AZZ incorporated Reports Results for the Fourth Quarter and Fiscal-Year 2005

April 08 2005 - 7:00AM

PR Newswire (US)

AZZ incorporated Reports Results for the Fourth Quarter and

Fiscal-Year 2005 For the Twelve Months - Revenues Increase 12%, Net

Income up 13%, Earnings per Share Increased 10% and Backlog is Up

22% FORT WORTH, Texas, April 8 /PRNewswire-FirstCall/ -- AZZ

incorporated (NYSE:AZZ), a manufacturer of electrical products and

a provider of galvanizing services today announced unaudited

financial results for the three and twelve-month periods ended

February 28, 2005. Revenues for the fourth quarter were $37.9

million, compared to $32.5 million for the comparable period last

year. Net income for the fourth quarter was $1.5 million, or $0.26

per diluted share, compared to net income of $1.2 million, or $0.22

per diluted share, in last year's fiscal fourth quarter. Backlog at

the end of the fourth quarter was $64.8 million, compared to $60.1

million at the end of the previous quarter and $53.1 million for

the fourth quarter of last year. Incoming orders for the fourth

quarter totaled $42.6 million while shipments for the quarter

totaled $37.9 million, resulting in a book to ship ratio of 112

percent for the quarter. For the fiscal year, the Company reported

revenues of $152.4 million, compared to $136.2 million for the

comparable period last year. Net income for the year was $4.8

million, or $0.87 per diluted share, compared to $4.3 million, or

$0.79 per diluted share for the comparable twelve-month period last

year. Incoming orders for the twelve-month period were $164.1

million, while year to date shipments totaled $152.4 million,

resulting in a book to ship ratio of 108 percent. Implementation

cost associated with the installation of our new ERP system and

Sarbanes Oxley compliance cost totaling $775,000 is included in

Selling, General and Administrative expense for the twelve month

period ending February 28, 2005. David H. Dingus, president and

chief executive officer of AZZ incorporated, commented, "We are

pleased to report double digit improvement in our revenues, net

income, fully diluted earnings per share and backlog for the fiscal

year. The revenue and earnings results for Fiscal 2005 exceeded our

previously issued guidance. We were fortunate that customer

scheduled shipment dates were maintained, and in some cases

expedited. The fourth quarter was also favorably impacted by

several quick turn jobs and increased demand for our hot dip

galvanizing services. We did see some flattening in the number of

new electrical quotation requests in December and January. It is

difficult at this time to determine if this is a trend or seasonal.

However, the dollar value of outstanding quotes did increase due

primarily to several large international quotes. It was a year of

extreme competitive conditions and accelerating cost. We were

disappointed that despite improving market conditions for our

electrical products, we were not able to recover our cost

escalation with price increases. Price pressures were and continue

to be extreme, and we have walked away from business which was

below our acceptable minimum levels. Demand for our galvanizing

services showed a very nice increase in the fourth quarter and

margins remained strong despite soaring increases in zinc cost."

Revenues for the Electrical and Industrial Products Segment were

$24.5 million for the fourth quarter, compared to $21.5 million in

the previous year's fourth quarter. Operating income for this

segment was $2.3 million, compared to $1.7 million in the fourth

quarter of last year. For the fiscal year ended February 28, 2005,

revenues were $100.5 million and operating income was $7.3 million

compared to $88.9 and $6.4 million, respectively, in the prior

fiscal year. Revenues for the Company's Galvanizing Service Segment

were $13.4 million for the fourth quarter, compared to $11.0

million in the previous year's comparable quarter. Operating income

was unchanged at $2.4 million in the fourth quarter as compared to

the same quarter last year. For the fiscal year, revenues were

$51.9 million, and operating income was $9.6 million compared to

$47.3 and $8.6 million, respectively, for the prior fiscal year.

Mr. Dingus concluded, "Despite the increases in market demand, we

believe that we will continue to see very competitive pricing due

to excess capacity and a continuing increase in commodity pricing,

particularly zinc that will inhibit our growth and keep pressure on

our margins. We will continue our efforts to aggressively manage

our way through these conditions in order to build upon the

accomplishments of fiscal 2005. Based upon evaluation of

information currently available to management, we are estimating

fiscal 2006 earnings to be within the range of $0.87 to $.97 per

diluted share and revenues to be within the range of $155 to $165

million. Our earnings per share estimate includes the completion of

Oracle ERP system implementation project costs and Sarbanes-Oxley

compliance costs of $550,000. AZZ incorporated will conduct a

conference call to discuss financial results for the fourth quarter

and fiscal year 2005 at 4:15 P.M. Eastern on April 8, 2005.

Interested parties can access the call at (877) 356-5706 or (706)

643-0580 (international). The call will be web cast via the

Internet at http://www.azz.com/AZZinvest.htm. A replay of the call

will be available for three days at (800) 642-1687, of (706)

645-9291 (international) confirmation #5171434, or for 30 days at

http://www.azz.com/AZZinvest.htm. AZZ incorporated is a specialty

electrical equipment manufacturer serving the global markets of

industrial, power generation, transmission and distribution, as

well as a leading provider of hot dip galvanizing services to the

steel fabrication market nationwide. Except for the statements of

historical fact, this release may contain forward-looking

statements that involve risks and uncertainties some of which are

detailed from time to time in documents filed by the Company with

the SEC. Those risks and uncertainties include, but are not limited

to: changes in customer demand and response to products and

services offered by the company, including demand by the electrical

power generation markets, electrical transmission and distribution

markets, the industrial markets, and the hot dip galvanizing

markets; prices and raw material costs, including zinc and natural

gas which are used in the hot dip galvanizing process; changes in

the economic conditions of the various markets the Company serves,

foreign and domestic, customer requested delays of shipments,

acquisition opportunities, adequacy of financing, and availability

of experienced management employees to implement the Company's

growth strategy. The Company can give no assurance that such

forward-looking statements will prove to be correct. AZZ

incorporated Condensed Consolidated Statement of Income (in

thousands except per share amount) Three Months Ended Twelve Months

Ended Feb. 28, Feb. 29, Feb. 28, Feb. 29, 2005 2004 2005 2004

(unaudited) (unaudited) (unaudited) (audited) Net sales $37,927

$32,505 $152,428 $136,201 Income before taxes $2,077 $1,982 $7,407

$6,878 Net income $1,460 $1,228 $4,812 $4,263 Net income per share

Basic $0.27 $0.23 $0.88 $0.80 Diluted $0.26 $0.22 $0.87 $0.79

Diluted average shares outstanding 5,538 5,475 5,517 5,397

Condensed Consolidated Balance Sheet (in thousands) Feb. 28, 2005

Feb. 29, 2004 (unaudited) (audited) Assets: Current assets $51,162

$43,713 Net property, plant and equipment $35,312 $34,201 Other

assets, net $42,161 $42,112 Total assets $128,635 $120,026

Liabilities and shareholders' equity: Current liabilities $26,324

$23,504 Long term debt due after one year $23,875 $25,375 Other

liabilities $3,117 $1,850 Shareholders' equity $75,319 $69,297

Total liabilities and shareholders' equity $128,635 $120,026

Condensed Consolidated Statement of Cash Flow (in thousands) Twelve

Months Twelve Months Ended Ended Feb. 28, 2005 Feb. 29,2004

(unaudited) (audited) Net cash provided by (used in) operating

activities $6,394 $14,963 Net cash provided by (used in) investing

activities ($6,638) ($2,920) Net cash provided by (used in)

financing activities ($684) ($12,582) Net increase (decrease) in

cash and cash equivalents ($928) ($539) Cash and cash equivalents

at beginning of year $1,445 $1,984 Cash and cash equivalents at end

of quarter $517 $1,445 Contact: Dana Perry, Senior Vice President

-- Finance and CFO AZZ incorporated 817-810-0095 Internet:

http://www.azz.com/ RCG Capital Markets Group, Inc. 480-675-0400

Retail: Robert Blum Institutional/Analysts: Joe Dorame Media:

Andrea Huttle Internet: http://www.rcgonline.com/ DATASOURCE: AZZ

incorporated CONTACT: Dana Perry, Senior Vice President -- Finance

and CFO of AZZ incorporated, +1-817-810-0095; or Retail, Robert

Blum, or Institutional/Analysts, Joe Dorame, or Media, Andrea

Huttle, all of RCG Capital Markets Group, Inc., +1-480-675-0400,

for AZZ incorporated Web site: http://www.rcgonline.com/ Web site:

http://www.azz.com/AZZinvest.htm Web site: http://www.azz.com/

Copyright

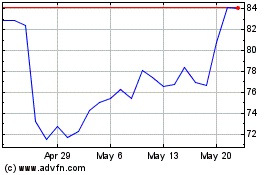

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024