Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

August 31 2023 - 3:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party other

than the Registrant ¨

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

AP ACQUISITION CORP

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing Proxy

Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

EXPLANATORY NOTE

On August 29, 2023, AP Acquisition Corp (the

“Company”) filed with the U.S. Securities and Exchange Commission (the “SEC”) a proxy statement (the “Original

Proxy Statement”) for the extraordinary general meeting of the Company’s shareholders to be held on September 15, 2023

at 10:00 a.m. Eastern Time. The Company is filing these definitive additional proxy materials to amend and supplement certain information

in the Original Proxy Statement. No other information in the Original Proxy Statement has been revised, supplemented, updated or amended.

SUPPLEMENT DATED AUGUST 31, 2023

TO

DEFINITIVE PROXY STATEMENT FOR THE EXTRAORDINARY

GENERAL MEETING OF SHAREHOLDERS OF

AP ACQUISITION CORP

TO BE HELD ON SEPTEMBER 15, 2023

AP ACQUISITION CORP

A Cayman Islands Exempted Company

10 Collyer Quay,

#37-00 Ocean Financial Center, Singapore

The following supplemental disclosure amends and

restates in its entirety the relevant section in the letter to shareholders of AP Acquisition Corp and the notice of extraordinary general

meeting and on page 26 of the Original Proxy Statement (amendments are marked, with new text bold and underlined, and deleted text

bold and stricken through):

On July 31 August 29,

2023, the most recent practicable date prior to the date of this proxy statement, the redemption price per share was approximately $10.78$10.87,

based on the aggregate amount on deposit in the Trust Account as of July 31 August 29, 2023 (including

interest earned on the funds held in the Trust Account and not previously released to the Company to pay its taxes), divided by the total

number of then outstanding public shares. The redemption price per share will be calculated based on the aggregate amount on deposit in

the Trust Account, including interest earned on the funds held in the Trust Account and not previously released to the Company to pay

its taxes, two business days prior to the initially scheduled date of the Extraordinary General Meeting. The closing price of the Class A

ordinary shares on the NYSE on August 28 August 29, 2023 was $10.89$10.91. Accordingly,

if the market price of the Class A ordinary shares were to remain the same until the date of the Extraordinary General Meeting, exercising

redemption rights would result in a public shareholder receiving approximately $0.11$0.04 less per share than

if the shares were sold in the open market (based on the per share redemption price as of July 31 August 29,

2023). The Company cannot assure shareholders that they will be able to sell their Class A ordinary shares in the open market, even

if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in its securities

when such shareholders wish to sell their shares.

— END OF DEFINITIVE ADDITIONAL MATERIALS

TO PROXY STATEMENT —

Forward-Looking Statements

This communication includes forward-looking statements that involve

risks and uncertainties. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are

subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. These forward-looking

statements and factors that may cause such differences include, without limitation, uncertainties relating to the Company’s shareholder

approval of the proposals described in the Original Proxy Statement, its inability to complete an initial business combination within

the required time period or, and other risks and uncertainties indicated from time to time in filings made, or to be made, with the SEC.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company

expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained

herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances

on which any statement is based.

Participants in the Solicitation

The Company and its directors, executive officers, other members of

management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies from the securityholders of

the Company in favor of the approval of the proposals described in the Original Proxy Statement. Investors and security holders may obtain

more detailed information regarding the names, affiliations and interests of the Company’s directors and officers in the Original

Proxy Statement, which may be obtained free of charge from the sources indicated above.

Additional Information and Where to Find It

The Company urges investors, shareholders and other interested persons

to read the Original Proxy Statement as well as other documents filed by the Company with the SEC, because these documents will contain

important information about the Company and the proposals. Shareholders may obtain copies of the Original Proxy Statement, without charge,

at the SEC’s website at www.sec.gov or by directing a request to Morrow Sodali LLC at (800) 662-5200.

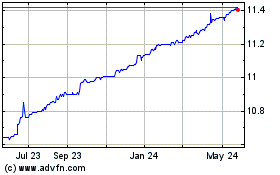

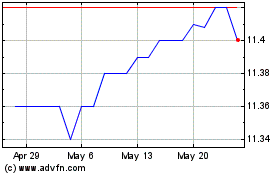

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Jan 2025 to Feb 2025

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Feb 2024 to Feb 2025