UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of September, 2015

Commission File Number: 000-36000

XTL Biopharmaceuticals Ltd.

(Translation of registrant’s name

into English)

5 HaCharoshet St.,

Raanana 4365603

Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Incorporation by Reference: This Form

6-K of XTL Biopharmaceuticals Ltd. is hereby incorporated by reference into the registration statements on Form S-8 (File No. 333-148085,

File No. 333-148754 and File No. 333-154795) and Form F-3 (File No. 333-194338).

On September 21, 2015, XTL Biopharmaceuticals Ltd. issued unaudited

interim condensed consolidated financial statements as of June 30, 2015. Attached hereto and incorporated by reference herein are

the following exhibits:

| 99.1 |

Operating and Financial Review and Prospects as of June 30, 2015. |

| |

|

| 99.2 |

Unaudited Interim Condensed Consolidated Financial Statements as of June 30, 2015. |

SIGNATURES.

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

XTL BIOPHARMACEUTICALS LTD. |

| |

|

| Date: September 21, 2015 |

By: |

/s/ Josh Levine |

| |

|

Josh Levine |

| |

|

Chief Executive Officer |

Exhibit 99.1

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

You should read

the following discussion of our operating and financial condition and prospects in conjunction with the financial statements

and the notes thereto included elsewhere in this 6-K, as well as in our Annual Report on Form 20-F filed on April 28, 2015.

Unless the context

requires otherwise, references in this report to “XTL,” the “Company,” “we,” “us”

and “our” refer to XTL Biopharmaceuticals Ltd, an Israeli company and our consolidated subsidiaries.

We have prepared

our consolidated financial statements in United States dollars and in accordance with International Financial Reporting Standards,

(“IFRS”) as issued by the International Accounting Standards Board (“IASB”). All references herein to “dollars”

or “$” are to US dollars, and all references to “Shekels” or “NIS” are to New Israeli Shekels.

Certain amounts presented herein may not sum due to rounding.

Forward Looking Statements

The following discussion

contains “forward-looking statements,” including statements regarding expectations, beliefs, intentions or strategies

for the future. These statements may identify important factors which could cause our actual results to differ materially from

those indicated by the forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance

on such forward-looking statements. Factors that could cause our actual results to differ materially from those expressed or implied

in such forward-looking statements include, but are not limited to:

| |

· |

the initiation, timing, progress and results of any preclinical studies, clinical trials and other product candidate development efforts; |

| |

· |

our ability to advance our product candidates into clinical trials or to successfully complete our preclinical studies or clinical trials; |

| |

· |

our receipt of regulatory approvals for our product candidates, and the timing of other regulatory filings and approvals; |

| |

· |

the clinical development, commercialization and market acceptance of our product candidates; |

| |

· |

our ability to establish and maintain corporate collaborations; |

| |

· |

the implementation of our business model and strategic plans for our business and product candidates; |

| |

· |

the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and our ability to operate our business without infringing the intellectual property rights of others; |

| |

· |

estimates of our expenses, future revenues, capital requirements and our needs for additional financing; |

| |

· |

competitive companies, technologies and our industry; and |

| |

· |

statements as to the impact of the political and security situation in Israel on our business. |

All forward-looking

statements attributable to us or persons acting on our behalf speak only as of the date of the 6-K to which this discussion is

attached and are expressly qualified in their entirety by the cautionary statements included herein. We undertake no obligations

to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect

the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

Overview

We are a biopharmaceutical

company engaged in the acquisition and development of pharmaceutical drugs for the treatment of unmet medical needs. Our current

drug development program is focused on the treatment of systemic lupus erythematosus.

We were established

as a corporation under the laws of Israel in 1993, and commenced operations to use and commercialize technology developed at the

Weizmann Institute, in Rehovot, Israel. Since commencing operations, our activities have been primarily devoted to developing our

technologies and drug candidates, acquiring pre-clinical and clinical-stage compounds, raising capital, purchasing assets for our

facilities, and recruiting personnel. We have had no drug product sales to date. Our major sources of working capital have been

proceeds from various private and public offerings of our securities and option and warrant exercises.

We have incurred negative

cash flow from operations each year since our inception and we anticipate incurring negative cash flows from operating activities

for the foreseeable future. We have spent, and expect to continue to spend, substantial amounts in connection with implementing

our business strategy, including our planned product development efforts, our clinical trials, and potential in-licensing and acquisition

opportunities.

Our research and development

expenses in the six months ended June 2015 and 2014 primarily consisted of expenses related to the hCDR1 and rHuEPO development

plan. As part of the preparations for future clinical trials of hCDR1, during the six months ended June 2015 and 2014 we engaged

regulatory and clinical consultants and commenced work on Chemistry, Manufacturing and Control (“CMC”) including production

and testing of the drug substance. Costs related to rHuEPO, during the six months ended June 2015 and 2014 consisted primarily

of fees for regulatory and other consultants.

Our general and administrative

expenses in the six months ended June 2015 and 2014 consist primarily of salaries, consultant fees, and related expenses for executive,

finance and other administrative personnel, professional fees, director fees and other corporate expenses, including investor relations,

business development costs and facilities related expenses. We expense our general and administrative expenses as incurred.

Our results of operations

in the six months ended June 30, 2015 include non-cash compensation expense as a result of the grants of XTL stock options. Compensation

expense for awards of options granted to employees and directors represents the fair value of the award (measured using the Black-Scholes

valuation model) recorded over the respective vesting periods of the individual stock options (see details below.)

For awards of options

and warrants to consultants and other third-parties, according to IFRS 2, the treatment of such options and warrants is the same

as employee options compensation expense (see note 20 to the consolidated financial statements for the year ended December 31,

2014). We record compensation expense based on the fair value of the award at the grant date according to the Black-Scholes valuation

model. According to the IFRS 2, in non-performance-based options, the Company recognizes options expenses using the graded vesting

method (accelerated amortization). Graded vesting means that portions of a single option grant will vest on several dates, equal

to the number of tranches. The Company treats each tranche as a separate share option grant; because each tranche has a different

vesting period, and hence the fair value of each tranche is different. Therefore, under this method the compensation cost amortization

is accelerated to earlier periods in the overall vesting period.

Our planned clinical

trials will be lengthy and expensive. Even if these trials show that our drug candidates are effective in treating certain indications,

there is no guarantee that we will be able to record commercial sales of any of our product candidates in the near future or generate

licensing revenues from upfront payments associated with out-licensing transactions. In addition, we expect losses in our drug

development activity to continue as we continue to fund development of our drug candidates. As we continue our development efforts,

we may enter into additional third-party collaborative agreements and may incur additional expenses, such as licensing fees and

milestone payments. As a result, our periodical results may fluctuate and a period-by-period comparison of our operating results

may not be a meaningful indication of our future performance.

Results of Operations for the three months ended June 30,

2015 compared to the three months to June 30, 2014

Revenues

We did not record any

revenues during each of the three-month periods ended June 30, 2015 and 2014.

Research and development expenses

Research and development

expenses for the three months ended June 30, 2015 were $69,000 compared to $34,000 in the same period in 2014. The increase in

expenses in 2015 compared to 2014 for this period is mainly due to our focus on preparing these assets for their upcoming clinical

trials including the completion of production of the drug substance for hCDR1.

General and administrative expenses

General and administrative

expenses for the three months ended June 30, 2015 were $0.4 million in line with general and administrative expenses for the same

period in 2014.

Financial income, net

Financial income, net

for the three months ended June 30, 2015 was $54,000 compared to $20,000 in the three months ended June 30, 2014. The increase

in financial income, net was mainly due to changes in fair value of marketable securities held in InterCure, a former subsidiary.

Loss from continuing operations

Loss from continuing

operations for the three months ended June 30, 2015 was $0.4 million compared to $0.4 million in the same period last year.

Total loss

Total loss for the

three months ended June 30, 2015 was $0.4 million compared to $0.7 million in the same period last year. The decrease in loss was

due to losses in 2014 from discontinued operations related to InterCure, a former subsidiary.

Results of Operations for the six months ended June 30, 2015

compared to the six months to June 30, 2014

Revenues

We did not record any

revenues during each of the six-month periods ended June 30, 2015 and 2014.

Research and development expenses

Research and development

expenses for the six months ended June 30, 2015 were $111,000 compared to $81,000 for the same period in 2014. The increase in

expenses in 2015 compared to 2014 for this period is mainly due to our focus on preparing these assets for their upcoming clinical

trials including the completion of production of the drug substance for hCDR1.

General and administrative expenses

General and administrative

expenses for the six months ended June 30, 2015 were $0.7 million compared with $0.9 million for the same period in 2014. The decrease

in general and administrative expenses was due to lower salary and share-based compensation costs in the six months ended June

30, 2015.

Financial income, net

Financial expense,

net for the six months ended June 30, 2015 was $186,000 compared to financial income, net of $17,000 for the six months ended June

30, 2014. The decrease in financial income, net was mainly due to changes in fair value of marketable securities held in InterCure,

a former subsidiary.

Loss from continuing operations

Loss from continuing

operations for the six months ended June 30, 2015 was $1.0 million, in line with loss from continuing operations for the same period

last year.

Total loss

Total loss for the

six months ended June 30, 2015 was $1.5 million in line with total loss in the same period last year. The loss from discontinued

operations for the six months ended June 30, 2015 and 2014 relate to losses from our investment in InterCure, a former subsidiary.

Significant Accounting Policies

We describe our significant

accounting policies more fully in Note 2 to our consolidated financial statements for the year ended December 31, 2014.

In addition, when we

cease to have control of a subsidiary, any retained interest in the entity is remeasured to its fair value at the date when control

is lost, with the change in carrying amount recognized in profit or loss. The fair value is the initial carrying amount for the

purposes of subsequently accounting for the retained interest as an associate or financial asset.

The discussion and

analysis of our financial condition and results of operations is based on our financial statements, which we prepare in accordance

with IFRS as issued by the IASB. The preparation of these financial statements requires us to make estimates and assumptions that

have an effect on the application of our accounting policies and on the reported amounts of assets, liabilities and expenses. Actual

results could differ from those estimates.

Liquidity and Capital Resources

We have financed our

operations from inception primarily through various proceeds from various private and public offerings of our securities and option

and warrant exercises. As of June 30, 2015, we had received net proceeds of approximately $80.2 million from various private placement

transactions, including net proceeds of approximately $1.5 million from the Bio-Gal transaction in August 2010, net proceeds of

approximately $45.7 million from our initial public offering in September 2000, net proceeds of approximately $15.4 million from

the 2004 placing and open offer transaction, net proceeds of approximately $1.75 million from our public offering on TASE in March

2011, net proceeds of approximately $3.4 million from our registered direct offering on Nasdaq in April 2015, and proceeds of approximately

$4.0 million from the exercise of options and warrants.

The discussion of our

liquidity and capital resources below excludes any balances in InterCure, as it is considered a discontinued operation as of December

31, 2014.

As of June 30, 2015,

we had approximately $4.8 million in cash and cash equivalents, an increase of approximately $ 2.7 million from December 31, 2014.

Net cash used in operating

activities for the six months ended June 30, 2015 was $0.9 million, compared to net cash used in operating activities of $1.3 million

for the six months ended June 30, 2014. The decrease in net cash used in operating activities mainly arises from non-cash adjustments

related to the disposal of InterCure, a former subsidiary.

Net cash provided by

investing activities for the six months ended June 30, 2015 was $0.01 million compared to net cash provided by investing activities

of $0.8 million for the six months ended June 30, 2014. The decrease in net cash provided by investing activities is primarily

due to proceeds from the sale of Proteologics and the release of short-term bank deposits in the first half of 2014.

Net cash provided by

financing activities for the six months ended June 30, 2015 was $3.6 million compared to net cash provided by investing activities

of $0.3 million for the six months ended June 30, 2014. The increase in net cash provided by investing activities is primarily

due to our registered direct offering in April 2015 that resulted in approximately $3.4 million in net proceeds.

We have incurred continuing

losses and depend on outside financing resources to continue our activities. Based on existing business plans, our management estimates

that our outstanding cash and cash equivalent balances will allow us to finance our activities for an additional period of at least

12 months from the date of this report. However, the amount of cash which we will need in practice to finance our activities depends

on numerous factors which include, but are not limited to, the timing, planning and execution of clinical trials of existing drugs

and future projects which we might acquire or other business development activities such as acquiring new technologies and/or changes

in circumstances which are liable to cause significant expenses to us in excess of management’s current and known expectations

as of the date of these financial statements and which will require us to reallocate funds against plans, also due to circumstances

beyond our control.

We expect to incur

additional losses through the end of 2015 and beyond arising from research and development activities, testing additional technologies

and operating activities, which will be reflected in negative cash flows from operating activities. In order to perform the clinical

trials aimed at developing a product until obtaining its marketing approval, we may be required to raise additional funds in the

future by issuing securities. Should we fail to raise additional capital in the future under standard terms, we will be required

to minimize our activities or sell or grant a sublicense to third parties to use all or part of its technologies.

Research and Development, Patents and Licenses, Etc.

Research and development

costs in 2014, 2013 and 2012 and for the six months ended June 30, 2015 substantially derived from costs related to the development

of our clinical assets. As part of the preparations in 2014 and during the six months ended June 30, 2015, we engaged regulatory

and clinical consultants and commenced work on CMC, including production and testing of the drug substance for hCDR1. As part of

the preparations for rHuEPO, we engaged regulatory and other consultants and conducted a study which consists of collecting preliminary

data on the existence of specific proteins in the blood of a group of multiple myeloma patients. The costs of such preparations

comprise of, among other things, costs in connection with medical regulation, patent registration costs, medical consulting costs

and payments to medical centers.

hCDR1 for the

Treatment of SLE

We intend to initiate

an advanced clinical trial, which will include the 0.5 mg (and a 0.25 mg) weekly dose. We estimate that the trial will take one

year to enroll patients, another year to conduct treatment, and additional time to analyze the results for a total of approximately

two and a half years.

rHuEPO for the

Treatment of Multiple Myeloma

The preliminary plan

received as part of the Bio-Gal transaction, included plans to perform a prospective, multi-center, open-label, Phase 2 study intended

to assess safety of rHuEPO when given to patients with advanced multiple myeloma and demonstrate its effects on survival, biological

markers related to the disease, immune improvements and quality of life.

While we have had preliminary

discussions with the FDA, drug suppliers and third party vendors for the planned study, we have not determined the final size and

scope of the study, and as a result, it is too early to estimate the clinical trial period and cost to complete the study.

The following table

sets forth the research and development costs for the years 2014, 2013 and 2012 and for the six months ended June 31, 2015 including

all costs related to the clinical-stage projects, our pre-clinical activities, and all other research and development. We in-licensed

hCDR1 in January 2014 and started preparations for clinical development of this asset during 2014. We started preparations for

rHuEPO clinical development in the last quarter of 2010 (after the completion of the Bio-Gal transaction on August 2010). We in-licensed

SAM-101 in November 2011 and in June 2015 decided to discontinue further development in order to focus on the development of hCDR1

and rHuEPO.

| | |

Research and Development Expenses in thousand $ | |

| | |

Six months ended

June 30, | | |

Year ended December 31, | |

| | |

2015 | | |

2014 | | |

2013 | | |

2012 | |

| | |

| | |

| | |

| | |

| |

| hCDR1 | |

| 106 | | |

| 206 | | |

| 9 | | |

| - | |

| rHuEPO | |

| 5 | | |

| 37 | | |

| 57 | | |

| 92 | |

| SAM-101 | |

| - | | |

| 25 | | |

| 16 | | |

| - | |

| Other | |

| - | | |

| 10 | | |

| | | |

| | |

| Total Research and Development | |

| 111 | | |

| 278 | | |

| 82 | | |

| 92 | |

While

we are currently focused on advancing each of our product development projects, our future research and development expenses will

depend on the clinical success of each product candidate, as well as ongoing assessments of each product candidate’s commercial

potential. In addition, we cannot forecast with any degree of certainty which product candidates may be subject to future out-licensing

arrangements, when such out-licensing arrangements will be secured, if at all, and to what degree such arrangements would affect

our development plans and capital requirements.

As we obtain results

from clinical trials, we may elect to discontinue or delay clinical trials for certain product candidates or projects in order

to focus our resources on more promising product candidates or projects. Completion of clinical trials by us or our licensees may

take several years or more, but the length of time generally varies according to the type, complexity, novelty and intended use

of a product candidate.

The cost of clinical

trials may vary significantly over the life of a project as a result of differences arising during clinical development, including,

among others:

| |

· |

the number of sites included in the clinical trials; |

| |

· |

the length of time required to enroll suitable patients; |

| |

· |

the number of patients that participate in the clinical trials; |

| |

· |

the duration of patient follow-up; |

| |

· |

the development stage of the product candidate; and |

| |

· |

the efficacy and safety profile of the product candidate. |

We expect our research

and development expenses to increase in the future from current levels as we continue the advancement of our clinical trials and

preclinical product development and to the extent we in-license new product candidates. The lengthy process of completing clinical

trials and seeking regulatory approval for our product candidates requires expenditure of substantial resources. Any failure or

delay in completing clinical trials, or in obtaining regulatory approvals, could cause a delay in generating product revenue and

cause our research and development expenses to increase and, in turn, have a material adverse effect on our operations. Because

of the factors set forth above, we are not able to estimate with any certainty when we would recognize any net cash inflows from

our projects.

Trend Information.

We are a development

stage company and it is not possible for us to predict with any degree of accuracy the outcome of our research, development or

commercialization efforts. As such, it is not possible for us to predict with any degree of accuracy any significant trends, uncertainties,

demands, commitments or events that are reasonably likely to have a material effect on our net sales or revenues, income from continuing

operations, profitability, liquidity or capital resources, or that would cause financial information to not necessarily be indicative

of future operating results or financial condition. However, to the extent possible, certain trends, uncertainties, demands, commitments

and events are identified in the preceding subsections.

Off-Balance Sheet Arrangements.

We have not entered

into any transactions with unconsolidated entities whereby we have financial guarantees, subordinated retained interests, derivative

instruments or other contingent arrangements that expose us to material continuing risks, contingent liabilities, or any other

obligations under a variable interest in an unconsolidated entity that provides us with financing, liquidity, market risk or credit

risk support.

Exhibit 99.2

XTL BIOPHARMACEUTICALS LTD.

INTERIM FINANCIAL INFORMATION

AS OF JUNE 30, 2015

UNAUDITED

INDEX

| |

Page |

| |

|

| Condensed Consolidated Financial Statements - in U.S. dollars: |

|

| |

|

| Condensed Consolidated Statements of Financial Position |

2 - 3 |

| |

|

| Condensed Consolidated Statements of Comprehensive Loss |

4 |

| |

|

| Condensed Consolidated Statements of Changes in Equity |

5 - 9 |

| |

|

| Condensed Consolidated Statements of Cash Flows |

10 - 12 |

| |

|

| Notes to Financial Statements |

13 - 19 |

- - - - - - - - - - - -

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2014 | |

| | |

Unaudited | | |

Audited | |

| | |

U.S. dollars in thousands | |

| | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 4,820 | | |

| 2,676 | | |

| 2,159 | |

| Short-term deposits | |

| - | | |

| 584 | | |

| - | |

| Marketable securities | |

| 281 | | |

| - | | |

| - | |

| Trade receivables | |

| - | | |

| 144 | | |

| - | |

| Other accounts receivable | |

| 124 | | |

| 531 | | |

| 437 | |

| Restricted deposits | |

| 32 | | |

| 188 | | |

| 21 | |

| Inventories | |

| - | | |

| 301 | | |

| - | |

| | |

| | | |

| | | |

| | |

| | |

| 5,257 | | |

| 4,424 | | |

| 2,617 | |

| | |

| | | |

| | | |

| | |

| Assets of disposal group classified as held for sale | |

| - | | |

| - | | |

| 505 | |

| | |

| | | |

| | | |

| | |

| | |

| 5,257 | | |

| 4,424 | | |

| 3,122 | |

| | |

| | | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | | |

| | |

| Property, plant and equipment, net | |

| 22 | | |

| 27 | | |

| 24 | |

| Intangible assets, net | |

| 2,582 | | |

| 2,773 | | |

| 2,498 | |

| | |

| | | |

| | | |

| | |

| | |

| 2,604 | | |

| 2,800 | | |

| 2,522 | |

| | |

| | | |

| | | |

| | |

| Total

assets | |

| 7,861 | | |

| 7,224 | | |

| 5,644 | |

The accompanying notes are an integral

part of the financial statements.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2014 | |

| | |

Unaudited | | |

Audited | |

| | |

U.S. dollars in thousands | |

| | |

| | |

| | |

| |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | | |

| | |

| Trade payables | |

| 61 | | |

| 525 | | |

| 217 | |

| Other accounts payable | |

| 170 | | |

| 823 | | |

| 298 | |

| | |

| | | |

| | | |

| | |

| | |

| 231 | | |

| 1,348 | | |

| 515 | |

| | |

| | | |

| | | |

| | |

| Liabilities of disposal group classified as held for sale | |

| - | | |

| - | | |

| 450 | |

| | |

| | | |

| | | |

| | |

| | |

| 231 | | |

| 1,348 | | |

| 965 | |

| | |

| | | |

| | | |

| | |

| NON-CURRENT LIABILITIES: | |

| | | |

| | | |

| | |

| Employee benefit liabilities | |

| - | | |

| 27 | | |

| - | |

| | |

| | | |

| | | |

| | |

| EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY: | |

| | | |

| | | |

| | |

| Ordinary share capital | |

| 6,606 | | |

| 6,180 | | |

| 6,198 | |

| Share premium and options | |

| 150,748 | | |

| 148,146 | | |

| 148,276 | |

| Accumulated deficit | |

| (149,744 | ) | |

| (147,126 | ) | |

| (148,322 | ) |

| Treasury shares | |

| - | | |

| (1,501 | ) | |

| (1,501 | ) |

| Reserve from transactions with non-controlling interests | |

| 20 | | |

| 9 | | |

| 9 | |

| | |

| | | |

| | | |

| | |

| | |

| 7,630 | | |

| 5,708 | | |

| 4,660 | |

| Non-controlling interests | |

| - | | |

| 141 | | |

| 19 | |

| | |

| | | |

| | | |

| | |

| Total

equity | |

| 7,630 | | |

| 5,849 | | |

| 4,679 | |

| | |

| | | |

| | | |

| | |

| Total

liabilities and equity | |

| 7,861 | | |

| 7,224 | | |

| 5,644 | |

The accompanying notes are an integral

part of the financial statements.

| |

|

|

|

|

| David Bassa |

|

Josh Levine |

|

David Kestenbaum |

| Chairman of the Board |

|

Chief Executive Officer |

|

Chief Financial Officer |

Date of approval of the financial statements

by the Company's Board: August 31, 2015.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS |

| | |

Six months ended

June 30, | | |

Three months ended

June 30, | | |

Year ended

December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | | |

2014 | |

| | |

Unaudited | | |

Audited | |

| | |

U.S. dollars in thousands (except per share data) | |

| | |

| | |

| | |

| | |

| | |

| |

| Research and development expenses | |

| (111 | ) | |

| (81 | ) | |

| (69 | ) | |

| (34 | ) | |

| (278 | ) |

| General and administrative expenses | |

| (746 | ) | |

| (916 | ) | |

| (412 | ) | |

| (369 | ) | |

| (1,744 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (857 | ) | |

| (997 | ) | |

| (481 | ) | |

| (403 | ) | |

| (2,022 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Finance income | |

| 19 | | |

| 22 | | |

| 14 | | |

| 20 | | |

| 41 | |

| Finance expenses | |

| (205 | ) | |

| (5 | ) | |

| 40 | | |

| - | | |

| (138 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Finance income (expenses), net | |

| (186 | ) | |

| 17 | | |

| 54 | | |

| 20 | | |

| (97 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations | |

| (1,043 | ) | |

| (980 | ) | |

| (427 | ) | |

| (383 | ) | |

| (2,119 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from discontinued operations | |

| (460 | ) | |

| (491 | ) | |

| - | | |

| (327 | ) | |

| (746 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total loss for the period | |

| (1,503 | ) | |

| (1,471 | ) | |

| (427 | ) | |

| (710 | ) | |

| (2,865 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss for the period attributable to: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

| (1,505 | ) | |

| (1,249 | ) | |

| (427 | ) | |

| (563 | ) | |

| (2,527 | ) |

| Non-controlling interests | |

| 2 | | |

| (222 | ) | |

| - | | |

| (147 | ) | |

| (338 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| (1,503 | ) | |

| (1,471 | ) | |

| (427 | ) | |

| (710 | ) | |

| (2,865 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share from continuing and discontinued operations (in U.S. dollars): | |

| | | |

| | | |

| | | |

| | | |

| | |

| From continuing operations | |

| (0.004 | ) | |

| (0.004 | ) | |

| (0.001 | ) | |

| (0.001 | ) | |

| (0.009 | ) |

| From discontinued operations | |

| (0.002 | ) | |

| (0.001 | ) | |

| - | | |

| (0.001 | ) | |

| (0.002 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss per share for the period | |

| (0.006 | ) | |

| (0.005 | ) | |

| (0.001 | ) | |

| (0.002 | ) | |

| (0.011 | ) |

The accompanying notes are an integral

part of the financial statements.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

| | |

Six

months ended June 30, 2015 | |

| | |

Attributable

to equity holders of the Company | | |

| |

| | |

Share

capital | | |

Share

premium

and options | | |

Accumulated

deficit | | |

Treasury

shares | | |

Reserve

from

transactions

with non-

controlling

interests | | |

Total | | |

Non-

controlling

interests | | |

Total

equity | |

| | |

U.S.

dollars in thousands | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as of January 1, 2015 (audited) | |

| 6,198 | | |

| 148,276 | | |

| (148,322 | ) | |

| (1,501 | ) | |

| 9 | | |

| 4,660 | | |

| 19 | | |

| 4,679 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss for the period | |

| - | | |

| - | | |

| (1,505 | ) | |

| - | | |

| - | | |

| (1,505 | ) | |

| 2 | | |

| (1,503 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based payment

to employees and others | |

| - | | |

| - | | |

| 83 | | |

| - | | |

| - | | |

| 83 | | |

| - | | |

| 83 | |

| Issuance of shares

and warrants | |

| 408 | | |

| 3,059 | | |

| - | | |

| - | | |

| - | | |

| 3,467 | | |

| - | | |

| 3,467 | |

| Sale of subsidiary

shares | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Deconsolidation

of subsidiary | |

| - | | |

| (587 | ) | |

| - | | |

| 1,501 | | |

| 11 | | |

| 925 | | |

| (21 | ) | |

| 904 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2015 (unaudited) | |

| 6,606 | | |

| 150,748 | | |

| (149,744 | ) | |

| - | | |

| 20 | | |

| 7,630 | | |

| - | | |

| 7,630 | |

The accompanying notes are an integral

part of the financial statements.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

| | |

Six

months ended June 30, 2014 | |

| | |

Attributable

to equity holders of the Company | | |

| | |

| |

| |

Share

capital | | |

Share

premium

and options | | |

Accumulated

deficit | | |

Treasury

shares | | |

Reserve

from

transactions with

non-controlling

interests | | |

Total | | |

Non-controlling

interests | | |

Total

equity | |

| | |

U.S.

dollars in thousands | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as of January 1, 2014 (audited) | |

| 6,093 | | |

| 148,327 | | |

| (146,073 | ) | |

| (2,091 | ) | |

| 9 | | |

| 6,265 | | |

| 520 | | |

| 6,785 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss

for the period | |

| - | | |

| - | | |

| (1,249 | ) | |

| - | | |

| - | | |

| (1,249 | ) | |

| (222 | ) | |

| (1,471 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive

loss | |

| - | | |

| - | | |

| (1,249 | ) | |

| - | | |

| - | | |

| (1,249 | ) | |

| (222 | ) | |

| (1,471 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based payment

to employees and others | |

| - | | |

| - | | |

| 196 | | |

| - | | |

| - | | |

| 196 | | |

| 6 | | |

| 202 | |

| Share-based payment

to vendor | |

| *) | | |

| 37 | | |

| - | | |

| - | | |

| - | | |

| 37 | | |

| - | | |

| 37 | |

| Sale of treasury shares | |

| - | | |

| (197 | ) | |

| - | | |

| 590 | | |

| - | | |

| 393 | | |

| (163 | ) | |

| 230 | |

| Exercise

of warrants and stock options into shares | |

| 87 | | |

| (21 | ) | |

| - | | |

| - | | |

| - | | |

| 66 | | |

| - | | |

| 66 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2014 (unaudited) | |

| 6,180 | | |

| 148,146 | | |

| (147,126 | ) | |

| (1,501 | ) | |

| 9 | | |

| 5,708 | | |

| 141 | | |

| 5,849 | |

*) Represents an amount lower than USD

1 thousand.

The accompanying notes are an integral

part of the financial statements.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

| | |

Three

months ended June 30, 2015 | |

| | |

Share

capital | | |

Share

premium

and options | | |

Accumulated

deficit | | |

Reserve

from transactions with

non-controlling interests | | |

Total | |

| | |

U.S.

dollars in thousands | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as of April 1, 2015 (unaudited) | |

| 6,206 | | |

| 147,765 | | |

| (149,354 | ) | |

| 20 | | |

| 4,637 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss

for the period | |

| - | | |

| - | | |

| (427 | ) | |

| - | | |

| (427 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based

payment to employees and others | |

| - | | |

| - | | |

| 37 | | |

| - | | |

| 37 | |

| Issuance

of shares and warrants | |

| 400 | | |

| 2,983 | | |

| - | | |

| - | | |

| 3,383 | |

| Sale

of subsidiary shares | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Deconsolidation

of subsidiary | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2015 (unaudited) | |

| 6,606 | | |

| 150,748 | | |

| (149,744 | ) | |

| 20 | | |

| 7,630 | |

The accompanying notes are an integral

part of the financial statements.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

| | |

Three

months ended June 30, 2014 | |

| | |

Attributable

to equity holders of the Company | | |

| | |

| |

| |

Share

capital | | |

Share

premium

and options | | |

Accumulated

deficit | | |

Treasury

shares | | |

Reserve

from

transactions with

non-controlling

interests | | |

Total | | |

Non-controlling

interests | | |

Total

equity | |

| | |

U.S.

dollars in thousands | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as of April 1, 2014 (unaudited) | |

| 6,093 | | |

| 148,167 | | |

| (146,626 | ) | |

| (1,501 | ) | |

| 9 | | |

| 6,142 | | |

| 286 | | |

| 6,428 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss for the period | |

| - | | |

| - | | |

| (563 | ) | |

| - | | |

| - | | |

| (563 | ) | |

| (147 | ) | |

| (710 | ) |

| Other

comprehensive loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive

loss | |

| - | | |

| - | | |

| (563 | ) | |

| - | | |

| - | | |

| (563 | ) | |

| (147 | ) | |

| (710 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based payment

to employees and others | |

| - | | |

| - | | |

| 63 | | |

| - | | |

| - | | |

| 63 | | |

| 2 | | |

| 65 | |

| Issuance of shares | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Sale of treasury shares | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercise

of warrants and stock options into shares | |

| 87 | | |

| (21 | ) | |

| - | | |

| - | | |

| - | | |

| 66 | | |

| - | | |

| 66 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2014 (unaudited) | |

| 6,180 | | |

| 148,146 | | |

| (147,126 | ) | |

| (1,501 | ) | |

| 9 | | |

| 5,708 | | |

| 141 | | |

| 5,849 | |

The accompanying notes are an integral

part of the financial statements.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

| | |

Year

ended December 31, 2014 | |

| | |

Attributable

to equity holders of the Company | | |

| |

| | |

Share

capital | | |

Premium

on

shares,

options and

warrants | | |

Accumulated

deficit | | |

Treasury

shares | | |

Reserve

from

transactions

with non-

controlling

interests | | |

Total | | |

Non-

controlling

interests | | |

Total

equity | |

| | |

U.S.

dollars in thousands | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as of January 1, 2014 (audited) | |

| 6,093 | | |

| 148,327 | | |

| (146,073 | ) | |

| (2,091 | ) | |

| 9 | | |

| 6,265 | | |

| 520 | | |

| 6,785 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive

loss | |

| - | | |

| - | | |

| (2,527 | ) | |

| - | | |

| - | | |

| (2,527 | ) | |

| (338 | ) | |

| (2,865 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based payment

to employees and others | |

| - | | |

| - | | |

| 278 | | |

| - | | |

| - | | |

| 278 | | |

| - | | |

| 278 | |

| Issuance of shares | |

| 14 | | |

| 158 | | |

| - | | |

| - | | |

| - | | |

| 172 | | |

| - | | |

| 172 | |

| Sale of treasury shares | |

| - | | |

| (197 | ) | |

| - | | |

| 590 | | |

| - | | |

| 393 | | |

| (163 | ) | |

| 230 | |

| Exercise

of options into shares | |

| 91 | | |

| (12 | ) | |

| - | | |

| - | | |

| - | | |

| 79 | | |

| - | | |

| 79 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of December 31, 2014 (audited) | |

| 6,198 | | |

| 148,276 | | |

| (148,322 | ) | |

| (1,501 | ) | |

| 9 | | |

| 4,660 | | |

| 19 | | |

| 4,679 | |

The accompanying notes are an integral

part of the financial statements.

| XTL BIOPHARMACEUTICALS LTD. |

| |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | |

Six months ended June 30, | | |

Three months ended June 30, | | |

Year ended December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | | |

2014 | |

| | |

Unaudited | | |

Audited | |

| | |

U.S. dollars in thousands | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss for the period | |

| (1,503 | ) | |

| (1,471 | ) | |

| (427 | ) | |

| (710 | ) | |

| (2,865 | ) |

| Adjustments to reconcile loss to net cash used in operating activities (a) | |

| 578 | | |

| 130 | | |

| (87 | ) | |

| 166 | | |

| 395 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net cash used in operating activities | |

| (925 | ) | |

| (1,341 | ) | |

| (514 | ) | |

| (544 | ) | |

| (2,470 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Proceeds from sale of investment in associate | |

| - | | |

| 291 | | |

| - | | |

| - | | |

| 291 | |

| Sale of investment in subsidiary | |

| 20 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Increase in restricted deposit | |

| (11 | ) | |

| (165 | ) | |

| (12 | ) | |

| (165 | ) | |

| 2 | |

| Decrease (increase) in short-term bank deposits | |

| - | | |

| 701 | | |

| - | | |

| 703 | | |

| 1,216 | |

| Purchase of property, plant and equipment | |

| (2 | ) | |

| (10 | ) | |

| (2 | ) | |

| (4 | ) | |

| (10 | ) |

| Purchase of intangible assets | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Other investments | |

| - | | |

| - | | |

| - | | |

| 4 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| 7 | | |

| 817 | | |

| (14 | ) | |

| 538 | | |

| 1,499 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of treasury shares | |

| - | | |

| 230 | | |

| - | | |

| - | | |

| 230 | |

| Proceeds from issuance of shares and warrants | |

| 3,559 | | |

| - | | |

| 3,559 | | |

| - | | |

| - | |

| Proceeds from exercise of stock options into shares | |

| - | | |

| 66 | | |

| - | | |

| 66 | | |

| 79 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by financing activities | |

| 3,559 | | |

| 296 | | |

| 3,559 | | |

| 66 | | |

| 309 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| 2,641 | | |

| (228 | ) | |

| 3,031 | | |

| 60 | | |

| (662 | ) |

| Gains (losses) from exchange rate differences on cash and cash equivalents | |

| 20 | | |

| 17 | | |

| 36 | | |

| 21 | | |

| (14 | ) |

| Reclassification of cash in subsidiary to assets of disposal group held for sale | |

| - | | |

| - | | |

| - | | |

| - | | |

| (52 | ) |

| Cash and cash equivalents at the beginning of the period | |

| 2,159 | | |

| 2,887 | | |

| 1,753 | | |

| 2,595 | | |

| 2,887 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents at the end of the period | |

| 4,820 | | |

| 2,676 | | |

| 4,820 | | |

| 2,676 | | |

| 2,159 | |

The accompanying notes are an integral

part of the financial statements.

XTL BIOPHARMACEUTICALS LTD.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

| |

Six months ended June 30, | | |

Three months ended June 30, | | |

Year ended December 31, | |

| | |

| |

2015 | | |

2014 | | |

2015 | | |

2014 | | |

2014 | |

| | |

| |

Unaudited | | |

Audited | |

| | |

| |

U.S. dollars in thousands | |

| (a) | |

Adjustments to reconcile loss to net cash used in operating activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Income and expenses not involving cash flows: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Depreciation and amortization | |

| 4 | | |

| 32 | | |

| 2 | | |

| 11 | | |

| 53 | |

| | |

Impairment of fixed and intangible assets in subsidiary | |

| - | | |

| 141 | | |

| - | | |

| 141 | | |

| 142 | |

| | |

Share-based payment transactions to employees and others | |

| 83 | | |

| 202 | | |

| 37 | | |

| 65 | | |

| 278 | |

| | |

Revaluation of short-term deposits | |

| - | | |

| (7 | ) | |

| - | | |

| (12 | ) | |

| 62 | |

| | |

Exchange rate differences on operating activities | |

| (20 | ) | |

| (17 | ) | |

| (36 | ) | |

| (21 | ) | |

| 14 | |

| | |

Disposal of investment in subsidiary | |

| 464 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

Change in employee benefit liabilities, net | |

| - | | |

| 16 | | |

| - | | |

| 17 | | |

| 12 | |

| | |

Change in marketable securities fair value | |

| 194 | | |

| - | | |

| (24 | ) | |

| - | | |

| - | |

| | |

Gain from sale of investment in associate | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| 725 | | |

| 367 | | |

| (21 | ) | |

| 201 | | |

| 561 | |

| | |

Changes in operating asset and liability items: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Decrease (increase) in trade receivables | |

| - | | |

| (18 | ) | |

| - | | |

| (29 | ) | |

| 58 | |

| | |

Decrease (increase) in other accounts receivable | |

| 110 | | |

| (349 | ) | |

| 52 | | |

| 42 | | |

| (130 | ) |

| | |

Decrease (increase) in inventories | |

| - | | |

| 1 | | |

| - | | |

| (93 | ) | |

| 184 | |

| | |

Increase (decrease) in trade payables | |

| (174 | ) | |

| (90 | ) | |

| (128 | ) | |

| 147 | | |

| (210 | ) |

| | |

Increase (decrease) in other accounts payable | |

| (83 | ) | |

| 219 | | |

| 10 | | |

| (103 | ) | |

| (68 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| (147 | ) | |

| (237 | ) | |

| (66 | ) | |

| (36 | ) | |

| (166 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| 578 | | |

| 130 | | |

| (87 | ) | |

| 165 | | |

| 395 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| (b) | |

Additional information on cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Interest received | |

| - | | |

| 3 | | |

| - | | |

| 3 | | |

| 9 | |

The accompanying notes are an integral

part of the financial statements.

XTL BIOPHARMACEUTICALS LTD.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

| |

Six months ended June 30, | | |

Three months ended June 30, | | |

Year ended December 31, | |

| | |

| |

2015 | | |

2014 | | |

2015 | | |

2014 | | |

2014 | |

| | |

| |

Unaudited | | |

Audited | |

| | |

| |

U.S. dollars in thousands | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| (c) | |

Non-cash activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Purchase of property, plant and equipment and intangible assets on suppliers' credit | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Allotment of shares to Aurum | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Conversion of convertible loan into capital in subsidiary | |

| 50 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Share-based payment for intangible assets | |

| 84 | | |

| 37 | | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Receivables from sale of investment in associate | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| |

Six months ended June 30, | | |

Three months ended June 30, | | |

Year ended December 31, | |

| | |

| |

2015 | | |

2014 | | |

2015 | | |

2014 | | |

2014 | |

| | |

| |

Unaudited | | |

Audited | |

| | |

| |

U.S. dollars in thousands | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| |

Disposal of consolidated subsidiary (see Note 5): | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Non-current assets held for sale | |

| 507 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

Non-current liabilities held for sale | |

| (449 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

Disposal of treasury shares | |

| 1,501 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

Negative premium from disposal of treasury shares | |

| (587 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

Investment in associate at fair value | |

| (482 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

Loss from disposal of subsidiary | |

| (464 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

Non-controlling interests | |

| (26 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

The accompanying notes are an integral

part of the financial statements.

XTL BIOPHARMACEUTICALS LTD.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2015 (UNAUDITED)

| a. | A general description of the Company and its activity: |

XTL Biopharmaceuticals Ltd.

(the “Company”) is engaged in the development of therapeutics for the treatment of unmet medical needs. The

Company was incorporated under the Israeli Companies Law on March 9, 1993. The registered office of the Company is located

at 5 HaCharoshet Street, Raanana 43656.

The Company’s American

Depository Shares (“ADSs”) are listed for trading on the Nasdaq Capital Market and its ordinary shares are traded

on the Tel-Aviv Stock Exchange (“TASE”).

On July 25, 2012, the Company

completed the acquisition of approximately 50.79% of the issued and outstanding share capital of InterCure Ltd. (“InterCure”),

a public company whose shares are traded on the TASE. As of June 30, 2015, the Company held approximately 5.82% of InterCure’s

issued and outstanding share capital. For additional information, see Note 5 below.

The Company is in the planning

stages and is undertaking various activities, regulatory and other, in order to perform a phase 2 clinical trial in hCDR1, a phase

2-ready asset for the treatment of Systemic Lupus Erythematosus (“SLE”). Based on the Company’s current

business plans and estimates, the clinical trial is expected to commence in the middle of 2016.

As of June 30, 2015, the Company

has the following subsidiary:

Xtepo Ltd. – a private

company incorporated in Israel which holds a license for the exclusive use of the patent for recombinant EPO (“rHuEPO”)

for the treatment of Multiple Myeloma patients.

XTL BIOPHARMACEUTICALS LTD.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2015 (UNAUDITED)

| b. | The Company has incurred continuing losses and depends

on outside financing resources to continue its activities. Based on existing business plans, the Company’s management estimates

that its outstanding cash and cash equivalent balances, including short-term deposits, will allow the Company to finance its activities

for an additional period of at least 12 months from the date of approval of these financial statements. However, the amount of

cash which the Company will need in practice to finance its activities depends on numerous factors which include, but are not

limited to, the timing, planning and execution of clinical trials of existing drugs and future projects which the Company might

acquire or other business development activities such as acquiring new technologies and/or changes in circumstances which are

liable to cause significant expenses to the Company in excess of management’s current expectations as of the date of these

financial statements and which will require the Company to reallocate funds against plans, also due to circumstances beyond its

control. |

| | The Company expects to incur additional losses in 2015

arising from research and development activities, testing additional technologies and operating activities, which will be reflected

in negative cash flows from operating activities. In order to perform the clinical trials aimed at developing a product until

obtaining its marketing approval, the Company may be required to raise additional funds in the future by issuing securities. Should

the Company fail to raise additional capital in the future under terms that are acceptable to the Company or at all, it will be

required to minimize its activities or sell or grant a sublicense to third parties to use all or part of its technologies. |

XTL BIOPHARMACEUTICALS LTD.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2015 (UNAUDITED)

| NOTE 2:- | BASIS OF PREPARATION OF THE CONDENSED FINANCIAL STATEMENTS |

| a. | The condensed consolidated financial information of the

Company as of June 30, 2015 and 2014, and for the respective interim periods of three months then ended (“interim financial

information”) has been prepared in accordance with IAS 34, “Interim Financial Reporting” (“IAS 34”)

and includes the additional disclosure requirements in accordance with Chapter D of the Israeli Securities Regulations (Periodic

and Immediate Reports), 1970. This interim financial information does not contain all the information and disclosures that are

required in the framework of the annual financial statements. This interim financial information should be read in conjunction

with the annual financial statements for 2014 and the accompanying notes which have been prepared in accordance with International

Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, and include

additional disclosure requirements in accordance with the Israeli Securities Regulations (Annual Financial Statements), 2010. |

| b. | Estimates – the preparation of the interim financial

statements requires the Company's management to make judgments and to use accounting estimates and assumptions that have an effect

on the application of the Company's accounting policies and on the reported amounts of assets, liabilities and expenses. Actual

results could differ from those estimates. |

| | In the preparation of these condensed consolidated interim financial statements, the significant

judgment exercised by management in applying the Company's accounting policies and the uncertainties involved in the key sources

of the estimates were identical to those in the annual consolidated financial statements for the year ended December 31, 2014. |

XTL BIOPHARMACEUTICALS LTD.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2015 (UNAUDITED)

| NOTE 3: | SIGNIFICANT ACCOUNTING POLICIES |

| | The Company's significant accounting policies and methods

of computation adopted in the preparation of the interim financial information are consistent with those followed in the preparation

of the annual financial statements for 2014. |

| (i) | When the Company ceases to have control of a subsidiary, any retained interest in the entity is

remeasured to its fair value at the date when control is lost, with the change in carrying amount recognized in profit or loss.

The fair value is the initial carrying amount for the purposes of subsequently accounting for the retained interest as an associate

or financial asset. |

XTL BIOPHARMACEUTICALS LTD.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2015 (UNAUDITED)

| NOTE 4: | SIGNIFICANT EVENTS DURING THE PERIOD |

| a. | On January 21, 2015, the Company issued Yeda 802,912 ordinary shares of the Company of 0.1NIS par

value each, as the second of six installments for the patent expenses reimbursement mentioned in Note 14g to the Company’s

2014 financial statements, representing a value of approximately $ 84 thousand. |

| b. | On February 1, 2015, the Company sold 2,166,667 shares of InterCure to a non-related third party,

for an amount of approximately $ 17 thousand. As a result, the Company’s holding in InterCure’s issued and outstanding

share capital decreased to approximately 49.87%. |

| c. | On February 12, 2015, the outstanding loan of $ 50 thousand owed by InterCure

to the Company was converted into 569,470 ordinary shares of InterCure, as part of the execution of the Agreement as presented

in Note 5 to the Company’s 2014 financial statements. After the conversion and the execution of the Agreement, the Company’s

holding in InterCure’s issued and outstanding share capital decreased to 36.53%. |

| d. | On February 12, 2015, the board of directors of the Company approved to

grant Mr. David Kestenbaum, Company’s Chief Financial Officer, with 100,000 non-tradable stock options, exercisable into

100,000 ordinary shares of the Company, 0.1 NIS par value each to Mr. Kestenbaum, with an exercise price of 0.40 NIS per-option.

50,000 options shall vest immediately following the grant date, and the remaining 50,000 options shall vest on a quarterly basis

over a period of three years. The fair value of all the stock options according to the Black-Scholes model pursuant to IFRS 2 as

of the date of grant was approximately $ 8,000. |

| e. | On March 23, 2015, InterCure issued 37,804,012 ordinary shares as part

of a rights offering, thus diluting the Company’s holding in InterCure’s issued and outstanding share capital to approximately

6.16%. |

| f. | On March 25, 2015, an extraordinary general meeting of shareholders of the Company approved the

following proposed resolutions: |

| 1. | Nomination of Mrs. Osnat Hillel Fain and Mr. Oded Nagar as external independent directors for a

term of three years, until March 22, 2018. Mrs. Hillel Fain and Mr. Nagar will each be granted monetary remuneration as set forth

in the notice of the extraordinary general meeting of the Company, including the allotment of 150,000 non-tradable stock options,

without consideration, exercisable into 150,000 ordinary shares of the Company, NIS 0.1 par value each, with an exercise price

of 0.40 NIS per-option. 50,000 options shall vest following the lapse of twelve months from the grant date, and the remaining 100,000

options shall vest on a quarterly basis over a period of two years. The fair value of all the stock options according to the Black-Scholes

model pursuant to IFRS 2 as of the date of grant was approximately $ 25,000. |

XTL BIOPHARMACEUTICALS LTD.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2015 (UNAUDITED)

| NOTE 4: | SIGNIFICANT EVENTS DURING THE PERIOD (Cont.) |

| 2. | Revision of the compensation of Mr. Josh Levine, Company’s Chief Executive Officer, by means

of an allocation of 100,000 non-tradable stock options, exercisable into 100,000 ordinary shares of the Company, 0.1 NIS par value

each to Mr. Levine, with an exercise price of 0.40 NIS per-option. 50,000 options shall vest immediately following the grant date,

and the remaining 50,000 options shall vest on a quarterly basis over a period of three years. The fair value of all the stock

options according to the Black-Scholes model pursuant to IFRS 2 as of the date of grant was approximately $ 8,000. |

| g. | On March 31, 2015, the Company and Green Forest mutually agreed to terminate the voting agreement

signed by the parties on February 12, 2015. Following said termination, the directors appointed by the Company resigned from the

board of directors of InterCure. |

| h. | In April 2015, the Company raised an amount of $ 4.0 million by means of

issuing a total of 1,777,778 ADSs to several investors. In addition, under the share purchase agreements, the investors received

unregistered warrants to purchase 888,889 ADSs. The warrants may be exercised at any time for a period of five and one-half years

from issuance and have an exercise price of $2.25 per ADS, subject to adjustment as set forth therein. |

| i. | On April 2, 2015, InterCure issued the Second Round Allotted Shares as

per the Agreement, thus diluting the Company’s holding in InterCure’s issued and outstanding share capital to approximately

5.82%. |

| j. | On June 1, 2015, the board of directors of the Company approved to grant

the Chief Financial Officer of the Company with 200,000 non-tradeable stock options, exercisable into 200,000 ordinary shares of

the Company, 0.1 NIS par value each, with an exercise price of 0.4283 NIS per-option. 1/3 of the options shall vest following the

lapse of twelve months from the grant date, and the remaining 2/3 of the options shall vest on a quarterly basis over a period

of two years. The fair value of all the stock options according to the Black-Scholes model pursuant to IFRS 2 as of the date of

grant was approximately $ 14,000. |

XTL BIOPHARMACEUTICALS LTD.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2015 (UNAUDITED)

| NOTE 5: | DECONSOLIDATION OF SUBSIDIARY |

In November 2014, InterCure

announced that its Audit Committee and Board of Directors approved the signing of an agreement with Green Forest Global Ltd. (the

“Agreement” and “Green Forest”, respectively) a company wholly owned by Mr. Alexander Rabinovitch,

an interested party in the Company.

| | Pursuant to the Agreement, following a reverse split in InterCure shares at a 10:1 ratio, Green

Forest will be allotted 2,622,647 ordinary shares of InterCure (the “First Round Allotted Shares”) representing

34.23% of the issued and outstanding shares of InterCure at the time of the allotment for an investment of $ 230 thousand. Further,

upon InterCure’s shares return to the main list of the TASE, an additional 2,622,648 ordinary shares of InterCure will be

allotted to Green Forest for an additional investment of $ 230 thousand (the “Second Round Allotted Shares”). |

In

addition, at the time of and as a condition for the completion of the transaction, the outstanding loan of $ 50 thousand owed

by InterCure to the Company will be converted to 569,470 ordinary shares of InterCure.

On December 23, 2014, the extraordinary

general meeting of InterCure approved the Agreement. Accordingly, InterCure’s net assets were reclassified in the Company’s

financial statements for the year ended December 31, 2014, and grouped into two separate items: Assets of Disposal Group Classified

as Held for Sale and Liabilities of Disposal Group Classified as Held for Sale, in accordance with guidelines set forth

in IFRS 5 – Non-current Assets Held for Sale and Discontinued Operations.

The Agreement

turned effective as of February 12, 2015. After the issuance of the 2,622,647 First Round Allotted Shares, as well as the conversion

of the loan granted to InterCure into 569,470 ordinary shares of InterCure, the Company’s holdings in InterCure were diluted

to 36.53% of the issued and outstanding share capital of InterCure, representing a loss of effective control in InterCure as of

that date.

As a result of the accounting

treatment for the deconsolidation of InterCure, the Company recorded a loss from discontinued operations of $ 464 thousand. In

addition, the Company recorded its remaining investment in InterCure shares at a fair value of $ 482 thousand, as quoted on the

TASE as of the loss of control date.

On March 23, 2015, InterCure

issued 37,804,012 ordinary shares as part of a rights offering, thus diluting the Company’s holding in InterCure’s

issued and outstanding share capital to approximately 6.16%.

On April 2,

2015, InterCure issued the Second Round Allotted Shares, thus diluting the Company’s holding in InterCure’s issued

and outstanding share capital to approximately 5.82%.

- - - - - - - - - - - -

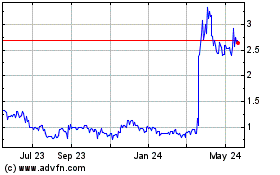

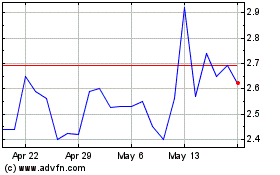

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jul 2023 to Jul 2024