Filed Pursuant to Rule 424(b)(3)

Registration No. 333-274233

PROSPECTUS

$200,000,000 ORDINARY SHARES

This prospectus relates to the issuance from time to time by Global Blue Group Holding AG, a public company incorporated under the laws of Switzerland (the “Company”), of ordinary shares in one or more offerings. The aggregate initial offering price of all ordinary shares sold under this prospectus will not exceed $200,000,000.

Our ordinary shares are listed on the New York Stock Exchange (the “NYSE”) under the symbol “GB”. The last reported sale price of our ordinary shares on August 5, 2024 was $4.57 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or prospectus supplements carefully before you make your investment decision. The registration of the ordinary shares covered by this prospectus does not mean that we will issue, offer or sell, as applicable, any ordinary shares. We may offer and sell the ordinary shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how we may sell the shares under “Plan of Distribution.” The Company is an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, is subject to reduced public company reporting requirements.

Investing in the Company’s securities involves risks. See "Risk Factors" beginning on page 13 of this prospectus and the other information included in and incorporated by reference in this prospectus and the applicable prospectus supplement. Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED AUGUST 6, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Any amendment or supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such amendment or supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. See “Where You Can Find More Information.” We have not authorized any other person to provide you with different or additional information. We do not take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates. This prospectus contains summaries of certain provisions contained in some of the documents described in this prospectus, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to in this prospectus have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described under “Where You Can Find More Information.” We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Except as otherwise set forth in this prospectus, we have not taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade name or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Certain amounts that appear in or that are incorporated by reference into this prospectus may not sum due to rounding.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference in this prospectus the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information filed subsequently with the SEC will automatically update and supersede it. Therefore, before you decide to invest in a particular offering under this shelf registration statement, you should always check for reports we may have filed with the SEC after the date of this prospectus. We incorporate by reference in this prospectus the following information:

•our Annual Report on Form 20-F for the fiscal year ended March 31, 2024, filed with the SEC on June 5, 2024; •the description of the securities contained in our registration statement on Form 8-A filed on August 27, 2020 pursuant to Section 12 of the Exchange Act, together with all amendments and reports filed for the purpose of updating that description; •any future filings on Form 20-F made with the SEC under the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, after date of this prospectus and prior to the termination of the offering of the securities offered by this prospectus;

•any future reports on Form 6-K that we furnish to the SEC after the date of this prospectus that are identified in such reports as being incorporated by reference in this prospectus.

Any statements made in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, the accompanying prospectus supplement, if applicable, or in any other subsequently filed document that is also incorporated or deemed to be incorporated by reference in this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, constitute a part of this prospectus.

You should not assume that the information in this prospectus, any prospectus supplement or any document incorporated by reference is accurate or complete at any date other than the date mentioned on the cover page of those documents.

You may request a copy of any and all of the information that has been incorporated by reference in this prospectus, at no cost, upon written or oral request made to Global Blue Group Holding AG, Zürichstrasse 38, 8306 Brüttisellen, Switzerland, Tel. +41 22 363 77 40; Attention: Corporate Secretary.

We file reports, including annual reports on Form 20-F, and other information with the SEC pursuant to the rules and regulations of the SEC that apply to foreign private issuers. You can read our SEC filings, including the registration statement, over the internet at the SEC’s website at www.sec.gov and at our website at www.globalblue.com. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus constitute forward-looking statements that do not directly or exclusively relate to historical facts. You should not place undue reliance on such statements because they are subject to numerous uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following:

•currency exchange rate risk in the conduct of business;

•high dependence on international travel;

•dependence on the overall level of consumer spending, which is affected by general economic conditions and spending patterns;

•sensitivity of net working capital to short-term, month-to-month volume growth, and any rapid volume growth and short-term, temporary surge of its net working capital;

•decrease in Value-Added Tax (“VAT”) rates or changes in VAT or VAT refund policies;

•changes in the regulatory environment, licensing requirements and government agreements;

•adaptation and enhancement of our existing technology offerings and ensuring continued resilience and uptime of our underlying technology platform;

•loss of merchant accounts or Post-Purchase Solutions (“PPS”) retailers to our competitors due to the competitive market;

•disintermediation of third-party serviced Tax-Free Shopping (“TFS”) processes;

•price harmonization or convergence between destination markets and home markets;

•taxation in multiple jurisdictions, which is complex and often requires making subjective determinations subject to scrutiny by, and disagreements with, tax regulators;

•adverse competition law rulings;

•integrity, reliability and efficiency of Global Blue’s compliance systems and framework;

•dependence of TFS business on airport concessions and agreements with agents;

•risks associated with operating in emerging markets;

•risks associated with the ongoing conflict between Russia and Ukraine, although we have no operations in Russia;

•risks associated with strategic arrangements or investments in joint ventures with third parties;

•failure to identify external business opportunities or realize the expected benefits from our strategic acquisitions;

•risks associated with data breaches, cybersecurity incidents and other failures or incidents involving Global Blue’s information technology systems or data (or information technology systems or data upon which Global Blue relies);

•reliance of the Payments business on relationships with Acquirers and involvement of card schemes;

•counterparty risk and credit risk;

•losses from fraud, theft and employee error;

•risks associated with climate change and environmental, social and governance issues;

•inability to attract, integrate, manage and retain qualified personnel or key employees;

•complex and stringent laws, regulations and industry standards relating to privacy, data protection and information security in the jurisdictions in which Global Blue operates;

•anti-money laundering, economic and trade sanctions and anti-bribery laws and regulation and related compliance costs and third-party risks;

•risks relating to intellectual property;

•risks relating to Global Blue’s use of open source software;

•litigation or investigations involving us, and resulting material settlements, fines or penalties;

•seasonality of Global Blue’s operating results;

•event of default resulting from failure to comply with covenants or other obligations contained in that certain credit agreement, dated November 24, 2023 (as amended from time to time, the “Facilities Agreement”) among certain subsidiaries of Global Blue and, among others, J.P. Morgan SE, as Facility Agent, Alter Domus Trustee (UK) Limited, as Security Agent, and J.P. Morgan SE, BNP Paribas, Deutsche Bank Aktiengesellschaft, Royal Bank of Canada and UBS AG London Branch, as Arrangers;

•reliance on our operating subsidiaries to provide funds necessary to meet our financial obligations, and the constraint on our ability to pay dividends;

•restrictions imposed on our business by our indebtedness, and the risk that a significant increase in our indebtedness could result in changes to the terms on which credit is extended to us;

•inability to generate sufficient cash to service our debt obligations;

•inability to execute strategic plans due to inability to generate sufficient cash flow;

•sustained financial market illiquidity or illiquidity at our financial institutions;

•interest rate risks;

•currency translation and transaction risk;

•impairment of intangible assets;

•the control by Silver Lake Management Company III, L.L.C. (or its affiliates) (“Silver Lake”) over us, and potential differences in the interests pursued by Silver Lake from the interests of our other securityholders;

•requirement for prior consent of or post-closing notification to the Bank of Italy, as well as restrictions and other requirements, for acquiring a direct or indirect substantial stake in our share capital, for so long as Global Blue Currency Choice Italia S.r.l. (“GBCCI”) holds a license from the Bank of Italy;

•limited ability of securityholders to bring an action against the Company or against its directors or officers or to enforce a judgment against the Company;

•status as an “emerging growth company,” and reduced disclosure and governance requirements applicable to emerging growth companies;

•status as a “foreign private issuer,” and reduced or different disclosure and governance requirements applicable to foreign private issuers;

•limited availability of attractive takeover proposals due to provisions in the Company’s articles of association (the “Articles of Association”) and Swiss law; and

•failure to maintain an effective system of internal controls, and the inability to accurately or timely report our financial condition or results of operations.

These and other factors are more fully discussed under “Risk Factors” and elsewhere in this prospectus. These risks could cause actual results to differ materially from those implied by forward-looking statements in this prospectus. You are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. New risks and uncertainties come up from time to time, and it is impossible for us to predict these events or how they may affect us. We do not undertake any obligation to update or revise any forward-looking statements after the date of this prospectus, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks and uncertainties, you should keep in mind that any event described in a forward-looking statement made in this prospectus or elsewhere might not occur.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in the Company’s securities. Before making an investment decision, you should read this entire prospectus carefully, especially “Risk Factors” and the financial statements and related notes thereto, and the other documents to which this prospectus refers. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information. Our Group

Global Blue serves as a strategic technology and payments partner for retailer effectiveness and shopper experience. Global Blue is the global leader in tax-free shopping, with an approximately 70% market share in the tax-free shopping segment and more than three times the size of its next largest competitor by market share. In addition to tax-free shopping services, Global Blue also offers payment solutions, including a range of FX Solutions, for which Global Blue is a leading provider. Global Blue also provides post-purchase solutions aimed to improve the experience of both domestic and e-commerce shoppers, and has also internally developed additional growth products, including solutions focusing on the hospitality and retail industry, data analytics as well as digital marketing. Global Blue operates across more than 50 countries and has enabled millions of shoppers to claim VAT refunds on international shopping or complete international transactions in their home currency. At its core, Global Blue is a technology platform that serves a network of more than 400,000 merchant stores globally through its TFS, Payments and Post Purchase Solutions (PPS) segments, facilitating millions of transactions and delivering economic benefits to a complex ecosystem of merchants, shoppers and customs and tax authorities.

Summary Risk Factors

Investing in the Company’s securities entails a high degree of risk. You should carefully consider such risks before deciding to invest in the Company’s securities. These risks include, among others:

•Global Blue is subject to currency exchange rate risk in the conduct of its business;

•Global Blue’s business is highly dependent on international travel;

•Global Blue’s business is dependent on the overall level of consumer spending, which is affected by general economic conditions and spending patterns;

•Global Blue’s net working capital is sensitive to short-term, month-to-month volume growth, and any rapid volume growth for any reason would lead to a short-term, temporary surge of its net working capital;

•a decrease in VAT rates or changes in VAT or VAT refund policies in countries in which Global Blue operates could negatively affect Global Blue’s business;

•changes in the regulatory environment, licensing requirements and government agreements could adversely affect Global Blue’s business;

•Global Blue must continually adapt and enhance its existing technology offerings and ensure continued resilience and uptime of its underlying technology platform to remain competitive in its industry;

•Global Blue operates in a competitive market and Global Blue may lose merchant accounts to Global Blue’s competitors;

•Global Blue’s business may be adversely affected by disintermediation of TFS processes;

•price harmonization or convergence between destination markets and home markets may adversely affect Global Blue’s business;

•Global Blue is subject to taxation in multiple jurisdictions, which is complex and often requires making subjective determinations subject to scrutiny by, and disagreements with, tax regulators;

•adverse competition law rulings could restrict Global Blue’s ability to expand or to operate its business as it wishes and could expose Global Blue to fines or other penalties;

•the integrity, reliability and efficiency of Global Blue’s internal controls and procedures may not be guaranteed;

•Global Blue’s TFS business is dependent on its airport concessions and agreements with agents;

•Global Blue operates in emerging markets and is exposed to risks associated with operating in such markets;

•Global Blue’s business, results of operations and financial condition may be adversely impacted by the ongoing conflict between Russia and Ukraine;

•Global Blue may be adversely affected by risks associated with strategic arrangements or investments in joint ventures with third parties;

•failure to identify external business opportunities or realize the expected benefits from Global Blue’s strategic acquisitions;

•Global Blue’s business is subject to complex and stringent laws, regulations and industry standards relating to privacy, data protection and information security in the jurisdictions in which Global Blue operates;

•Global Blue’s Payments business relies on relationships with Acquirers and on the involvement of card schemes;

•Global Blue is subject to counterparty risk and credit risk;

•Global Blue is subject to losses from fraud, theft and employee error;

•risks associated with climate change and environmental, social and governance issues may have an adverse effect on Global Blue’s business, financial condition and results of operations and damage Global Blue’s reputation;

•Global Blue may not be able to attract, integrate, manage and retain qualified personnel or key employees;

•Global Blue’s business is subject to anti-money laundering, sanctions and anti-bribery regulations and related compliance costs and third-party risks;

•Global Blue is subject to risks relating to intellectual property;

•Global Blue is subject to risks relating to its use of open source software;

•litigation or investigations involving Global Blue could result in material settlements, fines or penalties;

•seasonality may cause our operating results to fluctuate from quarter to quarter;

•failure to comply with the covenants or other obligations contained in the Facilities Agreement could result in an event of default, and any failure to repay or refinance the outstanding debt under the Facilities Agreement when due could have a material adverse effect on Global Blue;

•Global Blue relies on its operating subsidiaries to provide it with funds necessary to meet Global Blue’s financial obligations and Global Blue’s ability to pay dividends may be constrained;

•Global Blue’s indebtedness imposes restrictions on Global Blue’s business and a significant increase in Global Blue’s indebtedness could result in changes to the terms on which credited is extended to it;

•Global Blue requires cash to service its debt and its ability to generate cash depends on many factors beyond the Company’s control. Any failure to meet its debt service obligations could materially adversely affect the business, results of operations and financial conditions;

•Global Blue’s inability to generate sufficient cash flow could affect its ability to execute its strategic plans;

•Sustained financial market illiquidity, or illiquidity at our financial institutions, could adversely affect Global Blue’s business, financial conditions and results of operations;

•Global Blue is exposed to interest rate risks;

•Global Blue is exposed to currency translation and transaction risks;

•Global Blue’s consolidated financial statements include significant intangible assets which could be impaired;

•If the Company were a passive foreign investment company for U.S. federal income tax purposes for any taxable year, U.S. Holders of our ordinary shares could be subject to adverse U.S. federal income tax consequences.

•Fluctuations in operating results, quarter-to-quarter earnings and other factors, including incidents involving Global Blue’s customers and negative media coverage, may result in significant decreases or fluctuations in the price of Global Blue’s securities;

•Silver Lake is able to exert control over Global Blue. The interests pursued by Silver Lake could differ from the interests of Global Blue’s other security holders;

•for so long as Global Blue Currency Choice Italia S.r.l. holds a license from the Bank of Italy, acquiring a direct or indirect substantial stake in Global Blue’s share capital may require the prior consent of, or post-closing notification to, the Bank of Italy and may be subjected to restrictions and other requirements;

•security-holders have limited ability to bring an action against the Company or against its directors and officers, or to enforce a judgment against the Company or them, because the Company is incorporated in Switzerland, because the Company conducts a majority of its operations outside of the United States and because a majority of the Company’s directors and officers reside outside the United States;

•Global Blue is an “emerging growth company” and as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our ordinary shares may be less attractive to investors.

•the Company may not be able to make dividend distributions or repurchase shares without subjecting shareholders to Swiss withholding tax;

•Global Blue Warrants (as defined in this prospectus) will become exercisable for ordinary shares and Series A Preferred Shares (as defined in this prospectus) and Series B Preferred Shares (as defined in this prospectus) will be convertible into ordinary shares, which would increase the number of securities eligible for future resale in the public market and result in dilution to our shareholders, and may adversely affect the market price of our ordinary shares;

•the trading price of the Company’s securities may be volatile;

•reports published by analysts, including projections in those reports that differ from Global Blue’s actual results could adversely affect the price and trading volume of our ordinary shares;

•As a ‘foreign private issuer’ under the rules and regulations of the SEC, the Company is permitted to, and may, file less or different information with the SEC than an company incorporated in the United States or otherwise not filing as a ‘foreign private issuer’ and will follow certain home country corporate governance practices in lieu of certain requirements of the NYSE applicable to U.S. companies;

•provisions in the Articles of Association and Swiss law may limit the availability of attractive takeover proposals; and

•if Global Blue fails to maintain an effective system of internal controls, Global Blue may not be able to accurately or timely report its financial conditions or results of operations, which may adversely affects its business and the price of its securities.

Corporate Information

The Company is a stock corporation (Aktiengesellschaft) incorporated under Swiss law with operations primarily in Switzerland and was incorporated in December 2019 solely for the purpose of effectuating the business combination (the “Business Combination”) between Far Point Acquisition Corporation (“FPAC”) and Global Blue Group Holding AG (“Global Blue”), which was consummated on August 28, 2020.

The Company’s registered office and the mailing address of its principal executive office is Zürichstrasse 38, 8306 Brüttisellen, Switzerland and its telephone number is +41 22 363 77 40. The Company’s principal website address is www.globalblue.com. We do not incorporate the information contained on, or accessible through, the Company’s websites into this prospectus, and you should not consider it a part of this prospectus. The Company’s agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168.

SUMMARY TERMS OF THE OFFERING

The summary below describes the principal terms of the offering.

| | | | | |

| Securities being offered by us | Ordinary shares of the Company. |

Ordinary shares outstanding and on a fully diluted basis assuming the exercise of all outstanding existing warrants of the Company ("Global Blue warrants") and conversion of all outstanding Series A preferred shares ("Series A Preferred Shares") and Series B preferred shares ("Series B Preferred Shares") of the Company | 280,761,648, including 10,743,091 ordinary shares and 236 Series A Preferred Shares held in treasury (as of March 31, 2024) |

| Dividend policy | Other than as required under the terms of our Series B Preferred Shares to declare and pay in kind an annual dividend in the form of additional Series B Preferred Shares in an amount equal to 5% of the then-outstanding Series B Preferred Shares or disclosed elsewhere in this prospectus (including dividends with respect to the Series A Preferred Shares beginning in the financial year ended March 31, 2026), we do not plan to pay any dividends on our ordinary shares in the near future. The declaration and payment of any dividends in the future will be approved by the general meeting of shareholders upon proposal by the Board of Directors, and will depend on a number of factors, including the amount of our distributable profit and distributable reserves on an unconsolidated basis, our earnings, capital requirements, overall financial condition, applicable law and contractual restrictions. See “Dividend Policy.” |

Use of proceeds | We intend to use the net proceeds from the sales of ordinary shares as set forth in the applicable prospectus supplement and/or free writing prospectus. See “Use of Proceeds.” |

Market for our ordinary shares | Our ordinary shares are listed on the New York Stock Exchange (the “NYSE”) under the symbol “GB”. |

| Risk factors | Investing in our securities involves substantial risks. See “Risk Factors” for a description of certain of the risks you should consider before investing in the Company. |

RISK FACTORS

An investment in the Company’s securities carries a significant degree of risk. Before you decide to purchase the Company’s securities, you should carefully consider all risk factors set forth in the applicable prospectus supplement and the documents incorporated by reference in this prospectus, including the factors discussed under the heading “Risk Factors” in our most recent Annual Report on Form 20-F or any updates in our current reports on Form 6-K, which may be amended, supplemented or superseded from time to time by the other reports we file with the SEC in the future or by information in the applicable prospectus supplement. See “Incorporation of Certain Documents by Reference”. The risks and uncertainties we have described are not the only risks we face. Additional risks and uncertainties of which we are not presently aware or that we currently deem immaterial could also affect our business operations and financial condition. If any of these risks actually occur, our business, financial condition, results of operations or prospects could be materially affected. As a result, the trading price of the Company’s securities could decline and you could lose part or all of your investment.

USE OF PROCEEDS

The Company intends to use the net proceeds from the sales of ordinary shares as set forth in the applicable prospectus supplement and/or free writing prospectus.

DIVIDEND POLICY

The payment of any cash dividends will be dependent upon a number of factors including, but not limited to, the amount of the Company’s distributable profit and distributable reserves on an unconsolidated basis, revenue, earnings and financial condition of Global Blue from time to time. The Board of Directors may consider these and any other factors that it deems relevant and propose to the shareholders that a dividend or other distribution be paid, but cannot itself authorize the distribution.

Other than as pursuant to the terms of our Series B Preferred Shares to declare and pay in-kind an annual dividend in the form of additional Series B Preferred Shares in an amount equal to 5% of the then-outstanding Series B Preferred Shares or disclosed elsewhere in this prospectus supplement (including dividends with respect to the Series A Preferred Shares beginning in the financial year ended March 31, 2026), we do not plan to pay any dividends on our ordinary shares in the near future. The recommendation to the general meeting of shareholders to distribute any dividends in the future will be approved by the general meeting of shareholders upon proposal by the Board of Directors, and will depend on a number of factors, including the amount of our distributable profit and distributable reserves on an unconsolidated basis, our earnings, capital requirements, overall financial condition, applicable law and contractual restrictions.

TAXATION

Switzerland Taxation

The following summary sets forth the material Swiss tax consequences of receiving, owning and disposing of ordinary shares.

This summary is based upon Swiss tax laws and the practices of the Swiss tax authorities in effect on the date of this prospectus. Such law and administrative practice is subject to change at any time, possibly with retroactive effect. The summary does not constitute tax advice and is intended only as a general guide. It is not exhaustive and shareholders should consult their own tax advisors about the Swiss tax consequences (and tax consequences under the laws of other relevant jurisdictions) of the acquisition, ownership and disposal of ordinary shares.

Material Swiss Tax Consequences Relating to Our Ordinary Shares

The following is a general summary of the principal consequences under Swiss law, as currently in effect, of an investment in shares by a holder that is not a resident of Switzerland.

Swiss Withholding Tax

Non-taxable and taxable distributions

Dividends and other similar cash or in-kind distributions (including scrip or stock dividends) on ordinary shares made or paid by Global Blue are subject to Swiss withholding tax (Verrechnungssteuer), currently at a rate of 35% (applicable to the gross amount of the taxable distribution). The Swiss withholding tax must be withheld by the Company on the gross amount of the dividend or other distribution and be remitted to the Swiss Federal Tax Administration (Eidgenössische Steuerverwaltung). Dividends on ordinary shares made or paid by the Company out of capital contribution reserves (Reserven aus Kapitaleinlagen) confirmed by the Swiss tax authorities and distributions on ordinary shares made or paid by the Company based upon a reduction in the nominal value of ordinary shares (Nennwertherabsetzung) are exempt from Swiss withholding tax.

Provided, that the Company is not listed on a Swiss stock exchange, the Company will not be subject to restrictions on the payment of dividends out of capital contribution reserves applicable to Swiss listed companies. It is at the discretion of the Company to decide whether to distribute a dividend out of capital contributions reserves free of Swiss withholding tax and/or out of profit/retained earnings/non-qualifying reserves subject to Swiss withholding tax.

Capital gains realized on the sale of ordinary shares are not subject to Swiss withholding tax (other than in case of a sale to the Company (i) for cancellation, (ii) if the total of repurchased shares exceeds 10% of the Company’s share capital or (iii) if the repurchased ordinary shares are not resold within the applicable time period after the repurchase, if and to the extent the redemption price less the nominal value of the redeemed ordinary shares is not booked against confirmed capital contribution reserves).

Refund of Swiss withholding tax on taxable distributions

A holder of ordinary shares who is a resident of the U.S. for purposes of the U.S.-Swiss Treaty without a trade or business carried on through a permanent establishment in Switzerland to whom the shares are attributable or who is a qualified U.S. pension fund,other retirement arrangement or an individual retirement savings plan, and who, in each case, is also the beneficial owner of the shares and the dividend or other distribution and who meets the conditions of the U.S.-Swiss Treaty, may, if the holder is a qualified U.S. pension fund,other retirement arrangement or an individual retirement savings plan apply for a full refund of the Swiss withholding tax, if the holder is a corporation owning at least 10% of Global Blue voting rights apply for a refund of the Swiss withholding tax withheld in excess of the 5% reduced treaty rate and in all other cases apply, for a refund of the Swiss withholding tax withheld in excess of the 15% treaty rate. The claim for a refund must be filed on Swiss Tax Form 82 (82C for corporations, 82I for individuals, 82E for other entities and 82R for regulated investment companies), which forms, together with the form providing instructions, may be obtained from the Swiss embassy or any Swiss consulate general in the U.S., the Swiss Federal Tax Administration at the address below or may be downloaded from the

Swiss Federal tax Administration’s website. Four copies of the form must be duly completed and then signed before a notary public of the U.S. and three of them must then be sent to the Swiss Federal Tax Administration, Eigerstrasse 65, CH-3003 Bern, Switzerland. The form must be accompanied by suitable evidence demonstrating the deduction of the Swiss withholding tax, such as certificates of deduction, bank vouchers or credit slips. The form must be filed no later than December 31 of the third year following the calendar year in which the dividend subject to the withholding tax became payable.

Any other holder who is not resident in Switzerland and who does not hold the ordinary shares as part of a trade or business in Switzerland, may be entitled to a full or partial refund of the Swiss withholding tax deducted if the country in which the recipient resides for tax purposes has entered into a bilateral treaty for the avoidance of double taxation with Switzerland, the recipient is the beneficial owner of the ordinary shares and the dividend or distribution or the purchase price and any other conditions of the treaty are met. Refund forms are available on the Swiss Federal Tax Administration’s website.

Swiss Securities Turnover Tax

Secondary market dealings in ordinary shares in which no Swiss domestic securities dealer (as defined in the Swiss Federal Stamp Duty Act, including a Swiss bank) is a party or an intermediary to the transaction are not subject to Swiss securities turnover tax (Umsatzabgabe). For secondary market dealings in ordinary shares in which a Swiss domestic securities dealer (as defined in the Swiss Federal Stamp Duty Act, including a Swiss bank) is a party or an intermediary to the transaction, Swiss securities turnover tax at a rate of 0.15% of the purchase price of our ordinary shares will be payable if none of the exemptions provided for in the Swiss Federal Stamp Duty Act apply. Subject to applicable statutory exemptions in respect of the parties to a transaction, generally half of the tax is charged to each of the parties.

Swiss Income Tax

Holders resident outside of Switzerland and not engaged in trade or business in Switzerland

A holder of ordinary shares who is not a resident of Switzerland for Swiss tax purposes, and who, during the applicable tax year, has not engaged in a trade or business carried on through a permanent establishment in Switzerland for tax purposes, is not subject to any Swiss federal, cantonal or communal income tax as a result of the receipt of dividends or other distributions on ordinary shares or in respect of any capital gains realized on the sale of ordinary shares. See “—Swiss Withholding Tax” above for a summary of the Swiss withholding tax treatment of dividends and other distributions and capital gains on ordinary shares. See “—International Automatic Exchange of Information in Tax Matters” and “—Swiss Facilitation of the Implementation of the U.S. Foreign Account Tax Compliance Act” below for a summary on the exchange of information in respect of holding ordinary shares in an account or deposit with a financial institution or paying agent in Switzerland.

Shares held as assets of a Swiss business

For a holder who holds ordinary shares as part of a trade or business conducted in Switzerland, dividends and other distributions, including capital repayments or distributions out of capital contribution reserves, made or paid by the Company on ordinary shares, and capital gains or losses realized on the sale of ordinary shares are included in (or deducted from) taxable income in the relevant taxation period for purposes of Swiss federal, cantonal and communal individual or corporate income tax. This taxation treatment also applies to private individuals who are Swiss residents and qualify as “professional securities dealers” for income tax purposes.

A Swiss corporation or co-operative, or a non-Swiss corporation or a non-Swiss co-operative holding ordinary shares as part of a Swiss permanent establishment, may benefit from relief from Swiss taxation of the dividends or other distributions, including capital repayments or distributions out of capital contribution reserves, by way of a participation deduction (Beteiligungsabzug) if our ordinary shares held at the time of the dividend or other distribution have a market value of at least CHF 1 million or the ordinary shares represent 10% or more of our share capital.

Swiss Wealth Tax and Capital Tax

Shares held by holders resident outside of Switzerland and not engaged in trade or business in Switzerland

A holder of ordinary shares who is not a resident of Switzerland for Swiss tax purposes, and who, during the applicable tax year, has not engaged in a trade or business carried on through a permanent establishment in Switzerland for tax purposes, is not subject to any cantonal and communal wealth or annual capital tax because of the mere holding of our ordinary shares.

International Automatic Exchange of Information in Tax Matters

Switzerland has concluded a multilateral agreement with the European Union on the International Automatic Exchange of Information (the “AEOI”) in tax matters (the “AEOI Agreement”). This AEOI Agreement entered into force as of January 1, 2017 and applies to all 27 member states. Furthermore, on January 1, 2017, the Multilateral Competent Authority Agreement on the Automatic Exchange of Financial Account Information and, based on such agreement, a number of bilateral AEOI agreements with other jurisdictions entered into force. The Federal Act on the International Automatic Exchange of Information in Tax Matters, which is the primary legal basis for the implementation of the AEOI standard in Switzerland, entered into force on January 1, 2017, as well.

Based on such multilateral agreements and bilateral agreements and the implementing laws of Switzerland, Switzerland collects and exchanges data in respect of financial assets, which may include ordinary shares, held in, and income derived thereon and credited to, accounts or deposits with a paying agent in Switzerland for the benefit of individuals resident in an EU Member State or in a treaty state. Switzerland has signed and is expected to sign further bilateral or multilateral AEOI in tax matter agreements with other countries. Certain of these agreements entered into force on January 1, 2020, or will enter into force at a later date.

A list of such multilateral agreements and bilateral agreements of Switzerland in effect or signed and becoming effective can be found on the website of the State Secretariat for International Finance (SIF) (https://www.sif.admin.ch/sif/en/home/multilateral-relations/exchange-information-tax-matters/automatic-exchange-information/financial-accounts.html).

Swiss Facilitation of the Implementation of the U.S. Foreign Account Tax Compliance Act

Switzerland has concluded an intergovernmental agreement with the U.S. to facilitate the implementation of FATCA. The agreement ensures that the accounts held by U.S. persons with Swiss financial institutions are disclosed to the U.S. tax authorities either with the consent of the account holder or by means of group requests within the scope of administrative assistance. Information will not be transferred automatically in the absence of consent, and instead will be exchanged only within the scope of administrative assistance on the basis of the double taxation agreement between the U.S. and Switzerland. On September 20, 2019, the protocol of amendment to the double taxation treaty between Switzerland and the U.S. entered into force allowing U.S. competent authority in accordance with the information reported in aggregated form to request all the information on U.S. accounts without a declaration of consent and on non-consenting non-participating financial institutions.

On October 8, 2014, the Swiss Federal Council approved a mandate for negotiations with the U.S. on changing the current direct notification-based regime to a regime where the relevant information is sent to the Swiss Federal Tax Administration, which in turn provides the information to the U.S. tax authorities.

Certain U.S. Federal Income Tax Considerations to U.S. Holders

The following is a discussion of certain U.S. federal income tax considerations to U.S. Holders (as defined below) relating to the acquisition, ownership and disposition of the ordinary shares held as capital assets for U.S. federal income tax purposes as of the date hereof. In addition, the discussion set forth below is applicable only U.S. Holders (i) who are residents of the United States for purposes of the current U.S.-Swiss Treaty (the “Treaty”), (ii) whose common shares are not, for purposes of the Treaty, effectively connected with a permanent establishment in Switzerland and (iii) who otherwise qualify for the full benefits of the Treaty. The discussion below does not describe all of the tax consequences that may be relevant to holders in light of their particular circumstances,

including alternative minimum tax and Medicare contribution tax consequences, or holders who are subject to special rules, such as:

•financial institutions or financial services entities;

•insurance companies;

•regulated investment companies and real estate investment trusts;

•dealers or traders subject to a mark-to-market method of tax accounting with respect to the ordinary shares;

•a dealer or broker in securities or currencies;

•persons holding the ordinary shares as part of a “straddle,” constructive sale, hedging, integrated transactions or similar transactions;

•a person whose functional currency is not the U.S. dollar;

•a person liable for alternative minimum tax;

•a person required to accelerate the recognition of any item of gross income with respect to the ordinary shares as a result of such income being recognized on an applicable financial statement;

•a person actually or constructively owning 10% or more of the ordinary shares, Series A Preferred Shares and Series B Preferred Shares of the Company; or

•tax-exempt entities.

This discussion does not consider the tax treatment of entities that are partnerships or other pass-through entities for U.S. federal income tax purposes or persons who hold the ordinary shares through such entities. If a partnership or other pass-through entity for U.S. federal income tax purposes is the beneficial owner of ordinary shares, the U.S. federal income tax treatment of partners of the partnership will generally depend on the status of the partners and the activities of the partner and the partnership.

This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the "Code"), and administrative pronouncements, judicial decisions and final, temporary and proposed U.S. Treasury regulations all as of the date hereof, changes to any of which subsequent to the date of this prospectus may affect the tax consequences described in this prospectus. This discussion does not take into account potential suggested or proposed changes in such tax laws which may impact the discussion below and does not address any aspect of state, local or non-U.S. taxation, or any U.S. federal taxes other than income taxes. Each of the foregoing is subject to change, potentially with retroactive effect. Holders are urged to consult their tax advisors with respect to the application of U.S. federal tax laws to their particular situation, as well as any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction.

U.S. Holders

A “U.S. Holder” means a beneficial owner of ordinary shares, who or that is, for U.S. federal income tax purposes:

•an individual citizen or resident of the United States;

•a corporation (or other entity classified as a corporation for U.S. federal income tax purposes) organized in or under the laws of the United States, any state thereof or the District of Columbia;

•an estate, the income of which is includible in gross income for U.S. federal income tax purposes regardless of its source; or

•a trust if: (i) a court within the United States can exercise primary supervision over the administration of the trust, and one or more U.S. persons have the authority to control all substantial decisions of the trust; or (ii) the trust has a valid election in place be treated as a U.S. person.

This summary does not address the U.S. federal income tax considerations with respect to holders other than U.S. Holders.

THIS DISCUSSION IS ONLY A SUMMARY OF THE CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE ACQUISITION, OWNERSHIP AND DISPOSITION OF ORDINARY SHARES. EACH HOLDER OF ORDINARY SHARES IS URGED TO CONSULT ITS OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES TO SUCH INVESTOR, INCLUDING THE APPLICABILITY AND EFFECT OF ANY STATE, LOCAL, AND NON-U.S. TAX LAWS, AS WELL AS U.S. FEDERAL TAX LAWS AND ANY APPLICABLE TAX TREATIES.

Passive Foreign Investment Company Rules

Certain adverse U.S. federal income tax consequences could apply to a U.S. Holder if we are treated as a PFIC for any taxable year during which the U.S. Holder holds ordinary shares. A non-U.S. corporation, such as the Company, will be classified as a PFIC for U.S. federal income tax purposes for any taxable year in which, after applying certain look-through rules, either (i) 75% or more of its gross income for such year consists of certain types of “passive” income or (ii) 50% or more of the value of its assets (generally determined on the basis of a quarterly average) during such year produce or are held for the production of passive income. Passive income generally includes dividends, interest, royalties, rents, annuities, net gains from the sale or exchange of property producing such income and net foreign currency gains. For purposes of the PFIC income test and asset test described above, if the Company owns, directly or indirectly, 25% or more of the total value of the outstanding shares of another corporation, it will be treated as if it (a) held a proportionate share of the assets of such other corporation and (b) received directly a proportionate share of the income of such other corporation.

We do not currently expect the Company to be treated as a PFIC for the current taxable year or for foreseeable future taxable years. This conclusion is a factual determination, however, that must be made annually at the close of each taxable year and, thus, is subject to change. There can be no assurance that the Company will not be treated as a PFIC for any taxable year.

If the Company were to be treated as a PFIC, U.S. Holders holding ordinary shares could be subject to certain adverse U.S. federal income tax consequences with respect to gain realized on a taxable disposition of ordinary shares (or shares of any of the Company’s subsidiaries that are PFICs) and certain distributions received on such ordinary shares (or shares of any of the Company’s subsidiaries that are PFICs). Certain elections (including a mark-to-market election) may be available to U.S. Holders to mitigate some of the adverse tax consequences resulting from PFIC treatment. U.S. Holders should consult their tax advisors regarding the application of the PFIC rules to their investment in the Company.

Taxation of Distributions

A U.S. Holder generally will be required to include in gross income the amount of any cash distribution paid on ordinary shares treated as a dividend. A cash distribution on such ordinary shares generally will be treated as a dividend for U.S. federal income tax purposes to the extent the distribution is paid out of the Company’s current or accumulated earnings and profits (as determined under U.S. federal income tax principles). Such dividends paid by us will be taxable to a corporate U.S. Holder at regular rates and will not be eligible for the dividends-received deduction generally allowed to domestic corporations in respect of dividends received from other domestic corporations.

Distributions in excess of such earnings and profits generally will be applied against and reduce the U.S. Holder’s basis in such holder’s shares (but not below zero), and any excess will be treated as gain from the sale or exchange of such ordinary shares as described below under “—Gain or Loss on Sale, Taxable Exchange or Other Taxable Disposition of the ordinary shares.” It is not expected that the Company will determine earnings and profits

in accordance with U.S. federal income tax principles. Therefore, U.S. Holders should expect that a distribution will generally be treated as a dividend.

Any dividends received by a U.S. Holder (including any withheld taxes) will be includable in such U.S. Holder’s gross income as ordinary income on the day actually or constructively received by such U.S. Holder. Such dividends received by a non-corporate U.S. Holder will not be eligible for the dividends received deduction allowed to corporations under the Code. With respect to non-corporate U.S. Holders, certain dividends received from a “qualified foreign corporation” may be subject to reduced rates of taxation. A qualified foreign corporation includes a foreign corporation that is eligible for the benefits of a comprehensive income tax treaty with the United States that the U.S. Treasury Department determines to be satisfactory for these purposes and that includes an exchange of information provision. A foreign corporation is also treated as a “qualified foreign corporation” with respect to dividends paid by that corporation on shares that are readily tradable on an established securities market in the United States. U.S. Treasury Department guidance indicates that the ordinary shares, which are listed on the NYSE, will be readily tradable on an established securities market in the United States. There can be no assurance, however, that the ordinary shares will be considered readily tradable on an established securities market in later years or that the Company will be eligible for the benefits of such a treaty. Non-corporate U.S. Holders that do not meet a minimum holding period requirement during which they are not protected from the risk of loss or that elect to treat the dividend income as “investment income” pursuant to Section 163(d)(4) of the Code will not be eligible for the reduced rates of taxation regardless of the Company’s status as a qualified foreign corporation. In addition, the rate reduction will not apply to dividends if the recipient of a dividend is obligated to make related payments with respect to positions in substantially similar or related property. This disallowance applies even if the minimum holding period has been met. U.S. Holders should consult their own tax advisors regarding the application of these rules to their particular circumstances.

Non-corporate U.S. Holders will not be eligible for reduced rates of taxation on any dividends received from the Company if it is a PFIC in the taxable year in which such dividends are paid or in the preceding taxable year (see “—Passive Foreign Investment Company Rules” above).

The amount of any dividend paid in foreign currency will equal the U.S. dollar value of the foreign currency received calculated by reference to the exchange rate in effect on the date the dividend is received by a U.S. Holder, regardless of whether the foreign currency is converted into U.S. dollars. If the foreign currency received as a dividend is converted into U.S. dollars on the date they are received, the U.S. Holder generally will not be required to recognize foreign currency gain or loss in respect of the dividend income. If the foreign currency received as a dividend is not converted into U.S. dollars on the date of receipt, you will have a basis in the foreign currency equal to its U.S. dollar value on the date of receipt. Any gain or loss realized on a subsequent conversion or other disposition of the foreign currency will be treated as U.S. source ordinary income or loss.

As described more fully in “—Switzerland Taxation—Material Swiss Tax Consequences Relating to Our Ordinary Shares—Swiss Withholding Tax—Refund of Swiss withholding tax on taxable distributions” above, a U.S. Holder who is not a resident in Switzerland and who does not hold ordinary shares as part of a trade or business carried on through a permanent establishment in Switzerland may be entitled to a full or partial refund of Swiss withholding tax deducted on dividends. A U.S. Holder may be required to properly demonstrate to the Company and the Swiss tax authorities its entitlement to the refund under the Treaty. Subject to certain conditions and limitations (including a minimum holding period requirement) and the Foreign Tax Credit Regulations (as defined below), Swiss federal withholding taxes (Verrechnungssteuer) on dividends may be treated as foreign taxes eligible for credit against a U.S. Holder’s U.S. federal income tax liability. For purposes of calculating the foreign tax credit, dividends paid on the ordinary shares will be treated as income from sources outside the United States and will generally constitute passive category income. However, recently issued Treasury regulations that apply to taxes paid or accrued in taxable years beginning on or after December 28, 2021 (the “Foreign Tax Credit Regulations”) impose additional requirements for foreign taxes to be eligible for a foreign tax credit, and there can be no assurance that those requirements will be satisfied. A recent notice from the Internal Revenue Service (the “IRS”) indicates that the

IRS is considering proposing amendments to the Foreign Tax Credit Regulations and also allows taxpayers to defer the application of many aspects of the Foreign Tax Credit Regulations until further notice.

Instead of claiming a foreign tax credit, you may be able to deduct Swiss federal withholding taxes (Verrechnungssteuer) on dividends in computing your taxable income, subject to generally applicable limitations under United States law (including that a U.S. Holder is not eligible for a deduction for foreign income taxes paid or accrued in a taxable year if such U.S. Holder claims a foreign tax credit for any foreign income taxes paid or accrued in the same taxable year). The rules governing the foreign tax credit and deductions for foreign taxes are complex. U.S. Holders are urged to consult their tax advisors regarding the Foreign Tax Credit Regulations and availability of the foreign tax credit or a deduction under their particular circumstances.

Extraordinary Dividends

Dividends that exceed certain thresholds in relation to a U.S. Holder’s tax basis in ordinary shares could be characterized as “extraordinary dividends” under the Code. A corporate U.S. Holder that has held ordinary shares for two years or less before the dividend announcement date and that receives an extraordinary dividend will generally be required to reduce its tax basis in such ordinary shares with respect to which such dividend was made by the non-taxed portion of such dividend. If the amount of the reduction exceeds the U.S. Holder’s tax basis in such stock, the excess is taxable as capital gain realized on the sale or other taxable disposition of ordinary shares and will be treated as described under “—Gain or Loss on Sale, Taxable Exchange or Other Taxable Disposition of the Ordinary Shares” below. A non-corporate U.S. Holder that receives an extraordinary dividend will generally be required to treat any loss on the sale of ordinary shares as long-term capital loss to the extent of the extraordinary dividends the U.S. Holder receives that qualify for taxation at the special rates discussed above.

Gain or Loss on Sale, Taxable Exchange or Other Taxable Disposition of the Ordinary Shares

Subject to the PFIC rules discussed above, upon a sale or other taxable disposition of the ordinary shares, a U.S. Holder generally will recognize capital gain or loss in an amount equal to the difference between the amount realized and the U.S. Holder’s adjusted tax basis in ordinary shares.

Any such capital gain or loss generally will be long-term capital gain or loss if the U.S. Holder’s holding period for ordinary shares disposed of exceeds one year. Long-term capital gains recognized by non-corporate U.S. Holders will be eligible to be taxed at reduced rates. The deductibility of capital losses is subject to limitations. Any gain or loss recognized by a U.S. Holder will generally be treated as U.S. source gain or loss.

Tax Reporting and Backup Withholding

Individuals and certain domestic entities that are U.S. Holders will be required to report information with respect to such U.S. Holder’s investment in “specified foreign financial assets” on IRS Form 8938, subject to certain exceptions. An interest in the Company constitutes a specified foreign financial asset for these purposes. Persons who are required to report specified foreign financial assets and fail to do so may be subject to substantial penalties. U.S. Holders are urged to consult with their tax advisors regarding the foreign financial asset reporting obligations and their application to the ordinary shares.

Dividend payments with respect to the ordinary shares and proceeds from the sale, exchange, or other disposition of the ordinary shares may be subject to information reporting to the IRS and possible U.S. backup withholding. Backup withholding will not apply, however, to a U.S. Holder who furnishes a correct taxpayer identification number and makes other required certifications, or who is otherwise exempt from backup withholding and establishes such exempt status.

Backup withholding is not an additional tax. Amounts withheld as backup withholding may be credited against a U.S. Holder’s U.S. federal income tax liability, and a holder generally may obtain a refund of any excess amounts withheld under the backup withholding rules by timely filing the appropriate claim for refund with the IRS and furnishing any required information.

PLAN OF DISTRIBUTION

We may sell the offered securities from time to time in one or more transactions: (a) through agents; (b) through underwriters or dealers; (c) in the over-the-counter market; (d) in privately negotiated transactions; (e) directly to one or more purchasers; or (f) through a combination of any of these methods of sale. We will identify the specific plan of distribution, including any underwriters, dealers, agents or direct purchasers and their compensation in a prospectus supplement.

SERVICE OF PROCESS AND ENFORCEMENT OF CIVIL LIABILITIES

UNDER U.S. SECURITIES LAWS

The Company is incorporated in Switzerland and conducts a majority of its operations through its subsidiary, Global Blue Group AG, outside the United States. All of the Company’s assets are located outside the United States. A majority of the Company’s officers and directors reside outside the United States and a substantial portion of the assets of those persons are located outside of the United States. As a result, it could be difficult or impossible for you to bring an action against the Company or against these individuals outside of the United States in the event that you believe that your rights have been infringed under the applicable securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws outside of the United States could render you unable to enforce a judgment against the Company’s assets or the assets of the Company’s directors and officers.

In addition, the Articles of Association provide for arbitration in Zurich, Switzerland for corporate litigation, including, without limitation, legal proceedings between the Company, its directors and its shareholders.

LEGAL MATTERS

The validity of ordinary shares has been passed on by Niederer Kraft Frey AG, Swiss counsel to Global Blue.

EXPERTS

The financial statements of Global Blue Group Holding AG incorporated in this Prospectus by reference to the Annual Report on Form 20-F for the year ended March 31, 2024 have been so incorporated in reliance on the report of PricewaterhouseCoopers SA, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting. PricewaterhouseCoopers SA is a member of EXPERTsuisse—Swiss Expert Association for Audit, Tax and Fiduciary.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the periodic reporting and other information requirements of the Exchange Act as applicable to a “foreign private issuer,” and we will file annual reports and other information from time to time with the SEC in accordance with such requirements. Our SEC filings will be available to the public on the internet at a website maintained by the SEC located at www.sec.gov.

We also maintain an Internet website at www.globalblue.com. We make available, free of charge, through our website the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC: our Annual Reports on Form 20-F; our reports on Form 6-K; amendments to these documents; and other information as may be required by the SEC. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus.

ORDINARY SHARES

PROSPECTUS

August 6, 2024

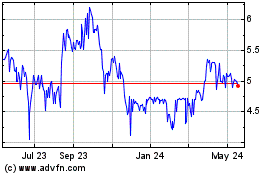

Global Blue (NYSE:GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

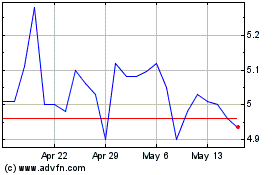

Global Blue (NYSE:GB)

Historical Stock Chart

From Jan 2024 to Jan 2025