Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

April 24 2023 - 3:07PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-252145

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 28, 2021)

OBLONG, INC.

SERIES A WARRANTS TO PURCHASE 1,000,000 SHARES OF COMMON STOCK

Under that certain prospectus, dated June 28, 2021 (the “Prospectus”), filed on June 29, 2021 pursuant to Rule 424(b)(5), as part of our registration statement on Form S-3 (File No. 333-252145) filed on January 15, 2021, under which Oblong, Inc. (the “Company”) registered its offering of (i) Series A Warrants (the “Warrants”) to purchase 1,000,000 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) issued by the Company pursuant to the Securities Purchase Agreement, dated June 28, 2021, that was entered into by the Company and each of the selling stockholders (the “Original Investors”) and (ii) 4,000,000 shares of Common Stock, including the 1,000,000 shares of Common Stock underlying the Warrants (the “Warrant Shares”).

This prospectus supplement modifies, supersedes and supplements certain information contained or incorporated by reference in the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement. This prospectus supplement is not complete without, and may only be delivered or utilized in connection with, the Prospectus, including any future amendments or supplements to it. You should read the entire Prospectus and any amendments or supplements carefully before you make an investment decision.

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “OBLG.” The last reported sale price of our Common Stock on April 21, 2023 was $2.57 per share.

Investing in our Common Stock involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have described under the caption “Risk Factors” on page 2 of the Prospectus and in the documents incorporated by reference into the Prospectus and in any amendments or supplements to it.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the Prospectus. Any representation to the contrary is a criminal offense.

WARRANT REPRICE TRANSACTION

As disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 24, 2023 (the “Current Report”), the Company and certain of the Original Investors (the “Participants”) entered into separate warrant repricing letter agreements with the Company, dated as of April 18, 2023 (the “Reprice Letter Agreements”). Pursuant to the Reprice Letter Agreements, each Participant agreed with the Company to exercise their respective Warrants in a cash exercise and the Company agreed with each Participant to amend their respective Warrants to reduce the exercise price per Warrant Share to $1.71. Additionally, the Participants agreed not to sell, transfer or otherwise dispose of any Warrant Shares from April 18, 2023 and through and including April 24, 2023.

Other than the reduction in the per share exercise price for the above-described Warrants, all other terms and provisions of the Warrants remain unchanged. Since not all of the Original Investors participated in the repricing, such non-participating Original Investors’ Warrants will continue to have their exercise price as provided in their Warrants, which as of the date hereof and after adjustments thereof is $60.00. The Company expects to receive aggregate gross proceeds of approximately $113,573 in connection with the exercise of the Warrants.

This prospectus supplement is being filed to update the information in the Prospectus with the information summarized above and contained in the Current Report.

The date of this prospectus supplement is April 24, 2023.

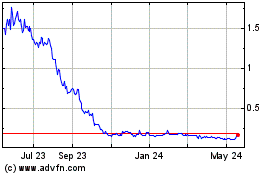

Oblong (NASDAQ:OBLG)

Historical Stock Chart

From Jan 2025 to Feb 2025

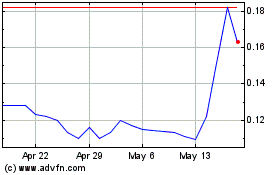

Oblong (NASDAQ:OBLG)

Historical Stock Chart

From Feb 2024 to Feb 2025