KALA BIO Announces $12,500,000 Private Placement

June 27 2024 - 7:00AM

KALA BIO, Inc. (NASDAQ:KALA), a clinical-stage biopharmaceutical

company dedicated to the research, development and

commercialization of innovative therapies for rare and severe

diseases of the eye, today announced that it has entered into a

securities purchase agreement with a select group of institutional

accredited investors for the sale, in a private placement, of

shares of its common stock and shares of its Series H Convertible

Non-Redeemable Preferred Stock (the “Series H Preferred Stock”),

for aggregate gross proceeds of approximately $12.5 million, before

deducting offering expenses.

The private placement was led by SR One with

participation from ADAR1 Capital Management and another life

sciences-focused investor.

In the private placement, KALA has agreed to sell

1,197,314 shares of its common stock at a price of $5.85 per share

and 9,393 shares of its Series H Preferred Stock at a price of

$585.00 per share. The private placement is expected to close on or

about June 28, 2024, subject to the satisfaction of customary

closing conditions.

KALA intends to use the net proceeds from the

private placement to advance the clinical development of KPI-012

for the treatment of persistent corneal epithelial defect, as well

as for general corporate purposes.

The securities to be sold in the private placement

have not been registered under the Securities Act of 1933, as

amended (the “Securities Act”), or applicable state securities

laws, and may not be offered or sold in the United States except

pursuant to an effective registration statement or an applicable

exemption from the registration requirements. KALA has agreed to

file a registration statement with the U.S. Securities and Exchange

Commission (the “SEC”) registering the resale of the shares of

common stock issued in the private placement and the shares of

common stock issuable upon conversion of the Series H Preferred

Stock issued in the private placement no later than the 30th day

after the closing of the private placement.

This press release shall not constitute an offer to

sell or the solicitation of an offer to buy, nor shall there be any

sale of securities of KALA in any state or other jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

the registration or qualification under the securities laws of any

such state or jurisdiction. Any offering of the securities under

the resale registration statement will only be made by means of a

prospectus.

About KALA BIO, Inc.

KALA is a clinical-stage biopharmaceutical company

dedicated to the research, development and commercialization of

innovative therapies for rare and severe diseases of the eye.

KALA’s biologics-based investigational therapies utilize KALA’s

proprietary mesenchymal stem cell secretome (MSC-S) platform.

KALA’s lead product candidate, KPI-012, is a human MSC-S, which

contains numerous human-derived biofactors, such as growth factors,

protease inhibitors, matrix proteins and neurotrophic factors that

can potentially correct the impaired corneal healing that is an

underlying etiology of multiple severe ocular diseases. KPI-012 is

currently in clinical development for the treatment of persistent

corneal epithelial defect (PCED), a rare disease of impaired

corneal healing, for which it has received Orphan Drug and Fast

Track designations from the U.S. Food and Drug Administration. KALA

is also targeting the potential development of KPI-012 for the

treatment of Limbal Stem Cell Deficiency and other rare corneal

diseases that threaten vision and has initiated preclinical studies

to evaluate the potential utility of its MSC-S platform for retinal

degenerative diseases, such as Retinitis Pigmentosa and Stargardt

Disease.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve substantial risks and

uncertainties. Any statements in this press release about KALA’s

future expectations, plans and prospects, including but not limited

to statements about KALA’s expectations with respect to the

expected closing of the private placement, the anticipated use of

net proceeds from the private placement and other statements

containing the words “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “target,”

“potential,” “likely,” “will,” “would,” “could,” “should,”

“continue,” and similar expressions constitute forward-looking

statements. Actual results may differ materially from those

indicated by such forward-looking statements as a result of various

important factors, including: whether the conditions for the

closing of the private placement will be satisfied; market

conditions and other factors discussed in the “Risk Factors”

section of KALA’s Annual Report on Form 10-K, most recently filed

Quarterly Report on Form 10-Q and other filings KALA makes with the

SEC. These forward-looking statements represent KALA’s views as of

the date of this press release and should not be relied upon as

representing KALA’s views as of any date subsequent to the date

hereof. KALA does not assume any obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Investor Contact:

Taylor

Steinertaylor.steiner@precisionaq.com212-362-1200

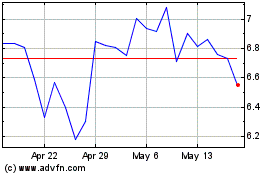

KALA BIO (NASDAQ:KALA)

Historical Stock Chart

From Jan 2025 to Feb 2025

KALA BIO (NASDAQ:KALA)

Historical Stock Chart

From Feb 2024 to Feb 2025