First Trust Announces Shareholder Approvals of the Mergers

March 01 2024 - 8:51AM

Business Wire

First Trust Advisors L.P. (“FTA”) announced today that

shareholders of First Trust Energy Income and Growth Fund (NYSE

American: FEN), First Trust MLP and Energy Income Fund (NYSE: FEI),

First Trust New Opportunities MLP & Energy Fund (NYSE: FPL) and

First Trust Energy Infrastructure Fund (NYSE: FIF) (the “Target

Funds” or each, individually, a “Target Fund”), each a closed-end

management investment company managed by FTA and sub-advised by

Energy Income Partners, LLC (“EIP”), approved the mergers of the

Target Funds into FT Energy Income Partners Enhanced Income ETF

(“EIPI”), a newly formed actively managed exchange-traded fund

(“ETF”) that will be traded on the NYSE Arca and will be managed by

FTA and sub-advised by EIP, at a joint special meeting of

shareholders on February 29, 2024.

As previously announced, the mergers were approved by the Boards

of Trustees of the Target Funds and EIPI on October 23, 2023. The

Boards of Trustees of the Target Funds believe the mergers may

benefit shareholders through (among other reasons) the

following:

- An anticipated significant reduction or elimination of the

discount to net asset value (“NAV”) at which the Target Funds’

shares have traded, as shares of ETFs typically trade at or near

their NAV due in part to the share creation and redemption features

of ETFs;

- The favorable tax attributes and the daily portfolio holdings

transparency that the open-end ETF structure would provide;

- The potential for similar or increased distributions resulting

from lower expenses and increased option premiums while reducing

the volatility associated with the use of leverage from borrowings;

and

- Lower overall total expense ratios.

Subject to the satisfaction of certain customary closing

conditions, the mergers of the Target Funds into EIPI are expected

to close by the end of April 2024, or as soon thereafter as

practicable. No assurance can be given as to the exact timing of

the closing of the mergers.

Upon the completion of a merger, shareholders of the applicable

Target Fund will receive shares of EIPI with a value equal to the

aggregate NAV of the Target Fund shares held by them immediately

prior to the merger and such shareholders will become shareholders

of EIPI, with the Target Fund thereafter terminated. The merger of

each Target Fund into EIPI is expected to qualify as a tax-free

reorganization for federal income tax purposes.

In connection with its merger into EIPI, each of FEN, FEI and

FPL will likely be required to recognize an adjustment to its NAV

as of February 29, 2024. Based on information available on February

28, 2024, FTA estimates that such adjustments will not

result in any change to the NAV of FEN and could result in an

increase in NAV of approximately $1,357,800 (or

$0.030 per share) for FEI and a decrease in NAV of

approximately $1,943,747 (or $0.083 per share) for

FPL. As FTA receives additional year‑end tax information from the

master limited partnerships (“MLPs”) held by the Target Funds, each

of FEN, FEI and FPL may need to further decrease its NAV from time

to time prior to the completion of its merger and EIPI may need to

decrease its NAV following the completion of the mergers. The

amount and timing of all of the foregoing potential NAV adjustments

will depend in part on the market prices and composition of the

Target Funds’ portfolio securities.

EIPI is an actively managed ETF that seeks a high level of total

return with an emphasis on current distributions paid to

shareholders. Under normal market conditions, EIPI will pursue its

investment objective by investing primarily in a portfolio of

equity securities in the broader energy market. EIPI will also seek

to enhance its income paying capacity by selling call options. In

advance of the merger of each Target Fund into EIPI, EIP

anticipates repositioning the Target Fund’s portfolio in order to

de-lever and align the Target Fund’s investments with the

investment strategies of EIPI, while continuing to seek to achieve

the Target Fund’s investment objective.

EIP believes that rapid changes to the energy system driven by

innovations like oil and gas completion technologies, renewable

energy and energy storage as well as government policies relating

to the energy system’s emissions, safety, reliability, resilience

and national security have created a wider range of and more

diversified opportunities in the energy sector than in the past.

The portfolio is anticipated to focus on companies with stable cash

flows and higher-than-average dividend payout ratios or companies

with cyclical cash flows that have lower and more sustainable

dividend payout ratios. This may include an initial portfolio

allocation for EIPI that includes 25% to 35% of pipeline C

Corporations, 25% to 35% of regulated and diversified utilities,

20% to 25% MLPs, 5% to 15% of other energy infrastructure

companies, 5% to 15% of integrated oil companies, and 2% to 5% of

renewable energy developers.

FTA is a federally registered investment advisor and serves as

the investment advisor of each Target Fund and EIPI. FTA and its

affiliate First Trust Portfolios L.P. (“FTP”), a FINRA registered

broker-dealer, are privately-held companies that provide a variety

of investment services. FTA has collective assets under management

or supervision of approximately $211 billion as of January 31, 2024

through unit investment trusts, exchange-traded funds, closed-end

funds, mutual funds and separate managed accounts. FTA is the

supervisor of the First Trust unit investment trusts, while FTP is

the sponsor. FTP is also a distributor of mutual fund shares and

exchange-traded fund creation units. FTA and FTP are based in

Wheaton, Illinois.

EIP serves as each Target Fund’s and EIPI’s investment

sub-advisor and provides advisory services to a number of

investment companies and partnerships for the purpose of investing

in MLPs and other energy infrastructure securities. EIP is one of

the early investment advisors specializing in this area. As of

January 31, 2024, EIP managed or supervised approximately $5.0

billion in client assets.

Additional Information about the Funds and Where to Find

It

This press release is not intended to, and shall not, constitute

an offer to purchase or sell shares of a Target Fund or EIPI.

Certain statements made in this news release that are not

historical facts are referred to as “forward-looking statements”

under the U.S. federal securities laws. Actual future results or

occurrences may differ significantly from those anticipated in any

forward-looking statements due to numerous factors. Generally, the

words “believe,” “expect,” “intend,” “estimate,” “anticipate,”

“project,” “will” and similar expressions identify forward-looking

statements, which generally are not historical in nature.

Forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ from the

historical experience of FTA and the funds managed by FTA and its

present expectations or projections. You should not place undue

reliance on forward-looking statements, which speak only as of the

date they are made. FTA, EIP, FEN, FEI, FPL, FIF and EIPI undertake

no responsibility to update publicly or revise any forward-looking

statements.

The annual and semi-annual reports of the Target Funds providing

additional information as to the Target Funds and, when available,

a Prospectus for EIPI containing important information about EIPI

can be requested free of charge by calling toll-free at

1-800-621-1675 or writing FTA at 120 East Liberty Drive, Suite 400,

Wheaton, IL 60187.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229262864/en/

Jeff Margolin – (630) 517-7643 Daniel Lindquist – (630) 765-8692

Chris Fallow – (630) 517-7628 Ryan Issakainen – (630) 765-8689

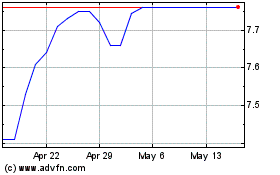

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Nov 2024 to Dec 2024

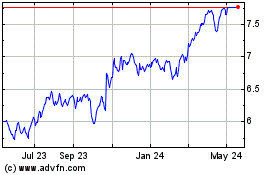

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Dec 2023 to Dec 2024