Security National Financial Corporation Reports Financial Results for the Year Ended December 31, 2023

April 01 2024 - 9:00AM

Security National Financial Corporation (SNFC) (NASDAQ symbol

"SNFCA") announced financial results for the year ended December

31, 2023.

For the twelve months ended December 31, 2023,

SNFC’s after-tax earnings from operations decreased 44% from

$25,690,000 in 2022 to $14,495,000 in 2023, on a 18% decrease in

revenues to $318,497,000.

Scott Quist, Chairman of the Board, President,

and Chief Executive Officer of SNFC, said, “2023 was a year where

the financial balance of our company demonstrated itself. With the

increasing interest rates and improving premium margins our life

insurance business segment had its best operational year ever,

earning $25,000,000. As death rates stabilized throughout 2023, and

as we implemented renewed emphasis on operational efficiencies, our

Cemetery and Mortuary segment had its best year ever, earning

nearly $8,500,000. Needless to say, we are very pleased with those

results. However, the increased interest rates continued to have a

devastating effect on our mortgage loan business with volumes

falling roughly an additional 35% below 2022’s already decreased

markets, with the net result being that our Mortgage segment lost

$17,500,000. Despite that loss, I thought our team battled the

market conditions extraordinarily well and positioned us to take

advantage of a very distraught mortgage loan market. I think it

worthy to remember that in the three years 2020 to 2022 our

Mortgage segment produced $98,000,000 of profit, so we think the

goal is worthy of our current efforts.

“We remain committed to the task of growth and

improved profitability. We view this current economic uncertainty

as a time to improve and expand in all our segments. In this tough

mortgage loan environment, we have necessarily greatly slimmed down

our office staffs, both pruned and increased our number of

producing loan officers, while emphasizing cost efficiencies and

metrics. In our Insurance segment we have increased premium rates

and initiated better measurement metrics for mortality,

persistency, and acquisition costs. In our Memorial

segment we have added key personnel, who we believe will drive

growth and improve operations. To be sure, growth in this

environment is expensive, but is nevertheless our

goal.”

SNFC has three business segments. The following

table shows the revenues and earnings before taxes for the twelve

months ended December 31, 2023, as compared to 2022, for each

business segment:

| |

|

|

|

|

|

|

|

|

|

|

|

|

Full year |

|

|

Revenues |

|

Earnings before Taxes |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

Life Insurance |

$ |

185,176,000 |

|

$ |

169,183,000 |

|

9.5% |

|

$ |

25,272,000 |

|

$ |

14,196,000 |

|

78.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cemeteries/Mortuaries |

$ |

31,938,000 |

|

$ |

28,948,000 |

|

10.3% |

|

$ |

8,444,000 |

|

$ |

6,094,000 |

|

38.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgages |

$ |

101,383,000 |

|

$ |

191,521,000 |

|

(47.1%) |

|

$ |

(17,416,000) |

|

$ |

14,087,000 |

|

(223.6%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

318,497,000 |

|

$ |

389,652,000 |

|

(18.3%) |

|

$ |

16,300,000 |

|

$ |

34,377,000 |

|

(52.6%) |

| |

|

|

|

|

|

|

|

|

|

|

|

Net earnings per common share was $.64 for the

twelve months ended December 31, 2023, compared to net earnings of

$1.12 per share for the prior year, as adjusted for the effect of

annual stock dividends. Book value per common share was $14.11 as

of December 31, 2023, compared to $13.88 as of December 31,

2022.

The Company has two classes of common stock

outstanding, Class A and Class C. There were 22,177,828 Class A

equivalent shares outstanding as of December 31, 2023.

This press release contains statements that, if

not verifiable historical fact, may be viewed as forward-looking

statements that could predict future events or outcomes with

respect to Security National Financial Corporation and its

business. The predictions in the statements will involve risk and

uncertainties and, accordingly, actual results may differ

significantly from the results discussed or implied in such

forward-looking statements.

If there are any questions, please contact Mr.

Garrett S. Sill or Mr. Scott Quist at:

Security National

Financial CorporationP.O. Box 57250Salt Lake City, Utah 84157Phone

(801) 264-1060Fax (801) 265-9882

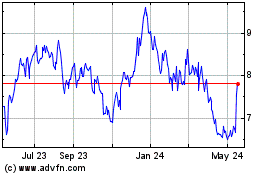

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Oct 2024 to Nov 2024

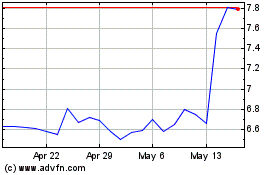

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Nov 2023 to Nov 2024