false

0000086115

false

0000086115

2023-12-07

2023-12-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2023

Safeguard Scientifics, Inc.

(Exact Name of registrant as Specified in Charter)

| Pennsylvania |

001-05620 |

23-1609753 |

| (State or other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer ID No.) |

150 N. Radnor Chester Rd., STE F-200 Radnor,

PA |

19087 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: 610-293-0600

Not applicable

(Former Name or Former Address if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock ($.10 par value) |

SFE |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

On December 7, 2023, the Board

of Directors of Safeguard Scientifics, Inc. (the “Company”) declared a special contingent cash dividend (the “Special

Dividend”) of $0.35 per share of the Company’s issued and outstanding common stock, payable on December 28, 2023, to shareholders

of record as of the close of business on December 19, 2023. The ex-dividend date will be December 29, 2023. On December 8, 2023, the Company issued a press release (the “Press Release”) regarding

the Special Dividend. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

The following exhibits are filed herewith:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Safeguard Scientifics, Inc. |

| |

|

|

| Date: December 8, 2023 |

By: |

/s/ G. Matthew Barnard |

| |

Name: |

G. Matthew Barnard |

| |

Title: |

General Counsel |

Exhibit 99.1

Safeguard Scientifics’ Board of Directors

Declares

Contingent Cash Dividend of $0.35 Per Share

Radnor, PA, December 8,

2023 - Safeguard Scientifics, Inc. (Nasdaq:SFE) (“Safeguard” or the “Company”) today announced that on December

7, 2023, its Board of Directors (the “Board”) declared a special cash dividend of $0.35 per share, payable on December 28,

2023 to shareholders of record as of the close of business on December 19, 2023 (the “Record Date”).

The dividend is contingent

on the adoption of amendments to the Company’s articles of incorporation effecting the reverse stock split and the forward stock

split of the Company’s common stock at the Special Meeting of Shareholders to be held on December 15, 2023, and the Board thereafter

giving effect to the Company’s previously announced plan to cease the registration of the Company’s common stock under the

Securities Exchange Act of 1934, as amended, and to delist the Company’s common stock from trading on The Nasdaq Stock Market LLC

(referred to as the “Transaction”). The terms of the stock splits and information about the overall going private Transaction

are set forth in the definitive proxy statement and Schedule 13E-3 filed with the Securities and Exchange Commission (the “SEC”)

by the Company.

This special cash dividend

is consistent with the Company’s strategy to return value to shareholders, and the Board has declared this dividend using Safeguard’s

excess cash that represents cash on hand less the amounts required to be retained to support Safeguard’s operations as a private

company, satisfy its liabilities and pay costs of the stock splits and the proposed Transaction.

Since the payment of the dividend

would represent more than 25% of the Company’s stock price on the declaration date of December 7, 2023, it is expected that the

Company’s shares will trade with “due bills” representing an assignment of the right to receive the dividend from the

Record Date through the closing of the Nasdaq Capital Market on the payment date of December 28, 2023 (this period of time representing

the “Dividend Right Period”). Thus, the Company’s shares are expected to trade with this “due bill” and

the assignment of the right to receive the dividend during the Dividend Right Period until the ex-dividend date of December 29, 2023,

the first business day after the payment date.

Shareholders who sell their

shares during the Dividend Right Period and prior to the ex-dividend date would be selling their right to the dividend and such shareholder

will not be entitled to receive the dividend. Due bills obligate a seller of shares to deliver the dividend payable on such shares to

the buyer and holder of the shares as of the payment date. The due bill obligations are settled customarily between the brokers representing

the buyers and sellers of the shares. The Company has no obligation for either the amount of the due bill or the processing of the due

bill. Buyers and sellers of the Company's shares should consult their broker before trading to be sure they understand the effect of Nasdaq's

due bill procedures.

U.S. FEDERAL TAX TREATMENT OF THE DIVIDEND

The Company currently believes

that, for U.S. federal tax purposes, the cash dividend will be treated as a return of capital to shareholders to the extent of their tax

basis in Safeguard’s common stock.

The ultimate tax treatment

of the dividend will be based on Safeguard’s current and accumulated earnings and profits for Safeguard’s year ending December

31, 2023. The process of determining current and accumulated earnings and profits requires a final determination of Safeguard’s

financial results for the year and a review of certain other factors. The final determination of the tax treatment of the dividend will

be based in part on factors that are outside of the control of Safeguard, including possible transactions involving our remaining companies,

and which cannot be ascertained at this time. Accordingly, the expected tax treatment of the dividend is based upon currently available

information and is subject to change. Safeguard expects to update information on the taxation of the dividend following the completion

of 2023.

The return of capital dividend

as reported on Form 8937 will be available on Safeguard’s website. The Form 8937 will be updated following the determination of

Safeguard’s financial results for the year ended December 31, 2023 and a review of certain other factors.

The information set forth

above is provided only for general use, and does not constitute a complete description of all of the U.S. federal tax consequences of

the receipt of the special cash dividend or the ownership and disposition of Safeguard’s common stock. Shareholders should consult

their own tax advisors concerning such consequences.

About Safeguard Scientifics

Historically, Safeguard Scientifics has provided

capital and relevant expertise to fuel the growth of technology-driven businesses. Safeguard has a distinguished track record of fostering

innovation and building market leaders that spans more than six decades. Safeguard is currently pursuing a focused strategy to value-maximize

and monetize its ownership interests over a multi-year time frame to drive shareholder value. For more information, please visit www.safeguard.com.

Additional Information and Where to Find It

THIS PRESS RELEASE IS NOT A REQUEST FOR OR SOLICITATION

OF A PROXY OR AN OFFER TO ACQUIRE OR SELL ANY SHARES OF COMMON STOCK. THE COMPANY FILED A DEFINITIVE PROXY STATEMENT AND OTHER REQUIRED

MATERIALS, INCLUDING SCHEDULE 13E-3, WITH THE SEC CONCERNING THE TRANSACTION ON NOVEMBER 2, 2023

AND WILL FILE OR FURNISH OTHER RELEVANT MATERIALS WITH THE SEC, AS APPLICABLE. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY

WERE FIRST MAILED OR OTHERWISE FURNISHED TO THE SHAREHOLDERS OF THE COMPANY ON NOVEMBER 2, 2023. THE COMPANY URGES ALL SHAREHOLDERS TO

READ THE DEFNITIVE PROXY STATEMENT, AS WELL AS ALL OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THOSE DOCUMENTS WILL INCLUDE IMPORTANT

INFORMATION. A FREE COPY OF ALL MATERIALS THE COMPANY FILES WITH THE SEC, INCLUDING THE COMPANY’S SCHEDULE 13E-3 AND DEFINITIVE

PROXY STATEMENT, ARE AVAILABLE AT NO COST ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS

FILED BY THE COMPANY MAY ALSO BE OBTAINED WITHOUT CHARGE BY DIRECTING A REQUEST TO SAFEGUARD SCIENTIFICS, INC., 150 N. RADNOR CHESTER

RD., STE F-200, RADNOR, PA 19087, ATTENTION: CORPORATE SECRETARY.

Participants in the Solicitation

The Company and its directors and executive officers

may be deemed to be participants in the solicitation of proxies in connection with the proposed Transaction. A list of the names of such

directors and executive officers and information concerning such participants’ ownership of common stock is set forth in the Company’s

definitive proxy statement filed with the SEC on November 2, 2023. Additional information about the interests of those participants may

also be obtained from reading such definitive proxy statement relating to the proposed Transaction, or by directing a request to Safeguard

Scientifics, Inc., 150 N. Radnor Chester Rd., Ste F-200, Radnor, Pa 19087, Attention: Corporate Secretary.

Forward

Looking Statements

This press

release may contain forward-looking statements that are being made pursuant to the Private Securities Litigation Reform Act of

1995, which provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information

so long as those statements are accompanied by meaningful cautionary statements identifying important factors that could cause actual

results to differ materially from those discussed in the statement. Such forward-looking statements include statements about the amount

and timing of Safeguard’s special cash dividend, as well as contingencies related to the payment of such dividend, the perceived

benefits and costs of the proposed Transaction, and the timing and shareholder approval of the stock splits. Such forward-looking statements

are subject to a number of known and unknown risks and uncertainties that could cause actual results, performance or achievements to differ

materially from those described or implied in such forward-looking statements. Accordingly, actual results may differ materially from

such forward-looking statements. The forward-looking statements relating to the proposed transaction are based on the Company’s

current expectations, assumptions, estimates and projections about the Company and involve significant risks and uncertainties, including

the many variables that may impact the Company’s projected cost savings, variables and risks related to consummation of the stock

splits and the proposed transaction, SEC regulatory review of the Company’s filings related to the proposed transaction, and the

continuing determination of the Board that the proposed transaction is in the best interests of all shareholders. The Company assumes

no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting such forward-looking statements.

SAFEGUARD CONTACT:

Mark Herndon

Chief Financial Officer

mherndon@safeguard.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

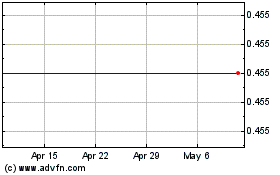

Safeguard Scientifics (NASDAQ:SFE)

Historical Stock Chart

From Apr 2024 to May 2024

Safeguard Scientifics (NASDAQ:SFE)

Historical Stock Chart

From May 2023 to May 2024