Invesco PowerShares Lowers Fees on Domestic FTSE RAFI ETF Portfolios

October 24 2008 - 3:15PM

Marketwired

Invesco PowerShares Capital Management LLC, a leading provider of

exchange-traded funds (ETFs) announced that expense ratios for its

eleven domestic PowerShares FTSE RAFI ETF portfolios will be

lowered to 39 basis points effective November 1, 2008.

The names and ticker symbols for the PowerShares FTSE RAFI ETFs

are listed below:

PRF PowerShares FTSE RAFI US 1000 Portfolio

PRFZ PowerShares FTSE RAFI US 1500 Small-Mid Portfolio

PRFM PowerShares FTSE RAFI Basic Materials Sector Portfolio

PRFG PowerShares FTSE RAFI Consumer Goods Sector Portfolio

PRFS PowerShares FTSE RAFI Consumer services Sector Portfolio

PRFE PowerShares FTSE RAFI Energy Sector Portfolio

PRFF PowerShares FTSE RAFI Financials Sector Portfolio

PRFH PowerShares FTSE RAFI Health Care Sector Portfolio

PRFN PowerShares FTSE RAFI Industrials Sector Portfolio

PRFQ PowerShares FTSE RAFI Telecom & Technology Sector Portfolio

PRFU PowerShares FTSE RAFI Utilities Sector Portfolio

"Invesco PowerShares pioneered fundamentals weighted ETFs

introducing the first broad based US 1000 portfolio in 2005,

followed by a US 1500 and sector portfolios in 2006," said Bruce

Bond, President and CEO of Invesco PowerShares.

The PowerShares' Fundamentals Weighted Portfolios are based on

FTSE? RAFI� indexes, uniquely constructed using four fundamental

measures to rank a company's size: book value, cash flow, sales and

dividends. The equities with the highest fundamental strength are

weighted according to fundamental scores.

"The PowerShares fundamentals weighted ETFs are an important

alternative to cap weighted portfolios seeking to provide investors

higher returns with lower volatility over time. We are pleased to

continue our industry leading role and will be lowering fees across

the entire domestic FTSE RAFI lineup," continued Bruce Bond.

Invesco PowerShares is leading the intelligent ETF revolution

through its family of more than 140 domestic and international

index-based and actively managed exchange-traded funds. With assets

under management as of September 30, 2008, of approximately $12.21

billion, PowerShares ETFs trade on all of the major U.S. stock

exchanges that trade ETFs. For more information, please visit us at

www.invescopowershares.com.

Invesco PowerShares is a part of Invesco Ltd., a leading

independent global investment management company dedicated to

helping people worldwide build their financial security. By

delivering the combined power of its distinctive worldwide

investment management capabilities, including AIM, Atlantic Trust,

Invesco, Perpetual, PowerShares, Trimark, and WL Ross, Invesco

provides a comprehensive array of enduring investment solutions for

retail, institutional and high-net-worth clients around the world.

Operating in 20 countries, the company is currently listed on the

New York Stock Exchange under the symbol "IVZ." Additional

information is available at www.invesco.com.

There are risks involved with investing in ETFs, including

possible loss of money. The Fund is not actively managed and is

subject to risk similar to stocks. Ordinary brokerage commissions

apply.

Shares are not FDIC insured, may lose value and have no bank

guarantee.

PowerShares� is a registered trademark of Invesco PowerShares

Capital Management LLC. Invesco PowerShares Capital Management LLC

and Invesco Aim Distributors, Inc. are indirect, wholly owned

subsidiaries of Invesco Ltd. The S-Network Emerging Infrastructure

Builders Index(SM) is licensed for use by Invesco PowerShares

Capital Management LLC. The PowerShares Emerging Markets

Infrastructure Portfolio is not sponsored, endorsed, sold or

promoted by S-NET. S-NET makes no representation or warranty,

express or implied, to the owners of the PowerShares Emerging

Markets Infrastructure Portfolio or any member of the public

regarding the advisability of investing in securities generally or

in the PowerShares Emerging Markets Infrastructure Portfolio

particularly or the ability of the S-Network Emerging

Infrastructure Builders Index(SM) to track the performance of the

securities market.

Shares are not individually redeemable and owners of the shares

may acquire those shares from the Fund and tender those shares for

redemption to the Fund in Creation Unit aggregations only,

typically consisting of 100,000 shares.

Invesco Aim Distributors, Inc. is the distributor of the

PowerShares Exchange-Traded Fund Trust II.

An investor should consider the Funds' investment objectives,

risks, charges and expenses carefully before investing. For this

and more complete information about the Funds call 800.983.0903 for

a prospectus. The prospectus contains this and other information

regarding the Funds. Please read the prospectus carefully before

investing.

Media Contacts: Kristin Sadlon Porter Novelli 212-601-8192 Email

Contact Bill Conboy BC Capital Partners 303-415-2290 Email

Contact

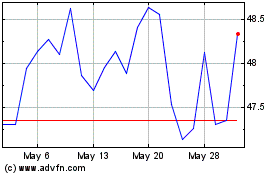

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Feb 2025 to Mar 2025

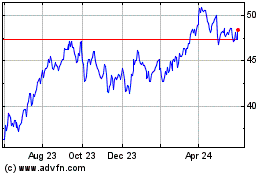

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Mar 2024 to Mar 2025