MOUNTAINSEED AND PLUMAS BANCORP ANNOUNCE SALE-LEASEBACK TRANSACTION

February 15 2024 - 8:00AM

Plumas Bancorp (Nasdaq: PLBC), the parent company of Plumas Bank,

and MountainSeed are proud to announce a sale-leaseback deal valued

at approximately $25.7 million. This transaction, which was

completed on February 14, 2024, further exemplifies MountainSeed’s

continued focus on sale-leaseback transactions and the advantages

that this strategy affords community banks and credit unions.

MountainSeed Real Estate Services acquired nine properties

operated as branches from Plumas Bank and leased each property back

to the bank for a 15-year lease term. Plumas Bank will continue to

operate the branch offices as usual.

MountainSeed and Plumas Bank have agreed to complete a second

sale-and-leaseback transaction for three additional Plumas Bank

properties. The sale is expected to be completed in March 2024.

“We are thrilled to work with Plumas Bank, and our capital

markets team’s momentum is off to a strong start in 2024. In this

specific transaction, the strategy is expected to improve the

Bank’s earnings profile and increase their book value in a

meaningful way. Everyone on their team has been a pleasure to work

with throughout the process, and we are excited for a long-term

relationship with such a well-run bank,” stated Patrick Roberts,

Chief Revenue Officer at MountainSeed.

“This sale-leaseback transaction will result in significant

benefits to both our shareholders and the communities that we

serve,” said Andrew J. Ryback, Director, President and CEO of

Plumas Bank and Plumas Bancorp. “The gains that we’ll generate

from the transaction will be used to offset unrealized losses in

our investment portfolio upon the restructuring of a portion of our

portfolio. The restructure will result in higher yields and

interest income streams for years to come while increasing our book

value per share in the current period.” Ryback added, “For our

communities, this transaction commits us to serving them for the

long term — 15 years with an option for 15

more. MountainSeed’s expertise helped to facilitate a powerful

sales-leaseback transaction which supports our long-term

objectives.”

###

About MountainSeedMountainSeed acts as a beacon

of trust and innovation in the real estate and banking industries,

serving as a partner to over 600 community banks and credit unions

across 50 states. MountainSeed has become the most active acquirer

of bank branches through sale-leaseback transactions. In addition,

the company processes over $5 billion in commercial real estate

transactions monthly, offering expertise to clients in the

commercial real estate and lending industries. Their tech-enabled

business provides clients access to a marketplace of products,

services, and real estate data.

About Plumas Bank and Plumas Bancorp Plumas

Bank is a subsidiary of Plumas Bancorp (NASDAQ: PLBC), a bank

holding company headquartered in Reno, Nevada. Plumas Bank is a

locally managed, award-winning community bank founded in 1980 and

headquartered in Quincy, California. With 15 branch offices in

Northeastern California and Northern Nevada, and loan production

offices in California and southern Oregon, Plumas Bank is one of

the top performing community banks in the country. For more

information regarding Plumas Bancorp and Plumas Bank, visit

plumasbank.com.

This news release includes forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Exchange Act of 1934, as amended and Plumas

Bancorp intends for such forward-looking statements to be covered

by the safe harbor provisions for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

Future events are difficult to predict, and the expectations

described above are necessarily subject to risk and uncertainty

that may cause actual results to differ materially and

adversely.

Forward-looking statements can be identified by the fact that

they do not relate strictly to historical or current facts. They

often include the words "believe," "expect," "anticipate,"

"intend," "plan," "estimate," or words of similar meaning, or

future or conditional verbs such as "will," "would," "should,"

"could," or "may" and include, among others, statements regarding

future sales of Plumas Bank’s properties and the financial impacts

of the sale and leaseback transactions. These forward-looking

statements are not guarantees of future performance, nor should

they be relied upon as representing management's views as of any

subsequent date. Forward-looking statements involve significant

risks and uncertainties, and actual results may differ materially

from those presented, either expressed or implied, in this news

release. Factors that might cause such differences include, but are

not limited to: The possibility that additional sales of real

estate may be delayed or may not occur based on the results of

MountainSeed’s due diligence or other factors, Plumas Bancorp’s

ability to successfully execute its business plans and achieve its

objectives; general economic and financial market conditions,

either nationally or locally in areas in which Plumas Bancorp

conducts its operations; changes in interest rates; continuing

consolidation in the financial services industry; new litigation or

changes in existing litigation; increased competitive challenges

and expanding product and pricing pressures among financial

institutions; legislation or regulatory changes which adversely

affect Plumas Bancorp’s operations or business; loss of key

personnel; and changes in accounting policies or procedures as may

be required by the Financial Accounting Standards Board or other

regulatory agencies and other risk factors described in the Plumas

Bancorp’s filings with the Securities and Exchange Commission,

including the Form 10-K for the year ended December 31, 2022 and

the Form 8-K filed on February 15, 2023.

For further information or inquiries, please contact:

Patrick Roberts, Chief Revenue Officer, MountainSeed

Email: proberts@mountainseed.com

Phone: 404-710-9642

Jamie Huynh, Investor Relations, Plumas Bancorp

investorrelations@plumasbank.com

775.786.0907 x8908

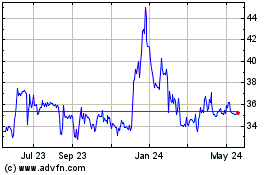

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Dec 2024 to Jan 2025

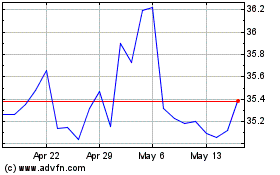

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Jan 2024 to Jan 2025