SonoSite, Inc. (Nasdaq:SONO), the world leader and

specialist in hand-carried ultrasound for the point-of-care, today

reported financial results for the third quarter and nine months

ended September 30, 2009.

REVENUE

Revenue in the third quarter of 2009 was $53.6 million, a

decrease of 13% compared to the third quarter of 2008. For the nine

months of 2009, revenue was $157.7 million, a decrease of 9%

compared to the nine months of 2008.

Overall revenue included $3.0 million for the quarter and nine

months just ended from the recently acquired CardioDynamics

International Corporation (CDIC).

Excluding CDIC, revenue in the third quarter was $50.6 million,

a decrease of 18% compared to the third quarter of 2008, and $154.7

million for the nine months just ended.

Foreign exchange had zero effect on third quarter revenue, but

had a negative impact of $6.7 million or 4% for the nine months

just ended.

OPERATING INCOME AND CASH FLOW

Overall, “reported” third quarter operating income was $2.3

million, including charges from CDIC of $3.1 million related to

operating results as well as acquisition and integration.

Operating income in the third quarter excluding CDIC was $5.4

million, a 10.7% operating margin versus a $3.0 million or 5.6%

operating margin in the second quarter 2009.

Cash Flow

Operating cash flow was $1.6 million for the quarter and $8.9

million for the nine months of 2009, as compared to $13.0 million

and $18.0 million for the comparable periods of 2008. Operating

cash flow reflects the decline in operating income and the $3.1

million impact of the CDIC acquisition.

Net income

For the third quarter of 2009, the Company recorded a net loss

of $0.2 million or $0.01 per share, compared to a net income of

$3.7 million or $0.21 per share in 2008. For the nine months of

2009, net income was $1.0 million or $0.06 per share compared to

$5.3 million or $0.30 per share, all of which include $3.1 million

in charges related to the CDIC acquisition.

COMMENTARY

“While revenue remained sluggish, gross margins and expense

management improved, resulting in a better than forecasted

operating margins of 10.7% in our core businesses, excluding CDIC,”

said Kevin M. Goodwin, SonoSite President and CEO. “The

revenue environment remains tight, US revenue levels continued

stabilizing and we experienced a few order delays in our

international business. Importantly, pricing and expense management

have continued to improve, resulting in steadily increasing

operating margin performance.”

“We also recently concluded an agreement with General Electric

to settle our patent disputes,” Mr. Goodwin stated. “As a part of

the settlement, both companies agreed to invest in an important new

education and clinical research foundation, which the companies

will co-fund, and which will contribute to the long-term market

adoption of best practices in point-of-care ultrasound.”

“Our 2009 outlook remains unchanged,” Mr. Goodwin said. “Going

forward, we intend to continuously improve our operating margins

and cash flow while preparing and positioning ourselves for the

resumption of revenue growth. We have numerous growth initiatives

in place, alongside a strengthening handle on pricing and expense

control. We are targeting operating margins of 11 – 13% for 2010.

These targets assume zero to low revenue growth rates. If we

realize greater growth rates, our operating margins will be

structured to improve further. These projections exclude $3.3

million of expected amortization for intangibles related to the

CDIC acquisition.”

As of September 30, 2009, the company held $248 million in cash

and investments and had outstanding senior convertible notes of

$120 million. The Company used $16.2 million for the CDIC

acquisition including re-payment of their debt.

2009 FINANCIAL OUTLOOK

The Company has updated its outlook to include the impact of the

CDIC acquisition:

- revenues in the range of $225 -

$230 million,

- gross margins are expected to be

level with 2008, and

- operating income in the range of

$10 - $11 million inclusive of negative $8 million in charges from

the CDIC acquisition.

NON-GAAP MEASURES

This release includes a discussion of management measures that

are non-GAAP. We believe it is useful for investors to understand

the comparison of operating results in 2009 versus 2008 by

eliminating the impact of the CDIC related charges using non-GAAP

measures.

Conference Call Information

SonoSite will hold a conference call on October 27th at 1:30 pm

PT/4:30 pm ET. The call will be broadcast live and can be accessed

via http://www.sonosite.com/company/investors. A replay of the

audio webcast will be available beginning October 27, 2009, 5:30 pm

PT and will be available until November 10, 2009, 9:59 pm PT by

dialing 719-457-0820 or toll-free 888-203-1112. The confirmation

code 1942151 is required to access the replay. The call will also

be archived on SonoSite’s website.

About SonoSite

SonoSite, Inc. (www.sonosite.com) is the innovator and world

leader in hand-carried ultrasound. Headquartered near Seattle, the

company is represented by ten subsidiaries and a global

distribution network in over 100 countries. SonoSite’s small,

lightweight systems are expanding the use of ultrasound across the

clinical spectrum by cost-effectively bringing high performance

ultrasound to the point of patient care.

Forward-looking Information

and the Private Litigation Reform Act of 1995

Certain statements in this press release relating to our future

financial position and operating results are “forward-looking

statements” for the purposes of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on the opinions and estimates

of our management at the time the statements are made and are

subject to risks and uncertainties that could cause actual results

to differ materially from those expected or implied by the

forward-looking statements. These statements are not guaranties of

future performance, are based on potentially inaccurate assumptions

and are subject to known and unknown risks and uncertainties,

including, without limitation, the risk that the acquisition of

CardioDynamics will not yield the expected potential benefits, our

ability to manufacture, market and sell our newest products,

spending patterns in the hospital market, healthcare reform and the

other factors contained in Item 1A. “Risk Factors” section of our

most recent Annual Report on Form 10-K filed with the Securities

and Exchange Commission. We caution readers not to place undue

reliance upon these forward-looking statements that speak only as

to the date of this release. We undertake no obligation to publicly

revise any forward-looking statements to reflect new information,

events or circumstances after the date of this release or to

reflect the occurrence of unanticipated events.

SonoSite, Inc.Selected

Financial Information

Condensed Consolidated

Statements of Income (in thousands except per share data)

(unaudited) Three Months Ended Nine Months Ended September 30,

September 30,

2009

2008

As Adjusted

2009

2008

As Adjusted

Revenue $ 53,571 $ 61,633 $ 157,661 $ 173,362 Cost of

revenue 16,021 18,562

48,033 50,962

Gross margin 37,550 43,071 109,628 122,400 Gross margin percentage

70.1 % 69.9 % 69.5 % 70.6 % Operating expenses: Research and

development 6,497 7,440 21,569 20,574 Sales, general and

administrative 28,874 28,254 81,682 86,712 Licensing income and

litigation settlement with Zonare - (2,643 ) (924 ) (2,643 )

Acquisition costs, net of bargain purchase (gain)

(110 ) - 469

- Total operating expenses 35,261 33,051

102,796 104,643 Operating income * 2,289 10,020 6,832 17,757

Other loss, net (3,013 ) (3,655

) (5,486 ) (8,591 )

(Loss) income before income taxes (724 ) 6,365 1,346 9,166

Income tax (benefit) provision (484 )

2,715 298 3,914

Net (loss) income $ (240 ) $ 3,650

$ 1,048 $ 5,252 Net

(loss) income per share: Basic $ (0.01 ) $ 0.22

$ 0.06 $ 0.31 Diluted $

(0.01 ) $ 0.21 $ 0.06 $

0.30 Weighted average common and potential common

shares outstanding: Basic 17,308

16,927 17,203 16,858

Diluted 17,308 17,592 17,650 17,488

Reconciliation of Non-GAAP operating income: Operating

income $ 2,289 $ 10,020 $ 6,832 $ 17,757 Adjustments to operating

income for: Acquisition costs, net of bargain purchase (gain) (110

) - 469 - CardioDynamics operations and integration costs

3,187 - 3,187

- Non-GAAP operating income $

5,366 $ 10,020 $ 10,488 $

17,757 *includes acquisition and

integration related charges of $4.2 million in third quarter and

$4.7 million for the nine months ended of 2009 reduced by a bargain

purchase gain of $1.1 million in both periods of 2009.

Condensed

Consolidated Balance Sheets (in thousands)

(unaudited) September 30,2009 December 31,2008

As Adjusted

Cash and cash equivalents $ 211,035 $ 209,258

Short-term investment securities 36,864 69,882 Accounts receivable,

net 55,414 66,094 Inventories 35,309 29,115 Deferred income taxes,

current 14,830 13,372 Prepaid expenses and other current assets

6,695 6,623 Total

current assets 360,147 394,344 Property and equipment, net

9,393 8,955 Investment securities - 578 Deferred income taxes 180

793 Intangible assets, net 28,841 16,829 Other assets

3,595 5,383 Total assets $

402,156 $ 426,882

Accounts payable $ 8,451 $ 6,189 Accrued expenses 21,616 31,921

Deferred revenue 2,485 2,755

Total current liabilities 32,552 40,865

Long-term debt, net 95,462 111,336 Deferred income taxes, net 6,776

9,871 Other non-current liabilities 14,423

13,750 Total liabilities 149,213

175,822 Shareholders' equity: Common stock and additional

paid-in capital 289,834 285,928 Accumulated deficit (34,988 )

(36,036 ) Accumulated other comprehensive (loss) income

(1,903 ) 1,168 Total

shareholders' equity 252,943

251,060 Total liabilities and shareholders' equity $

402,156 $ 426,882

Condensed

Consolidated Statements of Cash Flow (in

thousands) (unaudited) Nine Months Ended September 30,

2009

2008

As Adjusted

Operating activities: Net income $ 1,048 $ 5,252 Adjustments

to reconcile net income to net cash provided by operating

activities: Depreciation and amortization 3,647 3,086 Stock-based

compensation 5,201 5,209 Amortization of debt discount, debt

issuance costs 3,792 6,581 Gain on bargain purchase acquisition

(1,078 ) - Gain on convertible debt repurchase (1,339 ) - Non-cash

gain on litigation settlement with Zonare - (643 ) Changes in

working capital and other adjustments (2,360 )

(1,487 ) Net cash provided by operating activities

8,911 17,998 Investing activities: Investment securities,

net 33,939 62,368 Acquisition of CardioDynamics, net of cash

acquired (8,185 ) - Purchases of property and equipment (2,290 )

(2,198 ) Earn-out consideration associated with SonoMetric

acquisition (387 ) (921 ) Net

cash provided by investing activities 23,077 59,249

Financing activities: Excess tax benefit from exercise of stock

based compensation - 961 Repurchase of convertible debt and related

hedge transactions (20,416 ) - Repayment of convertible debt (5,250

) - Shares retired for taxes (1,285 ) - Proceeds from exercise of

stock-based awards 1,419 3,526

Net cash (used in) provided by financing activities

(25,532 ) 4,487 Effect of exchange rate changes on cash and

cash equivalents (4,679 ) 1,262

Net change in cash and cash equivalents 1,777 82,996 Cash

and cash equivalents at beginning of period 209,258 188,701

Cash and cash equivalents at end of period $ 211,035

$ 271,697

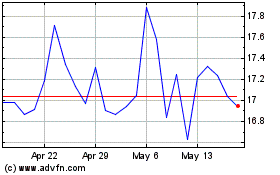

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Sep 2024 to Oct 2024

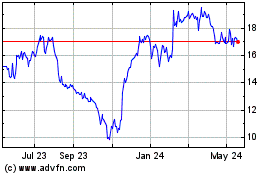

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Oct 2023 to Oct 2024