0001640384false00016403842024-11-132024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 13, 2024 |

LM FUNDING AMERICA, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37605 |

47-3844457 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1200 West Platt Street Suite 100 |

|

Tampa, Florida |

|

33606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 813 222-8996 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock par value $0.001 per share |

|

LMFA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2024, LM Funding America, Inc. (the “Company”) issued a press release announcing its financial results for the Three and Nine Months ended September 30, 2024.

The information furnished in this Item 2.02, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that Section. This information will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that the Company specifically incorporates it by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LM Funding America, Inc. |

|

|

|

|

Date: |

November 13, 2024 |

By: |

/s/ Richard Russell |

|

|

|

Richard Russell, CFO |

LM Funding America, Inc. Reports Financial Results and Provides Business Update for the Third Quarter of 2024

Conference Call to Be Held Today at 11:00 am ET

TAMPA, FL, November 13, 2024—LM Funding America, Inc. (NASDAQ: LMFA) (“LM Funding” or the “Company”), a cryptocurrency mining and technology-based specialty finance company, today provided a business update and reported financial results for the three and nine months ended September 30, 2024.

Financial highlights

•Held 142.3 Bitcoin on September 30, 2024, Valued at Approximately $12.4 Million Based on Recent Bitcoin Price of $87,000

•Digital mining cost of revenues (exclusive of depreciation and amortization) as a percentage of digital mining revenues showed substantial improvement versus the prior year quarter.

CEO commentary

Bruce Rodgers, Chairman and CEO of LM Funding, remarked, "Following the April halving event, we initiated a vertical integration strategy, focusing on locations with low-cost power and strong expansion potential. We are committed to identifying cost-effective sites that will enable the Company to drive growth and increase shareholder value. Additionally, we are excited to see Bitcoin recently reach an all-time high above $87,000—a milestone that reinforces our strategy of mining and holding Bitcoin as the price approaches the market projection target of over $100,000 by 2025."

Strategic Developments

•Vertical Integration Strategy: Following the halving event, the Company transitioned from an infrastructure-light approach to a vertical integration strategy. This shift, strategically coordinated with the expiration of hosting contracts, allowed the Company to secure lower-cost power sources ($0.3 - 0.5 cents per MW) and relocate miners to more cost-effective operations and expansion opportunities. This resulted in gross mining margin improvements to 35% for the quarter as comparted to 18% in the prior year.

•Leadership Appointment: Ryan Duran has been named president of US Digital Mining and Hosting Co LLC, a subsidiary. Duran will play a pivotal role in shaping the strategic direction and optimizing operational efficiency, positioning LM Funding at the forefront of the rapidly evolving cryptocurrency industry.

Ryan Duran, President of USDM, stated, "I look forward to driving our vertical integration strategy as we acquire cost-effective sites to lower our operating costs."

Quarterly Operational Highlights – Three Months ended September 30, 2024

•Bitcoin Mining: Mined 18.5 Bitcoins in Q3 2024, generating approximately $1.1 million in revenue at an average Bitcoin price of $60,870.

•Bitcoin Holdings: As of September 30, 2024, the Company held 142.3 Bitcoins valued at approximately $12.4 million based on a price of $87,000 on November 11, 2024.

•Revenue Impact: Total revenue for the third quarter of 2024 was approximately $1.3 million, a decrease of $2.1 million from the same period last year, primarily due to the anticipated effects of the April 2024 Bitcoin halving event and the transition of our mining machines to a new hosting site.

•Net Loss: The net loss for the third quarter was $4.8 million compared to a net loss of $4.7 million for the comparable quarter in 2023.

Quarterly Financial Highlights - Three Months ended September 30, 2024

•Revenue: Digital mining revenue decreased to $1.1 million in Q3 2024 from $3.3 million in Q3 2023, despite an increase in Bitcoin prices, due to reduced mined volume arising from the halving event and the repositioning of miners during the quarter.

•Operating Expenses: Operating expenses decreased to $5.7 million from $6.6 million year-on-year, due primarily to a decrease in digital mining costs in Bitcoin fair value offset in part by an increase in depreciation and amortization costs.

•Net Loss: LM Funding reported a net loss attributable to shareholders of approximately $6.4 million, factoring in a $1.7 million of deemed dividends resulting from warrant repricing and a $0.3 million unrealized loss on securities, compared to a $4.4 million loss in the prior year.

•Core EBITDA: Core EBITDA loss was $1.6 million in Q3 2024 from $0.6 million in Q3 2023, although positive Core EBITDA for the nine months of 2024 increased to $0.6 million due to expanded Bitcoin operations. (Core EBITDA is a non-GAAP financial measure, and a reconciliation of Core EBITDA to net loss can be found below).

CFO commentary

Richard Russell, CFO of LM Funding, stated, "We closed the quarter with approximately $14.9 million in cash and Bitcoin. With the recent rapid increase in BTC prices above $87,000, we are extremely optimistic about the financial prospects of Bitcoin and our business outlook."

Investor Conference Call

LM Funding will host a conference call today, November 13, 2024, at 11:00 A.M. Eastern Time to discuss the Company’s financial results for the quarter ended September 30, 2024, as well as the Company’s corporate progress and other developments.

The conference call will be available via telephone by dialing toll-free +1 888-506-0062 for U.S. callers or +1 973-528-0011 for international callers and entering access code 424451. A webcast of the call may be accessed at https://www.webcaster4.com/Webcast/Page/2917/51557 or on the investor relations section of the company’s website, https://www.lmfunding.com/investors/news-events/ir-calendar.

A webcast replay will be available on the investor relations section of the company’s website at https://www.lmfunding.com/investors/news-events/ir-calendar through November 13, 2025. A telephone replay of the call will be available approximately one hour following the call, through November 27, 2024, and can be accessed by dialing 877-481-4010 for U.S. callers or +1 919-882-2331 for international callers and entering access code 51557.

About LM Funding America

LM Funding America, Inc., (Nasdaq: LMFA) and its subsidiaries are a cryptocurrency mining business that commenced Bitcoin mining operations in September 2022. The Company also operates a technology-based specialty finance company that provides funding to nonprofit community associations (Associations) primarily located in the state of Florida, as well as in the states of Washington, Colorado, and Illinois, by funding a certain portion of the Associations' rights to delinquent accounts that are selected by the Associations arising from unpaid Association assessments.

Forward-Looking Statements

This press release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the Company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, uncertainty created by the risks of operating in the cryptocurrency mining business, uncertainty in the cryptocurrency mining business in general, problems with hosting vendors in the mining business, the capacity of our Bitcoin mining machines and our related ability to purchase power at reasonable prices, the ability to finance our planned cryptocurrency mining operations, our ability to acquire new accounts in our specialty finance business at appropriate prices, the potential need for additional capital in the future, changes in governmental regulations that affect our ability to collect sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, negative press regarding the debt collection industry, and the risk of pandemics such as the COVID-10 pandemic. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations.

Contact:

Crescendo Communications, LLC

Tel: (212) 671-1020

Email: LMFA@crescendo-ir.com

(tables follow)

LM Funding America, Inc. and Subsidiaries Consolidated Balance Sheets

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

2024 (Unaudited) |

|

2023 |

|

|

|

|

|

Assets |

|

|

|

|

Cash |

|

$ 5,913,215 |

|

$ 2,401,831 |

Digital assets - current (Note 2) |

|

3,983,800 |

|

3,416,256 |

Finance receivables |

|

25,410 |

|

19,221 |

Marketable securities (Note 5) |

|

18,844 |

|

17,860 |

Receivable from sale of Symbiont assets (Note 5) |

|

200,000 |

|

200,000 |

Current portion of notes receivable from Tech Infrastructure JV I LLC (Note 5) |

|

711,840 |

|

- |

Prepaid expenses and other assets |

|

416,516 |

|

4,067,212 |

Income tax receivable |

|

31,187 |

|

31,187 |

Current assets |

|

11,300,812 |

|

10,153,567 |

|

|

|

|

|

Fixed assets, net (Note 3) |

|

17,311,254 |

|

24,519,610 |

Deposits on mining equipment (Note 4) |

|

20,847 |

|

20,837 |

Notes receivable from Seastar Medical Holding Corporation (Note 5) |

|

- |

|

1,440,498 |

Notes receivable from Tech Infrastructure JV I LLC - net of current portion (Note 5) |

|

2,269,863 |

|

- |

Long-term investments - equity securities (Note 5) |

|

8,944 |

|

156,992 |

Investment in Seastar Medical Holding Corporation (Note 5) |

|

440,910 |

|

1,145,486 |

Digital assets - long-term (Note 2) |

|

5,000,000 |

|

- |

Operating lease - right of use assets (Note 7) |

|

109,380 |

|

189,009 |

Other assets |

|

73,857 |

|

86,798 |

Long-term assets |

|

25,235,055 |

|

27,559,230 |

Total assets |

|

$ 36,535,867 |

|

$ 37,712,797 |

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

Accounts payable and accrued expenses |

|

1,400,228 |

|

2,064,909 |

Note payable - short-term (Note 6) |

|

1,520,564 |

|

567,586 |

Due to related parties (Note 10) |

|

64,386 |

|

22,845 |

Current portion of lease liability (Note 7) |

|

109,931 |

|

110,384 |

Total current liabilities |

|

3,095,109 |

|

2,765,724 |

|

|

|

|

|

Note payable - long-term (Note 6) |

|

4,844,084 |

|

- |

Lease liability - net of current portion (Note 7) |

|

4,924 |

|

85,775 |

Long-term liabilities |

|

4,849,008 |

|

85,775 |

Total liabilities |

|

7,944,117 |

|

2,851,499 |

|

|

|

|

|

Stockholders' equity (Note 8) |

|

|

|

|

Preferred stock, par value $.001; 150,000,000 shares authorized; no shares issued and outstanding as of September 30, 2024 and December 31, 2023 |

|

- |

|

- |

|

|

|

|

|

Common stock, par value $.001; 350,000,000 shares authorized; 2,956,042 shares issued and outstanding as of September 30, 2024 and 2,492,964 as of December 31, 2023 |

|

2,822 |

|

2,493 |

Additional paid-in capital |

|

97,827,489 |

|

95,145,376 |

Accumulated deficit |

|

(67,628,539) |

|

(58,961,461) |

Total LM Funding America stockholders' equity |

|

30,201,772 |

|

36,186,408 |

Non-controlling interest |

|

(1,610,022) |

|

(1,325,110) |

Total stockholders' equity |

|

28,591,750 |

|

34,861,298 |

Total liabilities and stockholders’ equity |

|

$ 36,535,867 |

|

$ 37,712,797 |

|

|

|

|

|

LM Funding America, Inc. and Subsidiaries Consolidated Statements of Operations (unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Revenues: |

|

|

|

|

|

|

|

|

Digital mining revenues |

|

$ 1,127,455 |

|

$ 3,283,473 |

|

$ 8,618,436 |

|

$ 8,342,646 |

Specialty finance revenue |

|

97,558 |

|

101,535 |

|

303,222 |

|

474,544 |

Rental revenue |

|

30,460 |

|

34,500 |

|

92,766 |

|

111,486 |

Total revenues |

|

1,255,473 |

|

3,419,508 |

|

9,014,424 |

|

8,928,676 |

Operating costs and expenses: |

|

|

|

|

|

|

|

|

Digital mining cost of revenues (exclusive of depreciation and amortization shown below) |

|

730,716 |

|

2,708,473 |

|

5,742,773 |

|

6,737,971 |

Staff costs and payroll |

|

1,567,984 |

|

1,340,665 |

|

3,648,898 |

|

4,736,940 |

Depreciation and amortization |

|

2,349,634 |

|

1,516,873 |

|

7,115,404 |

|

3,487,866 |

Gain on fair value of Bitcoin, net |

|

(104,744) |

|

- |

|

(3,096,774) |

|

- |

Impairment loss on mining equipment |

|

- |

|

- |

|

1,188,058 |

|

- |

Impairment loss on mined digital assets |

|

- |

|

383,497 |

|

- |

|

822,650 |

Realized gain on sale of mined digital assets |

|

- |

|

(261,191) |

|

- |

|

(1,331,982) |

Professional fees |

|

628,686 |

|

419,173 |

|

1,622,914 |

|

1,228,503 |

Selling, general and administrative |

|

209,088 |

|

201,151 |

|

582,675 |

|

683,174 |

Real estate management and disposal |

|

31,144 |

|

26,453 |

|

89,430 |

|

127,611 |

Collection costs |

|

15,054 |

|

8,098 |

|

36,396 |

|

17,533 |

Settlement costs with associations |

|

- |

|

- |

|

- |

|

10,000 |

Loss on disposal of assets |

|

12,449 |

|

- |

|

54,506 |

|

|

Other operating costs |

|

229,784 |

|

246,735 |

|

667,401 |

|

704,589 |

Total operating costs and expenses |

|

5,669,795 |

|

6,589,927 |

|

17,651,681 |

|

17,224,855 |

Operating loss |

|

(4,414,322) |

|

(3,170,419) |

|

(8,637,257) |

|

(8,296,179) |

Unrealized gain (loss) on marketable securities |

|

(3,296) |

|

2,058 |

|

984 |

|

6,436 |

Impairment loss on prepaid machine deposits |

|

(12,941) |

|

- |

|

(12,941) |

|

(36,691) |

Unrealized loss on investment and equity securities |

|

(346,866) |

|

(778,078) |

|

(852,624) |

|

(10,317,613) |

Impairment loss on Symbiont assets |

|

- |

|

(750,678) |

|

- |

|

(750,678) |

Gain on fair value of purchased Bitcoin, net |

|

- |

|

- |

|

57,926 |

|

- |

Realized gain on securities |

|

|

|

1,788 |

|

|

|

1,788 |

Realized gain on sale of purchased digital assets |

|

- |

|

- |

|

- |

|

1,917 |

Credit loss on Seastar Medical Holding Corporation notes receivable |

|

- |

|

(22,344) |

|

- |

|

(22,344) |

Gain on adjustment of note receivable allowance |

|

- |

|

- |

|

- |

|

1,052,543 |

Other income - coupon sales |

|

- |

|

10,160 |

|

4,490 |

|

639,472 |

Other income - financing revenue |

|

- |

|

- |

|

- |

|

37,660 |

Interest expense |

|

(124,035) |

|

- |

|

(231,754) |

|

- |

Interest income |

|

98,343 |

|

39,657 |

|

124,696 |

|

210,881 |

Loss before income taxes |

|

(4,803,117) |

|

(4,667,856) |

|

(9,546,480) |

|

(17,472,808) |

Income tax expense |

|

- |

|

- |

|

- |

|

- |

Net loss |

|

$ (4,803,117) |

|

$ (4,667,856) |

|

$ (9,546,480) |

|

$ (17,472,808) |

Less: warrant repricing (Note 8) |

|

(1,704,305) |

|

- |

|

(1,704,305) |

|

- |

|

|

|

|

|

|

|

|

|

Less: loss attributable to non-controlling interest |

|

105,043 |

|

250,880 |

|

265,296 |

|

3,120,321 |

Net loss attributable to LM Funding America Inc. |

|

$ (6,402,379) |

|

$ (4,416,976) |

|

$ (10,985,489) |

|

$ (14,352,487) |

|

|

|

|

|

|

|

|

|

Basic loss per common share (Note 1) |

|

$ (2.41) |

|

$ (1.97) |

|

$ (4.35) |

|

$ (6.51) |

Diluted loss per common share (Note 1) |

|

$ (2.41) |

|

$ (1.97) |

|

$ (4.35) |

|

$ (6.51) |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

2,659,974 |

|

2,246,745 |

|

2,525,160 |

|

2,206,187 |

Diluted |

|

2,659,974 |

|

2,246,745 |

|

2,525,160 |

|

2,206,187 |

LM Funding America, Inc. and Subsidiaries Consolidated Statements of Cash Flows (Unaudited)

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

Net loss |

|

$ (9,546,480) |

|

$ (17,472,808) |

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

Depreciation and amortization |

|

7,115,404 |

|

3,487,866 |

Noncash lease expense |

|

79,629 |

|

70,545 |

Stock compensation |

|

76,322 |

|

917,057 |

Stock option expense |

|

332,415 |

|

1,611,795 |

Professional fees paid in common shares |

|

100,001 |

|

- |

Accrued investment income |

|

(123,076) |

|

(130,990) |

Digital assets other income |

|

(4,490) |

|

- |

Gain on fair value of Bitcoin, net |

|

(3,154,700) |

|

- |

Impairment loss on mining machines |

|

1,188,058 |

|

- |

Impairment loss on digital assets |

|

- |

|

822,650 |

Impairment loss on hosting deposits |

|

12,941 |

|

36,691 |

Impairment loss on Symbiont assets |

|

- |

|

750,678 |

Unrealized gain on marketable securities |

|

(984) |

|

(6,436) |

Realized gain on securities |

|

- |

|

(1,788) |

Unrealized loss on investment and equity securities |

|

852,624 |

|

10,317,613 |

Loss on disposal of fixed assets |

|

54,506 |

|

- |

Proceeds from securities |

|

- |

|

554,036 |

Realized gain on sale of digital assets |

|

- |

|

(1,333,899) |

Credit loss on Seastar Medical Holding Corporation notes receivable |

|

- |

|

22,344 |

Reversal of allowance loss on debt security |

|

- |

|

(1,052,543) |

Investments in marketable securities |

|

- |

|

(739,616) |

Change in operating assets and liabilities: |

|

|

|

|

Prepaid expenses and other assets |

|

3,650,696 |

|

(123,221) |

Hosting deposits |

|

- |

|

(54,691) |

Advances (repayments) to related party |

|

41,541 |

|

(31,090) |

Accounts payable and accrued expenses |

|

(664,681) |

|

682,405 |

Mining of digital assets |

|

(8,618,436) |

|

(8,352,805) |

Proceeds from sale of digital assets |

|

- |

|

7,487,058 |

Lease liability payments |

|

(81,304) |

|

(70,563) |

Net cash used in operating activities |

|

(8,690,014) |

|

(2,609,712) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

Net collections of finance receivables - original product |

|

(4,618) |

|

(8,765) |

Net collections of finance receivables - special product |

|

(1,571) |

|

14,009 |

Capital expenditures |

|

(1,228,428) |

|

(1,913,303) |

Proceeds from sale of fixed assets |

|

78,806 |

|

- |

Investment in Tech Infrastructure JV I LLC note receivable |

|

(2,867,195) |

|

- |

Investment in note receivable |

|

- |

|

(100,000) |

Collection of notes receivable |

|

1,449,066 |

|

1,761,727 |

Investment in digital assets |

|

- |

|

(35,157) |

Proceeds from sale of digital assets |

|

6,821,185 |

|

43,678 |

Proceeds from the sale of tether |

|

3,003 |

|

- |

Symbiont asset acquisition |

|

- |

|

(402,359) |

Distribution to members |

|

(19,616) |

|

- |

Net cash from (used in) investing activities |

|

4,230,632 |

|

(640,170) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

Proceeds from borrowings |

|

6,344,084 |

|

- |

Insurance financing repayments |

|

(547,022) |

|

(499,453) |

|

|

|

|

|

Insurance financing |

|

- |

|

86,886 |

Exercise of options |

|

25,000 |

|

- |

Proceeds from equity offering |

|

2,333,112 |

|

- |

Issue costs for equity offering |

|

(184,408) |

|

(106,550) |

Net cash from (used in) financing activities |

|

7,970,766 |

|

(519,117) |

NET DECREASE IN CASH |

|

3,511,384 |

|

(3,768,999) |

CASH - BEGINNING OF PERIOD |

|

2,401,831 |

|

4,238,006 |

CASH - END OF PERIOD |

|

$ 5,913,215 |

|

469,007 |

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF NON-CASH ACTIVITIES |

|

|

|

|

|

|

|

|

|

ROU assets and operating lease obligation recognized |

|

$ - |

|

$ 21,887 |

Reclassification of mining equipment deposit to fixed assets, net |

|

$ - |

|

$ 1,177,226 |

Change in accounting principle (see Note 1) |

|

$ 614,106 |

|

$ - |

SUPPLEMENTAL DISCLOSURES OF CASHFLOW INFORMATION |

|

|

|

|

Cash paid for taxes |

|

$ - |

|

$ - |

Cash paid for interest |

|

$ 222,697 |

|

$ - |

NON-GAAP FINANCIAL INFORMATION (unaudited)

Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Tax, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized loss on investment and equity securities, impairment loss on mined digital assets, impairment of long-lived assets, impairment of prepaid hosting deposits, contract termination costs and stock compensation expense and option expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of Bitcoin miners.

The following tables reconcile net loss, which we believe is the most comparable GAAP measure, to EBITDA and Core EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ (4,803,117) |

|

$ (4,667,856) |

|

|

$ (9,546,480) |

|

$(17,472,808) |

Interest expense |

|

124,035 |

|

- |

|

|

231,754 |

|

- |

Depreciation and amortization |

|

2,349,634 |

|

1,516,873 |

|

|

7,115,404 |

|

3,487,866 |

Income (loss) before interest, taxes & depreciation |

|

$ (2,329,448) |

|

$ (3,150,983) |

|

|

$ (2,199,322) |

|

$(13,984,942) |

Unrealized loss on investment and equity securities |

|

346,866 |

|

778,078 |

|

|

852,624 |

|

10,317,613 |

Gain on adjustment of note receivable allowance |

|

- |

|

- |

|

|

- |

|

(1,052,543) |

Impairment loss on mined digital assets |

|

- |

|

383,497 |

|

|

- |

|

822,650 |

Impairment loss on prepaid hosting deposits |

|

- |

|

- |

|

|

- |

|

36,691 |

Costs associated with At-the-Market Equity program |

|

- |

|

- |

|

|

119,050 |

|

- |

Contract termination costs |

|

250,001 |

|

- |

|

|

250,001 |

|

- |

Impairment loss on Symbiont assets |

|

- |

|

750,678 |

|

|

- |

|

750,678 |

Impairment loss on mining equipment |

|

- |

|

- |

|

|

1,188,058 |

|

- |

Stock compensation and option expense |

|

110,806 |

|

621,827 |

|

|

408,737 |

|

2,528,852 |

Core income (loss) before interest, taxes & depreciation |

|

$ (1,621,775) |

|

$ (616,903) |

|

|

$ 619,148 |

|

$ (581,001) |

|

|

|

|

|

|

|

|

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

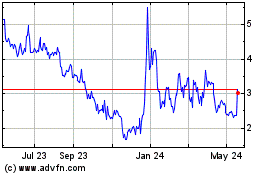

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Dec 2024 to Jan 2025

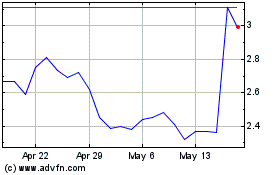

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Jan 2024 to Jan 2025