Tesla Maintains Lead but Chinese Automakers Are Closing the Gap in New Wards Intelligence’s SDV Ranking

February 05 2025 - 10:43AM

Business Wire

Wards Intelligence’s Software-Defined Vehicle (SDV) ranking, now

part of Omdia, reveals that while Tesla still holds the overall

lead, it has been surpassed in technological innovation by NIO and

Xiaomi, which now occupy second and third place, respectively. The

SDV concept represents a paradigm shift that has proven more

complex than initially anticipated—particularly for established

Western OEMs— but is advancing rapidly in China.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250205794200/en/

SDV Quadrants Organizational Readiness vs

Vehicle Platform Readiness (Graphic: Business Wire)

Xpeng and Rivian rank third and fourth, respectively, completing

the Leaders category. This category mainly consists of

battery-electric-vehicle disruptors that are digitally native,

prioritize a software-first approach, and are not constrained by

legacy platforms, systems, or organizational culture. “Overall,

this category includes automakers pushing the boundaries of SDV

innovation, as well as those refining and scaling zonal

architectures and other SDV-related technologies and practices,”

said Maite Bezerra, Principal Analyst at Wards Intelligence, now

part of Omdia.

In the Strong Contenders category—featuring Zeekr, Lucid,

Leapmotor, and BMW, among others—67% of automakers are now actively

commercializing SDVs, a notable shift from 2023 when most were

limited to semi-SDVs. This underscores both the rapid growth of the

SDV market and the intensifying competition within it. “Automakers

in this category, such as BYD, are particularly well-positioned to

challenge the current market leaders,” said Bezerra.

The Contenders category, including Hyundai, the

Volkswagen Group, and General Motors, among others, saw an uptick

in automakers deploying semi-SDVs and outlining more detailed SDV

strategies. However, they still need to make substantial progress

in bringing SDVs to production. Meanwhile, automakers in the

Followers category—which previously included OEMs without a

public SDV roadmap or specific timelines—have started setting clear

SDV goals in response to the market’s swift evolution.

Measuring SDV progress remains challenging due to inconsistent

definitions and lack of clear benchmarks. To address this, Wards

Intelligence conducts annual primary and secondary research,

utilizing advanced statistical tools to identify the most accurate

indicators of SDV advancement. In this edition, 27 automakers were

evaluated across five metrics: financial strength, portfolio

complexity, vehicle platform readiness, organizational readiness,

and SDV performance.

“Notably, 62% of the automakers in the Leaders and Strong

Contenders categories are either Chinese or Chinese-owned,

highlighting China’s increasing dominance in the SDV segment,” said

Bezerra. “Furthermore, only three of the 14 automakers in these

categories are Western incumbents. Both trends point to a continued

shift toward Chinese leadership and ongoing challenges for Western

automakers in 2025.”

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a

technology research and advisory group. Our deep knowledge of tech

markets combined with our actionable insights empower organizations

to make smart growth decisions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205794200/en/

Fasiha Khan - fasiha.khan@omdia.com

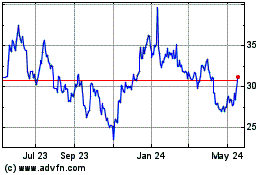

TechTarget (NASDAQ:TTGT)

Historical Stock Chart

From Mar 2025 to Apr 2025

TechTarget (NASDAQ:TTGT)

Historical Stock Chart

From Apr 2024 to Apr 2025