Digital Media Solutions, Inc. Announces Delisting From The New York Stock Exchange

September 25 2023 - 4:38PM

Digital Media Solutions, Inc. (NYSE: DMS) (“DMS” or the “Company”)

today announced that it will be delisted from the New York Stock

Exchange (the “NYSE”). The Company’s delisting follows the NYSE’s

determination under Rule 802.01B of the NYSE Listed Company Manual

that the Company did not meet the NYSE’s continued listing standard

that requires listed companies to maintain an average global market

capitalization of at least $15 million over a period of 30

consecutive trading days.

The Company’s delisting does not affect the Company’s business

operations and DMS continues to be focused on its core solutions in

service of its advertising clients. In addition, the delisting does

not cause an event of default under the senior secured credit

facility to which its subsidiaries are a party, and DMS continues

to be supported by its lenders as evidenced by the recent amendment

to its credit facility, which has provided the Company and

management with the flexibility needed to manage through the

current environment.

The Company will continue to be a Securities and Exchange

Commission (“SEC”) reporting company and anticipates that its Class

A common stock will begin trading on the over-the-counter markets

on September 26, 2023. The Company will consider relisting its

Class A common stock on a national securities exchange in the

future if the Board of Directors determines that doing so is in the

best interest of the Company and its stakeholders.

Forward-Looking Statements:

This press release includes “forward-looking statements” within

the meaning of that term in Section 27A of the Securities Act of

1933, as amended and Section 21E of the Securities Exchange Act of

1934, as amended, and are made in reliance upon such acts and the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. DMS’s actual results may differ from its

expectations, estimates and projections and consequently, you

should not rely on these forward-looking statements as predictions

of future events. These forward statements are often identified by

words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue,” and

similar expressions. These forward-looking statements include,

without limitation, DMS’s expectations with respect to its and

ClickDealer’s future performance and its ability to implement its

strategy and are based on the beliefs and expectations of our

management team from the information available at the time such

statements are made. These forward-looking statements involve

significant risks and uncertainties that could cause the actual

results to differ materially from the expected results. Most of

these factors are outside DMS’s control and are difficult to

predict. Factors that may cause such differences include, but are

not limited to: (1) the effect of delisting from the NYSE,

including on our relationships with third parties and employees;

(2) whether an over-the-counter trading market for our Class A

common stock will develop or persist; (3) our ability to meet any

requirements of any stock exchange for listing our securities in

the future; (4) our ability to attain the expected financial

benefits from the ClickDealer transaction; (5) any impacts to the

ClickDealer business from our acquisition thereof, (6) the COVID-19

pandemic or other public health crises; (7) management of our

international expansion as a result of the ClickDealer acquisition;

(8) changes in client demand for our services and our ability to

adapt to such changes; (9) the entry of new competitors in the

market; (10) the ability to maintain and attract consumers and

advertisers in the face of changing economic or competitive

conditions; (11) the ability to maintain, grow and protect the data

DMS obtains from consumers and advertisers, and to ensure

compliance with data privacy regulations in newly entered markets;

(12) the performance of DMS’s technology infrastructure; (13) the

ability to protect DMS’s intellectual property rights; (14) the

ability to successfully source, complete and integrate

acquisitions; (15) the ability to improve and maintain adequate

internal controls over financial and management systems, and

remediate material weaknesses therein, including any integration of

the ClickDealer business; (16) changes in applicable laws or

regulations and the ability to maintain compliance; (17) our

substantial levels of indebtedness; (18) volatility in the trading

price of our common stock and warrants; (19) fluctuations in value

of our private placement warrants; and (20) other risks and

uncertainties indicated from time to time in our filings with the

SEC, including those under “Risk Factors” in DMS’s Annual Report on

Form 10-K/A for the year ended December 31, 2022, filed on April 5,

2023 (“2022 Form 10-K/A”) and our subsequent filings with the SEC.

There may be additional risks that we consider immaterial or which

are unknown, and it is not possible to predict or identify all such

risks. DMS cautions that the foregoing list of factors is not

exclusive. DMS cautions readers not to place undue reliance upon

any forward-looking statements, which speak only as of the date

made. DMS does not undertake or accept any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any such statement is based.

About DMS:

Digital Media Solutions, Inc. (NYSE: DMS) is a leading provider

of data-driven, technology-enabled digital performance advertising

solutions connecting consumers and advertisers within the auto,

home, health, and life insurance, plus a long list of top consumer

verticals. The DMS first-party data asset, proprietary advertising

technology, significant proprietary media distribution, and

data-driven processes help digital advertising clients de-risk

their advertising spend while scaling their customer bases. Learn

more at https://digitalmediasolutions.com.

Investor Relations

investors@dmsgroup.com

For inquiries related to media, contact

marketing@dmsgroup.com

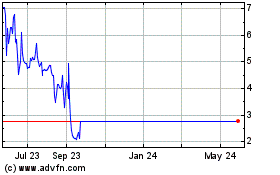

Digital Media Solutions (NYSE:DMS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Digital Media Solutions (NYSE:DMS)

Historical Stock Chart

From Dec 2023 to Dec 2024