As filed with the U.S. Securities and Exchange Commission on September 8, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-22562

Investment Company Act file number

Barings

Global Short Duration High Yield Fund

(Exact name of registrant as specified in charter)

300 South Tryon Street, Suite 2500, Charlotte, NC 28202

(Address of principal executive offices) (Zip code)

Corporation

Service Company (CSC)

251 Little Falls Drive

Wilmington, DE 19808

United States

(Name and

address of agent for service)

704-805-7200

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1. Reports to Stockholders.

BARINGS GLOBAL SHORT DURATION HIGH YIELD FUND

Semi-Annual Report

June 30, 2023

Barings Global Short Duration High Yield Fund

c/o Barings LLC

300 S Tryon St.

Suite 2500

Charlotte, NC 28202

704.805.7200

http://www.Barings.com/bgh

ADVISER

Barings LLC

300 S Tryon St.

Suite 2500

Charlotte, NC 28202

SUB-ADVISOR

Baring International Investment Limited

20 Old Bailey

London EC4M 78F UK

COUNSEL TO THE FUND

Dechert LLP

Three Bryant Park

1095 Avenue of the Americas

New York, NY, 10036-6797

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP

30 Rockefeller Plaza

New York, NY 10112

CUSTODIAN

US Bank

MK-WI-S302

1555 N. River Center Drive

Milwaukee, WI 53212

TRANSFER AGENT & REGISTRAR

U.S. Bancorp Fund Services, LLC, d/b/a

U.S. Bank Global Fund Services

615 E. Michigan St.

Milwaukee, WI 53202

FUND ADMINISTRATION/ACCOUNTING

U.S. Bancorp Fund Services, LLC, d/b/a

U.S. Bank Global Fund Services

615 E. Michigan St.

Milwaukee, WI 53202

PROXY VOTING POLICIES & PROCEDURES

The Trustees of Barings Global Short Duration High Yield Fund (the “Fund”) have delegated proxy voting responsibilities

relating to the voting of securities held by the Fund to Barings LLC (“Barings”). A description of Barings’ proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 1-866-399-1516;

(2) on the Fund’s website at http://www.barings.com/bgh; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

FORM N-PORT PART F

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT. This information is available

(1) on the SEC’s website at http://www.sec.gov; and (2) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available on the Fund’s website at

http://www.barings.com/bgh or upon request by calling, toll-free, 1-866-399-1516.

CERTIFICATIONS

The Fund’s President has submitted to the NYSE the annual CEO Certification as required by Section 303A.12(a) of the NYSE Listed Company Manual.

LEGAL MATTERS

The Fund has entered into contractual arrangements with an investment adviser, transfer agent and custodian (collectively “service providers”) who each provide services to the Fund. Shareholders are not parties to, or

intended beneficiaries of, these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service

providers, either directly or on behalf of the Fund.

Under the Fund’s Bylaws, any claims asserted against or on

behalf of the Fund, including claims against Trustees and officers must be brought in courts located within the Commonwealth of Massachusetts.

The Fund’s registration statement and this shareholder report are not contracts between the Fund and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any

rights conferred explicitly by federal or state securities laws that may not be waived.

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

OFFICERS OF THE FUND

Sean Feeley

President

Christopher Hanscom

Chief Financial Officer

Andrea Nitzan

Treasurer

Gregory MacCordy

Chief Compliance Officer

Ashlee Steinnerd

Chief Legal Officer

Alexandra Pacini

Secretary

Matthew Curtis

Tax Officer

Barings Global Short Duration High Yield Fund is a closed-end investment company, first offered to the public in 2012,

whose shares are traded on the New York Stock Exchange.

INVESTMENT OBJECTIVE & POLICY

Barings Global Short Duration High Yield Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Massachusetts. The Fund is

registered under the Investment Company Act of 1940, as amended, as a de facto diversified, closed-end management investment company with its own investment objective. The Fund’s common shares are listed on the New York Stock Exchange under the

symbol “BGH”.

The Fund’s primary investment objective is to seek as high a level of current income as the Adviser (as defined herein) determines is

consistent with capital preservation. The Fund seeks capital appreciation as a secondary investment objective when consistent with its primary investment objective. There can be no assurance that the Fund will achieve its investment objectives.

The Fund seeks to take advantage of inefficiencies between geographies, primarily the North American and Western European high yield bond and loan markets and within

capital structures between bonds and loans. For example, the Fund seeks to take advantage of differences in pricing between bonds and loans of an issuer denominated in U.S. dollars and substantially similar bonds and loans of the same issuer

denominated in Euros, potentially allowing the Fund to achieve a higher relative return for the same credit risk exposure.

1

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

Dear Fellow Shareholders,

We present the 2023 Semi-Annual Report for

the Barings Global Short Duration High Yield Fund (the “Fund”) to recap portfolio performance and positioning. We believe our Global High Yield Investments Group is one of the largest teams in the market primarily focused on North American

and Western European credit. Utilizing the Group’s unparalleled expertise, deep resources and time-tested process, we believe we can provide investors with an attractive level of current income to help navigate any market environment which may

lie ahead, and continue to uncover compelling opportunities across the global high yield market.

The Fund’s strategy focuses primarily on North American and

Western European high yield companies, with the flexibility to dynamically shift the geographic weighting in order to capture, in our opinion, the best risk-adjusted investment opportunities. Barings’ global capabilities on the ground in major

markets allow for us to be nimble in uncertain times and take advantage of unique opportunities as they arise. In addition, the strategy focuses closely on limiting the duration of the Fund, while maintaining what we consider to be a reasonable

amount of leverage.

Market Review

Global fixed income markets

navigated continued pressure from rising interest rates, persistent inflation, stress in the U.S. regional banking system, and the overhang of strains in China real estate, to generate strong performance through the first half of the year. Sharp

returns in January mitigated weakness and increased volatility at the end of the first quarter, driving returns in excess of 3% in both the U.S. and Europe in 1Q. Spread tightening in the second quarter was offset by the continued rise in interest

rates, resulting in more modest performance than the prior quarter. Corporate earnings continue to come in better than feared, while those companies missing earnings or reducing guidance are negatively impacted, driving increased dispersion in the

market. Meanwhile, default rates have continued to trend higher but remain modest compared to prior cycles and within long-term averages.

Slowing inflation data in

the closing months combined with strong equity markets bolstered risk appetite within high yield markets. Credit spreads peaked at 516 bps in March following the collapse of Silicon Valley Bank, before rallying through the second quarter to close at

390 bps, 79 bps tighter than year-end levels. Higher government bond yields offset some of this tightening, as yield-to-worst finished 46 bps lower at 8.50%. More cyclical areas of the market such as Leisure led, while Communications lagged.

Triple-C rated assets outperformed as spreads compressed across ratings buckets, in addition to a shorter duration profile. New issuance remained muted, with $95.6 billion pricing in total, while the overall high yield universe continued to shrink

as upgrades to investment grade significantly outpaced downgrades to high yield. European markets experienced similar dynamics, with the notable exception of underperformance within the lowest-rated sections of the market. The option-adjusted spread

for the European market tightened 61 bps to close at 464 bps, while yield-to-worst fell 17 bps to 7.79%. New issue activity totaled €32.8 billion.

Barings Global Short Duration High Yield Fund Overview and Performance

The Fund ended June 2023 with a portfolio of 179 issuers, in line with year-end levels. From a regional perspective, there was a slight shift in regional exposure from

year-end, with exposure to the United States declining to 81.2% from 81.4%; the United Kingdom remains the second largest exposure at 5.5% (See Country Composition chart below). The Fund’s exposure to Rest of World issuers, whose country of

risk is outside of the U.S. and Europe but fit within the Fund’s developed market focus, increased from year-end to 5.7%. The Fund’s primary exposure continues to be in the North American market, which features the most robust opportunity

set across fixed income markets.

As of June 30, 2023, the Fund’s positioning across the credit quality spectrum was as follows: 38.15% double-B rated and

above, 32.11% single-B rated, and 27.80% triple-C rated and below, with approximately 40.68% of the portfolio consisting of secured obligations. Compared to the end of the prior period, the Fund’s exposure to higher-rated credits increased,

primarily sourced from lower-rated triple-C and below securities. Non-publicly rated securities represented 1.94%.

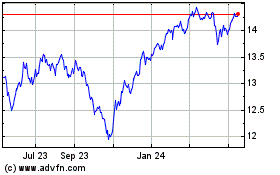

The distribution per share was constant

throughout the period at $0.1056 per share. The Fund’s share price and net asset value (“NAV”) ended the reporting period at $14.67 and $13.04, respectively, or at a 11.12% discount to NAV. Based on the Fund’s share price and NAV

on June 30, 2023, the Fund’s market price and NAV distribution rates—using the most recent monthly dividend, on an annualized basis—were 9.72% and 8.64%, respectively. Assets acquired through leverage, which

2

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

represented 25.17% of the Fund’s total assets at the end of June, were accretive to net investment income and benefited shareholders.

On a year-to-date basis through June 30, 2023, the NAV total return for the Fund was 7.89%, outperforming the global high yield bond market, as measured by the ICE Bank

of America Non-Financial Developed Markets High Yield Constrained Index, which returned 5.51% on a hedged to the U.S. dollar basis. From a market value perspective, the total return year-to-date through June 30, 2023 was 7.85%. The Fund generated

positive absolute and relative returns in each quarter to begin the year. The shorter-duration exposure, including floating rate allocations to 1st and 2nd lien senior secured loans and collateralized loan obligations, continued to benefit results.

The allocation to lower-rated credit also benefitted results given spread compression in the U.S. and positive returns across broader risk assets.

Market Outlook

With data indicating that inflation has moderated in

recent months, attention turns to the lagged impact of the interest rate hiking cycle on demand and economic growth. Labor markets remain solid, providing the Federal Reserve flexibility to maintain rates at an elevated level at least through

year-end. Consensus forecasts expect growth to continue to slow, although a significant downturn remains an unlikely outcome; similarly, while corporate fundamentals have deteriorated sequentially, revenue, EBITDA, and balance sheet metrics remain

above pre-pandemic levels, and near-term maturities remain limited and of higher ratings quality. Credit spreads may widen from current levels near historical averages, although attractive valuations on a dollar price and yield basis backstop

trading levels. Technical factors, including low levels of supply and elevated manager cash balances, also remain supportive. Meanwhile, elevated short-term rates have driven average coupons for floating rate asset classes higher and remain

supportive of total returns in these markets. While default rates are likely to increase this year and remain at a similar level into next year across the leveraged finance space, they are anticipated to remain at manageable levels near historical

averages with the impact mitigated by current income.

At Barings, we remain committed to focusing on corporate fundamentals as market sentiment can change quickly

and unexpectedly. Our focused and disciplined approach emphasizes our fundamental bottom-up research, with the goal of preserving investor capital while seeking to capture attractive capital appreciation opportunities that may exist through market

and economic cycles. On behalf of the Barings team, we continue to take a long-term view of investing and look forward to helping you achieve your investment goals.

Sincerely,

Sean Feeley

| 1. |

Ratings are based on Moody’s, S&P and Fitch. If securities are rated differently by the rating agencies, the

higher rating is applied and all ratings are converted to the equivalent Moody’s major rating category for purposes of the category shown. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating

and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility

of the security’s market value or of the liquidity of an investment in the security. Ratings of Baa3 or higher by Moody’s and BBB-or higher by S&P and Fitch are considered to be investment grade quality. |

| 2. |

Past performance is not necessarily indicative of future results. Current

performance may be lower or higher. All performance is net of fees, which is inclusive of advisory fees, administrator fees and interest expenses. |

3

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * |

The percentages shown above represent a percentage of the assets as of June 30, 2023. |

COUNTRY COMPOSITION (% OF ASSETS*)

| * |

The percentages shown above represent a percentage of the assets as of June 30, 2023. |

4

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL RETURNS JUNE 30, 2023 |

|

1 YEAR |

|

|

5 YEAR |

|

|

10 YEAR |

|

| Barings Global Short Duration High Yield Fund (BGH) |

|

|

11.23 |

% |

|

|

2.68 |

% |

|

|

4.86 |

% |

| ICE Bank of America Non-Financial Developed Markets High Yield

Constrained Index (HNDC) |

|

|

9.52 |

% |

|

|

3.34 |

% |

|

|

5.39 |

% |

Data for Barings Global Short Duration High Yield Fund (the “Fund”) represents returns based on the change in the Fund’s

net asset value assuming the reinvestment of all dividends and distributions. These returns differ from the total investment return based on market value of the Fund’s shares due to the difference between the Fund’s net asset value of its

shares outstanding (See the Fund’s Financial Highlights within this report for total investment return based on market value). Past performance is no guarantee of future results.

ICE Bank of America Non-Financial Developed Markets High Yield Constrained Index (HNDC) contains all securities in the ICE Bank

of America Global High Yield Index that are non-financials and from developed markets countries, but caps issuer exposure at 2%. Developed markets is defined as an FX G10 member, a Western European nation, or

a territory of the U.S. or a Western European nation. Indices are unmanaged. It is not possible to invest directly in an index.

The graph and table do not

reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

5

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

FINANCIAL REPORT

6

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

STATEMENT OF ASSETS AND LIABILITIES

(Unaudited)

|

|

|

|

|

| |

|

JUNE 30, 2023 |

|

|

|

| Assets |

|

|

|

|

| Investments, at fair value (cost $433,217,158) |

|

$ |

381,382,678 |

|

| Cash and cash equivalents |

|

|

13,992,903 |

|

| Foreign currency, at fair value (cost $615,674) |

|

|

601,432 |

|

| Interest and dividend receivable |

|

|

9,108,604 |

|

| Receivable for investments sold |

|

|

4,207,526 |

|

| Prepaid expenses and other assets |

|

|

56,821 |

|

|

|

|

|

|

| Total assets |

|

|

409,349,964 |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| Credit facility |

|

|

102,500,000 |

|

| Payable for investments purchased |

|

|

8,833,360 |

|

| Dividend payable |

|

|

2,118,791 |

|

| Payable to adviser |

|

|

276,528 |

|

| Unrealized depreciation on forward foreign exchange contracts |

|

|

611,804 |

|

| Accrued expenses and other liabilities |

|

|

708,264 |

|

|

|

|

|

|

| Total liabilities |

|

|

115,048,747 |

|

|

|

|

|

|

| Total net assets |

|

$ |

294,301,217 |

|

|

|

|

|

|

|

|

| Net assets: |

|

|

|

|

| Common shares, $0.00001 par value |

|

$ |

201 |

|

| Additional paid-in capital |

|

|

467,835,468 |

|

| Total accumulated loss |

|

|

(173,534,452 |

) |

|

|

|

|

|

| Total net assets |

|

$ |

294,301,217 |

|

|

|

|

|

|

|

|

| Common shares issued and outstanding (unlimited shares authorized) |

|

|

20,064,313 |

|

|

|

|

|

|

|

|

| Net asset value per share |

|

$ |

14.67 |

|

|

|

|

|

|

See accompanying Notes to the Financial

Statements.

7

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

STATEMENT OF OPERATIONS

(Unaudited)

|

|

|

|

|

| |

|

PERIOD FROM

JANUARY 1, 2023

THROUGH

JUNE 30, 2023 |

|

|

|

| Investment Income |

|

|

|

|

| Interest income |

|

$ |

20,338,658 |

|

| Dividend income (net of foreign taxes withheld of $55) |

|

|

87,862 |

|

| Other income |

|

|

152 |

|

|

|

|

|

|

| Total investment income |

|

|

20,426,672 |

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

| Interest expense |

|

|

2,932,796 |

|

| Advisory fees |

|

|

1,695,264 |

|

| Accounting and administration fees |

|

|

193,570 |

|

| Other operating expenses |

|

|

142,582 |

|

| Professional fees |

|

|

91,757 |

|

| Trustee fees |

|

|

76,639 |

|

| Excise tax on undistributed income |

|

|

— |

|

|

|

|

|

|

| Total expenses |

|

|

5,132,608 |

|

|

|

|

|

|

| Net investment income |

|

|

15,294,064 |

|

|

|

|

|

|

|

|

| Realized losses and unrealized appreciation/depreciation on investments and foreign currency related transactions |

|

|

|

|

| Net realized loss on investments |

|

|

(7,426,762 |

) |

| Net realized loss on forward foreign exchange contracts |

|

|

(315,203 |

) |

| Net realized loss on foreign currency related transactions |

|

|

(307,113 |

) |

|

|

|

|

|

| Net realized loss on investments, forward foreign exchange contracts and foreign currency transactions |

|

|

(8,049,078 |

) |

|

|

|

|

|

| Net change in unrealized appreciation/depreciation on investments |

|

|

14,136,100 |

|

| Net change in unrealized appreciation/depreciation on forward foreign exchange contracts |

|

|

(408,461 |

) |

| Net change in unrealized appreciation/depreciation on foreign currency transactions |

|

|

(161 |

) |

|

|

|

|

|

| Net change in unrealized appreciation/depreciation on investments, forward foreign exchange contracts and foreign currency

transactions |

|

|

13,727,478 |

|

|

|

|

|

|

| Net realized losses and unrealized appreciation/depreciation on investments and foreign currency

transactions |

|

|

5,678,400 |

|

|

|

|

|

|

| Net increase in net assets resulting from operations |

|

$ |

20,972,464 |

|

|

|

|

|

|

See accompanying Notes to the Financial

Statements.

8

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

STATEMENT OF CASH FLOWS

(Unaudited)

|

|

|

|

|

| |

|

PERIOD FROM

JANUARY 1, 2023

THROUGH

JUNE 30, 2023 |

|

|

|

| Cash flows from operating activities |

|

|

|

|

| Net increase in net assets resulting from operations |

|

$ |

20,972,464 |

|

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: |

|

|

|

|

| Purchases of long-term investments |

|

|

(97,853,817 |

) |

| Proceeds from sales of long-term investments |

|

|

106,353,232 |

|

| Net change in unrealized appreciation/depreciation on investments |

|

|

(14,136,100 |

) |

| Net realized loss on investments |

|

|

6,839,456 |

|

| Amortization and accretion |

|

|

(765,330 |

) |

| Net change in unrealized appreciation/depreciation on forward foreign exchange contracts |

|

|

408,461 |

|

| Changes in assets and liabilities: |

|

|

|

|

| Increase in receivable for investments sold |

|

|

(2,804,843 |

) |

| Increase in interest and dividend receivable |

|

|

(270,152 |

) |

| Increase in prepaid expenses and other assets |

|

|

(29,800 |

) |

| Decrease in payable to Adviser |

|

|

(12,897 |

) |

| Decrease in excise tax payable on undistributed income |

|

|

(1,017,478 |

) |

| Increase in payable for investments purchased |

|

|

8,748,064 |

|

| Decrease in accrued expenses and other liabilities |

|

|

(205,727 |

) |

|

|

|

|

|

| Net cash provided by operating activities |

|

|

26,225,533 |

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

| Advances from credit facility |

|

|

6,000,000 |

|

| Repayments on credit facility |

|

|

(12,000,000 |

) |

| Distributions paid to common shareholders |

|

|

(12,712,749 |

) |

|

|

|

|

|

| Net cash used in financing activities |

|

|

(18,712,749 |

) |

|

|

|

|

|

| Net change in cash |

|

|

7,512,784 |

|

| Cash and cash equivalents (including foreign currency), beginning of period |

|

|

7,081,551 |

|

|

|

|

|

|

| Cash and cash equivalents (including foreign currency), end of period |

|

$ |

14,594,335 |

|

|

|

|

|

|

|

|

| Supplemental disclosure of cash flow information |

|

|

|

|

| Excise taxes paid |

|

$ |

1,017,478 |

|

| Interest paid |

|

|

2,887,079 |

|

See accompanying Notes to the Financial

Statements.

9

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

|

|

|

|

|

|

| |

|

PERIOD FROM

JANUARY 1, 2023

THROUGH

JUNE 30, 2023 |

|

|

YEAR ENDED

DECEMBER 31, 2022 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

|

| Operations |

|

|

|

|

|

|

|

|

| Net investment income |

|

$ |

15,294,064 |

|

|

$ |

29,393,217 |

|

| Net realized loss on investments, forward foreign exchange contracts and foreign currency transactions |

|

|

(8,049,078 |

) |

|

|

(8,537,949 |

) |

| Net change in unrealized appreciation/depreciation on investments, forward foreign exchange contracts and foreign currency

translation |

|

|

13,727,478 |

|

|

|

(68,060,177 |

) |

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in net assets resulting from operations |

|

|

20,972,464 |

|

|

|

(47,204,909 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions to common shareholders |

|

|

|

|

|

|

|

|

| From distributable earnings |

|

|

(12,712,749 |

) |

|

|

(25,425,498 |

) |

|

|

|

|

|

|

|

|

|

| Total Distributions to common shareholders |

|

|

(12,712,749 |

) |

|

|

(25,425,498 |

) |

|

|

|

|

|

|

|

|

|

| Total increase (decrease) in net assets |

|

|

8,259,715 |

|

|

|

(72,630,407 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets |

|

|

|

|

|

|

|

|

| Beginning of period |

|

|

286,041,502 |

|

|

|

358,671,909 |

|

|

|

|

|

|

|

|

|

|

| End of period |

|

$ |

294,301,217 |

|

|

$ |

286,041,502 |

|

|

|

|

|

|

|

|

|

|

See accompanying Notes to the Financial

Statements.

10

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

PERIOD FROM

JANUARY 1,

2023

THROUGH

JUNE 30,

2023

(UNAUDITED) |

|

|

YEAR ENDED

DECEMBER 31,

2022 |

|

|

YEAR ENDED

DECEMBER 31,

2021 |

|

|

YEAR ENDED

DECEMBER 31,

2020 |

|

|

YEAR ENDED

DECEMBER 31,

2019 |

|

|

YEAR ENDED

DECEMBER 31,

2018 |

|

|

|

|

|

|

|

|

| Per Common Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value, beginning of period |

|

$ |

14.26 |

|

|

$ |

17.88 |

|

|

$ |

16.68 |

|

|

$ |

18.32 |

|

|

$ |

18.28 |

|

|

$ |

20.84 |

|

| Income from investment operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

0.76 |

|

|

|

1.46 |

|

|

|

1.72 |

|

|

|

1.59 |

|

|

|

1.87 |

|

|

|

1.89 |

|

| Net realized gain (loss) and unrealized appreciation/depreciation on investments and foreign currency transactions |

|

|

0.28 |

|

|

|

(3.81 |

) |

|

|

0.75 |

|

|

|

(1.86 |

) |

|

|

(0.05 |

) |

|

|

(2.67 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total increase (decrease) from investment operations |

|

|

1.04 |

|

|

|

(2.35 |

) |

|

|

2.47 |

|

|

|

(0.27 |

) |

|

|

1.82 |

|

|

|

(0.78 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less distributions to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

(0.63 |

) |

|

|

(1.27 |

) |

|

|

(1.27 |

) |

|

|

(1.37 |

) |

|

|

(1.78 |

) |

|

|

(1.78 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total distributions to common stockholders |

|

|

(0.63 |

) |

|

|

(1.27 |

) |

|

|

(1.27 |

) |

|

|

(1.37 |

) |

|

|

(1.78 |

) |

|

|

(1.78 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value, end of period |

|

$ |

14.67 |

|

|

$ |

14.26 |

|

|

$ |

17.88 |

|

|

$ |

16.68 |

|

|

$ |

18.32 |

|

|

$ |

18.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per common share market value, end of period |

|

$ |

13.04 |

|

|

$ |

12.68 |

|

|

$ |

17.34 |

|

|

$ |

15.09 |

|

|

$ |

17.53 |

|

|

$ |

15.95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investment return based on net asset

value (2) |

|

|

7.89 |

%(1) |

|

|

(12.88 |

)% |

|

|

15.71 |

% |

|

|

0.79 |

% |

|

|

10.77 |

% |

|

|

(3.42 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investment return based on market

value (2) |

|

|

7.85 |

%(1) |

|

|

(19.98 |

)% |

|

|

23.97 |

% |

|

|

(4.65 |

)% |

|

|

21.45 |

% |

|

|

(9.38 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Data and Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets, end of period (000’s) |

|

$ |

294,301 |

|

|

$ |

286,042 |

|

|

$ |

358,672 |

|

|

$ |

334,576 |

|

|

$ |

367,649 |

|

|

$ |

366,691 |

|

| Ratio of expenses (before reductions and reimbursements) to average net assets |

|

|

3.51 |

%(4) |

|

|

2.73 |

%(3) |

|

|

2.17 |

%(3) |

|

|

2.32 |

%(3) |

|

|

3.00 |

% |

|

|

2.93 |

% |

| Ratio of expenses (after reductions and reimbursements) to average net assets |

|

|

3.51 |

%(4) |

|

|

2.60 |

% |

|

|

1.95 |

% |

|

|

2.23 |

% |

|

|

3.00 |

% |

|

|

2.93 |

% |

| Ratio of net investment income (before reductions and reimbursements) to average net assets |

|

|

10.46 |

%(4) |

|

|

9.17 |

%(3) |

|

|

8.54 |

%(3) |

|

|

10.53 |

%(3) |

|

|

10.22 |

% |

|

|

9.34 |

% |

| Ratio of net investment income (after reductions and reimbursements) to average net assets |

|

|

10.46 |

%(4) |

|

|

9.31 |

% |

|

|

8.76 |

% |

|

|

10.61 |

% |

|

|

10.22 |

% |

|

|

9.34 |

% |

| Portfolio turnover rate |

|

|

25.34 |

%(1) |

|

|

34.04 |

% |

|

|

52.08 |

% |

|

|

42.21 |

% |

|

|

52.25 |

% |

|

|

48.92 |

% |

| (2) |

|

Total investment return calculation assumes reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions.

|

| (3) |

|

Effective August 6, 2020 the Adviser began waiving a portion of it’s management and other fees equal to an annual rate of 0.150% of the Fund’s managed assets. The waiver expired on August 31, 2022 (see Note

3). |

See

accompanying Notes to the Financial Statements.

11

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

SCHEDULE OF INVESTMENTS

June 30,

2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

SHARES |

|

|

COST |

|

|

FAIR

VALUE |

|

| Equities* — 0.53%: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks — 0.49%: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ESC CB 144A High Ridge¤ |

|

|

|

|

|

|

|

|

|

|

2,982 |

|

|

|

$0 |

|

|

|

$0 |

|

| KCA Deutag Ordinary A Shares |

|

|

|

|

|

|

|

|

|

|

25,580 |

|

|

|

1,103,387 |

|

|

|

1,432,480 |

|

| Travelex Private Equity+¤ |

|

|

|

|

|

|

|

|

|

|

17,136 |

|

|

|

1 |

|

|

|

0 |

|

| Naviera Armas Class B2 Shares Stapled To 1.5L SSNS+¤ |

|

|

|

|

|

|

|

|

|

|

1,194 |

|

|

|

0 |

|

|

|

0 |

|

| Naviera Armas Class B3 Shares+¤ |

|

|

|

|

|

|

|

|

|

|

169 |

|

|

|

0 |

|

|

|

0 |

|

| Naviera Armas Class A3 Shares+¤ |

|

|

|

|

|

|

|

|

|

|

133 |

|

|

|

0 |

|

|

|

0 |

|

| Naviera Armas Class A2 Shares Stapled To 1.5L SSNS+¤ |

|

|

|

|

|

|

|

|

|

|

937 |

|

|

|

0 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Common Stocks |

|

|

|

|

|

|

|

|

|

|

48,131 |

|

|

|

1,103,388 |

|

|

|

1,432,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Warrant — 0.04%: |

|

| Travelex Topco Limited+ |

|

|

|

|

|

|

|

|

|

|

2,218 |

|

|

|

0 |

|

|

|

119,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Warrant |

|

|

|

|

|

|

|

|

|

|

2,218 |

|

|

|

0 |

|

|

|

119,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Equities |

|

|

|

|

|

|

|

|

|

|

50,349 |

|

|

|

1,103,388 |

|

|

|

1,552,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

EFFECTIVE

INTEREST RATE ‡ |

|

|

DUE DATE |

|

|

PRINCIPAL |

|

|

COST |

|

|

FAIR

VALUE |

|

| Fixed Income — 129.06%: |

|

|

| Asset-Backed Securities — 14.50%: |

|

|

| CDO/CLO — 14.50%: |

|

| 610 FDG 2016-2R CLO LTD, 3M LIBOR + 7.250%+~^# |

|

|

12.50 |

% |

|

|

1/20/2032 |

|

|

|

$1,550,000 |

|

|

|

$1,534,190 |

|

|

|

$1,423,642 |

|

| Anchorage Capital 2016-9A ER2, 3M LIBOR + 6.820%+~^# |

|

|

12.08 |

|

|

|

7/15/2032 |

|

|

|

1,500,000 |

|

|

|

1,485,000 |

|

|

|

1,352,698 |

|

| Anchorage Capital CLO LTD 2013-1R, 3M LIBOR + 6.800%+~^# |

|

|

12.04 |

|

|

|

10/15/2030 |

|

|

|

1,000,000 |

|

|

|

977,213 |

|

|

|

911,781 |

|

| Anchorage Capital CLO LTD 2021-20 E, 3M LIBOR + 7.350%+~^# |

|

|

12.60 |

|

|

|

1/22/2035 |

|

|

|

1,000,000 |

|

|

|

980,000 |

|

|

|

872,071 |

|

| Ares CLO LTD 2013-27R2, 3M LIBOR + 6.750%+~^# |

|

|

12.02 |

|

|

|

10/30/2034 |

|

|

|

1,700,000 |

|

|

|

1,683,000 |

|

|

|

1,499,640 |

|

| Bain CAP CR CLO 2020-2R LTD, 3M LIBOR + 6.610%+~^# |

|

|

11.88 |

|

|

|

7/19/2034 |

|

|

|

1,000,000 |

|

|

|

990,000 |

|

|

|

878,887 |

|

| Ballyrock CLO LTD 2019-2R, 3M LIBOR + 6.500%+~^# |

|

|

11.88 |

|

|

|

11/20/2030 |

|

|

|

2,000,000 |

|

|

|

2,000,000 |

|

|

|

1,826,840 |

|

| BlueMountain CLO LTD 2018-23A, 3M LIBOR + 5.650%+~^# |

|

|

10.90 |

|

|

|

10/20/2031 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

854,203 |

|

| Canyon CLO LTD 2019-2R, 3M LIBOR + 6.750%+~^# |

|

|

12.01 |

|

|

|

10/16/2034 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

895,810 |

|

| Carbone CLO, LTD 2017-1A, 3M LIBOR + 5.900%+~^# |

|

|

11.15 |

|

|

|

1/21/2031 |

|

|

|

750,000 |

|

|

|

750,000 |

|

|

|

648,772 |

|

| Carlyle US CLO LTD 2019-3R, 3M LIBOR + 6.750%+~^# |

|

|

12.00 |

|

|

|

10/20/2032 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

934,625 |

|

See accompanying Notes to the Financial Statements.

12

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

EFFECTIVE

INTEREST RATE ‡ |

|

|

DUE DATE |

|

|

PRINCIPAL |

|

|

COST |

|

|

FAIR

VALUE |

|

|

| Asset-Backed Securities (Continued) |

|

|

| CDO/CLO (Continued) |

|

| Carlyle Global Market Strategies 2017-5A, 3M LIBOR + 5.300%+~^# |

|

|

10.55 |

% |

|

|

1/22/2030 |

|

|

|

$700,000 |

|

|

|

$700,000 |

|

|

|

$560,155 |

|

| CIFC Funding 2020-1 LTD, 3M LIBOR + 6.250%+~^# |

|

|

11.51 |

|

|

|

7/15/2036 |

|

|

|

1,900,000 |

|

|

|

1,900,000 |

|

|

|

1,745,182 |

|

| Galaxy CLO LTD 2017-24A, 3M LIBOR + 5.500%+~^# |

|

|

10.76 |

|

|

|

1/15/2031 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

879,683 |

|

| GoldenTree Loan Management 2018-3A, 3M LIBOR + 6.500%+~^# |

|

|

11.75 |

|

|

|

4/22/2030 |

|

|

|

1,500,000 |

|

|

|

1,467,276 |

|

|

|

1,059,724 |

|

| GoldenTree Loan Opportunities XI LTD 2015-11A, 3M LIBOR + 5.400%+~^# |

|

|

10.66 |

|

|

|

1/18/2031 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

448,423 |

|

| KKR Financial CLO LTD 2017-20, 3M LIBOR + 5.500%+~^# |

|

|

10.76 |

|

|

|

10/16/2030 |

|

|

|

1,500,000 |

|

|

|

1,500,000 |

|

|

|

1,302,789 |

|

| KKR Financial CLO LTD 34-2, 3M LIBOR + 6.850%+~^# |

|

|

12.11 |

|

|

|

7/17/2034 |

|

|

|

2,000,000 |

|

|

|

1,980,000 |

|

|

|

1,809,662 |

|

| KVK 2016-1A ER2, 3M LIBOR + 7.350%+~^# |

|

|

12.61 |

|

|

|

10/16/2034 |

|

|

|

3,000,000 |

|

|

|

2,970,000 |

|

|

|

2,385,237 |

|

| LCM LTD 2031-30, 3M LIBOR + 6.500%+~^# |

|

|

11.75 |

|

|

|

4/21/2031 |

|

|

|

1,100,000 |

|

|

|

1,100,000 |

|

|

|

895,086 |

|

| Madison Park Funding LTD 2015-19A, 3M LIBOR + 4.350%+~^# |

|

|

9.62 |

|

|

|

1/24/2028 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

962,684 |

|

| Madison Park Funding LTD 2018-29A, 3M LIBOR + 7.570%+~^ |

|

|

12.83 |

|

|

|

10/18/2030 |

|

|

|

2,000,000 |

|

|

|

1,960,000 |

|

|

|

1,645,140 |

|

| Madison Park Funding LTD XXXV 2019-35R E-R, 3M

LIBOR + 6.100%+~^# |

|

|

11.35 |

|

|

|

4/20/2032 |

|

|

|

1,400,000 |

|

|

|

1,400,000 |

|

|

|

1,322,290 |

|

| Madison Park Funding LTD 2019-32R E-R, 3M LIBOR +

6.200%+~^# |

|

|

11.47 |

|

|

|

1/22/2031 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

942,537 |

|

| Magnetite CLO LTD 2016-18A, 3M LIBOR + 7.600%+~^# |

|

|

12.92 |

|

|

|

11/15/2028 |

|

|

|

1,400,000 |

|

|

|

1,386,000 |

|

|

|

1,262,370 |

|

| Octagon 2021-57 LTD, 3M LIBOR + 6.600%+~^# |

|

|

11.86 |

|

|

|

10/16/2034 |

|

|

|

1,500,000 |

|

|

|

1,500,000 |

|

|

|

1,322,215 |

|

| OHA Credit Partners LTD 2015-11A, 3M LIBOR + 7.900%+~^# |

|

|

13.15 |

|

|

|

1/20/2031 |

|

|

|

2,000,000 |

|

|

|

1,970,323 |

|

|

|

1,596,160 |

|

| OHA Loan Funding LTD 2013-1A, 3M LIBOR + 7.900%+~^# |

|

|

13.17 |

|

|

|

7/23/2031 |

|

|

|

1,500,000 |

|

|

|

1,477,500 |

|

|

|

1,262,995 |

|

| Sound Point CLO XVIII 2018-18D, 3M LIBOR + 5.500%+~^# |

|

|

10.75 |

|

|

|

1/21/2031 |

|

|

|

2,000,000 |

|

|

|

2,000,000 |

|

|

|

1,325,176 |

|

| Sound Point CLO LTD 2020-27R, 3M LIBOR + 6.560%

E-R+~^# |

|

|

11.82 |

|

|

|

10/25/2034 |

|

|

|

1,400,000 |

|

|

|

1,372,000 |

|

|

|

1,131,018 |

|

| Sound Point CLO LTD Series 2020-1A Class ER, 3M LIBOR + 6.860%+~^# |

|

|

12.11 |

|

|

|

7/20/2034 |

|

|

|

1,600,000 |

|

|

|

1,584,000 |

|

|

|

1,315,934 |

|

| TICP CLO LTD 2018-10A, 3M LIBOR + 5.500%+~^# |

|

|

10.75 |

|

|

|

4/22/2030 |

|

|

|

1,000,000 |

|

|

|

961,745 |

|

|

|

884,512 |

|

| Wellfleet CLO LTD 2020-2R, 3M LIBOR + 7.250%+~^# |

|

|

12.51 |

|

|

|

7/17/2034 |

|

|

|

1,300,000 |

|

|

|

1,300,000 |

|

|

|

1,025,772 |

|

| Wellfleet CLO LTD 2017-3A, 3M LIBOR + 5.550%+~^# |

|

|

10.81 |

|

|

|

1/17/2031 |

|

|

|

1,500,000 |

|

|

|

1,500,000 |

|

|

|

990,116 |

|

See accompanying Notes to the Financial Statements.

13

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

EFFECTIVE

INTEREST RATE ‡ |

|

|

DUE DATE |

|

|

PRINCIPAL |

|

|

COST |

|

|

FAIR

VALUE |

|

|

| Asset-Backed Securities (Continued) |

|

|

| CDO/CLO (Continued) |

|

| Wind River 2017-1A ER, 3M LIBOR + 7.060%+~^# |

|

|

12.32 |

% |

|

|

4/18/2036 |

|

|

|

$2,000,000 |

|

|

|

$1,960,000 |

|

|

|

$1,655,266 |

|

| Wind River CLO LTD 2017-4A, 3M LIBOR + 5.800%+~^# |

|

|

11.18 |

|

|

|

11/20/2030 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

841,477 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total CDO/CLO |

|

|

|

|

|

|

|

|

|

|

50,300,000 |

|

|

|

49,888,247 |

|

|

|

42,670,572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Asset-Backed Securities |

|

|

|

|

|

|

|

|

|

|

50,300,000 |

|

|

|

49,888,247 |

|

|

|

42,670,572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank Loans§ — 11.78%: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beverage, Food and Tobacco — 0.41%: |

|

| Florida Food Products 2nd Lien T/L, 3M LIBOR + 8.0000%¤~ |

|

|

13.19 |

|

|

|

10/18/2029 |

|

|

|

1,500,000 |

|

|

|

1,461,415 |

|

|

|

1,200,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Beverage, Food and Tobacco |

|

|

|

|

|

|

|

|

|

|

1,500,000 |

|

|

|

1,461,415 |

|

|

|

1,200,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Broadcasting and Entertainment — 0.28%: |

|

| Dessert Holdings, 3M LIBOR + 7.2500%¤~ |

|

|

12.75 |

|

|

|

6/8/2029 |

|

|

|

1,000,000 |

|

|

|

982,700 |

|

|

|

830,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Broadcasting and Entertainment |

|

|

|

|

|

|

|

|

|

|

1,000,000 |

|

|

|

982,700 |

|

|

|

830,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chemicals, Plastics and Rubber — 0.64%: |

|

| Colouroz Investment 2 LLC, 3M LIBOR + 4.2500%~ |

|

|

9.52 |

|

|

|

9/21/2024 |

|

|

|

2,336,240 |

|

|

|

2,328,491 |

|

|

|

607,422 |

|

| Koppers Holdings Inc., SOFR + 4.0000%¤~ |

|

|

9.16 |

|

|

|

4/1/2030 |

|

|

|

1,287,097 |

|

|

|

1,249,182 |

|

|

|

1,283,879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Chemicals, Plastics and Rubber |

|

|

|

|

|

|

|

|

|

|

3,623,337 |

|

|

|

3,577,673 |

|

|

|

1,891,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diversified/Conglomerate Manufacturing — 1.43%: |

|

| CP Iris Holdco I 2nd Lien T/L (IPS), 3M LIBOR + 7.0000%¤~ |

|

|

12.25 |

|

|

|

9/21/2029 |

|

|

|

2,398,019 |

|

|

|

2,374,039 |

|

|

|

1,870,455 |

|

| SunSource, Inc., 3M LIBOR + 8.0000%~ |

|

|

13.20 |

|

|

|

4/30/2026 |

|

|

|

2,500,000 |

|

|

|

2,508,641 |

|

|

|

2,346,875 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Diversified/Conglomerate Manufacturing |

|

|

|

|

|

|

|

|

|

|

4,898,019 |

|

|

|

4,882,680 |

|

|

|

4,217,330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diversified/Conglomerate Service — 1.39%: |

|

| Quest Software, SOFR + 7.5000%¤~ |

|

|

12.70 |

|

|

|

1/18/2030 |

|

|

|

3,395,325 |

|

|

|

3,349,395 |

|

|

|

2,223,938 |

|

| Sonicwall, Inc., 3M LIBOR + 7.5000%~ |

|

|

12.66 |

|

|

|

5/18/2026 |

|

|

|

2,008,051 |

|

|

|

1,998,010 |

|

|

|

1,860,579 |

|

| Misys (Finastra), 3M LIBOR + 7.2500%~ |

|

|

12.08 |

|

|

|

6/16/2025 |

|

|

|

0 |

|

|

|

(2,737 |

) |

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Diversified/Conglomerate Service |

|

|

|

|

|

|

|

|

|

|

5,403,376 |

|

|

|

5,344,668 |

|

|

|

4,084,517 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ecological — 0.41%: |

|

| Patriot Container 2nd Lien T/L, 3M LIBOR + 7.7500%~ |

|

|

12.95 |

|

|

|

3/20/2026 |

|

|

|

1,400,000 |

|

|

|

1,336,159 |

|

|

|

1,202,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Ecological |

|

|

|

|

|

|

|

|

|

|

1,400,000 |

|

|

|

1,336,159 |

|

|

|

1,202,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying Notes to the Financial Statements.

14

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

EFFECTIVE

INTEREST RATE ‡ |

|

|

DUE DATE |

|

|

PRINCIPAL |

|

|

COST |

|

|

FAIR

VALUE |

|

|

|

|

|

|

|

| Bank Loans§ (Continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Electronics — 2.53%: |

|

| McAfee Enterprise 2nd Lien T/L, 3M LIBOR + 8.2500%~ |

|

|

13.53 |

% |

|

|

5/3/2029 |

|

|

|

$11,567,000 |

|

|

|

$11,488,368 |

|

|

|

$7,460,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Electronics |

|

|

|

|

|

|

|

|

|

|

11,567,000 |

|

|

|

11,488,368 |

|

|

|

7,460,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Healthcare, Education and Childcare — 1.10%: |

|

| Athenahealth, Inc., SOFR + 3.5000%~ |

|

|

7.82 |

|

|

|

1/14/2027 |

|

|

|

218,814 |

|

|

|

210,609 |

|

|

|

210,335 |

|

| Athenahealth, Inc., SOFR + 3.5000%~ |

|

|

8.60 |

|

|

|

1/26/2029 |

|

|

|

1,781,185 |

|

|

|

1,714,391 |

|

|

|

1,712,165 |

|

| Medical Solutions T/L, 3M LIBOR + 7.0000%~ |

|

|

11.99 |

|

|

|

9/22/2027 |

|

|

|

1,473,684 |

|

|

|

1,458,947 |

|

|

|

1,302,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Healthcare, Education and Childcare |

|

|

|

|

|

|

|

|

|

|

3,473,683 |

|

|

|

3,383,947 |

|

|

|

3,224,868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hotels, Motels, Inns and Gaming — 0.63%: |

|

| Four Seasons Holdings, Inc., 3M SOFR + 3.2500%~ |

|

|

8.50 |

|

|

|

11/30/2029 |

|

|

|

1,860,790 |

|

|

|

1,834,557 |

|

|

|

1,863,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Hotels, Motels, Inns and Gaming |

|

|

|

|

|

|

|

|

|

|

1,860,790 |

|

|

|

1,834,557 |

|

|

|

1,863,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Packaging and Containers — 1.47%: |

|

| Pretium Package Holdings 2nd Lien T/L (9/21), 3M LIBOR + 6.7500%~ |

|

|

11.76 |

|

|

|

9/21/2029 |

|

|

|

2,770,637 |

|

|

|

2,764,769 |

|

|

|

1,428,624 |

|

| Valcour Packaging (MOLD-RITE) 2nd Lien T/L, 3M LIBOR + 7.0000%~ |

|

|

12.09 |

|

|

|

9/30/2029 |

|

|

|

5,000,000 |

|

|

|

4,950,000 |

|

|

|

2,900,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Packaging and Containers |

|

|

|

|

|

|

|

|

|

|

7,770,637 |

|

|

|

7,714,769 |

|

|

|

4,328,624 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personal Transportation — 0.03%: |

|

| Bahia De Las Isletas SL, 3M EURIBOR + 10.0000%¤~ |

|

|

9.12 |

|

|

|

6/30/2025 |

|

|

|

86,584 |

|

|

|

84,202 |

|

|

|

81,915 |

|

| Bahia De Las Isletas SL, 3M EURIBOR + 10.0000%¤~ |

|

|

9.14 |

|

|

|

6/30/2025 |

|

|

|

17,741 |

|

|

|

18,127 |

|

|

|

18,391 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Packaging and Containers |

|

|

|

|

|

|

|

|

|

|

104,325 |

|

|

|

102,329 |

|

|

|

100,306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personal and Non Durable Consumer Products Mfg. Only — 0.36%: |

|

| Journey Personal Care Corp., 3M LIBOR + 4.2500%~ |

|

|

9.41 |

|

|

|

3/1/2028 |

|

|

|

1,247,348 |

|

|

|

986,574 |

|

|

|

1,063,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Packaging and Containers |

|

|

|

|

|

|

|

|

|

|

1,247,348 |

|

|

|

986,574 |

|

|

|

1,063,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Printing and Publishing — 0.30%: |

|

| Nielsen Holdings Ltd., 3M SOFR + 5.0000%~ |

|

|

10.00 |

|

|

|

4/11/2029 |

|

|

|

998,751 |

|

|

|

901,991 |

|

|

|

876,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Hotels, Motels, Inns and Gaming |

|

|

|

|

|

|

|

|

|

|

998,751 |

|

|

|

901,991 |

|

|

|

876,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transportation — 0.80%: |

|

| Worldwide Express 2nd Lien T/L, 3M LIBOR + 7.0000%~ |

|

|

12.16 |

|

|

|

7/26/2029 |

|

|

|

3,000,000 |

|

|

|

2,955,227 |

|

|

|

2,340,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Transportation |

|

|

|

|

|

|

|

|

|

|

3,000,000 |

|

|

|

2,955,227 |

|

|

|

2,340,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Bank Loans |

|

|

|

|

|

|

|

|

|

|

47,847,266 |

|

|

|

46,953,057 |

|

|

|

34,683,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying Notes to the Financial Statements.

15

Barings Global Short Duration High Yield Fund 2023 Semi-Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

EFFECTIVE

INTEREST RATE ‡ |

|

|

DUE DATE |

|

|

PRINCIPAL |

|

|

COST |

|

|

FAIR

VALUE |

|

| Corporate Bonds — 102.78%: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aerospace and Defense — 5.05%: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| American Airlines^ |

|

|

11.75 |

% |

|

|

7/15/2025 |

|

|

|

$5,337,000 |

|

|

|

$5,490,586 |

|

|

|

$5,851,930 |

|

| TransDigm Group, Inc. |

|

|

7.50 |

|

|

|

3/15/2027 |

|

|

|

5,893,000 |

|

|

|

5,899,465 |

|

|

|

5,901,179 |

|

| Triumph Group, Inc.^ |

|

|

9.00 |

|

|

|

3/15/2028 |

|

|

|

886,000 |

|

|

|

886,000 |

|

|

|

904,578 |

|

| Triumph Group, Inc. |

|

|

7.75 |

|

|

|

8/15/2025 |

|

|

|

2,289,000 |

|

|

|

2,289,000 |

|

|

|

2,206,571 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Aerospace and Defense |

|

|

|

|

|

|

|

|

|

|

14,405,000 |

|

|

|

14,565,051 |

|

|

|

14,864,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Automobile — 2.02%: |

|

| Adient PLC+^ |

|

|

8.25 |

|

|

|

4/15/2031 |

|

|

|

870,000 |

|

|

|

870,000 |

|

|

|

883,364 |

|

| Dexko Global Inc.^# |

|

|

6.63 |

|

|

|

10/15/2029 |

|

|

|

1,050,000 |

|

|

|

777,505 |

|

|

|

856,563 |

|

| Faurecia SE+# |

|

|

7.25 |

|

|

|

6/15/2026 |

|

|

|

1,385,000 |

|

|

|

1,470,577 |

|

|

|

1,569,879 |

|

| INA-Holding Schaeffler GmbH & Co KG+# |

|

|

8.75 |

|

|

|

5/15/2028 |

|

|

|

2,350,000 |

|

|

|

2,531,529 |

|

|