AZZ incorporated Reports Year-to-Date and Third Quarter Results of

Fiscal - Year 2005 For the Nine Months - Revenues Increase 10%, Net

Income Up 10%, Earnings Per Share Increased 7% and Backlog is Up

15% FORT WORTH, Texas, Jan. 6 /PRNewswire-FirstCall/ -- AZZ

incorporated (NYSE:AZZ), a manufacturer of electrical products and

a provider of galvanizing services today announced unaudited

financial results for the three and nine-month periods ended

November 30, 2004. Revenues for the third quarter were $38.3

million, compared to $33.3 million for the comparable period last

year. Net income for the third quarter was $1.2 million, or $0.22

per diluted share, compared to net income of $1.2 million, or $0.21

per diluted share, in last year's fiscal third quarter. Backlog at

the end of the third quarter was $60.1 million, compared to $53.8

million at the end of the previous quarter and $52.5 million for

the comparable period last year. Incoming orders for the third

quarter totaled $44.6 million while shipments for the quarter

totaled $38.3 million, resulting in a book to ship ratio of 116

percent. Outstanding debt at the end of the quarter was $27.8

million, down 10 percent from the February 29, 2004, fiscal year

end, resulting in a long-term debt to equity ratio of .30 to 1.

Shareholders Equity increased to $73.3 million or $13.30 per

diluted share. For the nine-month period, the Company reported

revenues of $114.5 million, compared to $103.7 million for the

comparable period last year. Net income for the nine months was

$3.4 million, or $0.61 per diluted share, compared to $3.0 million,

or $0.57 per diluted share for the comparable nine-month period

last year. Incoming orders for the nine-month period were $121.5

million, while year to date shipments totaled $114.5 million,

resulting in a book to ship ratio of 106 percent. Implementation

cost associated with the installation of our new ERP system in the

amount of $505,000 for the nine-month period are included in

Selling, General and Administrative expense for the nine month

period ending November 30, 2004. Revenues for the Electrical and

Industrial Products Segment were $25.0 million for the third

quarter, compared to $21.1 million in the previous year's third

quarter. Operating income for this segment was $1.7 million,

compared to $1.6 million in the third quarter of last year. For the

first nine months, revenues were $76.0 million and operating income

was $5.0 million compared to $67.4 and $4.6 million, respectively,

for the first nine months of the prior year. David H. Dingus,

president and chief executive officer of AZZ incorporated,

commented, "We are pleased to see an increase in quotation activity

in our Electrical and Industrial Products Segment, both

domestically and internationally. We have been disappointed that

this improved quotation level has not lead to improved pricing

opportunities. Competitive pricing pressures continue as our

industry still operates with a significant level of unused

capacity. As we have seen in previous quarters of the current

fiscal year, some opportunities were lost due to pricing being

below our acceptable margin level. Pricing pressures combined with

our inability to pass along many of the material cost increases we

have incurred, continue to put downward margin pressure on our

operating results. We will seek out all opportunities to recover

our cost increases while continuing our efforts to improve our

operating efficiency, lower our internal cost structure, and expand

our served markets. Further sustained recovery of our served

markets should lead to a better industry matching of capacity and

demand, and assist us in our margin improvement efforts." Revenues

for the Company's Galvanizing Service Segment were $13.3 million

for the third quarter, compared to $12.2 million in the previous

year's comparable quarter. Operating income for the Segment was

$2.4 million compared to $2.3 million in the same quarter last

year. For the first nine months of fiscal 2004, revenues were $38.5

million, and operating income was $7.1 million compared to $36.3

and $6.3 million, respectively, for the first nine months of the

prior year. Mr. Dingus continued, "We have seen another quarter

where the leverage that has been gained from market stabilization

and some modest recovery improved our operating performance. The

revenue and operating income for this segment continues at an

encouraging pace. Zinc and natural gas cost continue to be

extremely volatile, making it an extremely challenging environment

to match our pricing and cost, and sustain our margin performance.

While not as severe as in our Electrical and Industrial Products

Segment, market capacity does exceed demand and inhibits our

ability to achieve higher operating performance. We believe that a

sustained improvement in our served markets should continue to

reflect improved operating results for this Segment." Mr. Dingus

concluded, "On a year to date basis, our revenues and income are

consistent with our internal targets. This combined with the

evaluation of information currently available to management, we are

continuing to estimate FY2005 earnings to be within the range of

$0.75 to $0.85 per diluted share and revenues to be within the

range of $140 to $150 million. Our earnings per share estimate

includes the portion of Oracle ERP system implementation project

cost of $650,000, which does not qualify for capitalization, in

fiscal 2005." AZZ incorporated will conduct a conference call to

discuss financial results for the third quarter of fiscal 2005 at

4:15 P.M. Eastern on January 6, 2005. Interested parties can access

the call at (877) 356-5706. The call will be web cast via the

Internet at http://www.azz.com/AZZinvest.htm. A replay of the call

will be available for three days at (800) 642-1687, confirmation

#2884275, or for 30 days at http://www.azz.com/AZZinvest.htm. AZZ

incorporated is a specialty electrical equipment manufacturer

serving the global markets of industrial, power generation,

transmission and distribution, as well as a leading provider of hot

dip galvanizing services to the steel fabrication market

nationwide. Except for the statements of historical fact, this

release may contain forward-looking statements that involve risks

and uncertainties some of which are detailed from time to time in

documents filed by the Company with the SEC. Those risks and

uncertainties include, but are not limited to: changes in customer

demand and response to products and services offered by the

company, including demand by the electrical power generation

markets, electrical transmission and distribution markets, the

industrial markets, and the hot dip galvanizing markets; prices and

raw material costs, including zinc and natural gas which are used

in the hot dip galvanizing process; changes in the economic

conditions of the various markets the Company serves, foreign and

domestic, customer requested delays of shipments, acquisition

opportunities, adequacy of financing, and availability of

experienced management employees to implement the Company's growth

strategy. The Company can give no assurance that such

forward-looking statements will prove to be correct. AZZ

incorporated Condensed Consolidated Statement of Income (in

thousands except per share amount) Three Months Ended Nine Months

Ended Nov. 30, Nov. 30, Nov. 30, Nov. 30, 2004 2003 2004 2003

(unaudited) (unaudited) (unaudited) (unaudited) Net sales $38,297

$33,338 $114,501 $103,696 Income before taxes $1,911 $1,865 $5,329

$4,896 Net income $1,199 $1,156 $3,352 $3,035 Net income per share

Basic $0.22 $0.21 $0.62 $0.57 Diluted $0.22 $0.21 $0.61 $0.57

Diluted average shares outstanding 5,510 5,441 5,509 5,371

Condensed Consolidated Balance Sheet (in thousands) Nov. 30, 2004

February 29, 2004 (unaudited) (audited) Assets: Current assets

$46,953 $43,713 Net property, plant and equipment $35,486 $34,201

Other assets, net $42,253 $42,112 Total assets $124,692 $120,026

Liabilities and shareholders' equity: Current liabilities $27,249

$23,504 Long term debt due after one year $22,250 $25,375 Other

liabilities $1,939 $1,850 Shareholders' equity $73,254 $69,297

Total liabilities and shareholders' equity $124,692 $120,026

Condensed Consolidated Statement of Cash Flow (in thousands) Nine

Months Nine Months Ended Ended Nov. 30, 2004 Nov. 30, 2003

(unaudited) (unaudited) Net cash provided by (used in) operating

activities $8,719 $13,024 Net cash provided by (used in) investing

activities ($5,446) ($ 1,268) Net cash provided by (used in)

financing activities ($2,877) ($12,956) Net increase (decrease) in

cash and cash equivalents $396 ($1,200) Cash and cash equivalents

at beginning of year $1,445 $1,984 Cash and cash equivalents at end

of quarter $1,841 $784 DATASOURCE: AZZ incorporated CONTACT: Dana

Perry, Senior Vice President - Finance and CFO, AZZ incorporated,

+1-817-810-0095; or Retail, Robert Blum, or Institutional/Analysts,

Joe Dorame, or Media, Kristen Klein, all of The RCG Group,

+1-480-675-0400, for AZZ incorporated Web site:

http://www.azz.com/AZZinvest.htm Web site:

http://www.rcgonline.com/ Web site: http://www.azz.com/

Copyright

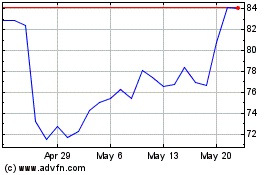

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

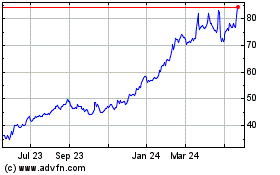

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024