FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2023

Brazilian

Distribution Company

(Translation of Registrant’s Name Into English)

Av. Brigadeiro Luiz Antonio,

3142 São Paulo, SP 01402-901

Brazil

(Address of Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F X Form

40-F

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (1)):

Yes ___ No X

(Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (7)):

Yes ___ No X

(Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

COMPANHIA

BRASILEIRA DE DISTRIBUIÇÃO

Publicly

Held Company

CNPJ/MF

No. 47.508.411/0001-56

NIRE 35.300.089.901

NOTICE TO THE MARKET

Clarifications about CVM/B3 inquiries

Companhia Brasileira de Distribuição

(“GPA” or “Company”), in compliance with Official Letter No. 341/2023/CVM/SEP/GEA-2, dated December

8, 2023 (“Official Letter”), hereby presents the clarifications requested by the Brazilian Securities and Exchange

Commission (“CVM”) regarding the news published on December 6, 2023, in the newspaper “Brazil Journal”

under the title “GPA wants to cut leverage by 50% in one year; expansion will focus on Minuto Pão” (“News”).

For better understanding and in line with the

guidelines contained in the Letter, its content is transcribed below:

|

Official Letter No. 341/2023/CVM/SEP/GEA-2

Rio de Janeiro, December 8, 2023.

To Mr.

Rafael Sirotsky Russowsky

Investor Relations Officer at

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

Tel.: (11) 3886-0533

E-mail: gpa.ri@gpabr.com

C/C: Superintendence of Listing and Supervision of Issuers of B3

S.A. – Brasil, Bolsa, Balcão

Emails: emissores@b3.com.br; ana.pereira@b3.com.br; ana.zane@b3.com.br

Subject: Request for clarification on news published in the

media

Dear Mr. Officer,

1. We refer to the Notice to the Market of the

type "Presentations to analysts/market agents" entitled "Investor Day 2023 Presentation", presented in the Empresas.NET

System at 9:53 am on 12/06/2023, and to the news published in the Brazil Journal news portal on 12/06/2023, entitled "GPA wants to

cut 50% of leverage in one year; expansion will focus on the Bread Minute", with the following content:

GPA wants to cut 50% of leverage

in a year; expansion will focus on the Bread Minute

Pedro Arbex

Grupo Pão de Açúcar

intends to open at least 45 new stores next year, most of them in Minuto Pão, its proximity format - which has shown a relevant

increase in margin.

The retailer also wants to reduce its

capex and intends to cut leverage in half, closing 2024 with a net debt equivalent to 1.2x EBITDA.

At the Investor Day that is taking place

today in São Paulo, GPA also said that it wants to reduce its cash burn by more than 50% next year – after it has

already fallen from BRL 2 billion in 2022 to less than BRL 1 billion this year.

By 2025, the plan is to return to

positive total cash generation, CEO Marcelo Pimentel said during the event.

The CEO also reinforced the guidance

of reaching an EBITDA margin of 8% to 9% next year - compared to 7% in the third quarter - and detailed the deliveries that have already

been made from the turnaround since he took charge of the company in April last year.

[...]

2. Regarding the highlighted excerpts, we request

your statement on the veracity of the information provided in the news article, and, if so, we request the following additional clarifications:

a) Regarding the projection regarding

the opening of 45 new stores in 2024, the information provided does not seem to be in line with the projection of the opening of 118 new

stores in 2024, 12 of which are supermarkets and 106 are proximity, which appears in item 3.1.d of version 3.0 of the Company's 2023 Reference

Form, presented in the Empresas.NET System on 10/11/2023. The Company must clarify whether this is a modification of the projection previously

disclosed and, if so, you must inform the reasons why you decided that the matter was not a Material Fact, pursuant to CVM Resolution

No. 44/21, in particular the provisions of item XXI of the sole paragraph of article 2;

b) regarding the projection regarding

the reduction of leverage by half, closing 2024 with a net debt equivalent to 1.2x EBITDA, you must clarify the reasons why you decided

that the matter was not a Material Fact, pursuant to CVM Resolution No. 44/21, in particular the provisions of item XXI of the sole paragraph

of article 2; and

c) with respect to the projection regarding

the reduction of its cash burn by more than 50% in 2024 and positive cash generation by 2025, you must clarify the reasons why you decided

that the matter was not a Material Fact, pursuant to CVM Resolution No. 44/21, in particular the provisions of item XXI of the sole paragraph

of article 2.

3. The Company must also inform in which documents

filed in the Empresas.NET System more information can be obtained on the subject.

4. Such statement must include a copy of this Letter

and be sent through the Empresas.NET System, category "Notice to the Market", type "Clarifications on CVM/B3 questions".

The fulfillment of this request for manifestation by means of a Notice to the Market does not exempt the eventual determination of liability

for the failure to timely disclose a Material Fact, pursuant to CVM Resolution No. 44/21.

5. As directed in item 4.3 of the Circular/Annual-2023-CVM/SEP

Letter, "the disclosure of projections is information of a material nature, subject to the determinations of CVM Resolution

No. 44/21, and the company's Disclosure Policy must also contemplate the adoption of this practice. According to item XXI of the sole

paragraph of article 2 of CVM Resolution No. 44/21, the modification of projections disclosed by the company is an example of a material

fact. Likewise, the initial disclosure of projections or the disclosure of projections referring to periods other than those of

previously disclosed projections are also considered material facts, and therefore the determinations of CVM Resolution No. 44/21 are

applicable" (emphasis added).

|

6. In this regard, we emphasize that, pursuant

to Article 8 of CVM Resolution No. 44/21, the controlling shareholders, officers, members of the board of directors, the fiscal council

and any bodies with technical or advisory functions, created by statutory provision, and employees of the company, must maintain the

confidentiality of information related to a material act or fact to which they have privileged access due to the position or position

they occupy, until its disclosure to the market, as well as ensuring that subordinates and third parties of its trust also do so,

jointly and severally liable with them in the event of non-compliance.

7. Pursuant to article 3 of CVM Resolution No.

44/21, it is incumbent upon the Investor Relations Officer to disclose and communicate to the CVM and, if applicable, to the stock

exchange and the entity of the organized over-the-counter market in which the securities issued by the company are admitted to trading,

any material act or fact that occurred or related to its business, as well as ensuring their wide and immediate dissemination, simultaneously

in all markets in which such securities are admitted to trading. According to paragraph 3 of the same article, it is incumbent upon

the Investor Relations Officer to ensure that the disclosure of a material act or fact in the manner provided for in the caput and in

paragraph 4 precedes or is made simultaneously with the dissemination of the information by any means of communication, including press

information, or in meetings of professional associations. investors, analysts or with a selected audience, in the country or abroad.

8. We also recall the obligation set forth in the

sole paragraph of article 4 of CVM Resolution No. 44/21, to inquire the Company's managers and controlling shareholders, as well as all

other persons with access to material acts or facts, in order to ascertain whether they are aware of information that must be disclosed

to the market.

9. In addition, it should be recalled that the

Reference Form (Item 11. Projections) must be updated within seven (7) business days from the change or disclosure of new projections

or estimates (item VIII of paragraph 3 or item V of paragraph 4 of article 25 of CVM Resolution No. 80/22).

10. We also remind you that, if projections and

estimates are disclosed, the issuer must, on a quarterly basis, in the appropriate field of the Quarterly Information Form (ITR) and in

the Standardized Financial Statements Form (DFP), compare the projections disclosed in the Reference Form and the results actually obtained

in the quarter, indicating the reasons for any differences (paragraph 4 of article 21 of CVM Resolution No. 80/22).

11. By order of the Superintendence of Relations

with Companies, we warn that it will be incumbent upon this administrative authority, in the exercise of its legal powers and, based on

item II, of article 9, of Law No. 6,385/76, and article 7, combined with article 8, of CVM Resolution No. 47/21, to determine the application

of a punitive fine, without prejudice to other administrative sanctions, in the amount of R$ 1,000.00 (one thousand reais), for non-compliance

with the requirements formulated, until December 11, 2023.

Best regards

Document electronically signed by Guilherme

Rocha Lopes, Manager, on 12/08/2023, at 5:20 pm, based on article 6 of Decree No. 8,539, of October 8, 2015.

Document electronically signed by Gustavo André

Ramos Inubia, Analyst, on 12/08/2023, at 5:48 pm, based on article 6 of Decree No. 8,539, of October 8, 2015. |

First, it should be clarified

that the information about the opening of at least 45 more new stores in 2024 should not be considered as a modification of the

performance projection (guidance) already disclosed by the Company. This is because this number is within the projection already

presented by the Company for store openings and for this reason the term "at least" was used, which indicates that this is a

minimum number and not a maximum number of stores. It should also be noted that this reference took into account only the openings of

stores in the "proximity" category, even though the News reported that only most of them would be Minuto Pão de Açúcar.

Regardless of the piece

of news published in the media, the Company decided, taking into account current market conditions and aiming for the best return for

shareholders, to review its store expansion plan and released, on this date, a relevant fact with a new store opening schedule to be performed

until 2026.

In relation to item b) of

the Official Letter, the Company has been widely disclosing its plan to reduce financial leverage, with several projects already completed

or in progress, such as the sale of the stake held by the Company in Almacenes Éxito S.A. and CNova N.V. and the potential public

offering of shares issued by the Company. However, the Company would like to emphasize that it did not provide a projection of its net

debt for 2024, which was an inference made by the journalist based on public information related to the Company’s current net debt

level, added to its existing and disclosed projection of adjusted EBITDA margin. Therefore, such information should not be considered

as a new performance projection (guidance) of the Company. In fact, information about the leverage reduction plan was widely disclosed

at the Company's investor day and appears in the presentation released to the market on page 102.

Finally, in relation to

item c) of the Official Letter, the Company understands that such information also does not constitute new projections and is part of

its adjusted EBITDA margin projection already disclosed to the market, which also depends on its cash generation capacity, with cash burn

having already shown a significant drop in the last year. It is important to note that the Company did not provide a number for its cash

generation in 2025, mentioning only that it would be positive, which also disqualifies the information as a projection.

Thus, to the extent that

the values and indicators referred to in the News and in the Presentation to Investors, as they were widely disclosed, including publication

on the Company’s and CVM websites, are not qualified as modifications or new performance projections (guidance), we understand

that this information would not give rise to the obligation to disclose a Material Fact pursuant to CVM Resolution No. 44, of August 23,

2021.

In view of all the above,

believing that it has clarified the questions presented in the Official Letter, the Company makes itself available to provide any additional

clarifications that may be necessary.

São Paulo, December 11, 2023.

Rafael Russowsky

Vice President of Finance and Investor Relations

Officer

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

| |

|

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

|

| Date: December

12, 2023 |

By: /s/ Marcelo Pimentel

|

| |

|

Name: |

Marcelo Pimentel |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

|

By: /s/

Rafael Sirotsky Russowsky |

| |

|

Name: |

Rafael Sirotsky Russowsky |

| |

|

Title: |

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

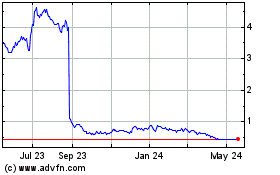

Companhia Brasileira de ... (NYSE:CBD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Companhia Brasileira de ... (NYSE:CBD)

Historical Stock Chart

From Feb 2024 to Feb 2025