Tokyo Lifestyle Co., Ltd. Announces Plan of ADS Ratio Change

November 12 2024 - 7:00AM

Tokyo Lifestyle Co., Ltd. (formerly known as Yoshitsu Co., Ltd,

“Tokyo Lifestyle” or the “Company”) (Nasdaq: TKLF), a retailer and

wholesaler of Japanese beauty and health products, sundry products,

luxury products, electronic products, as well as other products

in Hong Kong, Japan, North America and

the United Kingdom, today announced its plan to change the

ratio of its American Depositary Shares (“ADSs”) to its ordinary

shares from one ADS representing one ordinary share to one ADS

representing 10 ordinary shares (the “ADS Ratio Change”). The ADS

Ratio Change will become effective on November 15, 2024 (the

“Effective Date”).

For the Company’s ADS holders, the change in the

ADS Ratio will have the same effect as a one-for-ten reverse ADS

split and will not impact an ADS holder’s proportional equity

interest in the Company. The ADS Ratio Change is intended to

further support the liquidity in the Company’s ADSs and enable the

Company to regain compliance with the Nasdaq minimum bid price

requirement.

On the Effective Date, registered holders of the

Company’s ADSs held in certificated form will be required on a

mandatory basis to surrender their certificated ADSs to The Bank of

New York Mellon, the depositary bank (the “Depositary”), for

cancellation and received one new ADS in exchange for every 10

existing ADSs surrendered. Holders of uncertificated ADSs in the

Direct Registration System and The Depository Trust Company will

have their ADSs automatically exchanged.

The exchange of every 10 then-held (existing)

ADSs for one new ADS will occur automatically on the Effective

Date, with the then-held ADSs being cancelled and new ADSs being

issued by the Depositary. The Company’s ADSs will continue to be

traded on the Nasdaq Capital Market under the ticker symbol

“TKLF.”

No fractional new ADSs will be issued in

connection with the change in the ADS Ratio. Instead, fractional

entitlements to new ADSs will be aggregated and sold, and the net

cash proceeds from the sale of the fractional ADS entitlements

(after deduction of fees, taxes, and expenses) will be distributed

to the applicable ADS holders by the Depositary.

As a result of the ADS Ratio Change, the ADS

trading price is expected to increase proportionally, although the

Company makes no assurance that the ADS trading price following the

change will be proportionally equal to or greater than the ADS

trading price prior to the change, or that the change in the ADS

Ratio will have any effect on the liquidity of the Company’s

ADSs.

About Tokyo Lifestyle Co.,

Ltd.

Headquartered in Tokyo, Japan, Tokyo

Lifestyle Co., Ltd. (formerly known as Yoshitsu Co., Ltd) is a

retailer and wholesaler of Japanese beauty and health products,

sundry products, luxury products, electronic products, and other

products in Hong Kong, Japan, North America, and

the United Kingdom. The Company offers various beauty products

(including cosmetics, skincare, fragrance, and body care products),

health products (including over-the-counter drugs, nutritional

supplements, and medical supplies and devices), sundry products

(including home goods), and other products (including food and

alcoholic beverages). The Company currently sells its products

through directly-operated physical stores, through online stores,

and to franchise stores and wholesale customers. For more

information, please visit the Company's website

at https://www.ystbek.co.jp/irlibrary/.

Forward-Looking Statements

Certain statements in this press release are

forward-looking statements, within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended, and as defined in

the U.S. Private Securities Litigation Reform Act of 1995. These

forward-looking statements involve known and unknown risks and

uncertainties and are based on current expectations and projections

about future events and financial trends that the Company believes

may affect its financial condition, results of operations, business

strategy, and financial needs. Investors can identify these

forward-looking statements by words or phrases such as "may,"

"will," "expect," "anticipate," "aim," "estimate," "intend,"

"plan," "believe," "potential," "continue," "is/are likely to," or

other similar expressions. The Company undertakes no obligation to

update forward-looking statements to reflect subsequent occurring

events or circumstances, or changes in its expectations, except as

may be required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results in the Company's registration statement and in its

other filings with the U.S. Securities and Exchange Commission.

For more information, please

contact:

Tokyo Lifestyle Co.,

Ltd.Investor Relations

DepartmentEmail: ir@ystbek.co.jp

Ascent Investor Relations LLCTina

XiaoPresidentPhone:

+1-646-932-7242Email: investors@ascent-ir.com

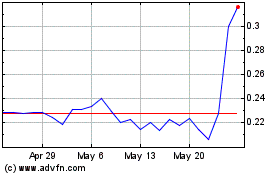

Tokyo Lifestyle (NASDAQ:TKLF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tokyo Lifestyle (NASDAQ:TKLF)

Historical Stock Chart

From Feb 2024 to Feb 2025