Share Purchase Agreement

Buyer

DAYLI TRINITY HOLDINGS, Ltd.

Seller

Mainstreamholdings, Ltd

2024. 12. 17.

Share Purchase Agreement

This Share Purchase Agreement (hereinafter referred to as “this Agreement”) is entered into on December 17, 2024 (hereinafter referred to as the “Effective Date”) by and between the parties below:

1.The Buyer, DAYLI TRINITY HOLDINGS, Ltd. (hereinafter referred to as the 'Buyer'), with its main office located at 15th Floor, Aju Building, 201, Teheran-ro, Gangnam-gu, Seoul, Republic of Korea

2.The Seller, Mainstream Holdings, Ltd. (hereinafter referred to as the “Seller”), with its main office located at #11-B-05, 11 Floor, 20, Gukjegeumyung-ro, Yeongdeungpo-gu, Seoul, Republic of Korea

In this Agreement, the Seller and the Buyer are individually referred to as “Party” and collectively as “Parties”. Additionally, the term “Counterparty” or “Other Party” refers to the Buyer in relation to the Sellers and to the seller in relation to the Buyer.

Preamble

1.TRINITY BIOTECH PLC (hereinafter referred to as the “Subsidiary”), with its headquarters located at IDA Business Park, Bray, County Wicklow, A98 H5C8, Ireland, primarily engages in the in vitro diagnostic testing business and is a company established and existing under the laws of Ireland.

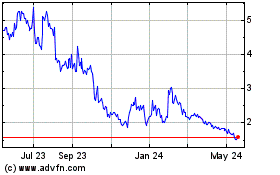

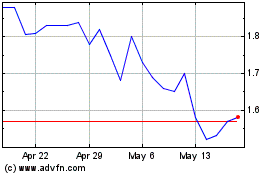

2.As of the date of this Agreement, MICO IVD HOLDINGS, LLC (hereinafter referred to as the “Target Company”) holds (i) A ordinary shares outstanding equivalent to 12.4% of the total issued shares of the Subsidiary, totaling 44,759,388 A Ordinary Shares (2,237,969 shares based on ADS, hereinafter referred to as the “Target Company Held Shares”), and (ii) unsecured subordinated convertible bonds issued by the Subsidiary on May 3, 2022, with a total face value of $20,000,000 (hereinafter referred to as the “Target Company Held Bonds”; collectively referred to as the “Target Company Held Securities”).

3.As of the Effective Date, the Seller currently owns 4,800 units (hereinafter referred to as the “Target Stake”) corresponding to 100% of the Target Company’s equity. The Seller intends to sell the Target Stake to the Buyer in accordance with the provisions of this Agreement. The Buyer intends to purchase the Target Stake from the Seller (hereinafter referred to as “this Transaction”).

In light of the foregoing, the Parties hereby enter into this Agreement as follows:

Article 1. Definitions

The terms used in this Agreement, unless otherwise defined in this Agreement, shall have the meanings as defined below:

“Laws” means, at any given time, the constitution, statutes, treaties, agreements, ordinances, rules, regulations, directives, bylaws, administrative regulations, and other similar rules and regulations that are validly enacted, in force, and possess legal force, as well as decisions, determinations, orders, and rulings of government agencies, adopted, promulgated, or applied by such government agencies.

“This Transaction” means (i) the sale and purchase transaction of the Target Stake as contemplated by this Agreement and (ii) the performance of various obligations or undertakings by each Party under this Agreement. Depending on the context, it may be interpreted to mean either (i) or (ii).

“Person” means an individual, corporation, non-corporate body or association, foundation, or government agency as defined hereinbelow.

“Proceedings” means any legal proceedings, application procedures, reconciliation in the course of trial, arbitration procedures, adjustment procedures, administrative adjudication procedures, inquiry procedures, investigation, or inspection procedures conducted by government agencies, and similar or equivalent procedures, as well as claims, filings, lawsuits, prosecutions, accusations, reports, notices of violation, or other disputes related thereto.

“Business Day” means a day on which commercial banks are open for business in the Republic of Korea (excluding Saturdays, Sundays, holidays, and days when only selected bank branches are open for business).

“Claim” means the existence of any cause of action or other matters where a written notice (including notice by electronic mail, as defined in this provision) has been claimed or is claimed to have been made or may be made.

“Government Agency” means legislative bodies, administrative agencies, judicial authorities, and natural persons, corporations, organizations, institutions, and other legal entities exercising delegated or equivalent authority or functions therefrom, both domestically and internationally (including arbitration institutions, the Korea Exchange, etc.).

“Government Approval” means all acts and procedures required by laws for approval, permission, registration, authorization, reporting, and notification in relation to any fact or action involving government agencies.

“Base Financial Statements (Target Company)” means the audited financial statements of the Target Company as of June 30, 2024.

“Base Financial Statements (Subsidiary)” means the publicly disclosed financial statements of the Subsidiary as of September 30, 2024.

“Encumbrances” means (i) security rights such as pledge, lien, mortgage, transferable collateral rights, (ii) lease, sublease, superficies, easements, and other rights to use or derive income, (iii) attachment, provisional attachment, provisional disposition, foreclosure, enforcement order, and other enforcement measures under the National Tax Collection Act or Local Tax Collection Act, (iv) acquisition prescription, adverse possession, conformity, expropriation, and other grounds for loss of ownership, and (v) agreements such as preemptive rights, trust, disposal prohibition, right of first refusal (RoFR), right of first offer (RoFO), call option, co-sale right (Drag Along Right), or tag-along right (Tag Along Right).

“Tax” or “Taxes” means corporate income tax, income tax, value-added tax, local tax, capital gains tax, education tax, property tax, acquisition tax, registration tax, license tax, customs duty, and all other taxes, national health insurance premiums, employment insurance premiums, national pension, industrial accident compensation insurance premiums, and other social security contributions imposed by government agencies, as well as surtax, interest, fines, penalties, and additional fees related thereto.

“Material Contract” means any of the following contracts, each of which is entered into by the Target Company as the Party and is currently in force: (i) if the aggregate amount of a series of contracts based on substantially the same cause exceeds the amount criteria specified below, the entire series of contracts related to the same cause shall be deemed a Material Contract; (ii) if multiple contracts are entered into in connection with a specific transaction, the entire series of such contracts shall be deemed a Material Contract; and (iii) the form of the contract, whether oral or written (regardless of the title), shall be considered, and whether it is explicit or implicit shall not be considered.

(1)(x) a contract for the sale or supply of assets or goods with a transaction value exceeding $1,000, (y) a contract for the purchase of assets or goods with a transaction value exceeding $1,000, and (z) a contract for the sale, purchase or supply of services with a transaction value exceeding $1,000.

(2)Contracts involving capital expenditures exceeding $1,000, whether already incurred or planned.

(3)Contracts related to providing collateral for real estate, personal property, or other assets with a book value or fair value exceeding $1,000.

(4)Lease or rental contracts for real estate, personal property, or other assets where the total amount, including security deposits and annual rent (or annual lease fees), exceeds $1,000.

(5)Contracts related to lending, borrowing, issuing or acquiring bonds, or providing guarantees for amounts exceeding $1,000 on a principal basis.

(6)Investment-related contracts for stocks, bonds, funds, or other financial instruments where the investment amount exceeds $1,000.

(7)Contracts entered into with shareholders or investors related to the issuance of stocks, shares, or bonds.

(8)Contracts related to option trading, including call options or put options, swap transactions, and other derivative transactions.

(9)Contracts related to the license or permission to use intellectual property rights. However, general software license agreements typically entered into in the ordinary course of business, following the terms of the licensor, are excluded.

(10)Contracts promising or providing compensation, benefits, or perks, regardless of their form or designation, to specific employees, such as stock options, special bonuses, performance incentives, salary guarantees, special allowances, etc. However, contracts that apply generally to all executives or employees and are typically paid or provided within normal ranges according to internal regulations are excluded.

(11)Contracts such as joint venture agreements, joint management agreements, co-ownership agreements, partnership agreements, or similar agreements with third parties involving the sharing of investments, profits, revenues, costs, or obligations.

(12)Any contracts entered into with other companies, shareholders, or investors (including past shareholders or investors), management, or other employees, related to investments in other companies, acquisition or disposal of shares, equities, or bonds of other companies, or rights and obligations as a shareholder or investor in other companies.

(13)Contracts related to mergers, demergers, significant business transfers, comprehensive stock swaps, or transactions related to the transfer of businesses.

(14)Contracts entered into with related parties or related parties of the seller (determined as of the date of the contract). However, contracts entered into in the ordinary course of business at fair market prices in accordance with the terms of the relevant company are excluded.

(15)Contracts entered into with government agencies.

(16)Contracts restricting the business, competition, monopoly rights, most favored nation conditions, minimum or exclusive purchase/supply conditions, and other agreements that restrict the ability of the target company to freely compete, purchase or sell, or otherwise conduct business.

(17)Contracts that constitute a breach or non-performance of any agreement by the target company, result in the loss of benefits or other rights under a deadline, cause an unfavorable

change in contract conditions, grant termination or rescission rights to the Counterparty, or give rise to approval rights for the Counterparty in connection with the conclusion of this Agreement or the performance of this transaction.

“Intellectual Property Rights” means, regardless of registration or application in the relevant country or region, (i) patents, copyrights, design rights, utility model rights, trademark rights, service mark rights, rights to computer program copyrights, rights to use trademarks, rights to internet domain names, inventions, discoveries, processes, technical data, specifications, technologies, databases, trade secrets, research and development information and outcomes, know-how, computer software, applications, systems, and all other intellectual property rights, and (ii) license rights to the above intellectual property rights received from others.

“Ordinary Course of Business (Business Activity)” means the lawful business activities that the Company regularly conducts within its usual business scope in the normal course of business, conforming to the past normal business practices (including compliance in terms of quantity, quality, and frequency).

“Related Party” means, in relation to any person, any other person who directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with such person. “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such person, whether through the ownership of voting securities, contract rights, or otherwise, and the existence of such control is determined as of the date of determining the Related Party status.

“Required Government Approval” means any approval that the relevant Party, the Target Company, and/or the Subsidiary must receive or complete in connection with the conclusion and performance of this Agreement.

“Required Third Party Approval” means any notice or consultation with a third party or approval or consent from a third party that the relevant party, the target company, and/or the subsidiary must receive or complete in connection with the conclusion and performance of this Agreement. This includes situations where failure to obtain such approval or consent, or failure to comply with the notice, consultation, or any other requirements, would constitute a breach of the agreement, entitle the counterparty to terminate or rescind the agreement, or result in other detrimental consequences such as loss of benefits under the agreement.

Article 2. Sale of Target Stake

Pursuant to this Agreement, the Seller agree to sell the Target Stake to the Buyer, and the Buyer agrees to purchase the Target Stake from the Seller.

Article 3. Purchase Price

The total purchase price for the Target Stake that the Buyer must pay to the Seller under this Agreement is KRW 15,000,000,000 (hereinafter referred to as the “Purchase Price”). The Purchase Price shall not be subject to any adjustments or settlements, except as provided in Article 8 regarding damages.

Article 4. Closing

4.1 Closing

The conclusion of this Transaction (hereinafter “Closing”) is based on the assumption that all the conditions precedent set forth in Article 5 are satisfied (including instances where one party waives the satisfaction of the conditions precedent as per Article 5). The Closing shall take place on December 20, 2024, or on a date agreed upon by the parties (hereinafter the “Closing Date”), at the office of DAYLI TRINITY HOLDINGS, Ltd., located at 15th Floor, Aju Building, 201, Teheran-ro, Gangnam-gu, Seoul, Republic of Korea (provided, however, that in the event the parties agree otherwise, it shall be at the agreed-upon location).

4.2 Seller' Performance at the Closing

Upon the Closing Date, the Seller shall, simultaneously with the Buyer's fulfillment of the matters set forth in Article 4.3, transfer the Target Stake, free from any encumbrances, and provide the following documents to the Buyer:

(1)Certificate of investment representing the Target Stake (if issued).

(2)A copy (original certified) of the register of employees of the Target Company, or equivalent document, evidencing the registration of the Target Company's employees in accordance with the contents compliant with this Transaction.

(3)Receipts for the Purchase Price.

(4)A copy (original certified) of the Seller's internal authorizing documents regarding the conclusion and performance of this Agreement.

(5)Any other documents reasonably requested by the Buyer in accordance with its rights under

4.3 Buyer's Performance at the Closing

On the Closing Date, the Buyer shall, concurrently with the Seller' fulfillment of the matters set forth in Article 4.2, perform the following:

(1)Immediately transfer the Purchase Price to the Seller's bank account, as notified in advance by the Seller (notification to be made no later than one (1) business day before the Closing Date).

(2)Provide the Seller with a copy (original certified) of the Buyer's internal authorizing documents regarding the conclusion and performance of this Agreement.

(3)Any other documents reasonably requested by the Seller in accordance with their rights under this Agreement.

Article 5. Preconditions for Closing

5.1 Preconditions for the Obligation of All Parties for the Closing

The obligation of each Party to conclude the Closing under this Agreement is conditional upon the satisfaction of the following conditions before the Closing:

(1) There shall be no laws that restrict or prohibit this Transaction contemplated.

5.2 Preconditions for the Buyer's Obligation for the Closing

The obligation of the Buyer to conclude the Closing under this Agreement is subject to the satisfaction of the following conditions or the written waiver thereof by the Buyer before the Closing:

(1)The representations and warranties of the Seller as stipulated in Article 7.1 of this Agreement shall be true and accurate as of the date of the agreement and the current date of the Closing (provided that if the representations and warranties are explicitly with respect to a specific date or specific point in time, they shall be true and accurate as of that date or time).

(2)The Seller shall have performed or complied with all covenants and obligations they are required to perform or comply with under this Agreement on or before the Closing date.

(3)The Seller, the Target Company, and the Relevant Subsidiary shall have obtained or completed all necessary government approvals and necessary third-party approvals that must be obtained or completed before the Closing, and in the process, no new conditions shall have been imposed or existing necessary third-party approvals or contract terms shall have been

unfavorably changed for the Target Company and the Relevant Subsidiary.

5.3 Preconditions for the Seller' Obligation for the Closing

The obligation of the Seller to conclude the Closing under this Agreement is subject to the satisfaction of the following conditions or the written waiver thereof by the Seller before the Closing:

(1)The representations and warranties of the Buyer as stipulated in Article 7.2 of this Agreement shall be true and accurate as of the date of the agreement and the current date of the Closing (provided that if the representations and warranties are explicitly with respect to a specific date or specific point in time, they shall be true and accurate as of that date or time).

(2)The Buyer shall have performed or complied with all covenants and obligations they are required to perform or comply with under this Agreement on or before the Closing Date.

(3)The Buyer shall have obtained or completed all necessary government approvals and necessary third-party approvals that must be obtained or completed before the Closing.

Article 6. Commitments

The parties hereby commit to the following actions or inactions from the date of the agreement until the Closing Date (provided that in the event this Agreement is terminated before the Closing Date, until the termination date):

(1)Each Party shall (i) promptly obtain any necessary third party approvals required for the conclusion and performance of this Agreement (including approvals required for the Target Company and the Relevant Subsidiary in the case of the Seller), (ii) submit timely the documents or materials required for this purpose to government agencies or other third parties, and (iii) use best efforts to fulfill the preconditions applicable to the Counterparty's obligation for the Closing under this Agreement. Each Party shall promptly notify the Counterparty, along with relevant documentation, upon obtaining any necessary third-party approvals as contemplated in this clause (in the case of the Seller, including approvals obtained for the Target Company and the Relevant Subsidiary).

(2)Each Party shall immediately notify the Counterparty if (i) the Party becomes aware of any reason why its representations and warranties under this Agreement may become inaccurate, (ii) the Party fails to perform or satisfy any material covenant, condition, or agreement under this Agreement, or (iii) the Party receives notice to obtain necessary third party approvals or any notice from government agencies related to the conclusion or performance of this Agreement or this Transaction contemplated hereby. However, such notification shall not be deemed a cure of such reason, a correction of a violation of representations and warranties, or a satisfaction of the conditions.

(3)The Seller, except for matters explicitly scheduled or required for performance under this Agreement for the completion of this Agreement (specifically including actions such as the agreement's conclusion and capital expenditure), shall ensure that, until the Closing, the Target Company (i) engages in business activities as usual in the ordinary course of business, (ii) maintains existing business relationships and employees, and (iii) refrains from taking any of the following actions without the prior written consent of the Buyer (provided, however, that the Buyer's consent shall not be unreasonably withheld or delayed, and unless the Buyer provides separate notice of disagreement within 3 business days of the date on which the Buyer requests consent, it shall be deemed to have consented):

1.Issuance of new securities or rights that could be converted into or exchanged for shares or otherwise give rise to an obligation to issue new shares.

2.Merger, division, or modification of terms of shares, change of type of shares, or any action that may increase or decrease the total number of issued shares, par value, or capital of the relevant company.

3.Amendment of articles of incorporation.

4.Declaration or payment of dividends.

5.Acquisition, disposition, or retirement of treasury shares.

6.Initiation of dissolution, bankruptcy, or reorganization proceedings.

7.Conclusion, application, modification, amendment, renewal, termination (including allowing expiration of the term without renewal), or rescission of significant contracts or government approvals; arbitrary or arbitrary acts or omissions constituting a material breach of obligations under significant contracts or government approvals upon notice or expiration of a certain period.

8.Increase in salary or other compensation for employees (excluding increases performed regularly in the ordinary course of business similar to the past) or changes in working conditions related to executives; establishment or amendment of provisions or policies related to executive bonuses or compensation; payment of new funds or consideration of a nature or consideration of new monetary or consideration in connection with the transaction, regardless of the nominal amount; changes in conditions, regulations, or policies related to compensation, benefits, or other employment conditions or welfare; and establishment, amendment, or abolition of provisions or policies related to compensation, benefits, or other employment conditions or welfare associated with the transaction.

9.Initiation, withdrawal, abandonment, or settlement of litigation or other legal proceedings.

10.Change in accounting policies, practices, or procedures; change in external auditors.

11.Agreement on tax audits, amendment of tax returns, change of taxable year, change in tax treatment principles or procedures, or waiver of tax refund rights.

12.Withdrawal, cancellation, waiver, or exemption of withdrawal rights or other rights.

(4)The Seller shall not, directly or indirectly, discuss or negotiate with any third party other than the Buyer regarding any transaction related to the Target Company, including the issuance of shares of the Target Company (including securities that can be converted into shares, as defined below), the transfer of shares of the Target Company, the transfer of the Target Company's business or significant assets, and financing transactions similar to or conflicting with the transaction contemplated hereby. If the Seller receive inquiries or proposals from such third parties, they shall promptly notify the Buyer of the content of such inquiries or proposals and the identity of the third party.

(5)The Seller shall cause the Target Company to (i) avoid interfering with the usual business activities of the Target Company and not violate relevant laws within the scope that does not interfere with the usual business activities and does not violate relevant laws, (ii) provide reasonable prior notice under the written consent of the Seller so that the Buyer's employees, advisors, agents can visit the Target Company's office and interview employees during business hours, and (iii) provide or allow access to documents and information requested reasonably by the Buyer's employees, advisors, agents.

(6)The Seller shall cause the Target Company to appoint the Buyer's designated person as an executive officer of the Target Company and to make the Member in the Limited Liability Agreement or Operating Agreement the Buyer, and take measures to change the Manager to the person designated by the Buyer, and the Buyer shall promptly notify the Seller of such designation and cooperate with the signing of the Agreement.

Article 7. Representations and Warranties

7.1 The Seller hereby make the representations and warranties to the Buyer set forth in Schedule 7.1.

7.2 The Buyer hereby makes the representations and warranties to the Seller set forth in Schedule 7.2.

Article 8. Indemnification

8.1 Seller' Indemnification Obligation

Subject to the conditions and limitations set forth in Article 8 of this Agreement, the Seller shall indemnify the Buyer for any losses incurred by the Buyer as a result of the Seller' representations, warranties, covenants, or other obligations under this Agreement.

8.2 Buyer's Indemnification Obligation

Subject to the conditions and limitations set forth in Article 8 of this Agreement, the Buyer shall indemnify the Seller for any losses incurred by the Seller as a result of the Buyer's representations, warranties, covenants, or other obligations under this Agreement.

8.3 Duration of Representations and Warranties

The representations and warranties made by each Party under this Agreement shall remain valid and effective for a period of 12 months from the Closing Date. In the event of a breach of any representation or warranty, the Party seeking indemnification (“Indemnified Party”) may notify the Other Party (“Indemnifying Party”) in writing within the specified period, providing detailed information on the specific items, content, supporting documentation, and the amounts of damages incurred (or a reasonable estimate if the amount is undetermined).

8.4 Limitation of Indemnification Liability

The indemnification liability of the parties under Article 8.1 and Article 8.2 is subject to the following limitations:

(1)The Indemnified Party must take all reasonable measures to minimize damages upon becoming aware of circumstances that could give rise to such damages. The Indemnified Party cannot claim indemnification for damages resulting from its failure to take reasonable steps to minimize damages.

(2)Indemnification liability under this Agreement shall not be duplicated for facts and circumstances constituting a violation of one or more representations, warranties, covenants, or obligations.

8.5 Third Party Claims

If a third party makes a claim against the Indemnified Party (including the Target Company) that could reasonably give rise to indemnification obligations of the Indemnifying Party under this Agreement, the Indemnified Party must, promptly after becoming aware of such claim, provide written notice to the Indemnifying Party, allowing the Indemnifying Party to take charge of the defense of such claim. However, the Indemnified Party may participate in the defense at its own expense, and the Indemnification liability of the Indemnifying Party is not exempted unless the Indemnified Party's notice results in actual harm to the Indemnifying Party. Except with the prior written consent of the Indemnified Party (excluding consent unreasonably withheld or delayed), the Indemnifying Party cannot settle, compromise, or otherwise adjust any such claim or litigation that affects the Indemnified Party's non-monetary obligations, or fully release the Indemnified Party from all liabilities related to such claim or litigation. If the Indemnifying Party does not, within 30 days from the date of receipt of the written notice, notify the Indemnified Party in writing that it will undertake the defense of the claim or litigation, or that it will not undertake the defense, the Indemnified Party is authorized to handle the claim or

litigation at the expense of the Indemnifying Party, unless otherwise agreed upon in writing by the Indemnifying Party (excluding unreasonable refusal or delay of such consent).

Article 9. Termination

9.1 Termination by Mutual Agreement

This Agreement may be terminated by written agreement of the parties at any time before the Closing.

9.2 Termination

This Agreement may be terminated by written notice from one Party to the other if any of the following events occur. However, the Party responsible for the occurrence of events listed below may not terminate this Agreement:

(1)If the representations and warranties of the Other Party are false or materially inaccurate, or if the Other Party breaches the covenants or obligations under this Agreement, resulting in the non-fulfillment of the conditions precedent to the terminating party's obligation to close this Agreement, and the breaching party fails to remedy the breach within 10 business days after receiving a written notice of such breach (provided that if the nature of the breach is such that it cannot be cured, the notice of remedy is not required, and the Party in breach cannot exercise termination rights under this section).

(2)If the Party fails to perform its obligations for the closing of this Agreement on the day it is required to perform, despite all conditions precedent to the closing obligation being satisfied or waived in writing, excluding cases where the failure to perform is due to the proper exercise of the simultaneous performance rights, and the non-performing Party cannot exercise termination rights under this section as a result of the Other Party's exercise of simultaneous performance rights.

(3)If bankruptcy proceedings or rehabilitation proceedings under the Debtor Rehabilitation and Bankruptcy Act are initiated against the Other Party, or an application for the commencement of such proceedings is filed with a court, or in the case of commencement of workout or similar procedures by creditors, or default in the payment of promissory notes.

(4)If the closing is not completed by the date one month after the execution date of this Agreement (hereinafter referred to as the “Closing Deadline”) (provided that the Party with attributable reasons for the failure of the closing under this Agreement cannot exercise termination rights under this section).

The parties may not terminate this Agreement after the closing under any circumstances. If the Party terminates this Agreement, it must do so in its entirety, and partial termination is not allowed. The Party

terminating this Agreement must give written notice to the Other Party, and upon such written notice, this Agreement is immediately terminated without any further action by the Parties.

9.3 Effects of Termination

(1)If this Agreement is terminated pursuant to Article 9.1 and Article 9.2, this Agreement and the rights and obligations arising hereunder are conclusively extinguished, and each Party is released from its obligations under this Agreement. However, the liability for a breach of obligations under this Agreement that occurred before termination shall not be extinguished and shall remain valid. The provisions of Articles 1, 8, and 11 of this Agreement shall continue to be effective even if this Agreement is terminated for reasons other than a breach. Termination of this Agreement does not affect the liability of the Party for a violation of its obligations under this Agreement before termination.

(2)If this Agreement is terminated, the Buyer shall (i) immediately return to the Seller all documents and materials received from the Seller, Seller's advisors, the Target Company, Subsidiaries related to this Transaction (including employees), and their representatives, and dispose of copies of such documents and materials held by the Buyer, and (ii) maintain in confidence all information obtained by the Buyer in connection with this Transaction.

Article 10. Confidentiality

10.1 Non-Disclosure

Each Party agrees not to disclose the contents of this Agreement to any third party without the prior written consent of the Other Party. Each Party shall maintain in confidence any confidential information concerning the Other Party (including but not limited to production methods, sales methods, and other technical or managerial information that is not publicly known, has independent economic value, and is kept confidential through reasonable efforts). However, the obligation of confidentiality does not apply to the following information or data:

(1)Information that is already publicly disclosed without a breach of the confidentiality obligation under this Agreement.

(2)Information obtained independently from a source other than this Agreement without a breach of the confidentiality obligation under this Agreement.

(3)Information developed independently without using or referring to information received from the Other Party.

(4)Information that is required to be provided or disclosed by law, court, or other government agencies. However, in such a case, each Party must disclose the information only to the extent

required by applicable laws and regulations.

(5)Information for which written consent has been obtained from the Other Party.

(6)Information provided to employees, special affiliates, and their employees, each Party's agents, advisors, shareholders, employees, investors and potential investors, lenders, and other stakeholders to the extent necessary for the performance of this Agreement or to obtain consent, approval, etc., within a reasonable scope. However, information within the reasonable scope of the purpose must be provided.

10.2 Return or Disposal of Confidential Information

In the event that this Agreement becomes null and void due to termination or any other reason, each Party must return or obtain the consent of the Other Party to dispose of the confidential information received from the Other Party and its employees and advisors related to this Transaction. Each Party must also keep all information obtained in connection with this Transaction confidential. However, if one Party notifies the Other Party of the receipt of confidential information and the Other Party unreasonably refuses to comply or delays receipt for more than one month without notice, the notifying party may dispose of the confidential information in a manner it deems appropriate.

10.3 Duration of Confidentiality Obligation

The confidentiality obligation under this Article shall remain effective for a period of one year even after the termination of this Agreement.

Article 11. Notice

Unless otherwise stipulated in this Agreement, any notice, demand, or other communication required under this Agreement or related to this Agreement shall be in writing and shall be delivered by registered mail, email, or courier service (which may be changed from time to time by notice under this clause). Notices related to this Agreement shall become effective upon receipt by the receiving party, and: (i) In the case of mail, at the time of delivery; (ii) In the case of registered mail or courier service, three (3) business days after the date of dispatch; (iii) In the case of email, when the recipient confirms receipt (provided that if the email is confirmed received after business hours on a business day, it shall be deemed received on the next business day).

Notice to the Buyer:

DAYLI TRINITY HOLDINGS, Ltd.

Address: 15th Floor, Aju Building, 201, Teheran-ro, Gangnam-gu, Seoul, Republic of Korea

Attention: Wonyong Park

Phone:

Email:

Notice to the Seller:

Mainstream Holdings Ltd.

Address: #11-B-05, 11 Floor, 20, Gukjegeumyung-ro, Yeongdeungpo-gu, Seoul, Republic of Korea

Attention: Park Heejoo

Phone:

Email:

Article 12. Miscellaneous Provisions

12.1 Entire Agreement

This Agreement constitutes the final and complete agreement between the parties regarding the subject matter of this Transaction, and any prior oral or written agreements are nullified by the execution of this Agreement.

12.2 Interpretation Principles

(i) “This Agreement”, other agreements, or documents refer to this Agreement, including modifications, amendments, or supplements made from time to time.

(ii) Terms such as “including”, “include”, etc., shall be deemed to include the phrase “without limitation”.

(iii) The singular includes the plural, and vice versa.

(iv) Unless expressly defined as “business days”, days refer to calendar days.

(v) “Or” is not exclusive but inclusive.

(vi) Phrases like “under this Agreement”, “in this Agreement”, etc., refer to the entire Agreement.

(vii) Sections, clauses, or appendices refer to the respective sections, clauses, or appendices of this Agreement.

(viii) Dates refer to dates in the Republic of Korea.

(ix) “Written” includes email or other electronic documents. Appendices and annexes are construed as if fully set forth in this Agreement. Section headings are inserted for convenience and do not affect the interpretation of the Agreement.

12.3 Assignment and Successors

No party may assign or transfer its position, rights, or obligations under this Agreement to a third party without the prior written consent of the Other Party.

12.4 Amendment and Waiver

Any changes to this Agreement must be in writing and signed by both parties. Failure to exercise any right by the Party does not waive that right, and any waiver must be in writing.

12.5 Severability

If any provision is invalid, illegal, or unenforceable, it shall be replaced with a valid provision that best reflects the original intent. The remaining provisions' validity, legality, or enforceability is unaffected.

12.6 Force Majeure

Neither Party is responsible for failure to fulfill obligations due to events beyond its control, such as fire, storm, flood, earthquake, war, government regulations, or actions.

12.7 Costs

Each Party bears its costs related to the execution and performance of this Agreement unless the agreement is terminated due to one Party's fault, in which case the defaulting Party bears all costs.

12.8 Late Payment Interest

If the Party fails to pay the required amount by the due date, it shall pay the Other Party interest at a rate of fifteen percent (15%) per annum from the day after the due date until the actual payment date.

12.9 Taxes

Except as otherwise specified, each Party is responsible for paying taxes imposed on it under South Korean law related to the execution and performance of this Agreement.

12.10 Governing Law

This Agreement is governed by the laws of South Korea.

12.11 Dispute Resolution

In case of any dispute arising out of or in connection with this Agreement, the parties shall make efforts to resolve it amicably. If no resolution is reached, the parties agree to submit to the exclusive jurisdiction of the Seoul Central District Court as the court of first instance.

[Below is the margin for the page with signatures and seals.]

In witness whereof, the Parties hereto have executed this Agreement on the date first above written, with the authorized representatives or agents of each Party affixing their names and signatures hereunder:

Buyer

/s/ Wonyong Park

DAYLI TRINITY HOLDINGS, Ltd.

15th Floor, Aju Building, 201, Teheran-ro, Gangnam-gu, Seoul, Republic of Korea

Authorized Representative: Wonyong Park

In witness whereof, the Parties hereto have executed this Agreement on the date first above written, with the authorized representatives or agents of each Party affixing their names and signatures hereunder:

Seller

/s/ Kim Changhee

Mainstream Holdings Ltd.

#11-B-05, 11 Floor, 20, Gukjegeumyung-ro, Yeongdeungpo-gu, Seoul, Republic of Korea

Authorized Representative: Kim Changhee

Schedule. 7.1

Representations and Warranties of the Seller

The Seller represents and warrants to the Buyer that the following statements are true and accurate as of the date of the Effective Date and the closing date of this Agreement. However, representations and warranties based on a specific date represent and warrant as of that specific date.

A. Information Regarding the Seller and Target Stake

(1)The Seller are a legal entity duly established and validly existing under the laws of the Republic of Korea.

(2)The Seller has the necessary authority and qualifications to enter into this Agreement and fulfill the obligations under this Agreement.

(3)The Seller have completed all valid and legal internal authorization procedures, including board resolutions, necessary for entering into and performing this Agreement.

(4)This Agreement is validly executed by the Seller and is enforceable against the Seller in accordance with the conditions of this Agreement.

(5)The execution and performance of this Agreement by the Seller do not violate the Seller' articles of incorporation or relevant laws.

(6)No governmental or third-party approvals necessary for the Seller to enter into and perform this Agreement are required. There are no legal actions prohibiting or restricting the transaction with the Seller, and there is no likelihood of such legal actions.

(7)The Seller have legal and valid ownership of the Target Stake, and these Stake have been lawfully issued without any restrictions. Ownership of the Target Stake will be transferred to the buyers upon the completion of this Transaction without any encumbrances.

B. Information Regarding the Target Company:

(1)Establishment and Existence. The Target Company is lawfully established and validly existing under the laws of the State of Delaware, and it has the legal authority, capacity, and power to engage in its current business activities and to own and use its assets. There are no reasons for the dissolution, liquidation, or initiation of bankruptcy, debtor recovery proceedings, or similar procedures for the Target Company under applicable laws.

(2)No Violations. The execution and performance of this Agreement by the Seller does not and will not (i) violate any applicable laws, regulations, or conditions of government approvals applicable to the Target Company; (ii) violate the organizational documents of the Target Company; (iii) result in the creation of any encumbrance on the shares or assets of the Target Company; (iv) constitute a violation or default under, accelerate (including after the giving of notice or lapse of time or both), or be a cause for termination, invalidity, cancellation, rescission, dissolution or suspension of, any agreement binding upon the Target Company or applicable to its assets; (v) otherwise have a material adverse effect on the Target Company, and there are no required third party approvals that the Target Company must obtain in connection with the execution and performance of this Agreement.

(3)Capital of the Target Company. As of the execution date of this Agreement, the Target Company's capital is $48,000,000, lawfully and validly paid in accordance with the laws of the State of Delaware. The Target Company has not issued any securities or rights that could convert or exchange into its shares, nor has it entered into any agreements related to the issuance of such securities. There is no dilution of the Target Company's shares.

(4)Audited Financial Statements of the Target Company. The audited financial statements of the Target Company have been prepared in accordance with relevant laws and International Financial Reporting Standards (IFRS). These financial statements accurately and fairly represent the consolidated and separate financial position, operating results, changes in equity, and cash flows of the Target Company as of the date and for the period indicated. Except for the obligations reflected in the financial statements, there are no outstanding liabilities, responsibilities, or obligations (including external liabilities or contingent liabilities). The Target Company's accounts receivable (including accounts receivable from sales) have been generated in the ordinary course of business, are recoverable within a reasonable period, and do not have any restrictions, offsets, or adjustments. The account receivables do not include any set-offs, deductions, or restrictions.

(5)Absence of Material Adverse Effect. (i) The Target Company has conducted its business in the ordinary course, and (ii) no events or circumstances have occurred or are reasonably expected to occur that would have a material adverse effect on the Target Company.

(6)Compliance with Laws. The Target Company has complied with all applicable laws concerning its current business operations, and it has not been subject to any sanctions by government agencies for violations of laws. There is no likelihood of receiving sanctions due to legal violations or similar events.

(7)Government Approval. The Target Company, in conducting its current business operations, has obtained all necessary government approvals (including approvals related to assets owned, used, or occupied by the Target Company, but not limited to them) which are legally and validly existing. The Target Company has complied with the conditions required by these government approvals, fulfilled obligations such as reporting, permits, compliance with standards, and various inspection

obligations accompanying these government approvals in a lawful manner. The Target Company has not engaged in any acts that could lead to their cancellation or suspension, and there are no reasons or circumstances that would result in a violation, cancellation, or suspension of these government approvals. No lawsuits related to these government approvals exist against the Target Company, and there is no risk of such lawsuits arising.

(8)Intellectual Property and Trade Secrets. The Target Company currently possesses legal and valid ownership or usage rights without encumbrances regarding intellectual property it owns or uses. Registrations and applications related to intellectual property are all in a valid state, and there are no grounds for the invalidation or cancellation of these intellectual property rights. The Target Company is not obligated to pay compensation to third parties (including former or current employees of the Target Company) in connection with the use of intellectual property, excluding fees payable under contracts related to the use of intellectual property. There are no rights held by third parties to claim compensation from the Target Company in relation to its intellectual property. The use of the Target Company's intellectual property does not conflict with the intellectual property of others, and the Target Company has not received any notices alleging infringement of third-party intellectual property. Regarding intellectual property corresponding to inventions created by employees and owned by the Target Company, the Target Company has legally succeeded to the rights in accordance with relevant laws, regulations, and agreements and has provided proper compensation to the inventors. Third parties do not infringe on the intellectual property of the Target Company. The Target Company has taken reasonable measures to protect its trade secrets and has not infringed on the trade secrets of third parties.

(9)Assets. The Target Company legally owns or has usage rights to real estate, medium and heavy machinery, automobiles, other tangible assets, memberships, and other intangible assets, and securities related to its current business operations. Regarding leased assets, the Target Company has complied with all lease agreements, paid all rents and other amounts due under the lease agreements before or on each due date, and has not violated or failed to fulfill any lease agreement.

(10)Owned Shares. As of the closing date, the Target Company does not hold shares or interests in any other company besides the shares it owns.

(11)Significant Contracts. Significant contracts of the Target Company have been legally executed, are binding on the Target Company and the other contracting parties, comply with relevant laws, and do not contain any provisions or circumstances that could render them void or cancellable. The Target Company can legally exercise its rights under these contracts. The Target Company has not received notices of termination, rescission, or refusal to perform contractual obligations or delays in performance under significant contracts, nor is there any concern about such events occurring.

(12)Personnel and Labor. Employment contracts, employment regulations, and collective bargaining agreements of the Target Company comply with relevant laws, and the Target Company has adhered to laws, employment contracts, employment regulations, and collective bargaining

agreements related to personnel and labor in all significant aspects. The Target Company has paid all wages, various allowances, bonuses, retirement benefits, and other contributions or contributions required to be paid to employees under laws, employment contracts, employment regulations, and collective bargaining agreements. The transaction does not accelerate or increase compensation or monetary payment obligations to employees or result in a change in the Target Company's obligations under labor contracts or other employment-related agreements. The Target Company is not currently experiencing strikes, collective actions, or labor disputes, and there is no anticipated risk of strikes, collective actions, or labor disputes. No lawsuits related to personnel and labor laws are currently underway, and there is no anticipated risk of such lawsuits.

(13)Related Party transactions. Conditions of the Related Party transactions entered into by the Target Company do not violate laws, conform to fair transaction conditions between independent parties, and are not unfavorable to the Target Company compared to normal transaction conditions with unrelated third parties.

(14)Taxation. The Target Company has timely paid all taxes it is obligated to pay under relevant laws, and all tax filings and reports required by law have been timely made and are accurate and factual (excluding cases where there are reasonable provisions for disputed amounts). Taxes that have been determined or confirmed but are not yet due have been properly accounted for as liabilities in the financial statements. There are no pending lawsuits related to taxes borne by the Target Company, and there is no anticipated risk of such lawsuits. The Target Company is not currently undergoing tax audits or investigations, and there is no expectation of such audits or investigations.

(15)Litigation. There are no ongoing or pending lawsuits related to the business of the Target Company or against the Target Company or its employees. There is no anticipated risk of such lawsuits arising.

(16)Environment, Safety, and Health. The Target Company has complied with environmental, safety, and health regulations in all significant aspects related to (i) the past and/or current business activities of the Target Company and (ii) properties owned or used by the Target Company in relation to air, water, waste, noise, land, marine pollution, environmental protection, hazardous substance management, safety, and health (“ES&H Requirements”). The Target Company holds all necessary government permits legally and validly in all significant aspects. There is no evidence that the Target Company has received notices of violations of ES&H Requirement-related laws or government permits from government agencies or third parties that could have a significant adverse impact. As far as the Seller are aware, there are no reasons to believe that investigations, post-remediation, corrective actions, or obligations to remedy or correct ES&H Requirement-related laws that would significantly adversely affect the Target Company's operations or assets are likely to occur.

(17)Insurance. The Target Company has obtained all insurance required by law or contract, and the insurance contracts entered into by the Target Company have been legally executed. The relevant

insurance premiums have been timely paid, and the insurance policies are currently valid. There are no limitations or burdens on the insurance claims rights of the Target Company. There are no ongoing lawsuits related to insurance contracts entered into by the Target Company, and there is no anticipated risk of such lawsuits.

(18)Loans and Collateral; Non-Existence of Default. There are no loans or collateral established in relation to the Target Company, and there are no collateral or guarantees provided by the Target Company for the debts of others or provided by others, including sellers. The Target Company is not in default on loans that have matured, and there are no reasons for loss of term benefit for loans that will mature.

C. Information Regarding Subsidiary

(1)Ownership of Subsidiary Shares. The Target Company legally owns shares of the Subsidiary and has legal and valid ownership rights. The shares of the Subsidiary were lawfully issued, and there are no limitations or burdens set on them.

(2)Establishment and Existence. The Subsidiary has been legally established under Irish law and validly exists. It is conducting its current business operations legally, possesses the necessary legal authority, capabilities, and permissions to own and use its assets. There is no reason, to the Seller' knowledge, for the Subsidiary to be dissolved or liquidated, commence insolvency or debtor recovery proceedings, or similar procedures.

(3)Non-Existence of Violations. To the Seller' knowledge, the execution and performance of this Agreement by the Seller do not (i) violate any applicable laws or government approvals concerning the Subsidiary, (ii) breach the organizational documents of the Subsidiary, (iii) result in any limitations on the Subsidiary's shares or assets, (iv) constitute a violation or default under any agreement binding the Subsidiary or relating to its shares or assets, or (v) have any other significantly adverse effect on the Subsidiary. To the Seller' knowledge, no necessary third party approvals are required for the execution and performance of this Agreement by the Subsidiary.

(4)Subsidiary's Financial Statements. To the Seller' knowledge, the financial statements of the Subsidiary have been prepared in accordance with relevant laws and International Financial Reporting Standards (IFRS). The consolidated and separate financial condition, operating results, changes in equity, and cash flows of the Subsidiary are accurately and fairly presented as of the date and for the periods indicated in the financial statements. Except for the liabilities reflected in the financial statements of the Subsidiary, there are no debts, liabilities, or obligations (including external debts or contingent liabilities) existing for the Subsidiary.

(5)Compliance with Laws. To the Seller' knowledge, the Subsidiary has complied with all applicable laws related to its current business operations, and there have been no sanctions imposed by government agencies on the Subsidiary for violations of laws. There is no anticipated risk of

sanctions due to violations of laws.

(6)Government Approval. To the Seller' knowledge, the Subsidiary has obtained all necessary government approvals in connection with its current business operations, and these approvals are legally and validly existing. The Subsidiary has complied with the conditions required by these government approvals and has not engaged in any acts that could lead to their cancellation or suspension. There are no existing lawsuits related to these government approvals against the Subsidiary, and there is no anticipated risk of such lawsuits.

(7)Litigation. To the Seller' knowledge, there are no ongoing or pending lawsuits related to the business of the Subsidiary, and there is no anticipated risk of such lawsuits arising.

Schedule. 7.2

Representations and Warranties of the Buyer

The Buyer represents and warrants to the Seller that the following statements are true and accurate as of the Effective Date and closing date of this Agreement. However, representations and warranties based on a specific date represent and warrant as of that specific date.

(1)The Buyer is a corporation duly established and validly existing under the laws of the Republic of Korea.

(2)The Buyer has the necessary authority and qualification to enter into this Agreement and perform its obligations under this Agreement.

(3)The Buyer has completed all valid and legal internal authorization procedures, including board resolutions, necessary to enter into this Agreement and perform its obligations under this Agreement.

(4)This Agreement has been legally entered into by the Buyer and is binding and enforceable against the Buyer in accordance with the terms and conditions of this Agreement.

(5)The Buyer’s entering into this Agreement and performing of the obligations does not violate the articles of incorporation of the Buyer or relevant laws and regulations.

|

This Agreement shall be provided in accordance with applicable laws and regulations and internal control standards. Loan Agreement - Lender - Institutions specified in Appendix 1 - Borrower - DAYLI Trinity Holdings, Ltd. December 17, 2023 |

Table of contents

|

|

Chapter 1 General Provisions |

3 |

Article 1-1 (Definitions) |

3 |

Article 1-2 (Interpretation) |

7 |

|

|

Chapter 2 Loans |

8 |

Article 2-1 (Loan Agreement) |

8 |

Article 2-2 (Purpose of the Loan) |

8 |

Article 2-3 (Drawdown) |

9 |

Article 2-4 (Conditions Precedent to Drawdown) |

9 |

Article 2-5 (Conditions Subsequent to Drawdown) |

9 |

Article 2-6 (Waiver of Lending Obligation) |

10 |

|

|

Chapter 3 Payment of Interest and Repayment of Loans |

10 |

Article 3-1 (Interest and Default Interest) |

10 |

Article 3-2 (Payment of Interest) |

10 |

Article 3-3 (Repayment of Loans) |

10 |

Article 3-4 (Voluntary Early Repayment) |

11 |

Article 3-5 (Mandatory Early Repayment) |

11 |

Article 3-6 (Early Repayment Fee) |

11 |

Article 3-7 (Payment Standards and Allocation of Paymentst) |

11 |

|

|

Chapter 4 Fund Management |

12 |

Article 4-1 (Opening and Management of Deposit Accounts) |

12 |

|

|

Chapter 5 Security |

13 |

Article 5-1 (Principles of Security Creation) |

13 |

Article 5-2 (Pledge of Shares) |

13 |

Article 5-3 (Pledge of Deposit Claims) |

13 |

Article 5-4 (Pledge of Settlement Amount Claims) |

13 |

|

|

Chapter 6 Representations, Warranties, and Covenants |

14 |

Article 6-1 (Representations and Warranties) |

14 |

Article 6-2 (Affirmative Covenants) |

15 |

Article 6-3 (Negative Covenants) |

15 |

|

|

Chapter 7 Default |

16 |

Article 7-1 (Events of Default) |

16 |

Article 7-2 (Loss of Benefit of Time) |

17 |

|

|

Chapter 8 Others |

17 |

Article 8-1 (Expenses) |

17 |

Article 8-2 (Notification) |

18 |

Article 8-3 (Assignment) |

19 |

Article 8-4 (Confidentiality) |

19 |

Article 8-5 (Retention of Documents) |

19 |

Article 8-6 (Others) |

20 |

Article 8-7 (Governing Law and Jurisdiction) |

20 |

|

|

Appendix 1 Lenders and Loan Agreements |

1 |

Appendix 2 Conditions Precedent Documents |

2 |

Appendix 3 Conditions Subsequent Documents |

3 |

|

|

Exhibit 1 Drawdown Request (Form) |

4 |

Exhibit 2 Subordination Undertaking (Form) |

5 |

Loan Agreement

This Loan Agreement (hereinafter referred to as “this Agreement”) is made and entered into as of December 17, 2024 (the “Effective Date”), by and between the following parties:

|

|

Lender |

Institutions specified in Appendix 1

(hereinafter be referred to individually as a "Lender" and collectively as “Lenders" as the context may require) |

|

|

Borrower |

DAYLI TRINITY HOLDINGS, Ltd. (the “Borrower”) |

|

|

The Lender and Borrower are individually referred to as the "Party", and collectively as the "Parties".

The Parties agree to enter into this Agreement under the following terms and conditions:

Chapter 1 General Provisions

Article 1-1 (Definitions)

The terms used in this Agreement shall have the following meanings, unless otherwise defined in this Agreement:

1.The term “Financial Obligations” as used in this Agreement refers to any of the following debts related to a company:

A.Debts Related to Deposits or Advances: Any debts arising from deposits or advances of any type that have the effect of debt or borrowings, excluding deposits or advances made by customers during the normal course of business activities

B.Debts on Securities or Similar Instruments: All debts evidenced by debentures, notes, securities, or certificates of a similar nature, excluding debts shown on notes or similar certificates issued in connection with accounts payable during the ordinary course of business

C.Interest-Bearing Debts: Debts where interest accrues as a normal consequence of borrowing

D.Secured Third-Party Financial Obligations: All financial obligations of third parties secured by the company’s assets, limited to the lower of the secured debt amount or, if applicable, the security limit

E.Conditional Sales or Ownership Transfers: Debts arising from conditional sales or other sales of ownership in connection with the company’s assets that have the nature of borrowing, excluding contractual obligations incurred in the ordinary course of business activities.

F.Deferred Payment Obligations: Debts related to the sale or servicing of assets where payment is deferred for more than ninety (90) days from the usual payment period

G.Guarantee Obligations: Obligations of the company related to guarantees for the financial obligations of a third party, limited to the extent of the guarantee limit specified in the relevant guarantee contract, if applicable

H.Financial Lease Obligations: Debts classified as financial leases on the company’s balance sheet. If the Korean corporate accounting standards applicable to the company do not distinguish between financial leases and operating leases, the term refers to all lease-related debts accounted for on the balance sheet

I.Liability for damages related to guarantees, letters of credit or other certificates issued by banks or financial institutions (except those issued in connection with payment obligations related to the purchase of goods in the ordinary course of the Borrower's business activities)

J.Liabilities from Sale of Trade Receivables: Liabilities related to the sale of trade receivables, excluding divestitures without recourse. Any release or termination provisions resulting from violations of standard representation warranties are deemed to be without recourse

K.Liabilities Related to Amounts Incurred from Other Transactions, Including Forward Contracts with the Effect of Borrowing: Liabilities arising from other transactions, including forward contracts that have the effect of borrowing.

L.Liabilities Related to Derivative Transactions for Hedging Purposes: Liabilities related to derivative transactions entered into for hedging purposes, limited to the market-assessed value of such transactions

2."Majority Lender" means (i) Before the drawdown, refers to the Lender(s) holding two-thirds (2/3) or more of the total Loan Commitments. (ii) After the drawdown, refers to the Lender(s) holding two-thirds (2/3) or more of the outstanding Loan.

3."Security Agreement" refers to all agreements and documents executed or prepared in connection with the collateral and rights provided or granted to the Lenders under Chapter 5 of this Agreement

4."Security Right" refers to the security interest (including personal guarantees) established under the Security Agreement.

5."Loan Transaction Agreement" refers to this Agreement, the Security Agreements, and all other contracts and ancillary documents prepared in connection with this Agreement.

6."Loan" refers to the principal amount of the loan drawn down under this Agreement, up to the limit of the Loan Commitment agreed upon by each Lender, or, depending on the context, the outstanding principal balance of the Loan at any given time.

7."Loan Maturity Date" refers to the date when the total Loan must be repaid in full, which is the corresponding date of the month 12 months after the Drawdown Date. However, with the consent of all Lenders, the Loan Maturity Date may be extended twice, for up to three (3) months each time. If the Loan Maturity Date falls on a non-Business Day, the Loan Maturity Date shall be the next Business Day.

8."Loan Commitment Amount" refers to the total amount of KRW 10,000,000,000 (Ten Billion Korean Won) that the Lenders have agreed to lend to the Borrower under this Agreement. Depending on the context, it may also refer to the amount each Lender is obligated to lend to the Borrower, as specified in Appendix 1 of this Agreement, within the conditions and limits of this Agreement.

9."Loan Principal and Interest" refers to the outstanding balance of the Loan, including accrued interest (including default interest).

10."Loan Interest Period" refers to the period starting from the Drawdown Date and ending on the date the Loan is fully repaid.

11."Loan Interest Payment Date" refers to the last day of the Loan Interest Period.

12."Price Return Swap (Agreement)" means the Price Return Swap Agreement concluded on December 20, 2023, and subsequently succeeded through the Amendment Agreement concluded on December 17, 2024, among Mico Co., Ltd. (hereinafter referred to as "Mico"), Mainstream Holdings LLC, and the Borrower. Under this agreement, the Borrower assumes the position of Mainstream Holdings LLC in the original Price Return Swap Agreement. The agreement governs the settlement of certain fixed profits the Borrower receives from Mico pursuant to the Price Return Swap Agreement, as well as variable profits generated from the Borrower's equity shares in the acquired Target Company.

13.“Target Company” refers to MICO IVD HOLDINGS, LLC, a company incorporated under the laws of the State of Delaware, United States.

14."Target Equity" refers to all equity interests issued by the Target Company to be acquired by the Borrower under the Share Purchase Agreement.

15."Share Purchase Agreement" refers to the share purchase agreement entered into on December 17, 2024, between the sellers, Mainstream Holdings LLC, and the Borrower, as the purchaser, whereby the Borrower agrees to acquire 4,800 units of equity interests in the Target Company held by the sellers.

16."Event of Default" refers to the occurrence of any of the following events concerning a corporation:

A.A suspension of transactions as defined in the Korea Financial Settlement Rules.

B.The corporation is insolvent, initiates liquidation or dissolution proceedings, or is subject to rehabilitation or bankruptcy proceedings under the Debtor Rehabilitation and Bankruptcy Act,

or any similar circumstances rendering normal operations impossible.

C.The corporation faces financial risks due to similar proceedings as stated in B, making it objectively difficult to perform its obligations under this Agreement

17."Business Day" refers to a day on which commercial banks in Korea are open for business, excluding Saturdays, Sundays, Labor Day, and public holidays designated under applicable laws.

18."Repayment Account" refers to the account defined in Article 4-1 of this Agreement.

19."Drawdown Period" refers to the period during which the Borrower may request a drawdown of the Loan Commitment, which shall be within one (1) month from the execution date of this Agreement.

20."Conditions Precedent" refers to the conditions set forth in Article 2-4 of this Agreement that must be satisfied prior to the drawdown of the Loan Commitment.

21."Drawdown Date" refers to the date on which the Lenders disburse the Loan Commitment to the Borrower in accordance with Article 2-4 and the terms of this Agreement. The term “Drawdown” refers to the act of such disbursement by the Lenders on the Drawdown Date.

22."Conditions subsequent" refers to the conditions set forth in Article 2-5 of this Agreement that must be satisfied after the drawdown of the Loan Commitment.

23.“Participation Ratio” Refers to, for each Lender (i) Before the drawdown, the ratio of the Lender’s Loan Commitment to the total Loan Commitments under this Agreement; or (ii) After the drawdown, the ratio of the Lender’s Loan to the total Loan under this Agreement.

24."Secured Obligation" refers to all monetary claims held by the Lenders against the Borrower under the Loan Transaction Agreement, including Loan Principal and Interest.

25."Secured Liabilities" refers to the monetary liabilities of the Borrower corresponding to the Secured Obligations under this Agreement.

26."Permitted Security" refers to security interests established on the Borrower’s assets that fall into any of the following categories:

A.Security interests established under the Loan Transaction Agreement.

B.Statutory liens or security interests arising by operation of law (including liens arising from taxation).

C.Security provided for taxes subject to appeal.

D.Security provided pursuant to judgments or decisions that do not constitute an Event of Default, or security deposited with the court for litigation or other legal proceedings.

E.Various liens arising in the ordinary course of the Borrower’s business activities (provided that such liens must be extinguished within three (3) months of their establishment).

F.Security provided to administrative authorities in connection with permits, licenses, or other approvals, provided that the Lenders are notified in advance.

G.Security provided in connection with Permitted Indebtedness.

H.Other security interests approved by the Majority Lenders

27."Permitted Indebtedness" refers to the financial obligations of the Borrower that fall into any of the following categories:

A.Financial obligations under the Loan Transaction Agreement.

B.Financial obligations under the Price Return Swap Agreement.

C.Financial obligations arising under applicable laws.

D.Financial obligations for refinancing purposes to repay all (or part of) the Loan.

F.Other financial obligations approved by the Majority Lenders

28."Subordinated Debt" refers to the Borrower’s financial obligations that meet all of the following conditions:

A.The maturity date of such obligations is later than the Loan Maturity Date.

B.No principal, interest, or other payment related to such obligations shall be made under any circumstances before the Secured Liabilities under this Agreement are fully repaid, including during rehabilitation or bankruptcy proceedings under the Debtor Rehabilitation and Bankruptcy Act.

C.If security is provided for such obligations, (i) No security shall be established on assets that are already secured for the benefit of the Lenders under this Agreement; and (ii) If security is provided on other assets, a senior security interest must first be granted for the benefit of the Lenders under this Agreement.

D.Before incurring such financial obligations, the creditor must submit a Subordination Undertaking, in substantially the same form as Exhibit 2, to the Lenders.

Article 1-2 (Interpretation)

1Unless otherwise provided in this Agreement, the terms and provisions of this Agreement shall be interpreted as follow:

1.Unless the context requires otherwise, references to singular terms include their plural forms and vice versa.

2.Unless otherwise required by the context, references to laws, statutes, or regulations in this Agreement include any substitutions, amendments, or revisions thereof made from time to time. Similarly, references to any contract or document include any modifications, amendments, supplements, or renewals thereof made from time to time.

3.The terms “law,” “statute,” or “regulation” in this Agreement include constitutions, statutes, orders, rules, treaties, conventions, agreements, subordinate or ancillary legislation, and all other provisions with legal effect. The term “tax” includes taxes, levies, fees, and any associated interest or penalties imposed or withheld by the relevant authority or taxing body.

4.Accounting terms used in this Agreement, unless otherwise defined, shall be interpreted in accordance with the Generally Accepted Accounting Principles (GAAP) in Korea.

5.References to the Lenders, the Borrower, or any other parties mentioned in this Agreement shall include their respective lawful successors, transferees of their rights, and/or assignees of their obligations.

6.References to “obligation” or “debt” shall be interpreted as “claim” or “liability,” respectively, from the perspective of the other party.

7.The terms “month,” “months,” or “calendar month” refer to a period beginning on a specific date of a given month and ending on the numerically corresponding date in the following month. If such a date does not exist in the following month or if the period begins on the last day of a month, it shall end on the last day of the following month.

8.Unless otherwise specified, appendices, exhibits, and forms attached to this Agreement are considered part of this Agreement. References to clauses, appendices, exhibits, and forms in this Agreement are references to those contained herein unless explicitly stated otherwise.

9.The titles, headings, preambles, and table of contents in this Agreement are for convenience only and do not form part of this Agreement or affect its interpretation.

10.References to the “corresponding date” refer to the date in the same calendar month corresponding numerically to a specified date, or in cases where no such date exists, the last day of that month.

11.The term “including” shall be interpreted as “including, without limitation.”

2Any matters not specified in this Agreement regarding the calculation of amounts such as interest, default interest, fees, or early repayment amounts shall follow the general practices of the Lender.

Chapter 2 Loans

Article 2-1 (Loan Agreement)

The Borrower shall receive loans for the full amount of the Loan Commitments from each Lender under this Agreement, and each Lender shall lend the full amount of its respective Loan Commitment to the Borrower in accordance with this Agreement.

Article 2-2 (Purpose of the Loan)

1The Borrower shall use the Loan exclusively for the following purposes: payment of the purchase price under the Share Purchase Agreement and related incidental expenses, payment of interest, fees, and other financial costs under the Loan Transaction Agreement, the Borrower’s operating funds, and any other purposes approved by all Lenders.

2The Borrower shall bear full responsibility for any liabilities arising from the use of the Loan for purposes other than those specified in Paragraph 1, and the Lenders shall not bear any responsibility in this regard.

Article 2-3 (Drawdown)

1The Borrower may request a drawdown of the Loan Commitment within the Drawdown Period, limited to one (1) instance, by submitting a Drawdown Request in the form and content specified in Exhibit 1 to the Lenders by no later than the Business Day immediately preceding the Drawdown Date (or any other date agreed upon by all Lenders).

2The drawdown request made under Paragraph 1 shall be irrevocable and may not be modified or withdrawn. The Borrower must accept the Loan disbursed by the Lenders.

3Upon receiving the Drawdown Request under Paragraph 1 and confirming that all Conditions Precedent to Drawdown are satisfied, each Lender shall disburse the Loan on the Drawdown Date by depositing its respective Loan amount into the account designated by the Borrower, as specified in the Drawdown Request.

Article 2-4 (Conditions Precedent to Drawdown)

Each Lender's obligation to disburse its Loan Commitment to the Borrower under this Agreement shall be subject to the satisfaction, waiver, or deferral (by the written consent of the respective Lender) of all the following conditions as of the Drawdown Date.

1.The Borrower shall have submitted to the Lenders the documents listed in Appendix 2 as the Conditions Precedent Documents by the Drawdown Date.

2.All Loan Transaction Agreements shall have been duly and validly executed in a manner satisfactory to the Lenders and binding on the relevant parties.

3.The Share Purchase Agreement shall have been duly executed and remain valid, and all Conditions Precedent to the closing of the Share Purchase Agreement (except for those conditions that by their nature can only be satisfied concurrently with the closing) shall have been satisfied or waived.

4.The representations and warranties specified in Article 6-1 shall be true and accurate in all material respects.

5.No Event of Default as specified in Article 7-1 shall have occurred.

Article 2-5 (Conditions Subsequent to Drawdown)

After the Drawdown, the Borrower shall submit the documents specified in Appendix 3 to the Lenders within the timeframe set forth in Appendix 3. Such documents must be in a form and content satisfactory to the Lenders.

1.The Conditions Precedent specified in Article 2-4 shall continue to remain in full force and effect.