As

filed with the Securities and Exchange Commission on August 13, 2021

Registration

No. -

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Protagenic

Therapeutics, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

06-1390025

|

(State

or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S.

Employer

Identification Number)

|

149

Fifth Avenue

New

York, New York 10010

212-994-8200

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Garo

Armen

Executive

Chairman

Protagenic

Therapeutics, Inc.

149

Fifth Avenue

New

York, New York 10010

212-994-8200

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies

to:

Dean

M. Colucci, Esq.

Michelle

Geller, Esq.

Kelly

R. Carr, Esq.

Duane

Morris LLP

1540

Broadway

New

York, New York 10036

Telephone:

(973) 424-2020

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following

box. [ ]

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

[ ]

|

Accelerated

filer

|

[ ]

|

|

|

|

|

|

|

Non-accelerated

filer

|

[ ]

|

Smaller

reporting company

|

[X]

|

|

|

|

|

|

|

|

|

Emerging

growth company

|

[ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be Registered(1)

|

|

|

Proposed Maximum Offering Price Per Security(2)

|

|

|

Proposed Maximum Aggregate Offering Price

|

|

|

Amount of Registration Fee

|

|

|

Common Stock, $0.0001 par value per share

|

|

|

6,801,607

|

|

|

$

|

1.93

|

|

|

$

|

13,127,101.51

|

|

|

$

|

1,432.17

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933 (the “Securities Act”), the Registrant is also registering hereunder an

indeterminate number of additional shares of common stock that shall be issuable to prevent dilution resulting from stock splits,

stock dividends or similar transactions.

|

|

(2)

|

Estimated

in accordance with Rule 457(c) solely for purposes of calculating the registration fee. The maximum price per Security and the maximum

aggregate offering price are based on the average of the $2.00 (high) and $1.86 (low) sale price of the Registrant's common stock

as reported on the Nasdaq on 08/12/2021, which date is within five business days prior to filing this Registration Statement.

|

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED August 13, 2021

PROSPECTUS

6,801,607

Shares of Common Stock Offered by Selling Stockholders

This

prospectus relates to the offer and sale of 6,801,607 shares of common stock par value $0.0001 per share for the account of the

selling stockholders named in this prospectus. All of these shares of common stock are being sold by the selling stockholders named in

this prospectus, or their respective pledgees, donees, assignees, transferees and successors-in-interest.

The

shares of common stock described in this prospectus or in any supplement to this prospectus may be sold from time to time pursuant to

this prospectus by the selling stockholders in ordinary brokerage transactions, in transactions in which brokers solicit purchases, in

negotiated transactions, or in a combination of such methods of sale, at fixed prices, at market prices prevailing at the time of sale,

at prices related to such prevailing market prices, at varying prices determined at the time of sale, or at negotiated prices. See “Selling

Stockholders” and “Plan of Distribution.” We cannot predict when or in what amounts a selling stockholder may sell

any of the shares offered by this prospectus.

We

are not selling any shares of our common stock, and we will not receive any of the proceeds from the sale of shares by the selling stockholders.

The selling stockholders will pay all brokerage fees and commissions and similar sale-related expenses. We are only paying expenses relating

to the registration of the shares with the U.S. Securities and Exchange Commission.

A

supplement to this prospectus may add, update or change information contained in this prospectus. You should read this prospectus and

any prospectus supplement, together with the documents we incorporate by reference, carefully before you invest.

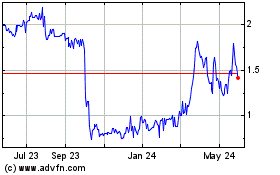

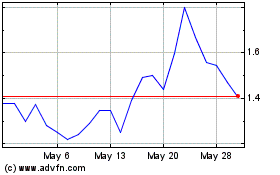

Our

common stock is listed on the Nasdaq Capital Market under the symbol “PTIX” and our Warrants are listed on the Nasdaq Capital

Market under the symbol “PTIXW.” On August 12, 2021, the last reported sales price for our common stock was $1.93

per share.

An

investment in our securities involves a high degree of risk. See the sections entitled “Risk Factors” in our most

recent Annual Report on Form 10-K and in any Quarterly Report on Form 10-Q, as well as in any prospectus supplement related to these

specific offerings.

This

prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is August 13, 2021

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we have filed with the U.S. Securities and Exchange Commission (the “SEC”)

utilizing a “shelf” registration process. Under this shelf registration process, the selling stockholders named in this prospectus

or any supplement to this prospectus may sell the securities described in this prospectus in one or more offerings. This prospectus provides

you with a general description of the securities. The selling stockholders are required to provide you with this prospectus and, in certain

cases, a prospectus supplement containing specific information about the selling stockholders and the terms upon which the securities

are being offered. A prospectus supplement may also add to, update or change the information contained in this prospectus. If there is

any inconsistency between the information in this prospectus and any applicable prospectus supplement, you should rely on the information

in the applicable prospectus supplement. Please carefully read this prospectus, any applicable prospectus supplement and any free writing

prospectus together with the additional information described under the headings “Where You Can Find More Information” and

“Information Incorporated by Reference.”

We

and the selling stockholders have not authorized anyone to provide any information or to make any representations other than those contained

in this prospectus or incorporated by reference in this prospectus. We and the selling stockholders take no responsibility for, and can

provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information

in this prospectus is accurate as of any date other than the date on the cover page of this prospectus or that any information we have

incorporated by reference is accurate as of any date other than the date of the documents incorporated by reference. Our business, financial

condition, results of operations and prospects may have changed since those dates.

In

this prospectus, unless otherwise indicated, “our company,” “Protagenic,” “we,” “us”

or “our” refer to Protagenic Therapeutics, Inc., a Delaware corporation, and its consolidated subsidiaries.

PROSPECTUS

SUMMARY

This

prospectus summary highlights certain information about our company and other information contained elsewhere in this prospectus or in

documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment

decision. You should carefully read the entire prospectus, any prospectus supplement, including the section entitled “Risk Factors”

and the documents incorporated by reference into this prospectus, before making an investment decision.

The

Company

We

are a biopharmaceutical corporation specializing in the discovery and development of therapeutics to treat stress-related neuropsychiatric

and mood disorders utilizing synthetic forms of endogenous brain signaling peptides that can dampen overactive stress responses.

The

mechanism by which we will target these stress-related disorders is based on over 15 years of work elucidating the role of Teneurin Carboxy-terminal

Associated Peptide (“TCAP”), which has been found to have a central role in maintaining healthy brain signaling. TCAP is

an endogenous counterbalance to the negative effects of stress and its criticality is underscored by a high degree of evolutionarily

preservation. TCAP signaling counteracts the effects of Corticotropin Releasing Factor on the Hypothalamic-Pituitary-Adrenal axis, thus

reducing the stress hormone cortisol. We intend to bring novel forms of TCAP into human clinical development as a treatment for stress-related

neuropsychiatric disorders. Our lead compound – PT00114 – is a 41-residue peptide synthetic form of TCAP that can be administered

subcutaneously, sublingually, or intra-nasally. In addition, we have a portfolio of earlier stage neuropeptides targeting the TCAP pathway

that are in preclinical evaluation.

Our

strategy is to develop TCAP neuropeptide-based drug candidates, beginning with PT00114, in stress-related indications, including, but

not limited to: treatment resistant depression (“TRD”), which is a subgroup of major depressive disorder (“MDD”);

addiction, recidivism, or substance use disorder (“SUD”); anxiety, including generalized anxiety disorder (“GAD”),

and post-traumatic stress disorder (“PTSD”).

Corporate

Information

We

are a Delaware corporation with one subsidiary, Protagenic Therapeutics Canada (2006) Inc., a corporation formed in 2006 under the laws

of the Province of Ontario, Canada. Our principal offices are located at 149 Fifth Avenue, New York, New York 10010. Our telephone number

is (212) 994-8200. The inclusion of our website address does not include or incorporate by reference into this prospectus supplement

or the accompanying prospectus any information on, or accessible through, our website. Our annual reports on Form 10-K, quarterly reports

on Form 10-Q and current reports on Form 8-K, together with amendments to these reports, are available on the “Investor Relations”

section of our website, free of charge, as soon as reasonably practicable after such material is electronically filed with, or furnished

to, the U.S. Securities and Exchange Commission (“SEC”).

This

Offering

We

are registering for resale by the selling stockholders named herein an aggregate shares of our Common Stock as described below.

|

Issuer:

|

|

Protagenic

Therapeutics, Inc

|

|

|

|

|

|

Securities

being offered:

|

|

6,801,607 shares

of our Common Stock

|

|

|

|

|

|

Use

of proceeds:

|

|

We

will not receive any of the proceeds from the sale or other disposition of shares of our Common Stock by the selling stockholders.

The selling stockholders will bear all selling and other expenses incurred in connection with the sale or other disposition by them

of the shares covered hereby.

|

|

|

|

|

|

Market

for common stock:

|

|

Our

Common Stock is listed on the Nasdaq Capital Market under the symbol “PTIX.” On August , 2021, the closing price

of our Common Stock was $1.93 per share.

|

|

|

|

|

|

Risk

factors:

|

|

See

“Risk Factors“ beginning on page for risks you should consider before investing in our shares.

|

RISK

FACTORS

Investing

in our securities involves risk. The prospectus supplement applicable to a particular offering of securities will contain a discussion

of the risks applicable to an investment in Protagenic and to the particular types of securities that we are offering under that prospectus

supplement. Before making an investment decision, you should carefully consider the risks described under “Risk Factors”

in the applicable prospectus supplement and the risks described in our most recent Annual Report on Form 10-K for the year ended December

31, 2020, as amended from time to time, which is incorporated herein by reference, or any updates in our Quarterly Reports on Form 10-Q,

together with all of the other information appearing in or incorporated by reference into this prospectus and any applicable prospectus

supplement, in light of your particular investment objectives and financial circumstances. Our business, financial condition or results

of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to

any of these risks, and you may lose all or part of your investment.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

or Securities Act, and Section 21E of the Securities Exchange Act of 1934, or Exchange Act. Forward-looking statements reflect the current

view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,”

“expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions,

as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements

contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook.

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future

conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes

in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking

statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore

against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from

those in the forward-looking statements include, without limitation, the results of clinical trials and the regulatory approval process;

our ability to raise capital to fund continuing operations; market acceptance of any products that may be approved for commercialization;

our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought against us;

competition from other providers and products; our ability to develop and commercialize new and improved products and services; changes

in government regulation; our ability to complete capital raising transactions; and other factors (including the risks contained in the

section entitled “Risk Factors” of the applicable prospectus supplement) relating to our industry, our operations and results

of operations. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect,

actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors

or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of

them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including

the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements

to actual results.

DIVIDEND

POLICY

We

have never paid any cash dividends on our common stock. We anticipate that we will retain funds and future earnings to support operations

and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future

following this offering, if at all. Any future determination to pay dividends will be at the discretion of our board of directors and

will depend on our financial condition, results of operations, capital requirements and other factors that our board of directors deems

relevant. In addition, the terms of any future debt or credit financings may preclude us from paying dividends.

USE

OF PROCEEDS

We

will not receive any of the proceeds from the sale of any shares of common stock offered by the selling stockholders under this prospectus.

Any proceeds from the sale of shares of common stock under this prospectus will be received by the selling stockholders. We are required

to pay certain offering fees and expenses in connection with the registration of the selling stockholders’ securities and to indemnify

the selling stockholders against certain liabilities. Please see “Selling Stockholders” for a list of the persons receiving

proceeds from the sale of the common stock covered by this prospectus.

SELLING

STOCKHOLDERS

The

following table sets forth information as of July 31, 2021 about the beneficial ownership of our common stock by the selling stockholders

both before and immediately after the offering.

Except

as otherwise noted in the table below, each of the Selling Stockholders acquired the shares being offering in connection with offerings

exempt from registration under the Securities Act in 2016 or earlier. Of those shares that were not issued in exempt sales in 2016 and

earlier, 79,500 shares of common stock were issued to the underwriters as restricted stock following our April 26, 2021 offering of common

stock (“April 26 Offering”) as part of the underwriting compen sation.

We

believe, based on the information furnished to us, that the selling stockholders have sole voting and investment power with respect to

all of the shares of common stock reported, subject to community property laws where applicable, unless otherwise indicated.

The

percent of beneficial ownership for the selling stockholders is based on 16,339,649 shares of common stock issued and outstanding

as of July 31, 2021. Unless otherwise stated in the footnotes to the table below and the information incorporated herein by reference,

to our knowledge.

Pursuant

to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares of our common stock as to which a stockholder

has sole or shared voting power or investment power, and also any shares of our common stock which the stockholder has the right to acquire

within 60 days, including upon exercise of stock options or other rights to purchase shares of our common stock.

Because

each selling security holder may dispose of all, none or some portion of their securities, no estimate can be given as to the number

of securities that will be beneficially owned by a selling security holder upon termination of this offering. Please read “Plan

of Distribution.” For purposes of the table below, however, we have assumed that after termination of this offering none of the

securities covered by this prospectus will be beneficially owned by the selling security holders and further assumed that the selling

security holders will not acquire beneficial ownership of any additional securities during the offering. In addition, the selling security

holders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time

to time, our securities in transactions exempt from the registration requirements of the Securities Act after the date on which the information

in the table is presented.

The

shares of common stock being offered pursuant to this prospectus may be offered for sale from time to time during the period the registration

statement of which this prospectus is a part remains effective, by or for the account of the selling stockholders. After the date of

effectiveness, the selling stockholders may have sold or transferred, in transactions covered by this prospectus or in transactions exempt

from the registration requirements of the Securities Act, some or all of their common stock. We may amend or supplement this prospectus

from time to time in the future to update or change this selling security holders list and the securities that may be resold.

Except

as described below, the selling stockholders are neither broker-dealers nor affiliates, as defined in Rule 405, of broker-dealers.

|

Name of selling stockholder

|

|

Shares beneficially owned prior to this offering(1)

|

|

|

Shares to be offered by this

|

|

|

Shares beneficially owned after this offering

|

|

|

|

|

Number

|

|

|

Percentage

|

|

|

prospectus

|

|

|

Number

|

|

|

Percentage

|

|

|

Garo H. Armen(2)(3)**

|

|

|

2,546,012

|

|

|

|

15.6

|

%

|

|

|

2,546,012

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Remik Hartounian**

|

|

|

442,194

|

|

|

|

2.7

|

%

|

|

|

442,194

|

|

|

|

—

|

|

|

|

—

|

%

|

|

University of Toronto(4)**

|

|

|

271,200

|

|

|

|

1.7

|

%

|

|

|

271,200

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Mark Berg**

|

|

|

255,000

|

|

|

|

1.6

|

%

|

|

|

255,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Greg Ekizian**

|

|

|

225,000

|

|

|

|

1.4

|

%

|

|

|

225,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Larry N. Feinberg**

|

|

|

200,000

|

|

|

|

1.2

|

%

|

|

|

200,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Denis J. Hickey**

|

|

|

200,000

|

|

|

|

1.2

|

%

|

|

|

200,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

William Kachioff**

|

|

|

187,986

|

|

|

|

1.2

|

%

|

|

|

187,986

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Nicole Berg**

|

|

|

167,194

|

|

|

|

1.0

|

%

|

|

|

167,194

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Louis Sanzo**

|

|

|

150,000

|

|

|

|

0.9

|

%

|

|

|

150,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Richard Pashayan**

|

|

|

150,000

|

|

|

|

0.9

|

%

|

|

|

150,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

David Lovejoy(3) **

|

|

|

148,800

|

|

|

|

0.9

|

%

|

|

|

148,800

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Richard & Christine Payne**

|

|

|

120,000

|

|

|

|

0.7

|

%

|

|

|

120,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Alexander K. Arrow(3) **

|

|

|

118,260

|

|

|

|

0.7

|

%

|

|

|

118,260

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Khajak Keledjian**

|

|

|

100,000

|

|

|

|

0.6

|

%

|

|

|

100,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Timothy McInerney**

|

|

|

100,000

|

|

|

|

0.6

|

%

|

|

|

100,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

SRAX, Inc. (5)**

|

|

|

99,061

|

|

|

|

*

|

%

|

|

|

99,061

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Dasa Sada, LLC**

|

|

|

80,000

|

|

|

|

*

|

%

|

|

|

80,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Neil Vaccaro**

|

|

|

80,000

|

|

|

|

*

|

%

|

|

|

80,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Joseph Perri**

|

|

|

80,000

|

|

|

|

*

|

%

|

|

|

80,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Carmine Sanzo**

|

|

|

75,000

|

|

|

|

*

|

%

|

|

|

75,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Kevin McColl**

|

|

|

72,000

|

|

|

|

*

|

%

|

|

|

72,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Daniel Vaccaro**

|

|

|

60,000

|

|

|

|

*

|

%

|

|

|

60,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Robert Caswell**

|

|

|

56,000

|

|

|

|

*

|

%

|

|

|

56,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Khalil Barrage(2) **

|

|

|

50,000

|

|

|

|

*

|

%

|

|

|

50,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Sharon Crowder**

|

|

|

50,000

|

|

|

|

*

|

%

|

|

|

50,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Anthony Venditti**

|

|

|

50,000

|

|

|

|

*

|

%

|

|

|

50,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Brandt Mandia**

|

|

|

40,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Prieur, C. James & Karen Ann Prieur, JTWROS**

|

|

|

40,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Robin Rosenthal**

|

|

|

40,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Lillian Tom**

|

|

|

40,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Michael Collado**

|

|

|

40,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Gregory Pappas**

|

|

|

40,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Robert Petrozzo

|

|

|

40,000

|

|

|

|

*

|

%

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Alan Young**

|

|

|

35,000

|

|

|

|

*

|

%

|

|

|

35,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Thomas Halling**

|

|

|

32,400

|

|

|

|

*

|

%

|

|

|

32,400

|

|

|

|

—

|

|

|

|

—

|

%

|

|

David

W. Boral (6)***

|

|

|

32,198

|

|

|

|

*

|

%

|

|

|

32,198

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Joseph

T. Rallo (6)***

|

|

|

32,197

|

|

|

|

*

|

%

|

|

|

32,197

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Carol Haggerty**

|

|

|

25,000

|

|

|

|

*

|

%

|

|

|

25,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Patricia Sorbara**

|

|

|

31,000

|

|

|

|

*

|

%

|

|

|

31,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

John Moraitis**

|

|

|

25,000

|

|

|

|

*

|

%

|

|

|

25,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Dean Glasser**

|

|

|

25,000

|

|

|

|

*

|

%

|

|

|

25,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Robert G. Jeffers**

|

|

|

25,000

|

|

|

|

*

|

%

|

|

|

25,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Stephen Dinicolantonio**

|

|

|

25,000

|

|

|

|

*

|

%

|

|

|

25,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Thomas D. Paul**

|

|

|

25,000

|

|

|

|

*

|

%

|

|

|

25,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Gordon Wong**

|

|

|

20,000

|

|

|

|

*

|

%

|

|

|

20,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Martin & Claudia Toner, JTWROS**

|

|

|

20,000

|

|

|

|

*

|

%

|

|

|

20,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Dalia Barsyte(3) **

|

|

|

10,000

|

|

|

|

*

|

%

|

|

|

10,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Jennifer Mandia**

|

|

|

10,000

|

|

|

|

*

|

%

|

|

|

10,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Benchmark Investments, LLC(7)***

|

|

|

7,155

|

|

|

|

*

|

%

|

|

|

7,155

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Patrick Sturgeon (8)***

|

|

|

3,200

|

|

|

|

*

|

%

|

|

|

3,200

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Michael Fontaine (8)***

|

|

|

1,250

|

|

|

|

*

|

%

|

|

|

1,250

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Graham Powis (8)***

|

|

|

1,250

|

|

|

|

*

|

%

|

|

|

1,250

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Robert Donohue (8)***

|

|

|

1,000

|

|

|

|

*

|

%

|

|

|

1,000

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Reilly Simmons (8)***

|

|

|

500

|

|

|

|

*

|

%

|

|

|

500

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Max Breckenridge (8)***

|

|

|

750

|

|

|

|

*

|

%

|

|

|

750

|

|

|

|

—

|

|

|

|

—

|

%

|

|

|

* Represents less than 0.5%.

** Subject to contractual lock-up until October 23, 2021

*** Subject to contractual lock-up until April 24, 2022

|

(1)

|

Beneficial

ownership is determined in accordance with Rule 13d-3 under the Exchange Act.

|

|

(2)

|

Member

of the Company’s board of directors.

|

|

(3)

|

Member

of the Company’s management team.

|

|

(4)

|

The

selling shareholder, University of Toronto, is the registered owner of shares of common stock. The jurisdiction of the selling shareholder

is Canada. Jennifer Frazer has voting and investment power over the shares of common

stock.

|

|

(5)

|

The

selling shareholder, SRAX, Inc., is the registered owner of shares of common stock. The jurisdiction of the selling shareholder is

the United States. Christopher Miglino has voting and investment power over the shares of common stock. The selling

shareholder received the common stock offered in this offering in 2020 as payment in kind for services rendered.

|

|

(6)

|

The

selling stockholder is an employee of EF Hutton, Division of Benchmark Investments, Inc., which is a registered broker-dealer that

acted as sole bookrunning manager in the April 26Offering.

|

|

(7)

|

The

selling stockholder is an affiliate of EF Hutton, Division of Benchmark Investments, Inc., which is a registered broker-dealer that

acted as sole bookrunning manager in the April 26Offering.

|

|

(8)

|

The

selling stockholder is an employee of Brookline Capital Markets, a division of Arcadia Securities, LLC, which is a registered

broker-dealer that acted as an underwriter in the April 26Offering.

|

DESCRIPTION

OF CAPITAL STOCK

The

following is a description of our Common Stock, $0.0001 par value (the “Common Stock”) and Preferred Stock, $0.000001 par

value (the “Preferred Stock”). The Common Stock is the only security of the Company registered pursuant to Section 12 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We

are authorized to issue is 120,000,000 shares of all classes of capital stock, of which 100,000,000 shares are Common Stock, $0.001 par

value per share, and 20,000,000 shares are Preferred Stock, $0.000001 par value per share. Our capital is stated in U.S. dollars. As

of July 31, 2021, we had 16,339,649 outstanding shares of Common Stock.

Common

Stock

Voting.

The holders of our common stock are entitled to one vote for each share held of record on all matters on which the holders are entitled

to vote (or consent pursuant to written consent).

Dividends.

The holders of our common stock are entitled to receive, ratably, dividends only if, when and as declared by our board of directors out

of funds legally available therefor and after provision is made for each class of capital stock having preference over the common stock.

We have never declared or paid dividends. We do not intend to pay cash dividends on our common stock for the foreseeable future, but

currently intend to retain any future earnings to fund the development and growth of our business. The payment of dividends if any, on

our common stock will rest solely within the discretion of our board of directors and will depend, among other things, upon our earnings,

capital requirements, financial condition, and other relevant factors.

Liquidation

Rights. In the event of our liquidation, dissolution or winding-up, the holders of our common stock are entitled to share, ratably,

in all assets remaining available for distribution after payment of all liabilities and after provision is made for each class of capital

stock having preference over the common stock.

Conversion

Rights. The holders of our common stock have no conversion rights.

Preemptive

and Similar Rights. The holders of our common stock have no preemptive or similar rights.

Redemption/Put

Rights. There are no redemption or sinking fund provisions applicable to the common stock. All of the outstanding shares of our

common stock are fully-paid and non-assessable.

Preferred

Stock

Under

the terms of our Third Amended and Restated Certificate of Incorporation, our board of directors have the authority, without further

action by our stockholders, to issue up to 20,000,000 shares of Preferred Stock in one or more series, to establish from time to time

the number of shares to be included in each such series, to fix the rights, preferences and privileges of the shares of each wholly unissued

series and any qualifications, limitations or restrictions thereon, and to increase or decrease the number of shares of any such series,

but not below the number of shares of such series then outstanding. The powers, preferences and relative, participating, optional and

other special rights of each series of Preferred Stock, and the qualifications, limitations or restrictions thereof, if any, may differ

from those of any and all other series at any time outstanding.

Our

board of directors may authorize the issuance of Preferred Stock with voting or conversion rights that could adversely affect the voting

power or other rights of the holders of our Common Stock. The purpose of authorizing our board of directors to issue Preferred Stock

and determine its rights and preferences is to eliminate delays associated with a stockholder vote on specific issuances. The issuance

of Preferred Stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other

things, have the effect of delaying, deferring or preventing a change in control of us and may adversely affect the market price of our

Common Stock and the voting and other rights of the holders of our Common Stock. It is not possible to state the actual effect of the

issuance of any shares of Preferred Stock on the rights of holders of Common Stock until the board of directors determines the specific

rights attached to that Preferred Stock.

Anti-Takeover

Effect of Delaware Law, Certain Charter and Bylaw Provisions

In

addition to the provisions included in our Third Amended and Restated Certificate of Incorporation and Bylaws, we are subject to the

provisions of Section 203 of the General Corporation Law of the State of Delaware, an anti-takeover law. In general, Section 203 prohibits

a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder”

for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business

combination is approved in the following prescribed manner:

|

|

●

|

prior

to the time of the transaction, the board of directors of the corporation approved either the business combination or the transaction

which resulted in the stockholder becoming an interested stockholder;

|

|

|

|

|

|

|

●

|

upon

completion of the transaction that resulted in the stockholder becoming an interested stockholder, the stockholder owned at least

85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining

the number of shares outstanding (1) shares owned by persons who are directors and also officers and (2) shares owned by employee

stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan

will be tendered in a tender or exchange offer; and

|

|

|

|

|

|

|

●

|

on

or subsequent to the time of the transaction, the business combination is approved by the

board and authorized at an annual or special meeting of stockholders, and not by written

consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which

is not owned by the interested stockholder.

|

Generally,

for purposes of Section 203, a “business combination” includes a merger, asset or stock sale, or other transaction resulting

in a financial benefit to the interested stockholder. An “interested stockholder” is a person who, together with affiliates

and associates, owns or, within three years prior to the determination of interested stockholder status, owned 15% or more of a corporation’s

outstanding voting securities.

Transfer

Agent and Registrar

American

Stock Transfer & Trust Company, LLC is the transfer agent and registrar for our common stock.

PLAN

OF DISTRIBUTION

Sale

of Common Stock by Selling Stockholders

The

selling stockholders and any of their pledgees, donees, assignees, transferees and successors-in-interest may, from time to time, sell,

separately or together, some or all of shares of our common stock covered by this prospectus on Nasdaq or any other stock exchange, market

or trading facility on which the shares are traded or in private transactions. These sales may be at fixed prices, at prevailing market

prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at

negotiated prices. To the extent any of the selling stockholders gift, pledge or otherwise transfer the securities offered hereby, such

transferees may offer and sell the securities from time to time under this prospectus, provided that, if required under the Securities

Act, and the rules and regulations promulgated thereunder, this prospectus has been amended under Rule 424(b)(3) or other applicable

provision of the Securities Act, they include the name of such transferee in the list of selling stockholders under this prospectus.

Subject to compliance with applicable law, the selling stockholders may use any one or more of the following methods when selling shares

of common stock:

|

|

●

|

ordinary

brokerage transactions and transactions in which the broker-dealer solicits the purchaser;

|

|

|

|

|

|

|

●

|

block

trades in which the broker-dealer will attempt to sell the shares of common stock as agent but may position and resell a portion

of the block as principal to facilitate the transaction;

|

|

|

|

|

|

|

●

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

●

|

an

exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

●

|

privately

negotiated transactions;

|

|

|

|

|

|

|

●

|

“at

the market” or through market makers or into an existing market for the shares of common stock;

|

|

|

|

|

|

|

●

|

through

one or more underwritten offerings on a firm commitment or best efforts basis;

|

|

|

|

|

|

|

●

|

settlement

of short sales entered into after the date of this prospectus;

|

|

|

|

|

|

|

●

|

agreements

with broker-dealers to sell a specified number of such shares of common stock at a stipulated price per share;

|

|

|

|

|

|

|

●

|

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

●

|

through

the distribution of common stock by any selling stockholder to its partners, members or securityholders;

|

|

|

|

|

|

|

●

|

a

combination of any such methods of sale; or

|

|

|

|

|

|

|

●

|

any

other method permitted pursuant to applicable law.

|

To

our knowledge, the selling stockholders have not entered into any agreements, understandings or arrangements with any underwriters or

broker/dealers regarding the sale of the shares of common stock covered by this prospectus. At any time a particular offer of the shares

of common stock covered by this prospectus is made, a revised prospectus or prospectus supplement, if required, will set forth the aggregate

amount of shares of common stock covered by this prospectus being offered and the terms of the offering, including the name or names

of any underwriters, dealers, brokers or agents. In addition, to the extent required, any discounts, commissions, concessions and other

items constituting underwriters’ or agents’ compensation, as well as any discounts, commissions or concessions allowed or

reallowed or paid to dealers, will be set forth in such revised prospectus or prospectus supplement. Any such required prospectus supplement,

and, if necessary, a post-effective amendment to the registration statement of which this prospectus is a part, will be filed with the

SEC to reflect the disclosure of additional information with respect to the distribution of the shares of common stock covered by this

prospectus.

To

the extent required, any applicable prospectus supplement will set forth whether or not underwriters may over-allot or effect transactions

that stabilize, maintain or otherwise affect the market price of the common stock at levels above those that might otherwise prevail

in the open market, including, for example, by entering stabilizing bids, effecting syndicate covering transactions or imposing penalty

bids.

The

selling stockholders may also sell shares of our common stock under Rule 144 under the Securities Act, if available, or in other transactions

exempt from registration, rather than under this prospectus. The selling stockholders have the sole and absolute discretion not to accept

any purchase offer or make any sale of securities if they deem the purchase price to be unsatisfactory at any particular time.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. If the selling stockholders effect

such transactions by selling securities to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents

may receive commissions in the form of discounts, concessions or commissions from the selling stockholders (and/or, if any broker-dealer

acts as agent for the purchaser of shares of common stock, from the purchaser) in amounts to be negotiated.

In

connection with the sale of the common stock or interests therein, the selling stockholders may enter into hedging transactions with

broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging

the positions they assume. The selling stockholders may also sell shares of the common sotck short after the effective date of the registration

statement of which this prospectus is a part and deliver these securities to close out their short positions, or loan or pledge the common

stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions

with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to

such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial

institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholders may from time to time pledge or grant a security interest in some or all of their shares of common stock to their

broker-dealers under the margin provisions of customer agreements or to other parties to secure other obligations. If a selling stockholder

defaults on a margin loan or other secured obligation, the broker-dealer or secured party may, from time to time, offer and sell the

shares of common stock pledged or secured thereby pursuant to this prospectus. The selling stockholders and any other persons participating

in the sale or distribution of the shares of common stock will be subject to applicable provisions of the Securities Act and the Exchange

Act, and the rules and regulations thereunder, including, without limitation, Regulation M. These provisions may restrict certain activities

of, and limit the timing of purchases and sales of any of the shares of common stock by, the selling stockholders or any other person,

which limitations may affect the marketability of the shares of common stock.

The

selling stockholders also may transfer the shares of our common stock in other circumstances, in which case the transferees, pledgees

or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

A

selling stockholder that is an entity may elect to make a pro rata in-kind distribution of shares of common stock to its members, partners

or shareholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus. To the extent that

such members, partners or shareholders are not affiliates of ours, such members, partners or shareholders would thereby receive freely

tradeable shares of common stock pursuant to the distribution through a registration statement.

The

selling stockholders and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or

discounts under the Securities Act. To our knowledge, no selling stockholder has entered into any agreement or understanding, directly

or indirectly, with any person to distribute the shares of our common stock.

We

are required to pay all fees and expenses incident to the registration of shares of our common stock. We have agreed to indemnify certain

selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act. We and

the selling stockholders may agree to indemnify underwriters, broker-dealers or agents against certain liabilities, including liabilities

under the Securities Act, and may also agree to contribute to payments which the underwriters, broker-dealers or agents may be required

to make.

There

can be no assurance that any selling stockholder will sell any or all of the securities registered pursuant to the registration statement

of which this prospectus is a part.

LEGAL

MATTERS

The

validity of the securities described in this prospectus will be passed upon for us by Duane Morris LLP, New York, New York. If the securities

are being distributed through underwriters or agents, the validity of the securities will be passed upon for the underwriters or agents

by counsel identified in the related prospectus supplement.

EXPERTS

Our

financial statements as of and for the years ended December 31, 2020 and 2019 incorporated by reference in this prospectus have been

audited by MaloneBailey, LLP, independent registered accounting firm, and are included in reliance on their report (the report on the

financial statements contains an explanatory paragraph regarding the Company’s ability to continue as a going concern) given upon

the authority of said firm as experts in auditing and accounting.

LIMITATION

ON LIABILITY AND DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons

pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against

such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person

of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus and any subsequent prospectus supplements do not contain all of the information in the Registration Statement. We have omitted

from this prospectus some parts of the Registration Statement as permitted by the rules and regulations of the SEC. Statements in this

prospectus concerning any document we have filed as an exhibit to the Registration Statement or that we otherwise filed with the SEC

are not intended to be comprehensive and are qualified in their entirety by reference to these filings. In addition, we file annual,

quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that contains

reports, proxy and information statements and other information that we file electronically with the SEC, including us. The SEC’s

Internet site can be found at http://www.sec.gov. In addition, we make available on or through our Internet site copies of these reports

as soon as reasonably practicable after we electronically file or furnished them to the SEC. Our Internet site can be found at http:www.protagenic.com.

Our website is not a part of this prospectus.

INFORMATION

INCORPORATED BY REFERENCE

We

have elected to incorporate certain information by reference into this prospectus. By incorporating by reference, we can disclose important

information to you by referring you to other documents we have filed or will file with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained

in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any statements

in the prospectus or any document previously incorporated by reference have been modified or superseded. This prospectus incorporates

by reference the documents set forth below that we have previously filed with the SEC under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”):

|

|

●

|

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Securities Exchange Commission on March 25,

2021;

|

|

|

●

|

our

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2021, filed with the Securities Exchange Commission on May

17, 2021;

|

|

|

●

|

the

description of our common stock set forth in the Registration Statement on Form 8-A12B filed with the Securities Exchange Commission

on April 26, 2021, including any amendment or report filed for the purpose of updating such description.

|

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration

statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective

amendment that indicates the termination of the offering of the securities made by this prospectus, which will become a part of this

prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information

provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information

in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent

that statements in the later-filed document modify or replace such earlier statements. We will furnish without charge to each person,

including any beneficial owner, to whom a prospectus is delivered, upon written or oral request, a copy of any or all of the documents

incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits that are specifically incorporated

by reference into such documents. You should direct any requests for documents to:

Protagenic

Therapeutics, Inc.

149

Fifth Avenue

New

York, New York 10010

212-994-8200

Attention:

Chief Financial Officer

PROSPECTUS

6,801,607

Shares of Common Stock Offered by Selling Stockholders

Part

II

Information

not required in prospectus

Item 13. Other Expenses of Issuance and Distribution

The

following table sets forth our costs and expenses in connection with the registration of our securities as described in this registration

statement.

|

|

|

AMOUNT

|

|

|

SEC registration fee

|

|

$

|

1,432.17

|

|

|

Legal fees and expenses

|

|

$

|

20,000

|

|

|

Accounting fees and expenses

|

|

$

|

10,000

|

|

|

Miscellaneous expenses

|

|

$

|

1000

|

|

|

Total

|

|

$

|

32,432.17

|

|

All

amounts are estimates, other than the SEC’s registration fee.

We

are paying all expenses of the offering listed above. No portion of these expenses will be borne by the selling stockholders.

The selling

stockholders, however, will pay all underwriting discounts and selling commissions, if any.

Item 14. Indemnification of Directors and Officers

We

are incorporated under the laws of the state of Delaware. Section 145 of the Delaware General Corporation Law provides that a Delaware

corporation may indemnify any persons who are, or are threatened to be made, parties to any threatened, pending or completed action,

suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation),

by reason of the fact that such person was an officer, director, employee or agent of such corporation, or is or was serving at the request

of such person as an officer, director, employee or agent of another corporation or enterprise. The indemnity may include expenses (including

attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection

with such action, suit or proceeding, provided that such person acted in good faith and in a manner he or she reasonably believed to

be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable

cause to believe that his or her conduct was illegal. A Delaware corporation may indemnify any persons who are, or are threatened to

be made, a party to any threatened, pending or completed action or suit by or in the right of the corporation by reason of the fact that

such person was a director, officer, employee or agent of such corporation, or is or was serving at the request of such corporation as

a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’

fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit provided such

person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests

except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to the corporation.

Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation

must indemnify him or her against the expenses that such officer or director has actually and reasonably incurred. Our charter and bylaws

provide for the indemnification of our directors and officers to the fullest extent permitted under the Delaware General Corporation

Law.

Section

102(b)(7) of the Delaware General Corporation Law permits a corporation to provide in its certificate of incorporation that a director

of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary

duties as a director, except for liability for:

|

|

●

|

any

breach of the director’s duty of loyalty to the corporation or its stockholders;

|

|

|

●

|

any

act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

●

|

any

act related to unlawful stock repurchases, redemptions or other distributions or payment of dividends; or

|

|

|

●

|

any

transaction from which the director derived an improper personal benefit.

|

These

limitations of liability do not affect the availability of equitable remedies such as injunctive relief or rescission. Our charter also

authorizes us to indemnify our officers, directors and other agents to the fullest extent permitted under Delaware law.

As

permitted by Section 145 of the Delaware General Corporation Law, our bylaws provide that:

|

●

|

we

may indemnify our directors, officers and employees to the fullest extent permitted by the Delaware General Corporation Law, subject

to limited exceptions;

|

|

●

|

we

may advance expenses to our directors, officers and employees in connection with a legal proceeding to the fullest extent permitted

by the Delaware General Corporation Law, subject to limited exceptions; and

|

|

●

|

the

rights provided in our bylaws are not exclusive.

|

Section

174 of the Delaware General Corporation Law provides, among other things, that a director who willfully or negligently approves of an

unlawful payment of dividends or an unlawful stock purchase or redemption may be held liable for such actions. A director who was either

absent when the unlawful actions were approved, or dissented at the time, may avoid liability by causing his or her dissent to such actions

to be entered in the books containing minutes of the meetings of the board of directors at the time such action occurred or immediately

after such absent director receives notice of the unlawful acts.

Our

Third Amended and Restated Certificate of Incorporation provides that no director shall be liable to us or our stockholders for monetary

damages for breach of fiduciary duty as a director to the fullest extent permitted by the DGCL.

We

have entered into Indemnification Agreements with the each of our directors and executive officers. Pursuant to our agreements, we will

be obligated, to the extent permitted by applicable law, to indemnify our directors and officers against all expenses, judgments, fines

and penalties incurred in connection with the defense or settlement of any actions brought against them by reason of the fact that they

were our directors or officers or assumed certain responsibilities at our direction.

We

also have purchased directors and officer’s liability insurance in order to limit our exposure to liability of indemnification

of directors and officers.

The

form of Underwriting Agreement, to be filed as Exhibit 1.1 hereto, provides for indemnification by the underwriters of us and our officers

who sign this Registration Statement and directors for specified liabilities, including matters arising under the Securities Act.

Item

15. Recent Sales of Unregistered Securities.

Original

Issuances of Stock and Warrants

2019-2020

Convertible Note Offering

From

November 21, 2019 through July 8, 2020, Protagenic Therapeutics, Inc. (the “Company”) entered into a Convertible Note Purchase

Agreement (“Purchase Agreement”) with accredited investors (the “Investors”), pursuant to which the Company issued

and sold unsecured convertible promissory notes (collectively, the “Notes”) to the Investors in the aggregate principal amount

of $1,570,000, as reported in Current Reports on Form 8-K filed on November 21, 2019, December 4, 2019, December 23, 2019, January 29,

2020, March 3, 2020, May 14, 2020, and July 8, 2020.

On

August 11, 2020, the Company notified investors in a conference call that it was re-opening the convertible note financing, with identical

terms to the previous round, except for the closing date, which has now been set at Friday, August 21st, at 5:00 pm.

On

August 28, 2020, the “Company” entered into a Convertible Note Purchase Agreement with certain accredited investors, pursuant

to which the Company issued and sold unsecured convertible promissory notes to the Investors in the aggregate principal amount of $427,500.

For

both sets of Notes, the Notes will be due on November 6, 2023 (the “Maturity Date”) and accrue simple interest at an annual

rate of 6% on the aggregate unconverted and outstanding principal amount, payable annually, beginning October 31, 2020. The Company will pay (a “PIK Payment”) the interest

due by adding such interest (including interest at the Default Rate, as defined below, if any) to the then-outstanding principal amount

of the Notes on each interest payment date and on the Maturity Date. Each PIK Payment will be preceded by written notice from the Company