SonoSite, Inc. (Nasdaq:SONO), the world leader and

specialist in hand-carried ultrasound for the point-of-care, today

reported financial results for the second quarter and first half

ended June 30, 2010.

REVENUE

Revenue increased 18% in the second quarter to $61.5 million and

13% for the first half of 2010 to $117.5 million, as compared to

the prior year comparable periods. These comparisons included

revenue of $3.8 million for the quarter and $7.0 million for the

first half of 2010 from CardioDynamics (CDIC), which was acquired

in the third quarter of 2009.

SECOND QUARTER HIGHLIGHTS:

- Revenue growth was led by

SonoSite’s US hospital channel, which was up 20%.

- Revenue from the international

business was impacted by a slowdown in Europe. The Company had

steady performances in several other international markets and was

up 2%. The International business sector profitability grew 7-8

times the “top line” growth rate, despite the slower revenue.

- Pricing discipline and an

improved product mix led to a 1.4 percentage point increase in

gross margins to 72% for the quarter.

- The Company had strong

performances across all four vertical clinical markets.

EBIT and EBITDAS

Second Quarter

Excluding charges of $2.5 million from the acquisition of

VisualSonics (VSI), which closed on June 30, 2010, second quarter

EBIT was $8.7 million, or 14% of revenue, representing an increase

of 145% compared to the prior year. Including charges for the

acquisition, EBIT for the second quarter was otherwise $6.1

million, or 10% of revenue.

First Half Results

For the first half of 2010, excluding acquisition charges, EBIT

was $11.3 million or 9.6% of revenue, an increase of 121% compared

to the prior year. Including acquisition charges, EBIT was

otherwise $8.8 million, or 7.5% of revenue, up 94% over the first

half of 2010.

Excluding acquisition charges, second quarter EBITDAS was $11.4

million, up 90% and $16.8 million, up 51% for the first half.

For the first half, cash flow from operations was $21.3 million

compared to $7.4 million from the prior year, representing an

increase of $13.9 million or 1.9 times the prior year.

EPS

Excluding acquisition charges, EPS was $0.29 per share for the

second quarter and $0.36 per share for the first half of 2010.

Including acquisition charges, EPS was $0.12 per share for the

second quarter, versus $0.02 per share in 2009 and $3.3 million

($0.20 per share), versus $1.3 million ($0.07 per share) in the

prior year’s first half.

Over the first half of 2010, the weighted average of

fully-diluted outstanding shares was 16.0 million compared to 17.6

million in the prior year. Over this period, 3.3 million shares

were purchased. At quarter end, fully-diluted shares were 15.1

million. Since quarter end, the Company has purchased an additional

475,000 shares and has approximately $30.0 million remaining in

Board-authorized “buyback” capital.

COMMENTARY

“The quarter was an excellent step forward for SonoSite as we

resumed strong revenue growth, and managed pricing and operating

expenses effectively,” said Kevin M. Goodwin, SonoSite President

and CEO. “We also were able to close the VSI acquisition by quarter

end. We finished with strong momentum, and a stable back log. We

will continue to focus on operating expense improvement as the year

goes on, alongside driving a larger revenue base with VSI.”

Mr. Goodwin continued, “We expect to operate the VSI subsidiary

in Toronto, Canada and will initiate plans to converge our

technologies beginning later this year, as well as initiatives to

further scale the pre-clinical business. We anticipate that VSI

will contribute approximately $17 million of revenues in the second

half with a positive operating contribution, excluding amortization

and stock compensation. We will also initiate actions on operating

synergies during the second half.”

2010 FINANCIAL OUTLOOK

The company updated guidance for the expected impact of the VSI

acquisition:

- Core business revenue growth of

10 – 12%. With the inclusion of $17.0 million of estimated revenue

from VSI, overall revenue growth is projected at 18-19%;

- increased gross margins to a range of

70-71%, up from previous guidance of 70%;

- reaffirmed Core business EBIT margins of

11 – 13%. With $7.0 million of transaction costs, amortization and

stock compensation expenses from the VSI acquisition, we project

EBIT margins of 8-9% on higher revenue;

- reaffirmed Core business EBITDAS margin

of 16 – 18%. Expect a positive contribution from VSI, and overall

EBITDAS margins of 15-17% and,

- full-year effective tax rate of

40% compared to previous guidance of 30%. The tax rate increase is

due to non-deductible transaction expenses from the VSI

acquisition.

Non-GAAP Measures

This release includes discussions of EBIT, EBITDAS and EPS

excluding acquisition related charges; these are non-GAAP financial

measures. SonoSite believes these measures are a useful complement

to results provided in accordance with GAAP. “EBITDAS” refers to

operating income (EBIT) before depreciation, amortization and

stock-based compensation.

Conference Call Information

SonoSite will hold a conference call on July 26 at 1:30 pm

PT/4:30 pm ET. The call will be broadcast live and can be accessed

via http://www.sonosite.com/company/investors.

A replay of the audio webcast will be available beginning July 26,

2010, 5:30 pm PT and will be available until August 9, 2010, 9:59

pm PT by dialing (719) 457-0820 or toll-free (888) 203-1112. The

confirmation code 2747293 is required to access the replay. The

call will also be archived on SonoSite’s website.

About SonoSite

SonoSite, Inc. (www.sonosite.com) is the innovator and world

leader in bedside and point-of-care ultrasound and an industry

leader in ultra high-frequency micro-ultrasound technology and

impedance cardiography equipment. Headquartered near Seattle, the

company is represented by fourteen subsidiaries and a global

distribution network in over 100 countries. SonoSite’s small,

lightweight systems are expanding the use of ultrasound across the

clinical spectrum by cost-effectively bringing high-performance

ultrasound to the point of patient care.

Forward-looking Information

and the Private Litigation Reform Act of 1995

Certain statements in this press release relating to our future

financial position and operating results are “forward-looking

statements” for the purposes of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on the opinions and estimates

of our management at the time the statements are made and are

subject to risks and uncertainties that could cause actual results

to differ materially from those expected or implied by the

forward-looking statements. These statements are not guaranties of

future performance, are based on potentially inaccurate assumptions

and are subject to known and unknown risks and uncertainties,

including, without limitation, the risk that the acquisition of

VisualSonics will not yield the expected potential benefits, our

ability to manufacture, market and sell our newest products, our

ability to manage expenses, spending patterns in the hospital

market, healthcare reform, prolonged adverse conditions in the U.S.

or world economies or SonoSite’s industry and the other factors

contained in Item 1A. “Risk Factors” section of our most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission. We caution readers not to place undue reliance upon

these forward-looking statements that speak only as to the date of

this release. We undertake no obligation to publicly revise any

forward-looking statements to reflect new information, events or

circumstances after the date of this release or to reflect the

occurrence of unanticipated events.

SonoSite, Inc.

Selected Financial Information

Condensed Consolidated Statements of Income (in thousands

except per share data) (unaudited) Three Months Ended Six Months

Ended June 30, June 30, 2010 2009

2010 2009 Revenue $ 61,549 $

52,285 $ 117,526 $ 104,090 Cost of revenue 17,195

15,299 33,475 32,012

Gross margin 44,354 36,986 84,051 72,078 Gross margin percentage

72.1 % 70.7 % 71.5 % 69.2 % Operating expenses: Research and

development 7,211 7,375 14,808 15,072 Sales, general and

administrative 30,996 27,584 60,425 53,387 Licensing income and

litigation settlement - (924 ) -

(924 ) Total operating expenses 38,207 34,035 75,233 67,535

Operating income (EBIT) 6,147 2,951 8,818 4,543 Other

loss, net (2,438 ) (2,269 ) (4,700 )

(2,473 ) Income before income taxes 3,710 682 4,119 2,070

Income tax provision 1,834 257

861 782 . . Net income $ 1,875 $

425 $ 3,257 $ 1,288 Net income

per share: Basic $ 0.13 $ 0.02 $ 0.21 $ 0.08

Diluted $ 0.12 $ 0.02 $ 0.20 $ 0.07

Weighted average common and potential common shares

outstanding: Basic 14,601 17,219

15,438 17,150 Diluted 15,100

17,619 15,950 17,567

Reconciliation of Non-GAAP Measures: Operating

income (EBIT) $ 6,147 $ 2,951 $ 8,818 $ 4,543 Adjustments

for EBIT:

Acquisition costs

2,515 579 2,515

579 Non-GAAP Adjusted EBIT $ 8,662 $ 3,530 $ 11,333 $

5,122 Adjustments for EBITDAS: Depreciation and amortization

1,611 1,071 3,344 2,109 Stock-based compensation 1,200

1,450 2,208 3,943

Non-GAAP Adjusted EBITDAS $ 11,473 $ 6,051 $

16,885 $ 11,174

Condensed

Consolidated Balance Sheets (in thousands) (unaudited) June 30,

December 31, 2010 2009 Cash and

cash equivalents $ 44,476 $ 183,065 Short-term investment

securities 65,372 74,682 Accounts receivable, net 64,180 71,347

Inventories 35,380 32,216 Deferred tax asset, current 7,482 7,350

Prepaid expenses and other current assets 9,538

12,034 Total current assets 226,428 380,694

Property and equipment, net 9,742 9,160 Investment in Carticept

4,000 - Deferred tax asset, net 682 775 Intangible assets, net

91,545 27,920 Other assets 4,451 4,425

Total assets $ 336,848 $ 422,974 Accounts

payable $

13,154

$ 6,175 Accrued expenses 23,975 25,923 Deferred revenue

5,575 5,504 Total current liabilities 42,704

37,602 Long-term debt, net 95,081 92,905 Deferred tax

liability, net 4,710 5,083 Deferred revenue 16,414 18,081 Other

non-current liabilities 16,012 14,873

Total liabilities 174,921 168,544 Shareholders'

equity: Common stock and additional paid-in capital 292,630 287,537

Accumulated deficit (129,806 ) (32,753 ) Accumulated other

comprehensive income (loss) (897 ) (354 ) Total

shareholders' equity 161,927 254,430

Total liabilities and shareholders' equity $ 336,848 $

422,974

Condensed Consolidated Statements

of Cash Flow (in thousands) (unaudited) Six Months Ended June

30, 2010 2009 Operating activities: Net

income $ 3,257 $ 1,288 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 3,344 2,109 Stock-based compensation 2,208 3,943

Deferred income tax provision (1,739 ) 863 Amortization of debt

discount, debt issuance costs 2,001 2,559 Non-cash gain on

litigation settlement - (924 ) Gain on convertible debt repurchase

- (1,339 ) Other adjustments (532 ) 199 Changes in working capital

12,774 (1,324 ) Net cash provided by operating

activities 21,313 7,374 Investing activities: Purchase of

investment securities, net 9,377 1,057 Purchases of property and

equipment (1,428 ) (1,810 ) Investment in Carticept (4,000 ) -

Purchase of VisualSonic, Inc, net of cash acquired (61,217 ) -

Payment of LumenVu contingent consideration (425 ) - Earn-out

consideration associated with SonoMetric acquisition -

(387 ) Net cash used in investing activities (57,693

) (1,140 ) Financing activities: Excess tax benefit from

exercise of stock-based compensation 532 - Repurchase of

convertible senior notes - (20,416 ) Repayment of VisualSonics Inc.

long-term debt (8,838 ) - Stock repurchase including transaction

costs (97,715 ) - Minimum tax withholdings on stock-based awards

(692 ) (852 ) Proceeds from exercise of stock-based awards

3,271 1,385 Net cash used in financing

activities (103,442 ) (19,883 ) Effect of exchange rate

changes on cash and cash equivalents 1,233

(1,743 ) Net change in cash and cash equivalents (138,589 )

(15,392 ) Cash and cash equivalents at beginning of period

183,065 209,258 Cash and cash equivalents at

end of period $ 44,476 $ 193,866

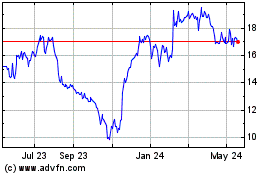

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jun 2024 to Jul 2024

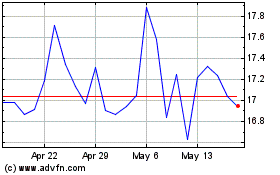

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jul 2023 to Jul 2024