuron completes IMM-124E Phase 2 clinical trial

The inpatient challenge phase of the Travelan®

clinical study led by Principal Investigator Dr Mohamed Al- Ibrahim at the Pharmaron CPC FDA inspected Clinical Research Facility Inpatient

Unit located in Baltimore, Maryland US, has been completed. The double-blind study was separated into two cohorts of approx. 30 subjects

(60 in total) dosed with Travelan® or placebo for two days prior to challenge and continuing dosing for a total of 7 days. All study

participants were challenged with Escherichia coli, monitored for symptoms, and treated with antibiotics. Safety data at two weeks and

4 weeks post challenge has been collected and the final 6 month follow up interviews were completed. The Phase 2 clinical trial was designed

to evaluate the safety and protective efficacy of Travelan® compared to a placebo in a controlled human infection model (CHIM). The

primary efficacy outcome is prevention and/or reduction of moderate to severe diarrhea. ClinicalTrials.gov Identifier: NCT05933525. Topline

clinical trial results demonstrate a 36.4% protective efficacy with single daily dose of Travelan® against Enterotoxigenic Escherichia

coli (ETEC) induced moderate to severe diarrhea compared to the placebo group (primary endpoint) even though the attack rate for this

study was 37%, much lower than the planned 70%. The attack rates on previous Phase 2 (Otto et al. 2011) were 73% and 86% with protective

efficacy of 90.9% and 76.7%. There was a 43.8% reduction in diarrhea of any severity in the Travelan® group compared to the Placebo

group during the 5-day period post challenge which is approaching statistical significance; p=0.066. The number of cumulative adverse

events per participant in the Travelan® group (58) was statistically significantly lower than the Placebo group (109); p<0.05.

The Phase 2 clinical study data also supports the excellent safety and tolerability profile of Travelan®. Immuron will now proceed

to hold an end of Phase 2 meeting with the U.S Food and Drug Administration to discuss the pivotal Phase 3 registration strategy and planned

clinical trials including recommended dosing to support a Biologics License Application (BLA) for Travelan® as a prophylactic medicine

for Travelers’ Diarrhea.

Immuron completes in-patient phase

of CampETEC Phase 2 clinical trial

The NMRC has recently completed

the in-patient stage of the campylobacter challenge clinical study. The clinical study was led by Principal Investigator Dr Kawsar Talaat,

MD at the Johns Hopkins University (JHU) Center for Immunization Research (CIR) Inpatient Unit, located at the JHU Bayview Medical Campus,

Baltimore, Maryland. U.S. A total of 30 participants were enrolled in the study, of which 27 participants were dosed with either the Investigational

Medical Product or placebo and all subjects were challenged with Campylobacter. All study volunteers were treated with antibiotics and

discharged from the clinic. The study participants returned as outpatients for several follow-up visits, with the last patient last visit

completed in June 2024. Headline results from the clinical trial are anticipated to be reported in late August 2024/early September 2024.

The Phase 2 clinical trial was designed to evaluate the safety and protective efficacy of the new product manufactured by Immuron compared

to a placebo in a controlled human infection model (CHIM). The primary efficacy outcome is prevention and/or reduction of moderate to

severe diarrhea. ClinicalTrials.gov Identifier: NCT06122870.

Uniformed Services University

Travelan® clinical field trial reaches 77% recruitment

USU’s Infectious Diseases

Clinical Research Program (IDCRP) and the UK Ministry of Defense are jointly conducting the randomized clinical trial to evaluate the

efficacy of Travelan® in Travelers’ Diarrhea. The P2TD study is a randomized, double-blind,

placebo controlled multicenter clinical trial designed to evaluate the effectiveness of IMM-124E (Travelan®)

passive immunoprophylaxis verses a placebo, during deployment or travel to a high-TD risk region (ClinicalTrials.gov Identifier: NCT04605783).

All study participants (866 in total) will be randomized to Travelan® or placebo (433 per arm).

The Problem: Travelers’

diarrhea (TD) remains a highly prevalent disease that impacts operational readiness of military personnel and is also debilitating to

civilians traveling to high-risk destinations. In addition to its acute morbidity, TD is associated with acquisition of antimicrobial

resistance genes and long-term sequelae. Current mitigation strategies including pre-travel counseling and antibiotics for prevention

and treatment which have important limitations, and there are currently no licensed, pathogen-specific vaccines for TD prevention.

The Approach: Passive immunotherapy

may offer safe and relatively inexpensive preventive strategies by promoting gut resistance to enteropathogens, and potentially lessening

the use of antibiotics. USU’s Infectious Diseases Clinical Research Program (IDCRP) and the UK Ministry of Defense are jointly conducting

the trial to evaluate the efficacy of Travelan® for TD prevention and inform strategies for Force Health Protection.

More than 77% of the target 866 study participants have

been recruited. Topline results are anticipated in 1Q 2025.

Immuron submits pre-IND for IMM-529 to the U.S. Food

and Drug Administration (FDA)

Immuron filed a pre-IND (investigational

new drug) application with the United States Food and Drug Administration (FDA) for IMM-529 on 1 July 2024. The company is planning to

submit a new IND to initiate the clinical development of IMM-529 for the treatment of CDI and prevention of recurrence of CDI. IMM-529

is the second therapeutic drug candidate the company has taken into the clinic and has been specifically developed to target (i) toxin

B, (ii) spores and (iii) vegetative cells of Clostridioides Difficile (C. Diff) which are thought to be the primary cause of C. Diff disease

recurrences. A research services agreement was executed with Monash University to assist with vaccine manufacture and stability testing

of the Investigational Medical Product to support the pre-IND information package. A research services agreement was executed with VivoPharm

Global Preclinical Services to conduct a GLP compliant toxicity study in rodents. The study protocol was submitted and approved by the

Animal Ethics Committee and the study has been completed with no adverse findings reported.

Presentation at The Military Health System Research

Symposium (MHSRS)

The MHSRS is the U.S. Department

of Defense’s premier scientific meeting that focuses specifically on the unique medical needs of the Warfighter. This annual symposium

brings together 3,000 healthcare professionals, researchers, U.S DoD leaders and decision markers as well as various funding bodies. The

company attended the meeting as an Exhibitor and presented two posters at the event. One entitled ‘Clinical Evaluation of an Oral

prophylactic for prevention of Travelers diarrhea in active-duty military assigned abroad.’ The company was also invited by the

Medical Technology Enterprise Consortium (MTEC) to showcase Immuron and its collaborative work with the U.S. Department of Defense including

an overview of the current MTEC award entitled ‘Biologics license application of a bovine immunoglobulin supplement that prevents

travelers’ diarrhea caused by enterotoxigenic Escherichia coli (ETEC).’ The Naval Medical Research Command (NMRC) also presented

a poster at the symposium on the new oral therapeutic targeting Campylobacter and Enterotoxigenic Escherichia coli (ETEC) developed in

collaboration with Immuron. The NMRC poster is entitled ‘Research and Development of Hyperimmune Bovine Colostrum Products for the

Prevention of Travelers’ Diarrhea.’ Copies of the presentations are available on the Company’s website. https://www.immuron.com.au/product-science/

U.S. Department of Defense funds Naval Medical

Research Command and Walter Reed Army Institute of Research development of enhanced formulations of Travelan®

The U.S. Department of Defense

has funded a new program for the Naval Medical Research Command and Walter Reed Army Institute of Research to develop enhanced formulations

of Travelan® potentially expanding the coverage of the product as a therapeutic against endemic military relevant diarrheal pathogens.

This work will utilize the extensive experience of the U.S. Department of Defense human infectious disease vaccine programs and will target

key protective antigens of the major enteric bacterial pathogens Campylobacter, Shigella and Enterotoxigenic E. coli strains not present

in the current product formulation. Immuron will negotiate a sub award for this new collaboration with NMRC and WRAIR to advance this

research.

Immuron Limited

Consolidated statement of profit or loss and other comprehensive income

For the year ended 30 June 2024

| | |

Notes | |

2024 $ | | |

2023

$ | |

| Revenue from contracts with customers | |

1 | |

| 4,902,865 | | |

| 1,804,705 | |

| Cost of goods sold | |

| |

| (1,566,068 | ) | |

| (495,558 | ) |

| Gross profit | |

| |

| 3,336,797 | | |

| 1,309,147 | |

| | |

| |

| | | |

| | |

| Other income | |

2(a) | |

| 3,408,199 | | |

| 2,591,498 | |

| Fair value gains/(losses) to financial assets | |

3(c) | |

| (557,676 | ) | |

| (523,666 | ) |

| Net foreign exchange gains/(losses) | |

| |

| (27,603 | ) | |

| 363,724 | |

| Movement in inventory provision | |

| |

| - | | |

| 430,932 | |

| | |

| |

| | | |

| | |

| General and administrative expenses | |

2(b) | |

| (4,555,726 | ) | |

| (4,220,905 | ) |

| Research and development expenses | |

2(b) | |

| (5,375,461 | ) | |

| (2,592,145 | ) |

| Selling and marketing expenses | |

2(b) | |

| (2,029,648 | ) | |

| (927,423 | ) |

| Operating loss | |

| |

| (5,801,118 | ) | |

| (3,568,838 | ) |

| |

Finance income | |

| |

| 327,756 | | |

| 116,323 | |

| Finance expenses | |

| |

| (7,576 | ) | |

| (9,652 | ) |

| Finance costs - net | |

| |

| 320,180 | | |

| 106,671 | |

| | |

| |

| | | |

| | |

| Share of loss from associates | |

5(b) | |

| (1,456,019 | ) | |

| (324,340 | ) |

| Loss before income tax | |

| |

| (6,936,957 | ) | |

| (3,786,507 | ) |

| | |

| |

| | | |

| | |

| Income tax expense | |

| |

| - | | |

| - | |

| Loss for the year | |

| |

| (6,936,957 | ) | |

| (3,786,507 | ) |

| | |

| |

| | | |

| | |

| Other comprehensive income | |

| |

| | | |

| | |

| Items that may be reclassified to profit or loss: | |

| |

| | | |

| | |

| Exchange differences on translation of foreign operations | |

4(b) | |

| 2,266 | | |

| (1,012 | ) |

| Total comprehensive loss for the year | |

| |

| (6,934,691 | ) | |

| (3,787,519 | ) |

| | |

Cents | | |

Cents | |

| Loss per share for loss attributable to the ordinary equity holders of the company: | |

| | |

| |

| Basic and diluted loss per share | |

| (3.04 | ) | |

| (1.66 | ) |

The above consolidated statement of profit or loss

and other comprehensive income should be read in conjunction with the accompanying notes.

Immuron Limited

Consolidated balance sheet

As at 30 June 2024

| | |

Notes | |

2024 $ | | |

2023

$ | |

| ASSETS | |

| |

| | |

| |

| Current assets | |

| |

| | |

| |

| Cash and cash equivalents | |

3(a) | |

| 11,657,315 | | |

| 17,159,764 | |

| Trade and other receivables | |

3(b) | |

| 1,387,573 | | |

| 417,420 | |

| Inventories | |

| |

| 1,584,608 | | |

| 839,968 | |

| Financial assets | |

3(c) | |

| - | | |

| 1,834,034 | |

| Other current assets | |

| |

| 96,841 | | |

| 158,151 | |

| Total current assets | |

| |

| 14,726,337 | | |

| 20,409,337 | |

| | |

| |

| | | |

| | |

Investments accounted

for using the equity method | |

5(b) | |

| - | | |

| 159,066 | |

| Property, plant and equipment | |

| |

| 154,347 | | |

| 200,133 | |

| Inventories | |

| |

| 669,285 | | |

| 1,219,646 | |

| Total non-current assets | |

| |

| 823,632 | | |

| 1,578,845 | |

| | |

| |

| | | |

| | |

Total

assets | |

| |

| 15,549,969 | | |

| 21,988,182 | |

| | |

| |

| | | |

| | |

LIABILITIES | |

| |

| | | |

| | |

| Current liabilities | |

| |

| | | |

| | |

| Trade and other payables | |

| |

| 2,135,852 | | |

| 1,192,769 | |

| Employee benefit obligations | |

| |

| 522,571 | | |

| 289,408 | |

| Other current liabilities | |

| |

| 40,556 | | |

| 38,767 | |

| Deferred income | |

3(d) | |

| - | | |

| 698,195 | |

| Total current liabilities | |

| |

| 2,698,979 | | |

| 2,219,139 | |

| | |

| |

| | | |

| | |

| Non-current liabilities | |

| |

| | | |

| | |

| Employee benefit obligations | |

| |

| 8,605 | | |

| 1,882 | |

| Other non-current liabilities | |

| |

| 132,941 | | |

| 150,325 | |

| Total non-current liabilities | |

| |

| 141,546 | | |

| 152,207 | |

| | |

| |

| | | |

| | |

Total

liabilities | |

| |

| 2,840,525 | | |

| 2,371,346 | |

| | |

| |

| | | |

| | |

Net

assets | |

| |

| 12,709,444 | | |

| 19,616,836 | |

| | |

| |

| | | |

| | |

| EQUITY | |

| |

| | | |

| | |

Share

capital | |

4(a) | |

| 88,504,043 | | |

| 88,436,263 | |

| Other reserves | |

4(b) | |

| 3,173,797 | | |

| 3,235,969 | |

| Accumulated losses | |

| |

| (78,968,396 | ) | |

| (72,055,396 | ) |

| | |

| |

| | | |

| | |

Total

equity | |

| |

| 12,709,444 | | |

| 19,616,836 | |

The above consolidated balance sheet should be read in conjunction

with the accompanying notes.

Immuron Limited

Consolidated statement of changes in equity

For the year ended 30 June 2024

| | |

| |

Attributable to owners of Immuron Limited | | |

| |

| | |

Notes | |

Share capital $ | | |

Other reserves $ | | |

Accumulated

losses $ | | |

Total

equity $ | |

| Balance at 1 July 2023 | |

| |

| 88,436,263 | | |

| 3,235,969 | | |

| (72,055,396 | ) | |

| 19,616,836 | |

| | |

| |

| | | |

| | | |

| | | |

| | |

Loss for the year | |

| |

| - | | |

| - | | |

| (6,936,957 | ) | |

| (6,936,957 | ) |

| Other comprehensive income | |

| |

| - | | |

| 2,266 | | |

| - | | |

| 2,266 | |

| Total comprehensive income/(loss) for the year | |

| |

| - | | |

| 2,266 | | |

| (6,936,957 | ) | |

| (6,934,691 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Transactions with owners in their

capacity as owners: | |

| |

| | | |

| | | |

| | | |

| | |

| Unlisted options vested in the period | |

| |

| - | | |

| 15,231 | | |

| - | | |

| 15,231 | |

| Options and warrants issued/expensed (net of adjustments) | |

4(b) | |

| - | | |

| (11,932 | ) | |

| - | | |

| (11,932 | ) |

| Options and warrants exercised | |

4(b) | |

| 67,780 | | |

| (43,780 | ) | |

| - | | |

| 24,000 | |

| Options and warrants forfeited | |

| |

| - | | |

| (23,957 | ) | |

| 23,957 | | |

| - | |

| | |

| |

| 67,780 | | |

| (64,438 | ) | |

| 23,957 | | |

| 27,299 | |

| | |

| |

| | | |

| | | |

| | | |

| | |

Balance at 30 June

2024 | |

| |

| 88,504,043 | | |

| 3,173,797 | | |

| (78,968,396 | ) | |

| 12,709,444 | |

| | |

Attributable to owners of Immuron Limited | | |

| |

| | |

Share capital $ | | |

Other reserves $ | | |

Accumulated

losses $ | | |

Total

equity $ | |

| Balance at 1 July 2022 | |

| 88,436,263 | | |

| 3,166,419 | | |

| (68,425,281 | ) | |

| 23,177,401 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss for the year | |

| - | | |

| - | | |

| (3,786,507 | ) | |

| (3,786,507 | ) |

| Other comprehensive loss | |

| - | | |

| (1,012 | ) | |

| - | | |

| (1,012 | ) |

| Total comprehensive loss for the year | |

| - | | |

| (1,012 | ) | |

| (3,786,507 | ) | |

| (3,787,519 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Transactions with owners in their capacity as owners: | |

| | | |

| | | |

| | | |

| | |

| Options and warrants issued/expensed (net of adjustments) | |

| - | | |

| 104,753 | | |

| - | | |

| 104,753 | |

| Options and warrants lapsed/expired | |

| - | | |

| (156,392 | ) | |

| 156,392 | | |

| - | |

| Performance rights issued/expensed | |

| - | | |

| 122,201 | | |

| - | | |

| 122,201 | |

| | |

| - | | |

| 70,562 | | |

| 156,392 | | |

| 226,954 | |

| | |

| | | |

| | | |

| | | |

| | |

| Balance at 30 June 2023 | |

| 88,436,263 | | |

| 3,235,969 | | |

| (72,055,396 | ) | |

| 19,616,836 | |

The above consolidated statement of changes in equity should

be read in conjunction with the accompanying notes.

Immuron Limited

Consolidated

statement of cash flows

For the year ended 30 June 2024

| | |

Notes | |

2024 $ | | |

2023

$ | |

| Cash flows from operating activities | |

| |

| | |

| |

| Receipts from customers | |

| |

| 4,734,350 | | |

| 1,912,689 | |

| Payments to suppliers and employees | |

| |

| (12,910,753 | ) | |

| (7,842,052 | ) |

| Australian R&D tax incentive refund | |

| |

| 395,001 | | |

| 251,986 | |

| Grants received from government and non-government sources | |

| |

| 1,901,263 | | |

| 3,082,182 | |

| Net cash (outflow) from operating activities | |

| |

| (5,880,139 | ) | |

| (2,595,195 | ) |

| | |

| |

| | | |

| | |

| Cash flows from investing activities | |

| |

| | | |

| | |

| Payments for property, plant and equipment | |

| |

| (195 | ) | |

| (7,739 | ) |

| Payment for acquisition of associate | |

| |

| - | | |

| (2,729,863 | ) |

| Interest received | |

| |

| 327,756 | | |

| 116,323 | |

| Net cash inflow (outflow) from investing activities | |

| |

| 327,561 | | |

| (2,621,279 | ) |

| | |

| |

| | | |

| | |

| Cash flows from financing activities | |

| |

| | | |

| | |

Proceeds from issues of shares | |

| |

| 24,000 | | |

| - | |

| Principal elements of lease payments | |

| |

| (15,595 | ) | |

| (35,015 | ) |

| Interest and other costs of finance paid | |

| |

| (7,576 | ) | |

| (9,652 | ) |

| Net cash inflow (outflow) from financing activities | |

| |

| 829 | | |

| (44,667 | ) |

| | |

| |

| | | |

| | |

| Net (decrease) in cash and cash equivalents | |

| |

| (5,551,749 | ) | |

| (5,261,141 | ) |

| Cash and cash equivalents at the beginning of the financial year | |

| |

| 17,159,764 | | |

| 22,110,278 | |

| Effects of exchange rate changes on cash and cash equivalents | |

| |

| 49,300 | | |

| 310,627 | |

| Cash and cash equivalents at end of year | |

3(a) | |

| 11,657,315 | | |

| 17,159,764 | |

The above consolidated statement of cash flows should be

read in conjunction with the accompanying notes.

Immuron Limited

Notes

to the financial statements

30 June 2024

| 1 | Revenue from contract with customers |

| (a) | Disaggregation of revenue from contracts with customers |

The group derives revenue from the transfer of hyperimmune

products at a point in time in the following major product lines and geographical regions:

| | |

| | |

Travelan

United | | |

| | |

Protectyn | | |

| |

| 2024 | |

Australia

$ | | |

States

$ | | |

Canada

$ | | |

Australia

$ | | |

Total

$ | |

| | |

| | |

| | |

| | |

| | |

| |

| Hyperimmune products revenue | |

| 3,702,876 | | |

| 1,075,614 | | |

| 80,888 | | |

| 43,487 | | |

| 4,902,865 | |

| Revenue from external customers | |

| 3,702,876 | | |

| 1,075,614 | | |

| 80,888 | | |

| 43,487 | | |

| 4,902,865 | |

| | |

| | |

Travelan

United | | |

| | |

Protectyn | | |

| |

| 2023 | |

Australia

$ | | |

States

$ | | |

Canada

$ | | |

Australia

$ | | |

Total

$ | |

| |

| | |

| | |

| | |

| | |

| |

| Hyperimmune products revenue | |

| 1,100,725 | | |

| 642,819 | | |

| 1,201 | | |

| 59,960 | | |

| 1,804,705 | |

| Revenue from external customers | |

| 1,100,725 | | |

| 642,819 | | |

| 1,201 | | |

| 59,960 | | |

| 1,804,705 | |

| 2 | Other income and expense items |

| | |

2024

$ | | |

2023

$ | |

| | |

| | |

| |

| Australian R&D tax incentive refund | |

| 764,981 | | |

| 392,877 | |

| MTEC R&D grant | |

| 2,599,458 | | |

| 2,158,936 | |

| Other income | |

| 15,760 | | |

| 11,685 | |

| EMDG grant | |

| 28,000 | | |

| 28,000 | |

| | |

| 3,408,199 | | |

| 2,591,498 | |

| (i) | Fair value of R&D tax incentive |

The group’s research and development (R&D) activities

are eligible under an Australian government tax incentive for eligible expenditure. Management has assessed these activities and expenditure

to determine which are likely to be eligible under the incentive scheme. Amounts are recognised when it has been established that the

conditions of the tax incentive have been met and that the expected amount can be reliably measured. For the year ended 30 June 2024,

the group has included an item in other income of $764,981 (2023: $392,877).

Immuron Limited

Notes to the

financial statements

30 June 2024

(continued)

| 2 | Other income and expense items (continued) |

| (b) | Breakdown of expenses by

nature |

| |

2024 $ | | |

2023

$ | |

| General and administrative expenses | |

| | |

| |

| Accounting and audit | |

| 576,540 | | |

| 657,970 | |

| Bad debts | |

| - | | |

| 2,376 | |

| Consulting | |

| 120,851 | | |

| 23,241 | |

| Depreciation | |

| 45,981 | | |

| 48,662 | |

| Employee benefits | |

| 2,353,625 | | |

| 1,874,963 | |

| Expected credit losses gain/(expense) | |

| (11,687 | ) | |

| 19,111 | |

| Insurance | |

| 321,679 | | |

| 434,699 | |

| Investor relations | |

| 206,300 | | |

| 194,754 | |

| Legal | |

| 195,971 | | |

| 233,243 | |

| Listing and share registry | |

| 163,949 | | |

| 152,954 | |

| Occupancy | |

| 24,122 | | |

| - | |

| Share-based payments expense | |

| 3,299 | | |

| 226,954 | |

| Superannuation | |

| 180,092 | | |

| 141,539 | |

| Travel and entertainment | |

| 196,369 | | |

| 105,535 | |

| Other | |

| 178,635 | | |

| 104,904 | |

| | |

| 4,555,726 | | |

| 4,220,905 | |

| | |

| | | |

| | |

| Research and development expenses | |

| | | |

| | |

| Consulting | |

| 277,128 | | |

| 111,530 | |

| Project research and development | |

| 5,098,333 | | |

| 2,480,615 | |

| | |

| 5,375,461 | | |

| 2,592,145 | |

| | |

| | | |

| | |

| Selling and marketing expenses | |

| | | |

| | |

| Selling | |

| 379,406 | | |

| 192,878 | |

| Marketing | |

| 1,310,979 | | |

| 474,926 | |

| Distribution costs | |

| 339,263 | | |

| 259,619 | |

| | |

| 2,029,648 | | |

| 927,423 | |

| 3 | Financial assets and financial liabilities |

| (a) | Cash and cash equivalents |

| |

2024 $ | | |

2023

$ | |

| Current assets | |

| | |

| |

| Cash at bank and in hand | |

| 11,657,315 | | |

| 17,159,764 | |

| (i) | Classification as cash equivalents |

Term deposits are presented as cash equivalents if

they have a maturity of three months or less from the date of acquisition and are repayable with 24 hours notice with no loss of interest.

Immuron Limited

Notes to the financial statements

30 June 2024

(continued)

| 3 | Financial assets and financial liabilities (continued) |

| (b) | Trade and other receivables |

| | |

| |

Current | | |

2024

Non-

current | | |

Total | | |

Current | | |

2023

Non-

current | | |

Total | |

| | |

Notes | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Trade receivables | |

| |

| 607,436 | | |

| - | | |

| 607,436 | | |

| 46,949 | | |

| - | | |

| 46,949 | |

| Loss allowance | |

| |

| (16,233 | ) | |

| - | | |

| (16,233 | ) | |

| (27,920 | ) | |

| - | | |

| (27,920 | ) |

| | |

| |

| 591,203 | | |

| - | | |

| 591,203 | | |

| 19,029 | | |

| - | | |

| 19,029 | |

| Accrued

income - Australian R&D tax incentive refund | |

| |

| 768,370 | | |

| - | | |

| 768,370 | | |

| 398,391 | | |

| - | | |

| 398,391 | |

| Other income receivables - R&D grants | |

| |

| 28,000 | | |

| - | | |

| 28,000 | | |

| - | | |

| - | | |

| - | |

| | |

| |

| 796,370 | | |

| - | | |

| 796,370 | | |

| 398,391 | | |

| - | | |

| 398,391 | |

| Total

trade and other receivables | |

| |

| 1,387,573 | | |

| - | | |

| 1,387,573 | | |

| 417,420 | | |

| - | | |

| 417,420 | |

| (i) | Classification as trade

receivables |

Trade receivables are amounts due from customers for goods

sold or services performed in the ordinary course of business. They are generally due for settlement within 30 days and therefore are

all classified as current. Trade receivables are recognised initially at the amount of consideration that is unconditional unless they

contain significant financing components, when they are recognised at fair value. The group holds the trade receivables with the objective

to collect the contractual cash flows and therefore measures them subsequently at amortised cost using the effective interest method.

These amounts primarily comprise receivables from the

Australian Taxation Office in relation to the R&D tax incentive.

| (iii) | Fair value of trade and other receivables |

Due to the short-term nature of the current receivables,

their carrying amount is considered to be the same as their fair value.

Immuron Limited

Notes to the financial statements

30 June 2024

(continued)

| 3 | Financial assets and financial liabilities (continued) |

The group classifies the following as financial assets

recognised at fair value through profit or loss (FVPL) as part of Immuron’s strategic investment in Ateria:

| ● | Immuron was entitled to 735,000 share options with a total exercise

price of £1,470,000 that expired on 31 July 2023. Immuron elected not to exercise 735,000 share options during the period ending

30 June 2024. |

| ● | Immuron received to 471,306 shares as Ateria consideration based

on performance targets. |

Financial assets mandatorily measured at FVPL include the following:

| | |

2024 | | |

2023 | |

| | |

$ | | |

$ | |

| | |

| | |

| |

| Current assets | |

| - | | |

| 221,620 | |

| Ateria share options | |

| - | | |

| 1,612,414 | |

| Ateria contingent shares | |

| - | | |

| 1,834,034 | |

| (i) | Amounts recognised in profit or loss |

During the year, the following losses were recognised

in profit or loss:

| | |

2024 | | |

2023 | |

| | |

$ | | |

$ | |

| | |

| | |

| |

| Fair value gains/(losses) to financial assets | |

| (557,676 | ) | |

| (523,666 | ) |

| |

| |

Ateria share

options | | |

Ateria

contingent

shares | | |

Total | |

| Reconciliation | |

Note | |

$ | | |

$ | | |

$ | |

| Balance at 1 July 2023 | |

| |

| 221,620 | | |

| 1,612,414 | | |

| 1,834,034 | |

| Fair value gains/(losses) to financial assets | |

| |

| (221,620 | ) | |

| (336,056 | ) | |

| (557,676 | ) |

| Net foreign exchange gains | |

| |

| - | | |

| 20,595 | | |

| 20,595 | |

| Fair value at 22 February 2024 | |

| |

| - | | |

| 1,296,953 | | |

| 1,296,953 | |

| Share of the loss in Ateria for the period | |

| |

| - | | |

| (101,603 | ) | |

| (101,603 | ) |

| Issue of Ateria contingent shares | |

5(b)(i) | |

| | | |

| (1,195,350 | ) | |

| (1,195,350 | ) |

| Balance at 30 June 2024 | |

| |

| - | | |

| - | | |

| - | |

On 22 February 2024, Immuron received 471,306 shares in

Ateria Health upon satisfying performance milestones.

Immuron Limited

Notes to the financial statements

30 June 2024

(continued)

| 3 | Financial assets and financial liabilities (continued) |

| | |

2024 | | |

2023 | |

| | |

$ | | |

$ | |

| | |

| | |

| |

| Current liabilities | |

| | |

| |

| Other deferred income | |

| - | | |

| 698,195 | |

| | |

| |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Notes | |

Shares | | |

Shares | | |

$ | | |

$ | |

| | |

| |

| | |

| | |

| | |

| |

| Ordinary shares | |

4(a)(i) | |

| 227,998,346 | | |

| 227,798,346 | | |

| 88,504,043 | | |

| 88,436,263 | |

| Fully paid | |

| |

| 227,998,346 | | |

| 227,798,346 | | |

| 88,504,043 | | |

| 88,436,263 | |

| (i) | Movements in ordinary

shares: |

| Details | |

Number of

shares | | |

Total

$ | |

| | |

| | |

| |

| Balance at 1 July 2022 | |

| 227,798,346 | | |

| 88,436,263 | |

| | |

| | | |

| | |

| Less: Transaction costs arising on share issues | |

| - | | |

| - | |

| | |

| | | |

| | |

| Balance at 30 June 2023 | |

| 227,798,346 | | |

| 88,436,263 | |

| | |

| | | |

| | |

| Issue at $0.12 on exercise of unlisted options (2024-03-12) | |

| 200,000 | | |

| 67,780 | |

| Less: Transaction costs arising on share issues | |

| - | | |

| - | |

| | |

| | | |

| | |

| Balance at 30 June 2024 | |

| 227,998,346 | | |

| 88,504,043 | |

Immuron Limited

Notes to the financial statements

30 June 2024

(continued)

| (a) | Share capital (continued) |

Ordinary shares entitle the holder to participate in dividends,

and to share in the proceeds of winding up the company in proportion to the number of and amounts paid on the shares held.

On a show of hands every holder of ordinary shares present

at a meeting in person or by proxy, is entitled to one vote, and upon a poll each share is entitled to one vote.

Ordinary shares have no par value and the company does not

have a limited amount of authorised capital.

The following table shows a breakdown of the consolidated

balance sheet line item ‘other reserves’ and the movements in these reserves during the year. A description of the nature

and purpose of each reserve is provided below the table.

| | |

| |

Share-based

payments | | |

Foreign

currency

translation | | |

Total other

reserves | |

| | |

Notes | |

$ | | |

$ | | |

$ | |

| At 1 July 2022 | |

| |

| 3,053,197 | | |

| 113,222 | | |

| 3,166,419 | |

| Currency translation differences | |

| |

| - | | |

| (1,012 | ) | |

| (1,012 | ) |

| Other comprehensive income | |

| |

| - | | |

| (1,012 | ) | |

| (1,012 | ) |

| Transactions with owners in

their capacity as owners | |

| |

| | | |

| | | |

| | |

| Options and warrants vested | |

4 (b)(ii) | |

| 122,201 | | |

| - | | |

| 122,201 | |

| Options and warrants issued/expensed | |

4 (b)(ii) | |

| 104,753 | | |

| - | | |

| 104,753 | |

| Options and warrants lapsed/expired | |

4 (b)(ii) | |

| (156,392 | ) | |

| - | | |

| (156,392 | ) |

| At 30 June 2023 | |

| |

| 3,123,759 | | |

| 112,210 | | |

| 3,235,969 | |

| | |

| |

| Share-based

payments | | |

| Foreign

currency

translation | | |

| Total other

reserves | |

| | |

Notes | |

| $ | | |

| $ | | |

| $ | |

| At 1 July 2023 | |

| |

| 3,123,759 | | |

| 112,210 | | |

| 3,235,969 | |

| Currency translation differences | |

| |

| - | | |

| 2,266 | | |

| 2,266 | |

| Other comprehensive income | |

| |

| - | | |

| 2,266 | | |

| 2,266 | |

| Transactions with owners in their capacity as owners | |

| |

| | | |

| | | |

| | |

| Options issued in the period (net of adjustments) | |

4 (b)(ii) | |

| (11,932 | ) | |

| - | | |

| (11,932 | ) |

| Options and warrants exercised | |

4 (b)(ii) | |

| (43,780 | ) | |

| - | | |

| (43,780 | ) |

| Options and warrants lapsed/expired | |

4 (b)(ii) | |

| (23,957 | ) | |

| - | | |

| (23,957 | ) |

| Options and warrants vested | |

| |

| 15,231 | | |

| - | | |

| 15,231 | |

| At 30 June 2024 | |

| |

| 3,059,321 | | |

| 114,476 | | |

| 3,173,797 | |

Immuron Limited

Notes to the financial statements

30 June 2024

(continued)

| (b) | Other reserves (continued) |

| (i) | Nature and purpose of other reserves |

Share-based payments

The share-based payment reserve records items recognised as

expenses on valuation of share options and warrants issued to key management personnel, other employees and and eligible contractors.

Foreign currency translation

Exchange differences arising on translation of foreign

controlled entities are recognised in other comprehensive income as described in note and accumulated in a separate reserve within equity.

The cumulative amount is reclassified to profit or loss when the net investment is disposed of.

| (ii) | Movements in options, warrants and performance rights: |

| Details | |

Number of

options or

performance

rights | | |

Total

$ | |

| Balance at 1 July 2022 | |

| 19,873,877 | | |

| 3,053,197 | |

| Share-based payments expenses - options | |

| 1,430,000 | | |

| 104,753 | |

| Lapse of unexercised options | |

| (8,424,157 | ) | |

| (156,392 | ) |

| Performance rights issued/expensed (i) | |

| - | | |

| 122,201 | |

| Balance at 30 June 2023 | |

| 12,879,720 | | |

| 3,123,759 | |

| Options issued in the period (net of adjustments) | |

| 1,000,000 | | |

| (11,932 | ) |

| Exercise of unlisted options at $0.12 (2024-03-12) | |

| (200,000 | ) | |

| (43,780 | ) |

| Lapse of unexercised options | |

| (173,600 | ) | |

| (23,957 | ) |

| Expense for share-based payments for options previously issued | |

| - | | |

| 15,231 | |

| Performance rights issued (i) | |

| 1,688,839 | | |

| - | |

| Balance at 30 June 2024 | |

| 15,194,959 | | |

| 3,059,321 | |

| (i) | During the fiscal year 2023, performance rights with a total

value of $122,201 were granted to key management personnel and staff as part of their performance bonus and the expense was recognised

during this period. On 12 July 2023, the Company issued the corresponding 1,688,839 performance rights during the fiscal year 2024. |

Immuron Limited

Notes to the

financial statements

30 June 2024

(continued)

| 5 | Interests in other entities |

| (a) | Principal subsidiaries |

The group’s principal subsidiaries at 30 June 2024

are set out below. Unless otherwise stated, they have share capital consisting solely of ordinary shares that are held directly by the

group, and the proportion of ownership interests held equals the voting rights held by the group. The country of incorporation or registration

is also their principal place of business.

| |

| |

Ownership interest held

by the group | |

| | |

Place of business/ | |

2024 | | |

2023 | |

| Name of entity | |

country of incorporation | |

% | | |

% | |

| Immuron Inc. | |

United States | |

| 100 | | |

| 100 | |

| Immuron Canada Limited | |

Canada | |

| 100 | | |

| 100 | |

| Anadis ESP Pty Ltd | |

Australia | |

| 100 | | |

| 100 | |

| (b) | Interests in associates |

| |

| |

Ownership interest held

by the group | |

| | |

Place of business/ | |

2024 | | |

2023 | |

| Name of entity | |

country of incorporation | |

% | | |

% | |

| Ateria Health Limited | |

United Kingdom | |

| 24 | | |

| 18 | |

| (i) | Summarised financial information for associates |

| | |

30 June | | |

30 June | |

| | |

2024 | | |

2023 | |

| The group’s share of loss for the period | |

| (1,456,019 | ) | |

| (324,340 | ) |

| | |

| |

30 June | | |

30 June | |

| |

Note | |

2024 | | |

2023 | |

| Recognised in: | |

| |

| | |

| |

| Share of loss for the period - 23.6% (2023: 17.5%) | |

| |

| (291,711 | ) | |

| (324,340 | ) |

| Impairment of investment in associate | |

3(c)(i) | |

| (1,164,308 | ) | |

| | |

| | |

| |

| (1,456,019 | ) | |

| (324,340 | ) |

| | |

2024 | | |

2023 | |

| Reconciliation of the consolidated entity’s carrying amount | |

$ | | |

$ | |

| Opening carrying amount | |

| 159,066 | | |

| - | |

| Investment in Ateria Health Limited | |

| - | | |

| 404,117 | |

| Acquisition of shares (Note 3(c) (i)) | |

| 1,195,350 | | |

| 79,289 | |

| Share of loss in Ateria for the period | |

| (190,108 | ) | |

| (324,340 | ) |

| Impairment of investment in Ateria | |

| (1,164,308 | ) | |

| - | |

| | |

| - | | |

| 159,066 | |

Immuron Limited

Notes to the financial statements

30 June 2024

(continued)

| 6 | Events occurring after the reporting period |

On 3 July 2024, the Company lodged the SEC Form F-3 registration

statement and secured the At-the-Market (ATM) funding facility with H.C. Wainwright & Co., LLC. with access of up to approximately

US$2m of funding.

No other matter or circumstance has occurred subsequent

to year end that has significantly affected, or may significantly affect, the operations of the group, the results of those operations

or the state of affairs of the group or economic entity in subsequent financial years.

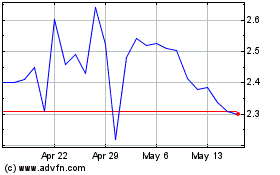

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Feb 2024 to Feb 2025