0001820630

false

NONE

0001820630

2023-09-07

2023-09-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

September 7, 2023

| Proterra Inc |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware |

001-39546 |

90-2099565 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

1815 Rollins Road

Burlingame, California 94010 |

| (Address of principal executive offices, including zip code) |

| |

| (864) 438-0000 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| N/A |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common Stock, par value $0.0001 per share |

|

PTRAQ |

|

* |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

* The registrant’s Class A common stock, which previously traded

on the Nasdaq Global Select Market under the symbol PTRA, began trading exclusively on the over-the-counter market on August 17, 2023

under the symbol “PTRAQ.”

| Item 7.01 | Regulation FD Disclosure. |

As previously disclosed, on August 7, 2023, Proterra Inc, a Delaware

corporation (the “Company”), and its subsidiary Proterra Operating Company, Inc. filed voluntary petitions for reorganization

under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (such court,

the “Bankruptcy Court” and such proceedings, the “Chapter 11 Cases”). The Chapter 11 Cases are currently jointly

administered under the caption In re Proterra Inc, Case No. 23-11120 (BLS) (Bankr. D. Del. 2023).

As previously disclosed, in connection with the commencement of the Chapter

11 Cases, the Company filed a number of motions with the Bankruptcy Court. Among these was a motion to establish certain procedures to

protect any potential value of the Company’s net operating loss carryforwards and other tax attributes (the “Tax Attributes,”

and such motion, the “NOL Motion”).

On August 10, 2023, the Bankruptcy Court entered an order approving the

NOL Motion on an interim basis (the “Interim Order”). On September 7, 2023, the Bankruptcy Court entered a final order approving

the NOL Motion (the “Final Order”).

The Final Order establishes certain procedures (the “Procedures”)

with respect to trading and transfers of Beneficial Ownership (as defined in the Final Order) of the Company’s Common Stock (as

defined in the Final Order) in order to protect any potential value of the Company’s Tax Attributes for use in connection with the

Chapter 11 Cases. As approved, the Procedures restrict transactions involving, and require notices of the holdings of and proposed transactions

by, any person or group of persons that is or, as a result of such a transaction, would become, a Substantial Shareholder of the Common

Stock issued by the Company. For purposes of the Procedures, a “Substantial Shareholder” is any person or entity that has

Beneficial Ownership of at least 10,252,500 shares of Common Stock (representing approximately 4.5% of all issued and outstanding shares

of Common Stock as of August 7, 2023). Pursuant to the Procedures, any person or entity that, at any time on or after August 7, 2023,

is or becomes a Substantial Shareholder must file with the Bankruptcy Court and serve notice upon the Declaration Notice Parties (as defined

in the Final Order), a declaration of their status as a Substantial Shareholder on or before the date that is the later of (i) 20 business

days after the date of the Notice of Interim Order (as defined in the Interim Order), which was August 11, 2023 and (ii) 10 calendar days

after such person or entity becomes a Substantial Shareholder.

As set out in the Procedures, at least 20 business days prior to entering

into any transfer of Beneficial Ownership of Common Stock that would result in (i) an increase or decrease in the amount of Common Stock

of which a Substantial Shareholder has Beneficial Ownership or (ii) any entity or person becoming or ceasing to be a Substantial Shareholder,

the parties to such transfer must file with the Bankruptcy Court and serve on the Declaration Notice Parties an advance written declaration

of the intended transfer.

The Procedures further provide, among other things, that any person or

entity that is or becomes a 50% Shareholder (as defined below) must file with the Bankruptcy Court and serve upon the Declaration Notice

Parties, a declaration of such status on or before the later of (i) 30 calendar days after the date of the Notice of Interim Order and

(ii) 10 calendar days after becoming a 50% Shareholder. For purposes of the Procedures, a 50% Shareholder is any person or entity that

currently is or becomes a “50-percent shareholder” within the meaning of section 382(g)(4)(D) of the Internal Revenue Code

and applicable Treasury Regulations. Prior to filing any U.S. federal, state or local tax return, or any amendment to such a return, claiming

any deduction for worthlessness of the Common Stock for a tax year ending before the Company’s emergence from Chapter 11 protection,

such 50% Shareholder must file with the Bankruptcy Court and serve upon the Declaration Notice Parties, an advance written notice of the

intended claim of worthlessness.

The Company will have 15 business days after receipt of written declarations

in connection with transfers of, and worthlessness with respect to, Beneficial Ownership of Common Stock to file objections with the Bankruptcy

Court and serve such objections upon such person or entity party to such transfer of Beneficial Ownership of Common Stock or such 50%

Shareholder, as applicable.

Any transfer of, or declaration of worthlessness with respect to, the Common

Stock or Beneficial Ownership of Common Stock in violation of the Procedures will be null and void ab initio and certain remedial

actions may be

required to restore the status quo ante. A direct or indirect holder

of, or prospective holder of, Common Stock should consult the NOL Motion, the Final Order, and the Procedures set forth therein.

In addition, the Final Order contains certain Procedures with respect to

trading and ownership of Claims against the Company and its subsidiary (the "Claims Trading Procedures"), which Claims Trading

Procedures come into effect only after a plan of reorganization is filed in the Chapter 11 Cases that contemplates the making of an election

under Section 382(l)(5) of the Internal Revenue Code. If the Claims Trading Procedures come into effect, they would, among other things,

require “Substantial Claimholders” to notify the Company of their status as such by filing a Notice of Substantial Claim Ownership

with the Bankruptcy Court and serve notice upon the Declaration Notice Parties. The Claims Trading Procedures would also require Substantial

Claimholders to follow certain procedures in advance of trading in Claims. Furthermore, the Claims Trading Procedures provide the Company

with a process pursuant to which it can petition the Bankruptcy Court to order a Substantial Claimholders to sell down Claims in excess

of such holder’s holdings as of the August 7, 2023. The definition of a Substantial Claimholder for these purposes will be determined

at the time that an applicable plan of reorganization is filed, and either disclosed in a disclosure statement filed with the Court, or

disclosed in a separate notice and filed with the Securities and Exchange Commission on Form 8-K.

The Notice of Final Order setting forth the Procedures is furnished as

Exhibit 99.1 to this current report on Form 8-K and is hereby incorporated by reference into this Item 7.01.

Court filings and further information about the Chapter 11 Cases can be

found at a website maintained by the Company’s claims agent, Kurtzman Carson Consultants LLC, at www.kccllc.net/proterra.

A direct link to the Notice of Final Order is as follows: https://www.kccllc.net/proterra/document/2311120230907000000000001.

The information contained in this Item 7.01 and Exhibit 99.1 hereto shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and shall not be incorporated by reference into any filings under the Securities Act of 1933, as amended, or the Exchange

Act, except as may be expressly set forth by specific reference in such filing.

Cautionary Note Regarding Trading in the Company’s Common Stock

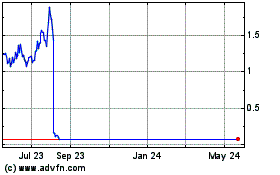

The Company’s stockholders are cautioned that the price of the Company’s

common stock may be volatile following the commencement of the Chapter 11 Cases and may decrease in value. Accordingly, any trading in

the Company’s common stock during the pendency of the Company’s Chapter 11 Cases is highly speculative and poses substantial

risks to purchasers of the Company’s common stock. External factors have caused and may continue to cause the market price and demand

for the Company’s common stock to fluctuate substantially. Accordingly, the Company cannot assure investors of the liquidity of

an active trading market, the ability to sell shares of the Company’s common stock when desired, or the prices that an investor

may obtain for the shares of the Company’s common stock.

Cautionary Note Regarding Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company’s

actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and other

factors, which could include the following: risks and uncertainties relating to the Company’s Chapter 11 Cases, including but not

limited to, the Company’s ability to obtain Bankruptcy Court approval with respect to motions in the Chapter 11 Cases, the effects

of the Chapter 11 Cases on the Company and on the interests of various constituents, Bankruptcy Court rulings in the Chapter 11 Cases

and the outcome of the Chapter 11 Cases in general, the length of time the Company will operate under the Chapter 11 Cases, risks associated

with any third-party motions in the Chapter 11 Cases, the potential adverse effects of the Chapter 11 Cases on the Company’s liquidity

or results of operations and increased legal and other professional costs necessary to execute the Company’s reorganization; the

conditions to which the Company’s cash collateral is subject and the risk that these conditions may not be satisfied for various

reasons, including for reasons outside of the Company’s control; the consequences of the acceleration of the Company’s debt

obligations and the trading price and volatility of the Company’s common stock. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

press release, including risks and uncertainties set forth in the sections

entitled “Risk Factors” in the Company’s Annual Report for the year ended December 31, 2022 filed with the Securities

and Exchange Commission on March 17, 2023, as amended on May 1, 2023, or the Company’s other filings with the SEC. The forward-looking

statements included in this Form 8-K speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as

a result of new information, future events, or otherwise. The Company does not give any assurance that it will achieve its expectations.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| |

|

| 99.1 |

|

Notice of Final Order |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PROTERRA INC |

|

| |

|

|

|

| |

|

|

|

Date: September 11, 2023 |

By: |

/s/ Gareth T. Joyce |

|

| |

|

Gareth T. Joyce |

|

| |

|

President and Chief Executive Officer |

|

EXHIBIT 99.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| |

) |

|

| In re: |

) |

Chapter 11 |

| |

) |

|

| PROTERRA INC, et al.,1 |

) |

Case No. 23-11120 (BLS) |

| |

) |

|

| Debtors. |

) |

(Jointly Administered) |

| |

) |

|

NOTICE

OF FINAL ORDER (I) ESTABLISHING

NOTIFICATION AND HEARING PROCEDURES FOR CERTAIN

TRANSFERS OF AND DECLARATIONS OF WORTHLESSNESS

WITH RESPECT TO COMMON STOCK OF PROTERRA INC AND CLAIMS

AGAINST DEBTORS AND (II) GRANTING RELATED RELIEF

TO: ALL ENTITIES (AS DEFINED BY SECTION 101(15) OF THE BANKRUPTCY

CODE) THAT MAY HOLD BENEFICIAL OWNERSHIP OF COMMON STOCK OF PROTERRA INC (THE “COMMON STOCK”):

PLEASE TAKE NOTICE that

on August 7, 2023 (the “Petition Date”), the above-captioned debtors and debtors in possession (collectively, the

“Debtors”) filed petitions with the United States Bankruptcy Court for the District of Delaware (the “Court”)

under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”). Subject to certain

exceptions, section 362 of the Bankruptcy Code operates as a stay of any act to obtain possession of property of or from the Debtors’

estates or to exercise control over property of or from the Debtors’ estates.

PLEASE TAKE FURTHER NOTICE that

on the Petition Date, the Debtors filed the Debtors’ Motion for Entry of Interim and Final Orders (I) Establishing Notification

and Hearing Procedures for Certain Transfers of and Declarations of Worthlessness with Respect to Common Stock of Proterra Inc and Claims

Against Debtors and (II) Granting Related Relief [Docket No. 5] (the “Motion”).

| 1 | The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, are as follows: Proterra Inc (9565); and Proterra Operating Company, Inc. (8459). The location of the Debtors’ service address is: 1815 Rollins Road, Burlingame, California 94010. |

PLEASE TAKE FURTHER NOTICE

that on September 7, 2023, the Court entered the Final Order (I) Establishing Notification and Hearing Procedures for Certain

Transfers of and Declarations of Worthlessness with Respect to Common Stock of Proterra Inc and Claims Against Debtors and (II) Granting

Related Relief [Docket No. 217] (the “Order”)2

approving procedures for certain purchases, sales or other transfers of, and declarations of worthlessness with respect

to, Beneficial Ownership of Common Stock, and certain acquisitions, dispositions, or trading of Claims set forth in Exhibit 1

attached to the Order (the “Procedures”).

PLEASE TAKE FURTHER NOTICE that,

pursuant to the Order, a Substantial Shareholder or person that may become a Substantial Shareholder may not consummate any purchase,

sale, or other transfer of Common Stock or Beneficial Ownership of Common Stock in violation of the Procedures, any such transaction in

violation of the Procedures shall be null and void ab initio, and certain remedial actions may be required to restore the status

quo.

PLEASE TAKE FURTHER NOTICE

that, pursuant to the Order, a 50% Shareholder may not claim a worthless stock deduction in respect of the Common Stock or

Beneficial Ownership of Common Stock in violation of the Procedures, any such deduction in violation of the Procedures is null and void

ab initio, and the 50% Shareholder shall be required to file an amended tax return revoking such proposed deduction.

PLEASE TAKE FURTHER NOTICE that,

pursuant to the Order, the Procedures shall apply to the holding and transfers of Common Stock or any Beneficial Ownership therein by

a Substantial Shareholder or someone who may become a Substantial Shareholder.

| 2 | Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Motion

or the Order, as applicable. |

PLEASE TAKE FURTHER NOTICE

that, pursuant to the Order, the Procedures shall apply in certain circumstances to acquisitions, dispositions, or trading of Claims

against the Debtors in violation of the Procedures, and the person or entity attempting to make such acquisition, disposition, or trade

shall be required to take remedial actions specified by the Debtors to appropriately reflect that such acquisition, disposition, or trade

is null and void ab initio.

PLEASE TAKE FURTHER NOTICE that

upon the request of any entity, the proposed notice, solicitation, and claims agent for the Debtors, Kurtzman Carson Consultants LLC,

will provide a copy of the Order and a form of each of the declarations required to be filed by the Procedures in a reasonable period

of time. The Order and such declarations are also available via PACER on the Court’s website at https://ecf.delb.uscourts.gov/ for

a fee, or at no charge by accessing the Debtors’ restructuring website at kccllc.net/proterra.

PLEASE TAKE FURTHER NOTICE

THAT FAILURE TO FOLLOW THE PROCEDURES SET FORTH IN THE ORDER SHALL CONSTITUTE A VIOLATION OF, AMONG OTHER THINGS, THE AUTOMATIC STAY PROVISIONS

OF SECTION 362 OF THE BANKRUPTCY CODE.

PLEASE TAKE FURTHER NOTICE

THAT ANY PROHIBITED PURCHASE, SALE, OTHER TRANSFER OF, OR DECLARATION OF WORTHLESSNESS WITH RESPECT TO BENEFICIAL

OWNERSHIP OF Common Stock, OR ANY ACQUISITION, DISPOSITION OR TRADING IN CLAIMS, IN EACH CASE, IN VIOLATION OF THE ORDER IS PROHIBITED

AND SHALL BE NULL AND VOID AB INITIO AND MAY BE SUBJECT TO ADDITIONAL SANCTIONS AS THIS COURT MAY DETERMINE.

PLEASE TAKE FURTHER NOTICE that

the requirements set forth in the Order are in addition to the requirements of applicable law and do not excuse compliance therewith.

| Dated: |

September 7, 2023 |

Respectfully submitted, |

|

| |

Wilmington, Delaware |

|

|

| |

|

|

|

| |

|

YOUNG CONAWAY STARGATT &

TAYLOR, LLP |

|

| |

|

|

|

|

| |

|

/s/ Shella Borovinskaya |

|

| |

|

Pauline

K. Morgan (No. 3650)

Andrew

L. Magaziner (No. 5426)

Shella Borovinskaya (No. 6758)

Rodney Square

1000 North King Street

Wilmington, Delaware 19801

Telephone: (302) 571-6600

Facsimile: (302) 571-1253

|

|

| |

|

Email: |

pmorgan@ycst.com

amagaziner@ycst.com

sborovinskaya@ycst.com |

|

| |

|

|

|

| |

|

- and -

PAUL, WEISS, RIFKIND,

WHARTON & GARRISON LLP

Paul M. Basta (admitted pro hac vice)

Robert A. Britton (admitted pro hac vice)

Michael J. Colarossi (admitted pro hac vice)

1285 Avenue of the Americas

New York, New York 10019

Tel: (212) 373-3000

Fax: (212) 757-3990 |

|

| |

|

Email:

|

pbasta@paulweiss.com

rbritton@paulweiss.com

mcolarossi@paulweiss.com |

|

| |

|

|

|

| |

|

Counsel to the Debtors and

Debtors in Possession |

|

| |

|

|

|

|

Exhibit 1

Procedures for Transfers of Beneficial Ownership

of Common Stock or Claims, and

Declarations of Worthlessness with Respect to Beneficial Ownership of Common Stock

PROCEDURES

FOR TRANSFERS OF

BENEFICIAL OWNERSHIP OF COMMON STOCK

OR CLAIMS AND DECLARATIONS OF WORTHLESSNESS

WITH RESPECT TO BENEFICIAL OWNERSHIP OF COMMON STOCK

Procedures for Transfers

of Beneficial Ownership of Common Stock1

| a. | Any person or Entity (as defined below) that, at any time on or after the Petition Date, is or becomes

a Substantial Shareholder (as defined below) must file with the Court, and serve upon: (i) the Debtors, 1815 Rollins Road, Burlingame,

California 94010, Attention: Jeffrey E. Mitchell (jmitchell@proterra.com); (ii) proposed counsel to the Debtors, Paul, Weiss, Rifkind,

Wharton & Garrison LLP, 1285 Avenue of the Americas, New York, New York 10019, Attention: Robert A. Britton (rbritton@paulweiss.com)

and Michael J. Colarossi (mcolarossi@paulweiss.com); (iii) proposed co-counsel to the Debtors, Young Conaway Stargatt & Taylor,

LLP, Rodney Square, 1000 North King St., Wilmington, Delaware 19801, Attention: Pauline K. Morgan (pmorgan@ycst.com), Andrew L. Magaziner

(amagaziner@ycst.com); (iv) proposed counsel to the Committee, (a) Lowenstein Sandler LLP, 1251 Avenue of the Americas, New York,

New York 10020, Attention: Jeffrey L. Cohen (jcohen@lowenstein.com), Eric S. Chafetz (echafetz@lowenstein.com), and Jordana L. Renert

(jrenert@lowenstein.com), and (b) Morris James LLP, 500 Delaware Avenue, Suite 1500, Wilmington, Delaware 19801, Attn: Eric Monzo

(emonzo@morrisjames.com) and Brya Keilson (bkeilson@morrisjames.com); and (v) counsel to the Second Lien Agent, Sidley Austin LLP, 787

Seventh Ave, New York, NY 10019, Attn: Thomas R. Califano (tom.califano@sidley.com) and Dennis M. Twomey (dtwomey@sidley.com) (collectively,

the “Declaration Notice Parties”), a declaration of such status, substantially in the form of Exhibit 1A

attached to these Procedures (each, a “Declaration of Status as a Substantial Shareholder”), on or before the later

of (A) 20 business days after the date of the Notice of Interim Order [D.I. 131, Exhibit I] and (B) 10 calendar days after

becoming a Substantial Shareholder; provided, that, for the avoidance of doubt, the other procedures set forth herein shall apply

to any Substantial Shareholder even if no Declaration of Status as a Substantial Shareholder has been filed. |

| b. | At least 20 business days prior to effectuating any transfer of Beneficial Ownership of Common Stock that

would result in an increase in the amount of Common Stock as to which a Substantial Shareholder has Beneficial Ownership or would result

in a person or Entity becoming a Substantial Shareholder (including the actual or deemed exercise of any Option to acquire Common Stock

that would result in the amount of Common Stock beneficially owned by any person or Entity that currently is or, as a result of the proposed

transaction, would be, a Substantial Shareholder), the parties to such transaction must file with the Court and serve upon the Declaration

Notice Parties an advance written declaration of the intended transfer of Common Stock, substantially in the form of Exhibit |

| 1 | Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Debtors’

Motion for Entry of Interim and Final Orders (I) Establishing Notification and Hearing Procedures for Certain Transfers of and Declarations

of Worthlessness with Respect to Common Stock of Proterra Inc and Claims Against Debtors and (II) Granting Related Relief (the “Motion”). |

1B attached to these Procedures

(each, a “Declaration of Intent to Accumulate Common Stock”).

| c. | At least 20 business days prior to effectuating any transfer of Beneficial Ownership of Common Stock that

would result in a decrease in the amount of Common Stock of which a Substantial Shareholder has Beneficial Ownership or would result in

a person or Entity ceasing to be a Substantial Shareholder, the parties to such transaction must file with the Court and serve upon the

Declaration Notice Parties an advance written declaration of the intended transfer of Common Stock, substantially in the form of Exhibit

1C attached to these Procedures (each, a “Declaration of Intent to Transfer Common Stock or Options” and,

together with a Declaration of Intent to Accumulate Common Stock, each, a “Declaration of Proposed Transfer”). |

| d. | The Debtors, in reasonable consultation with the Committee and the Second Lien Agent, shall have 15 business

days after receipt of a Declaration of Proposed Transfer to file with the Court and serve on such person or Entity an objection to any

proposed transfer of Beneficial Ownership of Common Stock described in the Declaration of Proposed Transfer on the grounds that such transfer

might adversely affect the Debtors’ ability to utilize their Tax Attributes. |

| e. | If the Debtors file an objection, the proposed transaction will remain ineffective unless such objection

is withdrawn by the Debtors or such transaction is approved by a final and non-appealable order of the Court. |

| f. | If the Debtors do not object within such 15-business day period, the proposed transaction may proceed

solely as set forth in the Declaration of Proposed Transfer. Further transactions within the scope of these Procedures must be the subject

of additional notices in accordance with these Procedures, with an additional 15-business day waiting period for each Declaration of Proposed

Transfer. |

| g. | For purposes of these Procedures for Transfers of Beneficial Ownership of Common Stock, (i) “Substantial

Shareholder” means any person or Entity that has Beneficial Ownership of at least 10,252,500 shares of Common Stock (representing

approximately 4.5 percent of all issued and outstanding shares of Common Stock as of the Petition Date); and (ii) “Entity”

has the meaning as such term is defined in section 1.382-3(a) of the Treasury Regulations, including any group of persons who have a formal

or informal understanding among themselves to make a coordinated acquisition of stock. |

Procedures for Declarations

of Worthlessness of Common Stock

| a. | Any person or Entity that currently is or becomes a 50% Shareholder (as defined below) must file with

the Court and serve the Declaration Notice Parties a declaration of such status, in the form of Exhibit 1D attached to these Procedures

(each, a “Declaration of Status as a 50% Shareholder”), on or before the later of (i) 30 calendar days after the

date of the Notice of Interim Order and (ii) 10 calendar days after becoming a 50% Shareholder; provided, that, for the avoidance

of doubt, the other procedures set forth herein shall apply to any 50% Shareholder even if no Declaration of Status as a 50% Shareholder

has been filed. |

| b. | Prior to filing any federal, state, or local tax return, or any amendment to such a return claiming any

deduction for worthlessness of the Common Stock for a tax year ending before the Debtors’ emergence from chapter 11 protection,

such 50% Shareholder must file with the Court and serve upon the Declaration Notice Parties an advance written notice substantially in

the form of Exhibit 1E attached to these Procedures (a “Declaration of Intent to Claim a Worthless Stock Deduction”). |

| i. | The Debtors, in reasonable consultation with the Committee and the Second Lien Agent, shall have 15 business

days after receipt of a Declaration of Intent to Claim a Worthless Stock Deduction to file with the Court and serve on such 50% Shareholder

an objection to any proposed claim of deduction for worthlessness described in the Declaration of Intent to Claim a Worthless Stock Deduction

on the grounds that such claim might adversely affect the Debtors’ ability to utilize their Tax Attributes. |

| ii. | If the Debtors file an objection, the 50% Shareholder shall not claim, or cause or be claimed, the proposed

worthless stock deduction to which the Declaration of Intent to Claim a Worthless Stock Deduction relates unless such objection is withdrawn

by the Debtors or the proposed worthless stock deduction is approved by a final and non-appealable order of the Court. |

| iii. | If the Debtors do not object within such 15-business day period, the filing of the tax return or amendment

with such claim will be permitted solely as set forth in the Declaration of Intent to Claim a Worthless Stock Deduction. Additional tax

returns or amendments within the scope of these Procedures must be the subject of additional notices as set forth herein, with an additional

15-business day waiting period. |

| c. | For purposes of these Procedures for Declarations of Worthlessness of Common Stock, a “50% Shareholder”

is any person or Entity that: (i) has Beneficial Ownership of 50 percent or more of the Common Stock; or (ii) would be a “50-percent

shareholder” (within the meaning of section 382(g)(4)(D) of the IRC and the applicable Treasury Regulations) of Common Stock

if such person or Entity claimed a worthless stock deduction with respect to the Common Stock at any time on or after the Petition Date. |

Procedures Applicable

to Transfers of Claims Against the Debtors

| a. | Disclosure of 382(l)(5) Plan. If the proponent of a plan of reorganization (a “Plan

Proponent”) determines that any reorganized Debtor likely could qualify for and benefit from the application of section 382(l)(5)

of the IRC and reasonably anticipates that the Post-Emergence Company will invoke such section, then the Plan Proponent, in proposing

a 382(l)(5) Plan, shall disclose the following in its proposed disclosure statement or, in the case of items (iii) through (v)

described below, a later, separate notice (collectively, the “Proposed 382(l)(5) Disclosure Statement”): |

| i. | Adequate information about the incremental tax benefits anticipated to be realized through the use of

section 382(l)(5) of the IRC that, taking into account the Debtors’ anticipated net unrealized built-in gains or net unrealized

built-in losses, would not otherwise be available; |

| ii. | A summary of any restrictions expected to be imposed on the transferability of securities issued under

the 382(l)(5) Plan in order to preserve such incremental tax benefits; |

| iii. | The (A) dollar amount of Claims (by class or other applicable classification) expected to result in a

one-percent (1%) interest in the New Common Stock and (B) number of any of the specified interests (the “Owned Interests”)

in the Debtors which shall include, but not necessarily be limited to, Common Stock expected to result in a one-percent (1%) interest

in the New Common Stock, in each case based upon then-available information; |

| iv. | A specified date (the “Determination Date”) that is not less than 10 days after the

service of the notice of the hearing with respect to the Proposed 382(l)(5) Disclosure Statement; |

| v. | A specified date (the “Reporting Deadline”) that is not less than 5 days after the

Determination Date, by which persons (including Entities) must serve on various parties the notice required by these Procedures (the “Notice

of Substantial Claim Ownership”); and |

| vi. | In the event that items (iii) through (v) above are disclosed in a separate notice after the filing of

the proposed disclosure statement, such items shall also be disclosed in a separate filing with the Securities and Exchange Commission

on Form 8-K. |

| b. | Notice of Substantial Claim Ownership. |

| i. | Any person (including any Entity) that beneficially owns either (i) more than a specified amount of Claims2

or (ii) a lower amount of Claims that (based on the applicable information set forth in the Proposed 382(l)(5) Disclosure Statement), |

| 2 | This “specified amount” is to be reasonably established by the Plan Proponent, taking into

account the terms of the 382(l)(5) Plan, and disclosed in the Proposed 382(l)(5) Disclosure Statement. The “specified

amount” may be expressed by class or type of Claim(s), if applicable. |

when taking into account any Owned Interests

beneficially owned by a holder of Claims (including pursuant to the applicable aggregation rules), in each case, that is reasonably expected

to result in such holder of Claims holding the Applicable Percentage of the New Common Stock, in each case as of the Determination Date,

shall serve upon the Plan Proponent and its counsel, the Committee’s counsel, and the Second Lien Agent’s counsel (and the

Declaration Notice Parties if the Debtors are not the Plan Proponent), a Notice of Substantial Claim Ownership, in substantially the form

annexed to the Procedures as Exhibit 1F (or as adjusted and annexed to the Proposed 382(l)(5) Disclosure Statement) on or

before the Reporting Deadline. Such person or Entity also shall set forth in the Notice of Substantial Claim Ownership its Beneficial

Ownership, if any, of any Owned Interests and whether it agrees to refrain from acquiring Beneficial Ownership of additional Owned Interests

(and Options to acquire the same) until after the effective date of the 382(l)(5) Plan and to immediately dispose of any Owned

Interests or Options (if acquired on or after the Petition Date and prior to submitting its Notice of Substantial Claim Ownership). A

person (including any Entity) that is required to file a Notice of Substantial Claim Ownership may or may not be a Substantial Claimholder.

The standard for a person (including an Entity) being required to file a Notice of Substantial Claim Ownership is different than the definition

of a Substantial Claimholder. At the election of the Substantial Claimholder, the Notice of Substantial Claim Ownership to be filed with

the Court (but not the Notice of Substantial Claim Ownership that is served upon the Declaration Notice Parties) may be redacted to exclude

the Substantial Claimholder’s taxpayer identification number.

| ii. | In order to assist in determining their eligibility to avail themselves of the relief set forth in section

382(l)(5) of the IRC, the Debtors may request3

from any person (including any Entity) that beneficially owns either (i) more than a specified amount of Claims (which may be expressed

by class or type of Claim(s), if applicable) or (ii) a lower amount of Claims that, when taking into account the Owned Interests beneficially

owned by a holder of Claims (including pursuant to the applicable aggregation rules), could result in such holder of Claims holding the

Applicable Percentage of the New Common Stock, in each case, as of the date specified in such request, information regarding its Beneficial

Ownership of Claims and Owned Interests (and Options to acquire the same) prior to the filing of the Proposed 382(l)(5) Disclosure

Statement, in a manner consistent with these Procedures. A response to such request shall be served upon the Declaration Notice Parties.

In addition, the Debtors shall disclose such request in a separate filing with the Securities and Exchange Commission on Form 8-K. |

| iii. | Any person (including any Entity) that fails to comply with its notification obligations set forth in

this paragraph shall, in addition to the consequences set forth in paragraph (d)(vii) below among other things, be subject to such remedy

as the Court may find appropriate upon motion by the Debtors, after service of the motion |

| 3 | For purposes of making this determination, such request shall include information comparable to the information

that would be required in a Proposed 382(l)(5) Disclosure Statement pursuant to these Procedures. |

upon such person or Entity and a hearing

on the motion in accordance with the Federal Rules of Bankruptcy Procedure, including, without limitation, ordering such noncompliant

person or Entity to divest itself promptly of any Beneficial Ownership of Claims to the extent of such person’s (or Entity’s)

ownership of an Excess Amount and imposing monetary damages for any costs reasonably incurred by the Debtors that were caused by the violation

and enforcement of this paragraph.

| c. | Claims Trading Before and After Determination Date. |

| i. | Any person (including any Entity) generally may trade freely and make a market in Claims until the Determination

Date. |

| ii. | After the Determination Date, any acquisition of Claims by a person (including any Entity) who filed or

is or was required to file a Notice of Substantial Claim Ownership or by a person or Entity who would be required to file a Notice of

Substantial Claim Ownership as a result of the consummation of the contemplated transaction if the proposed acquisition date had been

the Determination Date (each such person or Entity, a “Proposed Claims Transferee”) shall not be effective unless consummated

in compliance with these Procedures. |

| iii. | At least ten (10) days prior to the proposed date of any acquisition of Claims by a Proposed Claims Transferee

(a “Proposed Claims Acquisition Transaction”), such Proposed Claims Transferee shall serve upon the Plan Proponent

and its counsel, the Committee’s counsel, and the Second Lien Agent’s counsel (and the Declaration Notice Parties if the Debtors

are not the Plan Proponent) a notice of such Proposed Claims Transferee’s request to purchase, acquire, or otherwise accumulate

a Claim (a “Claims Acquisition Request”), in substantially the form annexed to the Procedures attached to the Final

Order as Exhibit 1G, which describes specifically and in detail the Proposed Claims Acquisition Transaction, regardless of whether

such transfer would be subject to the filing, notice, and hearing requirements set forth in Bankruptcy Rule 3001. At the election of the

Substantial Claimholder, the Claims Acquisition Request to be filed with the Court (but not the Claims Acquisition Request that is served

upon the Declaration Notice Parties) may be redacted to exclude the Substantial Claimholder’s taxpayer identification number. |

| iv. | The Plan Proponent may determine, in consultation with the Declaration Notice Parties (if the Debtors

are not the Plan Proponent), whether to approve a Claims Acquisition Request. If the Plan Proponent does not approve a Claims Acquisition

Request in writing within eight (8) business days after the Claims Acquisition Request is filed with the Court, the Claims Acquisition

Request shall be deemed rejected. |

| d. | Creditor Conduct and Sell-Down. |

| i. | To permit reliance by the Debtors on Treasury Regulations section 1.382-9(d)(3), upon the entry of the

Final Order, any Substantial Claimholder that participates in |

formulating any chapter 11 plan of reorganization

of or on behalf of the Debtors (which shall include, without limitation, making any suggestions or proposals to the Debtors or their advisors

with regard to such a chapter 11 plan of reorganization) shall not disclose or otherwise make evident to the Debtors that any Claims in

which such Substantial Claimholder has a Beneficial Ownership are Newly Traded Claims, unless compelled to do so by an order of a court

of competent jurisdiction or some other applicable legal requirement, provided, however, that the following activities shall

not constitute participation in formulating a chapter 11 plan of reorganization if, in pursuing such activities, the Substantial

Claimholder does not disclose or otherwise make evident (unless compelled to do so by an order of a court of competent jurisdiction or

some other applicable legal requirement) to the Debtors that such Substantial Claimholder has Beneficial Ownership of Newly Traded Claims:

filing an objection to a proposed disclosure statement or to confirmation of a proposed chapter 11 plan of reorganization; voting to accept

or reject a proposed chapter 11 plan of reorganization; reviewing or commenting on a proposed business plan; providing information on

a confidential basis to counsel to the Debtors; holding general membership on an official committee or an ad hoc committee; or taking

any action required by an order of the Court.

| ii. | Following the Determination Date, if the Plan Proponent determines that Substantial Claimholders must

sell or transfer all or a portion of their Beneficial Ownership of Claims in order to ensure that the requirements of section 382(l)(5)

of the IRC will be satisfied, the Plan Proponent may file a motion with the Court for entry of an order—after notice to counsel

to the Debtors (if the Debtors are not the Plan Proponent), counsel to the Committee, counsel to the Second Lien Agent, and the relevant

Substantial Claimholder(s) and a hearing—approving the issuance of a notice (each, a “Sell-Down Notice”) that

such Substantial Claimholder must sell, cause to sell, or otherwise transfer a specified amount of its Beneficial Ownership of Claims

(by class or other applicable classification) equal to the excess of (x) the amount of Claims beneficially owned by such Substantial Claimholder

over (y) the Maximum Amount for such Substantial Claimholder (such excess amount, an “Excess Amount”). The motion shall

be heard on expedited basis such that the Court can render a decision on the motion at or before the hearing on confirmation of the 382(l)(5)

Plan. If the Court approves the Plan Proponent’s motion for the issuance of a Sell-Down Notice, the Plan Proponent shall provide

the Sell-Down Notice to the relevant Substantial Claimholder(s). |

| iii. | Notwithstanding anything to the contrary in these Procedures, no Substantial Claimholder shall be required

to sell, cause to sell, or otherwise transfer any Beneficial Ownership of Claims if such sale or transfer would result in the Substantial

Claimholder’s Beneficial Ownership of an aggregate amount of Claims (by class or other applicable classification) that is less than

such Substantial Claimholder’s Protected Amount. |

| iv. | Each Sell-Down Notice shall direct the Substantial Claimholder to sell, cause to sell, or otherwise transfer

its Beneficial Ownership of the amount of Claims |

specified in the Sell-Down Notice to Permitted

Transferees (each sale or transfer, a “Sell-Down”); provided, however, that such Substantial Claimholder shall

not have a reasonable basis to believe that any such Permitted Transferee would own, immediately after the contemplated transfer, an Excess

Amount of Claims; provided, further, that a Substantial Claimholder that has properly notified the Permitted Transferee of its

Claims under these Procedures shall not be treated as having such reasonable basis in the absence of notification or actual knowledge

that such Permitted Transferee would own, after the transfer, an Excess Amount of Claims.

| v. | By the date that is the later of (i) five (5) days after the entry of an order confirming the 382(l)(5)

Plan and (ii) such other date specified in the Sell-Down Notice, as applicable, but before the effective date of the 382(l)(5)

Plan (the “Sell-Down Date”), each Substantial Claimholder subject to a Sell-Down Notice shall, as a condition to receiving

the New Common Stock, serve upon the Plan Proponent and its counsel, the Committee’s counsel, and the Second Lien Agent’s

counsel (and the Declaration Notice Parties if the Debtors are not the Plan Proponent) a notice, substantially in the form annexed to

the Procedures as Exhibit 1H that such Substantial Claimholder has complied with the terms and conditions set forth in these Procedures

and that such Substantial Claimholder does not and will not hold an Excess Amount of Claims as of the Sell-Down Date and at all times

through the effective date of the 382(l)(5) Plan (each, a “Notice of Compliance”). Any Substantial Claimholder

who fails to comply with this provision shall not receive the New Common Stock with respect to any Excess Amount of Claims. At the election

of the Substantial Claimholder, the Notice of Compliance to be filed with the Court (but not the Notice of Compliance that is served upon

the Declaration Notice Parties) may be redacted to exclude the Substantial Claimholder’s taxpayer identification number. |

| vi. | Other than information that is public or in connection with an audit or other investigation by the Internal

Revenue Service or other taxing authority, the Plan Proponent shall keep all Notices of Compliance and any additional information provided

by a Substantial Claimholder pursuant to these Procedures (the “Confidential Information”) strictly confidential and

shall not disclose the Confidential Information to any other person (including any Entity); provided, however, that the Plan Proponent

may disclose the identity of the Substantial Claimholder to its counsel and professional financial advisors, the Committee’s counsel

and professionals, the Second Lien Agent’s counsel and professionals, and of any other person(s) that are subject to a nondisclosure

agreement with the Plan Proponent, each of whom shall keep all Confidential Information strictly confidential, subject to further order

of the Court; provided, further, that to the extent the Plan Proponent reasonably determines such Confidential Information is necessary

to demonstrate to the Court the need for the issuance of a Sell-Down Notice, such Confidential Information (determined by, among other

things, whether such information was redacted in any public filing) shall be filed with the Court under seal. |

| vii. | Any person (including any Entity) that violates its obligations under these Procedures applicable to Claims

or, if applicable, its agreement not to acquire Beneficial Ownership of Owned Interests (and Options to acquire the same) or to immediately

dispose of any Owned Interests (if acquired on or after the Petition Date but prior to submitting its Notice of Substantial Claim Ownership)

in its Notice of Substantial Claim Ownership shall, pursuant to these Procedures, be precluded from receiving, directly or indirectly,

any consideration consisting of a Beneficial Ownership of the New Common Stock that is attributable to the Excess Amount of Claims for

such person or Entity and, if applicable, to the Owned Interests acquired (or not immediately disposed of) in violation of such agreement

by such person or Entity (or if the Owned Interests acquired (or not immediately disposed of) in violation of such agreement become Beneficial

Ownership of the New Common Stock without the need to receive new equity interests, such person or Entity shall be precluded as a result

of such violation (and, thus, in addition to any other amounts otherwise precluded hereunder) from receiving, directly or indirectly,

any consideration consisting of a Beneficial Ownership of the New Common Stock attributable to such person’s (or Entity’s)

Claims up to and including an amount equivalent to that represented by such Owned Interests), in each case including any consideration

in lieu thereof, provided, however, that such person (or Entity) may be entitled to receive any other consideration to which such

person (or Entity) may be entitled by virtue of holding Claims (this provision, the “Equity Forfeiture Provision”).

Any purported acquisition of, or other increase in the Beneficial Ownership of, the New Common Stock that is precluded by the Equity Forfeiture

Provision will be an acquisition of “Forfeited Equity.” Any acquirer of Forfeited Equity shall, promptly upon becoming

aware of such fact, return or cause to return the Forfeited Equity to the Debtors (or any successor to the Debtors, including the Post-Emergence

Company) or, if all of the equity consideration properly issued to such acquirer and all or any portion of such Forfeited Equity have

been sold prior to the time such acquirer becomes aware of such fact, such acquirer shall return or cause to return to the Debtors (or

any successor to the Debtors, including the Post-Emergence Company) (i) any Forfeited Equity still held by such acquirer and (ii) the

proceeds attributable to the sale of Forfeited Equity, calculated by treating the most recently sold equity as Forfeited Equity. Any acquirer

that receives Forfeited Equity and deliberately fails to comply with the preceding sentence shall be subject to such additional sanctions

as the Court may determine. Any Forfeited Equity returned to the Debtors, including the Post-Emergence Company, shall be distributed (including

a transfer to charity) or extinguished, in the Debtors’ sole discretion, in furtherance of the 382(l)(5) Plan. |

| viii. | In effecting any sale or other transfer of Claims pursuant to a Sell-Down Notice, a Substantial Claimholder

shall, to the extent that it is reasonably feasible to do so within the normal constraints of the market in which such sale takes place,

notify the acquirer of such Claims of the existence of these Procedures and the Equity Forfeiture Provision (it being understood that,

in all cases in which there is direct communication between a salesperson and a customer, including, without limitation, communication

via telephone, e-mail, and instant messaging, the |

existence of these Procedures and the Equity

Forfeiture Provision shall be included in such salesperson’s summary of the transaction).

| i. | No person (including any Entity) shall be subject to the approval provisions of paragraphs (b) and (c)

above or, in the case of Claims that are part of the transferor’s Protected Amount, the sell-down provisions of paragraph (d) above

with respect to any transfer described in Treasury Regulations section 1.382-9(d)(5)(ii) so long as such transfer is not for a principal

purpose of obtaining the New Common Stock or permitting the transferee to benefit from the losses of the Debtors within the meaning of

Treasury Regulations section 1.382-9(d)(5)(iii); provided, however, that any such transferee who becomes a Substantial Claimholder

following the filing of a Proposed 382(l)(5) Disclosure Statement shall serve upon the Plan Proponent and its counsel, the Committee’s

counsel, and the Second Lien Agent’s counsel (and the Declaration Notice Parties if the Debtors are not the Plan Proponent), a notice

of such status, substantially in the form annexed to the Procedures as Exhibit 1F, as provided in these Procedures. |

| ii. | For the avoidance of doubt, the trustee of any trust, any indenture trustee, subordination agent, registrar,

paying agent, transfer agent, loan or collateral agent, or any other entity serving in a similar capacity however designated, in each

case for any Claim or any Owned Interests, notes, bonds, debentures, property, or other debt securities or obligations (i) issued by any

of the Debtors, (ii) secured by assets of any of the Debtors or agreements with respect to such assets, or (iii) secured by assets leased

to any of the Debtors shall not be treated as a Substantial Claimholder solely to the extent that such entities are acting in the capacity

described above; provided, however, that neither any transferee of Claims nor any equity or beneficial owner of a trust shall be

excluded from these Procedures solely by reason of this provision. |

| f. | For purposes of these Procedures Applicable to Transfers of Claims Against the Debtors. |

| i. | “Applicable Percentage of the New Common Stock” means, (i) if only one class of the

New Common Stock is to be issued pursuant to the terms of a 382(l)(5) Plan and holders within each class of Claims receiving the

New Common Stock will receive a pro rata distribution of the New Common Stock, 4.5% of the number of shares of the New Common Stock

that the Debtors reasonably estimate will be outstanding immediately after the effective date of such 382(l)(5) Plan, as determined

for U.S. federal income tax purposes, or (ii) if multiple classes of the New Common Stock are issued pursuant to the terms of a 382(l)(5)

Plan or if holders within a class of Claims may receive a disproportionate distribution of New Common Stock relative to other holders

in the same class, a percentage of the number of shares of each class of the New Common Stock (which percentage may be different for each

such class) that have an aggregate fair market value equal to 4.5% of the fair market value of all the New Common Stock that the Debtors |

reasonably estimate will be outstanding

immediately after the effective date of such 382(l)(5) Plan, as determined for U.S. federal income tax purposes.

| ii. | “Beneficial Ownership” of a Claim or Owned Interest means: (A) the beneficial ownership

of a Claim or Owned Interest (as hereinafter defined) as determined in accordance with applicable rules under section 382 of the IRC,

the Treasury Regulations (other than Treasury Regulations section 1.382-2T(h)(2)(i)(A)), and rulings issued by the Internal Revenue Service

and as described herein (for such purpose, a Claim or Owned Interest is treated as if it were stock) and, thus, to the extent provided

in those sources, from time to time, shall include, without limitation, (x) direct, indirect and constructive ownership (but determined

without regard to any rule that treats stock of an entity as to which the constructive ownership rules apply as no longer owned by that

entity) (e.g., a holding company would be considered to beneficially own all Claims or Owned Interests owned or acquired by its

subsidiaries), (y) ownership by a holder’s family members, and (z) ownership by any Entity, Owned Interests, and/or stock; and (B)

the beneficial ownership of an Option (irrespective of the purpose for which such Option was issued, created, or acquired) with respect

to a Claim or Owned Interest. For the avoidance of doubt, Beneficial Ownership of a Claim or Owned Interests also includes the beneficial

ownership of any right to receive any equity consideration to be distributed in respect of a Claim or Owned Interests pursuant to a chapter

11 plan or any applicable bankruptcy court order. |

| iii. | “Claim” means any claim, as defined in section 101(5) of the Bankruptcy Code, against

any of the Debtors, whether secured or unsecured, other than any claims under or in connection with any of the Debtors’ proposed

debtor in possession financing facility (a “DIP Loan”). |

| iv. | “Entity” has the meaning as such term is defined in section 1.382-3(a) of the Treasury

Regulations, including any group of persons acting pursuant to a formal or informal understanding among themselves to make a coordinated

acquisition of Claims or the New Common Stock. |

| v. | “Holdings Report” means a Notice of Substantial Claim Ownership (as hereinafter defined)

received by the Declaration Notice Parties with respect to the Determination Date. |

| vi. | “Maximum Amount” means the maximum amount of Claims (by class or other applicable classification

of Claims) that may be held, as of the effective date of the 382(l)(5) Plan, by a Substantial Claimholder that was a Substantial

Claimholder as of the Determination Date, which the Debtors shall calculate as follows: (x) based upon the information provided by the

Substantial Claimholders in the Holdings Reports, the Debtors shall calculate the aggregate amount of Claims that all such Substantial

Claimholders must sell as a group to effectuate the 382(l)(5) Plan (the “Sell-Down Amount”); (y) the Debtors

shall calculate for each Substantial Claimholder the amount of such Substantial Claimholder’s pro rata share of the Sell-Down

Amount (i.e., the Sell-Down Amount multiplied by a fraction, (1) the |

numerator of which is the amount, if any,

of Claims identified in such Substantial Claimholder’s Holdings Report minus the greater of (A) the applicable Threshold Amount

and (B) the Protected Amount for such Substantial Claimholder, and (2) the denominator of which is the aggregate amount of Claims identified

in all of the Substantial Claimholders’ Holdings Reports minus the greater of (A) the aggregate applicable Threshold Amount for

all Substantial Claimholders and (B) the aggregate Protected Amount of all Substantial Claimholders; and (z) for each such Substantial

Claimholder, the Debtors shall subtract from the total Claims held by such Substantial Claimholder (as reported in the Holdings Report)

such Substantial Claimholder’s pro rata share of the Sell-Down Amount. The difference shall be the Maximum Amount.

| vii. | “New Common Stock” means the common stock and any other equity securities (including

securities that are treated as equity securities for U.S. federal income tax purposes) of the Post-Emergence Company, including Options

to acquire the same. |

| viii. | “Newly Traded Claims” means Claims (x) with respect to which a person (including any

Entity) acquired Beneficial Ownership after the date that was eighteen (18) months prior to the Petition Date and (y) that are not “ordinary

course” Claims, within the meaning of Treasury Regulations section 1.382-9(d)(2)(iv), of which the same person (including any Entity)

always has had Beneficial Ownership. |

| ix. | “Permitted Transferee” with respect to a Substantial Claimholder is a person (including

any Entity) whose holding of a Claim would not result in such Substantial Claimholder having Beneficial Ownership of such Claim. |

| x. | “Post-Emergence Company” means the reorganized Debtors or any successor thereto. |

| xi. | “Protected Amount” means the amount of Claims (by class or other applicable classification)

of which a holder had Beneficial Ownership on the Petition Date (or such later date as may be specified by the Plan Proponent in the Proposed

382(l)(5) Disclosure Statement) plus the amount of Claims of which such holder acquires, directly or indirectly, Beneficial

Ownership pursuant to trades entered into prior to the Petition Date (or such later date), but that had not yet closed as of the Petition

Date (or such later date), and the amount of Claims of which such holder acquires, directly or indirectly, Beneficial Ownership pursuant

to trades entered into after the Petition Date (or such later date) that have been approved by the Debtors in accordance with these Procedures

minus the amount of Claims of which such holder sells, directly or indirectly, Beneficial Ownership pursuant to trades entered into prior

to the Petition Date (or such later date), but that had not yet closed as of the Petition Date (or such later date). |

| xii. | “Substantial Claimholder” means any person (including any Entity) that beneficially

owns an aggregate dollar amount of Claims against the Debtors, or any Entity controlled by such person through which such person beneficially

owns |

Claims against the Debtors, of more than

the Threshold Amount other than any claims under or in connection with any DIP Loan. For the avoidance of doubt, section 382 of the IRC,

the Treasury Regulations, and all relevant IRS and judicial authority shall apply in determining whether the Claims of several persons

and/or Entities must be aggregated when a person’s (including an Entity’s) status as a Substantial Claimholder (for such purpose,

a Claim is treated as if it were stock).

| xiii. | “Threshold Amount” means an amount of Claims that, when taking into account the Owned

Interests beneficially owned by a holder of Claims (including under the applicable aggregation rules), could result in such holder of

Claims holding the Applicable Percentage of the New Common Stock. For this purpose, the Beneficial Ownership of an Option to acquire Owned

Interests shall be considered Beneficial Ownership of Owned Interests. Notwithstanding the foregoing, if a beneficial owner of Claims

does not agree to refrain from acquiring Beneficial Ownership of additional Owned Interests (and Options to acquire the same) or to dispose

of immediately any such Owned Interests or Options (if acquired on or after the Petition Date but prior to submitting its Notice of Substantial

Claim Ownership (as hereinafter defined)), the Threshold Amount for such beneficial owner of Claims shall be the “Minimum Threshold

Amount,” which shall be the amount of Claims beneficially owned by a holder of Claims continuously from the Petition Date to the

Sell-Down Date (as hereinafter defined). |

| xiv. | “382(l)(5) Plan” means a plan of reorganization that contemplates the use of

section 382(l)(5) of the IRC by a reorganized debtor to obtain certain incremental tax benefits. |

Notice Procedures

| a. | No later than three (3) business days following entry of the Final Order, or as soon as was reasonably

practicable thereafter, the Debtors will serve by first class mail a notice, substantially in the form of Exhibit 1I attached to

the Procedures (the “Notice of Final Order”), on the parties listed in paragraph 31 of the Motion (collectively, the “Notice

Parties”) and the Nominees. |

| b. | Upon receipt of the Notice of Interim Order or Notice of Final Order, as applicable, all Nominees shall

serve the applicable notice to any beneficial holders of the Common Stock as required pursuant to subparagraph (a), immediately above,

by no later than five (5) business days after being served with notice. Additionally, any Entity or broker or agent acting on such Entity’s

or individual’s behalf who sells Common Stock to another Entity shall be required to serve a copy of the Notice of Interim Order

or Notice of Final Order, as applicable, on such purchaser of such Common Stock or any broker or agent acting on such purchaser’s

behalf. |

| c. | Any Entity or broker or agent acting on such Entity’s or individual’s behalf who sells Common

Stock to another person or Entity shall be required to serve a copy of the Notice of Interim Order or Notice of Final Order, as applicable,

on such purchaser of such Common Stock or any broker or agent acting on such purchaser’s behalf. |

| d. | To the extent confidential information is required in any declaration described in these Procedures, such

confidential information may be filed and served in redacted form; provided that any such declarations served on the Debtors shall

not be in redacted form. The Debtors shall keep all information provided in such declarations strictly confidential and shall not disclose

the contents thereof to any person except to the extent (i) necessary to respond to a petition or objection filed with the Court, (ii)

otherwise required by law, or (iii) that the information contained therein is already public; provided that the Debtors may disclose

the contents thereof to their professional advisors, who shall keep all such declarations strictly confidential and shall not disclose

the contents thereof to any other person, subject to further Court order. If confidential information is necessary to respond to a petitioner’s

objection filed with the Court, such confidential information shall be filed under seal or in a redacted form. |

| e. | The Debtors may waive any and all restrictions, stays, and notification Procedures contained in the Notice

of Interim Order and Notice of Final Order. |

[Remainder of Page Intentionally Left Blank]

Exhibit 1A

Declaration of Status as a Substantial Shareholder

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| |

) |

|

| In re: |

) |

Chapter 11 |

| |

) |

|

| PROTERRA INC, et al.,1 |

) |

Case No. 23-11120 (BLS) |

| |

) |

|

| Debtors. |

) |

(Jointly Administered) |

| |

) |

|

DECLARATION

OF STATUS AS A SUBSTANTIAL SHAREHOLDER2

PLEASE TAKE NOTICE

that the undersigned party is/has become a Substantial Shareholder with respect to the common stock of Proterra Inc or with respect to

any Beneficial Ownership therein (the “Common Stock”).3

Proterra Inc is a debtor and debtor-in-possession in Case No. 23-11120 (BLS)

| 1 | The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal

tax identification number, are as follows: Proterra Inc (9565); and Proterra Operating Company, Inc. (8459). The location of the Debtors’

service address is: 1815 Rollins Road, Burlingame, California 94010. |

| 2 | For purposes of this Declaration: (i) a “Substantial Shareholder” is any person or Entity that has Beneficial Ownership

of at least 10,252,500 shares of Common Stock (representing 4.5 percent of all issued and outstanding shares of Common Stock outstanding

as of the Petition Date); (ii) “Beneficial Ownership” will be determined in accordance with the applicable rules of

section 382 of the Internal Revenue Code, the Treasury Regulations thereunder (other than Treasury Regulations section 1.382-2T(h)(2)(i)(A)),

and rulings issued by the Internal Revenue Service and includes, without limitation, direct, indirect, and constructive ownership (but

determined without regard to any rule that treats stock of an entity as to which the constructive ownership rules apply as no longer owned

by that entity) (e.g., (1) a holding company would be considered to beneficially own all equity securities owned by its subsidiaries,

(2) a partner in a partnership would be considered to beneficially own its proportionate share of any equity securities owned by such

partnership, (3) an individual and such individual’s family members may be treated as one individual, (4) persons and entities

acting in concert to make a coordinated acquisition of equity securities may be treated as a single entity, and (5) to the extent set

forth in Treasury Regulations section 1.382-4, a holder would be considered to beneficially own equity securities that such holder has

an Option (as defined herein) to acquire); (iii) an “Option” to acquire stock includes all interests described in Treasury

Regulations section 1.382-4(d)(9), including any contingent purchase right, warrant, convertible debt, put, call, stock subject to risk

of forfeiture, contract to acquire stock, or similar interest, regardless of whether such interest is contingent or otherwise not currently

exercisable; and (iv) “Entity” has the meaning as such term is defined in section 1.382-3(a) of the Treasury Regulations,

including any group of persons who have a formal or informal understanding among themselves to make a coordinated acquisition of stock. |

| 3 | For the avoidance of doubt, the definition of Common Stock shall not include record or Beneficial Ownership

in any securities to be issued in connection with a chapter 11 plan of reorganization of the Debtors. |

pending in the United States Bankruptcy Court

for the District of Delaware (the “Court”).

PLEASE TAKE FURTHER NOTICE

that, as of __________ , 2023, the undersigned party currently has Beneficial Ownership of _________ shares of the Common Stock and/or

Options to acquire _________ shares of the Common Stock. The following table sets forth (i) the number of shares of Common Stock and/or

the number of shares of Common Stock underlying the Options beneficially owned by the undersigned party and (ii) the date(s) on which

the undersigned party acquired Beneficial Ownership of such Common Stock and/or Options to acquire such Common Stock (categorized by class,

as applicable). In the case of Common Stock and/or Options that are not owned directly by the undersigned party but are nonetheless beneficially

owned by the undersigned party, the table sets forth (a) the name(s) of each record or legal owner of such shares of Common Stock and/or

Options that are beneficially owned by the undersigned party, (b) the number of shares of Common Stock and/or the number of shares of

the Common Stock underlying the Options beneficially owned by such undersigned party, and (c) the date(s) on which such Common Stock and/or

Options were acquired (categorized by class, as applicable).

| Name of Owner |

Shares Owned |

Date(s) Acquired |

| |

|

|

| |

|

|

| |

|

|

(Attach additional page or pages if necessary.)

PLEASE TAKE FURTHER NOTICE

that the last four digits of the taxpayer identification number of the undersigned party are ________.

PLEASE TAKE FURTHER NOTICE

that, pursuant to that certain Final Order (I) Establishing Notification and Hearing Procedures for Certain Transfers of and Declarations

of Worthlessness with Respect to Common Stock of Proterra Inc and Claims Against Debtors and (II) Granting Related Relief [Docket

No. ____] (the “Order”), this declaration (this “Declaration”) is being filed with the

Court and served upon the Declaration Notice Parties (as defined in the Order).

PLEASE TAKE FURTHER NOTICE

that, pursuant to 28 U.S.C. § 1746, under penalties of perjury, the undersigned party hereby declares that he or she has examined

this Declaration and accompanying attachments (if any) and, to the best of his or her knowledge and belief, this Declaration and any attachments

hereto are true, correct, and complete.

| |

Respectfully submitted, |

|

| |

|

|

| |

(Name of Substantial Shareholder) |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

|

|

| |

|

Name: |

|

|

| |

|

Address: |

|

|

| |

|

|

|

| |

|

Telephone: |

|

|

| |

|

Facsimile: |

|

|

| Dated: |

|

, |

20__ |

|

| |

, |

|

|

| (City) |

|

|

(State) |

|

Exhibit 1B

Declaration of Intent to Accumulate Common

Stock

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| |

) |

|

| In re: |

) |

Chapter 11 |

| |

) |

|

| PROTERRA INC, et al.,1 |

) |

Case No. 23-11120 (BLS) |

| |

) |

|

| Debtors. |

) |

(Jointly Administered) |

| |

) |

|

DECLARATION

OF INTENT TO ACCUMULATE COMMON STOCK2

PLEASE TAKE NOTICE

that the undersigned party hereby provides notice of its intention to purchase, acquire, or otherwise accumulate (the “Proposed

Transfer”) one or more shares of common stock of Proterra Inc or any Beneficial Ownership therein (the “Common Stock”).3

Proterra Inc is a debtor and

| 1 | The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal

tax identification number, are as follows: Proterra Inc (9565); and Proterra Operating Company, Inc. (8459). The location of the Debtors’

service address is: 1815 Rollins Road, Burlingame, California 94010. |

| 2 | For purposes of this Declaration: (i) a “Substantial Shareholder” is any person or Entity that has Beneficial Ownership

of at least 10,252,500 shares of Common Stock (representing 4.5 percent of all issued and outstanding shares of Common Stock outstanding

as of the Petition Date); (ii) “Beneficial Ownership” will be determined in accordance with the applicable rules of

section 382 of the Internal Revenue Code, the Treasury Regulations thereunder (other than Treasury Regulations section 1.382-2T(h)(2)(i)(A)),

and rulings issued by the Internal Revenue Service and includes, without limitation, direct, indirect, and constructive ownership (but

determined without regard to any rule that treats stock of an entity as to which the constructive ownership rules apply as no longer owned

by that entity) (e.g., (1) a holding company would be considered to beneficially own all equity securities owned by its subsidiaries,

(2) a partner in a partnership would be considered to beneficially own its proportionate share of any equity securities owned by such

partnership, (3) an individual and such individual’s family members may be treated as one individual, (4) persons and entities

acting in concert to make a coordinated acquisition of equity securities may be treated as a single entity, and (5) to the extent set

forth in Treasury Regulations section 1.382-4, a holder would be considered to beneficially own equity securities that such holder has

an Option (as defined herein) to acquire); (iii) an “Option” to acquire stock includes all interests described in Treasury

Regulations section 1.382-4(d)(9), including any contingent purchase right, warrant, convertible debt, put, call, stock subject to risk

of forfeiture, contract to acquire stock, or similar interest, regardless of whether such interest is contingent or otherwise not currently

exercisable; and (iv) “Entity” has the meaning as such term is defined in section 1.382-3(a) of the Treasury Regulations,

including any group of persons who have a formal or informal understanding among themselves to make a coordinated acquisition of stock. |

| 3 | For the avoidance of doubt, the definition of Common Stock shall not include record or Beneficial Ownership

in any securities to be issued in connection with a chapter 11 plan of reorganization of the Debtors. |

debtor in possession in Case No. 23-11120 (BLS)

pending in the United States Bankruptcy Court for the District of Delaware (the “Court”).

PLEASE TAKE FURTHER NOTICE

that, if applicable, on ___________ __, 2023, the undersigned party filed a declaration of status as a Substantial Shareholder with the

Court and served copies thereof as set forth therein.

PLEASE TAKE FURTHER NOTICE

that the undersigned party currently has Beneficial Ownership of _________ shares of Common Stock and/or Options to acquire _________

shares of Common Stock.

PLEASE TAKE FURTHER NOTICE

that, pursuant to the Proposed Transfer, the undersigned party proposes to purchase, acquire, or otherwise accumulate Beneficial Ownership

of _________ shares of Common Stock or an Option with respect to _________ shares of Common Stock. If the Proposed Transfer is permitted

to occur, the undersigned party will have Beneficial Ownership of _________ shares of Common Stock and/or Options to acquire _________

shares of Common Stock after such transfer becomes effective.

PLEASE TAKE FURTHER NOTICE

that the last four digits of the taxpayer identification number of the undersigned party are ___________.

PLEASE TAKE FURTHER NOTICE

that, pursuant to that certain Final Order (I) Establishing Notification and Hearing Procedures for Certain Transfers of and Declarations

of Worthlessness with Respect to Common Stock of Proterra Inc and Claims Against Debtors and (II) Granting Related Relief [Docket

No. ____] (the “Order”), this declaration (this “Declaration”) is being filed

with the Court and served upon the Declaration

Notice Parties (as defined in the Order).

PLEASE TAKE FURTHER NOTICE

that, pursuant to the Order, the undersigned party acknowledges that it is prohibited from consummating the Proposed Transfer unless and

until the undersigned party complies with the Procedures set forth therein.

PLEASE TAKE FURTHER NOTICE