Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

November 28 2023 - 11:34AM

Edgar (US Regulatory)

First Trust Dynamic Europe Equity Income

Fund (FDEU)

Portfolio of Investments

September 30, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (a) – 121.0%

|

|

|

| Aerospace & Defense – 1.9%

|

|

|

| 30,992

|

| Airbus SE

|

| $4,160,664

|

|

|

| Automobiles – 2.2%

|

|

|

| 25,418

|

| Bayerische Motoren Werke AG

|

| 2,590,037

|

| 32,839

|

| Mercedes-Benz Group AG

|

| 2,287,637

|

|

|

|

|

| 4,877,674

|

|

|

| Banks – 6.2%

|

|

|

| 80,814

|

| BNP Paribas S.A.

|

| 5,163,176

|

| 314,122

|

| HSBC Holdings PLC

|

| 2,471,645

|

| 482,760

|

| ING Groep N.V.

|

| 6,405,495

|

|

|

|

|

| 14,040,316

|

|

|

| Beverages – 3.9%

|

|

|

| 111,686

|

| Diageo PLC

|

| 4,134,374

|

| 27,411

|

| Pernod Ricard S.A.

|

| 4,574,537

|

|

|

|

|

| 8,708,911

|

|

|

| Broadline Retail – 1.9%

|

|

|

| 143,982

|

| Prosus N.V. (b)

|

| 4,250,121

|

|

|

| Building Products – 2.0%

|

|

|

| 74,344

|

| Cie de Saint-Gobain S.A.

|

| 4,470,779

|

|

|

| Capital Markets – 7.1%

|

|

|

| 189,935

|

| 3i Group PLC

|

| 4,803,964

|

| 56,728

|

| Amundi S.A. (c) (d)

|

| 3,199,702

|

| 267,960

|

| IG Group Holdings PLC

|

| 2,103,846

|

| 251,221

|

| Intermediate Capital Group PLC

|

| 4,239,099

|

| 159,806

|

| St. James’s Place PLC

|

| 1,622,618

|

|

|

|

|

| 15,969,229

|

|

|

| Chemicals – 0.9%

|

|

|

| 118,065

|

| Victrex PLC

|

| 2,023,918

|

|

|

| Commercial Services & Supplies – 0.4%

|

|

|

| 1,367,832

|

| Prosegur Cash S.A. (c) (d)

|

| 851,777

|

|

|

| Construction Materials – 1.4%

|

|

|

| 50,473

|

| Holcim Ltd.

|

| 3,241,168

|

|

|

| Diversified REITs – 1.9%

|

|

|

| 1,107,517

|

| British Land (The) Co., PLC

|

| 4,282,211

|

|

|

| Diversified Telecommunication Services – 2.8%

|

|

|

| 130,761

|

| Deutsche Telekom AG

|

| 2,746,693

|

| 318,706

|

| Telenor ASA

|

| 3,620,084

|

|

|

|

|

| 6,366,777

|

|

|

| Electric Utilities – 6.0%

|

|

|

| 710,843

|

| Enel S.p.A.

|

| 4,373,956

|

| 437,264

|

| Iberdrola S.A.

|

| 4,898,040

|

| 217,504

|

| SSE PLC

|

| 4,272,564

|

|

|

|

|

| 13,544,560

|

|

|

| Electrical Equipment – 2.5%

|

|

|

| 34,436

|

| Schneider Electric SE

|

| 5,715,243

|

First Trust Dynamic Europe Equity Income

Fund (FDEU)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (a) (Continued)

|

|

|

| Financial Services – 1.3%

|

|

|

| 1,228,449

|

| M&G PLC

|

| $2,957,193

|

|

|

| Food Products – 4.7%

|

|

|

| 40,000

|

| Danone S.A.

|

| 2,210,076

|

| 73,549

|

| Nestle S.A.

|

| 8,335,580

|

|

|

|

|

| 10,545,656

|

|

|

| Hotels, Restaurants & Leisure – 1.5%

|

|

|

| 78,788

|

| Whitbread PLC

|

| 3,329,917

|

|

|

| Household Durables – 2.0%

|

|

|

| 140,111

|

| Persimmon PLC

|

| 1,841,980

|

| 227,976

|

| Vistry Group PLC

|

| 2,536,760

|

|

|

|

|

| 4,378,740

|

|

|

| Insurance – 5.8%

|

|

|

| 111,794

|

| ASR Nederland N.V.

|

| 4,198,258

|

| 461,516

|

| Aviva PLC

|

| 2,194,947

|

| 221,761

|

| AXA S.A.

|

| 6,606,993

|

|

|

|

|

| 13,000,198

|

|

|

| Machinery – 4.1%

|

|

|

| 123,379

|

| Daimler Truck Holding AG

|

| 4,281,121

|

| 262,424

|

| Sandvik AB

|

| 4,842,290

|

|

|

|

|

| 9,123,411

|

|

|

| Media – 0.2%

|

|

|

| 1,110,771

|

| MFE-MediaForEurope N.V., Class A

|

| 469,510

|

|

|

| Metals & Mining – 6.0%

|

|

|

| 161,060

|

| Anglo American PLC

|

| 4,451,918

|

| 157,890

|

| BHP Group Ltd.

|

| 4,506,850

|

| 72,809

|

| Rio Tinto PLC

|

| 4,596,285

|

|

|

|

|

| 13,555,053

|

|

|

| Multi-Utilities – 2.9%

|

|

|

| 356,889

|

| National Grid PLC

|

| 4,267,315

|

| 76,166

|

| Veolia Environnement S.A.

|

| 2,208,842

|

|

|

|

|

| 6,476,157

|

|

|

| Oil, Gas & Consumable Fuels – 7.6%

|

|

|

| 504,358

|

| BP PLC

|

| 3,270,061

|

| 409,425

|

| Repsol S.A.

|

| 6,739,702

|

| 101,865

|

| Shell PLC

|

| 3,285,290

|

| 58,496

|

| TotalEnergies SE

|

| 3,853,555

|

|

|

|

|

| 17,148,608

|

|

|

| Paper & Forest Products – 1.0%

|

|

|

| 62,392

|

| UPM-Kymmene Oyj

|

| 2,141,849

|

|

|

| Personal Care Products – 3.6%

|

|

|

| 164,481

|

| Unilever PLC

|

| 8,153,186

|

|

|

| Pharmaceuticals – 20.0%

|

|

|

| 70,258

|

| AstraZeneca PLC

|

| 9,516,833

|

| 240,395

|

| GSK PLC

|

| 4,376,124

|

| 78,869

|

| Novartis AG

|

| 8,088,090

|

| 63,188

|

| Novo Nordisk A.S., Class B

|

| 5,767,530

|

First Trust Dynamic Europe Equity Income

Fund (FDEU)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (a) (Continued)

|

|

|

| Pharmaceuticals (Continued)

|

|

|

| 23,279

|

| Roche Holding AG

|

| $6,369,395

|

| 100,605

|

| Sanofi

|

| 10,793,883

|

|

|

|

|

| 44,911,855

|

|

|

| Professional Services – 5.1%

|

|

|

| 76,661

|

| Adecco Group AG

|

| 3,162,418

|

| 247,788

|

| RELX PLC

|

| 8,389,550

|

|

|

|

|

| 11,551,968

|

|

|

| Semiconductors & Semiconductor Equipment – 0.9%

|

|

|

| 63,007

|

| Infineon Technologies AG

|

| 2,088,687

|

|

|

| Software – 3.0%

|

|

|

| 51,567

|

| SAP SE

|

| 6,696,050

|

|

|

| Textiles, Apparel & Luxury Goods – 2.7%

|

|

|

| 50,291

|

| Cie Financiere Richemont S.A., Class A

|

| 6,153,484

|

|

|

| Tobacco – 4.6%

|

|

|

| 134,555

|

| British American Tobacco PLC

|

| 4,230,675

|

| 304,771

|

| Imperial Brands PLC

|

| 6,198,758

|

|

|

|

|

| 10,429,433

|

|

|

| Wireless Telecommunication Services – 2.9%

|

|

|

| 365,976

|

| Tele2 AB, Class B

|

| 2,803,051

|

| 4,035,972

|

| Vodafone Group PLC

|

| 3,782,839

|

|

|

|

|

| 6,585,890

|

|

|

| Total Investments – 121.0%

|

| 272,200,193

|

|

|

| (Cost $297,155,700)

|

|

|

| Number of Contracts

|

| Description

|

| Counterparty

|

| Notional Amount

|

| Exercise Price

(Euro)

|

| Expiration Date

|

| Value

|

| WRITTEN OPTIONS – (0.2)%

|

|

|

| Call Options Written – (0.2)%

|

|

|

|

|

|

|

|

|

|

|

| (6,000)

|

| EURO STOXX 50 Index

|

| UBS

|

| $(264,819,580)

|

| €4,300.00

|

| 10/20/23

|

| (108,474)

|

| (6,000)

|

| EURO STOXX 50 Index

|

| SG

|

| (264,819,580)

|

| 4,225.00

|

| 10/20/23

|

| (266,427)

|

| (6,000)

|

| EURO STOXX 50 Index

|

| SG

|

| (264,819,580)

|

| 4,375.00

|

| 10/20/23

|

| (37,427)

|

| (6,000)

|

| EURO STOXX 50 Index

|

| SG

|

| (264,819,580)

|

| 4,375.00

|

| 11/17/23

|

| (145,266)

|

|

|

| Total Written Options

|

|

|

|

|

|

|

|

|

| (557,594)

|

|

|

| (Premiums received $1,768,754)

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding Loans – (34.2)%

| (76,894,294)

|

|

| Net Other Assets and Liabilities – 13.4%

| 30,195,283

|

|

| Net Assets – 100.0%

| $224,943,588

|

| (a)

| All or a portion of these securities are available to serve as collateral for the outstanding loans and call options written.

|

| (b)

| Non-income producing security.

|

| (c)

| This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933, as amended (the “1933 Act”).

|

| (d)

| This security is exempt from registration upon resale under Rule 144A of the 1933 Act and may be resold in transactions exempt from registration, normally to

qualified institutional buyers. This security is not restricted on the foreign exchange where it trades freely without any additional registration. As such, it does not require the additional disclosure required of

restricted securities.

|

First Trust Dynamic Europe Equity Income

Fund (FDEU)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| Abbreviations throughout the Portfolio of Investments:

|

| CHF

| Swiss Franc

|

| DKK

| Danish Krone

|

| EUR

| Euro

|

| GBP

| British Pound Sterling

|

| NOK

| Norwegian Krone

|

| SEK

| Swedish Krona

|

| SG

| Societe Generale

|

| UBS

| UBS

|

Currency Exposure

Diversification

| % of Total

Investments

|

| EUR

| 43.9%

|

| GBP

| 36.9

|

| CHF

| 13.0

|

| SEK

| 2.8

|

| DKK

| 2.1

|

| NOK

| 1.3

|

| Total

| 100.0%

|

| Country Allocation†

| % of Total

Investments

|

| United Kingdom

| 39.4%

|

| France

| 17.9

|

| Switzerland

| 13.0

|

| Germany

| 7.6

|

| Netherlands

| 7.2

|

| Spain

| 4.6

|

| Sweden

| 2.8

|

| Denmark

| 2.1

|

| Australia

| 1.7

|

| Italy

| 1.6

|

| Norway

| 1.3

|

| Finland

| 0.8

|

| Total

| 100.0%

|

† Portfolio

securities are categorized based upon their country of incorporation.

Valuation Inputs

The Fund is

subject to fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of

the measurement date. The three levels of the fair value hierarchy are as follows:

| •

| Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

|

| •

| Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived

from observable market data.)

|

| •

| Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in

pricing the investment.

|

The inputs or

methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

First Trust Dynamic Europe Equity Income

Fund (FDEU)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

A summary of the inputs

used to value the Fund’s investments as of September 30, 2023 is as follows:

| ASSETS TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Common Stocks*

| $ 272,200,193

| $ 272,200,193

| $ —

| $ —

|

|

|

| LIABILITIES TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Written Options

| $ (557,594)

| $ —

| $ (557,594)

| $ —

|

| *

| See Portfolio of Investments for industry breakout.

|

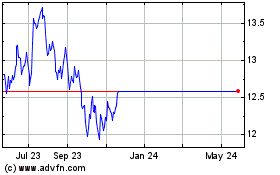

First Trust Dynamic Euro... (NYSE:FDEU)

Historical Stock Chart

From Jan 2025 to Feb 2025

First Trust Dynamic Euro... (NYSE:FDEU)

Historical Stock Chart

From Feb 2024 to Feb 2025