UMB closes largest acquisition in 111-year

history, increasing total assets by more than 30%

UMB Financial Corporation (Nasdaq: UMBF) announced that it will

close the acquisition of Heartland Financial USA, Inc. (Nasdaq:

HTLF) today, effective at 11:59 p.m. As a result of this successful

completion, UMB’s asset size will increase to approximately $68

billion (based on assets as of Dec. 31, 2024), expanding its

geographic footprint from eight to 13 states. The acquisition also

increases UMB’s private wealth management AUM/AUA by 32% and

significantly expands its retail deposit base.

“Today is a monumental day for our organization as we welcome

HTLF customers and associates to UMB,” said Mariner Kemper,

chairman and chief executive officer of UMB Financial Corporation.

“As the largest acquisition in our company’s history, this new

chapter presents a tremendous opportunity to expand our core

services and capabilities, while also introducing new communities

to our geographic footprint. We are ready and excited to help our

customers, existing and new, meet their financial goals.”

For more than a century, UMB has supported customers through

delivering comprehensive banking services and asset management

across its eight-state footprint and nationally. This acquisition

will expand UMB’s banking presence, adding California, Iowa,

Minnesota, New Mexico and Wisconsin to the existing footprint,

which includes Missouri, Arizona, Colorado, Illinois, Kansas,

Nebraska, Oklahoma and Texas. In addition, 104 new branches and 115

ATMs will be added to UMB’s current 93 banking centers and 235

ATMs, dramatically expanding the network for current and new

customers.

HTLF, which currently does business as Minnesota Bank &

Trust, Wisconsin Bank & Trust, Dubuque Bank & Trust,

Illinois Bank & Trust, Bank of Blue Valley, Citywide Banks,

Premier Valley Bank, Arizona Bank & Trust, New Mexico Bank

& Trust, First Bank & Trust, HTLF Food & AgriBusiness,

HTLF Specialized Industries, and HTLF Retirement Plan Services,

will operate as a division of UMB prior to the banking centers and

systems conversions, which is anticipated to occur in the fourth

quarter of 2025, after which time the divisions will operate as

UMB. Until that time, customers should continue to bank as they

normally do.

UMB is deeply invested in the communities in which it does

business, providing support through products, services, and

investments as well as corporate and associate giving. UMB is

committed to being a strong financial steward and is finalizing its

Community Benefits Agreement, which will detail how it will provide

support throughout its newly expanded footprint. Specific details

will be shared when the plan is finalized.

As previously announced, five HTLF board members now join the

UMB Financial Corporation Board of Directors: John Schmidt, Bradley

(Brad) Henderson, Jennifer (Jenny) Hopkins, Margaret Lazo and Susan

Murphy. With these additions, the UMBF Board grows to 16 board

members.

“As we look to the future, we remain excited and true to who we

are as an entrepreneurial-minded organization rooted in a more than

111-year history of steadfast commitment to our customers,

associates and the communities we serve,” said Kemper.

About UMB

UMB Financial Corporation (Nasdaq: UMBF) is a financial services

company headquartered in Kansas City, Missouri. UMB offers

commercial banking, which includes comprehensive deposit, lending,

investment and retirement plan services; personal banking, which

includes comprehensive deposit, lending, wealth management and

financial planning services; and institutional banking, which

includes asset servicing, corporate trust solutions, investment

banking and healthcare services. UMB operates branches throughout

Missouri, Arizona, California, Colorado, Iowa, Kansas, Illinois,

Minnesota, Nebraska, New Mexico, Oklahoma, Texas, and Wisconsin. As

the company’s reach continues to grow, it also serves business

clients nationwide and institutional clients in several countries.

For more information, visit UMB.com, UMB Blog, UMB Facebook and UMB

LinkedIn.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Rule 175 promulgated thereunder, and Section 21E of

the Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder, which statements involve inherent risks and

uncertainties. Any statements about UMB’s, HTLF’s or the combined

company’s plans, objectives, expectations, strategies, beliefs, or

future performance or events constitute forward-looking statements.

Such statements are generally identified as those that include

words or phrases such as “believes,” “expects,” “anticipates,”

“plans,” “trend,” “objective,” “continue,” or similar expressions

or future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “may,” or similar expressions. Forward-looking

statements involve known and unknown risks, uncertainties,

assumptions, estimates, and other important factors that change

over time and could cause actual results to differ materially from

any results, performance, or events expressed or implied by such

forward-looking statements. Such forward-looking statements include

but are not limited to statements about the benefits of the

previously announced business combination transaction between UMB

and HTLF (the “Transaction”), including future financial and

operating results, the combined company’s plans, objectives,

expectations and intentions, and other statements that are not

historical facts.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those projected. In addition to factors previously disclosed

in UMB’s and HTLF’s reports filed with the United States Securities

and Exchange Commission (the “SEC”), the following factors, among

others, could cause actual results to differ materially from

forward-looking statements or historical performance: the risk that

the benefits from the Transaction may not be fully realized or may

take longer to realize than expected, including as a result of

changes in, or problems arising from, general economic and market

conditions, interest and exchange rates, monetary policy, laws and

regulations and their enforcement, and the degree of competition in

the geographic and business areas in which UMB and HTLF operate;

the ability to promptly and effectively integrate the businesses of

UMB and HTLF; the possibility that the Transaction may be more

expensive to complete than anticipated, including as a result of

unexpected factors or events; reputational risk and potential

adverse reactions of UMB’s or HTLF’s customers, employees or other

business partners, including those resulting from the completion of

the Transaction; the dilution caused by UMB’s issuance of

additional shares of its capital stock in connection with the

Transaction; and the diversion of management’s attention and time

from ongoing business operations and opportunities on

merger-related matters.

These factors are not necessarily all of the factors that could

cause UMB’s, HTLF’s or the combined company’s actual results,

performance, or achievements to differ materially from those

expressed in or implied by any of the forward-looking statements.

Other factors, including unknown or unpredictable factors, also

could harm UMB’s, HTLF’s or the combined company’s results.

All forward-looking statements attributable to UMB, HTLF, or the

combined company, or persons acting on UMB’s or HTLF’s behalf, are

expressly qualified in their entirety by the cautionary statements

set forth above. Forward-looking statements speak only as of the

date they are made and UMB and HTLF do not undertake or assume any

obligation to update publicly any of these statements to reflect

actual results, new information or future events, changes in

assumptions, or changes in other factors affecting forward-looking

statements, except to the extent required by applicable law. If UMB

or HTLF update one or more forward-looking statements, no inference

should be drawn that UMB or HTLF will make additional updates with

respect to those or other forward-looking statements. Further

information regarding UMB, HTLF and factors which could affect the

forward-looking statements contained herein can be found in UMB’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000095017024018456/umbf-20231231.htm)

and its subsequent Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K, and its other filings with the SEC, in HTLF’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023

(and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000026/htlf-20231231.htm),

and its subsequent Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K and its other filings with the SEC, and the risks

described in UMB’s definitive joint proxy statement/prospectus

related to the Transaction, which was filed with the SEC on July 5,

2024 (and which is available at

https://www.sec.gov/Archives/edgar/data/101382/000119312524175612/d771152d424b3.htm).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131480645/en/

UMB Media Contact: Stephanie Hollander

Stephanie.Hollander@umb.com 816.729.1027

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Jan 2025 to Feb 2025

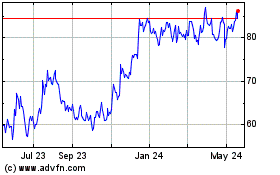

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Feb 2024 to Feb 2025