SonoSite, Inc. (Nasdaq:SONO), the world leader and specialist in

hand-carried ultrasound for the point-of-care, today reported

record financial results for the first quarter ended March 31,

2008. Worldwide revenue in the first quarter of 2008 grew 23% to

$52.5 million compared with the first quarter of 2007. Changes in

foreign currency rates increased worldwide revenue by approximately

4%. Compared to the first quarter of 2007, international revenue

grew 32% and US revenue grew 12%. In the US, hospital revenue grew

16% and office revenue grew 33%. The overall US growth rate was

offset by an expected decline in US enterprise revenue of 17%. For

the first quarter of 2008, SonoSite reported net income of $1.2

million, or $0.07 per diluted share, compared with a net loss of

$563,000 or $0.03 per share for the first quarter in 2007. Net

income in the quarter included a one-time, pre-tax charge of

$675,000 for integration of the former MarketBridge physician

office channel and the elimination of overhead within the company�s

marketing, general and administrative structure. Cash flow from

operations was $7.3 million in the quarter. �The year is off to an

excellent start and we are on track to achieve our growth and

profitability objectives for 2008,� said Kevin M. Goodwin, SonoSite

President and CEO. �We saw good momentum across our major markets

driven by strong reception to our new products which accounted for

over 40% of the quarter�s revenue.� �The international group

continued their blistering pace and marked the sixth consecutive

quarter of growth exceeding 20%,� Mr. Goodwin said. �In the US, we

saw good performance in the hospital and office sectors immediately

after integrating these channels inside the company during the

first quarter. We are looking forward to a year of continued

progress in the US.� In the first quarter, gross margin grew to 72%

compared with 70% in the first quarter of 2007 and reflected the

positive impact of the company�s new fourth generation products,

the M-Turbo� and S Series� products introduced in October 2007, as

well as the favorable impact of foreign currency rates. Operating

expenses grew 10% to $35.4 million (including the previously

mentioned one-time charge) compared with the same period in 2007.

Changes in foreign currency rates and the one-time charge increased

operating expenses by 4%. As of March 31, 2008, cash, cash

equivalents and investments were $315.9 million. Company Outlook

SonoSite management updated its 2008 financial objectives.

Management�s "base plan" is to achieve revenue growth of at least

15%, gross margins of approximately 70% and operating margins of 9

- 10%. Due to lower market interest rates, the company expects

interest income to be offset by interest expense in 2008. The

company expects to have a tax rate of approximately 39% for the

year, virtually all of which is a non-cash item. Income taxes are

largely a non-cash expense due to unused net operating loss

carryforwards. The company reiterated its target to achieve a 15%

operating margin in 2009. Conference Call Information SonoSite will

hold a conference call today at 1:30 pm PT/4:30 pm ET. The call

will be broadcast live and can be accessed via the �Investors�

Section of SonoSite�s website at www.sonosite.com. A replay of the

audio webcast will be available beginning April 28, 2008, at 4:30

pm (PT) until May 23, 2008, at 12:00 midnight (PT) by dialing

719-457-0820 or toll-free 888-203-1112. The confirmation code

8481608 is required to access the replay. The call will also be

archived on SonoSite�s website at http://ir.sonosite.com. About

SonoSite SonoSite, Inc. (www.sonosite.com) is the innovator and

world leader in hand-carried ultrasound. Headquartered near

Seattle, the company is represented by ten subsidiaries and a

global distribution network in over 100 countries. SonoSite�s

small, lightweight systems are expanding the use of ultrasound

across the clinical spectrum by cost-effectively bringing high

performance ultrasound to the point of patient care. The company

employs over 600 people worldwide. Forward-looking Information and

the Private Litigation Reform Act of 1995 Certain statements in

this press release relating to the market acceptance of our

products, possible future sales relating to expected orders, and

our future financial position and operating results are

�forward-looking statements� for the purposes of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on the opinions and

estimates of our management at the time the statements are made and

are subject to risks and uncertainties that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. These statements are not guaranties of

future performance and are subject to known and unknown risks and

uncertainties and are based on potentially inaccurate assumptions.

Factors that could affect the rate and extent of market acceptance

of our products, the receipt of expected orders, and our financial

performance include our ability to successfully manufacture, market

and sell our ultrasound systems, our ability to accurately forecast

customer demand for our products, our ability to manufacture and

ship our systems in a timely manner to meet customer demand,

variability in quarterly results caused by the timing of large

project orders from governmental or international entities and the

seasonality of hospital purchasing patterns, timely receipts of

regulatory approvals to market and sell our products, regulatory

and reimbursement changes in various national health care markets,

constraints in government and public health spending, the ability

of our distribution partners and other sales channels to market and

sell our products, the impact of patent litigation, our ability to

execute our acquisition strategy, the effect of transactions and

activities associated with our issuance of senior convertible debt

in July 2007 on the market price of our common stock, and as well

as other factors contained in the Item 1A. �Risk Factors� section

of our most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission. We caution readers not to place

undue reliance upon these forward-looking statements that speak

only as to the date of this release. We undertake no obligation to

publicly revise any forward-looking statements to reflect new

information, events or circumstances after the date of this release

or to reflect the occurrence of unanticipated events. � SonoSite,

Inc. Selected Financial Information � � Consolidated Statements of

Operations (in thousands except per share data) (unaudited) Three

Months Ended March 31, � 2008 � � 2007 � � Revenue $ 52,499 $

42,795 Cost of revenue � 14,659 � � 12,875 � Gross margin 37,840

29,920 Gross margin percentage 72.1 % 69.9 % � Operating expenses:

Research and development 6,197 6,143 Sales, general and

administrative � 29,249 � � 26,025 � Total operating expenses

35,446 32,168 � Operating income (loss) 2,394 (2,248 ) � Other

income (loss), net � (151 ) � 1,302 � � Income (loss) before income

taxes 2,243 (946 ) � Income tax provision (benefit) � 998 � � (383

) � Net income (loss) $ 1,245 � $ (563 ) � � Net income (loss) per

share: Basic $ 0.07 � $ (0.03 ) Diluted $ 0.07 � $ (0.03 ) � �

Weighted average common and potential common shares outstanding:

Basic � 16,770 � � 16,494 � Diluted � 17,406 � � 16,494 � � � � �

Condensed Consolidated Balance Sheets (in thousands) (unaudited)

March 31, December 31, � 2008 � � 2007 � � Cash and cash

equivalents $ 171,857 $ 188,701 Short-term investment securities

141,358 119,873 Accounts receivable, net 53,071 60,954 Inventories

33,090 29,740 Deferred income taxes, current 12,944 13,138 Prepaid

expenses and other current assets � 3,434 � � 7,759 � Total current

assets 415,754 420,165 � Property and equipment, net 9,517 10,133

Investment securities 2,715 1,257 Deferred income taxes 12,444

12,959 Intangible assets, net 16,349 16,346 Other assets � 10,248 �

� 9,521 � Total assets $ 467,027 � $ 470,381 � � Accounts payable $

5,863 $ 8,868 Accrued expenses 19,212 24,431 Deferred revenue,

current portion 3,361 3,502 Deferred tax liability , current � 115

� � 115 � Total current liabilities 28,551 36,916 � Long-term debt

225,000 225,000 Deferred tax liability 4,528 4,528 Other

liabilities, net of current portion � 11,706 � � � 11,075 � Total

liabilities 269,785 277,519 � Shareholders' equity: Common stock

and additional paid-in capital 239,023 236,325 Accumulated deficit

(43,648 ) (44,893 ) Accumulated other comprehensive income � 1,867

� � 1,430 � Total shareholders' equity � 197,242 � � 192,862 �

Total liabilities and shareholders' equity $ 467,027 � $ 470,381 �

� � � � Condensed Consolidated Statements of Cash Flow (in

thousands) (unaudited) Three Months Ended March 31, � 2008 � � 2007

� Operating activities: Net income (loss) $ 1,245 $ (563 )

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization 1,064 1,103 Stock-based

compensation 1,879 1,920 Deferred taxes and other 1,004 (1,321 )

Changes in working capital � 2,142 � � 9,560 � Net cash provided by

operating activities 7,334 10,699 � Investing activities:

Investment securities, net (22,321 ) 777 Purchases of property and

equipment (355 ) (1,050 ) Earn-out consideration associated with

SonoMetric acquisition � (921 ) � (654 ) Net cash used in investing

activities (23,597 ) (927 ) � Financing activities: Exercise of

stock options � 685 � � 1,564 � Net cash provided by financing

activities 685 1,564 � Effect of exchange rate changes on cash and

cash equivalents � (1,266 ) � (222 ) � Net change in cash and cash

equivalents (16,844 ) 11,114 Cash and cash equivalents at beginning

of period � 188,701 � � 45,673 � Cash and cash equivalents at end

of period $ 171,857 � $ 56,787 �

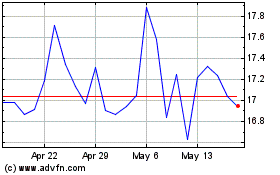

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jun 2024 to Jul 2024

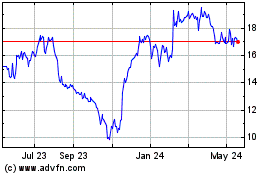

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jul 2023 to Jul 2024