Broadstone Net Lease Provides First Quarter 2024 Business Update

April 03 2024 - 3:10PM

Business Wire

Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the

“Company,” “we,” “our,” or “us”), today provided a business update

for the quarter ended March 31, 2024. Additionally, the Company

announced that it will be participating in the Morgan Stanley

Triple Net REIT Day on April 9, 2024.

Q1 2024 BUSINESS UPDATE

- During the first quarter, we invested $40.1 million, including

$37.1 million in development fundings and $3.0 million in revenue

generating capital expenditures. The development fundings primarily

relate to our previously disclosed state-of-the-art one million

square foot tri-climate distribution facility in Sarasota, Florida,

which is expected to open in the third quarter of 2024. The

facility will be leased to UNFI pursuant to a 15-year net lease

with multiple renewal options and 2.50% annual rent escalations.

The stabilized yield upon completion is estimated to be

approximately 7.2%, and together with rent escalations will

translate into a GAAP capitalization rate of approximately 8.3%.

The revenue generating capital expenditures had a weighted average

initial cash capitalization rate of 8.0%, lease term of 8.0 years,

and annual rent increase of 2.5%.

- Through the date of this release, we have $282.7 million of

committed investments, including $202.8 million in acquisitions

under control, $74.1 million of commitments to fund developments,

and $5.8 million of commitments to fund revenue generating capital

expenditures with existing tenants. The $202.8 million in

acquisitions under control, which we define as under contract or

executed letter of intent, include $105.7 million in industrial

properties and $97.1 million in retail and restaurant properties.

$149.5 million of the acquisitions are off-market deals sourced

directly through developer and other relationships. We anticipate

these acquisitions will close during April and May of 2024.

- During the first quarter, we sold 37 clinically-oriented

healthcare properties for gross proceeds of $251.7 million at a

weighted average capitalization rate of 7.9%. The properties

represented approximately 48% of our clinically-oriented healthcare

portfolio and had a weighted average remaining lease term of 4.4

years. As a result of the sale, our healthcare portfolio decreased

to 13.4% of ABR at March 31, 2024. Our industrial, restaurant,

retail, and office portfolio represented 54.2%, 14.2%, 11.9%, and

6.3%, respectively, of ABR at March 31, 2024.

- During the first quarter, we collected 99.0% of base rents due

for all properties under lease, and our portfolio was 99.2% leased

based on rentable square footage, with only three of our 759 total

properties vacant and not subject to a lease as of quarter

end.

MANAGEMENT COMMENTARY

“I am excited to announce that we have closed on the sale of

$251.7 million of our clinically-oriented properties as part of our

healthcare portfolio simplification strategy, with the entirety of

the net proceeds slated for redeployment into our $282.7 million of

investments under control,” said John Moragne, BNL's Chief

Executive Officer. “With continued strong portfolio operating

performance during the first quarter and continued solid balance

sheet fundamentals, this is a significant milestone in building the

momentum needed for multiple expansion, long-term growth, and

increased shareholder value. Looking ahead, we remain optimistic

about the year, and confident in our ability to execute on our

strategic vision and drive sustained growth across our diversified

real estate assets.”

About Broadstone Net Lease, Inc.

BNL is an industrial-focused, diversified net lease REIT that

invests in primarily single-tenant commercial real estate

properties that are net leased on a long-term basis to a

diversified group of tenants. Utilizing an investment strategy

underpinned by strong fundamental credit analysis and prudent real

estate underwriting, as of March 31, 2024, BNL’s diversified

portfolio consisted of 759 individual net leased commercial

properties with 752 properties located in 44 U.S. states and seven

properties located in four Canadian provinces across the

industrial, restaurant, healthcare, retail, and office property

types.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our plans, strategies, and

prospects, both business and financial. Such forward-looking

statements can generally be identified by our use of

forward-looking terminology such as “outlook,” “potential,” “may,”

“will,” “should,” “could,” “seeks,” “approximately,” “projects,”

“predicts,” “expect,” “intends,” “anticipates,” “estimates,”

“plans,” “would be,” “believes,” “continues,” or the negative

version of these words or other comparable words. Forward-looking

statements, including our 2024 guidance and assumptions, involve

known and unknown risks and uncertainties, which may cause BNL’s

actual future results to differ materially from expected results,

including, without limitation, risks and uncertainties related to

general economic conditions, including but not limited to increases

in the rate of inflation and/or interest rates, local real estate

conditions, tenant financial health, property investments and

acquisitions, and the timing and uncertainty of completing these

property investments and acquisitions, and uncertainties regarding

future distributions to our stockholders. These and other risks,

assumptions, and uncertainties are described in Item 1A “Risk

Factors” of the Company's Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, which was filed with the SEC on

February 22, 2024, which you are encouraged to read, and will be

available on the SEC’s website at www.sec.gov. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date they are made. The Company assumes no obligation to,

and does not currently intend to, update any forward-looking

statements after the date of this press release, whether as a

result of new information, future events, changes in assumptions,

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240403548331/en/

Company Contact:

Brent Maedl Director, Corporate Finance & Investor Relations

brent.maedl@broadstone.com 585.382.8507

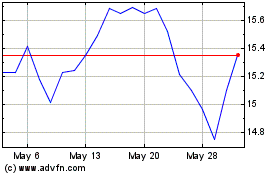

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

From Nov 2023 to Nov 2024