UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of

November, 2024

Commission File

Number: 001-35129

Arcos Dorados

Holdings Inc.

(Exact name of

registrant as specified in its charter)

Río Negro

1338, First Floor

Montevideo, Uruguay,

11100

(Address of principal

executive office)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

ARCOS DORADOS

HOLDINGS INC.

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Press Release dated November 13, 2024 titled “Arcos Dorados Reports

Third Quarter Financial Results” |

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

Arcos Dorados Holdings Inc. |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Juan David Bastidas |

| |

|

|

|

Name: |

Juan David Bastidas |

| |

|

|

|

Title: |

Chief Legal Counsel |

Date:

November 13, 2024

Item

1

Arcos

Dorados

3Q 2024

Results

November

13, 2024

|

|

|

ARCOS DORADOS REPORTS THIRD QUARTER FINANCIAL

RESULTS |

|

| • | Total revenues of $1.1 billion

established a new high for a third quarter. |

| • | Systemwide comparable sales¹

grew 32.1% year-over-year, with positive average check and guest volume contributing to the result. |

| • | Digital channel sales (from

Mobile App, Delivery and Self-order Kiosks) rose 16% versus the prior year period and represented 58% of systemwide sales in third quarter. |

| • | Loyalty Program implemented

in three markets, grew to 12.9 million registered members2. |

| • | Consolidated Adjusted EBITDA¹

was $125.0 million, with an 11.0% margin. |

| • | Net Income was $35.2 million

in the quarter, or $0.17 per share. |

Montevideo,

Uruguay, November 13, 2024 – Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the “Company”),

Latin America and the Caribbean’s largest restaurant chain and the world’s largest independent McDonald’s franchisee,

today reported unaudited results for the three and nine months ended September 30, 2024.

|

Third

Quarter 2024 Highlights |

|

| • | Consolidated revenues totaled

$1.1 billion, rising in US dollars despite weaker local currencies. |

| • | Systemwide comparable sales¹

rose 32.1% versus the third quarter of 2023, including the impact of high inflation in Argentina over the last 12 months. |

| • | Consolidated Adjusted EBITDA¹

reached $125.0 million, with an 11.0% margin. |

| • | Net Income was $35.2 million,

with a 3.1% margin. |

| • | Net Debt to Adjusted EBITDA

leverage ratio ended the third quarter at 1.2x, unchanged from the end of the previous quarter. |

| • | The Company opened 19 Experience

of the Future (EOTF) restaurants in the quarter, all of them free-standing, including 11 in Brazil. |

| • | Digital channel sales grew 16%,

including strong performances in Mobile App and Delivery as well as the continued growth of the Loyalty Program. |

1 For

definitions, please refer to page 15 of this document.

2 As

of September 30, 2024.

|

Message

from Marcelo Rabach, Chief Executive Officer |

|

Third

quarter 2024 results demonstrate the resilience of Arcos Dorados’ business model. Sales and profitability were strong, as US dollar

revenue set a new high for a third quarter and Adjusted EBITDA was the second highest for a third quarter. Notably, comparable guest

counts rose for the 14th consecutive quarter, with broad-based traffic increases in the region. This helped drive systemwide

comp sales growth in all three divisions, despite more challenging economic and consumer environments.

Our

strategy, built around Digital, Delivery and Drive-thru, remained an unmatched structural competitive advantage across all markets. In

line with McDonald’s global growth strategy, we expect our restaurant opening pipeline to unlock even more shareholder value, as

we capture the significant expansion opportunity over the next several years. Our balance sheet is as strong as ever, which allows us

to continue ramping up on the Fourth “D” of our strategy: Development. With that in mind, moving forward, we will begin referring

to our Four D’s Strategy.

For

the year-to-date through September, we opened 56 Experience of the Future restaurants, including 32 openings in Brazil. And, since the

fourth quarter began, we either opened or broke ground on all the restaurants we plan to open this year.

I believe

there are so many reasons to be excited about the future for Arcos Dorados and its shareholders, including: operating the world’s

most beloved QSR Brand, executing the successful Four D’s Strategy, the largest market share in the region’s quick service

restaurant (QSR) industry, by far, and a strong balance sheet to support future growth. In addition, we operate the region’s most

modernized restaurant portfolio with the highest number of free-standing locations that we believe will continue to be a structural competitive

advantage for the foreseeable future.

Finally,

we believe we are operating in the world’s best ZIP code. Latin America has one of the globe’s most underpenetrated QSR industries.

While it is true we have political and economic cycles, we are the least impacted emerging market when it comes to the serious geopolitical

issues in other parts of the world. And, the consumer class continues to grow in Latin America’s biggest markets, which will generate

growing demand for the world’s most popular QSR Brand.

It will

be our job to capitalize on these opportunities in the years to come.

1 |

Consolidated

Results

|

|

Consolidated

Results |

|

Figure

1. AD Holdings Inc Consolidated: Key Financial Results

(In

millions of U.S. dollars, except as noted)

| |

3Q23

(a) |

Currency

Translation

(b) |

Constant

Currency

Growth

(c) |

3Q24

(a+b+c) |

%

As Reported |

%

Constant Currency |

| Total

Restaurants (Units) |

2,339 |

|

|

2,410 |

|

|

| |

|

|

|

|

|

|

| Sales by Company-operated

Restaurants |

1,075.3 |

(416.5) |

424.6 |

1,083.4 |

0.8% |

39.5% |

| Revenues from franchised

restaurants |

49.8 |

(14.1) |

14.6 |

50.2 |

0.9% |

29.3% |

| Total

Revenues |

1,125.1 |

(430.7) |

439.2 |

1,133.7 |

0.8% |

39.0% |

| Systemwide

Comparable Sales |

|

|

|

|

|

32.1% |

| Adjusted

EBITDA |

129.1 |

(33.7) |

29.6 |

125.0 |

-3.2% |

22.9% |

| Adjusted

EBITDA Margin |

11.5% |

|

|

11.0% |

-0.5 p.p. |

|

| Net income (loss) attributable

to AD |

59.7 |

2.8 |

(27.3) |

35.2 |

-41.0% |

-45.7% |

| Net

income attributable to AD Margin |

5.3% |

|

|

3.1% |

-2.2 p.p. |

|

| No. of shares outstanding

(thousands) |

210,655 |

|

|

210,663 |

|

|

| EPS

(US$/Share) |

0.28 |

|

|

0.17 |

|

|

Arcos

Dorados’ total revenues of $1.1 billion, a new high for a third quarter, despite the challenging macroeconomic and consumer environments

in the region. Systemwide comparable sales rose 32.1% with positive contributions from both average check and guest volumes. The Company’s

systemwide comparable sales grew 1.6x blended inflation for the period, excluding Argentina.

The

Three-D’s strategy (Digital, Delivery and Drive-thru), which has been a key component of the Company’s success in recent

years, continues to be a structural competitive advantage across all markets, leading to continued market share gains throughout the

Company’s footprint. According to the Company’s proprietary research, McDonald’s brand gained five points of value

share across its operating footprint in the third quarter compared with the prior year period.

Sales

from Arcos Dorados’ Digital platform rose 16% versus the prior year and generated 58% of systemwide sales. Guests are increasingly

choosing the seamless experience offered by the Mobile App’s functionalities, self-order kiosks in restaurants and McDelivery.

Sales growth was strong both inside restaurants as well as in the Company’s off-premise channels. The latter (Delivery and Drive-thru)

generated 43% of systemwide sales in the third quarter, combined.

As of

September 30, 2024, the Company’s customer relationship management (CRM) platform had approximately 94 million unique registered

users. As of the end of October 2024, the Loyalty Program reached almost 14 million registered members across three markets. The Loyalty

Program has become a key driver of customer engagement, including an increase of 25% in identified sales compared to the same period

last year.

|

Adjusted EBITDA Bridge |

|

($ million)

Third

quarter consolidated Adjusted EBITDA reached $125.0 million, with strong local currency growth offset by an unfavorable exchange rate

environment and the ongoing economic adjustment in Argentina. This result included a $5.6 million positive impact from a recovery related

to social security contributions in Brazil.

Consolidated

Adjusted EBITDA margin was 11.0%. Food and Paper (F&P) costs remained relatively stable when compared to the previous year. Leverage

in General and Administrative expenses (G&A) and a better result in the Other Operating Income line were more than offset by higher

Payroll expenses and a deleveraging of Occupancy & Other Operating expenses as a percentage of revenue, compared with the prior year

period.

|

Notable

items in the Adjusted EBITDA reconciliation |

|

Included

in Adjusted EBITDA: The result for the third quarter of 2024 included a $5.6 million positive impact from a recovery related to social

security contributions in Brazil.

Excluded

from Adjusted EBITDA: There were no notable items excluded from Adjusted EBITDA in either the third quarter of 2024 or the third

quarter of 2023.

|

Non-operating

Results |

|

Arcos

Dorados’ non-operating results for the third quarter included a net interest expense of $8.5 million and a $2.8 million gain from

non-cash foreign exchange and derivative instruments. The Company recorded an income tax expense of $39.6 million in the quarter.

Net

income attributable to the Company totaled $35.2 million, or $0.17 per share, in the third quarter of 2024. Total weighted average shares

amounted to 210,663,057 in the third quarter compared to 210,654,969 in the prior year’s quarter.

2 |

Divisional

Results

|

|

Brazil

Division |

|

Figure

2. Brazil Division: Key Financial Results

(In

millions of U.S. dollars, except as noted)

| |

3Q23

(a) |

Currency

Translation

(b) |

Constant

Currency

Growth

(c) |

3Q24

(a+b+c) |

%

As Reported |

%

Constant Currency |

| Total

Restaurants (Units) |

1,113 |

|

|

1,160 |

|

|

| |

|

|

|

|

|

|

| Total

Revenues |

439.2 |

(58.7) |

50.9 |

431.5 |

-1.8% |

11.6% |

| Systemwide

Comparable Sales |

|

|

|

|

|

6.8% |

| Adjusted

EBITDA |

77.8 |

(10.6) |

11.7 |

79.0 |

1.5% |

15.1% |

| Adjusted

EBITDA Margin |

17.7% |

|

|

18.3% |

0.6

p.p. |

|

Brazil’s

revenues totaled $431.5 million, strongly impacted by the material depreciation of the Brazilian real versus the prior year. Systemwide

comparable sales rose 6.8% year-over-year, or 1.6x inflation in the period, on top of double-digit growth in the prior year quarter.

Digital

sales generated almost 70% of the division’s systemwide sales in the period. Delivery sales rose 14% in US dollars versus the prior

year and represented 22% of systemwide sales. At the end of October, the Loyalty program reached almost 13 million users. The program

is proving highly effective in attracting new customers, recovering previously lost customers, and significantly boosting frequency.

"Meu Méqui" continues to evolve in the country, strengthening customer engagement and reinforcing the Company’s

commitment to deliver personalized experiences.

Based

on Company research, Brazil leads in all its brand attributes, and achieved an all-time high “Top of Mind” score while also

improving its market-leading score as the “Favorite Brand.”

These

results reflect strong marketing activities during the quarter. The launch of the “Why I call Méqui, Méqui”

campaign increased guests’ emotional connection with the McDonald’s Brand. Core product sales benefitted from the “Piscininha

de Cheddar” that leveraged Brazilians’ love for melted cheddar. New flavors in cones, McFlurry and McShake brought innovation

to the Dessert category in the quarter. The family business also benefitted from Happy Meal licenses such as “Despicable Me 4”,

which featured an exclusive menu and special activations in restaurants.

As reported

Adjusted EBITDA in the division totaled $79.0 million in the quarter, rising 1.5% in US dollars versus the prior year period, despite

the depreciation of the Brazilian currency. Adjusted EBITDA margin was 18.3%, an expansion of 60 basis points. Excluding the recovery

related to social security contributions, Brazil’s margin contracted 70 basis points mainly due to higher F&P costs and Royalty

expenses as a percentage of revenue.

|

North

Latin American Division (NOLAD) |

|

| |

|

|

Figure

3. NOLAD Division: Key Financial Results

(In

millions of U.S. dollars, except as noted)

| |

3Q23

(a) |

Currency

Translation

(b) |

Constant

Currency

Growth

(c) |

3Q24

(a+b+c) |

%

As Reported |

%

Constant Currency |

| Total

Restaurants (Units) |

638 |

|

|

649 |

|

|

| |

|

|

|

|

|

|

| Total

Revenues |

295.6 |

(10.2) |

24.3 |

309.7 |

4.8% |

8.2% |

| Systemwide

Comparable Sales |

|

|

|

|

|

6.2% |

| Adjusted

EBITDA |

32.3 |

(0.9) |

(0.8) |

30.7 |

-5.0% |

-2.4% |

| Adjusted

EBITDA Margin |

10.9% |

|

|

9.9% |

-1.0

p.p. |

|

As reported

revenues in NOLAD totaled $309.7 million, up 4.8% versus the prior year quarter. Systemwide comparable sales rose 6.2% year-over-year,

or 2.3x the division’s blended inflation in the period, driven by strong guest traffic trends in these markets.

The

Company has been investing in the modernization and digitalization of its restaurants in the division. As a result, digital sales continued

to grow, and increased 37% versus the prior year, representing 40% of systemwide sales in the quarter. This growth reflects significant

increases in Delivery and Self-Order Kiosk sales versus the prior year quarter.

In Costa

Rica, the Loyalty Program was launched in May 2024 and has rapidly gained traction among customers, with over 500,000 members joining

within the first five months (representing nearly 10% of the country's population). This swift adoption has played a crucial role in

driving strong identified sales penetration in the market.

NOLAD’s

marketing campaigns focused on menu items designed for families, with Happy Meal licenses featuring “Yu-Gi-Oh and Hello Kitty”.

Arcos Dorados also developed a collaboration with Korean pop group BTS to enhance its chicken credentials with Gen Z customers. The collaboration

introduced a variety of Asian-inspired sauces, special packaging and collectible characters for the iconic Chicken McNuggets. In Mexico,

“Best Burger” has successfully increased core product sales by highlighting their unique taste and unmatched quality.

As reported

Adjusted EBITDA in the division was $30.7 million in the quarter, down 5.0% versus the prior year in US dollars, partly due to the depreciation

of local currencies versus the prior year. Adjusted EBITDA margin declined by 100 basis points in the period, with lower G&A expenses

offset by higher Payroll expenses as well as an increase in Occupancy & Other Operating expenses as a percentage of revenue.

|

South

Latin American Division (SLAD) |

|

Figure

4. SLAD Division: Key Financial Results

(In

millions of U.S. dollars, except as noted)

| |

3Q23

(a) |

Currency

Translation

(b) |

Constant

Currency

Growth

(c) |

3Q24

(a+b+c) |

%

As Reported |

%

Constant Currency |

| Total

Restaurants (Units) |

588 |

|

|

601 |

|

|

| |

|

|

|

|

|

|

| Total

Revenues |

390.3 |

(361.8) |

364.0 |

392.5 |

0.6% |

93.3% |

| Systemwide

Comparable Sales |

|

|

|

|

|

90.4% |

| Adjusted

EBITDA |

41.8 |

(41.5) |

35.5 |

35.7 |

-14.5% |

84.9% |

| Adjusted

EBITDA Margin |

10.7% |

|

|

9.1% |

-1.6

p.p. |

|

As reported

revenues in SLAD totaled $392.5 million, driven by a 90.4% increase in systemwide comparable sales versus the prior year, which includes

the effect of Argentina and Venezuela’s high inflation rates. Excluding Argentina, the division’s systemwide comparable sales

grew 1.3x blended inflation.

Results

in the third quarter reflect a more challenging consumer environment, as well as significant macroeconomic and currency headwinds in

Argentina, which further pressured the division’s margin. Against this backdrop, the Company focused on leveraging its competitive

advantages to strengthen value perception and brand preference among guests, which contributed to increased value share across the division,

including an additional seven points in Chile and four points in Argentina.

Digital

sales represented 57% of systemwide sales in SLAD in the quarter, mainly due to the strong performance of the Mobile Order and Pay functionality

on the Mobile App and the continued increase in sales penetration from Delivery.

In Uruguay,

the Loyalty Program is delivering outstanding results. Launched in April 2024, the program boosted identified sales penetration in this

country and drove important increases in guest frequency. These results underscore the program’s impact on guest engagement and

potential future sales growth.

The

Company continued to strengthen the connection with its key consumer targets through the Copa America soccer tournament, with special

edition sandwiches and campaigns supporting its sponsorship of national teams. In Argentina, taking advantage of its unique passion for

soccer, the brand took over Copa America with the “Grand Leyenda” sandwich featuring soccer super star Angel Di María.

Arcos Dorados also continued strengthening the connection with families, with activations and campaigns related to top licenses such

as “Despicable Me 4”, “Inside Out 2” and “Yu-Gi-Oh and Hello Kitty”, significantly improving brand

attributes related to families. The Company also kept its focus on improving the value for money perception, building compelling entry

level meals with a strong customer response.

As reported

Adjusted EBITDA totaled $35.7 million in the third quarter, which includes the negative impact of the depreciation of local currencies.

Adjusted EBITDA margin contracted 160 basis points versus the prior year quarter. The division’s Adjusted EBITDA margin was positively

impacted by lower F&P costs as a percentage of revenue, despite the challenging macroeconomic environment in Argentina. This was

offset by higher Payroll and Occupancy & Other Operating expenses as a percentage of revenue.

|

New

Unit Development |

|

Figure

5. Total Restaurants (end of period)*

| |

September

2024 |

June

2024 |

March

2024 |

December

2023 |

September

2023 |

| Brazil |

1,160 |

1,150 |

1,141 |

1,130 |

1,113 |

| NOLAD |

649 |

649 |

647 |

647 |

638 |

| SLAD |

601 |

596 |

593 |

584 |

588 |

| TOTAL |

2,410 |

2,395 |

2,381 |

2,361 |

2,339 |

*Considers

Company-operated and franchised restaurants at period-end

Figure

6. Footprint as of September 30, 2024

| |

Store

Type* |

Total

Restaurants |

Ownership |

McCafes |

Dessert

Centers |

| |

FS |

IS |

MS

& FC |

Company

Operated |

Franchised |

| Brazil |

610 |

91 |

459 |

1,160 |

713 |

447 |

124 |

2,003 |

| NOLAD |

408 |

47 |

194 |

649 |

495 |

154 |

19 |

524 |

| SLAD |

257 |

124 |

220 |

601 |

507 |

94 |

205 |

734 |

| TOTAL |

1,275 |

262 |

873 |

2,410 |

1,715 |

695 |

348 |

3,261 |

FS:

Free-Standing; IS: In-Store; MS: Mall Store; FC: Food Court.

The Company

opened 19 Experience of the Future (EOTF) restaurants in the third quarter of 2024, all of them freestanding units, including 11 restaurants

in Brazil. For the first nine months of 2024, the Company opened 56 EOTF restaurants, including 53 freestanding units and 32 units in

Brazil.

Arcos

Dorados continued modernizing existing restaurants and, as of the end of September 2024, there were 1,560 EOTF restaurants making up

65% of the Company’s total footprint.

The

restaurant development plan remains on track and the Company expects to meet its full year guidance of 80 to 90 restaurant openings in

2024.

|

Balance

Sheet & Cash Flow Highlights |

|

Figure

7. Consolidated Debt and Financial Ratios

(In

thousands of U.S. dollars, except ratios)

| |

September

30, |

December

31, |

| 2024 |

2023 |

| Total

Cash & cash equivalents (i) |

120,807 |

246,767 |

| Total Financial Debt

(ii) |

719,068 |

728,093 |

| Net

Financial Debt (iii) |

598,261 |

481,326 |

| LTM Adjusted EBITDA |

485,340 |

472,304 |

| Total Financial Debt

/ LTM Adjusted EBITDA ratio |

1.5 |

1.5 |

| Net Financial Debt

/ LTM Adjusted EBITDA ratio |

1.2 |

1.0 |

| LTM Net income attributable

to AD |

146,133 |

181,274 |

| Total Financial Debt

/ LTM Net income attributable to AD ratio |

4.9 |

4.0 |

| Net

Financial Debt / LTM Net income attributable to AD ratio |

4.1 |

2.7 |

| (i) | Total

cash & cash equivalents include short-term investment. |

| (ii) | Total

financial debt includes short-term debt, long-term debt, accrued interest payable and derivative

instruments (including the asset portion of derivatives amounting to $68.2 million and $46.5

million as a reduction of financial debt as of September 30, 2024 and December 31, 2023,

respectively). |

| (iii) | Net

financial debt equals total financial debt less total cash & cash equivalents. |

As of

September 30, 2024, total cash and cash equivalents were $120.8 million and total financial debt (including the net derivative instrument

position) was $719.1 million. Net debt (total financial debt minus total cash and cash equivalents) was $598.3 million, up from $481.3

million at the end of 2023, due to the lower cash balance.

The

net debt to Adjusted EBITDA leverage ratio ended the quarter at 1.2x, unchanged from the end of the second quarter 2024.

Net

cash generated from operating activities for the nine months ended September 30, 2024, totaled $159.8 million. Cash used in net investing

activities totaled $192.2 million, including capital expenditures of $239.2 million, partially compensated by $45.8 million in net proceeds

from financial investments. Net cash used in financing activities was $42.9 million, which included $37.9 million corresponding to the

first three installments of the 2024 dividend.

3 |

Recent

Developments

|

|

Recent

Developments |

|

Moody’s

Rating Action

In October

2024, Moody’s upgraded Arcos Dorados’ corporate and senior debt rating to Ba1 from Ba2, following Brazil’s sovereign

debt rating action. To support the upgrade, Moody’s cited the Company's solid marketing position in Latin America as the largest

independent McDonald’s franchisee worldwide. The ratings were also supported by Arcos Dorados’ liquidity condition and geographic

diversification of the Company's solid restaurant base.

Letter

of Credit

On October

25, 2024, the Company signed a letter of credit with Banco Bilbao Vizcaya Argentaria (“BBVA”) of $45 million. Additionally,

on October 28, 2024, Arcos terminated a $45 million letter of credit with Credit Suisse.

Revolving

Credit Facility

On October

31, 2024, Arcos Dorados signed a $25 million revolving credit facility with Banco Santander Brasil, that matures on October 31, 2026.

Each loan under this agreement will bear interest annually at TERM SOFR plus a range between 3.20% and 3.60%.

|

Third

Quarter 2024 Earnings Webcast |

|

A

webcast to discuss the information contained in this press release will be held today, November 13, 2024, at 10:00 a.m. ET. In order

to access the webcast, members of the investment community should follow this link: Arcos Dorados Third

Quarter 2024 Earnings Webcast.

A

replay of the webcast will be available later today in the investor section of the Company’s website: www.arcosdorados.com/ir.

Investor

Relations Contact

Dan Schleiniger

VP of Investor

Relations

Arcos

Dorados

daniel.schleiniger@mcd.com.uy

|

Media Contact

David Grinberg

VP of Corporate Communications

Arcos Dorados

david.grinberg@mcd.com.uy

|

Follow us on:

|

Definitions |

|

In

analyzing business trends, management considers a variety of performance and financial measures which are considered to be non-GAAP including:

Adjusted EBITDA, Constant Currency basis, Systemwide sales, and Systemwide comparable sales growth.

Adjusted

EBITDA: In addition to financial measures prepared in accordance with the general accepted accounting principles (GAAP), this press

release and the accompanying tables use a non-GAAP financial measure titled ‘Adjusted EBITDA’. Management uses Adjusted EBITDA

to facilitate operating performance comparisons from period to period.

Adjusted

EBITDA is defined as the Company’s operating income plus depreciation and amortization plus/minus the following losses/gains included

within other operating income (expenses), net, and within general and administrative expenses on the statement of income: gains from

sale or insurance recovery of property and equipment, write-offs of long-lived assets, and impairment of long-lived assets.

Management

believes Adjusted EBITDA facilitates company-to-company operating performance comparisons by backing out potential differences caused

by variations such as capital structures (affecting net interest expense and other financing results), taxation (affecting income tax

expense) and the age and book depreciation of facilities and equipment (affecting relative depreciation expense), which may vary for

different companies for reasons unrelated to operating performance. Figure 8 of this earnings release includes a reconciliation for Adjusted

EBITDA. For more information, please see Adjusted EBITDA reconciliation in Note 9 – Segment and geographic information –

of our financial statements (6-K Form) filed today with the S.E.C.

Constant

Currency basis: refers to amounts calculated using the same exchange rate over the periods under comparison to remove the effects

of currency fluctuations from this trend analysis. To better discern underlying business trends, this release uses non-GAAP financial

measures that segregate year-over-year growth into two categories: (i) currency translation and (ii) constant currency growth. (i) Currency

translation reflects the impact on growth of the appreciation or depreciation of the local currencies in which the Company conducts its

business against the US dollar (the currency in which the Company’s financial statements are prepared). (ii) Constant currency

growth reflects the underlying growth of the business excluding the effect from currency translation. The Company also calculates variations

as a percentage in constant currency, which are also considered to be non-GAAP measures, to provide a more meaningful analysis of its

business by identifying the underlying business trends, without distortion from the effect of foreign currency fluctuations.

Systemwide

sales: Systemwide sales represent measures for both Company-operated and sub-franchised restaurants. While sales by sub-franchisees

are not recorded as revenues by the Company, management believes the information is important in understanding its financial performance

because these sales are the basis on which it calculates and records sub-franchised restaurant revenues and are indicative of the financial

health of its sub-franchisee base.

Systemwide

comparable sales growth: this non-GAAP measure, refers to the change, on a constant currency basis, in Company-operated and sub-franchised

restaurant sales in one period from a comparable period for restaurants that have been open for thirteen months or longer (year-over-year

basis) including those temporarily closed. Management believes it is a key performance indicator used within the retail industry and

is indicative of the success of the Company’s initiatives as well as local economic, competitive and consumer trends. Sales by

sub-franchisees are not recorded as revenues by the Company.

|

About

Arcos Dorados |

|

Arcos Dorados is the world’s

largest independent McDonald’s franchisee, operating the largest quick service restaurant chain in Latin America and the Caribbean.

It has the exclusive right to own, operate and grant franchises of McDonald’s restaurants in 20 Latin American and Caribbean countries

and territories with more than 2,400 restaurants, operated by the Company or by its sub-franchisees, that together employ more than 100

thousand people (as of 09/30/2024). The Company is also committed to the development of the communities in which it operates, to providing

young people their first formal job opportunities and to utilize its Recipe for the Future

to achieve a positive environmental impact. Arcos Dorados is listed for trading on the New York Stock Exchange (NYSE: ARCO). To learn

more about the Company, please visit the Investors section of our website: www.arcosdorados.com/ir.

|

Cautionary

Statement on Forward-Looking Statements |

|

This press release

contains forward-looking statements. The forward-looking statements contained herein include statements about the Company’s business

prospects, its ability to attract customers, its expectation for revenue generation, its outlook and guidance for 2024 and the renewal

of its Master Franchise Agreement with McDonald’s. These statements are subject to the general risks inherent in Arcos Dorados'

business. These expectations may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove

to be incorrect. In addition, Arcos Dorados' business and operations involve numerous risks and uncertainties, many of which are beyond

the control of Arcos Dorados, which could result in Arcos Dorados' expectations not being realized or otherwise materially affect the

financial condition, results of operations and cash flows of Arcos Dorados. Additional information relating to the uncertainties affecting

Arcos Dorados' business is contained in its filings with the Securities and Exchange Commission. The forward-looking statements are made

only as of the date hereof, and Arcos Dorados does not undertake any obligation to (and expressly disclaims any obligation to) update

any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence

of unanticipated events.

|

Third

Quarter 2024 Consolidated Results |

|

Figure

8. Third Quarter 2024 Consolidated Results

(In

thousands of U.S. dollars, except per share data)

| |

For

Three-Months ended |

For

Nine-Months ended |

| |

September

30, |

September

30, |

| |

2024 |

2023 |

2024 |

2023 |

| REVENUES |

|

|

|

|

| Sales by Company-operated

restaurants |

1,083,447 |

1,075,328 |

3,175,578 |

3,016,212 |

| Revenues from franchised

restaurants |

50,238 |

49,782 |

150,364 |

140,211 |

| Total

Revenues |

1,133,685 |

1,125,110 |

3,325,942 |

3,156,423 |

| OPERATING COSTS AND

EXPENSES |

|

|

|

|

| Company-operated restaurant

expenses: |

|

|

|

|

| Food

and paper |

(381,175) |

(376,023) |

(1,115,088) |

(1,061,634) |

| Payroll

and employee benefits |

(207,894) |

(200,904) |

(603,392) |

(580,286) |

| Occupancy

and other operating expenses |

(315,571) |

(300,456) |

(930,182) |

(843,176) |

| Royalty

fees |

(67,163) |

(65,058) |

(198,527) |

(180,317) |

| Franchised restaurants

- occupancy expenses |

(20,720) |

(21,424) |

(62,995) |

(60,053) |

| General and administrative

expenses |

(68,070) |

(67,806) |

(209,682) |

(202,924) |

| Other operating income

(expenses), net |

6,733 |

(2,364) |

15,519 |

4,219 |

| Total

operating costs and expenses |

(1,053,860) |

(1,034,035) |

(3,104,347) |

(2,924,171) |

| Operating

income |

79,825 |

91,075 |

221,595 |

232,252 |

| Net interest expense

and other financing results |

(8,480) |

(4,973) |

(39,059) |

(26,960) |

| (Loss)

gain from derivative instruments |

(516) |

900 |

733 |

(13,220) |

| Foreign

currency exchange results |

3,292 |

1,286 |

(15,823) |

22,231 |

| Other non-operating

income (expenses), net |

758 |

(106) |

106 |

(100) |

| Income

before income taxes |

74,879 |

88,182 |

167,552 |

214,203 |

| Income tax expense,

net |

(39,589) |

(28,072) |

(76,695) |

(87,922) |

| Net

income |

35,290 |

60,110 |

90,857 |

126,281 |

| Net income attributable

to non-controlling interests |

(76) |

(389) |

(502) |

(785) |

| Net

income attributable to Arcos Dorados Holdings Inc. |

35,214 |

59,721 |

90,355 |

125,496 |

| Net income attributable to Arcos Dorados Holdings Inc. Margin as a % of total revenues |

3.1% |

5.3% |

2.7% |

4.0 |

| Earnings

per share information ($ per share): |

|

|

|

|

| Basic net income per

common share |

$ 0.17 |

$ 0.28 |

$ 0.43 |

$ 0.60 |

| Weighted-average number

of common shares outstanding-Basic |

210,663,057 |

210,654,969 |

210,659,761 |

210,625,346 |

| Adjusted

EBITDA Reconciliation |

|

|

|

|

| Net income attributable

to Arcos Dorados Holdings Inc. |

35,214 |

59,721 |

90,355 |

125,496 |

| Net income attributable

to non-controlling interests |

76 |

389 |

502 |

785 |

| Income tax expense,

net |

39,589 |

28,072 |

76,695 |

87,922 |

| Other non-operating

income (expenses), net |

(758) |

106 |

(106) |

100 |

| Foreign currency exchange

results |

(3,292) |

(1,286) |

15,823 |

(22,231) |

| (Loss) gain from derivative

instruments |

516 |

(900) |

(733) |

13,220 |

| Net interest expense

and other financing results |

8,480 |

4,973 |

39,059 |

26,960 |

| Depreciation and amortization |

45,411 |

37,286 |

133,704 |

105,806 |

| Operating charges excluded

from EBITDA computation |

(237) |

759 |

(2,583) |

1,622 |

| Adjusted

EBITDA |

124,999 |

129,120 |

352,716 |

339,680 |

| Adjusted

EBITDA Margin as % of total revenues |

11.0

% |

11.5

% |

10.6

% |

10.8

% |

|

Third

Quarter 2024 Results by Division |

|

Figure

9. Third Quarter 2024 Consolidated Results by Division

(In

thousands of U.S. dollars)

| |

For

Three-Months ended |

as |

Constant |

|

For

Nine-Months ended |

as |

Constant |

| |

September

30, |

reported |

Currency |

|

September

30, |

reported |

Currency |

| |

2024 |

2023 |

Incr/(Decr)% |

Incr/(Decr)% |

|

2024 |

2023 |

Incr/(Decr)% |

Incr/(Decr)% |

| Revenues |

|

|

|

|

|

|

|

|

|

| Brazil |

431,473 |

439,213 |

-1.8% |

11.6% |

|

1,322,400 |

1,218,610 |

8.5% |

13.6% |

| NOLAD |

309,684 |

295,641 |

4.8% |

8.2% |

|

922,610 |

832,497 |

10.8% |

9.7% |

| SLAD |

392,528 |

390,256 |

0.6% |

93.3% |

|

1,080,932 |

1,105,316 |

-2.2% |

105.5% |

| TOTAL |

1,133,685 |

1,125,110 |

0.8% |

39.0% |

|

3,325,942 |

3,156,423 |

5.4% |

44.8% |

| |

|

|

|

|

|

|

|

|

|

| Operating

Income (loss) |

|

|

|

|

|

|

|

|

|

| Brazil |

61,157 |

59,374 |

3.0% |

16.8% |

|

186,393 |

156,376 |

19.2% |

24.9% |

| NOLAD |

17,337 |

21,779 |

-20.4% |

-18.4% |

|

48,511 |

54,136 |

-10.4% |

-11.8% |

| SLAD |

24,175 |

34,187 |

-29.3% |

66.0% |

|

58,336 |

97,101 |

-39.9% |

28.6% |

| Corporate

and Other |

(22,844) |

(24,265) |

5.9% |

-75.8% |

|

(71,645) |

(75,361) |

4.9% |

-94.6% |

| TOTAL |

79,825 |

91,075 |

-12.4% |

11.1% |

|

221,595 |

232,252 |

-4.6% |

-4.7% |

| |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

|

|

|

|

|

|

|

|

| Brazil |

79,007 |

77,848 |

1.5% |

15.1% |

|

240,621 |

206,450 |

16.6% |

22.1% |

| NOLAD |

30,683 |

32,308 |

-5.0% |

-2.4% |

|

85,446 |

84,218 |

1.5% |

0.3% |

| SLAD |

35,705 |

41,780 |

-14.5% |

84.9% |

|

91,017 |

119,370 |

-23.8% |

60.4% |

| Corporate

and Other |

(20,396) |

(22,816) |

10.6% |

-73.8% |

|

(64,368) |

(70,358) |

8.5% |

-95.1% |

| TOTAL |

124,999 |

129,120 |

-3.2% |

22.9% |

|

352,716 |

339,680 |

3.8% |

15.0% |

Figure

10. Average Exchange Rate per Quarter*

| |

Brazil |

Mexico |

Argentina |

| 3Q24 |

5.55 |

18.95 |

941.31 |

| 3Q23 |

4.88 |

17.07 |

312.54 |

Local $ per 1 US$

|

Summarized

Consolidated Balance Sheet |

|

Figure

11. Summarized Consolidated Balance Sheet

(In

thousands of U.S. dollars)

| |

|

September

30, |

December

31, |

| |

|

2024 |

2023 |

| ASSETS |

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

|

115,908 |

196,661 |

| Short-term investments |

|

4,899 |

50,106 |

| Accounts and notes receivable, net |

|

135,059 |

147,980 |

| Other current assets (1) |

|

250,123 |

210,531 |

| Derivative instruments |

|

266 |

— |

| Total current assets |

|

506,255 |

605,278 |

| Non-current assets |

|

|

|

| Property and equipment, net |

|

1,161,066 |

1,119,885 |

| Net intangible assets and goodwill |

|

67,942 |

70,026 |

| Deferred income taxes |

|

103,964 |

98,163 |

| Derivative instruments |

|

67,914 |

46,486 |

| Equity method investments |

|

16,457 |

18,111 |

| Leases right of use asset |

|

963,296 |

954,564 |

| Other non-current assets (2) |

|

74,223 |

106,725 |

| Total non-current assets |

|

2,454,862 |

2,413,960 |

| Total assets |

|

2,961,117 |

3,019,238 |

| LIABILITIES AND EQUITY |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

|

328,168 |

374,986 |

| Taxes payable (3) |

|

152,866 |

163,143 |

| Accrued payroll and other liabilities |

|

142,591 |

142,487 |

| Royalties payable to McDonald’s

Corporation |

|

16,886 |

21,292 |

| Provision for contingencies |

|

1,239 |

1,447 |

| Interest payable |

|

19,069 |

7,447 |

| Financial debt (4) |

|

46,621 |

37,361 |

| Operating lease liabilities |

|

96,031 |

93,507 |

| Total current liabilities |

|

803,471 |

841,670 |

| Non-current liabilities |

|

|

|

| Accrued payroll and other liabilities |

|

21,913 |

27,513 |

| Provision for contingencies |

|

34,912 |

49,172 |

| Financial debt (5) |

|

721,558 |

729,771 |

| Deferred income taxes |

|

6,082 |

1,166 |

| Operating lease liabilities |

|

859,707 |

853,107 |

| Total non-current liabilities |

|

1,644,172 |

1,660,729 |

| Total liabilities |

|

2,447,643 |

2,502,399 |

| Equity |

|

|

|

| Class A shares of common stock |

|

389,967 |

389,907 |

| Class B shares of common stock |

|

132,915 |

132,915 |

| Additional paid-in capital |

|

8,659 |

8,719 |

| Retained earnings |

|

605,986 |

566,188 |

| Accumulated other comprehensive loss |

|

(605,957) |

(563,081) |

| Common stock in treasury |

|

(19,367) |

(19,367) |

| Total Arcos Dorados Holdings Inc shareholders’

equity |

|

512,203 |

515,281 |

| Non-controlling interest in subsidiaries |

|

1,271 |

1,558 |

| Total equity |

|

513,474 |

516,839 |

| Total

liabilities and equity |

|

2,961,117 |

3,019,238 |

| (1) | Includes

"Other receivables", "Inventories" and "Prepaid expenses and other current assets”. |

| (2) | Includes

"Miscellaneous" and "Collateral deposits". |

| (3) | Includes

"Income taxes payable" and "Other taxes payable". |

| (4) | Includes

"Short-term debt”, “Current portion of long-term debt" and "Derivative instruments”. |

| (5) | Includes

"Long-term debt, excluding current portion" and "Derivative instruments". |

Thank

you!

|

|

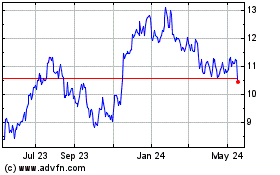

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Feb 2025 to Mar 2025

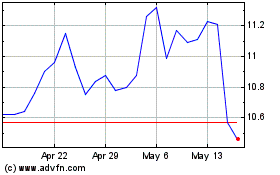

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Mar 2024 to Mar 2025