Syneos Health, Inc. (Nasdaq: SYNH) (“Syneos Health” or the

“Company”), a leading fully integrated biopharmaceutical solutions

organization, today announced that the Company’s stockholders

approved an agreement to take the Company private through an

acquisition by a consortium of private investment firm affiliates

comprised of Elliott Investment Management L.P., Patient Square

Capital, and Veritas Capital at a special meeting of stockholders

held earlier today. As previously announced, under the terms of the

agreement, Syneos Health stockholders will receive $43.00 in cash

for each share of Syneos Health common stock owned at the closing

of the transaction, if completed.

“We thank our stockholders for their strong support for this

transaction,” said Michelle Keefe, CEO of Syneos Health. “We look

forward to closing the transaction, further executing on our growth

priorities, and driving customer success by delivering

fit-for-purpose, integrated solutions that help them bring

life-saving therapies to patients.”

Completion of the transaction is expected in the second half of

2023, subject to the satisfaction of customary closing conditions,

including regulatory approvals.

The final voting results of the Syneos Health special meeting

will be reported in a Form 8-K to be filed by Syneos Health with

the U.S. Securities and Exchange Commission.

Date of Second Quarter 2023 Results

Syneos Health will file its Quarterly Report on Form 10-Q by

Wednesday, August 9, 2023. In light of the pending transaction,

Syneos Health will not conduct an earnings conference call.

About Syneos HealthSyneos Health® (Nasdaq:SYNH)

is a leading fully integrated biopharmaceutical solutions

organization built to accelerate customer success. We translate

unique clinical, medical affairs and commercial insights into

outcomes to address modern market realities.

We bring together a talented team of professionals, who work

across more than 110 countries, with a deep understanding of

patient and physician behaviors and market dynamics.

Together we share insights, use the latest technologies and

apply advanced business practices to speed our customers’ delivery

of important therapies to patients. Syneos Health supports a

diverse, equitable and inclusive culture that cares for colleagues,

customers, patients, communities and the environment. To learn more

about how we are Shortening the distance from lab to

life®, visit syneoshealth.com or subscribe to our

podcast.

About Elliott Investment Management

Elliott Investment Management L.P. manages

approximately $55.2 billion of assets as of December 31, 2022.

Founded in 1977, it is one of the oldest investment managers of its

kind under continuous management. The Elliott funds’ investors

include pension plans, sovereign wealth funds, endowments,

foundations, funds-of-funds, high net worth individuals and

families, and employees of the firm.

About Patient Square

CapitalPatient Square Capital

(www.patientsquarecapital.com) is a dedicated health care

investment firm that partners with best-in-class management teams

whose products, services and technologies improve health. Patient

Square Capital utilizes deep industry expertise, a broad network of

relationships and a partnership approach to make investments in

companies grow and thrive. Patient Square Capital invests in

businesses that strive to improve patient lives, strengthen

communities, and create a healthier world.

About Veritas Capital Veritas

Capital is a longstanding technology investor with over $40 billion

of assets under management and a focus on companies operating at

the intersection of technology and government. The firm invests in

companies that provide critical products, software, and services,

primarily technology and technology-enabled solutions, to

government and commercial customers worldwide. Veritas seeks to

create value by strategically transforming the companies in which

it invests through organic and inorganic means. Leveraging

technology to make a positive impact across vitally important

areas, such as healthcare, education, and national security, is

core to the firm. Veritas is a proud steward of national assets,

improving the quality of healthcare while reducing cost, advancing

our educational system, and protecting our nation and allies. For

more information, visit www.veritascapital.com.

Forward-Looking Statements Certain statements

contained in this press release constitute forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. All

statements, other than statements of historical fact, are

statements that could be deemed forward-looking statements,

including statements containing the words “predicts,” “plans,”

“expects,” “anticipates,” “believes,” “goal,” “target,” “estimate,”

“potential,” “may,” “might,” “could,” “see,” “seek,” “forecast,”

and similar words. All statements, other than historical facts,

including statements regarding the expected timing of the closing

of the proposed transaction; the ability of the parties to obtain

any required regulatory approvals in connection with the proposed

transaction; the ability of the parties to complete the proposed

transaction considering the various closing conditions; the

expected benefits of the proposed transaction; execution of the

Company’s strategy and future growth initiatives; the expected date

of release of the Company’s second quarter 2023 financial results;

and any assumptions underlying any of the foregoing, are

forward-looking statements. The forward-looking statements are

based on Syneos Health’s current plans and expectations and involve

risks and uncertainties which are, in many instances, beyond its

control, and which could cause actual results to differ materially

from those included in or contemplated or implied by the

forward-looking statements. Such risks and uncertainties include,

among others: (i) the occurrence of any event, change or other

circumstance that could give rise to the termination of the merger

agreement, including the failure to close the proposed transaction

by November 10, 2023; (ii) the failure to obtain certain required

regulatory approvals to the completion of the proposed transaction

or the failure to satisfy any of the other conditions to the

completion of the proposed transaction; (iii) any difficulties of

Star Parent, Inc., an affiliated entity of Elliott Investment

Management, Patient Square Capital and Veritas Capital, in

financing the transaction as a result of uncertainty or adverse

developments in the debt or equity capital markets or otherwise;

(iv) the effect of the announcement of the proposed transaction on

the ability of Syneos Health to retain and hire key personnel and

maintain relationships with its key business partners and

customers, and others with whom it does business, or on its

operating results and businesses generally; (v) the response of

competitors to the proposed transaction; (vi) risks associated with

the disruption of management’s attention from ongoing business

operations due to the proposed transaction; (vii) the ability to

meet expectations regarding the timing and completion of the

proposed transaction; (viii) significant costs associated with the

proposed transaction; (ix) ongoing and potential future litigation

relating to the proposed transaction; (x) restrictions during the

pendency of the proposed transaction that may impact Syneos

Health’s ability to pursue certain business opportunities; and (xi)

the risk factors set forth in Syneos Health’s Annual Report on Form

10-K for the fiscal year ended December 31, 2022 as updated by its

Quarterly Report on Form 10-Q for the quarterly period ended March

31, 2023 and other filings with the Securities and Exchange

Commission, copies of which are available free of charge on Syneos

Health’s website at www.investor.syneoshealth.com. Syneos Health

assumes no obligation and does not intend to update these

forward-looking statements, except as required by law.

Investor Relations ContactRonnie SpeightSenior

Vice President, Investor Relations+1 919 745

2745Investor.Relations@syneoshealth.com

Media ContactGary GatyasExecutive Director,

External Communications+1 908 763

3428Gary.gatyas@syneoshealth.com

Syneos Health (NASDAQ:SYNH)

Historical Stock Chart

From Jan 2025 to Feb 2025

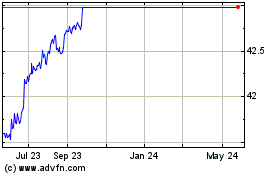

Syneos Health (NASDAQ:SYNH)

Historical Stock Chart

From Feb 2024 to Feb 2025