For the fourth quarter of 2023, the Company reports:

- Net loss attributable to common shareholders of $(150)

million, or $(1.76) per diluted common share, and operating loss of

$(107) million, or $(1.25) per diluted common share

- As previously announced, net adverse prior year reserve

development of $425 million, pre-tax, or 33.6 points, and

underlying operating income of $254 million, or $2.94 per diluted

common share

- Improvement of 3.7 points in the current accident year

combined ratio to 91.0%

For the year ended 2023, the Company reports:

- Net income available to common shareholders of $346 million,

or $4.02 per diluted common share, and operating income of $486

million, or $5.65 per diluted common share

- As previously announced, net adverse prior year reserve

development of $412 million, pre-tax, or 8.1 points, and underlying

operating income of $847 million, or $9.85 per diluted common

share

- Improvement of 4.5 points in the current accident year

combined ratio to 91.8%

- Return on average common equity ("ROACE") of 7.9% and

operating ROACE of 11.0%

- Book value per diluted common share of $54.06, an increase

of $7.11, or 15.1%, compared to December 31, 2022

AXIS Capital Holdings Limited ("AXIS Capital" or "AXIS" or "the

Company") (NYSE: AXS) today announced financial results for the

fourth quarter ended December 31, 2023.

Commenting on the fourth quarter 2023 financial results, Vince

Tizzio, President and CEO of AXIS Capital, said:

"This was a transformative year for AXIS, one

where we further elevated all aspects of how we operate and go to

market, and we believe the Company is on a clear path to becoming a

specialty underwriting leader. We’re capitalizing on favorable

conditions in our chosen specialty markets while exhibiting

underwriting discipline and strong cycle management. This was

evidenced by our operating income of $486 million and a 4.5 point

year-over-year improvement in the current accident year combined

ratio to 91.8%.

"We’re energized by the continued profitable

growth within our core specialty insurance business, highlighted by

year-over-year increases in premium generation of 10% including new

business premiums of 18%, and an excellent current accident year

combined ratio of 87.4%. In parallel, we further solidified our

repositioning of AXIS Re as a focused specialist reinsurer with

increased profitability and reduced volatility.

"In 2023, through our 'How We Work' program,

we made significant improvements to our operational infrastructure,

while investing in talent, and becoming a more efficient and

consistent company. We look ahead to 2024 with excitement. We have

a robust global platform, strong and deep relationships with our

customers, a great team and culture – and we’re relentlessly

committed to taking this Company to the next level."

Consolidated Highlights*

- Net income available to common shareholders for the year ended

December 31, 2023 was $346 million, or $4.02 per diluted common

share, compared to net income available to common shareholders of

$193 million, or $2.25 per diluted common share, for the same

period in 2022.

- Operating income(1) for the year ended December 31, 2023 was

$486 million, or $5.65 per diluted common share, compared to

operating income of $498 million, or $5.81 per diluted common

share, for the same period in 2022.

- Underlying operating income(2) for the year ended December 31,

2023 was $847 million, or $9.85 per diluted common share.

- Book value per diluted common share was $54.06 at December 31,

2023, an increase of $2.89, or 5.6%, compared to September 30,

2023, driven by net unrealized investment gains reported in

accumulated other comprehensive income (loss), partially offset by

net loss for the period, and common share dividends declared.

- Book value per diluted common share increased by $7.11, or

15.1%, over the past twelve months, driven by net income, and net

unrealized investment gains reported in accumulated other

comprehensive income (loss), partially offset by common share

dividends declared.

- Adjusted for dividends declared, book value per diluted common

share increased by $8.87, or 18.9%, over the past twelve

months.

- Book yield of fixed maturities was 4.2% at December 31, 2023,

compared to 3.5% at December 31, 2022. The market yield was 5.4% at

December 31, 2023.

- Net investment income for the fourth quarter of 2023 was $187

million, compared to $147 million, for the fourth quarter of 2022,

attributable to an increase in income from our fixed maturities

portfolio due to increased yields.

* Amounts may not reconcile due to rounding differences. 1

Operating income (loss) and operating income (loss) per diluted

common share are non-GAAP financial measures as defined in SEC

Regulation G. The reconciliations to the most comparable GAAP

financial measures, net income (loss) available (attributable) to

common shareholders and earnings (loss) per diluted common share,

respectively, and a discussion of the rationale for the

presentation of these items are provided later in this press

release. 2 Underlying operating income (loss) and underlying

operating income (loss) per diluted common share are non-GAAP

financial measures as defined in SEC Regulation G. The

reconciliations to the most comparable GAAP financial measures, net

income (loss) available (attributable) to common shareholders and

earnings (loss) per diluted common share, respectively, and a

discussion of the rationale for the presentation of these items are

provided later in this press release.

Fourth Quarter Consolidated Underwriting

Highlights3

- Gross premiums written increased by $26 million, or 1%, to $1.8

billion with an increase of $113 million, or 8% in the insurance

segment, partially offset by a decrease of $87 million, or 30% in

the reinsurance segment.

- Net premiums written decreased by $24 million, or 2%, ($30

million, or 3%, on a constant currency basis(4)), to $1.1 billion

with an increase of $83 million, or 9% in the insurance segment,

offset by a decrease of $107 million, or 51% in the reinsurance

segment.

Quarters ended December

31,

KEY RATIOS

2023

2022

Change

Current accident year loss ratio,

excluding catastrophe and weather-related losses(5)

55.4

%

55.5

%

(0.1 pts)

Catastrophe and weather-related losses

ratio

2.1

%

4.7

%

(2.6 pts)

Current accident year loss ratio

57.5

%

60.2

%

(2.7 pts)

Prior year reserve development ratio

33.6

%

(0.6

%)

34.2 pts

Net losses and loss expenses ratio

91.1

%

59.6

%

31.5 pts

Acquisition cost ratio

20.1

%

20.6

%

(0.5 pts)

General and administrative expense

ratio

13.4

%

13.9

%

(0.5 pts)

Combined ratio

124.6

%

94.1

%

30.5 pts

Current accident year combined ratio

91.0

%

94.7

%

(3.7 pts)

Current accident year combined ratio,

excluding catastrophe and weather-related losses

88.9

%

90.0

%

(1.1 pts)

- Pre-tax catastrophe and weather-related losses, net of

reinsurance, were $26 million ($21 million, after-tax), (Insurance:

$23 million; Reinsurance: $3 million), or 2.1 points.

- Net (adverse) favorable prior year reserve development was

$(425) million (Insurance: $(182) million; Reinsurance: $(243)

million).

3 All comparisons are with the same period of the prior year,

unless otherwise stated. 4 Amounts presented on a constant currency

basis are non-GAAP financial measures as defined in SEC Regulation

G. The constant currency basis is calculated by applying the

average foreign exchange rate from the current year to prior year

amounts. The reconciliations to the most comparable GAAP financial

measures is provided above and a discussion of the rationale for

the presentation of these items is provided later in this press

release. 5 The current accident year loss ratio, excluding

catastrophe and weather-related losses is calculated by dividing

the current accident year losses less pre-tax catastrophe and

weather-related losses, net of reinsurance, by net premiums earned

less reinstatement premiums.

Full Year Consolidated Underwriting

Highlights

- Gross premiums written increased by $142 million, or 2%, to

$8.4 billion with an increase of $555 million, or 10% in the

insurance segment, partially offset by a decrease of $413 million,

or 16% in the reinsurance segment.

- Net premiums written decreased by $161 million, or 3% ($101

million, or 2%, on a constant currency basis), to $5.1 billion with

an increase of $381 million, or 11% in the insurance segment,

offset by a decrease of $542 million, or 29% in the reinsurance

segment.

Years ended December

31,

KEY RATIOS

2023

2022

Change

Current accident year loss ratio,

excluding catastrophe and weather-related losses

55.9

%

55.5

%

0.4 pts

Catastrophe and weather-related losses

ratio

2.7

%

7.8

%

(5.1 pts)

Current accident year loss ratio

58.6

%

63.3

%

(4.7 pts)

Prior year reserve development ratio

8.1

%

(0.5

%)

8.6 pts

Net losses and loss expenses ratio

66.7

%

62.8

%

3.9 pts

Acquisition cost ratio

19.7

%

19.8

%

(0.1 pts)

General and administrative expense

ratio

13.5

%

13.2

%

0.3 pts

Combined ratio

99.9

%

95.8

%

4.1 pts

Current accident year combined ratio

91.8

%

96.3

%

(4.5 pts)

Current accident year combined ratio,

excluding catastrophe and weather-related losses

89.1

%

88.5

%

0.6 pts

- Pre-tax catastrophe and weather-related losses, net of

reinsurance, were $138 million ($116 million, after-tax),

(Insurance: $111 million; Reinsurance: $27 million), or 2.7

points.

- Net (adverse) favorable prior year reserve development was

$(412) million (Insurance: $(176) million; Reinsurance: $(236)

million).

Segment Highlights

Insurance Segment

Quarters ended December

31,

($ in thousands)

2023

2022

Change

Gross premiums written

$

1,583,378

$

1,470,805

7.7

%

Net premiums written

969,871

886,786

9.4

%

Net premiums earned

916,779

830,514

10.4

%

Underwriting income (loss)

(61,675

)

123,370

nm

Underwriting ratios:

Current accident year loss ratio,

excluding catastrophe and weather-related losses

52.0

%

49.3

%

2.7 pts

Catastrophe and weather-related losses

ratio

2.5

%

4.1

%

(1.6 pts)

Current accident year loss ratio

54.5

%

53.4

%

1.1 pts

Prior year reserve development ratio

19.8

%

(0.5

%)

20.3 pts

Net losses and loss expenses ratio

74.3

%

52.9

%

21.4 pts

Acquisition cost ratio

19.1

%

18.6

%

0.5 pts

Underwriting-related general and

administrative expense ratio

13.3

%

13.7

%

(0.4 pts)

Combined ratio

106.7

%

85.2

%

21.5 pts

Current accident year combined ratio

86.9

%

85.7

%

1.2 pts

Current accident year combined ratio,

excluding catastrophe and weather-related losses

84.4

%

81.6

%

2.8 pts

nm - not meaningful is defined as a

variance greater than +/- 100%

- Gross premiums written increased by $113 million, or 8% ($102

million, or 7%, on a constant currency basis), attributable to

increases in all lines of business with the exception of

professional lines which decreased in the quarter, principally due

to the unattractive pricing environment for U.S. public D&O

business.

- Net premiums written increased by $83 million, or 9% ($74

million, or 8%, on a constant currency basis), reflecting the

increase in gross premiums written in the quarter, together with a

decrease in premiums ceded in professional lines.

- The current accident year loss ratio, excluding catastrophe and

weather-related losses is consistent with recent quarters whereas

the ratio in the prior year quarter was particularly

favorable.

- The acquisition cost ratio increased by 0.5 points, primarily

related to an increase in profit commissions.

- The underwriting-related general and administrative expense

ratio decreased by 0.4 points, mainly driven by an increase in net

premiums earned, partially offset by an increase in personnel

costs.

Years ended December

31,

($ in thousands)

2023

2022

Change

Gross premiums written

$

6,140,764

$

5,585,581

9.9

%

Net premiums written

3,758,720

3,377,906

11.3

%

Net premiums earned

3,461,700

3,134,155

10.5

%

Underwriting income

260,944

327,318

(20.3

%)

Underwriting ratios:

Current accident year loss ratio,

excluding catastrophe and weather-related losses

51.8

%

51.0

%

0.8 pts

Catastrophe and weather-related losses

ratio

3.2

%

6.5

%

(3.3 pts)

Current accident year loss ratio

55.0

%

57.5

%

(2.5 pts)

Prior year reserve development ratio

5.1

%

(0.5

%)

5.6 pts

Net losses and loss expenses ratio

60.1

%

57.0

%

3.1 pts

Acquisition cost ratio

18.7

%

18.4

%

0.3 pts

Underwriting-related general and

administrative expense ratio

13.7

%

14.2

%

(0.5 pts)

Combined ratio

92.5

%

89.6

%

2.9 pts

Current accident year combined ratio

87.4

%

90.1

%

(2.7 pts)

Current accident year combined ratio,

excluding catastrophe and weather-related losses

84.2

%

83.6

%

0.6 pts

- Gross premiums written increased by $555 million, or 10%,

attributable to increases in all lines of business with the

exception of professional lines which decreased in the year

principally due to the unattractive pricing environment for U.S.

public D&O business, together with the reduction in activity in

transactional liability business.

- Net premiums written increased by $381 million, or 11% ($392

million, or 12%, on a constant currency basis), reflecting the

increase in gross premiums written, together with a decrease in

premiums ceded in professional lines.

Reinsurance Segment

Quarters ended December

31,

($ in thousands)

2023

2022

Change

Gross premiums written

$

200,915

$

287,891

(30.2

%)

Net premiums written

102,384

209,768

(51.2

%)

Net premiums earned

348,494

509,648

(31.6

%)

Underwriting income (loss)

(212,398

)

8,861

nm

Underwriting ratios:

Current accident year loss ratio,

excluding catastrophe and weather-related losses

64.5

%

65.5

%

(1.0 pts)

Catastrophe and weather-related losses

ratio

0.8

%

5.7

%

(4.9 pts)

Current accident year loss ratio

65.3

%

71.2

%

(5.9 pts)

Prior year reserve development ratio

69.8

%

(0.8

%)

70.6 pts

Net losses and loss expenses ratio

135.1

%

70.4

%

64.7 pts

Acquisition cost ratio

22.6

%

23.7

%

(1.1 pts)

Underwriting-related general and

administrative expense ratio

5.1

%

4.7

%

0.4 pts

Combined ratio

162.8

%

98.8

%

64.0 pts

Current accident year combined ratio

93.0

%

99.6

%

(6.6 pts)

Current accident year combined ratio,

excluding catastrophe and weather-related losses

92.2

%

93.9

%

(1.7 pts)

nm - not meaningful is defined as a

variance greater than +/- 100%

- Gross premiums written decreased by $87 million, or 30% ($83

million, or 29%, on a constant currency basis), primarily

attributable to a lower level of positive premium adjustments in

the quarter compared to the prior year and the timing of renewals

of significant contracts.

- Net premiums written decreased by $107 million, or 51% ($104

million, or 49%, on a constant currency basis), reflecting the

decrease in gross premiums written in the quarter, together with an

increase in premiums ceded associated with a new quota share

retrocession agreement.

- The current accident year loss ratio, excluding catastrophe and

weather-related losses, decreased by 1.0 point, principally due to

favorable pricing over loss trends experienced in most lines of

business. In addition, the prior year quarter included the impact

of a year-to-date update to loss ratios to reflect the inflationary

environment.

- The acquisition cost ratio decreased by 1.1 points, primarily

related to an increase in ceding commissions from retrocessional

agreements due to changes in business mix largely associated with

increases in credit and surety, accident and health, liability, and

motor lines written in recent periods.

Years ended December

31,

($ in thousands)

2023

2022

Change

Gross premiums written

$

2,215,761

$

2,629,014

(15.7

%)

Net premiums written

1,343,605

1,885,150

(28.7

%)

Net premiums earned

1,622,081

2,026,171

(19.9

%)

Underwriting income (loss)

(100,182

)

31,365

nm

Underwriting ratios:

Current accident year loss ratio,

excluding catastrophe and weather-related losses

64.8

%

62.6

%

2.2 pts

Catastrophe and weather-related losses

ratio

1.6

%

9.7

%

(8.1 pts)

Current accident year loss ratio

66.4

%

72.3

%

(5.9 pts)

Prior year reserve development ratio

14.6

%

(0.4

%)

15.0 pts

Net losses and loss expenses ratio

81.0

%

71.9

%

9.1 pts

Acquisition cost ratio

21.7

%

21.9

%

(0.2 pts)

Underwriting-related general and

administrative expense ratio

4.9

%

5.3

%

(0.4 pts)

Combined ratio

107.6

%

99.1

%

8.5 pts

Current accident year combined ratio

93.0

%

99.5

%

(6.5 pts)

Current accident year combined ratio,

excluding catastrophe and weather-related losses

91.4

%

89.8

%

1.6 pts

nm - not meaningful is defined as a

variance greater than +/- 100%

- Gross premiums written decreased by $413 million, or 16% ($365

million, or 14%, on a constant currency basis) including a decrease

of $280 million attributable to run-off lines. In addition, a

decrease of $19 million was associated with the exit from aviation

business. In ongoing specialty lines, decreases in liability,

motor, and professional lines were due to non-renewals.

- Net premiums written decreased by $542 million, or 29% ($493

million, or 26%, on a constant currency basis), reflecting the

decrease in gross premiums written, together with an increase in

premiums ceded associated with a new quota share retrocession

agreement.

Investments

Quarters ended December

31,

Years ended December

31,

($ in thousands)

2023

2022

2023

2022

Net investment income

$

186,937

$

147,085

$

611,742

$

418,829

Net investments gains (losses)

23,041

(42,558

)

(74,630

)

(456,789

)

Change in net unrealized gains (losses) on

fixed

maturities(6)

466,386

233,273

448,477

(909,150

)

Interest in income (loss) of equity method

investments

1,328

(3,045

)

4,163

1,995

Total

$

677,692

$

334,755

$

989,752

$

(945,115

)

Average cash and investments(7)

$

16,395,033

$

15,782,384

$

16,155,418

$

15,963,535

Total return on average cash and

investments, pre-tax:

Including investment related foreign

exchange movements

4.1

%

2.1

%

6.1

%

(5.9

%)

Excluding investment related foreign

exchange movements(8)

3.8

%

1.6

%

5.8

%

(5.2

%)

- Net investment income increased by $40 million, or 27%, in the

quarter, compared to the fourth quarter of 2022, attributable to an

increase in income from our fixed maturities portfolio due to

increased yields.

- Net investment gains recognized in net income for the quarter

included net unrealized gains of $50 million ($37 million excluding

foreign exchange movements), attributable to an increase in the

market value of our equity securities portfolio.

- Net unrealized gains, pre-tax of $466 million ($422 million

excluding foreign exchange movements) were recognized in other

comprehensive income (loss) in the quarter due to an increase in

the market value of our fixed maturities portfolio attributable to

a decline in yields, compared to net unrealized gains, pre-tax of

$233 million ($182 million excluding foreign exchange movements)

recognized during the fourth quarter of 2022.

- Book yield of fixed maturities was 4.2% at December 31, 2023,

compared to 3.5% at December 31, 2022. The market yield was 5.4% at

December 31, 2023.

6 Change in net unrealized gains (losses) on fixed maturities is

calculated by taking net unrealized gains (losses) at period end

less net unrealized gains (losses) at the prior period end. 7 The

average cash and investments balance is calculated by taking the

average of the monthly fair value balances. 8 Pre-tax total return

on cash and investments excluding foreign exchange movements is a

non-GAAP financial measure as defined in SEC Regulation G. The

reconciliation to pre-tax total return on cash and investments, the

most comparable GAAP financial measure, also included foreign

exchange (losses) gains of $60 million and $78 million for the

quarters ended December 31, 2023 and 2022, respectively, and

foreign exchange (losses) gains of $51 million and $(110) million

for the years ended December 31, 2023 and 2022, respectively.

Capitalization / Shareholders’

Equity

December 31,

December 31,

($ in thousands)

2023

2022

Change

Total capital(9)

$

6,576,910

$

5,952,224

$

624,686

- Total capital of $6.6 billion included $1.3 billion of debt and

$550 million of preferred equity, compared to $6.0 billion at

December 31, 2022, with the increase driven by net income, and net

unrealized investment gains reported in accumulated other

comprehensive income (loss), partially offset by common share

dividends declared.

- On December 7, 2023, the Company's Board of Directors

authorized the renewal of the share repurchase program for up to

$100 million of the Company's common shares, effective January 1,

2024, through December 31, 2024.

Book Value per diluted common

share

December 31,

September 30,

December 31,

2023

2023

2022

Book value per diluted common

share(10)

$

54.06

$

51.17

$

46.95

- Dividends declared were $0.44 per common share in the current

quarter and $1.76 per common share over the past twelve

months.

Three months ended,

Twelve months ended,

December 31, 2023

December 31, 2023

Change

% Change

Change

% Change

Book value per diluted common share

$

2.89

5.6

%

$

7.11

15.1

%

Book value per diluted common share -

adjusted for dividends declared

$

3.33

6.5

%

$

8.87

18.9

%

- Book value per diluted common share increased by $2.89 in the

quarter, driven by net unrealized investment gains reported in

accumulated other comprehensive income (loss), partially offset by

the net loss for the period, and common share dividends

declared.

- Book value per diluted common share increased by $7.11 over the

past twelve months, driven by net income, and net unrealized

investment gains reported in accumulated other comprehensive income

(loss), partially offset by common share dividends declared.

- Adjusted for net unrealized investment losses, after-tax,

reported in accumulated other comprehensive income (loss), book

value per diluted common share was $58.05.

- Adjusted for dividends declared, the book value per diluted

common share increased by $3.33 for the quarter, and increased by

$8.87 over the past twelve months.

9 Total capital represents the sum of total shareholders' equity

and debt. 10 Calculated using the treasury stock method.

Conference Call

We will host a conference call on Thursday, February 1, 2024 at

9:30 a.m. (EST) to discuss the fourth quarter and year-end

financial results and related matters. The teleconference can be

accessed by dialing 1-877-883-0383 (U.S. callers), or

1-412-902-6506 (international callers), and entering the passcode

4812106 approximately ten minutes in advance of the call. A live,

listen-only webcast of the call will also be available via the

Investor Information section of our website at www.axiscapital.com.

A replay of the teleconference will be available for two weeks by

dialing 1-877-344-7529 (U.S. callers), or 1-412-317-0088

(international callers), and entering the passcode 6289247. The

webcast will be archived in the Investor Information section of our

website.

In addition, an investor financial supplement for the quarter

ended December 31, 2023 is available in the Investor Information

section of our website.

About AXIS Capital

AXIS Capital, through its operating subsidiaries, is a global

specialty underwriter and provider of insurance and reinsurance

solutions. The Company has shareholders’ equity of $5.3 billion at

December 31, 2023, and locations in Bermuda, the United States,

Europe, Singapore and Canada. Its operating subsidiaries have been

assigned a financial strength rating of "A+" ("Strong") by Standard

& Poor’s and "A" ("Excellent") by A.M. Best. For more

information about AXIS Capital, visit our website at

www.axiscapital.com.

Website and Social Media Disclosure

We use our website (www.axiscapital.com) and our corporate

LinkedIn (AXIS Capital) and X Corp. (@AXIS_Capital) accounts as

channels of distribution of Company information. The information we

post through these channels may be deemed material. Accordingly,

investors should monitor these channels, in addition to following

our press releases, SEC filings and public conference calls and

webcasts. In addition, e-mail alerts and other information about

AXIS Capital may be received by those enrolled in our "E-mail

Alerts" program which can be found in the Investor Information

section of our website (www.axiscapital.com). The contents of our

website and social media channels are not part of this press

release.

Follow AXIS Capital on LinkedIn and X Corp.

LinkedIn: http://bit.ly/2kRYbZ5

AXIS CAPITAL HOLDINGS

LIMITED

CONSOLIDATED BALANCE

SHEETS

DECEMBER 31, 2023 (UNAUDITED)

AND DECEMBER 31, 2022

2023

2022

(in thousands)

Assets

Investments:

Fixed maturities, available for sale, at

fair value

$

12,234,742

$

11,326,894

Fixed maturities, held to maturity, at

amortized cost

686,296

698,351

Equity securities, at fair value

588,511

485,253

Mortgage loans, held for investment, at

fair value

610,148

627,437

Other investments, at fair value

949,413

996,751

Equity method investments

174,634

148,288

Short-term investments, at fair value

17,216

70,310

Total investments

15,260,960

14,353,284

Cash and cash equivalents

953,476

751,415

Restricted cash and cash equivalents

430,509

423,238

Accrued interest receivable

106,055

94,418

Insurance and reinsurance premium balances

receivable

3,067,554

2,733,464

Reinsurance recoverable on unpaid losses

and loss expenses

6,323,083

5,831,172

Reinsurance recoverable on paid losses and

loss expenses

575,847

539,676

Deferred acquisition costs

450,950

473,569

Prepaid reinsurance premiums

1,916,087

1,550,370

Receivable for investments sold

8,767

16,052

Goodwill

100,801

100,801

Intangible assets

186,883

197,800

Operating lease right-of-use assets

108,093

92,214

Loan advances made

305,222

87,160

Other assets

456,385

438,338

Total assets

$

30,250,672

$

27,682,971

Liabilities

Reserve for losses and loss expenses

$

16,434,018

$

15,168,863

Unearned premiums

4,747,602

4,361,447

Insurance and reinsurance balances

payable

1,792,719

1,609,924

Debt

1,313,714

1,312,314

Federal Home Loan Bank advances

85,790

81,388

Payable for investments purchased

26,093

19,693

Operating lease liabilities

123,101

102,577

Other liabilities

464,439

386,855

Total liabilities

24,987,476

23,043,061

Shareholders' equity

Preferred shares

550,000

550,000

Common shares

2,206

2,206

Additional paid-in capital

2,383,030

2,366,253

Accumulated other comprehensive income

(loss)

(365,836

)

(760,300

)

Retained earnings

6,440,528

6,247,022

Treasury shares, at cost

(3,746,732

)

(3,765,271

)

Total shareholders' equity

5,263,196

4,639,910

Total liabilities and shareholders'

equity

$

30,250,672

$

27,682,971

AXIS CAPITAL HOLDINGS

LIMITED

CONSOLIDATED STATEMENTS OF

OPERATIONS

FOR THE QUARTERS AND YEARS

ENDED DECEMBER 31, 2023 AND 2022

Quarters ended

Years ended

2023

(Unaudited)

2022

(Unaudited)

2023

(Unaudited)

2022

(in thousands, except per

share amounts)

Revenues

Net premiums earned

$

1,265,273

$

1,340,162

$

5,083,781

$

5,160,326

Net investment income

186,937

147,085

611,742

418,829

Net investment gains (losses)

23,041

(42,558

)

(74,630

)

(456,789

)

Other insurance related income

6,050

3,076

22,495

13,073

Total revenues

1,481,301

1,447,765

5,643,388

5,135,439

Expenses

Net losses and loss expenses

1,152,262

798,214

3,393,102

3,242,410

Acquisition costs

253,918

275,573

1,000,945

1,022,017

General and administrative expenses

169,849

187,472

684,446

680,343

Foreign exchange losses (gains)

69,871

78,989

58,115

(157,945

)

Interest expense and financing costs

18,344

16,426

68,421

63,146

Reorganization expenses

—

9,485

28,997

31,426

Amortization of intangible assets

2,729

2,729

10,917

10,917

Total expenses

1,666,973

1,368,888

5,244,943

4,892,314

Income (loss) before income taxes and

interest in income (loss) of equity method investments

(185,672

)

78,877

398,445

243,125

Income tax (expense) benefit

41,762

(27,341

)

(26,316

)

(22,037

)

Interest in income (loss) of equity method

investments

1,328

(3,045

)

4,163

1,995

Net income (loss)

(142,582

)

48,491

376,292

223,083

Preferred share dividends

7,563

7,563

30,250

30,250

Net income (loss) available

(attributable) to common shareholders

$

(150,145

)

$

40,928

$

346,042

$

192,833

Per share data

Earnings (loss) per common

share:

Earnings (loss) per common share

$

(1.76

)

$

0.48

$

4.06

$

2.27

Earnings (loss) per diluted common

share

$

(1.76

)

$

0.48

$

4.02

$

2.25

Weighted average common shares

outstanding

85,268

84,667

85,142

84,864

Weighted average diluted common shares

outstanding

85,268

85,655

86,012

85,669

Cash dividends declared per common

share

$

0.44

$

0.44

$

1.76

$

1.73

AXIS CAPITAL HOLDINGS

LIMITED

CONSOLIDATED SEGMENTAL DATA

(UNAUDITED)

FOR THE QUARTERS ENDED

DECEMBER 31, 2023 AND 2022

2023

2022

Insurance

Reinsurance

Total

Insurance

Reinsurance

Total

(in thousands)

Gross premiums written

$

1,583,378

$

200,915

$

1,784,293

$

1,470,805

$

287,891

$

1,758,696

Net premiums written

969,871

102,384

1,072,255

886,786

209,768

1,096,554

Net premiums earned

916,779

348,494

1,265,273

830,514

509,648

1,340,162

Other insurance related income (loss)

(289

)

6,339

6,050

89

2,987

3,076

Net losses and loss expenses

(681,515

)

(470,747

)

(1,152,262

)

(439,268

)

(358,946

)

(798,214

)

Acquisition costs

(175,050

)

(78,868

)

(253,918

)

(154,859

)

(120,714

)

(275,573

)

Underwriting-related general and

administrative expenses(11)

(121,600

)

(17,616

)

(139,216

)

(113,106

)

(24,114

)

(137,220

)

Underwriting income (loss)(12)

$

(61,675

)

$

(212,398

)

(274,073

)

$

123,370

$

8,861

132,231

Net investment income

186,937

147,085

Net investment gains (losses)

23,041

(42,558

)

Corporate expenses(11)

(30,633

)

(50,252

)

Foreign exchange (losses) gains

(69,871

)

(78,989

)

Interest expense and financing costs

(18,344

)

(16,426

)

Reorganization expenses

—

(9,485

)

Amortization of intangible assets

(2,729

)

(2,729

)

Income (loss) before income taxes

and interest in income (loss) of equity method

investments

(185,672

)

78,877

Income tax (expense) benefit

41,762

(27,341

)

Interest in income (loss) of equity method

investments

1,328

(3,045

)

Net income (loss)

(142,582

)

48,491

Preferred share dividends

7,563

7,563

Net income (loss) available

(attributable to common shareholders

$

(150,145

)

$

40,928

Net losses and loss expenses ratio

74.3

%

135.1

%

91.1

%

52.9

%

70.4

%

59.6

%

Acquisition cost ratio

19.1

%

22.6

%

20.1

%

18.6

%

23.7

%

20.6

%

General and administrative expense

ratio

13.3

%

5.1

%

13.4

%

13.7

%

4.7

%

13.9

%

Combined ratio

106.7

%

162.8

%

124.6

%

85.2

%

98.8

%

94.1

%

11 Underwriting-related general and administrative expenses is a

non-GAAP financial measure as defined in SEC Regulation G. The

reconciliation to general and administrative expenses, the most

comparable GAAP financial measure, also included corporate expenses

of $31 million and $50 million for the quarters ended December 31,

2023 and 2022, respectively. Underwriting-related general and

administrative expenses and corporate expenses are included in the

general and administrative expense ratio. 12 Consolidated

underwriting income (loss) is a non-GAAP financial measure as

defined in SEC Regulation G. The reconciliation to net income

(loss), the most comparable GAAP financial measure, is presented in

the table above.

AXIS CAPITAL HOLDINGS

LIMITED

CONSOLIDATED SEGMENTAL

DATA

FOR THE YEARS ENDED DECEMBER

31, 2023 (UNAUDITED) AND 2022

2023

2022

Insurance

Reinsurance

Total

Insurance

Reinsurance

Total

(in thousands)

Gross premiums written

$

6,140,764

$

2,215,761

$

8,356,525

$

5,585,581

$

2,629,014

$

8,214,595

Net premiums written

3,758,720

1,343,605

5,102,325

3,377,906

1,885,150

5,263,056

Net premiums earned

3,461,700

1,622,081

5,083,781

3,134,155

2,026,171

5,160,326

Other insurance related income (loss)

(198

)

22,693

22,495

559

12,514

13,073

Net losses and loss expenses

(2,080,001

)

(1,313,101

)

(3,393,102

)

(1,785,854

)

(1,456,556

)

(3,242,410

)

Acquisition costs

(648,463

)

(352,482

)

(1,000,945

)

(577,838

)

(444,179

)

(1,022,017

)

Underwriting-related general and

administrative expenses(13)

(472,094

)

(79,373

)

(551,467

)

(443,704

)

(106,585

)

(550,289

)

Underwriting income (loss)(14)

$

260,944

$

(100,182

)

160,762

$

327,318

$

31,365

358,683

Net investment income

611,742

418,829

Net investment gains (losses)

(74,630

)

(456,789

)

Corporate expenses(13)

(132,979

)

(130,054

)

Foreign exchange (losses) gains

(58,115

)

157,945

Interest expense and financing costs

(68,421

)

(63,146

)

Reorganization expenses

(28,997

)

(31,426

)

Amortization of intangible assets

(10,917

)

(10,917

)

Income before income taxes and interest

in income of equity method investments

398,445

243,125

Income tax expense

(26,316

)

(22,037

)

Interest in income of equity method

investments

4,163

1,995

Net income

376,292

223,083

Preferred share dividends

30,250

30,250

Net income available to common

shareholders

$

346,042

$

192,833

Net losses and loss expenses ratio

60.1

%

81.0

%

66.7

%

57.0

%

71.9

%

62.8

%

Acquisition cost ratio

18.7

%

21.7

%

19.7

%

18.4

%

21.9

%

19.8

%

General and administrative expense

ratio

13.7

%

4.9

%

13.5

%

14.2

%

5.3

%

13.2

%

Combined ratio

92.5

%

107.6

%

99.9

%

89.6

%

99.1

%

95.8

%

13 Underwriting-related general and administrative expenses is a

non-GAAP financial measure as defined in SEC Regulation G. The

reconciliation to general and administrative expenses, the most

comparable GAAP financial measure, also included corporate expenses

of $133 million and $130 million for the years ended December 31,

2023 and 2022, respectively. Underwriting-related general and

administrative expenses and corporate expenses are included in the

general and administrative expense ratio. 14 Consolidated

underwriting income (loss) is a non-GAAP financial measure as

defined in SEC Regulation G. The reconciliation to net income

(loss), the most comparable GAAP financial measure, is presented in

the table above.

AXIS CAPITAL HOLDINGS

LIMITED

NON-GAAP FINANCIAL MEASURES

RECONCILIATION (UNAUDITED)

OPERATING INCOME, UNDERLYING

OPERATING INCOME, AND OPERATING RETURN ON AVERAGE COMMON

EQUITY

FOR THE QUARTERS AND YEARS

ENDED DECEMBER 31, 2023 AND 2022

Quarters ended

Years ended

2023

2022

2023

2022

(in thousands, except per

share amounts)

Net income (loss) available (attributable)

to common shareholders

$

(150,145

)

$

40,928

$

346,042

$

192,833

Net investment (gains) losses (15)

(23,041

)

42,558

74,630

456,789

Foreign exchange losses (gains) (16)

69,871

78,989

58,115

(157,945

)

Reorganization expenses (17)

—

9,485

28,997

31,426

Interest in (income) loss of equity method

investments (18)

(1,328

)

3,045

(4,163

)

(1,995

)

Income tax benefit

(2,348

)

(8,397

)

(17,488

)

(23,177

)

Operating income (loss) (19)

$

(106,991

)

$

166,608

$

486,133

$

497,931

Net losses and loss expenses (20)

425,001

—

425,001

—

Associated income tax benefit (20)

(64,038

)

—

(64,038

)

—

Underlying operating income

$

253,972

$

166,608

$

847,096

$

497,931

Earnings (loss) per diluted common

share

$

(1.76

)

$

0.48

$

4.02

$

2.25

Net investment (gains) losses

(0.27

)

0.50

0.87

5.33

Foreign exchange losses (gains)

0.82

0.92

0.68

(1.84

)

Reorganization expenses

—

0.11

0.34

0.37

Interest in (income) loss of equity method

investments

(0.02

)

0.04

(0.05

)

(0.02

)

Income tax benefit

(0.02

)

(0.10

)

(0.21

)

(0.28

)

Operating income (loss) per diluted common

share (19)

$

(1.25

)

$

1.95

$

5.65

$

5.81

Net losses and loss expenses

4.93

—

4.94

—

Associated income tax benefit

(0.74

)

—

(0.74

)

—

Underlying operating income per diluted

common share

$

2.94

$

1.95

$

9.85

$

5.81

Weighted average common shares

outstanding

85,268

84,667

85,142

84,864

Weighted average diluted common shares

outstanding (19)

85,268

85,655

86,012

85,669

Weighted average diluted common shares

outstanding

86,270

85,655

86,012

85,669

Average common shareholders' equity

$

4,598,202

$

3,941,666

$

4,401,553

$

4,475,283

Annualized return on average common

equity

(13.1

%)

4.2

%

7.9

%

4.3

%

Annualized operating return on average

common equity (21)

(9.3

%)

16.9

%

11.0

%

11.1

%

15Tax expense (benefit) of $(1) million and $(2) million for the

quarters ended December 31, 2023 and 2022, respectively, and $(10)

million and $(36) million for the years ended December 31, 2023 and

2022, respectively. Tax impact is estimated by applying the

statutory rates of applicable jurisdictions, after consideration of

other relevant factors including the ability to utilize capital

losses. 16Tax expense (benefit) of $(1) million and $(5) million

for the quarters ended December 31, 2023 and 2022, respectively,

and $(3) million and $16 million for the years ended December 31,

2023 and 2022, respectively. Tax impact is estimated by applying

the statutory rates of applicable jurisdictions, after

consideration of other relevant factors including the tax status of

specific foreign exchange transactions. 17Tax expense (benefit) of

$nil and $(1) million for the quarters ended December 31, 2023 and

2022, respectively, and $(5) million and $(4) million for the years

ended December 31, 2023 and 2022, respectively. Tax impact is

estimated by applying the statutory rates of applicable

jurisdictions. 18Tax expense (benefit) of $nil for the quarters and

years ended December 31, 2023 and 2022. Tax impact is estimated by

applying the statutory rates of applicable jurisdictions. 19Due to

the operating loss recognized for the quarter ended December 31,

2023, the share equivalents were anti-dilutive. 20Net adverse prior

year reserve development of $425 million, pre-tax ($361 million,

post-tax) for the quarter ended December 31, 2023. 21Annualized

operating return on average common equity ("operating ROACE") is a

non-GAAP financial measure as defined in SEC Regulation G. The

reconciliation to annualized ROACE, the most comparable GAAP

financial measure is presented in the table above, and a discussion

of the rationale for its presentation is provided later in this

press release.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of section 27A of the Securities Act of 1933 and

section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts included in this press

release, including statements regarding our estimates, beliefs,

expectations, intentions, strategies or projections are

forward-looking statements. We intend these forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements in the United States federal securities

laws. In some cases, these statements can be identified by the use

of forward-looking words such as "may", "should", "could",

"anticipate", "estimate", "expect", "plan", "believe", "predict",

"potential", "intend" or similar expressions. These forward-looking

statements are not historical facts, and are based on current

expectations, estimates and projections, and various assumptions,

many of which, by their nature, are inherently uncertain and beyond

management's control.

Forward-looking statements contained in this press release may

include, but are not limited to, information regarding our

estimates for losses and loss expenses, measurements of potential

losses in the fair market value of our investment portfolio and

derivative contracts, our expectations regarding the performance of

our business, our financial results, our liquidity and capital

resources, the outcome of our strategic initiatives including our

exit from catastrophe and property reinsurance lines of business,

our expectations regarding pricing and other market and economic

conditions including the liquidity of financial markets,

developments in the commercial real estate market, inflation, our

growth prospects, and valuations of the potential impact of

movements in interest rates, credit spreads, equity securities'

prices, and foreign currency exchange rates.

Forward-looking statements only reflect our expectations and are

not guarantees of performance. These statements involve risks,

uncertainties, and assumptions. Accordingly, there are or will be

important factors that could cause actual events or results to

differ materially from those indicated in such statements. We

believe that these factors include, but are not limited to, the

following:

Insurance Risk

- the cyclical nature of the insurance and reinsurance business

leading to periods with excess underwriting capacity and

unfavorable premium rates;

- the occurrence and magnitude of natural and man-made disasters,

including the potential increase of our exposure to natural

catastrophe losses due to climate change and the potential for

inherently unpredictable losses from man-made catastrophes, such as

cyber-attacks;

- the effects of emerging claims, systemic risks, and coverage

and regulatory issues, including increasing litigation and

uncertainty related to coverage definitions, limits, terms and

conditions;

- actual claims exceeding reserves for losses and loss

expenses;

- losses related to the Israel-Hamas conflict, the Russian

invasion of Ukraine, terrorism and political unrest, or other

unanticipated losses;

- the adverse impact of inflation;

- the failure of any of the loss limitation methods we

employ;

- the failure of our cedants to adequately evaluate risks;

Strategic Risk

- underwriting and investment exposure in light of the recent

disruption in the banking sector, which we expect to be within our

risk appetite for an event of this nature;

- changes in the political environment of certain countries in

which we operate or underwrite business, including the United

Kingdom's withdrawal from the European Union;

- the loss of business provided to us by major brokers;

- a decline in our ratings with rating agencies;

- the loss of one or more of our key executives;

- increasing scrutiny and evolving expectations from investors,

customers, regulators, policymakers and other stakeholders

regarding environmental, social and governance matters;

- the adverse impact of contagious diseases (including COVID-19)

on our business, results of operations, financial condition, and

liquidity;

Credit and Market Risk

- the inability to purchase reinsurance or collect amounts due to

us from reinsurance we have purchased;

- the failure of our policyholders or intermediaries to pay

premiums;

- general economic, capital and credit market conditions,

including banking and commercial real estate sector instability,

financial market illiquidity and fluctuations in interest rates,

credit spreads, equity securities' prices, and/or foreign currency

exchange rates;

- breaches by third parties in our program business of their

obligations to us;

Liquidity Risk

- the inability to access sufficient cash to meet our obligations

when they are due;

Operational Risk

- changes in accounting policies or practices;

- the use of industry models and changes to these models;

- difficulties with technology and/or data security;

- the failure of the processes, people or systems that we rely on

to maintain our operations and manage the operational risks

inherent to our business, including those outsourced to third

parties;

Regulatory Risk

- changes in governmental regulations and potential government

intervention in our industry;

- inadvertent failure to comply with certain laws and regulations

relating to sanctions, foreign corrupt practices, data protection

and privacy; and

Risks Related to Taxation

Readers should carefully consider the risks noted above together

with other factors including but not limited to those described

under Item 1A, 'Risk Factors' in our most recent Annual Report on

Form 10-K filed with the Securities and Exchange Commission

("SEC"), as those factors may be updated from time to time in our

periodic and other filings with the SEC, which are accessible on

the SEC's website at www.sec.gov.

We undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Rationale for the Use of Non-GAAP Financial

Measures

We present our results of operations in a way we believe will be

meaningful and useful to investors, analysts, rating agencies and

others who use our financial information to evaluate our

performance. Some of the measurements we use are considered

non-GAAP financial measures under SEC rules and regulations. In

this press release, we present underwriting-related general and

administrative expenses, consolidated underwriting income (loss),

current accident year combined ratio, operating income (loss) (in

total and on a per share basis), annualized operating return on

average common equity ("operating ROACE"), underlying operating

income (loss) (in total and on a per share basis), amounts

presented on a constant currency basis and pre-tax total return on

cash and investments excluding foreign exchange movements which are

non-GAAP financial measures as defined in SEC Regulation G. We

believe that these non-GAAP financial measures, which may be

defined and calculated differently by other companies, help explain

and enhance the understanding of our results of operations.

However, these measures should not be viewed as a substitute for

those determined in accordance with accounting principles generally

accepted in the United States of America ("U.S. GAAP").

Underwriting-Related General and

Administrative Expenses

Underwriting-related general and administrative expenses include

those general and administrative expenses that are incremental

and/or directly attributable to our underwriting operations. While

this measure is presented in the 'Segment Information' note to our

Consolidated Financial Statements, it is considered a non-GAAP

financial measure when presented elsewhere on a consolidated

basis.

Corporate expenses include holding company costs necessary to

support our worldwide insurance and reinsurance operations and

costs associated with operating as a publicly-traded company. As

these costs are not incremental and/or directly attributable to our

underwriting operations, these costs are excluded from

underwriting-related general and administrative expenses, and

therefore, consolidated underwriting income (loss). General and

administrative expenses, the most comparable GAAP financial measure

to underwriting-related general and administrative expenses, also

includes corporate expenses.

The reconciliation of underwriting-related general and

administrative expenses to general and administrative expenses, the

most comparable GAAP financial measure, is presented in the

'Consolidated Segmental Data' section of this press release.

Consolidated Underwriting Income

(Loss)

Consolidated underwriting income (loss) is a pre-tax measure of

underwriting profitability that takes into account net premiums

earned and other insurance related income (loss) as revenues and

net losses and loss expenses, acquisition costs and

underwriting-related general and administrative expenses as

expenses. While this measure is presented in the 'Segment

Information' note to our Consolidated Financial Statements, it is

considered a non-GAAP financial measure when presented elsewhere on

a consolidated basis.

We evaluate our underwriting results separately from the

performance of our investment portfolio. As a result, we believe it

is appropriate to exclude net investment income and net investment

gains (losses) from our underwriting profitability measure.

Foreign exchange losses (gains) in our consolidated statements

of operations primarily relate to the impact of foreign exchange

rate movements on our net insurance-related liabilities. However,

we manage our investment portfolio in such a way that unrealized

and realized foreign exchange losses (gains) on our investment

portfolio, including unrealized foreign exchange losses (gains) on

our equity securities, and foreign exchange losses (gains) realized

on the sale of our available for sale investments and equity

securities recognized in net investment gains (losses), and

unrealized foreign exchange losses (gains) on our available for

sale investments in other comprehensive income (loss), generally

offset a large portion of the foreign exchange losses (gains)

arising from our underwriting portfolio, thereby minimizing the

impact of foreign exchange rate movements on total shareholders'

equity. As a result, we believe that foreign exchange losses

(gains) in our consolidated statements of operations in isolation

are not a meaningful contributor to our underwriting performance.

Therefore, foreign exchange losses (gains) are excluded from

consolidated underwriting income (loss).

Interest expense and financing costs primarily relate to

interest payable on our debt and Federal Home Loan Bank advances.

As these expenses are not incremental and/or directly attributable

to our underwriting operations, these expenses are excluded from

underwriting-related general and administrative expenses, and

therefore, consolidated underwriting income (loss).

Reorganization expenses in 2023 include impairments of computer

software assets and severance costs mainly attributable to our "How

We Work" program which is focused on simplifying our operating

structure. Reorganization expenses in 2022 included severance costs

and impairments of computer software assets mainly attributable to

our exit from catastrophe and property reinsurance lines of

business which was part of an overall approach to reduce our

exposure to volatile catastrophe risk. Reorganization expenses are

primarily driven by business decisions, the nature and timing of

which are not related to the underwriting process. Therefore, these

expenses are excluded from consolidated underwriting income

(loss).

Amortization of intangible assets arose from business decisions,

the nature and timing of which are not related to the underwriting

process. Therefore, these expenses are excluded from consolidated

underwriting income (loss).

We believe that the presentation of underwriting-related general

and administrative expenses and consolidated underwriting income

(loss) provides investors with an enhanced understanding of our

results of operations by highlighting the underlying pre-tax

profitability of our underwriting activities. The reconciliation of

consolidated underwriting income (loss) to net income (loss), the

most comparable GAAP financial measure, is presented in the

'Consolidated Segmental Data' section of this press release.

Current accident year combined

ratio

Current accident year combined ratio represents underwriting

results exclusive of net favorable (adverse) prior year reserve

development. We believe that the presentation of current accident

year combined ratio provides investors with an enhanced

understanding of our results of operations by highlighting the

profitability of our underwriting activities excluding the impact

of volatile prior year reserve development. A reconciliation to the

most comparable GAAP financial measure, combined ratio is provided

in the 'Fourth Quarter Consolidated Underwriting Highlights' and

'Full Year Consolidated Underwriting Highlights' sections of this

press release.

Operating Income (Loss)

Operating income (loss) represents after-tax operational results

exclusive of net investment gains (losses), foreign exchange losses

(gains), reorganization expenses and interest in income (loss) of

equity method investments.

Although the investment of premiums to generate income and

investment gains (losses) is an integral part of our operations,

the determination to realize investment gains (losses) is

independent of the underwriting process and is heavily influenced

by the availability of market opportunities. Furthermore, many

users believe that the timing of the realization of investment

gains (losses) is somewhat opportunistic for many companies.

Foreign exchange losses (gains) in our consolidated statements

of operations primarily relate to the impact of foreign exchange

rate movements on net insurance-related liabilities. However, we

manage our investment portfolio in such a way that unrealized and

realized foreign exchange losses (gains) on our investment

portfolio, including unrealized foreign exchange losses (gains) on

our equity securities, and foreign exchange losses (gains) realized

on the sale of our available for sale investments and equity

securities recognized in net investment gains (losses), and

unrealized foreign exchange losses (gains) on our available for

sale investments in other comprehensive income (loss), generally

offset a large portion of the foreign exchange losses (gains)

arising from our underwriting portfolio, thereby minimizing the

impact of foreign exchange rate movements on total shareholders'

equity. As a result, we believe that foreign exchange losses

(gains) in our consolidated statements of operations in isolation

are not a meaningful contributor to the performance of our

business. Therefore, foreign exchange losses (gains) are excluded

from operating income (loss).

Reorganization expenses in 2023 include impairments of computer

software assets and severance costs mainly attributable to our "How

We Work" program which is focused on simplifying our operating

structure. Reorganization expenses in 2022 included severance costs

and impairments of computer software assets mainly attributable to

our exit from catastrophe and property reinsurance lines of

business which was part of an overall approach to reduce our

exposure to volatile catastrophe risk. Reorganization expenses are

primarily driven by business decisions, the nature and timing of

which are not related to the underwriting process. Therefore, these

expenses are excluded from consolidated operating income

(loss).

Interest in income (loss) of equity method investments is

primarily driven by business decisions, the nature and timing of

which are not related to the underwriting process. Therefore, this

income (loss) is excluded from operating income (loss).

Certain users of our financial statements evaluate performance

exclusive of after-tax net investment gains (losses), foreign

exchange losses (gains), reorganization expenses and interest in

income (loss) of equity method investments to understand the

profitability of recurring sources of income.

We believe that showing net income (loss) available

(attributable) to common shareholders exclusive of after-tax net

investment gains (losses), foreign exchange losses (gains),

reorganization expenses and interest in income (loss) of equity

method investments reflects the underlying fundamentals of our

business. In addition, we believe that this presentation enables

investors and other users of our financial information to analyze

performance in a manner similar to how our management analyzes the

underlying business performance. We also believe this measure

follows industry practice and, therefore, facilitates comparison of

our performance with our peer group. We believe that equity

analysts and certain rating agencies that follow us, and the

insurance industry as a whole, generally exclude these items from

their analyses for the same reasons. The reconciliation of

operating income (loss) to net income (loss) available

(attributable) to common shareholders, the most comparable GAAP

financial measure, is presented in the 'Non-GAAP Financial Measures

Reconciliation' section of this press release.

We also present operating income (loss) per diluted common share

and annualized operating ROACE, which are derived from the

operating income (loss) measure and are reconciled to the most

comparable GAAP financial measures, earnings (loss) per diluted

common share and annualized return on average common equity

("ROACE"), respectively, in the 'Non-GAAP Financial Measures

Reconciliation' section of this press release.

Underlying Operating Income

(Loss)

Underlying operating income (loss) represents underwriting

results exclusive of net adverse prior year reserve development of

$425 million, pre-tax and $361 million, post-tax for the fourth

quarter of 2023. We believe that the presentation of underlying

operating income (loss) provides investors with an enhanced

understanding of our results of operations by highlighting the

profitability of our underwriting activities excluding the impact

of the fourth quarter net adverse prior year reserve development.

The reconciliation of underlying operating income (loss) to net

income (loss) available (attributable) to common shareholders, the

most comparable GAAP financial measure, is presented in the

'Non-GAAP Financial Measures Reconciliation' section of this press

release.

We also present underlying operating income (loss) per diluted

common share which is derived from the underlying operating income

(loss) measure and is reconciled to the most comparable GAAP

financial measure, earnings (loss) per diluted common share in the

'Non-GAAP Financial Measures Reconciliation' section of this press

release.

Constant Currency Basis

We present gross premiums written and net premiums written on a

constant currency basis in this press release. The amounts

presented on a constant currency basis are calculated by applying

the average foreign exchange rate from the current year to the

prior year amounts. We believe this presentation enables investors

and other users of our financial information to analyze growth in

gross premiums written and net premiums written on a constant

basis. The reconciliation to gross premiums written and net

premiums written on a GAAP basis is presented in the 'Insurance

Segment' and 'Reinsurance Segment' sections of this press

release.

Pre-Tax Total Return on Cash and

Investments excluding Foreign Exchange Movements

Pre-tax total return on cash and investments excluding foreign

exchange movements measures net investment income (loss), net

investments gains (losses), interest in income (loss) of equity

method investments, and change in unrealized gains (losses)

generated by average cash and investment balances. We believe this

presentation enables investors and other users of our financial

information to analyze the performance of our investment portfolio.

The reconciliation of pre-tax total return on cash and investments

excluding foreign exchange movements to pre-tax total return on

cash and investments, the most comparable GAAP financial measure,

is presented in the 'Investments' section of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240131562965/en/

Cliff Gallant (Investor Contact): (415) 262-6843;

investorrelations@axiscapital.com Nichola Liboro (Media Contact):

(917) 705-4579; nichola.liboro@axiscapital.com

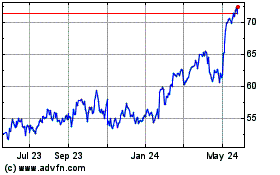

Axis Capital (NYSE:AXS)

Historical Stock Chart

From Dec 2024 to Jan 2025

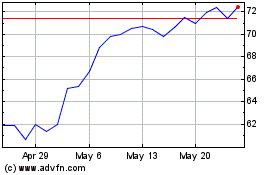

Axis Capital (NYSE:AXS)

Historical Stock Chart

From Jan 2024 to Jan 2025