Processa Pharmaceuticals Provides Product Pipeline and Financial Update

August 28 2024 - 7:00AM

Processa Pharmaceuticals, Inc. (Nasdaq: PCSA) (Processa or the

Company), a clinical-stage pharmaceutical company focused on

developing the next generation of chemotherapeutic drugs with

improved efficacy and safety, provides updates on its product

pipeline, upcoming milestones and business activities, and reports

financial results for the three and six months ended June 30, 2024.

“We made significant progress in advancing our

three development programs year-to-date, with a particular focus on

our lead candidate NGC-Cap,” said George Ng, Chief Executive

Officer of Processa Pharmaceuticals. “Upon receiving FDA clearance

of our NGC-Cap IND application, we initiated a Phase 2 clinical

trial in metastatic breast cancer. We look forward to enrolling

patients in this multicenter, open-label study and expect to have

an initial data readout in mid-2025.”

Key Program UpdatesProcessa is

focused on developing next-generation chemotherapies (NGC) by

improving widely used U.S. Food and Drug Administration

(FDA)-approved oncology drugs to extend a patient’s survival and/or

improve their quality of life. This is achieved by altering how

drugs are metabolized and/or distributed in the body, including how

they reach cancer cells. In addition, Processa utilizes its

Regulatory Science Approach, including the principles associated

with FDA’s Project Optimus Oncology initiative, in the development

of its NGC drug products to achieve a more favorable benefit-risk

profile.

Processa’s updated corporate presentation,

including its product pipeline, is available on the company’s

website.

- PCS6422: Next-Generation

Capecitabine (NGC-Cap)

- NGC-Cap is a combination of PCS6422

and capecitabine, which is the oral prodrug of the cancer drug

5-fluorouracil (5-FU). PCS6422 alters the metabolism of 5-FU,

resulting in more 5-FU distributed to cancer cells.

- In July 2024, the FDA cleared the

Company’s Investigational New Drug application (IND) application

for a Phase 2 trial with NGC-Cap in metastatic or advanced breast

cancer. Subsequently, Processa initiated the Phase 2 study

(NCT06568692) , which is a global, multicenter, open-label,

adaptive design trial comparing two different doses of NGC-Cap to

FDA-approved monotherapy capecitabine in approximately 60 to 90

patients. As agreed to with the FDA, the breast cancer indication

should lead to a more efficient development program while providing

a greater likelihood of approval.

- The NGC-Cap Phase 1b study

evaluated ascending doses of capecitabine when combined with a

fixed dose of PCS6422 in patients with advanced, relapsed or

refractory progressive gastrointestinal cancer. These patients had

to relapse from or fail all other treatments. NGC-Cap demonstrated

greater 5-FU exposure and lower fluoro-beta-alanine (FBAL) exposure

with a better or similar side-effect profile compared with

monotherapy capecitabine, as well as preliminary anti-tumor

activity. In all evaluable patients who received one dose of

PCS6422 and seven days of capecitabine, partial responses or stable

disease was observed in 66.7% (8 out of 12) of patients with

progression-free survival of approximately 5 to 11 months across

these patients.

- In April 2024, Processa presented

an abstract at the American Association for Cancer Research (AACR)

Annual Meeting 2024, including new Phase 1b data on NGC-Cap in

patients with advanced, relapsed or refractory progressive

gastrointestinal cancer. NGC-Cap demonstrated 5-10 times greater

5-FU exposure than monotherapy capecitabine at a significantly

lower dose, along with a favorable safety profile. As such, NGC-Cap

holds potential for improved efficacy in more patients due to a

higher distribution of 5-FU to cancer cells. Further, the extremely

low exposure of FBAL, the primary catabolite formed from the

metabolism of 5-FU, across all NGC-Cap doses resulted in fewer

catabolite-related side effects, with only one patient having Grade

1 hand-foot-syndrome, an FBAL side effect that often requires dose

modifications.

- PCS3117: Next-Generation

Gemcitabine (NGC-Gem)

- NGC-Gem is an oral analog of

gemcitabine (Gemzar®) that is converted to its active metabolite by

a different enzyme system, with potential for a positive response

in gemcitabine patients including those inherently resistant to or

who acquire resistance to gemcitabine.

- Processa is evaluating the

potential of NGC-Gem in patients with pancreatic and other cancers,

as well as ways to identify patients who are more likely to respond

to NGC-Gem than gemcitabine alone. The Company plans to meet with

the FDA in late 2024 or early 2025 to discuss potential trial

designs, including implementation of the Project Optimus

initiative.

- PCS11T: Next-Generation Irinotecan

(NGC-Iri)

- NGC-Iri is an analog of SN38, the

active metabolite of irinotecan, that is expected to have an

improved safety-efficacy profile in every type of cancer where

irinotecan is used.

- As announced

earlier this month, two studies in a human melanoma xenograft mouse

model measured SN-38 in tumors, plasma and other tissues following

administration of NGC-Iri, irinotecan and Onivyde®, the liposomal

formulation of irinotecan. One study compared NGC-Iri with

irinotecan, and the other compared irinotecan with Onivyde®. The

results found that mice administered NGC-Iri had greater

accumulation of SN-38 in the tumor compared with other tissues and

that less SN-38 accumulated in non-cancer tissues, which could lead

to improved efficacy with a more favorable adverse event profile

compared with irinotecan and Onivyde®.

- In April 2024, Processa presented a

second abstract at AACR titled “Application of phase 1 and

pre-clinical data to assist in determining the optimal dosage

regimen for cancer drugs using the principles of Project Optimus.”

This abstract describes the FDA Project Optimus Initiative and

draft optimal dosage regimen (ODR) guidance, which requires an ODR

justified by a dose-ranging efficacy and safety study, as opposed

to a maximum tolerated dose approach. Processa provided NGC-Iri

preclinical study examples to demonstrate how the shape of the

exposure-response relationships for safety and efficacy can be

determined from these pre-clinical studies. By better understanding

the exposure-response relationship earlier in the development

process, defining the recommended dose range and optimal dosage

regimen becomes easier in an efficacy-safety study, in a pivotal

study, and for FDA approval.

- The Company is currently evaluating

the manufacturing process and potential sites for NGC-Iri. In

addition, Processa is defining the potential paths to approval,

which include defining the target patient population and the type

of cancer, with the expectation to conduct IND-enabling toxicology

studies in 2025.

Second Quarter Financial

Results

Research and development expenses for the second

quarter of 2024 were $1.7 million, unchanged from the second

quarter of 2023. General and administrative expenses for the second

quarter of 2024 were $1.4 million, compared with $1.0 million for

the second quarter of 2023, primarily due to an increase in

professional fees.

The net loss for the second quarter of 2024 was

$3.0 million, or $1.01 per share, compared with the net loss for

the second quarter of 2023 of $2.6 million, or $1.94 per share. All

per-share figures reflect a 1-for-20 reverse stock split that was

effective as of January 22, 2024.

Cash and cash equivalents were $5.6 million as

of June 30, 2024.

About Processa Pharmaceuticals, Inc.

Processa is a clinical-stage pharmaceutical

company focused on developing the Next Generation Chemotherapy

(NGC) drugs with improved safety and efficacy. Processa’s NGC drugs

are modifications of existing FDA-approved oncology therapies

resulting in an alteration of the metabolism and/or distribution of

these drugs while maintaining the existing mechanisms of killing

the cancer cells. By combining its novel oncology pipeline with

proven cancer-killing active molecules and its Regulatory Science

Approach, Processa’s strategy is to develop more effective therapy

options with improved tolerability for cancer patients through an

efficient regulatory path.

For more information, visit our website

at www.processapharma.com.

Forward-Looking Statements

This release contains forward-looking

statements. The statements in this press release that are not

purely historical are forward-looking statements which involve

risks and uncertainties. Actual future performance outcomes and

results may differ materially from those expressed in

forward-looking statements. Please refer to the documents filed by

Processa Pharmaceuticals with the SEC, specifically the most recent

reports on Forms 10-K and 10-Q, which identify important risk

factors which could cause actual results to differ from those

contained in the forward-looking statements.

Company Contact:Patrick

Lin(925) 683-3218plin@processapharma.com

Investor Relations

Contact:Yvonne BriggsLHA Investor Relations(310)

691-7100ybriggs@lhai.com

[Financial Tables to follow]PROCESSA

PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, except share

information) (unaudited)

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,571 |

|

|

$ |

4,706 |

|

|

Prepaid expenses and other |

|

|

1,907 |

|

|

|

926 |

|

|

Total Current Assets |

|

|

7,478 |

|

|

|

5,632 |

|

|

|

|

|

|

|

|

|

|

|

|

Property and Equipment, net |

|

|

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets |

|

|

|

|

|

|

|

|

|

Lease right-of-use assets, net of accumulated amortization |

|

|

115 |

|

|

|

146 |

|

|

Security deposit |

|

|

6 |

|

|

|

6 |

|

|

Total Other Assets |

|

|

121 |

|

|

|

152 |

|

|

Total Assets |

|

$ |

7,601 |

|

|

$ |

5,787 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Current maturities of lease liabilities |

|

$ |

93 |

|

|

$ |

84 |

|

|

Accounts payable |

|

|

953 |

|

|

|

312 |

|

|

Due to licensor |

|

|

- |

|

|

|

189 |

|

|

Due to related parties |

|

|

- |

|

|

|

- |

|

|

Accrued expenses |

|

|

505 |

|

|

|

146 |

|

|

Total Current Liabilities |

|

|

1,551 |

|

|

|

731 |

|

|

Non-current Liabilities |

|

|

|

|

|

|

|

|

|

Non-current lease liabilities |

|

|

26 |

|

|

|

67 |

|

|

Total Liabilities |

|

|

1,577 |

|

|

|

798 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Common stock, par value $0.0001, 100,000,000 shares authorized:

2,873,883 issued and 2,868,883 outstanding at June 30, 2024; and

1,291,000 issued and 1,286,000 outstanding at December 31,

2023 |

|

|

1 |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

87,429 |

|

|

|

80,658 |

|

|

Treasury stock at cost — 5,000 shares at June 30, 2024 and December

31, 2023 |

|

|

(300 |

) |

|

|

(300 |

) |

|

Accumulated deficit |

|

|

(81,106 |

) |

|

|

(75,369 |

) |

|

Total Stockholders’ Equity |

|

|

6,024 |

|

|

|

4,989 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

7,601 |

|

|

$ |

5,787 |

|

PROCESSA PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except per share

data)(unaudited)

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

$ |

1,730 |

|

|

$ |

1,688 |

|

|

$ |

3,270 |

|

|

$ |

3,343 |

|

|

General and administrative expenses |

|

|

1,352 |

|

|

|

1,026 |

|

|

|

2,622 |

|

|

|

3,477 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Loss |

|

|

(3,082 |

) |

|

|

(2,714 |

) |

|

|

(5,892 |

) |

|

|

(6,820 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense),

net |

|

|

72 |

|

|

|

102 |

|

|

|

155 |

|

|

|

185 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Operating Loss Before

Income Tax Benefit |

|

|

(3,010 |

) |

|

|

(2,612 |

) |

|

|

(5,737 |

) |

|

|

(6,635 |

) |

| Income Tax Benefit |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(3,010 |

) |

|

$ |

(2,612 |

) |

|

$ |

(5,737 |

) |

|

$ |

(6,635 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss per Common Share -

Basic and Diluted |

|

$ |

(1.01 |

) |

|

$ |

(1.94 |

) |

|

$ |

(2.11 |

) |

|

$ |

(5.34 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Common Shares

Used to Compute Net Loss Applicable to Common Shares - Basic and

Diluted |

|

|

2,983,283 |

|

|

|

1,346,808 |

|

|

|

2,724,903 |

|

|

|

1,243,475 |

|

# # #

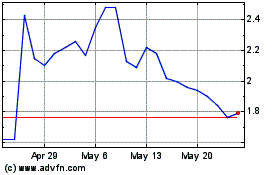

Processa Pharmaceuticals (NASDAQ:PCSA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Processa Pharmaceuticals (NASDAQ:PCSA)

Historical Stock Chart

From Feb 2024 to Feb 2025