The Board of Trustees of First Trust Dynamic Europe Equity

Income Fund (the "Fund") (NYSE: FDEU), CUSIP 33740D107, previously

approved a managed distribution policy for the Fund (the "Managed

Distribution Plan") in reliance on exemptive relief received from

the Securities and Exchange Commission which permits the Fund to

make periodic distributions of long-term capital gains as

frequently as monthly each tax year.

The Fund has declared a distribution payable on November 15,

2023, to shareholders of record as of November 2, 2023, with an

ex-dividend date of November 1, 2023. This Notice is meant to

provide you information about the sources of your Fund’s

distributions. You should not draw any conclusions about the Fund's

investment performance from the amount of its distribution or from

the terms of its Managed Distribution Plan.

The following tables set forth the estimated amounts of the

current distribution and the cumulative distributions paid this

fiscal year to date for the Fund from the following sources: net

investment income ("NII"); net realized short-term capital gains

("STCG"); net realized long-term capital gains ("LTCG"); and return

of capital ("ROC"). These estimates are based upon information as

of October 31, 2023, are calculated based on a generally accepted

accounting principles ("GAAP") basis and include the prior fiscal

year-end undistributed net investment income. The amounts and

sources of distributions are expressed per common share.

5 Yr. Avg.

Annualized Current

Annual Total

Fund

Fund

Fiscal

Total Current

Current Distribution

($)

Current Distribution

(%)

Dist. Rate as a

Return

Ticker

Cusip

Year

End

Distribution

NII

STCG

LTCG

ROC (2)

NII

STCG

LTCG

ROC(2)

% of

NAV(3)

on

NAV(4)

FDEU

33740D107

12/31/2023

$0.07000

$0.03332

-

-

$0.03668

47.60%

-

-

52.40%

6.80%

2.76%

Fund

Fund

Fiscal

Total Cumulative Fiscal

YTD

Cumulative Distributions

Fiscal YTD ($)

Cumulative Distributions

Fiscal YTD (%)

Cumulative Fiscal YTD

Distributions as

Cumulative Fiscal YTD Total

Return

Ticker

Cusip

Year

End

Distributions(1)

NII

STCG

LTCG

ROC (2)

NII

STCG

LTCG

ROC(2)

a % of

NAV(3)

on

NAV(4)

FDEU

33740D107

12/31/2023

$0.77000

$0.36652

-

-

$0.40348

47.60%

-

-

52.40%

6.23%

1.47%

(1) Includes the most recent monthly

distribution paid on November 15, 2023.

(2) The Fund estimates that it has

distributed more than its income and net realized capital gains;

therefore, a portion of your distribution may be a return of

capital. A return of capital may occur, for example, when some or

all of the money that you invested in the Fund is paid back to you.

A return of capital distribution does not necessarily reflect the

Fund's investment performance and should not be confused with

"yield" or "income."

(3) Based on Net Asset Value ("NAV") as of

October 31, 2023.

(4) Total Returns are through October 31,

2023.

The amounts and sources of distributions reported in this Notice

are only estimates and are not being provided for tax reporting

purposes. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon the Fund's investment

experience during the remainder of its fiscal year and may be

subject to changes based on tax regulations. The Fund will send you

a Form 1099-DIV for the calendar year that will tell you how to

report these distributions for federal income tax purposes. You

should not use this Notice as a substitute for your Form

1099-DIV.

First Trust Advisors L.P. ("FTA") is a federally registered

investment advisor and serves as the Fund's investment advisor. FTA

and its affiliate First Trust Portfolios L.P. ("FTP"), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $187 billion as of

October 31, 2023 through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts. FTA is the supervisor of the First Trust unit investment

trusts, while FTP is the sponsor. FTP is also a distributor of

mutual fund shares and exchange-traded fund creation units. FTA and

FTP are based in Wheaton, Illinois.

Janus Henderson Investors US LLC, formerly Janus Capital

Management LLC ("Janus Henderson" or the "Sub-Advisor"), a legal

entity of Janus Henderson Investors, serves as the Fund's

investment sub-advisor. Janus Henderson Investors is headquartered

in London and is a global investment management firm that provides

a full spectrum of investment products and services to clients

around the world. With offices in 24 cities with more than 2,300

employees, Janus Henderson Investors managed approximately $308.3

billion in assets as of September 30, 2023.

Principal Risk Factors: Risks are inherent in all investing.

Certain risks applicable to the Fund are identified below, which

includes the risk that you could lose some or all of your

investment in the Fund. The principal risks of investing in the

Fund are spelled out in the Fund's annual shareholder reports. The

order of the below risk factors does not indicate the significance

of any particular risk factor. The Fund also files reports, proxy

statements and other information that is available for

review.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost. There can be no assurance that the Fund's investment

objectives will be achieved. The Fund may not be appropriate for

all investors.

The Fund is subject to risks, including the fact that it is a

diversified closed-end management investment company.

Market risk is the risk that a particular security, or shares of

a fund in general may fall in value. Securities are subject to

market fluctuations caused by such factors as general economic

conditions, political events, regulatory or market developments,

changes in interest rates and perceived trends in securities

prices. Shares of a fund could decline in value or underperform

other investments as a result. In addition, local, regional or

global events such as war, acts of terrorism, spread of infectious

disease or other public health issues, recessions, natural

disasters or other events could have significant negative impact on

a fund.

Current market conditions risk is the risk that a particular

investment, or shares of the fund in general, may fall in value due

to current market conditions. As a means to fight inflation, the

Federal Reserve and certain foreign central banks have raised

interest rates and expect to continue to do so, and the Federal

Reserve has announced that it intends to reverse previously

implemented quantitative easing. Recent and potential future bank

failures could result in disruption to the broader banking industry

or markets generally and reduce confidence in financial

institutions and the economy as a whole, which may also heighten

market volatility and reduce liquidity. In February 2022, Russia

invaded Ukraine which has caused and could continue to cause

significant market disruptions and volatility within the markets in

Russia, Europe, and the United States. The hostilities and

sanctions resulting from those hostilities have and could continue

to have a significant impact on certain fund investments as well as

fund performance and liquidity. The COVID-19 global pandemic, or

any future public health crisis, and the ensuing policies enacted

by governments and central banks have caused and may continue to

cause significant volatility and uncertainty in global financial

markets, negatively impacting global growth prospects.

Net investment income paid by the Fund to its shareholders is

derived from the premiums it receives from writing (selling) call

options and from the dividends and interest it receives from the

equity securities and other investments held in the Fund's

portfolio and short-term gains thereon. Premiums from writing

(selling) call options and dividends and interest payments made by

the securities in the Fund's portfolio can vary widely over time.

Dividends on equity securities are not fixed but are declared at

the discretion of an issuer's board of directors. There is no

guarantee that the issuers of the equity securities in which the

Fund invests will declare dividends in the future or that if

declared they will remain at current levels. The Fund cannot assure

as to what percentage of the distributions paid on the common

shares, if any, will consist of qualified dividend income or

long-term capital gains, both of which are taxed at lower rates for

individuals than are ordinary income and short-term capital

gains.

Because the Fund will invest primarily in securities of non-U.S.

issuers, which are generally denominated in non-U.S. currencies,

there are risks not typically associated with investing in

securities of U.S. issuers. Non-U.S. issuers are subject to higher

volatility than securities of U.S. issuers. An investor may lose

money if the local currency of a non-U.S. market depreciates

against the U.S. dollar. The Fund may invest from time to time a

substantial amount of its assets in issuers located in a single

country or region.

Investments in securities of issuers located in emerging market

countries are considered speculative and there is a heightened risk

of investing in emerging markets securities. Financial and other

reporting by companies and government entities also may be less

reliable in emerging market countries. Shareholder claims that are

available in the U.S., as well as regulatory oversight and

authority that is common in the U.S., including for claims based on

fraud, may be difficult or impossible for shareholders of

securities in emerging market countries or for U.S. authorities to

pursue.

Political or economic disruptions in European countries, even in

countries in which a fund is not invested, may adversely affect

security values and thus the fund's holdings. A significant number

of countries in Europe are member states in the European Union

("EU"), and the member states no longer control their own monetary

policies. In these member states, the authority to direct monetary

policies, including money supply and official interest rates for

the Euro, is exercised by the European Central Bank.

Investments in issuers located in the United Kingdom may subject

a fund to regulatory, political, currency, security and economic

risk specific to the United Kingdom. The United Kingdom has one of

the largest economies in Europe and is heavily dependent on trade

with the EU, and to a lesser extent the United States and China.

The United Kingdom vote to leave the EU and other recent rapid

political and social change throughout Europe make the extent and

nature of future economic development in Europe and the effect on

securities issued by European issuers difficult to predict.

The Fund will engage in practices and strategies that will

result in exposure to fluctuations in foreign exchange rates, thus

subjecting it to foreign currency risk.

The market value of REIT shares and the ability of the REITs to

distribute income may be adversely affected by several factors.

The Fund's use of derivatives may result in losses greater than

if they had not been used, may require the Fund to sell or purchase

portfolio securities at inopportune times, may limit the amount of

appreciation the Fund can realize on an investment, or may cause

the Fund to hold a security that it might otherwise sell.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

In the event of conversion to an open-end management investment

company, the Common Shares would cease to be listed on the NYSE or

other national securities exchange, and such Common Shares would

thereafter be redeemable at NAV at the option of the Common

Shareholder, rather than traded in the secondary market at market

price, which, for closed-end fund shares, may at times be at a

premium to NAV. Any Borrowings or Preferred Shares of the Fund

would need to be repaid or redeemed upon conversion and,

accordingly, a portion of the Fund's portfolio may need to be

liquidated, potentially resulting in, among other things, lower

current income.

The risks of investing in the Fund are spelled out in the

shareholder reports and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial professionals are responsible for evaluating investment

risks independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

Forward-Looking Statements

Certain statements made in this press release that are not

historical facts are referred to as "forward‑looking statements"

under the U.S. federal securities laws. Actual future results or

occurrences may differ significantly from those anticipated in any

forward‑looking statements due to numerous factors. Generally, the

words "believe," "expect," "intend," "estimate," "anticipate,"

"project," "will" and similar expressions identify forward‑looking

statements, which generally are not historical in nature.

Forward‑looking statements are subject to certain risks and

uncertainties that could cause actual results to differ from those

anticipated in any forward-looking statements. You should not place

undue reliance on forward‑looking statements, which speak only as

of the date they are made. The Fund undertakes no responsibility to

update publicly or revise any forward‑looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231115458145/en/

Inquiries: Derek Maltbie (630) 765-8499

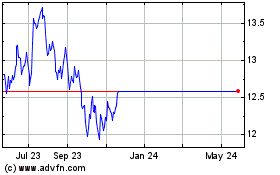

First Trust Dynamic Euro... (NYSE:FDEU)

Historical Stock Chart

From Nov 2024 to Dec 2024

First Trust Dynamic Euro... (NYSE:FDEU)

Historical Stock Chart

From Dec 2023 to Dec 2024