Northern Trust Universe Data: Strong Q3 for U.S. Institutional Investors as Global Markets Continue 2024 Gains

November 07 2024 - 9:15AM

Business Wire

Global equity and fixed income markets had strong performance in

the third quarter, lifting U.S. institutional plan gains across

segments. The Northern Trust All Funds Over $100 Million plan

universe achieved a median return of 4.7% for the quarter, placing

it in the top quartile of returns over the past decade, while

one-year median returns approached 20%.

The Northern Trust Universe tracks the performance of 388 large

U.S. institutional investment plans, with a combined asset value of

more than $1.4 trillion, which subscribe to performance measurement

services as part of Northern Trust's asset servicing offerings.

The Northern Trust Corporate (ERISA) universe produced a median

return of 6.4% for the quarter, while the Northern Trust Foundation

and Endowment (F&E) universe had a median return of 4.2%, and

the Northern Trust Public Funds universe posted a median return of

4.5% for the period ending September 30.

“In the third quarter, the Fed's much-anticipated rate cut was

finally enacted, and institutional investors grew more optimistic

as equity markets climbed, driven by solid corporate earnings and

renewed confidence in the economy's growth,” said John Turney,

Global Head of Total Portfolio Solutions. “The quarter's strong

performance across most sectors has lifted hopes for the future,

painting a picture of resilient market strength.”

U.S. equities experienced strong gains in the third quarter,

with some indices reaching new highs. The Northern Trust U.S.

Equity Program universe produced a 6.3% median return for the third

quarter.

Despite the “Magnificent Seven” leading the U.S. equity market's

18-month rally, mid and small-cap stocks outperformed in the third

quarter. The Russell 1000 Large Cap Index increased by 6.1%, while

the Russell 2000 Small Cap Index rose by 9.3% during the same

period, highlighting the stronger performance of small cap stocks

over large cap stocks.

Strong returns in the fixed income markets were fueled by

actions taken by the Federal Reserve and the European Central Bank

to ease monetary policy by cutting interest rates. The Northern

Trust U.S. Fixed Income program universe median return was 5.0% for

the quarter. The U.S. Ten-Year Government Bond yield fell from

4.47% to 3.73% during the quarter and the U.S. Two-Year Government

Bond yield fell 66 basis points to 3.93%.

The ERISA Plan one, three, and five-year median returns were

18.1%, -0.2%, and 4.3%, respectively. The ERISA Plans’ heavy

allocation to public equity and fixed income contributed to the

outperformance for the quarter relative to other plan segments.

The Public Funds universe median returns for the one, three, and

five-year periods stand at 16.7%, 4.6% and 8.1%, respectively. The

median quarter allocation to U.S. and International Equity are

27.6% and 12.5%, respectively. The median exposure to U.S. Fixed

Income for Public Funds is 22.3%. Strong performance in public

market holdings has led to a slight reduction in the median

allocation for Private Equity, from 13.7% to 13.0%.

The Foundations & Endowments median one, three, and

five-year returns were 17.2%, 4.4% and 9.1%, respectively. The

median allocation to private equity is 21.0%, while the median

allocation to hedge funds is 8.3%.

Results as of September 30, 2024:

3rd Qtr

1Yr

3Yr

5Yr

ERISA

6.4%

18.1%

-0.2%

4.3%

Public Funds

4.5%

16.7%

4.6%

8.1%

Foundations & Endowments

4.2%

17.2%

4.4%

9.1%

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has a global presence

with offices in 24 U.S. states and Washington, D.C., and across 22

locations in Canada, Europe, the Middle East and the Asia-Pacific

region. As of September 30, 2024, Northern Trust had assets under

custody/administration of US$17.4 trillion, and assets under

management of US$1.6 trillion. For more than 135 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit us on

northerntrust.com. Follow us on X (formerly Twitter) @NorthernTrust

or Northern Trust Corporation on LinkedIn.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/terms-and-conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107085700/en/

Media Europe, Middle East, Africa & Asia-Pacific: Camilla

Greene +44 (0) 20 7982 2176 Camilla_Greene@ntrs.com Simon Ansell +

44 (0) 20 7982 1016 Simon_Ansell@ntrs.com US & Canada: John

O’Connell +1 312 444 2388 John_O’Connell@ntrs.com

http://www.northerntrust.com

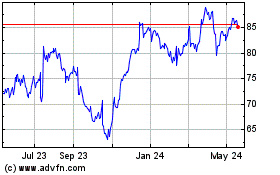

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

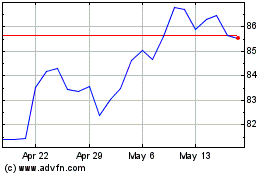

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Jan 2024 to Jan 2025