Oncocyte Corporation Announces $10.2 Million Private Placement of Securities Priced At-The-Market Under Nasdaq Rules

October 02 2024 - 5:35PM

Oncocyte Corporation (Nasdaq: OCX) (“Oncocyte” or the “Company”), a

diagnostics technology company, today announced that it has entered

into a securities purchase agreement (the “Purchase Agreement”)

with new and existing investors, including Bio-Rad Laboratories,

Inc., one of the Company’s strategic partners. The gross proceeds

to the Company from the private placement are expected to be

approximately $10.2 million, before deducting the placement agent’s

fees and other offering expenses payable by the Company. The

Company intends to use the net proceeds for working capital and

general corporate purposes.

The Purchase Agreement represents the purchase

and sale in a private placement of an aggregate of 3,461,138 shares

of common stock, at a purchase price of $2.948 per share of common

stock. Certain insiders of the Company subscribed for 37,037 of the

shares of common stock sold in the private placement, at a purchase

price of $2.970 per share of common stock. The private placement

was priced “at-the-market” under the rules and regulations of The

Nasdaq Stock Market LLC and is expected to close on or about

October 4, 2024, subject to the satisfaction of customary closing

conditions.

“This funding helps us to continue delivering on

the promise that we made to expand access to organ transplant

rejection testing globally. We are grateful for the support of our

current and new shareholders who share our vision of democratizing

access for transplant patients, transplant centers, and transplant

researchers around the world,” said Oncocyte’s President and Chief

Executive Officer Josh Riggs. “Our team remains committed to

executing on our strategy and creating shareholder value.”

“We are thrilled to have strong support from

both new and existing investors, including our valued corporate

partner, Bio-Rad Laboratories,” said Oncocyte’s Chief Financial

Officer Andrea James. “This offering reflects growing confidence in

our business opportunity and the market potential we are

addressing.”

Needham & Company is acting as the exclusive

placement agent for the private placement.

The securities described above are being offered

and sold in a private placement under Section 4(a)(2) of the

Securities Act of 1933, as amended (the “Act”), and Regulation D

promulgated thereunder, and have not been registered under the Act,

or applicable state securities laws. Accordingly, such securities

issued in the private placement may not be offered or sold in the

United States except pursuant to an effective registration

statement or an applicable exemption from the registration

requirements of the Act and such applicable state securities

laws.

The Company also entered into a registration

rights agreement, dated as of October 2, 2024, by and among the

Company and the investors party thereto (the “Registration Rights

Agreement”), pursuant to which it agreed to file a registration

statement under the Act with the Securities and Exchange Commission

(the “SEC”), covering the resale of the shares of common stock to

be issued in the private placement no later than 15 days following

the date of the Registration Rights Agreement, and to use best

efforts to have the registration statement declared effective as

promptly as practical thereafter, and in any event no later than 30

days following the date of the Registration Rights Agreement (or 45

days following the date of the Registration Rights Agreement in the

event of a “full review” by the SEC).

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or other jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

other jurisdiction.

About Oncocyte

CorporationOncocyte Corporation is a molecular diagnostics

technology company. The Company’s tests are designed to help

provide clarity and confidence to physicians and their patients.

VitaGraft™ is a clinical blood-based solid organ transplantation

monitoring test. GraftAssure™ is a research use only blood-based

solid organ transplantation monitoring test. DetermaIO™ is a gene

expression test that assesses the tumor microenvironment to predict

response to immunotherapies. DetermaCNI™ is a blood-based

monitoring tool for monitoring therapeutic efficacy in cancer

patients.

VitaGraft™, GraftAssure™, DetermaIO™, and DetermaCNI™ are

trademarks of Oncocyte Corporation.

Forward-Looking Statements

This press release contains “forward-looking

statements” made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. All statements

pertaining to the Company’s expectations regarding the completion

of the offering, the satisfaction of customary closing conditions

related to the offering, the intended use of proceeds from the

offering in this press release constitute forward-looking

statements.

These statements may be identified by the use of

forward-looking expressions, including, but not limited to,

“expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,”

“potential,” “predict,” “project,” “should,” “would” and similar

expressions and the negatives of those terms. These statements

relate to future events or our financial performance and involve

known and unknown risks, uncertainties, and other factors, such as

market and other conditions, which may cause actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Such factors include market

conditions, the ability of the Company to satisfy all conditions

precedent to the closing of the private placement, the completion

of the private placement, as well as those set forth in the

Company’s annual, quarterly and current reports (i.e., Form 10-K,

Form 10-Q and Form 8-K) as filed or furnished with the SEC and any

subsequent public filings. Prospective investors are cautioned not

to place undue reliance on such forward-looking statements, which

speak only as of the date of this press release. The Company

undertakes no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events or

otherwise, except as required by law.

Investor Contact:

Jeff RamsonPCG Advisory(646)

863-6893jramson@pcgadvisory.com

Andrea JamesChief Financial Officer,

Oncocyteajames@oncocyte.com

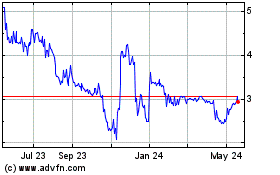

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Dec 2024 to Jan 2025

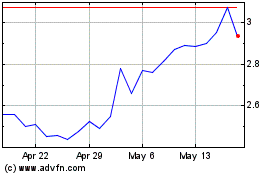

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Jan 2024 to Jan 2025