The information in this preliminary pricing supplement

is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an offer to buy these

Notes in any jurisdiction where the offer or sale is not permitted.

|

Subject to Completion, dated December 19, 2024

Pricing Supplement dated January , 2025

(To Product Supplement No. RLN-1 dated November 25, 2024, Prospectus

Supplement dated May 26, 2022 and Prospectus dated May 26, 2022) |

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-264388

|

$

Senior Medium-Term Notes, Series I

Redeemable Fixed Rate Notes, Due January 10, 2030

| Issuer: |

Bank of Montreal |

| Principal Amount: |

$1,000 per Note |

| Trade Date: |

January 8, 2025 |

| Issue Date: |

January 10, 2025 |

| Stated Maturity Date: |

January 10, 2030. The Notes are subject to redemption by Bank of Montreal prior to the Stated Maturity Date as set forth below under “Optional Redemption.” The Notes are not subject to repayment at the option of any holder of the Notes prior to the Stated Maturity Date. |

| Payment at Maturity: |

Unless redeemed prior to maturity by Bank of Montreal, a holder will receive on the Stated Maturity Date a cash payment in U.S. dollars equal to $1,000 per Note, plus any accrued and unpaid interest. |

| Interest Payment Dates: |

Semi-annually on the 10th day of each January and July, commencing July 10, 2025, and ending on the Stated Maturity Date or Optional Redemption Date, if applicable. |

| Interest Period: |

With respect to an Interest Payment Date, the period from, and including, the immediately preceding Interest Payment Date (or, in the case of the first Interest Period, the Issue Date) to, but excluding, that Interest Payment Date. |

| Interest Rate: |

5.25% per annum. See “General Terms of the Notes—Fixed Rate Notes” in the accompanying product supplement for a discussion of the manner in which interest on the Notes will be calculated, accrued and paid. |

| Optional Redemption: |

The Notes are redeemable by Bank of Montreal, in whole, but not in part, on the Optional Redemption Dates, at 100% of their Principal Amount plus accrued and unpaid interest to, but excluding, the redemption date. Bank of Montreal will give notice to the holders of the Notes at least 5 business days and not more than 30 business days prior to the Optional Redemption Date in the manner described in the accompanying prospectus supplement under “Description of the Notes We May Offer—Notices.” |

Optional Redemption

Dates: |

Semi-annually on the 10th day of each January and July, commencing January 10, 2026 and ending July 10, 2029. |

| Day Count Convention: |

30/360; Unadjusted |

| Listing: |

The Notes will not be listed on any securities exchange. |

| Denominations: |

$1,000 and any integral multiples of $1,000 |

| CUSIP: |

06376BYZ5 |

| Bail-inable Notes: |

The Notes are bail-inable notes (as defined in the accompanying prospectus supplement) and are subject to conversion in whole or in part—by means of a transaction or series of transactions and in one or more steps—into common shares of Bank of Montreal or any of its affiliates under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act (the “CDIC Act”) and to variation or extinguishment in consequence, and subject to the application of the laws of the Province of Ontario and the federal laws of Canada applicable therein in respect of the operation of the CDIC Act with respect to the Notes. |

The Notes involve risks not associated with an investment in conventional

debt securities. See “Selected Risk Considerations” beginning on page PS-4 herein and “Risk Factors” beginning

on page PS-5 of the accompanying product supplement, page S-2 of the prospectus supplement and page 8 of the prospectus.

The Notes are the unsecured obligations of Bank of Montreal, and, accordingly,

all payments on the Notes are subject to the credit risk of Bank of Montreal. If Bank of Montreal defaults on its obligations, you could

lose some or all of your investment. The Notes are not insured by the Federal Deposit Insurance Corporation, the Deposit Insurance Fund,

the Canada Deposit Insurance Corporation or any other governmental agency.

Neither the Securities and Exchange Commission nor any state securities

commission or other regulatory body has approved or disapproved of these Notes or passed upon the accuracy or adequacy of this pricing

supplement or the accompanying product supplement, prospectus supplement and prospectus. Any representation to the contrary is a criminal

offense.

| |

Original Issue Price(1) |

Underwriting Discount(2) |

Proceeds to Bank of Montreal(2) |

| Per Note |

$1,000.00 |

$15.00 |

$985.00 |

| Total |

$ |

$ |

$ |

| (1) | The original issue price for an eligible institutional investor and an investor purchasing the Notes in a fee-based advisory account

will vary based on then-current market conditions and the negotiated price determined at the time of each sale; provided, however, the

original issue price for such investors will not be less than $985.00 per Note and will not be more than $1,000 per Note. The original

issue price for such investors reflects a foregone selling concession with respect to such sales as described below. |

| (2) | BMO Capital Markets Corp. (“BMOCM”) will receive discounts and commissions of up to $15.00 per Note, and from such

underwriting discount will allow selected dealers a selling concession of up to $15.00 per Note depending on market conditions that are

relevant to the value of the Notes at the time an order to purchase the Notes is submitted to BMOCM. Dealers who purchase the Notes for

sales to eligible institutional investors and fee-based advisory accounts may forgo some or all selling concessions. See “Supplemental

Plan of Distribution” below. |

BMO CAPITAL MARKETS

ADDITIONAL INFORMATION ABOUT THE ISSUER AND

THE NOTES

You should read this pricing supplement together

with product supplement no. RLN-1 dated November 25, 2024, the prospectus supplement dated May 26, 2022 and the prospectus dated May 26,

2022 for additional information about the Notes. To the extent that disclosure in this pricing supplement is inconsistent with the disclosure

in the product supplement, prospectus supplement or prospectus, the disclosure in this pricing supplement will control. Certain defined

terms used but not defined herein have the meanings set forth in the product supplement, prospectus supplement or prospectus.

Our Central Index Key, or CIK, on the SEC website

is 927971. When we refer to “we,” “us” or “our” in this pricing supplement, we refer only to Bank

of Montreal.

You may access the product supplement, prospectus

supplement and prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filings for the

relevant date on the SEC website):

| · | Product Supplement No. RLN-1 dated November 25, 2024: |

https://www.sec.gov/Archives/edgar/data/927971/000121465924019570/x1121240424b2.htm

| · | Prospectus Supplement and Prospectus dated May 26, 2022: |

https://www.sec.gov/Archives/edgar/data/927971/000119312522160519/d269549d424b5.htm

AGREEMENT WITH RESPECT TO THE EXERCISE OF

CANADIAN BAIL-IN POWERS

By its acquisition of the Notes, each holder or beneficial owner of

that Note is deemed to (i) agree to be bound, in respect of that Note, by the CDIC Act, including the conversion of that Note, in whole

or in part—by means of a transaction or series of transactions and in one or more steps— into common shares of Bank of Montreal

or any of its affiliates under subsection 39.2(2.3) of the CDIC Act and the variation or extinguishment of that Note in consequence, and

by the application of the laws of the Province of Ontario and the federal laws of Canada applicable therein in respect of the operation

of the CDIC Act with respect to that Note; (ii) attorn and submit to the jurisdiction of the courts in the Province of Ontario with respect

to the CDIC Act and those laws; (iii) have represented and warranted that Bank of Montreal has not directly or indirectly provided financing

to the holder or beneficial owner of the bail-inable notes for the express purpose of investing in the bail-inable notes; and (iv) acknowledge

and agree that the terms referred to in paragraphs (i) and (ii), above, are binding on that holder or beneficial owner despite any provisions

in the indenture or that Note, any other law that governs that Note and any other agreement, arrangement or understanding between that

holder or beneficial owner and Bank of Montreal with respect to that Note.

Holders and beneficial owners of any Note will have no further rights

in respect of that Note to the extent that Note is converted in a bail-in conversion, other than those provided under the bail-in regime,

and by its acquisition of an interest in any Note, each holder or beneficial owner of that Note is deemed to irrevocably consent to the

converted portion of the Principal Amount of that Note and any accrued and unpaid interest thereon being deemed paid in full by Bank of

Montreal by the issuance of common shares of Bank of Montreal (or, if applicable, any of its affiliates) upon the occurrence of a bail-in

conversion, which bail-in conversion will occur without any further action on the part of that holder or beneficial owner or the trustee;

provided that, for the avoidance of doubt, this consent will not limit or otherwise affect any rights that holders or beneficial owners

may have under the bail-in regime.

See “Risk Factors— The Notes Will Be Subject to Risks,

Including Non-payment In Full or, in the Case of Bail-inable Notes, Conversion in Whole or in Part – By Means of a Transaction or

Series of Transactions and in One or More Steps – Into Common Shares of the Bank or Any of its Affiliates, Under Canadian Bank Resolution

Powers” and “Description of the Notes We May Offer—Special Provisions Related to Bail-inable Notes” in the accompanying

prospectus supplement and prospectus for a description of provisions applicable to the Notes as a result of Canadian bail-in powers.

SELECTED RISK CONSIDERATIONS

The Notes involve risks not associated with an investment in conventional

debt securities. Some of the risks that apply to an investment in the Notes are summarized below, but we urge you to read the more detailed

explanation of the risks relating to the Notes generally in the “Risk Factors” sections of the accompanying product supplement

and prospectus supplement. You should reach an investment decision only after you have carefully considered with your advisors the appropriateness

of an investment in the Notes in light of your particular circumstances.

Risks Relating To The Notes Generally

The Amount Of Interest You Receive May Be Less Than The Return You

Could Earn On Other Investments.

Interest rates may change significantly over the term of the Notes,

and it is impossible to predict what interest rates will be at any point in the future. The interest rate payable on the Notes may be

more or less than prevailing market interest rates at any time during the term of the Notes. As a result, the amount of interest you receive

on the Notes may be less than the return you could earn on other investments.

The Per Annum Interest Rate Will Affect Our Decision To Redeem The

Notes.

It is more likely that we will redeem the Notes prior to the Stated

Maturity Date during periods when the remaining interest is to accrue on the Notes at a rate that is greater than that which we would

pay on a conventional fixed-rate non-redeemable debt security of comparable maturity. If we redeem the Notes prior to the Stated Maturity

Date, you may not be able to invest in other debt securities that yield as much interest as the Notes.

The Notes Are Subject To Credit Risk.

The Notes are our obligations and are not, either directly or indirectly,

an obligation of any third party. Any amounts payable under the Notes are subject to our creditworthiness. As a result, our actual and

perceived creditworthiness may affect the value of the Notes and, in the event we were to default on our obligations under the Notes,

you may not receive any amounts owed to you under the terms of the Notes.

Risks Relating To The Value Of The Notes And Any Secondary Market

The Underwriting Discount, Offering Expenses And Certain Hedging

Costs Are Likely To Adversely Affect The Price At Which You Can Sell Your Notes.

Assuming no changes in market conditions or any other relevant factors,

the price, if any, at which you may be able to sell the Notes will likely be lower than the original issue price. The original issue price

includes, and any price quoted to you is likely to exclude, the underwriting discount paid in connection with the initial distribution,

offering expenses and the projected profit that our hedge counterparty (which may be one of our affiliates) expects to realize in consideration

for assuming the risks inherent in hedging our obligations under the Notes. In addition, any such price is also likely to reflect dealer

discounts, mark-ups and other transaction costs, such as a discount to account for costs associated with establishing or unwinding any

related hedge transaction. The price at which the agent or any other potential buyer may be willing to buy your Notes will also be affected

by the interest rate provided by the Notes and by the market and other conditions discussed in the next risk factor.

The Value Of The Notes Prior To Maturity Will Be Affected By Numerous

Factors, Some Of Which Are Related In Complex Ways.

The value of the Notes prior to maturity will be affected by interest

rates at that time and a number of other factors, some of which are interrelated in complex ways. The effect of any one factor may be

offset or magnified by the effect of another factor. The following factors, which are described in more detail in the accompanying product

supplement, are expected to affect the value of the Notes: interest rates and our creditworthiness.

The Notes Will Not Be Listed On Any Securities Exchange And We Do

Not Expect A Trading Market For The Notes To Develop.

The Notes will not be listed or displayed on any securities exchange.

Although the agent and/or its affiliates may purchase the Notes from holders, they are not obligated to do so and are not required to

make a market for the Notes. There can be no assurance that a secondary market will develop. Because we do not expect that any market

makers will participate in a secondary market for the Notes, the price at which you may be able to sell your Notes is likely to depend

on the price, if any, at which the agent is willing to buy your Notes.

If a secondary market does exist, it may be limited. Accordingly, there

may be a limited number of buyers if you decide to sell your Notes prior to maturity. This may affect the price you receive upon such

sale. Consequently, you should be willing to hold the Notes to maturity.

Risk Relating To Conflicts Of Interest

A Dealer Participating In The Offering Of The Notes Or Its Affiliates

May Realize Hedging Profits Projected By Its Proprietary Pricing Models In Addition To Any Selling Concession And/Or Other Fee, Creating

A Further Incentive For The Participating Dealer To Sell The Notes To You.

If any dealer participating in the offering of the Notes, which we

refer to as a “participating dealer,” or any of its affiliates conducts hedging activities for us in connection with the Notes,

that participating dealer or its affiliates will expect to realize a projected profit from such hedging activities, if any, and this projected

hedging profit will be in addition to any concession and/or other fee that the participating dealer realizes for the sale of the Notes

to you. This additional projected profit may create a further incentive for the participating dealer to sell the Notes to you.

SUPPLEMENTAL TAX CONSIDERATIONS

In the opinion of our counsel, Davis Polk & Wardwell LLP, the Notes

should be treated as debt instruments for U.S. federal tax purposes.

Both U.S. and non-U.S. holders should read the section of the accompanying

product supplement entitled “United States Federal Income Tax Considerations.”

You should consult your tax advisor regarding all aspects of the

U.S. federal tax consequences of an investment in the Notes, as well as any tax consequences arising under the laws of any state, local

or non-U.S. taxing jurisdiction.

This discussion supplements the discussion in “United States

Federal Income Tax Considerations” in the accompanying product supplement and should be read in conjunction therewith.

SUPPLEMENTAL PLAN OF DISTRIBUTION

BMOCM, a wholly owned subsidiary of Bank of Montreal, is the agent

for the distribution of the Notes. We have agreed to sell to BMOCM, and BMOCM has agreed to purchase from us, all of the Notes at the

original issue price less the underwriting discount specified on the cover page of this pricing supplement. The agent may resell the Notes

to other securities dealers at the original issue price less a concession not in excess of the underwriting discount. BMOCM will receive

an underwriting discount in the amount indicated on the cover hereof, and from such underwriting discount will allow selected dealers

a selling concession in an amount not to exceed such underwriting discount depending on market conditions that are relevant to the value

of the Notes at the time an order to purchase the Notes is submitted to the agent. Dealers who purchase the Notes for sales to eligible

institutional investors and fee-based advisory accounts may forgo some or all selling concessions.

The agent or another affiliate of ours expects to realize hedging profits

projected by its proprietary pricing models to the extent it assumes the risks inherent in hedging our obligations under the Notes. If

any dealer participating in the distribution of the Notes or any of its affiliates conducts hedging activities for us in connection with

the Notes, that dealer or its affiliate will expect to realize a profit projected by its proprietary pricing models from such hedging

activities. Any such projected profit will be in addition to any discount or concession received in connection with the sale of the Notes

to you.

If all of the Notes are not sold on the Trade Date at the original

offering price, the agent and/or dealers may change the offering price and the other selling terms and thereafter from time to time may

offer the Notes for sale in one or more transactions at market prices prevailing at the time of sale, at prices related to market prices

or at negotiated prices.

BMOCM may, but is not obligated to, make a market in the Notes. BMOCM

will determine any secondary market prices that it is prepared to offer in its sole discretion.

We may use this pricing supplement in the initial sale of the Notes.

In addition, BMOCM or another of our affiliates may use this pricing supplement in market-making transactions in any Notes after their

initial sale. Unless BMOCM or we inform you otherwise in the confirmation of sale, this pricing supplement is being used by BMOCM in a

market-making transaction.

See “Supplemental Plan of Distribution” in the accompanying

product supplement, “Supplemental Plan of Distribution (Conflicts of Interest)” in the accompanying prospectus supplement

and “Plan of Distribution (Conflicts of Interest)” in the accompanying prospectus for more information.

PS-7

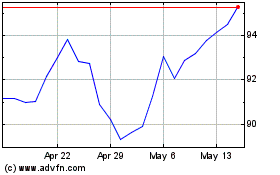

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Dec 2023 to Dec 2024