Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 08 2024 - 4:10PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2024

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

NOTICE ON RELATED-PARTY TRANSACTIONS

São Paulo, July 8, 2024 - Braskem

S.A. (“Braskem”), in compliance with article 33, XXXII of CVM Resolution 80/2022, hereby informs its shareholders and the

market in general of the following transaction between related parties:

| Parties |

Braskem and Petróleo Brasileiro S.A. – Petrobras ("Petrobras"). |

| Relationship with the issuer |

Petrobras is a Shareholder with Significant Influence over Braskem. |

| Purpose |

Spot purchase and sale agreement of polymer-grade propylene from the Alberto Pasqualini Refinery ("REFAP") between Braskem, as seller, and Petrobras, as buyer, which achieved the new amount of R$50 million on June 27, 2024. |

| Key Terms and Conditions |

On January 7, 2022, the

signing of 5 propylene agreements between Petrobras and Braskem regarding (i) Planalto de Paulínia Refinery (REPLAN), (ii) Henrique

Lage Refinery (REVAP), (iii) Presidente Getúlio Vargas Refinery (REPAR), (iv) Capuava Refinery (RECAP) and (v) Duque de Caxias

Refinery (REDUC) were announced through Notice on Related Party Transactions.

In these contracts, there

are clauses that provide flexibility for negotiating prices and reallocating quantities between contracts signed between the parties.

On June 15, 2023, the first

spot contract of purchase by Braskem and sale by Petrobras of propylene polymer grade from REFAP was signed, which was the object of a

Notice on Related Party Transactions on September 26, 2023.

On September 29, 2023, the

second spot contract of purchase by Braskem and sale by Petrobras of propylene polymer grade from REFAP was signed “(Second REFAP

Contract”), which was the object of a Notice on Related Party Transactions on November 13, 2023.

Posteriorly, propylene volumes

from the purchase and sale contract of propylene polymer grade from REPAR by Braskem and Petrobras ("REPAR Contract") were reallocated

to the Second REFAP Contract, which was the object of a Notice on Transaction with Related Parties on December 18, 2023.

On February 9, 2024, the

third spot contract for the propylene polymer grade purchase by Braskem and sale by Petrobras from REFAP (“Third REFAP Contract”)

was signed, with effective date from February 9, 2024, until Mach 31, 2024, which were postponed until April 30, 2024, and subsequently

until June 30, 2024. The Third REFAP Contract initially contemplated a sale of polymer-grade propylene estimated at 285 tons.

Propylene volumes from the

REPAR Contract were reallocated to the Third REFAP Contract, reaching the new amount of R$50 million on March 28, 2024, which was the

object of a Notice on Transaction with Related Parties on April 9, 2024.

The Third REFAP Contract

reached a new amount of R$50 million on June 27, 2024, as detailed below:

Net

accumulated amount of the Third REFAP Contract until 06/27/2024: R$100.4 million, of which R$1.6 million are specific to the Third REFAP

Contract and R$ 98.8 million from the reallocation of resources available in the REPAR Contract.

The

prices charged are based on international reference prices for propylene polymer grade. |

1

| Date of signing of the Amendment |

Agreement

signed on February 2, 2024, valid from February 2, 2024, to March 31, 2024, extended until June 30, 2024, which achieved the new amount

of R$50 million on June 27, 2024. |

| Possible participation of the counterparty, its partners, or managers in the issuer's decision-making process or negotiation of the transaction as representatives of the issuer |

The

counterparty and its partners and managers have not participated in Braskem’s decision process or the negotiations of the mentioned

agreements. |

| Detailed justification of the reasons why the issuer's management considers that the transaction has complied with commutative conditions or provides for an appropriate reverse payment |

The

transaction was made regarding the purchase of propylene referenced in international prices. |

2

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: July 8, 2024

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Pedro van Langendonck Teixeira de Freitas |

| |

|

|

| |

|

Name: |

Pedro van Langendonck Teixeira de Freitas |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This

report on Form 6-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. These statements are statements that are not historical facts, and are based on our management’s current view and estimates

of future economic and other circumstances, industry conditions, company performance and financial results, including any potential

or projected impact of the geological event in Alagoas and related legal proceedings and of COVID-19 on our business, financial

condition and operating results. The words “anticipates,” “believes,” “estimates,” “expects,”

“plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements.

Statements regarding the potential outcome of legal and administrative proceedings, the implementation of principal operating and

financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting our

financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the

current views of our management and are subject to a number of risks and uncertainties, many of which are outside of the our control.

There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions

and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such

assumptions or factors, including the projected impact of the geological event in Alagoas and related legal proceedings and the

unprecedented impact of COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders,

could cause actual results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the

year ended December 31, 2019 filed with the SEC, as well as any subsequent filings made by us pursuant to the Exchange Act, each

of which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact

any forward-looking statements in this presentation.

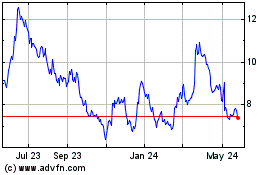

Braskem (NYSE:BAK)

Historical Stock Chart

From Jan 2025 to Feb 2025

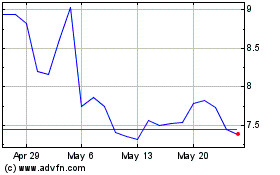

Braskem (NYSE:BAK)

Historical Stock Chart

From Feb 2024 to Feb 2025