Vertical Issues Shareholder Letter

Vertical Aerospace Ltd. (“Vertical” or the "Company") (NYSE:

EVTL; EVTLW), a global aerospace and technology company that is

pioneering zero emission aviation, announces its financial results

for the first half of the year ended June 30, 2024. Vertical has

also issued a shareholder letter in conjunction with the filing of

its first half-year results, which is posted to its investor

relations website at investor.vertical-aerospace.com.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240917135638/en/

The new VX4 prototype, which has

completed Phase 1 of piloted flight tests. (Photo: Business

Wire)

Stuart Simpson, CEO at Vertical, said:

“During the past few months we have delivered our most advanced

full-scale VX4 prototype, have gone from first powered ground test

to 'wheels up’ in just one week and completed the first phase of

our piloted test flight programme. Every day I continue to be

deeply impressed by the phenomenal engineers we have and the

progress we are making here in Bristol as we build a new generation

of aviation. This could not be a more exciting time to follow

Vertical as we accelerate through our piloted flight tests and work

closely with the UK Civil Aviation Authority, our home regulator,

on the path to certification.”

First Half-Year 2024 and Recent Operational Updates

- Flight tests of new VX4 prototype: Vertical unveiled its

next full-scale VX4 prototype in July and began piloted flight

tests days later, following the UK Civil Aviation Authority (CAA)

issuing a Permit to Fly. This more advanced aircraft has 60% of its

technology from tier-one aerospace partners, up from 10% on the

previous prototype, marking a significant step towards the final

certification aircraft. This is also the first use of Vertical’s

proprietary batteries, designed and developed at the Vertical

Energy Centre, in a piloted aircraft. Vertical’s new proprietary

propellers designed specifically for eVTOLs are optimised for low

noise and made of carbon fibre composite using a single-shot cure

process to maximise integrity.

- The VX4 recently completed Phase 1 of the piloted test flight

programme. During Phase 1, the VX4 prototype conducted multiple

piloted tethered flights and ground runs, across 20 piloted test

sorties, completing a total of 70 individual test points, measuring

35,000 flight and system parameters. Vertical is now preparing to

progress to piloted untethered thrustborne testing, as soon as it

receives permission from the CAA. The flight tests have already

shown the aircraft’s incredible stability – particularly in ground

effect, typically one of the most challenging flight

conditions.

- Certification Progress: The CAA expanded the scope of

Vertical’s Design Organisation Approval (DOA), which is a

requirement for the Type Certification of the VX4 and its entry

into service. At the same time, there has been strong regulatory

collaboration, with the European Union Aviation Safety Agency

(EASA) and the CAA agreeing how they will work together on the

certification of the VX4.

- Go To Market: At the Farnborough International Airshow,

the team met existing and prospective customers, investors,

suppliers, regulators and government agencies, who were able to

explore the new prototype using a unique Apple Vision Pro

experience. Vertical also brought its customers together in London

for their Pioneers event in Q2 to bring them up to speed on the

latest developments and hear their feedback. In August, the UK

Ministry of Defence (MOD) accepted Vertical’s application to join

their Uncrewed Air Systems Heavy Lift Challenge framework. The aim

of this £95m framework is to define capabilities and test solutions

for the Royal Navy for non-weaponised cargo drone operations, with

a special focus on ship-to-shore and ship-to-ship missions.

Acceptance onto this framework means Vertical can participate in

tenders issued by the Royal Navy, facilitating Vertical’s access to

R&D funding, development support and in particular, the

collaboration across the Uncrewed Air System community that

membership of Defence Equipment & Support’s Heavy Lift

Capability Framework provides.

- Our People: Vertical continues to attract world-class

aerospace professionals, including, Martyn Ashford, Head of

Aircraft Programmes Development from Leonardo. It also appointed

Ben Story to the Board of Directors as an independent non-executive

director and Charlotte Cowley as Director of Strategic Finance

responsible for executing Vertical’s fundraising strategy. Ben was

formerly Strategic Marketing Director at FTSE 100 Rolls-Royce plc

and, before that, Managing Director at Citi. Charlotte has

previously led Investor Relations for the FTSE100 Burberry Group

plc, and FTSE250 Aston Martin Lagonda plc, where she supported

successful capital raises. In May 2024, Stuart Simpson, formerly

Vertical’s CFO and a seasoned FTSE100 executive, was appointed as

CEO to lead the company through the pivotal phase of certifying and

commercializing its VX4 aircraft. Stephen Fitzpatrick, founder,

majority shareholder and former CEO of Vertical, remains on

Vertical’s board of directors as a non-executive director, focusing

on business strategy and the delivery of the company’s vision. In

September 2024, Vincent Casey was appointed to rejoin the Vertical

Board as a Non-Executive Director, having previously served as a

member of the board of directors from May 2021 to August 2023 and

as Vertical’s Chief Financial Officer from November 2020 to

February 2023. Vincent is currently the Chief Financial Officer at

Ovo Energy, a leading energy supply group that includes one of

Europe’s largest independent energy retailers, a company he joined

in 2013.

First Half-Year 2024 and Recent Financial Updates

- Vertical maintained its industry-leading capital efficiency

with an H1 2024 operating loss of £20 million ($25 million). The

operating loss for the period primarily reflects the spend to

successfully complete Vertical’s second full-scale prototype

aircraft.

- In May 2024, Vertical mutually agreed to exit Rolls-Royce's

contract to design an Electric Propulsion Unit (EPU). Under the

agreement, Vertical received $34 million from Rolls-Royce which is

expected to cover the anticipated costs of an alternative EPU

design contract and provided an extension to the cash runway. This

followed Rolls-Royce's announcement in November 2023 of its

intention to seek a partner or buyer for its advanced air mobility

activities. Vertical is already working with other EPU suppliers

and does not anticipate this having any impact on the completion of

their prototypes.

- Over the half, Vertical was awarded an £8 million ($10 million)

UK Government grant from the Aerospace Technology Institute (ATI)

for its next-generation propeller development. Vertical also

received a cash amount of $25 million from Imagination Aero

Investments Ltd., a company owned by Vertical founder, Stephen

Fitzpatrick, in connection with an investment agreement dated

February 22, 2024 (the “Investment Agreement”). Vertical is in

discussion with regards to the second $25 million tranche of the

investment committed under the Investment Agreement, which remains

outstanding.

Financial Outlook

- As of June 30, 2024, Vertical had cash and cash equivalents of

£67m / $84m.

- The 2024 capital plan continues to remain on track, with net

cash outflows from operations in the second half of the year

expected to be between £40m to £45m.

- Net cash outflows incurred in the second half of the year will

be in relation to the advancement of Vertical’s piloted flight test

programme.

- As of the date of this report, Vertical had approximately £48m

/ $63m of cash and cash equivalents on hand.

- As previously announced, Vertical will need to raise capital to

fund its future operations and remain as a going concern. Vertical

intends to do so and are in discussions regarding potential third

party investment. The timely receipt of an amount equal or

equivalent to the second tranche committed under the Investment

Agreement is required to extend its projected cash runway into the

third quarter of 2025 (from the second quarter of 2025).

- On September 16, 2024, following the requisite shareholder

approvals at Vertical’s Annual General Meeting earlier on the same

day, Vertical’s Board of Directors authorised the implementation of

a reverse share split at a ratio of 1 for 10, with an effective

date of September 20, 2024.

The above forward-looking statements reflect our expectations

for the six months ending June 30, 2024, as of September 17, 2024,

and are subject to substantial uncertainty. Our results are based

on assumptions that we believe to be reasonable as of this date,

but may be materially affected by many factors, as discussed below

in “Forward-Looking Statements.”

About Vertical Aerospace

Vertical Aerospace is a global aerospace and technology company

pioneering electric aviation.

Vertical is creating a safer, cleaner and quieter way to travel.

Vertical's VX4 is a piloted, four passenger, Electric Vertical

Take-Off and Landing (eVTOL) aircraft, with zero operating

emissions. Vertical combines partnering with leading aerospace

companies, including GKN, Honeywell and Leonardo, with developing

its own proprietary battery and propeller technology to create the

world’s most advanced and safest eVTOL.

Vertical has 1,500 pre-orders of the VX4 worth $6bn, with

customers across four continents, including Virgin Atlantic,

American Airlines, Japan Airlines, GOL and Bristow. Headquartered

in Bristol, the epicentre of the UK’s aerospace industry, Vertical

was founded in 2016 by Stephen Fitzpatrick, founder of the OVO

Group, Europe’s largest independent energy retailer.

Vertical's experienced leadership team comes from top tier

automotive and aerospace companies such as Rolls-Royce, Airbus, GM

and Leonardo. Together they have previously certified and supported

over 30 different civil and military aircraft and propulsion

systems.

Unaudited Condensed Consolidated Interim

Statements of Income and Comprehensive Income

H1’2024

£ 000

H1’2023

£ 000

Research and development expenses

(31,951)

(27,500)

Administrative expenses

(20,710)

(24,266)

Related party administrative expenses

(42)

(42)

Other operating income

32,763

2,861

Operating loss

(19,940)

(48,947)

Finance income

7,397

32,333

Finance costs

(11,026)

(8,140)

Net finance income/(costs)

(3,629)

24,193

Loss before tax

(23,569)

(24,754)

Income tax expense

6,448

12,984

Net loss for the period

(17,121)

(11,770)

Foreign exchange translation

differences

1,162

(6,922)

Total comprehensive loss for the

period

(15,959)

(18,692)

Unaudited Condensed Consolidated Interim

Statement of Cashflows

H1’2024

£ 000

H1’2023

£ 000

Cash flows from operating activities

Net loss for the period

(17,121)

(11,770)

Adjustments to cash flows from non-cash

items:

Depreciation and amortization

1,094

990

Depreciation on right of use assets

326

327

Finance costs/(income)

3,629

(24,193)

Share based payment transactions

4,785

7,056

Income tax credit

(6,448)

(12,984)

Non-cash gain (settled in treasury

shares)

(803)

-

(14,538)

(40,574)

Working capital adjustments:

(Decrease)/increase in trade and other

receivables

(3,035)

802

Increase/(decrease) in trade and other

payables

84

(4,603)

Income taxes received

15,838

11,319

Net cash outflow from operating

activities

(1,651)

(33,056)

Cash flows from investing activities

Decrease in financial assets at amortized

cost

-

59,886

Acquisitions of property plant and

equipment

(391)

(1,304)

Acquisition of intangible assets

-

(73)

Interest income on deposits

1,168

2,337

Net cash inflow from investing

activities

777

60,846

Cash flows from financing activities

Proceeds from issue of shares

-

180

Proceeds from issue of shares to related

party

15,629

-

Proceeds from issue of warrants to related

party

3,907

-

Payments to lease creditors

(396)

(349)

Net cash (outflow) from financing

activities

19,140

(169)

Net increase/(decrease) in cash at

bank

18,266

27,621

Cash at bank as at January 1

48,680

62,927

Effect of foreign exchange rate

changes

(160)

(855)

Cash at bank as at June 30

66,786

89,693

Unaudited Condensed Consolidated Interim

Statement of Financial Position

H1’2024

£ 000

H1’2023

£ 000

Non-current assets

Property, plant and equipment

3,653

3,821

Right of use assets

2,128

2,453

Intangible assets

481

1,018

6,262

7,292

Current assets

Trade and other receivables

20,058

26,413

Restricted cash

1,700

1,700

Cash and cash equivalents

66,786

48,680

88,544

76,793

Total assets

94,806

84,085

Equity

Share capital

17

17

Other reserve

97,254

86,757

Treasury share reserve

(803)

-

Share premium

273,824

257,704

Accumulated deficit

(412,373)

(394,257)

Total equity

(42,081)

(49,779)

Non-current liabilities

Lease liabilities

1,748

1,977

Provisions

327

256

Derivative financial liabilities

112,770

109,291

Trade and other payables

3,955

3,922

118,800

115,446

Current liabilities

Lease liabilities

558

643

Warrant liabilities

610

907

Trade and other payables

16,919

16,868

18,087

18,418

Total liabilities

136,887

133,864

Total equity and liabilities

94,806

84,085

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995 that relate to our current expectations and views of future

events. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements as

contained in Section 27A of the Securities Act and Section 21E of

the Exchange Act. Any express or implied statements contained in

this press release that are not statements of historical fact may

be deemed to be forward-looking statements, including, without

limitation, statements regarding the design and manufacture of the

VX4, our future results of operations and financial position and

expected financial performance and operational performance,

liquidity, growth and profitability strategies, business strategy

and plans and objectives of management for future operations,

including the building and testing of our prototype aircrafts on

timelines projected, selection of suppliers, certification and the

commercialization of the VX4 and our ability to achieve regulatory

certification of our aircraft product on any particular timeline or

at all, our ability and plans to raise additional capital to fund

our operations, including as a result of any ongoing or future

discussions with potential investors, statements regarding receipt

of the committed funding from Company’s founder and majority owner,

our plans to mitigate the risk that we are unable to continue as a

going concern, our plans for capital expenditures, the expectations

surrounding pre-orders and commitments, the features and

capabilities of the VX4, the transition towards a net-zero

emissions economy, as well as statements that include the words

“expect,” “intend,” “plan,” “believe,” “project,” “forecast,”

“estimate,” “may,” “should,” “anticipate,” “will,” “aim,”

“potential,” “continue,” “are likely to” and similar statements of

a future or forward-looking nature. Forward-looking statements are

neither promises nor guarantees, but involve known and unknown

risks and uncertainties that could cause actual results to differ

materially from those projected, including, without limitation: our

limited operating history without manufactured non-prototype

aircraft or completed eVTOL aircraft customer order; our potential

inability to raise additional funds when we need or want them, or

at all, to fund our operations; our limited cash and cash

equivalents and recurring losses from our operations raise

significant doubt (or raise substantial doubt as contemplated by

PCAOB standards) regarding our ability to continue as a going

concern; our potential inability to produce or launch aircraft in

the volumes or timelines projected; the potential inability to

obtain the necessary certifications for production and operation

within any projected timeline, or at all; the inability for our

aircraft to perform at the level we expect and may have potential

defects; our history of losses and the expectation to incur

significant expenses and continuing losses for the foreseeable

future; the market for eVTOL aircraft being in a relatively early

stage; any accidents or incidents involving eVTOL aircraft could

harm our business; our dependence on partners and suppliers for the

components in our aircraft and for operational needs; the potential

that certain strategic partnerships may not materialize into

long-term partnership arrangements; all of the pre-orders received

are conditional and may be terminated at any time and any

pre-delivery payments may be fully refundable upon certain

specified dates; any circumstances; any potential failure to

effectively manage our growth; our inability to recruit and retain

senior management and other highly skilled personnel; we have

previously identified material weaknesses in our internal controls

over financial reporting which if we fail to properly remediate,

could adversely affect our results of operations, investor

confidence in us and the market price of our ordinary shares; as a

foreign private issuer we follow certain home country corporate

governance rules, are not subject to U.S. proxy rules and are

subject to Exchange Act reporting obligations that, to some extent,

are more lenient and less frequent than those of a U.S. domestic

public company; and the other important factors discussed under the

caption “Risk Factors” in our Annual Report on Form 20-F filed with

the U.S. Securities and Exchange Commission (“SEC”) on March 14,

2024, as such factors may be updated from time to time in our other

filings with the SEC. Any forward-looking statements contained in

this press release speak only as of the date hereof and accordingly

undue reliance should not be placed on such statements. We disclaim

any obligation or undertaking to update or revise any

forward-looking statements contained in this press release, whether

as a result of new information, future events or otherwise, other

than to the extent required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917135638/en/

For more information: Justin Bates, Head of

Communications Justin.bates@vertical-aerospace.com +44 7878357463

Samuel Emden, Head of Investor Affairs

Samuel.emden@vertical-aerospace.com +447816 459 904

Vertical Media Kit Available here.

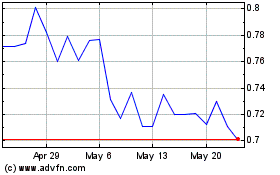

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Feb 2024 to Feb 2025