Tattooed Chef, Inc. (Nasdaq: TTCF) (“Tattooed Chef” or the

“Company”), a leader in plant-based foods, today announced

financial results for the first quarter ended March 31, 2023 (“Q1

2023”). The Company also announced that it has filed its Annual

Report on Form 10-K for the year ended December 31, 2022 and its

Quarterly Report on Form 10-Q for the period ended March 31, 2023

with the Securities and Exchange Commission.

The Company also provided an update on its

previously announced cost reduction initiatives, current business

and operating activities, and outlook.

“Our results for Q1 2023 reflect progress

towards our previously announced cost reduction and expansion

initiatives,” said Sam Galletti, President and CEO. “We reduced

total operating expenses by 37%, or $8.6 million, in Q1 2023

compared to the first quarter of 2022 (“Q1 2022”). We also reported

narrowed net losses and narrowed Adjusted EBITDA** losses compared

to Q1 2022, despite a decline in net revenue. Our

progress is further evidenced when comparing Q1 2023 to the fourth

quarter ended December 31, 2022 (“Q4 2022”). Comparing

Q1 2023 to Q4 2022, we improved our gross loss by $8.6 million,

reduced total operating expenses by $4.2 million (excluding

non-cash charges incurred in Q4 2022), and narrowed our net loss

and Adjusted EBITDA** loss by approximately $10 million (excluding

non-cash goodwill impairment incurred in Q4 2022) and $12.5

million, respectively.

“Our focus has shifted from growth to

profitability, and we are implementing the actions required to meet

client and consumer demand and ensure our long-term success. We

remain confident in our ability to achieve cost savings of up to

$40 million or more in 2023. We now expect to reach breakeven

Adjusted EBITDA** and become cash flow neutral during the third

quarter of 2024 through a combination of continuing cost

reductions, efficiency gains, inventory management, rationalization

of underperforming products, new product introductions, and

targeted retail expansion. This is hard work, but it is also my

life’s work and I and the rest of Tattooed Chef team are committed

to seeing it through.”

“As a mission driven brand, we deliver great

tasting, better-for-you food, that is beneficial for people and the

planet,” said Sarah Galletti, Chief Creative Officer and the

Tattooed Chef. “With the concept of nostalgic, tasty, innovative,

plant-based food as our true north, we believe the future for

Tattooed Chef is incredibly meaningful and exciting.”

2023 First Quarter Overview

- Net revenue

declined by $8.6 million, or 12.7%, to $59.1 million from $67.7

million in Q1 2022, due primarily to a decline in Tattooed Chef

branded products with one customer as previously disclosed during

Q3 last year, and higher trade promotional spend reflected our

support of a seasonally higher focus by our club customers on

healthy eating products during Q1 2023 as compared to Q1 2022.

- Cost of goods sold

declined nominally to $63.2 million from $63.6 million in Q1 2022.

Cost of goods sold was impacted by inflationary pressure on raw

materials and packaging costs that impacted some of the Company’s

best-selling products, higher labor and third-party services, and

open capacity at the manufacturing sites. The Company continues to

focus on building more efficient distribution networks and

production lines through automation, along with the integration of

an ERP system throughout all facilities.

- Gross loss was

$(4.1) million as compared to gross profit of $4.1 million in Q1

2022, which was primarily due to inflationary pressures on raw

materials and packaging, and the increase in trade spend.

- Operating expenses

declined by $8.6 million, or 37%, to $14.7 million from $23.3

million in Q1 2022. The decrease was primarily driven by the

Company’s previously announced cost reduction initiatives.

- Net loss narrowed

to $(19.0) million, or $(0.23) per share, from a net loss of

$(20.2) million, or $(0.25) per share, in Q1 2022.

- Adjusted EBITDA**

loss narrowed to $(15.3) million from Adjusted EBITDA** loss of

$(16.0) million in Q1 2022.

Select Financial Information Comparing

Q1 2023 to Q4 2022

|

(in 000s, unaudited) |

Q1 2023 |

Q4 2022 |

Change |

|

Net revenue |

$59,092 |

$51,393 |

$7,699 |

|

Cost of Goods Sold |

$63,239 |

$64,120 |

$(881) |

|

Gross Loss |

$(4,147) |

$(12,727) |

$(8,580) |

|

Total Operating Expenses |

$14,706 |

$44,502 |

$(29,796) |

|

Net Loss* |

$(19,028) |

$(54,726) |

$(35,698) |

|

Adjusted EBITDA** Loss |

$(15,346) |

$(27,877) |

$(12,531) |

*Total Operating Expenses and Net loss for Q4

2022 included non-cash goodwill impairment charge of $25.6 million

related to a US GAAP goodwill impairment

**Adjusted EBITDA is a Non-GAAP measurement. See

“Non-GAAP Measures” below.

Launch of New Refrigerated and Ambient

Plant-Based Products

During Q1 2023, the Company launched its new

refrigerated Oat Butter Bars, with initial exposure at select small

retailers. In Q2 2023, the Company secured initial shelf

space for its ambient Grain Free Tortilla Chips at Target.

These new products represent the Company’s expansion outside

the freezer aisle.

Financial Condition

At March 31, 2023, cash was $3.5 million

compared to $5.8 million at December 31, 2022 and the net amount

drawn on the Company’s line of credit was approximately $4.0

million during Q1 2023. Net cash used in operating activities was

$(5.7) million compared to net cash used in operating activities of

$(26.4) million in Q1 2022. Capital expenditures totaled $0.5

million and primarily reflected general business needs.

The Company is seeking to raise additional debt

or equity capital in the near future, see further disclosures in

2022 Form 10-K and 2023 first quarter 10-Q.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any securities. Any

offers, solicitations of offers to buy, or any sales of securities

will be made in accordance with the registration requirements of

the Securities Act of 1933, as amended.

2023 Outlook

The Company's business and operations continue

to be affected by a variety of macroeconomic issues, including

inflation, rising interest rates, recession fears, increased

competition, and supply chain disruptions, and their potential

impact on consumer behavior and consumer demand for our products.

The Company also expects some quarter-to-quarter fluctuations in

its results, specifically in the 2023 second quarter due to an

operational disruption at a cold storage vendor that is impacting

certain delivery schedules.

Based on current business conditions and

outlook, the Company is providing the following outlook for the

full year 2023:

- Net revenues are

expected to be in the range of $200 to $205 million, as compared to

net revenues of $231 million in 2022.

- Annual costs

savings of approximately $40 million, generated by several factors,

including:

- $15 million

reduction in 2023 marketing expenses to an estimated $12 - $17

million, as compared to 2022 marketing expenses of $25.6

million

- $6 million in

operational and automation-derived savings, primarily driven by a

reduction in labor and increased productivity in the same

footprint;

- $7 million

reduction in promotional programs (contra revenue) that are

estimated to produce approximately $7 million in cost savings

- Gross margin

should continue to improve on sequential quarterly basis during

2023.

Conference Call and Webcast

The Company will host a conference call on

Tuesday, May 16 at 4:30 p.m. Eastern Time. Investors interested in

participating in the live call can dial:

- (877) 407-9753

from the U.S.

- (201) 493-6739

internationally.

The call will be webcast and available on the

Investors section of the Company’s website at www.tattooedchef.com.

The webcast will be archived for 30 days.

About Tattooed Chef

Tattooed Chef is a leading plant-based food

company offering a broad portfolio of innovative and sustainably

sourced plant-based foods. Tattooed Chef’s signature products

include ready-to-cook bowls, zucchini spirals, riced cauliflower,

acai and smoothie bowls, cauliflower pizza crusts, wood-fired

plant-based pizzas, handheld burritos, quesadillas, and Mexican

entrees, which are available in the frozen food sections of leading

national retail food and club stores across the United States as

well as on Tattooed Chef’s e-commerce site. Understanding consumer

lifestyle and food trends, a commitment to innovation, and

self-manufacturing allows Tattooed Chef to continuously introduce

new products. Tattooed Chef provides approachable, great tasting

and chef-created products to the growing group of plant-based

consumers as well as the mainstream marketplace. For more

information, please visit www.tattooedchef.com.

Follow us on social: Facebook, Instagram,

TikTok, Twitter, and LinkedIn and Taste the Jams on Spotify.

Forward Looking Statements

Certain statements made in this release are

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this release, words

such as “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose,” “trend,” “accelerate,”

“expansion,” “new,” “leverage,” “continues,” “maintains,”

“opportunities,” “outlook,” “next,” “achieve,” “become,”

“increase,” “expand,” “beyond,” “potential,” “growth,” “pipeline,”

“guidance” and variations of these words or similar expressions (or

the negative versions of such words or expressions) are intended to

identify forward-looking statements. These forward-looking

statements are not guarantees of future performance, conditions or

results, and involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of

which are outside Tattooed Chef’s control, that could cause actual

results or outcomes to differ materially from those discussed in

the forward-looking statements. Important factors, among others,

that may affect actual results or outcomes include: the ability to

successfully reduce spending; the ability to achieve positive

EBITDA or cash flow; the ability to raise additional debt or equity

capital on acceptable terms, or at all; the ability to achieve

anticipated cost savings; the ability to build brand awareness and

continue to launch innovative products; continued acceptance of

Tattooed Chef branded products by new retail customers; the ability

to increase in-store count and points of distribution; the outcome

of any legal proceedings that may be instituted against Tattooed

Chef; the ability to effectively and efficiently integrate recent

and/or new acquisitions; competition and the ability of the

business to grow and manage growth profitably; the impact of

inflation, particularly with respect to freight and container

expenses; the effect of possible supply chain disruption;

uncertainty around the ability to bring the new operational sites

up to full capacity; our ability to raise prices without

decrementing sales volumes; and other risks and uncertainties

indicated from time to time in our annual report on Form 10-K for

the year ended December 31, 2022 filed with the Securities and

Exchange Commission (the “SEC”), including those under “Risk

Factors” therein, and other factors identified in past and future

filings with the SEC, available at www.sec.gov. Some of these risks

and uncertainties may be amplified by COVID-19 or hostilities in

Ukraine. Tattooed Chef undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

Non-GAAP Measures

The Company seeks to achieve profitable,

long-term growth by monitoring and analyzing key operating metrics,

including Adjusted EBITDA. The Company defines EBITDA as net income

before interest, taxes, depreciation and amortization. Adjusted

EBITDA further adjusts EBITDA by adding back non-cash items,

acquisition and integration costs, business transformation

initiatives, and infrequent or unusual losses and gains in a

non-recurring nature. The Company’s management uses this non-GAAP

financial metric and related computations to evaluate and manage

the business and to plan and make near and long-term operating and

strategic decisions. The management team believes this non-GAAP

financial metric is useful to investors to provide supplemental

information in addition to the GAAP financial results. Management

reviews the use of its primary key operating metrics from

time-to-time. Adjusted EBITDA is not intended to be a substitute

for any GAAP financial measure and as calculated, may not be

comparable to similarly titled measures of performance of other

companies in other industries or within the same industry. The

Company’s management team believes it is useful to provide

investors with the same financial information that it uses

internally to make comparisons of historical operating results,

identify trends in underlying operating results, and evaluate its

business.

|

INVESTORS |

|

|

|

Stephanie Dieckmann, CFO |

|

Devin Sullivan, Managing Director |

|

Tattooed Chef |

|

The Equity Group Inc. |

|

(562) 602-0822 |

|

dsullivan@equityny.com |

|

|

|

|

| |

|

TATTOOED CHEF, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS (unaudited)(in thousands, except

for share information) |

| |

| |

March 31,2023 |

|

December 31,2022 |

| ASSETS |

|

|

|

| CURRENT

ASSETS |

|

|

|

|

Cash |

$ |

3,509 |

|

|

$ |

5,782 |

|

|

Accounts receivable, net |

|

25,128 |

|

|

|

20,976 |

|

|

Inventory |

|

59,359 |

|

|

|

77,957 |

|

|

Prepaid expenses and other current assets |

|

5,051 |

|

|

|

4,351 |

|

| TOTAL CURRENT

ASSETS |

|

93,047 |

|

|

|

109,066 |

|

| Property, plant and equipment,

net |

|

71,472 |

|

|

|

73,052 |

|

| Operating lease right-of-use

asset, net |

|

18,462 |

|

|

|

19,231 |

|

| Finance lease right-of-use

asset, net |

|

5,426 |

|

|

|

5,468 |

|

| Intangible assets, net |

|

1,565 |

|

|

|

1,653 |

|

| Other assets |

|

329 |

|

|

|

297 |

|

| TOTAL

ASSETS |

$ |

190,301 |

|

|

$ |

208,767 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

Accounts payable |

$ |

50,728 |

|

|

$ |

57,235 |

|

|

Accrued expenses |

|

10,584 |

|

|

|

7,615 |

|

|

Line of credit |

|

24,329 |

|

|

|

20,314 |

|

|

Notes payable, current portion |

|

4,996 |

|

|

|

5,056 |

|

|

Forward contract derivative liability |

|

150 |

|

|

|

447 |

|

|

Operating lease liabilities, current portion |

|

2,365 |

|

|

|

2,437 |

|

|

Other current liabilities |

|

408 |

|

|

|

269 |

|

| TOTAL CURRENT

LIABILITIES |

|

93,560 |

|

|

|

93,373 |

|

| Warrant liability |

|

9 |

|

|

|

6 |

|

| Operating lease liabilities,

net of current portion |

|

15,068 |

|

|

|

15,604 |

|

| Notes payable, net of current

portion |

|

1,058 |

|

|

|

1,183 |

|

| Notes payable of related

parties, net of current portion |

|

10,000 |

|

|

|

10,000 |

|

| TOTAL

LIABILITIES |

|

119,695 |

|

|

|

120,166 |

|

| COMMITMENTS AND

CONTINGENCIES (See Note

16) |

|

|

|

| |

|

|

|

| STOCKHOLDERS’

EQUITY |

|

|

|

|

Preferred stock - $0.0001 par value; 10,000,000 shares authorized,

none issued and outstanding at March 31, 2023 and December 31,

2022 |

|

— |

|

|

|

— |

|

|

Common stock- $0.0001 par value; 1,000,000,000 shares authorized;

83,658,357 shares and 83,658,357 shares issued and outstanding at

March 31, 2023 and December 31, 2022, respectively |

|

8 |

|

|

|

8 |

|

|

Additional paid in capital |

|

255,093 |

|

|

|

254,190 |

|

|

Accumulated other comprehensive loss |

|

(1,604 |

) |

|

|

(1,674 |

) |

|

Accumulated deficit |

|

(183,267 |

) |

|

|

(164,182 |

) |

| TOTAL STOCKHOLDERS’

EQUITY ATTRIBUTABLE TO TATTOOED CHEF, INC. |

|

70,230 |

|

|

|

88,342 |

|

| Noncontrolling interest |

|

376 |

|

|

|

259 |

|

| TOTAL STOCKHOLDERS’

EQUITY |

|

70,606 |

|

|

|

88,601 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

190,301 |

|

|

$ |

208,767 |

|

The accompanying notes are an integral part of

the unaudited condensed consolidated financial statements.

| |

|

TATTOOED CHEF, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONSAND COMPREHENSIVE LOSS

(unaudited)(in thousands, except for share and per

share information) |

| |

| |

Three Months EndedMarch 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Net revenue |

$ |

59,092 |

|

|

$ |

67,688 |

|

| Cost of goods sold |

|

63,239 |

|

|

|

63,621 |

|

| Gross (loss) profit |

|

(4,147 |

) |

|

|

4,067 |

|

| Operating expenses |

|

14,706 |

|

|

|

23,332 |

|

| Loss from operations |

|

(18,853 |

) |

|

|

(19,265 |

) |

| Interest expense |

|

(457 |

) |

|

|

(41 |

) |

| Other income (expense),

net |

|

416 |

|

|

|

(611 |

) |

| Loss before provision for

income taxes |

|

(18,894 |

) |

|

|

(19,917 |

) |

| Income tax expense |

|

134 |

|

|

|

256 |

|

| Net loss |

|

(19,028 |

) |

|

|

(20,173 |

) |

|

Less: net income attributable to noncontrolling interests |

|

57 |

|

|

|

— |

|

|

Net loss attributable to Tattooed Chef, Inc. |

$ |

(19,085 |

) |

|

$ |

(20,173 |

) |

| |

|

|

|

| Net loss per common

share |

|

|

|

|

Basic |

$ |

(0.23 |

) |

|

$ |

(0.25 |

) |

|

Diluted |

$ |

(0.23 |

) |

|

$ |

(0.25 |

) |

| |

|

|

|

| Weighted average

common shares |

|

|

|

|

Basic |

|

83,251,691 |

|

|

|

82,237,898 |

|

|

Diluted |

|

83,251,691 |

|

|

|

82,237,898 |

|

| |

|

|

|

| Other comprehensive

loss, net of tax |

|

|

|

| Foreign currency translation

adjustments |

|

70 |

|

|

|

(430 |

) |

| Comprehensive loss |

|

(18,958 |

) |

|

|

(20,603 |

) |

|

Less: comprehensive income attributable to the noncontrolling

interest |

|

57 |

|

|

|

— |

|

|

Comprehensive loss attributable to Tattooed Chef, Inc.

stockholders |

$ |

(19,015 |

) |

|

$ |

(20,603 |

) |

The accompanying notes are an integral part of

the unaudited condensed consolidated financial statements.

| |

|

TATTOOED CHEF, INC.Adjusted EBITDA

Reconciliation (in thousands) |

| |

| |

|

Three Months Ended |

| (in

thousands) |

|

3/31/2023 |

|

3/31/2022 |

|

12/31/2022 |

|

Net loss |

|

$ |

(19,028 |

) |

|

$ |

(20,173 |

) |

|

$ |

(54,726 |

) |

| Interest |

|

|

457 |

|

|

|

41 |

|

|

|

361 |

|

| Income tax expense |

|

|

134 |

|

|

|

256 |

|

|

|

412 |

|

| Depreciation and

amortization |

|

|

2,200 |

|

|

|

1,507 |

|

|

|

1,693 |

|

| EBITDA |

|

|

(16,237 |

) |

|

|

(18,369 |

) |

|

|

(52,260 |

) |

| Adjustments |

|

|

|

|

|

|

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

25,552 |

|

|

Stock compensation expense |

|

|

903 |

|

|

|

1,287 |

|

|

|

1,605 |

|

|

Loss (gain) on foreign currency forward contracts |

|

|

150 |

|

|

|

1,023 |

|

|

|

(2,104 |

) |

|

Loss (gain) on warrant remeasurement |

|

|

3 |

|

|

|

(207 |

) |

|

|

(127 |

) |

|

Unrealized foreign currency gains |

|

|

(165 |

) |

|

|

— |

|

|

|

(1,063 |

) |

|

Acquisition expense |

|

|

— |

|

|

|

105 |

|

|

|

5 |

|

|

ERP implementation |

|

|

— |

|

|

|

159 |

|

|

|

515 |

|

| Total adjustments |

|

|

891 |

|

|

|

2,367 |

|

|

|

24,383 |

|

| Adjusted

EBITDA |

|

$ |

(15,346 |

) |

|

$ |

(16,002 |

) |

|

$ |

(27,877 |

) |

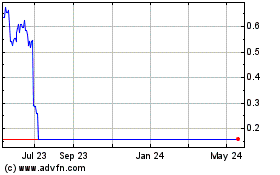

Tattooed Chef (NASDAQ:TTCF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tattooed Chef (NASDAQ:TTCF)

Historical Stock Chart

From Feb 2024 to Feb 2025