Mainz Biomed Provides Full Year 2022 Financial Results

April 10 2023 - 2:01AM

Mainz Biomed N.V. (NASDAQ:MYNZ) (“Mainz Biomed” or the “Company”),

a molecular genetics diagnostic company specializing in the early

detection of cancer, announced today financial results for the

fiscal year ended December 31, 2022.

“Throughout the year we operated in a position of financial

strength enabling us to achieve meaningful growth across

commercial, operational and product development fronts,” commented

Guido Baechler, Chief Executive Officer of Mainz Biomed. “Heading

into fiscal 2023, we have a defined set of priorities intended to

facilitate our goal of becoming the leading developer of premier

cancer-focused early detection and disease prevention molecular

diagnostics.”

Key Highlights and 2022 Accomplishments

- Expanded international commercial activities for ColoAlert, the

Company’s highly efficacious and easy-to-use detection test for

colorectal cancer (CRC), including five new lab partners in Germany

and Italy

- Acquired exclusive rights to five novel mRNA biomarkers which

have demonstrated unique ability to identify advanced adenomas

(curable precancerous polyps)

- Executed a USD 25.8 million (gross) follow-on offering of

ordinary shares

- Initiated and commenced patient enrollment in European and U.S.

studies (ColoFuture/eAArly DETECT) evaluating the integration of

Mainz’s portfolio of proprietary and novel gene expression (mRNA)

biomarkers into ColoAlert; potential to identify advanced adenomas,

a type of pre-cancerous polyp often attributed to CRC; Results from

both studies expected in 2023

- Initiated ReconAAsense, U.S. Pivotal Clinical Study with

Company’s CRC screening test; anticipate commencing patient

enrollment in the second half of 2023

- Enhanced leadership team with appointments to Board of

Directors and Company executives to lead commercial and product

development groups, with former executives and senior management

from Roche, Abbott, Luminex, and Qiagen; expanded Medical Advisory

Board of global leaders in molecular diagnostic development

- Achieved multiple preclinical milestones supporting the

continued development of PancAlert, a potential first-in-class

screening test for pancreatic cancer

Consolidated Statements of Financial

Position

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

|

|

2022 |

|

|

2021 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

|

|

$ |

17,141,775 |

|

|

$ |

8,727,542 |

|

|

Trade and other receivables, net |

|

|

|

|

259,138 |

|

|

|

111,842 |

|

|

Inventories |

|

|

|

|

175,469 |

|

|

|

- |

|

|

Prepaid expenses |

|

|

|

|

801,959 |

|

|

|

769,825 |

|

| Total Current

Assets |

|

|

|

|

18,378,341 |

|

|

|

9,609,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

661,692 |

|

|

|

37,884 |

|

|

Intangible asset |

|

|

|

|

- |

|

|

|

- |

|

|

Right-of-use asset |

|

|

|

|

1,177,695 |

|

|

|

393,702 |

|

|

Other asset |

|

|

|

|

23,275 |

|

|

|

- |

|

|

Total assets |

|

|

|

$ |

20,241,003 |

|

|

$ |

10,040,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES

AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

|

$ |

2,656,679 |

|

|

$ |

784,786 |

|

|

Accrued payroll |

|

|

|

|

260,000 |

|

|

|

233,710 |

|

|

Accounts payable – related party |

|

|

|

|

- |

|

|

|

84,750 |

|

|

Convertible debt |

|

|

|

|

43,057 |

|

|

|

45,666 |

|

|

Convertible debt – related party |

|

|

|

|

32,181 |

|

|

|

32,221 |

|

|

Loans payable |

|

|

|

|

- |

|

|

|

22,754 |

|

|

Loans payable – related party |

|

|

|

|

- |

|

|

|

92,792 |

|

|

Silent partnership |

|

|

|

|

759,168 |

|

|

|

- |

|

|

Silent partnership – related party |

|

|

|

|

206,167 |

|

|

|

- |

|

|

Lease liabilities |

|

|

|

|

285,354 |

|

|

|

55,076 |

|

| Total current

liabilities |

|

|

|

|

4,242,606 |

|

|

|

1,351,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silent partnerships |

|

|

|

|

687,128 |

|

|

|

1,463,981 |

|

|

Silent partnerships – related party |

|

|

|

|

256,086 |

|

|

|

476,138 |

|

|

Lease liabilities |

|

|

|

|

959,116 |

|

|

|

387,766 |

|

|

Total Liabilities |

|

|

|

|

6,144,936 |

|

|

|

3,679,640 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’

equity |

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

|

|

|

164,896 |

|

|

|

141,075 |

|

| Share premium |

|

|

|

|

38,831,542 |

|

|

|

13,126,493 |

|

| Reserve |

|

|

|

|

18,079,741 |

|

|

|

9,736,066 |

|

| Accumulated

deficit |

|

|

|

|

(43,032,294 |

) |

|

|

(16,644,958 |

) |

| Accumulated other

comprehensive income |

|

|

|

|

52,182 |

|

|

|

2,479 |

|

| Total shareholders’

equity |

|

|

|

|

14,096,067 |

|

|

|

6,361,155 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

liabilities and shareholders’ equity |

|

|

|

$ |

20,241,003 |

|

|

$ |

10,040,795 |

|

Consolidated Statements of Comprehensive

Loss

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Years EndedDecember 31, |

|

|

| |

|

|

|

2022 |

|

|

2021 |

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

ColoAlert revenue |

|

|

|

$ |

519,728 |

|

|

$ |

226,438 |

|

|

|

Covid-19 and other revenue |

|

|

|

|

10,149 |

|

|

|

350,910 |

|

|

| Total

revenue |

|

|

|

|

529,877 |

|

|

|

577,348 |

|

|

| Cost of

revenue |

|

|

|

|

347,726 |

|

|

|

399,726 |

|

|

| Gross

profit |

|

|

|

|

182,151 |

|

|

|

177,622 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

17,328,942 |

|

(a) |

|

8,478,017 |

(a) |

|

|

Sales and marketing |

|

|

|

|

5,702,143 |

|

|

|

957,522 |

|

|

|

Research and development |

|

|

|

|

3,660,495 |

|

|

|

466,689 |

|

|

| Total operating

expenses |

|

|

|

|

26,691,580 |

|

|

|

9,902,228 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

|

|

(26,509,429 |

) |

|

|

(9,724,606 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other

income (expense) |

|

|

|

|

122,093 |

|

|

|

(1,965,492 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income (loss)

before income tax |

|

|

|

|

(26,387,336 |

) |

|

|

(11,690,098 |

) |

|

| Income taxes

provision |

|

|

|

|

- |

|

|

|

- |

|

|

| Net

loss |

|

|

|

$ |

(26,387,336 |

) |

|

$ |

(11,690,098 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency

translation gain (loss) |

|

|

|

|

49,703 |

|

|

|

204,969 |

|

|

|

Comprehensive loss |

|

|

|

$ |

(26,337,633 |

) |

|

$ |

(11,485,129 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic and

dilutive loss per ordinary share |

|

|

|

$ |

(1.86 |

) |

|

$ |

(1.62 |

) |

|

| Weighted

average number of ordinary shares outstanding |

|

|

|

|

14,157,492 |

|

|

|

7,210,889 |

|

|

(a) General

and administrative expenses included $9.9 million and $6.6 million

of non-cash stock-based compensation, depreciation and amortization

in the twelve months ended December 31, 2022 and 2021,

respectively.

About ColoAlertColoAlert®, Mainz Biomed’s

flagship product, delivers high sensitivity and specificity in a

user-friendly, at-home colorectal cancer (CRC) screening kit. This

non-invasive test can be indicative of tumors as determined by

analyzing tumor DNA, offering better early detection than fecal

occult blood tests (FOBT). Based on PCR-technology, ColoAlert

detects more cases of colorectal cancer than other stool tests and

allows for an earlier diagnosis (Gies et al.,

2018). The product is commercially available in select EU

countries through a network of leading independent laboratories,

corporate health programs and via direct sales. To receive

marketing approval in the US, ColoAlert will be evaluated in the

FDA-registration trial ‘ReconAAsense’. Once approved in the US, the

Company’s commercial strategy is to establish scalable distribution

through a collaborative partner program with regional and national

laboratory service providers across the country.

About Colorectal CancerColorectal cancer (CRC)

is the third most common cancer globally, with more than 1.9

million new cases reported in 2020, according to World Cancer

Research Fund International. The US Preventive Services Task Force

recommends that screening with stool DNA tests such as ColoAlert

should be conducted once every three years starting at age 45. Each

year in the US, 16.6 million colonoscopies are performed. However,

roughly one-third of US residents aged 50-75 have never been

screened for colon cancer. This gap in screening represents a

$4.0B+ total market opportunity in the US.

About Mainz Biomed NVMainz Biomed develops

market-ready molecular genetic diagnostic solutions for

life-threatening conditions. The Company’s flagship product is

ColoAlert, an accurate, non-invasive and easy-to-use,

early-detection diagnostic test for colorectal cancer based on

real-time Polymerase Chain Reaction-based (PCR) multiplex detection

of molecular-genetic biomarkers in stool samples. ColoAlert is

currently marketed across Europe. The Company is running a pivotal

FDA clinical study for US regulatory approval. Mainz Biomed’s

product candidate portfolio also includes PancAlert, an early-stage

pancreatic cancer screening test. To learn more,

visit mainzbiomed.com or follow us

on LinkedIn, Twitter and Facebook.

For media inquiries, please contact

press@mainzbiomed.com

In Europe:

MC Services AGAnne Hennecke/Caroline Bergmann+49 211 529252

20mainzbiomed@mc-services.eu

In the US:

Spectrum ScienceMelissa Laverty/Valerie Enes+1 540 272

6465mainz@spectrumscience.com

For investor inquiries, please

contact info@mainzbiomed.com

Forward-Looking Statements

Certain statements made in this press release are

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements may be identified by the use of

words such as “anticipate”, “believe”, “expect”, “estimate”,

“plan”, “outlook”, and “project” and other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. These forward-looking statements

reflect the current analysis of existing information and are

subject to various risks and uncertainties. As a result, caution

must be exercised in relying on forward-looking statements. Due to

known and unknown risks, actual results may differ materially from

the Company’s expectations or projections. The following factors,

among others, could cause actual results to differ materially from

those described in these forward-looking statements: (i) the

failure to meet projected development and related targets; (ii)

changes in applicable laws or regulations; (iii) the effect of the

COVID-19 pandemic on the Company and its current or intended

markets; and (iv) other risks and uncertainties described herein,

as well as those risks and uncertainties discussed from time to

time in other reports and other public filings with the Securities

and Exchange Commission (the “SEC”) by the Company. Additional

information concerning these and other factors that may impact the

Company’s expectations and projections can be found in its initial

filings with the SEC, including its annual report on Form 20-F

filed on May 5, 2022. The Company’s SEC filings are available

publicly on the SEC’s website at www.sec.gov. Any forward-looking

statement made by us in this press release is based only on

information currently available to Mainz Biomed and speaks only as

of the date on which it is made. Mainz Biomed undertakes no

obligation to publicly. update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise, except as required by law.

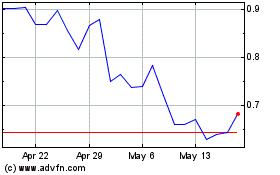

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

From Dec 2023 to Dec 2024