UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-41858

Okeanis Eco Tankers Corp.

(Translation of registrant’s name into English)

c/o OET

Chartering Inc., Ethnarchou Makariou Ave., & 2 D. Falireos St., 185 47 N. Faliro, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

INFORMATION CONTAINED IN THIS

FORM 6-K REPORT

Attached

to this report on Form 6-K as Exhibit 99.1 is a copy of the

press release published by Okeanis Eco Tankers Corp. on May 16, 2024, titled “Okeanis Eco Tankers Corp. – Unaudited

Condensed Financial Statements for the First Quarter and Three-Month Period of 2024.”

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

Okeanis Eco Tankers Corp. |

| |

|

| |

By: |

/s/

Iraklis Sbarounis |

| |

Name: |

Iraklis Sbarounis |

| |

Title: |

Chief Financial Officer |

Date:

May 16, 2024

Exhibit 99.1

Okeanis Eco Tankers Corp. – Unaudited Condensed Financial

Statements for the First Quarter and Three-Month Period of 2024

ATHENS, GREECE, May 16, 2024: Okeanis Eco Tankers

Corp. (the “Company” or “OET” or “Okeanis”) (NYSE:ECO / OSE:OET), today reported unaudited condensed

financial statements for the first quarter and three-month period of 2024, which are attached to this press release.

Selected

Q1 2024 and Recent Highlights:

| · | Time charter equivalent ("TCE", a non-IFRS measure*) revenue

and Adjusted EBITDA (a non-IFRS measure*) of $81.0 million and $65.2 million, respectively. Adjusted profit and Adjusted earnings per

share (non-IFRS measures*) for the period of $39.6 million or $1.23 per basic & diluted share. |

| · | Fleetwide daily TCE rate of $63,600 per operating day; VLCC and

Suezmax TCE rates of $68,800 and $56,700 per operating day, respectively. |

| · | Daily vessel operating expenses (“opex”, a non-IFRS

measure*) of $9,208 per calendar day, including management fees. |

| · | In Q2 2024 to date, 82% of the available VLCC spot days have been

booked at an average TCE rate of $75,900 per day and 57% of the available Suezmax spot days have been booked at an average TCE rate of

$60,800 per day. |

| · | The Company paid an amount of approximately $21.2 million or $0.66

per share in March 2024 as a dividend classified for accounting purposes as a return of paid-in capital. |

*The Company uses certain financial information

calculated on a basis other than in accordance with generally accepted accounting principles, including TCE, Adjusted EBITA, Adjusted

profit, Adjusted earnings per share, and opex. For a reconciliation of these non-IFRS measures please refer to the end of the attached

report.

Declaration

of 1Q 2024 dividend

The Company’s board of directors declared

a dividend of $1.10 per common share to shareholders. Dividends payable to common shares registered in the Euronext VPS will be distributed

in NOK. The cash payment will be classified as a return of paid-in-capital and will be paid on June 20, 2024, to shareholders of record

as of June 5, 2024. The common shares will be traded ex-dividend on the NYSE as from and including June 5, 2024, and the common shares

will be traded ex-dividend on the Oslo Børs as from and including June 4, 2024. Due to the implementation of Central Securities

Depository Regulation (CSDR) in Norway, dividends payable on common shares registered with Euronext VPS are expected to be distributed

to Euronext VPS shareholders on or about June 25, 2024.

A presentation related to our results can be

found on our website: http://www.okeanisecotankers.com/reports/.

Information found on our website is not incorporated

by reference into this press release.

OET will be hosting a conference call and webcast at 13:30 CET on Thursday

May 16, 2024, to discuss the Q1 2024 results. Participants may access the webcast using the following

link and dial-in details:

https://events.q4inc.com/attendee/182966276

Standard International Access: +44 20 3936 2999

USA: +1 646 664 1960

Norway: +47 815 03 308

Password: 487447

An audio

replay of the conference call will be available on our website:

http://www.okeanisecotankers.com/reports/

Contacts

Company

Iraklis Sbarounis, CFO

Tel: +30 210 480 4200

ir@okeanisecotankers.com

Investor Relations / Media

Contact

Nicolas Bornozis, President

Capital Link, Inc.

230 Park Avenue, Suite 1540,

New York, N.Y. 10169

Tel: +1 (212) 661-7566

okeanisecotankers@capitallink.com

About OET

OET is a leading international

tanker company providing seaborne transportation of crude oil and refined products. The Company was incorporated on April 30, 2018 under

the laws of the Republic of the Marshall Islands and is listed on Oslo Børs under the symbol OET and the New York Stock Exchange

under the symbol ECO. The sailing fleet consists of six modern scrubber-fitted Suezmax tankers and eight modern scrubber-fitted VLCC tankers.

Forward-Looking Statements

This communication

contains “forward-looking statements”, including as defined under U.S. federal securities laws. Forward-looking statements

provide the Company’s current expectations or forecasts of future events. Forward-looking statements include statements about the

Company’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts

or that are not present facts or conditions. Words or phrases such as “anticipate,” “believe,” “continue,”

“estimate,” “expect,” “hope,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “will” or similar words or phrases,

or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily

mean that a statement is not forward-looking. Forward-looking statements are subject to known and unknown risks and uncertainties and

are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by

the forward-looking statements. The Company’s actual results could differ materially from those anticipated in forward-looking

statements for many reasons, including as described in the Company’s filings with the U.S. Securities and Exchange Commission.

Accordingly, you should not unduly rely on these forward-looking statements, which speak only as of the date of this communication. Factors

that could cause actual results to differ materially include, but are not limited to, the Company's operating or financial results; the

Company's liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company operates;

shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent

acquisitions and dispositions, business strategy, areas of possible expansion or contraction, and expected capital spending or operating

expenses; risks associated with operations; broader market impacts arising from war (or threatened war) or international hostilities;

risks associated with pandemics (including COVID-19), including effects on demand for oil and other products transported by tankers and

the transportation thereof; and other factors listed from time to time in the Company's filings with the U.S. Securities and Exchange

Commission. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly

any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with

respect thereto or any change in events, conditions or circumstances on which any statement is based. You should, however, review the

factors and risks the Company describes in the reports it files and furnishes from time to time with the U.S. Securities and Exchange

Commission, which can be obtained free of charge on the U.S. Securities and Exchange Commission’s website at www.sec.gov.

This information

is subject to the disclosure requirements pursuant to Section 5-12 of the Norwegian Securities Trading Act.

Okeanis Eco Tankers Corp. Reports

Financial Results for the First Quarter and Three-Month Period of 2024

ATHENS, GREECE, May 16, 2024 – Okeanis

Eco Tankers Corp. (together with its subsidiaries, unless context otherwise dictates, “OET” or the

“Company”) (NYSE: ECO, OSE: OET) today reported its unaudited condensed financial results for the first quarter and

three-month period of 2024.

Financial performance

| · | Revenues

for Q1 2024 of $111.1 million, down from $112.6 million in Q1 2023. |

| · | Profit

for Q1 2024 of $41.6 million, down from $51.6 million in Q1 2023. |

| · | Earnings

per share for Q1 2024 of $1.29, down from $1.60 for Q1 2023. |

| · | Cash

(including restricted cash) of $109.0 million as of March 31, 2024, compared to $118.0 million

as of March 31, 2023. |

Alternative

performance metrics

| · | Time

charter equivalent ("TCE", a non-IFRS measure*) revenue for Q1 2024 of $81.0 million,

down from $88.4 million in Q1 2023. |

| · | Adjusted

profit* and Adjusted earnings per share* (non-IFRS measures*) for Q1 2024 of $39.6 million

or $1.23 per basic and diluted share. |

| · | Fleetwide

daily TCE rate for Q1 2024 of $63,600 per operating day; VLCC and Suezmax TCE rates of $68,800

and $56,700 per operating day, respectively. |

| · | Daily

vessel operating expenses (“Opex”, a non-IFRS measure) of $9,208 per calendar

day, including management fees. |

| · | In

Q2 2024 to date, 82% of the available VLCC spot days have been booked at an average TCE rate

of $75,900 per day and 57% of the available Suezmax spot days have been booked at an average

TCE rate of $60,800 per day. |

Declaration

of 1Q 2024 dividend

The Company’s board of directors declared a dividend of $1.10 per common share to shareholders. Dividends payable to common shares

registered in the Euronext VPS will be distributed in NOK. The cash payment will be classified as a return of paid-in-capital and will

be paid on June 20, 2024, to shareholders of record as of June 5, 2024. The common shares will be traded ex-dividend on the NYSE as from

and including June 5, 2024, and the common shares will be traded ex-dividend on the Oslo Børs as from and including June 4, 2024.

Due to the implementation of Central Securities Depository Regulation (CSDR) in Norway, dividends payable on common shares registered

with Euronext VPS are expected to be distributed to Euronext VPS shareholders on or about June 25, 2024.

Financial results

overview

| | |

|

| |

Q1 2024 | |

Q1 2023 | |

YoY Change |

|

| Commercial | |

|

VLCC Daily TCE* | |

$68,800 | |

$72,700 | |

(5% |

) |

| Performance | |

|

Suezmax Daily TCE* | |

$56,700 | |

$68,200 | |

(17% |

) |

| | |

|

Fleetwide Daily TCE* | |

$63,600 | |

$70,800 | |

(10% |

) |

| | |

|

Fleetwide Daily Opex* | |

$9,208 | |

$8,885 | |

4% |

|

| | |

|

Time Charter Coverage* | |

- | |

29% | |

- |

|

| | |

|

| |

Q1 2024 | |

Q1 2023 | |

YoY Change |

|

| Income | |

|

TCE Revenue* | |

$81.0 | |

$88.4 | |

(8% |

) |

| Statement | |

|

Adjusted EBITDA* | |

$65.2 | |

$74.4 | |

(12% |

) |

| USDm

exc. EPS | |

|

Adjusted Profit* | |

$39.6 | |

$51.4 | |

(23% |

) |

| | |

|

Adjusted Earnings Per Share* | |

$1.23 | |

$1.60 | |

(23% |

) |

| | |

|

| |

As of March 31, 2024 | |

As of March 31, 2023 | |

YoY Change |

|

| Balance

Sheet | |

|

Total Interest-Bearing Debt | |

$693.7 | |

$727.0 | |

(5% |

) |

| USDm | |

|

Total Cash (incl. Restricted Cash) | |

$109.0 | |

$118.0 | |

(8% |

) |

| | |

|

Total Assets | |

$1,148.5 | |

$1,188.7 | |

(3% |

) |

| | |

|

Total Equity | |

$428.4 | |

$433.6 | |

(1% |

) |

| | |

|

Leverage** | |

58% | |

58% | |

- |

|

*The Company uses

certain financial information calculated on a basis other than in accordance with generally accepted accounting principles, including

TCE, Adjusted EBIDTA, Adjusted profit, Adjusted earnings per share, and Opex. For a reconciliation of these non-IFRS measures, please

refer to the end of this report.

**Leverage is calculated

as net debt over net debt plus equity.

Key information

and management commentary

| · | The

Company paid an amount of approximately $21.2 million or $0.66 per share in March 2024 as

a dividend classified as a return of paid-in capital. |

| · | TCE

revenue in Q1 2024 decreased by 8%, compared to Q1 2023, due to a corresponding decrease

in TCE rates. |

| · | Voyage

expenses for Q1 2024 of $28.9 million, up from $22.2 million in Q1 2023. The 30% increase

is attributable to the higher spot exposure and bunker fuel consumption. |

| · | Interest

and finance costs for Q1 2024 of $15.8 million, up from $14.7 million in Q1 2023. The increase

is attributable to the higher prevailing SOFR rates in Q1 2024. Total indebtedness as of

March 31, 2024, was $693.7 million, a 5% decrease compared to the prior year. |

| · | In

Q1 2024, the Company renegotiated two of its existing loans, secured over the vessels Nissos

Kea and Nissos Nikouria, which resulted in the recognition of a modification gain amounting

to $2.3 million. |

| · | The

Company recorded a profit of $41.6 million in Q1 2024, compared to a profit of $51.6 million

in Q1 2023. The decrease derives mainly from the lower revenues generated from operations,

the higher interest expense, and the higher administrative expenses. |

Fleet

As of March 31,

2024, the Company’s fleet was comprised of the following 14 vessels with an average age of 5 years and aggregate capacity of approximately

3.5 million deadweight tons:

| · | six

Suezmax vessels with an average age of 6 years; and |

| · | eight

VLCC vessels with an average age of 4 years. |

Presentation

OET will be hosting a conference call and webcast

at 13:30 CET on Thursday May 16, 2024 to discuss the Q1 2024 results. Participants may access the conference call using the below dial-in

details:

Standard International Access: +44 20 3936 2999

USA: +1 646 664 1960

Norway: +47 815 03 308

Password: 487447

The webcast will include a slide presentation

and will be available on the following link:

https://events.q4inc.com/attendee/182966276

An audio replay

of the conference call will be available on our website:

http://www.okeanisecotankers.com/reports/

Recent financial developments

Liquidity update

| Vessel |

Outstanding

Balance as

of March 31, 2024 |

Interest

Rate

(SOFR(S)+Margin)** |

| Milos |

$34,499,462 |

S+1.75% |

| Poliegos |

31,410,757 |

S+7.01% |

| Kimolos |

31,282,034 |

S+1.90% |

| Folegandros |

31,282,034 |

S+1.90% |

| Nissos

Sikinos |

40,122,854 |

S+1.85% |

| Nissos

Sifnos |

40,121,092 |

S+1.85% |

| Nissos

Rhenia |

53,604,921 |

S+5.18% |

| Nissos

Despotiko |

53,931,776 |

S+5.18% |

| Nissos

Donoussa |

57,229,362 |

S+2.50% |

| Nissos

Kythnos |

57,229,362 |

S+2.50% |

| Nissos

Keros |

43,267,676 |

S+1.90% |

| Nissos

Anafi |

73,095,276 |

S+1.90% |

| Nissos

Kea |

64,083,739 |

S+2.00% |

| Nissos

Nikouria |

82,500,708 |

S+2.00%(*) |

| Total |

$693,661,053 |

S+2.75% |

* Does not include

Sponsor debt element due for repayment in Q2 of 2024

** Post the transition

from LIBOR to SOFR as the base rate, certain financings include an applicable Credit Adjustment Spread (“CAS”) on top of

the SOFR base rate

On January 26,

2024, we entered into amendments to the existing sale and leaseback agreements for the VLCC vessels Nissos Kea and Nissos Nikouria (the

“Existing Leases Amendments”) with CMB Financial Leasing. The Existing Leases Amendments, effective from the first quarter

of 2024, provide for a reduction of the pricing of the variable amount of charterhire payable thereunder to 200 basis points over the

applicable Term SOFR on both vessels, extend maturities to December 2030 for the Nissos Kea and March 2031 for the Nissos Nikouria, and

eliminate the previously stipulated early prepayment fees in the case of exercise of the purchase options by the Company after the first

year.

According to IFRS

9 “Financial Instruments”, each of the Existing Leases Amendments is considered a modification of existing loans, that resulted

to the recognition of a modification gain of $2.3 million, which has been included in the Company’s statement of profit or

loss.

On January 29,

2024, we entered into a new sale and leaseback agreement of approximately $73.5 million for the VLCC vessel Nissos Anafi (the “Anafi

Lease”) with CMB Financial Leasing to refinance its loan with Credit Agricole. The agreement provides for a bareboat charter with the charterhire being paid on a quarterly

basis, is priced at 190 basis points over the applicable Term SOFR and matures in seven years. The Anafi Lease includes purchase options

for the Company after the first year and throughout the tenor of the lease and is guaranteed by the Company.

On January 31,

2024, we entered into a new $34.7 million senior secured credit facility with a syndicate led by Kexim Asia Limited to finance the option

to purchase back, in February 2024, the Suezmax vessel Milos from its current sale and lease back financier. The facility is repaid

quarterly, matures in six years, is priced at 175 basis points over the applicable Term SOFR, is secured by the Milos, and is

guaranteed by the Company.

On March 29, 2024, we repaid $16.7 million

to Okeanis Marine Holdings S.A., an entity controlled by Mr. Ioannis Alafouzos, as repayment of the Sponsor’s loan principal relating

to the acquisition of the Nissos Kea.

Related parties’

update

On March 1, 2024, each of our vessel owning subsidiaries

entered into an ETS Services Agreement with KMC, which agreement is effective as of January 1, 2024, pursuant to which KMC obtains, transfers

and surrenders emission allowances under the EU Emissions Trading Scheme that came into effect on January 1, 2024, and KMC provides the

vessel with emission data in a timely manner to enable compliance with any emission scheme(s) applicable to the vessel. No additional

fee is payable under these agreements as the services are part of the technical management fee under the existing technical management agreements.

These agreements may be terminated by either party for cause, immediately upon written notice or for any reason, upon two months’

written notice. These agreements shall also be deemed automatically terminated on the date of termination of the relevant technical management

agreements.

Share capital

and distributions

In

March 2024, the Company distributed an amount of approximately $21.2 million or $0.66 per

share via a dividend that is classified as a return of paid-in-capital.

On May 16, 2024,

the Company had 32,194,108 shares outstanding (net of 695,892 treasury shares).

Unaudited condensed

consolidated statements of comprehensive income

| | |

For

the Three months

ended March 31, |

|

| USD | |

2024 | |

2023 |

|

| Revenue | |

$111,123,340 | |

$112,552,594 |

|

| | |

| |

|

|

| Operating expenses | |

| |

|

|

| Commissions | |

(1,180,243) | |

(1,889,504) |

|

| Voyage expenses | |

(28,914,696) | |

(22,214,299) |

|

| Vessel operating expenses | |

(10,584,217) | |

(10,060,793) |

|

| Management fees | |

(1,146,600) | |

(1,134,000) |

|

| Depreciation | |

(10,154,491) | |

(9,985,837) |

|

| General

and administrative expenses | |

(4,066,590) | |

(2,858,607) |

|

| Total

operating expenses | |

($56,046,837) | |

($48,143,040) |

|

| Operating

profit | |

$55,076,503 | |

$64,409,554 |

|

| | |

| |

|

|

| Other income / (expenses) | |

| |

|

|

| Interest income | |

679,243 | |

1,055,993 |

|

| Interest and other

finance costs, net | |

(15,840,568) | |

(14,682,095) |

|

| Unrealized (loss)/gain,

net on derivatives | |

(333,883) | |

214,510 |

|

| Realized net gain on

derivatives | |

71,844 | |

50,180 |

|

| Gain from modification

of loans | |

2,266,294 | |

- |

|

| Foreign

exchange (loss)/gain, net | |

(363,830) | |

555,614 |

|

| Total other expenses, net | |

($13,520,900) | |

($12,805,798) |

|

| | |

| |

|

|

| Profit

for the period | |

$41,555,603 | |

$51,603,756 |

|

| | |

| |

|

|

| Other

comprehensive income | |

- | |

- |

|

| Total

comprehensive income for the period | |

$41,555,603 | |

$51,603,756 |

|

| | |

| |

|

|

| Profit attributable to the owners

of the Group | |

$41,555,603 | |

$51,603,756 |

|

| Total comprehensive income attributable

to the owners of the Group | |

$41,555,603 | |

$51,603,756 |

|

| | |

| |

|

|

| Earnings per share - basic & diluted | |

$1.29 | |

$1.60 |

|

| Weighted average no. of shares - basic & diluted | |

32,194,108 | |

32,194,108 |

|

Unaudited condensed

consolidated statements of financial position

| | |

As of | |

As of |

|

| USD | |

March

31, 2024 | |

December

31, 2023 |

|

| ASSETS | |

| |

|

|

| Non-current

assets | |

| |

|

|

| Vessels,

net | |

$978,299,124 | |

$988,068,180 |

|

| Other

fixed assets | |

14,990 | |

87,252 |

|

| Restricted

cash | |

4,010,000 | |

3,010,000 |

|

| Total

non-current assets | |

$982,324,114 | |

$991,165,432 |

|

| Current

assets | |

| |

|

|

| Inventories | |

$23,702,551 | |

$25,354,017 |

|

| Trade

and other receivables | |

33,557,141 | |

57,336,089 |

|

| Claims

receivable | |

- | |

115,528 |

|

| Prepaid

expenses and other current assets | |

3,813,256 | |

3,037,366 |

|

| Current

accounts due from related parties | |

137,001 | |

- |

|

| Derivative

financial instruments | |

8,293 | |

229,373 |

|

| Current

portion of restricted cash | |

1,129,379 | |

1,884,852 |

|

| Cash

& cash equivalents | |

103,873,661 | |

49,992,391 |

|

| Total

current assets | |

$166,221,282 | |

$137,949,616 |

|

| TOTAL

ASSETS | |

$1,148,545,396 | |

$1,129,115,048 |

|

| SHAREHOLDERS'

EQUITY & LIABILITIES | |

| |

|

|

| Shareholders'

equity | |

| |

|

|

| Share

capital | |

$32,890 | |

$32,890 |

|

| Additional

paid-in capital | |

99,815,903 | |

121,064,014 |

|

| Treasury

shares | |

(4,583,929) | |

(4,583,929) |

|

| Other

reserves | |

(29,908) | |

(29,908) |

|

| Retained

earnings | |

333,204,684 | |

291,649,081 |

|

| Total

shareholders' equity | |

$428,439,640 | |

$408,132,148 |

|

| Non-current

liabilities | |

| |

|

|

| Long-term

borrowings, net of current portion | |

$631,341,659 | |

$615,333,863 |

|

| Retirement

benefit obligations | |

34,539 | |

32,692 |

|

| Total

non-current liabilities | |

$631,376,198 | |

$615,366,555 |

|

| Current

liabilities | |

| |

|

|

| Trade

payables | |

$21,003,994 | |

$23,522,506 |

|

| Accrued

expenses | |

5,252,471 | |

3,485,042 |

|

| Current

accounts due to related parties | |

- | |

659,974 |

|

| Derivative

financial instrument | |

134,688 | |

- |

|

| Current

portion of long-term borrowings | |

62,338,405 | |

77,948,823 |

|

| Total

current liabilities | |

$88,729,558 | |

$105,616,345 |

|

| TOTAL

LIABILITIES | |

$720,105,756 | |

$720,982,900 |

|

| TOTAL

SHAREHOLDERS' EQUITY & LIABILITIES | |

$1,148,545,396 | |

$1,129,115,048 |

|

Unaudited condensed consolidated statement

of changes in shareholders’ equity

| | |

Number | |

Share | |

Additional

paid-in | |

Treasury | |

Other | |

Retained | |

|

|

| USD,

except share amounts | |

of

shares | |

capital | |

capital | |

Shares | |

Reserves | |

Earnings | |

Total |

|

| Balance

- January 1, 2023 | |

$32,194,108 | |

$32,890 | |

$280,424,849 | |

($4,583,929) | |

($28,606) | |

$146,398,057 | |

$422,243,261 |

|

| Profit

for the period | |

- | |

- | |

- | |

- | |

- | |

51,603,756 | |

51,603,756 |

|

| Capital

distribution | |

- | |

- | |

(40,242,635) | |

- | |

- | |

- | |

(40,242,635) |

|

| Balance

- March 31, 2023 | |

$32,194,108 | |

$32,890 | |

$240,182,214 | |

($4,583,929) | |

($28,606) | |

$198,001,813 | |

$433,604,382 |

|

| | |

| |

| |

| |

| |

| |

| |

|

|

| Balance - January

1, 2024 | |

$32,194,108 | |

$32,890 | |

$121,064,014 | |

($4,583,929) | |

($29,908) | |

$291,649,081 | |

$408,132,148 |

|

| Profit

for the period | |

- | |

- | |

- | |

- | |

- | |

41,555,603 | |

41,555,603 |

|

| Capital

distribution | |

- | |

- | |

(21,248,111) | |

- | |

- | |

- | |

(21,248,111) |

|

| Balance

- March 31, 2024 | |

$32,194,108 | |

$32,890 | |

$99,815,903 | |

($4,583,929) | |

($29,908) | |

$333,204,684 | |

$428,439,640 |

|

Unaudited condensed

consolidated statements of cash flows

| | |

For the

Three months

ended March 31, |

|

| USD | |

2024 | |

2023 |

|

| | |

| |

|

|

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| |

|

|

| Profit for the period | |

$41,555,603 | |

$51,603,756 |

|

| | |

| |

|

|

| Adjustments to reconcile

profit to net cash provided by operating activities: | |

| |

|

|

| Depreciation | |

10,154,491 | |

9,985,837 |

|

| Interest expense | |

14,502,441 | |

14,257,907 |

|

| Amortization of loan financing fees and

loan modification gain | |

778,269 | |

269,461 |

|

| Unrealized gain/(loss), net on derivatives | |

221,080 | |

(459,209) |

|

| Interest income | |

(679,243) | |

(1,055,993) |

|

| Foreign exchange differences | |

364,051 | |

(555,109) |

|

Gain

from modification of loans | |

(2,266,294) | |

- |

|

| Other

non-cash items | |

108 | |

(14,239) |

|

| Total reconciliation adjustments | |

$23,074,903 | |

$22,428,655 |

|

| | |

| |

|

|

| Changes in working capital: | |

| |

|

|

| Trade and other receivables | |

23,941,326 | |

18,673,987 |

|

| Prepaid expenses and other current assets | |

(776,391) | |

(1,562,894) |

|

| Inventories | |

1,651,466 | |

(2,050,603) |

|

| Trade payables | |

(1,678,401) | |

7,422,935 |

|

| Accrued expenses | |

1,425,770 | |

(1,305,223) |

|

| Deferred revenue | |

- | |

(108,000) |

|

| Claims receivable | |

115,528 | |

(23,742) |

|

Payments

to related parties | |

(796,975) | |

(39,771) |

|

| Total changes in working capital | |

$23,882,323 | |

$21,006,689 |

|

| Interest

paid | |

(14,158,543) | |

(13,818,852) |

|

| Net

cash provided by operating activities | |

$74,354,286 | |

$81,220,248 |

|

| | |

| |

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| |

|

|

| Increase in restricted cash | |

(244,527) | |

(121,100) |

|

| Dry-dock expenses | |

(1,033,323) | |

(100,127) |

|

| Interest

received | |

511,348 | |

544,666 |

|

| Net

cash (used in)/provided by investing activities | |

($766,502) | |

$323,439 |

|

| | |

| |

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| |

|

|

| Proceeds from long-term borrowings | |

108,150,000 | |

- |

|

| Repayments of long-term borrowings | |

(105,541,651) | |

(12,263,739) |

|

| Capital distribution | |

(21,248,111) | |

(40,242,635) |

|

| Payments

of loan financing fees | |

(708,219) | |

- |

|

| Net

cash used in financing activities | |

($19,347,981) | |

($52,506,374) |

|

| Effects of exchange rate changes of cash

held in foreign currency | |

(358,533) | |

547,999 |

|

| Net change in cash and cash equivalents | |

54,239,803 | |

29,037,313 |

|

| Cash

and cash equivalents at beginning of period | |

49,992,391 | |

68,802,495 |

|

| Cash

and cash equivalents at end of period | |

$103,873,661 | |

$98,387,807 |

|

USE AND RECONCILIATION

OF ALTERNATIVE PERFORMANCE MEASURES

The Group evaluates its vessels’ operations

and financial results, principally by assessing their revenue generation (and not by the type of vessel, employment, customer, or type

of charter). Among others, TCE, EBITDA, Adjusted EBITDA, Daily Opex, Adjusted Profit/(loss) and Adjusted Earnings/(loss) per share, are

used as key performance indicators.

Daily TCE

The Daily Time

Charter Equivalent Rate (“TCE rate”) is a measure of the average daily revenue performance of a vessel. The TCE rate is not

a measure of revenue under generally accepted accounting principles (i.e., it is a non-GAAP measure) or IFRS and should not be considered

as an alternative to any measure of revenue and financial performance presented in accordance with IFRS. We calculate the TCE rate by

dividing revenues (time charter and/or voyage charter revenues), less commission and voyage expenses, by the number of operating days

(calendar days less scheduled and unscheduled aggregate technical off-hire days less off-hire days due to unforeseen circumstances) during

that period. Our calculation of the TCE rate may not be comparable to that reported by other companies. We define calendar days as the

total number of days the vessels were in our possession for the relevant period. Calendar days are an indicator of the size of our fleet

during the relevant period and affect the amount of expenses that we record during that period. We define operating days as the number

of calendar days in a period less any scheduled or unscheduled days that our vessels are off-hire due to unforeseen technical and commercial

circumstances. We and the shipping industry use operating days to measure the aggregate number of days in a period that our vessels

generate revenues. The period a vessel is not being chartered or is unable to perform the services for which it is required under a charter

is “off-hire”.

We use the TCE rate because it provides a means of comparison between different types of vessel employment and, therefore, assists our

decision-making process with regards to the operation and use of our vessels. We believe the TCE rate provides additional meaningful information

to our investors, constituting a comparison to gross profit margin, the most directly comparable GAAP and IFRS measure, that also enables

our management to evaluate the performance and deployment of our fleet.

The following table

sets forth our computation of TCE rates, including a reconciliation of revenues to the TCE rates (unaudited) for the periods presented:

| | |

For the

Three months

ended March 31, |

|

| USD | |

2024 | |

2023 |

|

| | |

| |

|

|

| Revenue | |

$111,123,340 | |

$112,552,594 |

|

| Voyage

expenses | |

(28,914,696) | |

(22,214,299) |

|

| Commissions | |

(1,180,243) | |

(1,889,504) |

|

| Time

charter equivalent revenue | |

$81,028,401 | |

$88,448,791 |

|

| Calendar

days | |

1,274 | |

1,260 |

|

| Off-hire

days | |

- | |

(10) |

|

| Operating

days | |

1,274 | |

1,250 |

|

| Daily

TCE | |

$63,602 | |

$70,783 |

|

EBITDA, Adjusted

EBITDA, Adjusted Profit and Adjusted Earnings per share

Earnings before

interest, tax, depreciation and amortization (EBITDA) is an alternative performance measure, derived directly from the statement of profit

or loss and other comprehensive income by adding back to profit/(loss) depreciation, amortization, interest and finance costs and subtracting

interest income. Adjusted EBITDA is defined as EBITDA before non-recurring items, unrealized losses/(gains) on derivatives,

realized losses/(gains) on derivatives, foreign exchange (gains)/losses, (gain)/loss from loan modifications, impairment loss and gain/(loss)

on disposal of vessels.Adjusted profit/(loss) is defined as reported profit/(loss) before non-recurring items, unrealized losses/(gains)

on derivatives, impairment loss, loan modification gain/(loss) and gain/(loss) on disposal of vessels. Adjusted earnings/(loss) per share

is defined as adjusted profit/(loss) divided by the weighted average number of common shares outstanding in the period.

Furthermore, EBITDA,

adjusted EBITDA, adjusted profit/(loss) and adjusted earnings/(loss) per share have certain limitations in use and should not be considered

alternatives to reported profit/(loss), operating profit, cash flows from operations, earnings per share or any other GAAP or IFRS measure

of financial performance. EBITDA, adjusted EBITDA, adjusted profit/(loss) and adjusted earnings/(loss) per share exclude some, but not

all, items that affect profit/(loss).

EBITDA, Adjusted EBITDA, Adjusted Profit and

Adjusted Earnings per share are not measures of revenues under generally accepted accounting principles (non-GAAP measures)

or IFRS and should not be considered as an alternative to any measure of revenue and financial performance presented in accordance with

IFRS. EBITDA, Adjusted EBITDA, Adjusted Profit and Adjusted Earnings per share are used as supplemental financial measures by management

and external users of financial statements to assess our operating performance. We believe that EBITDA, Adjusted EBITDA, Adjusted Profit

and Adjusted Earnings per share assist our management and our investors by providing useful information that increases the comparability

of our operating performance from period to period and against our previous performance and the operating performance of other companies

in our industry that provide relevant information. We believe EBITDA, Adjusted EBITDA, Adjusted Profit and Adjusted Earnings provides

additional meaningful information in conjunction with revenues, the most directly comparable GAAP and IFRS measure, because it provides

meaningful information in evaluating our financial performance.

Our method of computing

EBITDA, Adjusted EBITDA, Adjusted profit/(loss) and Adjusted earnings/(loss) per share may not be consistent with similarly titled measures

of other companies and, therefore, might not be comparable with other companies.

The following table

sets forth a reconciliation of profit to EBITDA (unaudited) and adjusted EBITDA (unaudited) for the periods presented:

| | |

For the

Three months

ended March 31, |

|

| USD | |

2024 | |

2023 |

|

| Profit

for the period | |

$41,555,603 | |

$51,603,756 |

|

| Depreciation | |

10,154,491 | |

9,985,837 |

|

| Interest

and finance costs | |

15,840,568 | |

14,682,095 |

|

| Interest

income | |

(679,243) | |

(1,055,993) |

|

| EBITDA | |

$66,871,419 | |

$75,215,695 |

|

| Unrealized

(loss)/gain, net on derivatives | |

333,883 | |

(214,510) |

|

| Realized

net gain on derivatives | |

(71,844) | |

(50,180) |

|

| Gain

from modification of loans | |

(2,266,294) | |

- |

|

| Foreign

exchange (loss)/gain, net | |

363,830 | |

(555,614) |

|

| Adjusted

EBITDA | |

$65,230,994 | |

$74,395,391 |

|

The following table

sets forth a reconciliation of profit to adjusted profit (unaudited) and a computation of adjusted earnings per share (unaudited) for

the periods presented:

| | |

For the

Three months

ended March 31, |

|

| USD | |

2024 | |

2023 |

|

| Profit

for the period | |

$41,555,603 | |

$51,603,756 |

|

| Gain

on modification of loans | |

(2,266,294) | |

- |

|

| Unrealized

(loss)/gain, net on derivatives | |

333,883 | |

(214,510) |

|

| Adjusted

Profit | |

$39,623,192 | |

$51,389,246 |

|

| Weighted

average number of common shares outstanding in the period | |

32,194,108 | |

32,194,108 |

|

| Adjusted

earnings per share, basic and diluted | |

$1.23 | |

$1.60 |

|

Daily Opex

Daily Opex are

calculated as vessel operating expenses and technical management fees divided by calendar days, for the relevant periods.

Daily Opex per vessel is an alternative performance

measure that provides meaningful information to our management with regards to our vessels’ efficiency and deployment. Daily Opex

is not a measure of revenue under generally accepted accounting principles (i.e., it is a non-GAAP measure) or IFRS and should not be

considered as an alternative to any measure of expenses and financial performance presented in accordance with IFRS. Our reconciliation

of daily Opex, including management fees, may deviate from that reported by other companies. We believe Daily Opex provides additional

meaningful information in conjunction with Vessel operating expenses, the most directly comparable GAAP and IFRS measure, because it

provides meaningful information in evaluating our financial performance.

The following table

sets forth our reconciliation of daily Opex (unaudited) for the periods presented:

| | |

For the

Three months

ended March 31, |

|

| USD | |

2024 | |

2023 |

|

| Vessel operating expenses | |

$10,584,217 | |

$10,060,793 |

|

| Management

fees | |

1,146,600 | |

1,134,000 |

|

| Total

vessel operating expenses | |

$11,730,817 | |

$11,194,793 |

|

| Calendar

days | |

1,274 | |

1,260 |

|

| Daily

Opex | |

$9,208 | |

$8,885 |

|

| Daily

Opex excluding management fees | |

$8,308 | |

$7,985 |

|

Forward-Looking

Statements

This communication

contains “forward-looking statements”, including as defined under U.S. federal securities laws. Forward-looking statements

provide the Company’s current expectations or forecasts of future events. Forward-looking statements include statements about the

Company’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts

or that are not present facts or conditions. Words or phrases such as “anticipate,” “believe,” “continue,”

“estimate,” “expect,” “hope,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “will” or similar words or phrases,

or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily

mean that a statement is not forward-looking. Forward-looking statements are subject to known and unknown risks and uncertainties and

are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by

the forward-looking statements. The Company’s actual results could differ materially from those anticipated in forward-looking

statements for many reasons, including as described in the Company’s filings with the U.S. Securities and Exchange Commission.

Accordingly, you should not unduly rely on these forward-looking statements, which speak only as of the date of this communication. Factors

that could cause actual results to differ materially include, but are not limited to, the Company’s operating or financial results;

the Company’s liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company

operates; shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending

or recent acquisitions and dispositions, business strategy, areas of possible expansion or contraction, and expected capital spending

or operating expenses; risks associated with operations; broader market impacts arising from war (or threatened war) or international

hostilities; risks associated with pandemics (including COVID-19), including effects on demand for oil and other products transported

by tankers and the transportation thereof; and other factors listed from time to time in the Company’s filings with the U.S. Securities

and Exchange Commission. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations

with respect thereto or any change in events, conditions, or circumstances on which any statement is based. You should, however, review

the factors and risks the Company describes in the reports it files and furnishes from time to time with the U.S. Securities and Exchange

Commission, which can be obtained free of charge on the U.S. Securities and Exchange Commission’s website at www.sec.gov.

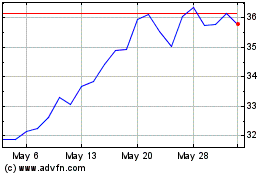

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From Mar 2024 to Mar 2025