Third Quarter 2022 Highlights

- Revenue totaled $40.2 million

- Total orders were $40.3 million

- Net loss totaled $(1,046.1) million, which included a non-cash

goodwill impairment charge of $1,066.6 million

- Adjusted net loss1 was $(1.8) million

- Adjusted EBITDA1 totaled $7.1 million, representing an Adjusted

EBITDA margin1 of 17.5%

Year-to-Date 2022 Highlights

- Revenue increased 13.8% to $122.7 million

- Total orders increased 3.4% to $123.8 million

- Net loss totaled $(994.3) million; adjusted net loss1 totaled

$(2.5) million

- Adjusted EBITDA1 was $21.9 million, representing an Adjusted

EBITDA margin1 of 17.8%

Fathom Digital Manufacturing Corp. (NYSE: FATH), an

industry leader in on-demand digital manufacturing services, today

announced financial results for the three and nine months ended

September 30, 2022.

Three Months Ended

Nine Months Ended

($ in thousands)

9/30/2022

9/30/2021

9/30/2022

9/30/2021

Revenue

$40,210

$41,481

$122,737

$107,887

Net loss

$(1,046,107)

$(3,476)

$(994,295)

$(8,058)

Adjusted net income (loss)1

$(1,773)

$(1,074)

$(2,544)

$1,296

Adjusted EBITDA1

$7,056

$8,647

$21,900

$23,820

Adjusted EBITDA margin1

17.5%

20.8%

17.8%

22.1%

1 See “Non-GAAP Financial Information.” Reconciliations of

non-GAAP financial measures are included in the appendix.

“Our results for the third quarter were in-line with

management’s expectations as Fathom extended its proven track

record of profitability in the company’s core operations and cash

generation despite the challenging macro environment,” said Ryan

Martin, Fathom Chief Executive Officer. “We also continue to build

positive momentum for our new commercial activities as both orders

and revenue achieved monthly sequential growth throughout the

quarter, highlighted by record orders for our additive

manufacturing services in the month of September. Our focus remains

on accelerating engagement with Fortune 500-tier customers and

increasing the scalability of our robust on-demand digital

manufacturing platform to drive long-term profitable growth.”

Summary of Financial Results

Revenue for the third quarter of 2022 was $40.2 million compared

to $41.5 million in the third quarter of 2021, a decrease of 3.1%

primarily due to lower volumes. For the nine months ended September

30, 2022, revenue increased 13.8% to $122.7 million from $107.8

million for the same period in 2021 with higher sales driven by

acquisition-related activity and growth within Fathom’s strategic

accounts.

Gross profit for the third quarter of 2022 totaled $15.1

million, or 37.5% of revenue, compared to $14.9 million, or 35.9%

of revenue, in the third quarter of 2021. Gross profit for the nine

months ended September 30, 2022 was $42.6 million, or 34.7% of

revenue, which includes approximately $3.2 million in non-cash

purchase accounting adjustments, compared to $41.8 million, or

38.7% of revenue, for the same period in 2021. Excluding the $3.2

million in non-cash purchase accounting adjustments, gross profit

for the nine months ended September 30, 2022 totaled $45.8 million,

or 37.3% of revenue.

Net loss for the third quarter of 2022 was $(1,046.1) million

compared to a net loss of $(3.5) million in the third quarter of

2021. Net loss for the third quarter of 2022 included a non-cash

goodwill impairment charge of $1,066.6 million as the result of an

interim impairment analysis, which was triggered by the sustained

decline in Fathom’s share price, lower market multiples for a

relevant peer group, higher discount rate due to the rising

interest rate environment and challenging macroeconomic conditions.

The impairment charge has no impact on the company’s cash position,

liquidity, or covenant tests under its credit agreement.

Excluding goodwill impairment as well as the revaluation of

Fathom warrants and earnout shares, stock compensation expense, and

other costs, Fathom reported an adjusted net loss in the third

quarter of 2022 of $(1.8) million compared to an adjusted net loss

of $(1.1) million for the same period in 2021.

Net loss for the nine months ended September 30, 2022 was

$(994.3) million compared to a net loss of $(8.1) million for the

same period in 2021. For the nine months ended September 30, 2022,

Fathom reported an adjusted net loss of $(2.5) million compared to

adjusted net income of $1.3 million for the same period in

2021.

Adjusted EBITDA for the third quarter of 2022 totaled $7.1

million versus $8.6 million for the same period in 2021 primarily

due to lower volumes as well as the incurrence of public company

expenses totaling approximately $2.1 million. The Adjusted EBITDA

margin in the quarter was 17.5% compared to 20.8% in the third

quarter of 2021.

For the nine months ended September 30, 2022, Adjusted EBITDA

totaled $21.9 million versus $23.8 million for the same period in

2021 primarily due to recurring public company expenses totaling

approximately $6.4 million. The Adjusted EBITDA margin for the nine

months ended September 30, 2022 was 17.8% compared to 22.1% for the

same period in 2021.

2022 Outlook

For the full year 2022, Fathom expects revenue to range between

$163 million and $165 million, representing year-over-year growth

of approximately 7% to 8.5%. Fathom also expects Adjusted EBITDA to

range between $30 million and $32 million, representing a

year-over-year decrease of approximately (12.5%) to (7%) and an

implied Adjusted EBITDA margin of 18.4% to 19.4%. This outlook, as

of November 14, 2022, reflects management’s current projections and

macroeconomic outlook, and excludes the impact of any potential

acquisitions.

Conference Call

Fathom will host a conference call on Monday, November 14, 2022,

at 8:30 am Eastern Time. The dial-in number for callers in the U.S.

is +1-844-200-6205 and the dial-in number for international callers

is +1-929-526-1599. The access code for all callers is 412487. The

conference call will be broadcast live over the Internet and

include a slide presentation. To access the webcast and supporting

materials, please visit the investor relations section of Fathom’s

website at https://investors.fathommfg.com.

A replay of the conference call can be accessed through November

21, 2022, by dialing +1-866-813-9403 (US) or +1-226-828-7578

(international), and then entering the access code 414890. The

webcast will also be archived on Fathom’s website.

About Fathom Digital Manufacturing

Fathom is one of the largest on-demand digital manufacturing

platforms in North America, serving the comprehensive product

development and low- to mid-volume manufacturing needs of some of

the largest and most innovative companies in the world. With more

than 25 unique manufacturing processes and a national footprint

with nearly 450,000 square feet of manufacturing capacity across 12

facilities, Fathom seamlessly blends in-house capabilities across

plastic and metal additive technologies, CNC machining, injection

molding and tooling, sheet metal fabrication, and design and

engineering. With more than 35 years of industry experience, Fathom

is at the forefront of the Industry 4.0 digital manufacturing

revolution, serving clients in the technology, defense, aerospace,

medical, automotive and IOT sectors. Fathom's certifications

include: ITAR Registered, ISO 9001:2015 Design Certified, ISO

9001:2015, ISO 13485:2016, AS9100:2016, and NIST 800-171. To learn

more, visit https://fathommfg.com/.

Forward-Looking Statements

Certain statements made in this press release are

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Words such as “estimates,”

“projects,” “expects,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,”

“future,” “propose,” “target,” “goal,” “objective,” “outlook” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements are

not guarantees of future performance, conditions or results, and

involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside

the control of Fathom Digital Manufacturing Corporation (“Fathom”)

that could cause actual results or outcomes to differ materially

from those discussed in the forward-looking statements. Important

factors, among others, that may affect actual results or outcomes

include: the inability to recognize the anticipated benefits of our

business combination with Altimar Acquisition Corp. II; changes in

general economic conditions, including as a result of the COVID-19

pandemic; the outcome of litigation related to or arising out of

the business combination, or any adverse developments therein or

delays or costs resulting therefrom; the ability to meet the New

York Stock Exchange’s listing standards following the consummation

of the business combination; costs related to the business

combination and additional factors discussed in Fathom’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2021,

filed with the Securities and Exchange Commission (the “SEC”) on

April 8, 2022 as well as Fathom’s other filings with the SEC. If

any of the risks described above materialize or our assumptions

prove incorrect, actual results could differ materially from the

results implied by our forward-looking statements. There may be

additional risks that Fathom does not presently know or that Fathom

currently believes are immaterial that could also cause actual

results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect

Fathom’s expectations, plans or forecasts of future events and

views as of the date of this press release. These forward-looking

statements should not be relied upon as representing Fathom’s

assessments as of any date subsequent to the date of this press

release. Accordingly, undue reliance should not be placed upon the

forward-looking statements. Fathom undertakes no obligation to

update or revise any forward-looking statements made by management

or on its behalf, including with respect to the financial guidance

for full year 2022 contained herein, whether as a result of future

developments, subsequent events or circumstances or otherwise,

except as required by law.

Non-GAAP Financial Information

This press release includes Adjusted Net Income, Adjusted EBITDA

and Adjusted EBITDA margin, which are non-GAAP financial measures

that we use to supplement our results presented in accordance with

U.S. GAAP. We believe Adjusted Net Income, Adjusted EBITDA and

Adjusted EBITDA margin are useful in evaluating our operating

performance, as they are similar to measures reported by our public

competitors and regularly used by security analysts, institutional

investors and other interested parties in analyzing operating

performance and prospects. Adjusted Net Income, Adjusted EBITDA and

Adjusted EBITDA margin are not intended to be a substitute for any

U.S. GAAP financial measure and, as calculated, may not be

comparable to other similarly titled measures of performance of

other companies in other industries or within the same

industry.

We define and calculate Adjusted Net Income as net income (loss)

before the impact of any change in the estimated fair value of the

company’s warrants or earnout shares, reorganization expenses,

goodwill impairment, stock-based compensation, and certain other

non-cash and non-core items, as described in the reconciliation

included in the appendix to this press release. We define and

calculate Adjusted EBITDA as net income (loss) before the impact of

interest income or expense, income tax expense and depreciation and

amortization, and further adjusted for the following items: change

in the estimated fair value of the company’s warrants or earnout

shares, reorganization expenses, goodwill impairment, stock-based

compensation, and certain other non-cash and non-core items, as

described in the reconciliation included in the appendix to this

press release. Adjusted EBITDA excludes certain expenses that are

required in accordance with U.S. GAAP because they are

non-recurring (for example, in the case of reorganization

expenses), non-cash (for example, in the case of depreciation,

amortization, goodwill impairment, and stock-based compensation) or

are not related to our underlying business performance (for

example, in the case of interest income and expense). Adjusted

EBITDA margin represents Adjusted EBITDA divided by total revenue.

We include these non-GAAP financial measures because they are used

by management to evaluate Fathom’s core operating performance and

trends and to make strategic decisions regarding the allocation of

capital and new investments.

Information reconciling forward-looking Adjusted EBITDA to GAAP

financial measures is unavailable to Fathom without unreasonable

effort. The company is not able to provide reconciliations of

forward-looking Adjusted EBITDA to GAAP financial measures because

certain items required for such reconciliations are outside of

Fathom's control and/or cannot be reasonably predicted, such as the

provision for income taxes. Preparation of such reconciliations

would require a forward-looking balance sheet, statement of income

and statement of cash flow, prepared in accordance with GAAP, and

such forward-looking financial statements are unavailable to Fathom

without unreasonable effort. Fathom provides a range for its

Adjusted EBITDA forecast that it believes will be achieved, however

it cannot accurately predict all the components of the Adjusted

EBITDA calculation. Fathom provides an Adjusted EBITDA forecast

because it believes that Adjusted EBITDA, when viewed with the

company's results under GAAP, provides useful information for the

reasons noted above. However, Adjusted EBITDA is not a measure of

financial performance or liquidity under GAAP and, accordingly,

should not be considered as an alternative to net income or cash

flow from operating activities as an indicator of operating

performance or liquidity.

Consolidated Statements of

Comprehensive Income (Loss)

($ in thousands)

Three Months Ended

Nine Months Ended

September 30, 2022

September 30, 2021

September 30, 2022

September 30, 2021

Revenue

$

40,210

$

41,481

$

122,737

$

107,887

Cost of revenue

25,144

26,581

80,126

66,080

Gross profit

15,066

14,900

42,611

41,807

Operating expenses

Selling, general, and administrative

11,960

10,681

38,341

27,111

Depreciation and amortization

4,627

2,148

13,595

7,355

Restructuring

996

-

996

-

Goodwill impairment

1,066,564

-

1,066,564

-

Total operating expenses

1,084,147

12,829

1,119,496

34,466

Operating (loss) income

(1,069,081

)

2,071

(1,076,885

)

7,341

Interest expense and other (income)

expense

Interest expense

2,406

4,376

5,738

8,800

Other expense

81

442

276

9,007

Other income

(25,548

)

-

(88,771

)

(3,215

)

Total interest expense and other (income)

expense, net

(23,061

)

4,818

(82,757

)

14,592

Net loss before income tax

(1,046,020

)

(2,747

)

(994,128

)

(7,251

)

Income tax (benefit) expense

87

729

167

807

Net loss

(1,046,107

)

(3,476

)

(994,295

)

(8,058

)

Weighted average Class A common shares

outstanding

Basic

62,816,174

55,348,018

Diluted

62,816,174

55,348,018

Q3 2022 Revenue by Product Line

Reported Three Months

Ended

($ in thousands)

9/30/2022

% Revenue

9/30/2021

% Revenue

% Change

Revenue By Product Line

Additive manufacturing

$3,154

7.8%

$4,480

10.8%

-29.6%

Injection molding

$5,984

14.9%

$7,812

18.8%

-23.4%

CNC machining

$15,530

38.6%

$14,160

34.1%

9.7%

Precision sheet metal

$13,719

34.1%

$13,284

32.0%

3.3%

Other revenue

$1,823

4.5%

$1,745

4.2%

4.5%

Total

$40,210

100%

$41,481

100%

-3.1%

First Nine Months 2022 Revenue by

Product Line

Reported Nine Months

Ended

($ in thousands)

9/30/2022

% Revenue

9/30/2021

% Revenue

% Change

Revenue By Product Line

Additive manufacturing

$11,713

9.5%

$13,322

12.3%

-12.1%

Injection molding

$19,892

16.2%

$20,941

19.4%

-5.0%

CNC machining

$43,441

35.4%

$30,063

27.9%

44.5%

Precision sheet metal

$43,153

35.2%

$38,494

35.7%

12.1%

Other revenue

$4,538

3.7%

$5,067

4.7%

-10.4%

Total

$122,737

100%

$107,887

100%

13.8%

Consolidated Balance Sheets

($ in thousands)

Period Ended

September 30,

2022

December 31,

2021

Assets

(unaudited)

Current assets

Cash

$

8,004

$

20,357

Accounts receivable, net

27,237

25,367

Inventory

15,831

13,165

Prepaid expenses and other current

assets

3,170

1,836

Total current assets

54,242

60,725

Property and equipment, net

49,197

44,527

Right-of-use operating lease assets,

net

10,774

-

Right-of-use financing lease assets,

net

2,308

-

Intangible assets, net

255,947

269,622

Goodwill

121,779

1,189,464

Other non-current assets

1,415

2,036

Total assets

$

495,662

$

1,566,374

Liabilities and Shareholders’

Equity

Current liabilities

Accounts payable

$

11,779

$

9,409

Accrued expenses

8,162

5,957

Current operating lease liability

2,164

-

Current financing lease liability

195

-

Contingent consideration

700

2,748

Current portion of debt

31,955

29,697

Other current liabilities

2,037

2,058

Total current liabilities

56,992

49,869

Long-term debt, net

116,187

120,491

Fathom earnout shares liability

11,910

64,300

Sponsor earnout shares liability

1,790

9,380

Warrant liability

5,900

33,900

Payable to related parties pursuant to the

tax receivable agreement (includes $4,400 and $4,600 at fair value,

respectively)

26,100

4,600

Noncurrent contingent consideration

-

850

Noncurrent operating lease liability

9,041

-

Noncurrent financing lease liability

2,176

-

Deferred tax liability

-

17,570

Other noncurrent liabilities

-

4,655

Total liabilities

230,096

305,615

Commitments and Contingencies:

Redeemable non-controlling interest in

Fathom Holdco, LLC.

161,407

841,982

Shareholders' Equity:

Class A common stock, $0.0001 par value;

300,000,000 shares authorized; 65,529,753 issued and outstanding as

of September 30, 2022 and 50,785,656 issued and outstanding as of

December 31, 2021

6

5

Class B common stock, $0.0001 par value;

180,000,000 shares authorized; 70,153,051 shares issued and

outstanding as of September 30, 2022 and 84,294,971 shares issued

and outstanding as of December 31, 2021

7

8

Class C common stock, $.0001 par value;

10,000,000 shares authorized; 0 shares issued and outstanding as of

September 30, 2022 and December 31, 2021

-

-

Preferred Stock, $.0001 par value;

10,000,000 shares authorized; 0 shares issued and outstanding as of

September 30, 2022 and December 31, 2021

-

-

Additional paid-in-capital

584,313

466,345

Accumulated other comprehensive loss

-

Accumulated deficit

(480,167

)

(47,581

)

Shareholders’ equity attributable to

Fathom Digital Manufacturing Corporation

104,159

418,777

Total Liabilities, Shareholders’ Equity,

and Redeemable Non-Controlling Interest

$

495,662

$

1,566,374

Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income

(Loss)

($ in thousands)

Three Months Ended

Nine Months Ended

September 30, 2022

September 30, 2021

September 30, 2022

September 30, 2021

Net loss

$

(1,046,107)

$

(3,476)

$

(994,295)

$

(8,058)

Acquisition expenses(1)

-

-

-

4,045

Stock compensation

1,762

-

5,687

-

Inventory step-up amortization

-

(277)

3,241

-

Goodwill impairment

1,066,564

1,066,564

Restructuring

996

-

996

-

Change in fair value of warrant

liability(2)

(7,400)

-

(28,000)

-

Change in fair value of earnout shares

liability(2)

(18,080)

-

(59,980)

-

Change in fair value of tax receivable

agreement2)

-

-

(200)

-

Integration, non-recurring, non-operating,

cash, and non-cash costs(3)

492

2,679

3,443

5,309

Adjusted net income (loss)

$

(1,773)

$

(1,074)

$

(2,544)

$

1,296

1 Represents expenses incurred related to business acquisitions;

2 Represents the impacts from the change in fair value related to

both the earnout shares liability, the warrant liability and the

tax receivable agreement associated with the business combination

completed on December 23, 2021; 3 Represents adjustments for other

integration, non-recurring, non-operating, cash, and non-cash costs

related primarily to integration costs for new acquisitions,

severance, and management fees paid to our principal owner.

Reconciliation of GAAP Net Income

(Loss) to Adjusted EBITDA

($ in thousands)

Three Months Ended

Nine Months Ended

September 30, 2022

September 30, 2021

September 30, 2022

September 30, 2021

Net loss

$

(1,046,107)

$

(3,476)

$

(994,295)

$

(8,058)

Depreciation and amortization

6,335

4,381

18,539

12,006

Interest expense, net

2,406

4,376

5,738

8,800

Income tax expense

88

729

167

807

Acquisition expenses(1)

-

-

-

4,045

Inventory step-up amortization

-

(277)

3,241

-

Stock compensation

1,762

-

5,687

-

Goodwill impairment

1,066,564

-

1,066,564

-

Restructuring

996

-

996

-

Change in fair value of warrant

liability(2)

(7,400)

-

(28,000)

-

Change in fair value of earnout shares

liability(2)

(18,080)

-

(59,980)

-

Change in fair value of tax receivable

agreement(2)

-

-

(200)

-

Contingent consideration(3)

-

235

-

(1,120)

Loss on extinguishment of debt(4)

-

-

-

2,031

Integration, non-recurring, non-operating,

cash, and non-cash costs(5)

492

2,679

3,443

5,309

Adjusted EBITDA

$

7,056

$

8,647

$

21,900

$

23,820

1 Represents expenses incurred related to business acquisitions;

2 Represents the impacts from the change in fair value related to

both the earnout shares liability, the warrant liability and the

tax receivable agreement associated with the business combination

completed on December 23, 2021; 3 Represents the change in fair

value of contingent consideration payable to former owners of

acquired businesses; 4 Represents amounts paid to refinance debt in

April of 2021; 5 Represents adjustments for other integration,

non-recurring, non-operating, cash, and non-cash costs related

primarily to integration costs for new acquisitions, severance, and

management fees paid to our principal owner.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221113005150/en/

Michael Cimini Director, Investor Relations Fathom Digital

Manufacturing (262) 563-5575 michael.cimini@fathommfg.com

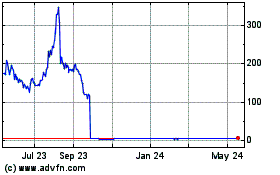

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Jan 2025 to Feb 2025

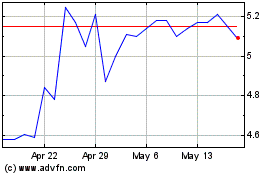

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Feb 2024 to Feb 2025