Global Blue Releases the Monthly Tax Free Shopping Business Update for June 2024

July 05 2024 - 5:07AM

Business Wire

- Fresh data from Global Blue reveals that the global dynamic

recovery for Tax Free Shopping accelerated across Continental

Europe and Asia Pacific.

- Globally, issued Sales in Store like-for-like recovery

reached 168%1 in June 2024 compared to the same period in 2019, vs.

163%1 in April/May 2024 and 140%1 in Q1 2024.

An accelerating worldwide recovery, compared to 2019

levels

Globally, June 2024 recovery is ahead of April/May 2024

recovery, reaching 168%1 vs. 163%1 in April/May and 140%1 in Q1.

This is driven by a solid momentum across destinations.

In Continental Europe, June 2024 recovery has slightly

accelerated compared to April/May 2024, reaching 147%1 in June vs.

141%1 in April/May and 128%1 in Q1, propelled by strong recoveries

in France (164%1), Spain (160%1) and Italy (163%1). In terms of

origin markets, GCC shopper recovery significantly

influenced the positive impact of the recovery in June, reaching

335%1 vs. 302%1 in April/May. This seasonal boost is linked to the

shift in the Eid Al Adha calendar2. US shopper recovery also

remains strong, reaching 317%1 in June vs. 308%1 in April/May.

In Asia Pacific, the recovery rate remained strong at

236%1 in June vs. 223%1 in April/May. Regarding origin

markets, travelers from Hong Kong and Taiwan continue to lead

the recovery, reaching 764%1 in June vs. 601%1 in April/May. North

East Asia travelers follow closely, with a recovery rate of 386%1

in June vs. 352%1 in April/May.

For Mainland Chinese shoppers, the worldwide issued Sales

in Store like-for-like recovery reached 122%1 in June, in line with

April/May and 101%1 in Q1 ‘24. Within Continental Europe,

Mainland Chinese shopper recovery reached 58%1 in June vs. 63%1 in

April/May. In Asia Pacific, Mainland Chinese shopper

recovery continues to accelerate, reaching 214%1 in June and 190%1

in April/May.

A strong year-on-year performance for international

shopping

When analyzing the year-on-year variation in Tax Free Shopping

growth, the worldwide issued Sales in Store like-for-like

year-on-year performance reached +32%3 in June 2024 vs. +47%3 in

April/May and +40%3 in Q1.

In Continental Europe, the issued Sales in Store growth

rate grew by +14%3 in June 2024 vs. last year, influenced by a

positive dynamic across nationalities. Regarding origin

markets, the positive momentum for issued Sales in Store growth

is visible across all nationalities, with GCC shoppers leading the

way, with the US at +39%3 and Mainland Chinese at a +13%3 growth

rate in June 2024.

In Asia Pacific, the issued Sales in Store growth rate

continues to remain high, reaching +92%3 in June 2024 vs. last

year. All nationalities contributed positively, with

Mainland Chinese leading the way at +161%3 in June 2024 vs. 2023,

North East shoppers at +122%3 and Hong Kong and Taiwan at

+66%3.

APPENDIX

Worldwide recovery rate (versus 2019) rate

Issued SIS L/L

recovery1

(in % of 2019)

% Issued SIS 2019

June

2024

May

2024

April

2024

March

2024

CY Q1

2024

CY Q4

2023

France

22%

164%

170%

158%

160%

165%

140%

Italy

24%

163%

164%

145%

135%

123%

123%

Spain

14%

160%

169%

166%

152%

151%

133%

Germany

13%

90%

73%

73%

69%

65%

74%

Other countries

27%

137%

127%

129%

121%

126%

111%

Total Continental Europe

100%

147%

145%

137%

130%

128%

118%

Japan

54%

359%

360%

262%

235%

232%

225%

Singapore

42%

85%

103%

81%

111%

92%

75%

South Korea

4%

170%

164%

140%

127%

125%

111%

Total Asia Pacific

100%

236%

250%

192%

181%

166%

150%

Total worldwide

100%

168%

172%

153%

145%

140%

127%

Worldwide Year-on-Year Growth Rate (2024 vs. 2023)

Issued SIS L/L

Year-on-Year

Growth3

% Issued SIS 2023

June

2024

May

2024

April

2024

March

2024

February

2024

CY

Q1 2024

France

26%

+5%

+14%

+13%

+3%

+21%

+11%

Italy

25%

+15%

+29%

+30%

+20%

+44%

+29%

Spain

15%

+29%

+33%

+38%

+18%

+52%

+32%

Germany

8%

-1%

-7%

+15%

-10%

+9%

+6%

Other countries

26%

+16%

+21%

+24%

+9%

+30%

+16%

Total Continental

Europe

100%

+14%

+19%

+25%

+9%

+32%

+19%

Japan

65%

+135%

+222%

+167%

+146%

+170%

+137%

Singapore

27%

-2%

+2%

-4%

+24%

+36%

25%

South Korea

8%

+61%

+58%

+63%

+96%

+138%

110%

Total Asia Pacific

100%

+92%

+134%

+103%

+102%

+120%

97%

Total worldwide

100%

+32%

+47%

+46%

+33%

57%

40%

GLOSSARY

- Gulf Cooperation Council countries include:

Kuwait, Qatar, Saudi Arabia, United Arab Emirates, Bahrain, Oman -

South East Asia includes: Indonesia, Thailand, Cambodia,

Philippines, Vietnam, Malaysia, Singapore - North East Asia

includes: Japan, South Korea

ABOUT GLOBAL BLUE

Global Blue is the business partner for the shopping journey,

providing technology and services to enhance the experience and

drive performance.

With over 40 years of expertise, today we connect thousands of

retailers, acquirers, and hotels with nearly 80 million consumers

across 53 countries, in three industries: Tax Free Shopping,

Payments and Post-Purchase solutions.

With over 2,000 employees, Global Blue generated €28bn Sales in

Store and €422M revenue in FY 2023/24. Global Blue is listed on the

New York Stock Exchange.

For more information, please visit www.globalblue.com

Global Blue Monthly Intelligence Briefing, June 2024, Source:

Global Blue

1 Recovery rate is equal to 2024 Issued Sales in Store divided

by 2019 Issued Sales in Store, like-for-like (i.e.: at constant

merchant scope and exchange rates). 2 Eid Al Adha took place from

June 15, 2024, to June 20, 2024, while it took place from August

10, 2019 to August 14, 2019. 3 Growth rate variation year-on-year

(2024 vs. the same period in 2023)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240705935221/en/

MEDIA Virginie Alem – SVP Marketing & Communications

Mail: valem@globalblue.com

INVESTOR RELATIONS Frances Gibbons – Head of Investor

Relations Mob: +44 (0)7815 034 212 Mail:

fgibbons@globalblue.com

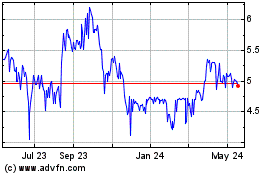

Global Blue (NYSE:GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

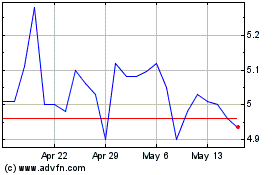

Global Blue (NYSE:GB)

Historical Stock Chart

From Jan 2024 to Jan 2025