SonoSite, Inc. (Nasdaq:SONO), the world leader and

specialist in hand-carried ultrasound for the point-of-care, today

reported financial results for the fourth quarter and year ended

December 31, 2009.

REVENUE

Revenues in the fourth quarter of 2009 were $69.7 million, a

decrease of 1% compared to the fourth quarter of 2008. Full year of

2009 revenues were $227.4 million, down 7% versus full year of

2008.

Revenues for the partial year acquisition of CardioDynamics were

$4.2 million for the fourth quarter and $7.1 million for the full

year of 2009.

Excluding partial year revenues from CDIC, SonoSite fourth

quarter revenues were $65.5 million, down 7% versus the fourth

quarter of 2008. Full year revenues excluding CDIC were $220.3

million, a decrease of 10% compared to 2008.

Changes in foreign currency rates increased worldwide revenues

by 4% in the fourth quarter and decreased revenues by 2% for the

full year.

OPERATING INCOME AND CASH FLOW

Fourth Quarter Results

Fourth quarter operating income was $6.8 million, an increase of

46% compared to the fourth quarter of 2008. Operating income for

the fourth quarter 2009 included charges from CDIC of $3.3 million,

related to operating results as well as acquisition and

integration.

Excluding CDIC, operating income in the fourth quarter of 2009

was $10.1 million, an increase of 117% compared to the fourth

quarter of 2008. Operating margins reached 15.4% for the

quarter.

Full Year Results

For the full year of 2009, operating income was $13.7 million,

including charges from CDIC of $6.9 million; a decrease of 39%

compared to the full year of 2008.

Excluding CDIC, full year of 2009 operating income was $20.6

million, down 8% versus the full year of 2008 on a $24 million or

10% revenue decline versus full year 2008.

Cash Flow

Operating cash flow was $15.3 million for the quarter and $24.4

million for the full year of 2009, as compared to $11.2 million and

$29.2 million for the comparable periods of 2008. Operating cash

flow for the full year of 2009 reflects the $21 million received to

settle a patent dispute in the fourth quarter.

Net income

For the fourth quarter of 2009, the Company recorded net income

of $2.2 million or $0.12 per share, compared to $6.0 million or

$0.34 per share in 2008. For the full year of 2009, net income was

$3.2 million or $0.18 per share compared to $11.2 million or $0.64

per share for the full year of 2008. Excluding non-recurring items

such as bond gains, acquisition expenses, and patent royalty

revenue, net income would have been $0.36 per share for the full

year of 2009 or essentially even with 2008.

COMMENTARY

“In a very tough year we simply got stronger as a company,

improving our operating model and tightening our capital allocation

process,” said Kevin M. Goodwin, SonoSite President and CEO. “We

successfully integrated CardioDynamics which included significant

changes to their sales force during the fourth quarter, while

successfully closing out our litigation matters and achieving 9%

operating margins, a level similar to 2008, despite core revenues

falling by $24 million or 10%.”

“With a difficult year behind us we are stronger and more

focused on growth initiatives for 2010 and beyond. We have leaned

out our ‘SG&A structure’ and are deploying our strategy across

four key vertical markets,” said Mr. Goodwin.

“We have also initiated market development in cardiovascular

disease management markets enabling us to expand our role in the

cardiovascular health marketplace.”

“Additionally, we are at work on revising our capital structure

with the recently announced “Dutch Auction” tender offer to

repurchase $100 million of our shares. Following a two year

evaluation of investment alternatives, it became clear to us that

investing in our own stock was our best choice,” Mr. Goodwin

further commented.

As of December 31, 2009, the company held $257.7 million in cash

and investments and had outstanding senior convertible notes of

$114.7 million for net liquidity of $143.0 million.

2010 FINANCIAL OUTLOOK

The company provided the following guidance:

- Revenue growth of up to 10%

- Level gross margin

- Operating margin of 11 –

13%

NON-GAAP MEASURES

This release includes a discussion of management measures that

are non-GAAP. We believe it is useful for investors to understand

the comparison of operating results in 2009 versus 2008 by

eliminating the impact of the CDIC related charges, convertible

debt repurchase, and partial year patent royalty revenues using

non-GAAP measures.

Conference Call Information

SonoSite will hold a conference call on February 11 at 1:30 pm

PT/4:30 pm ET. The call will be broadcast live and can be accessed

via http://www.sonosite.com/company/investors.

A replay of the audio webcast will be available beginning February

11, 2010, 5:30 pm PT and will be available until February 25, 2010,

9:59 pm PT by dialing 719-457-0820 or toll-free 888-203-1112. The

confirmation code 7406921 is required to access the replay. The

call will also be archived on SonoSite’s website.

About SonoSite

SonoSite, Inc. (www.sonosite.com) is the innovator and world

leader in hand-carried ultrasound. Headquartered near Seattle, the

company is represented by ten subsidiaries and a global

distribution network in over 100 countries. SonoSite’s small,

lightweight systems are expanding the use of ultrasound across the

clinical spectrum by cost-effectively bringing high performance

ultrasound to the point of patient care.

Forward-looking Information

and the Private Litigation Reform Act of 1995

Certain statements in this press release relating to our future

financial position and operating results are “forward-looking

statements” for the purposes of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on the opinions and estimates

of our management at the time the statements are made and are

subject to risks and uncertainties that could cause actual results

to differ materially from those expected or implied by the

forward-looking statements. These statements are not guaranties of

future performance, are based on potentially inaccurate assumptions

and are subject to known and unknown risks and uncertainties,

including, without limitation, the risk that the acquisition of

CardioDynamics will not yield the expected potential benefits, our

ability to manufacture, market and sell our newest products,

spending patterns in the hospital market, healthcare reform,

prolonged adverse conditions in the U.S. or world economies or

SonoSite’s industry and the other factors contained in Item 1A.

“Risk Factors” section of our most recent Annual Report on Form

10-K filed with the Securities and Exchange Commission. We caution

readers not to place undue reliance upon these forward-looking

statements that speak only as to the date of this release. We

undertake no obligation to publicly revise any forward-looking

statements to reflect new information, events or circumstances

after the date of this release or to reflect the occurrence of

unanticipated events.

SonoSite, Inc.

Selected Financial

Information

Condensed Consolidated Statements of Income

(in thousands except per share data)

(unaudited) Three Months Ended Twelve Months Ended December 31,

December 31,

2009

2008

As Adjusted

2009

2008

As Adjusted

Revenue $ 69,728 $ 70,162 $ 227,389 $ 243,524 Cost of

revenue 21,433 22,753

69,466 73,715

Gross margin 48,295 47,409 157,923 169,809 Gross margin percentage

69.3 % 67.6 % 69.5 % 69.7 % Operating expenses: Research and

development 7,468 8,124 29,037 28,698 Sales, general and

administrative 33,979 34,610

115,206 118,679

Total operating expenses 41,447 42,734 144,243 147,377

Operating income* 6,848 4,675 13,680 22,432 Other

(loss) income, net** (2,695 ) 5,500

(8,181 ) (3,091 ) Income

before income taxes 4,153 10,175 5,499 19,341 Income tax

provision 1,967 4,206

2,265 8,120 Net

income $ 2,186 $ 5,969 $ 3,234

$ 11,221 Net income per share: Basic $

0.13 $ 0.35 $ 0.19 $

0.66 Diluted $ 0.12 $

0.34 $ 0.18 $ 0.64

Weighted average common and

potential common shares outstanding:

Basic 17,346 17,028

17,239 16,892

Diluted 17,832 17,511

17,698 17,486

Reconciliation of Non-GAAP net income: Income before

income taxes $ 4,153 $ 10,175 $ 5,499 $ 19,341 Adjustments to

income before income taxes for: Patent royalty revenue (652 ) -

(652 ) - Acquisition of CardioDynamics: Acquisition costs, net of

bargain purchase (gain) (79 ) - 389 - Integration costs 1,591 -

4,301 - Amortization of intangible assets 892 - 1,252 - Operating

loss, net 885 - 1,001 - Loss (gain) on repurchase of convertible

debt, net 239 (8,246 )

(1,100 ) (8,246 ) Non-GAAP income

before income taxes 7,029 1,929 10,690 11,095 Non-GAAP

income tax provision 3,329 797

4,403 4,658

Non-GAAP net income $ 3,700 $ 1,132 $

6,287 $ 6,437 Non-GAAP net

income per share: Basic $ 0.21 $ 0.07 $

0.36 $ 0.38 Diluted $

0.21 $ 0.06 $ 0.36 $ 0.37

Weighted average common and

potential common shares outstanding:

Basic 17,346 17,028

17,239 16,892

Diluted 17,832

17,511 17,698

17,486 *includes acquisition and

integration related charges of $3.3 million in the fourth quarter

and $8.0 million for the year ended 2009 reduced by a bargain

purchase gain of $1.1 million in the year to date.

**includes (gain) loss on

repurchase of convertible debt, net of deferred financing

costs.

Condensed Consolidated Balance Sheets

(in thousands) (unaudited) December 31,2009 December 31,2008

As Adjusted

Cash and cash equivalents $ 183,065 $ 209,258

Short-term investment securities 74,682 69,882 Accounts receivable,

net 71,347 66,094 Inventories 29,554 29,115 Deferred income taxes,

current 7,861 13,372 Prepaid expenses and other current assets

11,019 6,623 Total

current assets 377,528 394,344 Property and equipment, net

9,160 8,955 Investment securities - 578 Deferred income taxes, net

775 793 Intangible assets, net 27,920 16,829 Other assets

4,425 5,383 Total assets

$ 419,808 $ 426,882

Accounts payable $ 6,175 $ 6,189 Accrued expenses 25,605 31,921

Deferred revenue, current portion 5,504

2,755 Total current liabilities 37,284 40,865

Long-term debt, net 92,905 111,336 Deferred income taxes,

net 2,722 9,871 Deferred revenue 18,081 1,367 Other non-current

liabilities 13,670 12,383

Total liabilities 164,662 175,822 Shareholders'

equity: Common stock and additional paid-in capital 291,514 285,928

Accumulated deficit (32,802 ) (36,036 ) Accumulated other

comprehensive income (3,566 ) 1,168

Total shareholders' equity 255,146

251,060 Total liabilities and

shareholders' equity $ 419,808 $ 429,882

Condensed Consolidated Statements of Cash Flow

(in thousands) (unaudited) Twelve Months Ended

December 31,

2009

2008

As Adjusted

Operating activities: Net income $ 3,234 $ 11,221

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 5,352 4,125

Stock-based compensation 6,632 8,709 Amortization of debt discount

and debt issuance costs 5,015 8,305 Deferred income tax provision

303 3,552 Gain on convertible debt repurchase (1,100 ) (8,246 )

Gain on purchase of CardioDynamics (1,099 ) - Other adjustments 586

(170 ) Changes in working capital 5,434

1,675 Net cash provided by operating

activities 24,357 29,171 Investing activities: Investment

securities, net (3,824 ) 50,390 Purchases of property and equipment

(2,586 ) (2,841 ) Acquisition of CardioDynamics (8,185 ) - Earn-out

consideration associated with SonoMetric acquisition

(387 ) (921 ) Net cash (used in) provided by

investing activities (14,982 ) 46,628 Financing activities:

Excess tax benefit from exercise of stock based compensation 144

1,025 Shares retired for taxes (1,342 ) - Retirement of convertible

debt and related hedge transactions (30,360 ) (61,923 ) Proceeds

from exercise of stock options & employee stock purchase plan

1,769 4,551 Net

cash used in financing activities (29,789 ) (56,347 ) Effect

of exchange rate changes on cash and cash equivalents

(5,779 ) 1,105 Net change in cash and

cash equivalents (26,193 ) 20,557 Cash and cash equivalents at

beginning of period 209,258

188,701 Cash and cash equivalents at end of period $

183,065 $ 209,258

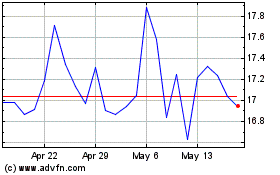

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jun 2024 to Jul 2024

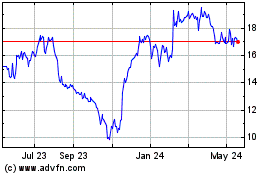

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jul 2023 to Jul 2024