false000171218900017121892023-08-102023-08-100001712189us-gaap:CommonStockMember2023-08-102023-08-100001712189th:WarrantsToPurchaseCommonStockMember2023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 11, 2023 (August 10, 2023)

TARGET HOSPITALITY CORP.

(Exact Name of Registrant as Specified in Its Charter)

001-38343

(Commission File Number)

|

Delaware

|

98-1378631

|

|

(State or Other Jurisdiction of Incorporation)

|

(I.R.S. Employer Identification No.)

|

9320 LAKESIDE BLVD., SUITE 300

THE WOODLANDS, Texas 77381

(Address of principal executive offices, including zip code)

(832) 709-2563

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

THCommon stock, par value $0.0001 per share

|

|

TH

|

|

NASDAQ

|

Warrants to purchase common stock

|

|

THWWW

|

|

NASDAQ

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.☐

| Item 1.01 |

Entry into a Material Definitive Agreement.

|

On August 10, 2023, Arrow Bidco, LLC (“Arrow Bidco”) and certain other subsidiaries of Target Hospitality Corp. entered into a second amendment (the

“Amendment”) to the ABL Credit Agreement, dated as of March 15, 2019, (as amended, amended and restated, supplemented or otherwise modified from time to time prior to the date of the Amendment, the “Credit Agreement”), by and among Arrow Bidco,

the borrowers and guarantors party thereto from time to time, the lenders and fronting banks party thereto from time to time and Bank of America, N.A., as administrative agent and collateral agent.

The Amendment amends the Credit Agreement to, among other things, modify the springing maturity that will accelerate the maturity of the facility if any

of the Senior Secured Notes (as defined in the Credit Agreement) remain outstanding from the date that is six months prior to the stated maturity date thereof to the date that is ninety-one days prior to the stated maturity date thereof.

The foregoing description of the Amendment is qualified in its entirety by reference to the full text of the Amendment, a copy of which is attached to

this Current Report on Form 8-K as Exhibit 10.1, and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Exhibit Description

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be

signed on its behalf by the undersigned, hereunto duly authorized.

|

|

Target Hospitality Corp.

|

|

|

|

|

|

By:

|

/s/ Heidi D. Lewis

|

|

Dated: August 11, 2023

|

|

Name: Heidi D. Lewis

|

|

|

|

Title: Executive Vice President, General Counsel and Secretary

|

3

Execution Version

SECOND AMENDMENT TO THE ABL CREDIT AGREEMENT

This Second Amendment to the ABL Credit Agreement (this “Amendment”) is dated as of August 10, 2023 and is entered into by and among Arrow Bidco, LLC, a Delaware limited liability company (the “Administrative Borrower”), Topaz Holdings LLC, a Delaware limited liability company (“Holdings”), the other Loan Parties party hereto, Bank of America, N.A., as administrative agent and collateral agent for itself and the other Secured Parties (collectively, in such capacities, the “Agent”) and as Swingline Lender, each Fronting Bank party hereto and each of the Revolver Lenders party hereto (which shall

constitute all of the Revolver Lenders under the Existing ABL Credit Agreement).

RECITALS

WHEREAS,

reference is made to the ABL Credit Agreement, dated as of March 15, 2019 (as amended by the First Amendment to the ABL Credit Agreement dated as of February 1, 2023, and as further amended, amended and restated, supplemented or otherwise modified from

time to time prior to the date hereof, the “Existing ABL Credit Agreement”, and as amended by this Amendment, the “Amended ABL Credit Agreement”), among the Administrative Borrower, Holdings, the Borrowers and Guarantors party thereto from time to

time, the Lenders and Fronting Banks party thereto from time to time, and Bank of America, N.A., as the Agent;

WHEREAS, the

Borrowers have requested that the Revolver Facility Termination Date as set forth in the Existing ABL Credit Agreement shall be amended as set forth in Section 2

hereof;

NOW, THEREFORE,

in consideration of the covenants and agreements contained herein, as well as other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section 1. Defined Terms. Capitalized terms used but not defined herein (including in the introductory paragraph hereof and the recitals hereto) shall have the meanings assigned to such terms in the Amended ABL Credit Agreement.

Section 2. Amended ABL Credit Agreement.

(a) Subject to the occurrence of the Second Amendment Effective Date, the Existing ABL Credit Agreement shall hereby be amended to amend and restate the following definition as set

forth below:

“Revolver Facility Termination Date: February

1, 2028; provided that if any Senior Secured Note (or any Refinancing Indebtedness in respect thereof) remains outstanding on the date that is ninety-one (91) days prior to the stated maturity date thereof (such date, the “Springing Maturity Date”), the Revolver Facility Termination Date shall be the Springing Maturity Date. In the event that one or more Extensions are effected in accordance with Section

2.1.10, then the Revolver Facility Termination Date of each Tranche of Revolver Commitments shall be determined based on the respective stated maturity applicable thereto.”

Section 3. Conditions to Effectiveness of Amendment.

The effectiveness of this Amendment is subject to the satisfaction of the following conditions precedent (the date of

the satisfaction of such conditions precedent being referred to herein as the “Second Amendment Effective Date”):

|

(a)

|

Execution. The

Agent executing this Amendment and receiving a duly executed counterpart of this Amendment from the Administrative Borrower, Holdings, the other Loan Parties, each Revolver Lender, the Swingline Lender and each Fronting Bank;

|

|

(b)

|

Fees and Expenses.

Prior to or substantially concurrently with the Second Amendment Effective Date, the Administrative Borrower shall have paid (or shall have caused to be paid) all fees and reasonable out-of-pocket expenses required to be paid on or prior to

the Second Amendment Effective Date (in the case of expenses, to the extent invoiced at least two Business Days prior to the Second Amendment Effective Date (except as otherwise agreed to by the Borrowers)).

|

|

(c)

|

No Default. No

Default or Event of Default has occurred and is continuing on the Second Amendment Effective Date both before and after giving effect to this Amendment;

|

|

(d)

|

Representations and

Warranties. The representations and warranties of each Loan Party in the Loan Documents shall be true and correct in all material respects as of the Second Amendment Effective Date and are hereby made (it being understood and

agreed that any representation or warranty which by its terms is made as of a specified date shall be required to be true and correct in all material respects only as of such specified date, and any representation or warranty qualified by

materiality, material adverse effect or similar language shall be true and correct in all respects, but as so qualified);

|

|

(e)

|

Closing Certificate.

The Agent shall have received a certificate of a Senior Officer or “Authorized Officer” of the Administrative Borrower dated as of the Second Amendment Effective Date confirming satisfaction of the conditions set forth in clauses (c) and (d)

of this Section 3.

|

Section 4. Reaffirmation. Each Loan Party hereby (i) ratifies and affirms all the provisions of the Existing ABL Credit Agreement and the other Loan Documents as amended hereby, (ii) agrees that the terms and conditions of the

Existing ABL Credit Agreement, the Security Documents and the other Loan Documents, including the guarantee and security provisions set forth therein, shall continue in full force and effect as amended hereby, and shall not be impaired or limited by

the execution or effectiveness of this Amendment and (iii) acknowledges and agrees that the Collateral continues to secure, to the fullest extent possible in accordance with the Existing ABL Credit Agreement as amended hereby, the payment and

performance of the applicable Secured Obligations in accordance with the Existing ABL Credit Agreement as amended hereby. The terms and conditions of the Guarantee and the Security Documents are hereby reaffirmed by the Loan Parties.

Section 5. Representations

and Warranties. To induce the other parties hereto to enter into this Amendment, each Loan Party hereby represents and warrants to the Agent and the Revolver Lenders that the following statements are true and correct:

(a) each Loan Party has the corporate or other organizational power and authority to execute, deliver and carry out the terms and provisions of this Amendment and has taken all

necessary corporate or other organizational action to authorize the execution, delivery and performance of this Amendment;

(b) each Loan Party has duly executed and delivered this Amendment and this Amendment constitutes the legal, valid and binding obligation of such Loan Party enforceable in accordance

with its terms, in each case subject to (i) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium, arrangement or similar laws relating to or affecting creditors’ rights generally and (ii) general equitable principles (whether

considered in a proceeding in equity or at law); and

(c) neither the execution, delivery or performance by any Loan Party of this Amendment nor compliance with the terms and provisions of this Amendment nor the consummation of the

transactions contemplated hereby will (a) contravene any material provision of any Applicable Law applicable to such Loan Party, (b) result in any breach of any of the terms, covenants, conditions or provisions of, or constitute a default under, or

result in the creation or imposition of (or the obligation to create or impose) any Lien upon any of the property or assets of such Loan Party (other than Liens created under the Loan Documents and Permitted Liens) pursuant to, the terms of any

material indenture, loan agreement, lease agreement, mortgage, deed of trust, agreement or other material instrument to which such Loan Party is a party or by which it or any of its property or assets is bound, (c) violate any provision of the

Organic Documents of such Loan Party, or (d) violate any provision of the Senior Secured Notes.

Section 6. Effect on the Loan Documents.

(a) As of the Second Amendment Effective Date, each reference in the Existing ABL Credit Agreement to “this Agreement,” “hereunder,” “hereof,” “herein,” or words of like import, and

each reference in the other Loan Documents to the “Credit Agreement” (including, without limitation, by means of words like “thereunder”, “thereof” and words of like import), shall mean and be a reference to the Amended ABL Credit Agreement.

(b) Except as specifically amended herein, all Loan Documents shall continue to be in full force and effect and are hereby in all respects ratified and confirmed.

(c) The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of any Revolver Lender, any Fronting Bank, the Swingline

Lender or the Agent under any of the Loan Documents, nor constitute a waiver of any provision of the Loan Documents, except as expressly contemplated hereby. Nothing herein contained shall be construed as a substitution or novation of the

obligations outstanding under the Existing ABL Credit Agreement or any other Loan Document or instruments securing the same, which shall remain in full force and effect as modified hereby.

(d) The parties hereto acknowledge and agree that, on and after the Second Amendment Effective Date, this Amendment shall constitute a Loan Document for all purposes of the Amended

ABL Credit Agreement.

Section 7. GOVERNING LAW. THIS AMENDMENT AND ANY DISPUTE, CLAIM OR CONTROVERSY ARISING OUT OF OR RELATING TO THIS

AMENDMENT (WHETHER ARISING IN CONTRACT, TORT OR OTHERWISE) SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAW OF

THE STATE OF NEW YORK.

Section 8. Miscellaneous.

(a) This Amendment is binding and enforceable as of the Second Amendment Effective Date against each party hereto and their respective successors and permitted assigns.

(b) Section headings used in this Amendment are for convenience of reference only and are not to affect the construction hereof or be taken into consideration in the interpretation

hereof.

(c) Each of the parties hereto hereby agrees that Sections 14.6, 14.8, 14.14 and 14.16 of the Existing ABL Credit Agreement are incorporated by reference herein, mutatis mutandis, and

shall have the same force and effect with respect to this Amendment as if originally set forth herein.

[SIGNATURE PAGES FOLLOW]

IN WITNESS WHEREOF,

the parties hereto have caused this Amendment to be duly executed and delivered by their respective proper and duly authorized officers or representatives as of the day and year first above written.

ARROW BIDCO, LLC,

as the Administrative Borrower and a Guarantor

|

By:

|

/s/ Eric T. Kalamaras

|

|

|

Name: Eric T. Kalamaras

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

TOPAZ HOLDINGS LLC,

as Holdings and a Guarantor

|

By:

|

/s/ Eric T. Kalamaras

|

|

|

Name: Eric T. Kalamaras

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

TARGET LOGISTICS MANAGEMENT, LLC,

as a Borrower and a Guarantor,

|

By:

|

/s/ Eric T. Kalamaras

|

|

|

Name: Eric T. Kalamaras

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

TLM EQUIPMENT, LLC,

as a Borrower and a Guarantor

|

By:

|

/s/ Eric T. Kalamaras

|

|

|

Name: Eric T. Kalamaras

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

US IRON BIDCO, LLC,

as a Borrower and a Guarantor

|

By:

|

/s/ Eric T. Kalamaras

|

|

|

Name: Eric T. Kalamaras

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

RL SIGNOR HOLDINGS, LLC,

as a Borrower and a Guarantor,

|

By:

|

/s/ Eric T. Kalamaras

|

|

|

Name: Eric T. Kalamaras

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

BANK OF AMERICA, N.A.,

as the Agent, a Revolver Lender, the Swingline Lender and a Fronting Bank

|

By:

|

/s/ Alexandra Mills

|

|

|

Name: Alexandra Mills

|

|

|

Title: Vice President

|

Deutsche Bank AG New York Branch,

as a Revolver Lender and a Fronting Bank

|

By:

|

/s/ Philip Tancorra

|

|

|

Name: Philip Tancorra

|

|

|

Title: Director

|

|

By:

|

/s/ Frank Fazio

|

|

|

Name: Frank Fazio

|

|

|

Title: Managing Director

|

GOLDMAN SACHS BANK USA,

as a Revolver Lender and a Fronting Bank

|

By:

|

/s/ Neal Osborn

|

|

|

Name: Neal Osborn

|

|

|

Title: Authorized Signatory

|

Texas Capital Bank,

as a Revolver Lender and a Fronting Bank

|

By:

|

/s/ Andrew Anderson

|

|

|

Name: Andrew Anderson

|

|

|

Title: Vice President

|

10

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=th_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

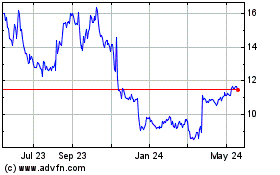

Target Hospitality (NASDAQ:TH)

Historical Stock Chart

From Jan 2025 to Feb 2025

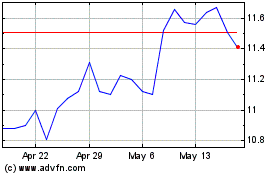

Target Hospitality (NASDAQ:TH)

Historical Stock Chart

From Feb 2024 to Feb 2025