Mainz Biomed Announces Stock Split

November 29 2024 - 7:45AM

Mainz Biomed N.V. (

NASDAQ:MYNZ) (“Mainz Biomed” or

the “Company”), a molecular genetics diagnostic company

specializing in the early detection of cancer, today announced a

1-for-40 reverse stock split of its issued and outstanding shares.

The reverse stock split was authorized by the Board of Directors of

the Company pursuant to shareholder approval granted at its

Extraordinary Shareholders Meeting on November 20, 2024.

The reverse stock split is expected to become effective on

December 3, 2024 (the "Effective Date"), and the Company’s ordinary

shares are expected to begin trading on the split-adjusted basis on

the Nasdaq under the Company's existing trading symbol "MYNZ" at

market open on December 3, 2024, upon Nasdaq's approval. The new

CUSIP number for the Company's ordinary shares following the

reverse stock split will be N5436L119.

The reverse stock split is intended to increase the market price

per share of its common stock to comply with the continued listing

standards of the Nasdaq Capital Market under Nasdaq Listing Rule

5550(a)(2) and to make investments in the Company more attractive

to investors by increasing the trading price of the Company's

ordinary shares on such market.

Information for Stockholders

On the Effective Date, every 40 issued and outstanding ordinary

shares of the Company will be converted automatically into one

share of the Company's ordinary shares without any change in the

par value per share. Once effective, the reverse stock split will

reduce the number of ordinary shares issued and outstanding from

approximately 80.1 million shares to approximately 2.0 million.

Immediately after the reverse stock split, each stockholder's

percentage ownership interest in the Company and proportional

voting power will remain unchanged, except for minor changes and

adjustments that will result from the treatment of fractional

shares. The Company will not issue fractional shares but will pay

cash in lieu of fractional shares. The rights and privileges of the

holders of ordinary shares of the Company will be substantially

unaffected by the reverse stock split.

Shareholders who hold their shares in brokerage accounts or in

"street name" will have their positions automatically adjusted to

reflect the reverse stock split, subject to each broker's

particular processes, and will not be required to take any action

in connection with the reverse stock split.

Registered shareholders holding pre-split shares of the

Company's ordinary shares electronically in book-entry form are not

required to take any action to receive post-split shares. Those

shareholders holding shares of the Company's ordinary shares in

certificate form will receive a transmittal letter from our

transfer agent, Transhare Corporation, with instructions as soon as

practicable after the Effective Date.

Nasdaq Capital Market Compliance

Mainz Biomed’s securities are currently listed on Nasdaq. In May

2024, the Company received written notice (the “Notice”) from the

Listing Qualifications Department of Nasdaq notifying that, based

on the closing bid price of Mainz Biomed’s ordinary shares for the

last 30 consecutive trading days, the Company no longer complied

with the minimum bid price requirement for continued listing on the

Nasdaq Capital Market. Nasdaq Listing Rule 5550(a)(2) requires

listed securities to maintain a minimum bid price of $1.00 per

share (the “Minimum Bid Price Requirement”), and Nasdaq Listing

Rule 5810(c)(3)(A) provides that a failure to meet the Minimum Bid

Price Requirement exists if the deficiency continues for a period

of 30 consecutive trading days. Pursuant to the Nasdaq Listing

Rules, Mainz Biomed were provided with an initial compliance period

of 180 calendar days to regain compliance with the Minimum Bid

Price Requirement. To regain compliance, the closing bid price of

ordinary shares has to be at least $1.00 per share for a minimum of

10 consecutive trading days prior to November 25, 2024.

Additionally, the Company no longer meets the minimum $2,500,000

minimum stockholders’ equity requirement for continued listing on

the Nasdaq Capital Market set forth in Listing Rule 5550(b)(1).

On November 27, 2024, Mainz Biomed received a staff

determination letter (the “Determination Letter”) from Nasdaq

stating that the Company had not regained compliance with the

Minimum Bid Price Requirement by November 25, 2024, and is not

eligible for a second 180-day period The Determination Letter has

no immediate effect on the listing of Mainz Biomed’s ordinary

shares on the Nasdaq Capital Market. The Company intends to shortly

file a hearing request that automatically stays any suspension or

delisting action pending the hearing and the expiration of any

additional extension period granted by the Nasdaq Hearing Panel

(the “Panel”) following the hearing. In that regard, pursuant to

the Nasdaq Listing Rules, the Panel has the authority to grant an

extension not to exceed 180 days from the date of the Determination

Letter.

Please visit Mainz Biomed’s official website for

investors at mainzbiomed.com/investors/ for more

information

Please follow us to stay up to

date:LinkedInX (Previously

Twitter)Facebook

About Mainz Biomed NVMainz Biomed develops

market-ready molecular genetic diagnostic solutions for

life-threatening conditions. The Company’s flagship product is

ColoAlert®, an accurate, non-invasive and easy-to-use,

early-detection diagnostic test for colorectal cancer. ColoAlert®

is marketed across Europe. The Company is currently running a

pivotal FDA clinical study for US regulatory approval. Mainz

Biomed’s product candidate portfolio also includes PancAlert, an

early-stage pancreatic cancer screening test based on real-time

Polymerase Chain Reaction-based (PCR) multiplex detection of

molecular-genetic biomarkers in stool samples. To learn more, visit

mainzbiomed.com or follow us on

LinkedIn,

Twitter and

Facebook.

For media inquiries

MC Services AGAnne Hennecke/Caroline Bergmann+49 211 529252

20mainzbiomed@mc-services.eu

For investor inquiries, please contact

info@mainzbiomed.com

Forward-Looking Statements

Certain statements made in this press release are

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements may be identified by the use of

words such as “anticipate”, “believe”, “expect”, “estimate”,

“plan”, “outlook”, and “project” and other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. These forward-looking statements

reflect the current analysis of existing information and are

subject to various risks and uncertainties. As a result, caution

must be exercised in relying on forward-looking statements. Due to

known and unknown risks, actual results may differ materially from

the Company’s expectations or projections. The following factors,

among others, could cause actual results to differ materially from

those described in these forward-looking statements: (i) the

failure to meet projected development and related targets; (ii)

changes in applicable laws or regulations; (iii) the effect of the

COVID-19 pandemic on the Company and its current or intended

markets; and (iv) other risks and uncertainties described herein,

as well as those risks and uncertainties discussed from time to

time in other reports and other public filings with the Securities

and Exchange Commission (the “SEC”) by the Company. Additional

information concerning these and other factors that may impact the

Company’s expectations and projections can be found in its initial

filings with the SEC, including its annual report on Form 20-F

filed on April 9, 2024. The Company’s SEC filings are available

publicly on the SEC’s website at www.sec.gov. Any forward-looking

statement made by us in this press release is based only on

information currently available to Mainz Biomed and speaks only as

of the date on which it is made. Mainz Biomed undertakes no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise, except as required by law.

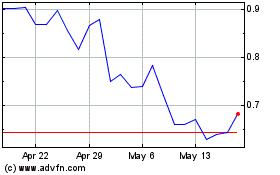

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

From Dec 2023 to Dec 2024